Professional Documents

Culture Documents

Cases Labor Finals Exam

Uploaded by

suchezia lopez0 ratings0% found this document useful (0 votes)

24 views7 pagesCASES LABOR FINALS EXAM

Original Title

CASES LABOR FINALS EXAM

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCASES LABOR FINALS EXAM

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views7 pagesCases Labor Finals Exam

Uploaded by

suchezia lopezCASES LABOR FINALS EXAM

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 7

MANAGEMENT PREROGATIVE Paguio Transport Corp.

did not submit any proof to

Abbott Laboratories vs. Alcaraz support these allegations. Well-settled is the rule that

Employee fails to qualify as a regular employee in the employer has the burden of proving that the

accordance with reasonable standards dismissal of an employee is for a just cause.

Yrasuegui vs. PAL •“boundary system” do not receive fixed wages – but it

the weight standards of PAL constitute a continuing is not sufficient to withdraw the relationship

qualification of an employee in order to keep the job. Insular Life Assurance Co. vs. NLRC

“Meiorin Test” NO emrel. Basiao has freedom with his own time and

(1) the employer must show that it adopted the selling methods, time, place, and means of soliciting

standard for a purpose rationally connected to the the insurance. There are also no quotas and he is just

performance of the job; compensated based on the result of his work. SC

(2) the employer must establish that the standard is stated that Basiao was just an independent contract

reasonably necessary to the accomplishment of that and not an employee. NOT EVERY FORM OF CONTROL

workrelated purpose; and MAY CONSTITUTES AN EMPLOYER-EMPLOYEE

(3) the employer must establish that the standard is RELATIONSHIP.

reasonably necessary in order to accomplish the Manila Golf and Country Club vs. IAC

legitimate work-related purpose NO. Persons rendering caddying services are NOT

Duncan Association vs. GLAXO employees of said clubs.

Glaxo’s policy prohibiting an employee from having a Regarding the IAC’s contention: The Manila Golf &

relationship with an employee of a competitor company Country Club’s regulations do not constrict the actions

is a VALID EXERCISE OF MANAGEMENT PREROGATIVE of the caddies, it does not leave them no freedom of

– right to guard its trade secrets, manufacturing choice. Regarding the “group rotation system” it is a

formulas, and other confidential programs. mere assurance that the work will be equally and fairly

Glaxo DOES NOT IMPOSE an ABSOLUTE prohibition distributed

against relationships between its employees and those Dy Keh Beng vs. Int’l Labor

of competitor companies. Control Test: Considering that the work of the

EMPLOYER-EMPLOYEE RELATIONSHIP complainants are engage in the manufacturing of

Brotherhood Labor Unity Movement baskets it is to expect that Dy would have to observe,

Selection and Engagement: impose requirements of size and quality of the kaing,

The records fail to show that San Miguel entered into and also subjected to Dy’s specifications.

mere oral agreements of employment with the workers. Domasig vs. NLRC (Cata Garments)

But the fact that workers have average of 7 years of EmRel: IDs are presented as a bona fide employee of

staying and working in the company concludes there the company and not just a mere security purpose.

engagement of the workers are necessary in the usual Cash vouchers are also an indication of petitioner’s

business of the company. salary. Employee since he is more than a year.

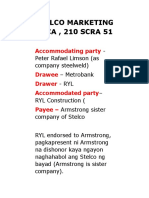

Payment of the worker’s wages Villamaria vs. CA

The amount paid by San Miguel Corporations to the The “kasunduan-hulog scheme” will not extinguish the

alleged independent contractor considers no business employer-employee relationship of Villamaria Motors

expenses or capital outlay to the alleged independent and Bustamante. The owner still manages and regulate

contractor considers no business expenses or capital the drivers whether they follow routes and the rules

outlay of the latter. Nor is the profit or gain of the regarding the business operations. Therefore, the

alleged contractor in the conduct of its business control is still in the hands of the owner or operator.

provided for as an amount over and above the workers’ The driver also shows that he performs activities that

wages. are necessary to the usual business

Power of dismissal Makati Haberdashery vs. NLRC

San Miguel Corporation dismissed the petitioners from EmRel. Element of control is present. The manner and

their company and refused them to entry such quality of cutting, sewing and ironing.

premises There was no illegal dismissal to the two workers

Control Test accused of the copied Barong Tagalog design, because

There is evidence that SMC’s right to impose when they were asked to explain to their employer, the

disciplinary measures for violation or infractions of its workers did not but instead went AWOL. Imposing

rules and regulations proves that the company has disciplinary sanctions upon an employee for just and

control over the petitioners. valid cause is within the rights of the employer.

Continental Marble Corp. vs. NLRC Caurdanetaan Piece Workers Union

NO employer-employee relationship. Element of control EmRel. Caurdanetaan Piece Workers Union members

is lacking. (petitioners) performed work which is directly related,

• He is also not included in the payroll nor in the list of necessary and vital to the operations of Corfarm.

employees submitted by the Continental to SSS Moreover, Corfarm did not even allege, much less

•Nasayao works at his own pleasures, which is not prove, that petitioner's members have "substantial

subject to hours or conditions of work and paid capital or investment in the form of tools, equipment,

according to the results of his own work. machineries, [and] work premises, among others.

•Therefore, there is no employer-employee relationship Payment of wages: respondent did not contradict

and there is no basis for an award of unpaid salaries or petitioner's allegation that it paid wages directly to

wages to Rodito Nasayao. these workers without the intervention of any third-

Paguio Transport Corp. vs. NLRC party independent contractor

Wilfredo Melchor was illegally dismissed by Paguio. Power to Dismiss: wielded the power of dismissal over

•He “was not afforded the twin requirements of due petitioners; in fact, its exercise of this power was the

process. (twin req= notice and hearing) progenitor of the illegal dismissal case

•NLRC rejected it claim of 3 vehicular accident because Orlando Farm Growers Inc.

there is no proof that was presented for the claim. Several circulars and memos were produced during the

Therefore, a mere allegation of his reckless driving association's existence regarding, among other things,

cannot constitute for his dismissal absences without official permission, loitering in the

work area, and disciplinary procedures that every

worker is required to follow. The staff were also given EmRel. As cameramen, editors and reporters, it

identity cards. appears that Petitioners were subject to the control and

Maraguinot vs. VIVA Films supervision of Respondents which provided them with

There exist an employee- employer relationship the equipment essential for the discharge of their

between the petitioners and the private respondents functions. right to control not only the end result but

because of the ff. reasons that nowhere in the also the manner and means utilized to achieve the

appointment slip does it appear that it was the same.

producer who hired the crew members. Moreover, it

was VIVA’s corporate name appearing on heading of Francisco vs. NLRC

the slip. It can likewise be said that it was VIVA who

EmRel. She was selected and engaged by the company

paid for the petitioners’ salaries. Respondents also

for compensation and is economically dependent upon

admit that the petitioners were part of a work pool

respondent for her continued employment in that line

wherein they attained the status of regular employees

of business. Her main job function involved accounting

because of the ff. requisites: (a) There is a continuous

and tax services rendered to respondent corporation on

rehiring of project employees even after cessation of a

a regular basis over an indefinite period of

project; (b) The tasks performed by the alleged

engagement. Kasei Corporation has the power to

“project employees” are vital, necessary and

control petitioner with the means and methods by

indispensable to the usual business or trade of the

which the work is to be accomplished

employer; and (c) However, the length of time which

Two-tiered test:

the employees are continually re-hired is not

(1) The putative employer’s power to control the

controlling but merely serves as a badge of regular

employee with respect to the means and methods

employment.

by which the work is to be accomplished (control

Sonza vs. ABS-CBN

test)

NO EmRel. (a) Selection and engagement of employee

(2) The underlying economic realities of the activity or

ABS-CBN engaged Sonza's services to co-host its

relationship (test of economic realisties of the

television and radio programs because of his peculiar

activity or relationship)

skills, talent and celebrity status. These are indicative,

but not conclusive, of an independent contractual

relationship (b) Payment of wages: The Court held that

whatever benefits Sonza enjoyed (SSS, Medicare, 13th

month pay) arose from contract and not because of an

employer-employee relationship. (c) Power of

Dismissal: For violation of any provision of the

Agreement, either party may terminate their

relationship. Sonza failed to show that ABS-CBN could

terminate his services on grounds other than breach of

contract, such as retrenchment to prevent losses as

provided under labor laws. (d) Power of Control: The

control test is the most important test our courts apply

in distinguishing an employee from an independent

contractor. This test is based on the extent of control

the hirer exercises over a worker. The greater the

supervision and control the hirer exercises, the more

likely the worker is deemed an employee. The converse

holds true as well – the less control the hirer exercises,

the more likely the worker is considered an

independent contractor.

Orozco vs. CA

NO. The “control” being asserted by the Orozco is not

the type of control contemplated under the four-fold

test in labor law. The main determinant therefore is

whether the rules set by the employer are meant to

control not just the results of the work but also the

means and methods to be used by the hired party in

order to achieve such results.

Economic Dependence Test:

(1) the extent to which the services performed are an

integral part of the employer’s business;

(2) the extent of the worker’s investment in equipment

and facilities;

(3) the nature and degree of control exercised by the

employer;

(4) the worker’s opportunity for profit and loss;

(5) the amount of initiative, skill, judgment or

foresight required for the success of the claimed

independent enterprise;

(6) the permanency and duration of the relationship

between the worker and the employer; and

(7) the degree of dependency of the worker upon the

employer for his continued employment in that line of

business.

Begino vs. ABS-CBN

ART. 106. Contractor or subcontractor. - Whenever an

employer enters into contract with another person for

the performance of the former's work, the employees

of the contractor and of the latter's subcontractor, if

any,

shall be paid in accordance with the provisions of this

Code.

In the event that the contractor or subcontractor fails

to pay the wage of his employees in accordance with

LEAVES ART. 97-100 this Code, the employer shall be jointly and severally

Songco vs. NLRC liable with his contractor or subcontractor to such

In the computation of backwages and separation pay, employees to the extent of the work performed under

account must be taken not only of the basic salary of the contract, in the same manner and extent that he is

the employee, but also of the transportation and liable to employees directly employed by him.

emergency living allowances. xxx

The nature of the work of a salesman and the reason ART. 107 Indirect employer. - The provisions of the

for such type of remuneration for services rendered immediately preceding Article shall likewise apply to

demonstrate that commissions are part of Songco, et any

al's wage or salary. person, partnership, association or corporation which,

Since the commissions in the present case were earned not being an employer, contracts with an independent

by actual transactions attributable to Song, et al., contractor for the performance of any work, task, job

these should be included in their separation pay. In or project.

the computation thereof, what should be taken into In this case, the GSIS cannot evade liability by claiming

account is the average commission earned during their that it had fully paid complainants' salaries.

last year of employment. In Rosewood Processing, Inc. v. National Labor

Relations Commission, the Court explained the

Millares vs. NLRC rationale for the

The allowances are not part of the wages of the joint and several liability of the employer, thus:

employees. The court agrees with the observation of The joint and several liability of the employer or

the Office of the Solicitor General that the subject principal was enacted to ensure compliance with the

allowances were temporarily, not regularly, received by provisions of the Code, principally those on statutory

petitioners. minimum wage. The contractor or subcontractor is

made liable by virtue of his or her status as a direct

American Wire Union vs. American Wire employer, and the principal as the indirect employer of

• ART. 100. PROHIBITION AGAINST ELIMINATION the contractor's employees. This liability facilitates, if

OR DIMINUTION OF BENEFITS. The granting of a bonus not guarantees, payment of the workers'

is a management prerogative, something given in compensation, thus, giving the workers ample

addition to what is ordinarily received by or strictly due protection as mandated by the 1987 Constitution. This

the recipient. Thus, a bonus is not a demandable and is not unduly burdensome to the employer. Should the

enforceable obligation, except when it is made part of indirect employer be constrained to pay the workers, it

the wage, salary, or compensation of the employee. can recover whatever amount it had paid in accordance

with the terms of the service contract between itself

Lepanto Ceramics Inc.

and the contractor.

A bonus is granted and paid to an employee for his

Aliviado vs. Proctor and Gamble

industry and loyalty which contributed to the success of

WON Promm-Gem and SAPS are labor-only contractors

the employer's business and made possible the

or legitimate job contractors?

realization of profits. For a bonus to be enforceable, it

ART. 106. Contractor or subcontractor. – XXX There is

must have been promised by the employer and

"labor-only" contracting where the person supplying

expressly agreed upon by the parties.

workers to an employer does not have substantial

Eastern Telecom Phils capital or investment in the form of tools, equipment,

machineries, work premises, among others, and the

DO 174-17 (ARTICLE 106-107) workers recruited and placed by such person are

Spic N’ Spam Services performing activities which are directly related to the

Job contracting. In permissible job contracting, the principal business of such employer. In such cases, the

principal agrees to put out or farm out with a person or intermediary shall be considered merely as

contractor or subcontractor the performance or an agent of the employer who shall be responsible to

completion of a specific job, work or service within a the workers in the same manner and extent as if the

definite or predetermined period, regardless of whether latter were directly employed by him.

such job, work or service is to be performed or In the case of Promm-Gem, its financial statements

completed within or outside the premises of the show that it has authorized capital stock of P1 million

principal. The test is whether the independent and a capital available for operations. Promm-Gem

contractor has contracted to do the work according to supplied its complainant- workers with the relevant

his own methods and without being subject to the materials for them to perform their work and also

principal’s control except only as to the results, he has issued uniforms to them. It is also relevant to mention

substantial capital, and he has assured the contractual that Promm-Gem already considered the complainants

employees entitlement to all labor and occupational working under it as its regular, not merely contractual

safety and health standards, free exercise of the right or project employees. The court finds that Promm-

to self-organization, security of tenure, and social and Gem has substantial investment which relates to the

welfare benefits work to be performed. Under the circumstances, it

GSIS vs. NLRC cannot be sustained as a labor-only contractor but a

WON GSIS is jointly and severally liable for the legitimate independent contractor.

payment of money claims On the other hand, SAPS is considered merely an agent

HELD: Articles 106 and 107 of the Labor Code provide: of the principal employer and the latter is responsible

to the employees of the labor-only contractor as if such Article 13(b), or any of the prohibited practices

employees had been directly employed by the principal enumerated under Art. 34 of the Labor Code;

employer. Consequently, the following petitioners, *he has no valid license or authority required by law to

having been recruited and supplied by SAPS -- which enable one to lawfully engage in recruitment and

engaged in labor-only contracting -- are considered as placement of workers; and

the employees of P&G: Parenthetically, unlike Promm- * the illegal recruitment is committed by a group of

Gem which dismissed its employees for grave three (3) or more persons conspiring or confederating

misconduct and breach of trust due to disloyalty, SAPS with one another.

dismissed its employees upon the initiation of P&G. It is •When illegal recruitment is committed by a syndicate

evident that SAPS does not carry on its own business or in large scale, i.e., if it is committed against three

because the termination of its contract with P&G (3) or more persons individually or as a group, it is

automatically meant for it also the termination of its considered an offense involving economic sabotage.

employees’ services.

It is obvious from its act that SAPS had no other clients It also reveals that MPM Agency was never licensed by

and had no intention of seeking other clients in order to the POEA to recruit workers for overseas employment.

further its merchandising business. From all indications Accused claimed he is not an officer nor employee, but

SAPS existed to cater solely to the need of P&G for the an active involvement of each in the recruitment scam

supply of employees in the latter’s merchandising was directed at one single purpose – to divest

concerns only. complainants with their money on the pretext of

Under the circumstances prevailing in the instant case, guaranteed employment abroad.

the court does not consider SAPS as an independent Republic vs. Principalia

contractor. Principalia has a clear and convincing right to

There is labour - only contracting when: operate as a recruitment agency. POEA would have no

(1) The contractor or subcontractor does not have authority to exercise its regulatory functions over

substantial capital Principalia because the matter had already been

(2) The contractor or subcontractor does not have brought to the jurisdiction of the DOLE.

investments in the form of tools, equipment, •Principalia has been granted the license to recruit and

machineries, supervision, work premises, among others process documents for Filipinos interested to work

(3) The contractor’s or subcontractor’s employees abroad.

recruited and placed are performing activities which are •Thus, POEA’s action of suspending Principalia’s license

directly related to the main business operation of the before final adjudication by the DOLE would be

principal premature and would amount to a violation of the

(4) The contractor or subcontractor does not exercise latter’s right to recruit and deploy workers.

the right to control over the performance of the work of Stolt-Nielsen and Chung Gai

the employees first employment contract between them and

MIGRANT WORKERS ACT Medequillo is different from and independent of the

PP vs. Melissa Chua second contract subsequently executed upon his

It is clear that any recruitment activities to be repatriation to Manila; Court held that novation took

undertaken by non-licensee or non-holder of contracts, place in this case.

or as in the present case, an agency with an expired Requisites of Novation:

license, shall be deemed illegal and punishable under (1) previous valid obligation;

Article 39 of the Labor Code of the Philippines. (2) agreement of the parties concerned to a new contract;

•And illegal recruitment is deemed committed in large (3) extinguishment of the old contract

scale if committed against three or more persons (4) validity of the new contract.

individually or as a group. the Court held that even without actual deployment,

Elements of large-scale illegal prosecution: the perfected contract gives rise to obligations on the

(1) the accused undertook a recruitment activity under part of Stolt-Nielsen and Chung Gai Ship

Article 13 (b) or any prohibited practice under Article perfection of the contract, which in this case coincided

34 of the Labor Code; with the date of execution thereof, occurred when

(2) the accused did not have the license or the petitioner and respondent agreed on the object and the

authority to lawfully engage in the recruitment and cause, as well as the rest of the terms and conditions

placement of workers; and therein.

(3) the accused committed such illegal activity against Dulay vs. Aboitiz

three or more persons individually or as a group. clearly involves the interpretation or implementation of

PP vs. Domingo Panis the said CBA. only in the absence of a CBA that parties

The number of persons dealt with is not an essential may opt to submit the dispute to either the NLRC or to

ingredient of the act of recruitment and placement of voluntary arbitration. Court finds no error in the ruling

workers. Any of the acts mentioned in the basic rule in of the CA that the voluntary arbitrator has jurisdiction

Article 13(b) win constitute recruitment and placement over the instant case.

even if only one prospective worker is involved. Sameer Overseas Placement vs. Cabilles

Thenamaris Ship’s Management For Cabiles' termination, Sameer was unable to provide

The Court declared in Serrano vs. Gallant Maritime that any valid reasons. Employers are free to set reasonable

the clause “or for three months for every year of the rules and requirements, but this prerogative must not

unexpired term, whichever is less” is provided in the be abused and must be tempered with the employee’s

5th paragraph of Section 10 of R.A. No. 8042 is right to security of tenure. employees may not be

unconstitutional for being violative of the rights of terminated without a valid or just cause (substantive

Overseas Filipino Workers (OFWs) to equal protection due process) and without observing proper procedure

of the laws. (procedural due process).

PP vs. Gallo the Court emphasized that employees have the right to

To commit syndicated illegal recruitment, three security of tenure even if they relocate to work in a

elements must be established: different jurisdiction. Contract of employment of

*the offender undertakes either any activity within the Cabiles was perfected in the Philippines, then

meaning of recruitment and placement defined under constitutional guarantee of security of tenure all apply.

To demonstrate that a dismissal for inefficiency at work

is justified, the following conditions must be true:

1. The employee shall be evaluated in accordance

with the standards of behavior and craftsmanship

established by the employer;

2. The employee has to be informed of the expected

standards of behavior and performance;

3. A appropriate amount of time before the

employee's performance review, the message was

made. In this instance, Sameer was unable to provide

proof that Cabiles's work was insufficient to meet

Wacoal's standards.

There was no evidence to support Cabiles's lack of

knowledge on the performance and efficiency criteria of

Wacoal.

Sunace International Management

The act of the foreigner-principal in renewing the

contract of Divina is not attributable to Sunace. It is

incorrect to assume that because Sunace was in

constant contact with the foreign "principal" (sic), it

knew of and approved of the contract's prolongation.

The communication doesn't offer any proof that Sunace

was aware of the new contract that was signed.

•The agency is revoked if the principal directly

manages the business entrusted to the agent, dealing

directly with third persons.

Princess Talent Center vs. Masagca

Unlawfully fired. absence of a written contract attesting

to the six-month extension of respondent's

employment, the same is essentially acknowledged by

petitioners, with the exception of the defense that

there is no proof of their knowledge of or participation

in said extension and as a result they cannot be held

accountable for the actions that took place between

respondent and Same Entertainment Company

(SAENCO) during the extension period.

Even after the respondent's work visa had already

expired, SAENCO extended the Employment Contract

for an additional six months. Even if it is true that the

respondent was unable to continue working legally in

South Korea without a work visa, the petitioners cannot

use this justification to excuse the early end of the

respondent's prolonged employment.

SAENCO, as the principal/employer, and petitioner

PTCPI, as the recruitment/placement agency, are

jointly and severally liable for the monetary judgments

in favor of the respondent, an employee who was

wrongfully terminated.

Step 2: Compute wage between 8:00AM – 5:00PM

using holiday wage rate

(8 hours x P200 = P1,600)

Step 3: Compute OT Premium Pay between 5:00pm-

10:00pm

[(30% x Wage per Hour) + Wage per hour] x no. of OT

hours

3. REST DAYS OR SPECIAL HOLIDAYS

[Rest day or special holiday wage rate (130%) + 30%

of rest day or special holiday wage rate]

Step 1: Get hourly wage rate

(Daily Wage ÷ hours worked) x 130%

Night Differential (P800 ÷ 8 hours) x 130% = P130

Ordinary day Night Shift

• (Hourly rate × 10% × hours between 10pm-6am) Step 2: Compute wage between 8:00am – 5:00pm using

= Ordinary Day Night Differential special holiday wage rate

Rest day Night Shift 8 hours x P130 = P1,040

• (Hourly rate × 130% × 10% × hours between Step 3: Compute OT Premium Pay between 5:00pm –

10pm-6am) = Rest Day Night Differential 10:00pm

Special Holiday Night Shift [(30% x holiday wage per hour) + holiday wage per hour] x

• (Hourly rate × 130% × 10% × hours between no. of OT hours

10pm-6am) = Special Holiday Night Differential 4. SCHEDULED REST DAY which is also a Special

Special Holiday and at the same time Rest day Holiday

Night Shift [Rest day & special holiday wage rate (150%) + 30% of

• (Hourly rate × 150% × 10% × hours between rest day & special holiday wage rate]

10pm-6am) = Special Holiday Rest day Night Step 1: Get hourly wage rate

Differential (Daily Basic Wage ÷ number of hours worked) x rest day &

Regular Holiday Night Shift special holiday wage rate

• (Hourly rate × 200% × 10% × hours between (P800 ÷ 8 hours) x 150% = P150

10pm-6am) = Regular Holiday Night Differential Step 2: Compute wage between 8:00 am – 5:00pm using

Regular Holiday and at the same time Rest day special holiday wage rate

Night Shift 8 hours x P150 = P1,200

• (Hourly rate × 260% × 10% × hours between Step 3: Compute OT Premium Pay between 5:00pm-

10pm-6am) = Regular Holiday Rest day Night 10:00pm

Differential [(30% x Holiday Wage per hour) + holiday wage per hour]

Double Holiday Night Shift x no. of OT hours

• (Hourly rate × 330% × 10% × hours between 5.SCHEDULED REST DAY which is Also a Legal or

10pm-6am) = Double Holiday Night Differential Regular Holiday

Double Holiday and at the same time Rest day, [Rest day & legal holiday wage rate + 30% of rest day &

Night Shift legal holiday wage rate (260%)]

• (Hourly rate × 390% × 10% × hours between Step 1: Get hourly wage rate

10pm-6am) = Double Holiday Rest day Night (Daily basic wage ÷ number of hours worked) x rest day &

Differential legal holiday wage rate

NSD WITH OVERTIME (P800 ÷ 8 hours) x 260% = P260

• [(10% x OT wage per hour) x no. of hours of work Step 2: Compute wage between 8:00am-5:00pm using

performed between 10pm-6am] holiday wage rate

Step 1: Get regular wage per hour 8 hours x P260 = P2,080

Hourly wage / 8 = wage per hour Step 3: Compute OT Premium Pay between 5:00pm –

Step 2: Compute the OT Pay between (5:00pm - 10:00pm

12:00pm) [(30% x Holiday wage per hour) + holiday wage per hour]

[(25% x regular wage per hour) + regular wage per x no. of OT hours

hour x no. of OT hours] (COMPUTATION NG OT) 6. DOUBLE HOLIDAY

Step 3: Compute the NSD [Double Holiday Wage Rate (300%) + 300% of Double

[(10% x OT wage per hour) x no. of hours of work Holiday Wage Rate]

performed between 10pm-6am] Step 1: Get hourly wage rate

Step 4: Compute the total wage earned (Daily Basic Wage ÷ Number of Hours worked) x rest day &

Daily wage + OT Pay + NSD = total wage earned legal holiday wage rate

OVERTIME PAY (P800 ÷ 8 hours) x 300% = P300

1. REGULAR WORKDAYS Step 2: Compute wage between 8:00am-5:00pm using

[Regular Basic Wage + 25% of regular wage] special holiday wage rate

Step 1: Get regular wage per hour 8 hours x P300 = P2,400

Daily wage ÷ number of hours worked Step 3: Compute OT premium Pay between 5:00pm –

Step 2: Compute the OT Pay 10:00pm

[ (25% x wage per hour) + (wage per hour) x no. of [(30% x Double Holiday Wage per hour) + double holiday

OT hours ] wage per hour] x no. of OT hours

Step 3: Compute the total wage earned COMPENSATION FOR REST DAY, SUNDAY, OR

Regular wage + OT Premium = total wage earned HOLIDAY WORK

2. LEGAL OR REGULAR HOLIDAYS DAY PREMIUM PAY

[Holiday wage rate (200%) +30% of OT holiday rate] Work on a Scheduled Rest 30% of regular wage

Step 1: Get hourly wage rate Day

(Daily Basic Wage ÷ Number of hours worked) x No regular workdays and 30% of regular wage for

Regular Holiday Wage Rate no specific rest days work performed on

(P800 ÷ 8hrs) x 200% = P200 Sundays and Holidays

Work on Sundays when it 30% of regular wage since work performed on said

is his established rest day days is considered work on

Work on Special holiday 30% regular wage ordinary working days

Work on special holiday 50% of regular wage

falling on scheduled rest LIST OF SPECIAL DAYS

day 1. National

Work on regular holiday 260% of regular wage a. All Saint’s Day – November 1

falling on scheduled rest b. Last Day of the Year – December 31

day c. Ninoy Aquino Day – Monday nearest August

LIST OF REGULAR HOLIDAY 21 (RA 9492, July 25, 2007)

(E.O 292 as Amended by R.A. 9492) d. Other days declared by law

1.New Year’s Day – January 1

2.Maundy Thursday – movable date 2. Local

3.Good Friday – movable date Those declared by law or ordinances (e.g. Makati

4.Araw ng Kagitingan / Day of Valor – Monday nearest April Day for Makati City only)

9

5.Labor Day – Monday nearest May 1 DOUBLE HOLIDAY PAY (i.e. Araw ng Kagitingan and Good

6.Independence Day – Monday nearest June 12 Friday falls on the same day)

7.National Heroes Day – Last Monday of August 1. 200% of the basic wage

8.Bonifacio Day – Monday nearest November 30 a. Entitled even if said holiday is unworked

9.Christmas Day – December 25 b. To give employee only 100% would reduce the

10.Rizal Day – December 30 number of holidays

11.Eid’l Fitr – movable date

12.Eid’l Adha – movable date (E.O 292 as amended) 2. 300% if he worked on 2 regular holidays falling on

SPECIAL (NON-WORKING) the same day

1.Chinese New Year – Feb 12

2.EDSA People Power – Feb 25 390% if he reported for work on a double holiday

3.Black Saturday – Apr 3 which is also his rest day, where is now entitled to

4.Ninoy Aquino Day – Nov 1 an additional 30% based on the rate of 300% for

5.All Saints’ Day – Nov 1 that day

6.Feast of the Immaculate Mary – Dec 8

7.Last Day of the Year – Dec 31

HOLIDAYS FORMULA

Regular Holidays a. During employee’s

regular workday

i. If unworked

(Daily Rate + Cost

of Living Allowance)

x 100%

ii. If worked:

1. 1st 8hours – [(Daily rate +

COLA) x 200%] + [30%

(Daily rate x 200%)]

2. Excess of 8hrs. – (Hourly

rate of the basic daily wage x

200% x 130% x 130% x

numbers of hours worked)

Special Days such 1. If unworked – no pay unless

as Special Non- there is a favorable company

Working Day, Special policy, practice or collective

Public Holiday, bargaining agreement (CBA)

Special National granting payment of wages on

Holiday, and special days even if unworked

Nationwide special 2. If worked

days i. 1st 8 hrs – (Daily rate x

130%) + COLA

ii. Excess of 8 hrs.- (Hourly rate

of the basic daily wage x 130%

x 130% x number of hours

worked)

3. Falling on the employee’s

rest day and if worked

i. 1st 8hrs – (Daily rate x 150%)

+ COLA

ii. Excess of 8hrs. – (Hourly rate

of the basic daily wage x 150%

x 130% x number of hours

worked)

Special Working a. For work performed, an

Holidays employee is entitled only to his

basic rate

b. No premium pay is required

You might also like

- J. Del Castillo - Labor LawDocument57 pagesJ. Del Castillo - Labor LawLeigh aliasNo ratings yet

- Temic Automotive Phils. vs. Temic Automotive Phils. Inc. Employee Union-FFWDocument2 pagesTemic Automotive Phils. vs. Temic Automotive Phils. Inc. Employee Union-FFWtalla aldover100% (4)

- #45 - Paragale v. GmaDocument2 pages#45 - Paragale v. GmaKê MilanNo ratings yet

- Digest of Labor Cases Week 1Document20 pagesDigest of Labor Cases Week 1Jazztine ArtizuelaNo ratings yet

- Labor Law & Social Legislation Case Doctrines - Labor Relations (4D1920)Document172 pagesLabor Law & Social Legislation Case Doctrines - Labor Relations (4D1920)Arlyn MacaloodNo ratings yet

- Asian Steel Vs WCCDocument18 pagesAsian Steel Vs WCCMichelle Alen CalloNo ratings yet

- None of The Rules and Regulations Provided For in The Insurance Code Can Justifiably Be Said To Establish An Employer-Employee RelationshipDocument31 pagesNone of The Rules and Regulations Provided For in The Insurance Code Can Justifiably Be Said To Establish An Employer-Employee RelationshipkarlNo ratings yet

- Totality of Infractions DoctrineDocument6 pagesTotality of Infractions DoctrineNowell Sim100% (1)

- Labor Case DigestsDocument33 pagesLabor Case Digestsprince lisingNo ratings yet

- Labor Law Review CasesDocument26 pagesLabor Law Review CasesMarie Gabay DamoclesNo ratings yet

- ASIAN ALCOHOL V NLRCDocument3 pagesASIAN ALCOHOL V NLRCAyleen RamosNo ratings yet

- LR Cases KDJ (Due Nov 28, Dec 3-5)Document5 pagesLR Cases KDJ (Due Nov 28, Dec 3-5)Khian JamerNo ratings yet

- Case Digest, Art 82 LCDocument34 pagesCase Digest, Art 82 LCNeapolle FleurNo ratings yet

- Pacquing V Coca-ColaDocument2 pagesPacquing V Coca-ColaLisley Gem Amores100% (1)

- Labor (w2-w3 Digests)Document21 pagesLabor (w2-w3 Digests)asiaNo ratings yet

- Labor Law FinalDocument15 pagesLabor Law FinalED RCNo ratings yet

- Antonio Valeroso and Allan Legatona v. Skycable Corporation G.R. No. 202015, 13 July 2016Document15 pagesAntonio Valeroso and Allan Legatona v. Skycable Corporation G.R. No. 202015, 13 July 2016bentley CobyNo ratings yet

- Labor Relations Digests Part 2Document13 pagesLabor Relations Digests Part 2Raymer OclaritNo ratings yet

- Labor Relations DigestsDocument10 pagesLabor Relations DigestsRaymer OclaritNo ratings yet

- Labor Midterm CasesDocument147 pagesLabor Midterm CasesLing EscalanteNo ratings yet

- Generally Considered Are The Following:: Unfair Labor Practice Guaranteed and Reliable Labor ContractorsDocument8 pagesGenerally Considered Are The Following:: Unfair Labor Practice Guaranteed and Reliable Labor ContractorskmanligoyNo ratings yet

- For Basic Framework of Labor LawDocument5 pagesFor Basic Framework of Labor LawjanahandreasNo ratings yet

- BN LABSTAN Employer Employee Relationship DigestDocument52 pagesBN LABSTAN Employer Employee Relationship DigestRoseanne MateoNo ratings yet

- Begino v. ABS-CBNDocument3 pagesBegino v. ABS-CBNDyrene Rosario UngsodNo ratings yet

- Case Digest - Begino Vs ABSDocument2 pagesCase Digest - Begino Vs ABSJanine ChloeNo ratings yet

- LABOR BATCH 3 - Almeda V Asahi, Aklan V San MiguelDocument3 pagesLABOR BATCH 3 - Almeda V Asahi, Aklan V San MiguelasdfghjkattNo ratings yet

- Labor Standards 83-86Document6 pagesLabor Standards 83-86Carlo John C. RuelanNo ratings yet

- Arabit Vs Jardine CASE DIGESTDocument2 pagesArabit Vs Jardine CASE DIGESTmegzycutes3871No ratings yet

- Paragele, Et Al. v. GMADocument2 pagesParagele, Et Al. v. GMAAlelie Joy MalazarteNo ratings yet

- Aliviado V P&GDocument4 pagesAliviado V P&GIsh Guidote0% (1)

- Labor - DigestsDocument35 pagesLabor - DigestsEdan Marri CaneteNo ratings yet

- Benigno Et - Al. vs. ABS-CBN - GR No. 199166Document3 pagesBenigno Et - Al. vs. ABS-CBN - GR No. 199166Sean AndersonNo ratings yet

- Assignment No 9Document14 pagesAssignment No 9Lara DelleNo ratings yet

- PALS Labor Law 2016 PDFDocument67 pagesPALS Labor Law 2016 PDFFaye Cience BoholNo ratings yet

- Assignment No 9Document11 pagesAssignment No 9Lara DelleNo ratings yet

- Assignment No 9Document19 pagesAssignment No 9Lara DelleNo ratings yet

- PALS Labor Law 2016Document67 pagesPALS Labor Law 2016Mariel Grace DelinNo ratings yet

- Abott Laboratories, Phils. vs. Alcaraz Facts: RulingDocument3 pagesAbott Laboratories, Phils. vs. Alcaraz Facts: RulingLara DelleNo ratings yet

- Assignment No 9Document11 pagesAssignment No 9Lara DelleNo ratings yet

- MALICDEM Vs MARULAS INDUSTRIALDocument1 pageMALICDEM Vs MARULAS INDUSTRIALLara DelleNo ratings yet

- Independent Contractors and Labor Only Contractors Case Why Did The Laborers Sue? Contractor/ Nature of Work Legit Contractor or Labor Only-Only?Document8 pagesIndependent Contractors and Labor Only Contractors Case Why Did The Laborers Sue? Contractor/ Nature of Work Legit Contractor or Labor Only-Only?Reena MaNo ratings yet

- Paragele Vs Gma Network G.R. NO. 235315, JULY 13, 2020 FactsDocument2 pagesParagele Vs Gma Network G.R. NO. 235315, JULY 13, 2020 FactsEd Ech100% (1)

- Labor Law CasesDocument45 pagesLabor Law CasesFay FernandoNo ratings yet

- Magsalin v. NOWMDocument2 pagesMagsalin v. NOWMCZARINA ANN CASTRONo ratings yet

- Defense Reply (English 2)Document12 pagesDefense Reply (English 2)ChugsNo ratings yet

- Condition of Employment: Employee With Respect To The Means and Methods by Which The Work Is To Be AccomplishedDocument9 pagesCondition of Employment: Employee With Respect To The Means and Methods by Which The Work Is To Be AccomplishedBigs BeguiaNo ratings yet

- Case Digest Art. 82Document30 pagesCase Digest Art. 82Claire RoxasNo ratings yet

- Magsalin Et. Al. V National Organization of Working Men Et. Al. DigestDocument2 pagesMagsalin Et. Al. V National Organization of Working Men Et. Al. DigestMark Leo BejeminoNo ratings yet

- Labor Law Notes (Duano) 1Document9 pagesLabor Law Notes (Duano) 1FernandoNo ratings yet

- BLUM vs. Zamora - DigestDocument2 pagesBLUM vs. Zamora - DigestBigs BeguiaNo ratings yet

- A Nate Casket Maker vs. ArangoDocument11 pagesA Nate Casket Maker vs. ArangoaudreyNo ratings yet

- Amdg Labor II Atty CadizDocument18 pagesAmdg Labor II Atty CadizbobbyrickyNo ratings yet

- Ulp CasesDocument4 pagesUlp Casesrussel leah mae malupengNo ratings yet

- Singer Sewing Machine Co. V DrilonDocument2 pagesSinger Sewing Machine Co. V DrilonHannah PlopinioNo ratings yet

- Labor HomeworkDocument67 pagesLabor HomeworkIris Jiana Sta MariaNo ratings yet

- 26 Paragele V Gma NetworkDocument2 pages26 Paragele V Gma NetworkJuani Onex AngubNo ratings yet

- Chavez v. NLRCDocument19 pagesChavez v. NLRCBruce Wait For It MendozaNo ratings yet

- 4 - Case DigestDocument32 pages4 - Case DigestJoshua RiveraNo ratings yet

- Francisco vs. NLRC Et Al Facts: Ruling:: BAUTISTA, Coleen Joyce Q. Page of 1 58Document58 pagesFrancisco vs. NLRC Et Al Facts: Ruling:: BAUTISTA, Coleen Joyce Q. Page of 1 58ColeenNo ratings yet

- Success In the Payroll Management Business: How to Start Your Own Payroll Management BusinessFrom EverandSuccess In the Payroll Management Business: How to Start Your Own Payroll Management BusinessRating: 2.5 out of 5 stars2.5/5 (2)

- STATEDocument3 pagesSTATEsuchezia lopezNo ratings yet

- Termination of EmploymentDocument4 pagesTermination of Employmentsuchezia lopezNo ratings yet

- Stelco Marketing VDocument16 pagesStelco Marketing Vsuchezia lopezNo ratings yet

- Art. 315. Swindling (Estafa) - : 1st. The Penalty ofDocument12 pagesArt. 315. Swindling (Estafa) - : 1st. The Penalty ofsuchezia lopezNo ratings yet

- Shoemart Vs NLRCDocument6 pagesShoemart Vs NLRCsuchezia lopezNo ratings yet

- Cocomangas Hotel Resort VsDocument6 pagesCocomangas Hotel Resort Vssuchezia lopezNo ratings yet

- What Is A ConstitutionDocument6 pagesWhat Is A Constitutionsuchezia lopezNo ratings yet

- BP 22 VS ESTAFA Copy 1Document8 pagesBP 22 VS ESTAFA Copy 1suchezia lopezNo ratings yet

- Document 3Document5 pagesDocument 3suchezia lopezNo ratings yet

- Crim - Robbery, Theft, Estafa, Malicious MischiefDocument3 pagesCrim - Robbery, Theft, Estafa, Malicious Mischiefsuchezia lopezNo ratings yet

- Week 1 CasesDocument24 pagesWeek 1 Casessuchezia lopezNo ratings yet

- I. Normal Hours of WorkDocument50 pagesI. Normal Hours of Worksuchezia lopezNo ratings yet

- Migrant WorkersDocument41 pagesMigrant Workerssuchezia lopezNo ratings yet

- Robbery and TheftDocument38 pagesRobbery and Theftsuchezia lopezNo ratings yet

- First Week CASESDocument34 pagesFirst Week CASESsuchezia lopezNo ratings yet

- ARTICLESSSDocument3 pagesARTICLESSSsuchezia lopezNo ratings yet

- Article MidtermsDocument2 pagesArticle Midtermssuchezia lopezNo ratings yet

- Article 7-11Document6 pagesArticle 7-11suchezia lopezNo ratings yet

- Freedom of Speech CASESDocument35 pagesFreedom of Speech CASESsuchezia lopezNo ratings yet

- NOTESDocument5 pagesNOTESsuchezia lopezNo ratings yet

- Six Basic Human NeedsDocument2 pagesSix Basic Human Needssuchezia lopezNo ratings yet

- Article 1-5Document14 pagesArticle 1-5suchezia lopezNo ratings yet

- Article 106-109Document7 pagesArticle 106-109suchezia lopezNo ratings yet

- Ty v. PeopleDocument11 pagesTy v. PeopleArren RelucioNo ratings yet

- Law On AgencyDocument11 pagesLaw On AgencyJoseph Dimalanta Dajay100% (1)

- Indian Contract Act 1872Document31 pagesIndian Contract Act 1872MITRA SIMRAN ANEEL 2010331No ratings yet

- 02 Handout 1Document9 pages02 Handout 1PopoyNo ratings yet

- About Your Device Protection: Important InformationDocument20 pagesAbout Your Device Protection: Important InformationjoopNo ratings yet

- Limited Quotation For Partition Work in Department of FTV, SUPVADocument8 pagesLimited Quotation For Partition Work in Department of FTV, SUPVAAman AhlawatNo ratings yet

- Law On Contracts Notes 1Document5 pagesLaw On Contracts Notes 1Rose Marie Lacsamana BarreteNo ratings yet

- PD6 - Legal Aspects (UK) - Questions and AnswersDocument8 pagesPD6 - Legal Aspects (UK) - Questions and AnswersDavid Olorato NgwakoNo ratings yet

- Jaguar Security V Sales PDFDocument6 pagesJaguar Security V Sales PDFBea MarañonNo ratings yet

- Labor Cases - DO 18-02Document87 pagesLabor Cases - DO 18-02jackieheyNo ratings yet

- Agency Cases (Diolosa VS Ca Until PNB VS Ca PDF HighlightedDocument28 pagesAgency Cases (Diolosa VS Ca Until PNB VS Ca PDF HighlightedMary Fatima BerongoyNo ratings yet

- 2022 141 Taxmann Com 223 New Delhi CESTAT 18 02 2022Document30 pages2022 141 Taxmann Com 223 New Delhi CESTAT 18 02 2022pradeepkumarsnairNo ratings yet

- Notes On Non Impairment ClauseDocument26 pagesNotes On Non Impairment ClauseXsyclyn Faith Bello Lumbatan100% (4)

- Commercial Law Assignment 2Document4 pagesCommercial Law Assignment 2jofradayoNo ratings yet

- LTD Case DigestsDocument8 pagesLTD Case DigestsChim100% (2)

- Unknown Owner v. Asian TerminalsDocument3 pagesUnknown Owner v. Asian TerminalsKaren Joy MasapolNo ratings yet

- 63-Barretto V ManilaDocument1 page63-Barretto V ManilaMaribel Nicole LopezNo ratings yet

- PROPERTY Lecture01Document10 pagesPROPERTY Lecture01Ia HernandezNo ratings yet

- PNB V Lopez VitoDocument3 pagesPNB V Lopez VitomisterdodiNo ratings yet

- 2021 SALES Syllabus-RAR RevisedDocument57 pages2021 SALES Syllabus-RAR RevisedJONAH MAE SAMPANGNo ratings yet

- Niblet V ConfectionersDocument12 pagesNiblet V ConfectionersKrishna AhujaNo ratings yet

- Persons and Family Relations PDFDocument211 pagesPersons and Family Relations PDFfatimanginasalNo ratings yet

- A. Scope & Nature of Employee's Right Constitutional Statutory Basis: C. Purpose of Exercise of Right: Two-FoldDocument12 pagesA. Scope & Nature of Employee's Right Constitutional Statutory Basis: C. Purpose of Exercise of Right: Two-FoldKhukeiNo ratings yet

- Tankeh Vs DBP (G.R. No. 171428, November 11, 2013)Document35 pagesTankeh Vs DBP (G.R. No. 171428, November 11, 2013)Ezra RamajoNo ratings yet

- KASUS CUP CorporationDocument7 pagesKASUS CUP CorporationNia Azura SariNo ratings yet

- Tender Proposed Sosion Cattle DipDocument73 pagesTender Proposed Sosion Cattle DipSolidr ArchitectsNo ratings yet

- Real Estate VocabularyDocument69 pagesReal Estate VocabularyCarlos Alberto RojasNo ratings yet

- The Oxford Handbook of International Antitrust EconomicsDocument665 pagesThe Oxford Handbook of International Antitrust EconomicsSystem InformaticaNo ratings yet

- Issue 21: - January - April 2013 - January - April 2013Document276 pagesIssue 21: - January - April 2013 - January - April 2013ohmslaw_ArigiNo ratings yet

- Facility Management Plan TemplateDocument15 pagesFacility Management Plan Templatekumarfm2022No ratings yet