Professional Documents

Culture Documents

Amalthea Letter 202207

Uploaded by

Alessio CalcagnoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amalthea Letter 202207

Uploaded by

Alessio CalcagnoCopyright:

Available Formats

Amalthea Fund – July 2022

The Bronte Amalthea Fund is a global long/short fund targeting double digit returns over the long term, managed by a performance orientated

firm with a process and portfolio that we feel is genuinely different. Objectives include lowering the risk of permanent loss of capital and

providing global diversification without the market/drawdown risks typical of long-only funds. We believe a highly diversified short book

substantially reduces risk and enables profits to be made in tough markets

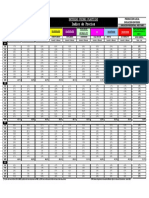

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun FYTD

FY13 5.4% 1.3% 6.8%

FY14 6.0% -2.5% 0.4% 3.6% 5.7% 4.3% -3.7% 0.2% -2.6% 0.9% 3.4% -0.8% 15.2%

FY15 -0.9% -1.6% 2.7% 1.7% 3.4% 4.9% 2.3% -0.1% 1.7% -1.7% 4.4% -1.7% 15.6%

FY16 6.1% 0.9% -0.2% 3.8% -1.3% -1.4% 0.5% 1.8% -4.1% -3.4% 5.1% -3.4% 3.8%

FY17 2.5% -0.8% -2.5% -1.3% -1.5% 6.1% -2.0% 1.6% 1.0% 7.0% 7.2% -3.7% 13.6%

FY18 -0.9% 1.5% 1.1% 5.9% -1.3% -1.6% 4.4% 4.1% 1.5% 3.7% -2.0% 2.9% 20.8%

FY19 0.1% 3.8% -1.8% -0.4% -3.9% 6.5% -3.6% 3.4% 0.0% 2.2% 0.1% 0.7% 7.1%

FY20 1.5% -0.4% 1.3% 3.4% 3.1% -2.1% 4.3% 4.2% 11.0% -5.1% -0.1% -4.8% 16.5%

FY21 -0.1% -3.9% 1.7% -0.7% -5.0% -5.7% -7.3% -3.7% 8.2% 5.5% 3.2% -2.2% -10.7%

FY22 9.7% 3.0% -4.5% 1.1% 1.8% 7.3% 4.4% -5.6% -4.6% 5.2% 2.2% 0.1% 20.7%

FY23 -0.7% -0.7%

The fund lost 0.73% vs. a boisterous +5.97% for

the globally diverse ACWI Index (in $A) - with the

market actively hostile to our strategy. Nonsense

retail stocks performed exceptionally well and we

are short those. That said, we run a fairly balanced

book and would expect to underperform - but not

by quite this much. We think we performed about

3% worse than “model” (or what we would have

expected given market moves). There were no real

culprits. Just a variety of little nicks. More

seriously our leverage has increased and so we are

marginally reducing the size of our portfolio to

offset this. In summary the month was not good,

but not threatening.

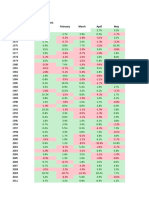

Fund Features Portfolio Analytics 1

Investment Objective Maximise risk-adjusted returns with Metric Amalthea MSCI ACWI

high double-digit returns over 3- (in AUD)

year periods.

Min. initial investment $100,000 (for qualifying investors) Sharpe Ratio 2 0.83 1.07

Min additional investment $50,000 Sortino Ratio 1.51 1.88

Applications/redemptions Monthly Annualised Standard Deviation 12.54% 10.76%

Distribution Annual Largest Monthly Loss -7.30% -8.00%

Management fee 1.5% Largest Drawdown -30.01% -15.97%

Performance allocation 20% Winning Month Ratio 0.59 0.64

Administrator Citco Fund Services Cumulative return 3 170.21% 205.67%

Auditor Ernst & Young 1-year annualised return 9.16% -5.79%

Custodians/PBs Fidelity, Morgan Stanley, JP 3-year annualised return 7.08% 8.02%

Morgan 5-year annualised return 10.21% 10.80%

Annual return since inception 11.34% 12.84%

1 Performance and analytics are provided only for Amalthea ordinary class units. Actual performance will differ for clients due to timing of their investment and the class of their units in the Amalthea fund

2 Sharpe and Sortino ratios assume the Australian cash rate as the applicable risk-free rate

3 Returns are net of all fees

Disclaimer: This report has been prepared by Bronte Capital Management Pty Limited. This report is for distribution only under such circumstances as may be permitted by applicable law. It has no regard to the

specific investment objectives, financial situation or particular needs of any specific recipient. It is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell

any securities or related financial instruments. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein

nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the report. The report should not be regarded by recipients as a substitute for the exercise of

their own judgement. Any opinions expressed in this report are subject to change without notice. The analysis contained herein is based on numerous assumptions. Different assumptions could result in

materially different results. Bronte Capital Management Pty Limited is under no obligation to update or keep current the information contained herein. Past performance is not necessarily a guide to future

performance. Estimates of future performance are based on assumptions that may not be realised.

Bronte Capital Management Pty Ltd (AFS License: 334325, IARD No. 151222)

Suite 1703 Tower 2, 101 Grafton Street, Bondi Junction, Australia.

Phone: +61 2 8318 7711 • Email: investor.relations@brontecapital.com

You might also like

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Data 2Document14 pagesData 2abhimanyu.chawla5503No ratings yet

- Amalthea Letter 202206Document9 pagesAmalthea Letter 202206Alessio CalcagnoNo ratings yet

- Ganymede Update 202305Document1 pageGanymede Update 202305Pranab PattanaikNo ratings yet

- Amalthea Letter 202106Document7 pagesAmalthea Letter 202106J Pierre RicherNo ratings yet

- Views On Markets and SectorsDocument19 pagesViews On Markets and SectorskundansudNo ratings yet

- RV Capital Factsheet 2017-03Document1 pageRV Capital Factsheet 2017-03Rocco HuangNo ratings yet

- Mercer-Capital Bank Valuation AKG PDFDocument60 pagesMercer-Capital Bank Valuation AKG PDFDesmond Dujon HenryNo ratings yet

- Alquity Factsheet Africa USD A EnglishDocument3 pagesAlquity Factsheet Africa USD A Englishyomak94018No ratings yet

- Derivatives and Risk ManagementDocument136 pagesDerivatives and Risk Managementabbas ali100% (3)

- Third Point Investors Limited: Feeder Fund Into Third Point Offshore Fund, LTDDocument4 pagesThird Point Investors Limited: Feeder Fund Into Third Point Offshore Fund, LTDPranab PattanaikNo ratings yet

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDocument31 pagesFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNo ratings yet

- Salinan REVISI Window Dressing CalcDocument148 pagesSalinan REVISI Window Dressing CalcPTPN XIIINo ratings yet

- JULY 2009: Monthly UpdateDocument33 pagesJULY 2009: Monthly UpdatepuneetggNo ratings yet

- Kantar Worldpanel Consumer Insights Asia Q3'20 FINALDocument23 pagesKantar Worldpanel Consumer Insights Asia Q3'20 FINALTiger HồNo ratings yet

- 6 DCF ModelDocument14 pages6 DCF ModelkumarmayurNo ratings yet

- 2022.07 Pavise Monthly Letter FlagshipDocument4 pages2022.07 Pavise Monthly Letter FlagshipKan ZhouNo ratings yet

- Financial Statement AnalysisDocument31 pagesFinancial Statement AnalysisAK_Chavan100% (1)

- LA Economic Vitals Dec Jan 2021Document5 pagesLA Economic Vitals Dec Jan 2021ChrisMNo ratings yet

- Proximus Consensus Ahead of q1 2023Document4 pagesProximus Consensus Ahead of q1 2023Laurent MillerNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Exhibit 1: Greenwood'S Composite Performance vs. Msci Acwi All Cap (Net)Document4 pagesExhibit 1: Greenwood'S Composite Performance vs. Msci Acwi All Cap (Net)Kan ZhouNo ratings yet

- EDHEC-Risk Alternative Indexes - Overview February 2011Document1 pageEDHEC-Risk Alternative Indexes - Overview February 2011chris_clair9652No ratings yet

- Newbrook Long - Short Equity Strategy - 4Document3 pagesNewbrook Long - Short Equity Strategy - 4dch204No ratings yet

- Consumer Insights AsiaDocument23 pagesConsumer Insights AsiaDương Huy Chương ĐặngNo ratings yet

- Hedge Fund Indices MayDocument3 pagesHedge Fund Indices Mayj.fred a. voortmanNo ratings yet

- Giverny Capital - Annual Letter 2018 Web PDFDocument18 pagesGiverny Capital - Annual Letter 2018 Web PDFMario Di MarcantonioNo ratings yet

- 3 Cash Flow Model 0Document14 pages3 Cash Flow Model 0kumarmayurNo ratings yet

- Burgiss Manager Universe - Global Private Capital Returns2QDocument5 pagesBurgiss Manager Universe - Global Private Capital Returns2QDavid TollNo ratings yet

- Satori Fund II LP Monthly Newsletter - 2023 06Document7 pagesSatori Fund II LP Monthly Newsletter - 2023 06Anthony CastelliNo ratings yet

- Axis Bank InvestmentDocument32 pagesAxis Bank Investment22satendraNo ratings yet

- US Small CapsDocument13 pagesUS Small Capsjulienmessias2No ratings yet

- Ramayana Sales Trend & Projection (Unaudited) : Projected Net Sales - 2017 Actual Net Sales - 2017Document9 pagesRamayana Sales Trend & Projection (Unaudited) : Projected Net Sales - 2017 Actual Net Sales - 2017Gilang RamadhanNo ratings yet

- Giverny Capital Annual Letter 2019Document17 pagesGiverny Capital Annual Letter 2019milandeepNo ratings yet

- Stress Test 032020Document4 pagesStress Test 032020Nayro RodriguesNo ratings yet

- Table 531 2Document15 pagesTable 531 2UfficioNo ratings yet

- Greenwich Hedge Fund Index Performance and Sentiment IndexDocument2 pagesGreenwich Hedge Fund Index Performance and Sentiment Indexj.fred a. voortmanNo ratings yet

- Glenview Capital Third Quarter 2009Document12 pagesGlenview Capital Third Quarter 2009balevinNo ratings yet

- Presentation 1Q17Document17 pagesPresentation 1Q17Multiplan RINo ratings yet

- BNM - Analisis Financiero Estructural Nov 2000 - Oct 2001Document2 pagesBNM - Analisis Financiero Estructural Nov 2000 - Oct 2001gonzaloromaniNo ratings yet

- KMX Write Up RedditDocument4 pagesKMX Write Up Redditapi-404463664No ratings yet

- National Consumer Spending Trends Data - ENDocument17 pagesNational Consumer Spending Trends Data - ENNormelNo ratings yet

- 01-3 Plan Lineal VendedorDocument26 pages01-3 Plan Lineal VendedorJefer AnHe VelezNo ratings yet

- CCAFDocument8 pagesCCAFsanket patilNo ratings yet

- Icici Manufacture in India Fund - Investor PDFDocument30 pagesIcici Manufacture in India Fund - Investor PDFkashifbeg786No ratings yet

- TG6 FF3F - VariablesDocument10 pagesTG6 FF3F - VariablesPaolo HiginioNo ratings yet

- Pivot Tables2 Crypto Forecasting 16 MarchDocument332 pagesPivot Tables2 Crypto Forecasting 16 MarchNaresh KumarNo ratings yet

- Indice de Precios: Materias Primas PlasticasDocument1 pageIndice de Precios: Materias Primas PlasticasMelisa JaksicNo ratings yet

- Pivot Tables2 12 March 2021Document103 pagesPivot Tables2 12 March 2021Naresh KumarNo ratings yet

- The GIC WeeklyDocument12 pagesThe GIC WeeklyedgarmerchanNo ratings yet

- DAFNA FactSheetDocument2 pagesDAFNA FactSheetfxarb098No ratings yet

- Extraordinary When One Looks at The Performance of The Broader Universe" As Well As WhenDocument9 pagesExtraordinary When One Looks at The Performance of The Broader Universe" As Well As Whenravi_405No ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- RV Capital Letter 2019-06Document10 pagesRV Capital Letter 2019-06Rocco HuangNo ratings yet

- Investmentz AugustDocument11 pagesInvestmentz AugustAnimesh PalNo ratings yet

- Nielsen Market Pulse Q2 2018Document6 pagesNielsen Market Pulse Q2 2018K57.CTTT BUI NGUYEN HUONG LYNo ratings yet

- Jones Electrical DistributionDocument7 pagesJones Electrical Distributionsd717No ratings yet

- BOLT DCF ValuationDocument1 pageBOLT DCF ValuationOld School ValueNo ratings yet

- Key Tenets To Reduce Risks While Investing in EquitDocument8 pagesKey Tenets To Reduce Risks While Investing in EquitdigthreeNo ratings yet

- BlueMar Capital Monthly Snapshot - Mar 2020Document1 pageBlueMar Capital Monthly Snapshot - Mar 2020YehoNo ratings yet

- New Balance $9,940.40 Minimum Payment Due $99.00 Payment Due Date 08/23/22Document13 pagesNew Balance $9,940.40 Minimum Payment Due $99.00 Payment Due Date 08/23/22Rahul SharmaNo ratings yet

- Fee Details Fee Details Fee DetailsDocument1 pageFee Details Fee Details Fee DetailsTabish KhanNo ratings yet

- Virgin AtlanticDocument15 pagesVirgin AtlanticTahmida DUNo ratings yet

- Internship Report On BAJK 2022Document37 pagesInternship Report On BAJK 2022Husnain AwanNo ratings yet

- HZS120F8Document2 pagesHZS120F8saimunNo ratings yet

- SAP-Vendor Registration FormDocument3 pagesSAP-Vendor Registration FormShubhada EngineeringNo ratings yet

- IE578 FlexSim Report DraftDocument14 pagesIE578 FlexSim Report DraftPaula MoraNo ratings yet

- Group 1 - Atlas ElectricaDocument27 pagesGroup 1 - Atlas ElectricaRenneil LagmanNo ratings yet

- 4.49 Estimate of Coconut 2016-17Document2 pages4.49 Estimate of Coconut 2016-17Projna MondalNo ratings yet

- Eruj Port Qasim FileDocument29 pagesEruj Port Qasim Filejony9246No ratings yet

- Research Insights Report On Housing Market and Forecasts - September 2022 - Issue 4Document12 pagesResearch Insights Report On Housing Market and Forecasts - September 2022 - Issue 4Carlos makhandiaNo ratings yet

- Microeconomics (Monopoly, CH 10)Document32 pagesMicroeconomics (Monopoly, CH 10)Vikram SharmaNo ratings yet

- Principles of AccountingDocument183 pagesPrinciples of AccountingJoe UpZone100% (1)

- Sdo Batangas: Department of EducationDocument10 pagesSdo Batangas: Department of EducationJomarie LagosNo ratings yet

- Planning Personal Finances: Unit 1Document28 pagesPlanning Personal Finances: Unit 1Prathamesh KhopkarNo ratings yet

- Lesson Plan Business Finance (Sources)Document2 pagesLesson Plan Business Finance (Sources)Eduardo Ramos, Jr.No ratings yet

- BAC 303 Module 4Document18 pagesBAC 303 Module 4Nina Bithany MacutoNo ratings yet

- Case Study Accounting Policy, Changes in Accounting Estimate, and ErrorsDocument2 pagesCase Study Accounting Policy, Changes in Accounting Estimate, and ErrorsHAO HUYNH MINH GIANo ratings yet

- 6 Unit 8 Corporate RestructureDocument19 pages6 Unit 8 Corporate RestructureAnuska JayswalNo ratings yet

- Evonik Company Presentation (January 2018)Document94 pagesEvonik Company Presentation (January 2018)Yang Sunman100% (1)

- Final exam.QT Chiến LượcDocument19 pagesFinal exam.QT Chiến LượcSnow NhiNo ratings yet

- Subject: Eitd Class: II MBA LogisticsDocument23 pagesSubject: Eitd Class: II MBA LogisticsSaravananSrvnNo ratings yet

- Haier Case Analysis - Group 2Document15 pagesHaier Case Analysis - Group 2FIZZA ZAIDI-IBM 21IN616No ratings yet

- 2020 RsetDocument542 pages2020 RsetAndrea MercadoNo ratings yet

- IAS 37 - SummaryDocument4 pagesIAS 37 - SummaryRenz Francis LimNo ratings yet

- Department of Labor: Cedapr01Document28 pagesDepartment of Labor: Cedapr01USA_DepartmentOfLaborNo ratings yet

- BS Delhi 22-02-2024Document20 pagesBS Delhi 22-02-2024Lokesh KatalNo ratings yet

- Bba ProjectDocument47 pagesBba ProjectAayush SomaniNo ratings yet

- The Directors ReportDocument1 pageThe Directors ReportTENDEKAI MASOKANo ratings yet

- Case StudyDocument16 pagesCase StudyRocket SinghNo ratings yet