Professional Documents

Culture Documents

History of Microwave in The California Bay Area

Uploaded by

Maciej Jüngst0 ratings0% found this document useful (0 votes)

26 views4 pagesOriginal Title

History of Microwave in the California Bay Area

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views4 pagesHistory of Microwave in The California Bay Area

Uploaded by

Maciej JüngstCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

50 Years of Microwave Communications Systems Development

in the San Francisco Bay Area

Ferdo Ivanek

Stanford University, Stanford, California 94305, USA

circuit components and of procurement from specialized

Abstract -- This historical overview summarizes the rich suppliers including local ones. Outsourcing and off-shoring

industrial heritage in terrestrial microwave communications started early and increased over time. The thrust of ongoing

systems in the Bay Area over the past 50 years. Local new systems development was consistently toward greater

companies have established themselves among the world’s versatility, user friendliness, and cost competitiveness. These

technologically most advanced and most competitive suppliers were of crucial importance for successful participation in the

of systems for use in telecommunications infrastructures, worldwide market for point-to-point microwave systems that

cellular infrastructures, and broadband wireless access. What

currently amounts to approximately $4B per year.

particularly sets the Bay Area companies apart from the rest of

the major global players in the same markets is the spirit and Systems development and manufacturing in this market

successful practice of entrepreneurship that greatly facilitates segment emerged in different ways. While multiplex

effective adaptations to changing market conditions. systems manufacturers intent on increasing their market with

Index Terms -- Microwave communication, technological new products took the early lead, specialized microwave

innovation, history. systems manufacturers soon followed and predominated. But

some of the subsequent market entrants came from the

I. INTRODUCTION government market sector or started as microwave

semiconductor device manufacturers. Accelerating

This is a great story of technological advances, shifting technological progress and the growing and shifting

market requirements and entrepreneurship, which deserves telecommunications market demanded corresponding

telling in more detail than can be done in this paper. It all changes in the existing microwave systems industry and

started in the 1950s when microwave communications continually attracted new entrants. As a result, a complex

systems development in the Bay Area reached critical mass picture emerges that defies neat categorization and simple

due to three synergistic developments: (1) the 1951 description. The approach chosen in this paper is therefore to

completion of AT&T’s 107-station 4 GHz New York – San follow the historical trail by highlighting key developments

Francisco microwave system, (2) the post-WWII expansion to the extent possible within the limited page budget.

of local microwave tube manufacturing into commercial

products, (3) the rapid growth of the local electronics

industry in a favorable entrepreneurial climate. The III. THE HISTORICAL TRAIL

following decades saw rapid industrial growth and A. The Trunk of the Corporate Tree

technological advances in terrestrial and satellite microwave

communications systems development in the Bay Area, but The historical beginning of microwave radio

the great majority of these industrial activities concentrated manufacturing in the Bay Area was in 1953 at Lenkurt

on terrestrial applications on which this paper focuses . Electric that was established in 1944 in San Francisco as a

wireline telephone multiplex manufacturer and relocated to

San Carlos by 1947. Its first radio product was a 48-channel

II. BASIC TRENDS analog 900 MHz system used by independent telephone

The milestone technological advances in this market companies, Bell System companies and pipelines. The radio

segment were “transistorization” in the 1960s, digital product line eventually expanded to 2400 channel capacities

systems in the 1970s, synthesized frequency tuning in the in frequency bands through 11-13 GHz. In 1959 Lenkurt

1980s, and digital signal processing with programmable became a subsidiary of General Telephone & Electronics.

digital modulation in the 1990s, accompanied by a GTE Lenkurt’s employment in San Carlos peaked to over

continuing trend toward higher spectral efficiencies, more 4000 employees by the mid 1960s, but GTE closed this Bay

robust architectures, and the use of ever higher frequency Area radio manufacturing operation in 1982 while retaining

bands. The local industry successfully adapted to the for a time its Arizona, New Mexico and Texas facilities.

competitive large scale introduction of fiber optic Significantly, Lenkurt (called “Lenkurt U” by appreciative

transmission systems in the 1980s, by introducing new former employees) turned out to be a fertile breeding ground

generations of digital radio systems for local access for new local ventures stimulated by ever brighter prospects

applications and mobile infrastructures. There was a mix of in microwave communications. Foremost among these was

in-house manufacturing of key active microwave integrated Farinon Electric, established in 1958 in San Carlos to

address an unfilled niche market for narrow-band, multi-

channel radios. The first product line used vacuum tubes and B. Branching Out

operated in frequency bands between 72 MHz and 2700

Different patterns emerged in subsequent spin-offs and

MHz with capacities up to 36 analog channels. Farinon

start-ups, depending on the founders’ different backgrounds

delivered its first all solid-state 2 GHz radio in 1965. By

and objectives, and on how they adapted to technological

1980, when the company became the Farinon Division of

advances and changing market conditions in their pursuit of

Harris Corporation, it had expanded the analog product line

sustainable business.

to 11 GHz and a variety of video microwave systems in the

The earliest amongst other spin-offs were Karkar

bands between 2 and 13 GHz, and introduced a first

Electronics and Western Multiplex. Both started as

generation of digital radios in the same bands and in the 18

multiplex equipment suppliers and expanded to microwave

GHz band. New generations of point-to-point and multipoint

systems, but in entirely different ways. Karkar, the second

digital radios followed in frequency bands up to 38 GHz.

largest Lenkurt spin-off, started manufacturing carrier

The current most advanced product families offer 4 to 180

multiplex systems in 1960 in San Francisco, but became a

Mb/s capacity and multiples thereof in frequency bands

niche microwave system supplier in 1980, launching a 6

ranging from 4 GHz to 38 GHz, thus capable of satisfying a

GHz high-capacity 6000 channel single-sideband analog

great variety of needs in the different segments of the

system product line and delivering it to MCI in substantial

worldwide point-to-point microwave market. In 1998 the

quantities until 1985 when the company was sold to General

Harris Farinon Division was renamed Harris Microwave

Signal and this product line was terminated. A 256 QAM

Communications Division (MCD). By 1999 most

modem was added to this product line for modular

manufacturing had migrated to Texas, and in 2002 the

conversion to digital traffic.

division’s headquarters and engineering operations were

Western Multiplex, a 1979 spin-off from Farinon, started

moved to North Carolina, but proprietary microwave

with digital modems and analog baseband equipment for

integrated circuits (MIC) engineering and manufacturing as

microwave radio, and in 1990 started offering a variety of

well as MCD sales management remain in the Bay Area.

point-to-point microwave systems in the 2 GHz to 6 GHz

A group of Farinon executives left the company and in

frequency range. This included the industry’s first spread-

1984 formed Digital Microwave Corporation (DMC),

spectrum radios for the license exempt 2.4 GHz and 5.8 GHz

located in San Jose. It was intended to serve the domestic

bands, and a Gigabit Ethernet bridge. The product lines

bypass market which appeared promising in view of the Bell

expanded to point-to-multipoint and mesh networks based

System divestiture. However, Mercury Communications of

on the IEEE 802.11 standards (Wi-Fi). In 2002 the company

the U.K. became the first major bypass customer for the first

merged with Proxim and adopted its name. In 2005 it was

DMC product line operating in the 23 GHz band. This

acquired by Terabeam and as Proxim Wireless its current

foreshadowed the company’s future market position which is

product development includes applications based on the

strongest in international sales. However, the major future

IEEE 802.16 standard (WiMAX). This corporate

market turned out to be in mobile infrastructures which

transformation exemplifies the emergence and growth of the

DMC addressed with expanded product offerings in bands

new breed of “wireless” microwave communications

between 2 GHz and 38 GHz with capacities ranging up to

systems suppliers growing in numbers in a dynamic process

155 Mb/s and multiples thereof. The company started off-

involving numerous start-ups and subsequent mergers,

shoring production of subassemblies from the beginning and

acquisitions and restructuring. More about these in Section

is currently off-shoring all manufacturing except proprietary

IV.A.

MICs, as well as substantial part of engineering. In 2002

P-Com, a 1992 spin-off from DMC, developed first a 38

DMC was renamed Stratex Networks.

GHz radio based on a conventional 10-14 GHz radio design,

Besides of course Lenkurt Electric, Harris MCD and

and started shipping in 1993, mostly to European mobile

Stratex Networks stand out as the two largest microwave

service providers. Additional products of the same family

systems suppliers in the Bay Area during the past 50 years

were introduced in the 23 GHz and 50 GHz bands.

and, coincidentally, the only survivors in the long run. Both

Manufacturing was outsourced. The company’s international

have global presence in their markets and are among the

presence broadened and shipments peaked in 2000, but

world’s technologically most advanced and most

subsequent declining sales resulted in restructuring,

competitive companies in their business. Thus they represent

downsizing and refocusing on wireless mesh routers for the

the trunk of the microwave communications systems tree in

license exempt bands 2.4 GHz, 4.9 GHz and 5.8 GHz. In

the Bay Area. A number of technologically advanced Bay

2005 P-Com was renamed Wave Wireless. This

Area off-shoots participated in niches of the same market

transformation is also in line with the predominant

with apparent success for various lengths of time, but

“wireless” orientation of microwave systems start-ups in the

eventually exited in one way or another. While Farinon /

last decade or so.

Harris MCD and DMC / Stratex Networks had their share of

The 1995 P-Com spin-off Netro developed along a similar

ups and downs, the critical common contributor to their

path. The company’s first family of digital radio operating in

survival in the fierce global competition seems to be their

the 10 GHz, the 26-28 GHz local multipoint distribution

variety of products that found a great variety of customers in

service (LMDS) bands and the 39 GHz band generated

a large number of countries.

substantial interest in some international markets but

suffered severe demand decline in 2001, which brought IV. ENABLING TECHNOLOGY

about downsizing and refocusing. In 2002 Netro acquired

AT&T Wireless’ product line of 1.9 GHz and 2.3 GHz Starting the development and manufacture of commercial

broadband wireless access (BWA) systems and the microwave communications systems in the Bay Area was

following year the Canadian company SR Telecom acquired facilitated by the rapid post-WWII growth of the local

Netro. electronics industry, in particular the specialized RF and

The 1998 Netro spin-off BridgeWave started in the microwave companies serving the military market, and the

LMDS bands but focused in 2002 on the license exempt 60 microwave tube manufacturers. Planar microwave triodes

GHz band. The current point-to-point systems product line from Eimac (founded as Eitel-McCullough in 1934) and

provides 100 Mb/s and 1 Gb/s capacities. klystrons from Varian Associates (founded in 1948) were

Adding to the variety of spin-offs at an early stage are used in the vacuum tube microwave radio generations, and

California Microwave and Avantek, both emerging from Varian traveling wave tube amplifiers even in some later

Applied Technology (ATI) which served the government systems using solid state components in all other active

market. Avantek started in 1965 with a line of solid-state RF microwave functions. Varian acquired Eimac in 1964. At a

components, expanded it into the microwave range, started later stage, when solid-state microwave devices became

in-house manufacture of Si transistors and GaAs FETs, and available, Varian and Litton Industries developed their own

in 1972 introduced a 2 GHz digital radio product line using in-house capabilities to replace their vacuum tube products

these devices. It was manufactured until 1988 when this with solid-state oscillators and amplifiers, serving OEMs.

product line was sold to Telesciences, and in 1993 to Fairchild Semiconductor started developing Si RF

California Microwave. Avantek’s RF devices division was transistors in the late 1950s, and delivering “microwave

acquired by Hewlett-Packard in 1991. sources” using transistors oscillators and varactor multipliers

California Microwave, founded in 1968, started with a in 1965. Varian started GaAs device development in the

product line in competition with microwave sources that early 1960s, and Gunn diode deliveries in 1969. Beginning

originated in 1963 at the Fairchild Microwave Division in 1970, Farinon introduced Gunn diode local oscillators and

which was subsequently acquired by the East Coast 1W transmitter oscillators and amplifiers into analog and

company Frequency Sources. The main users were Bell digital radios for the 6 GHz, 7 GHz and 11 GHz bands.

System companies retrofitting their 4 GHz, 6 GHz and 11 The first GaAs MESFET was demonstrated at Fairchild in

GHz electron tube systems with solid-state subassemblies, 1967, and the company began delivering Ga As FETs in

and upgrading to higher capacities. California Microwave 1970. Hewlett-Packard started work on GaAs MESFETs in

later expanded into a variety of microwave system product 1969. A succession of Bay Area spin-offs from Fairchild and

lines for a variety of customers, mainly through acquisitions. Hewlett Packard ended up with three existing Bay Area

After a change of management in 1997 the company started manufacturers serving the commercial microwave systems

selling off business entities, changed name to Adaptive market with products ranging from discrete devices to

Broadband in 1999, sold its remaining microwave systems hybrid microwave integrated Circuits (MICs) to monolithic

product line in 2000 and was acquired by Moseley MICs (MMICs): Microwave Technology, MIMIX and

Associates in 2001. Excelics. A much larger number of intermediate local spin-

There were a number of additional manufacturers of offs and start-ups from the 1970s and 1980s are no longer in

point-to-point microwave systems that participated in this business.

market in various ways and exited some years ago under Farinon started building and using low-noise GaAs FET

various circumstances. Among these are (years indicate amplifiers in 1975 in the 2 GHz band, and power amplifiers

actual system deliveries): Kebby Microwave (1964-1968) in 1977. An in-house MIC facility was built in 1972. Farinon

which became Farinon Microwave, Granger Associates spin-off DMC also built an in-house MIC facility.

(!970-1992) and Granger/Telettra (1986-1991), Culbertson The ultimate example of this in-house trend is Intel’s

Industries (1971-1974), and Aydin Microwave (1990-1999). Centrino with a Wi-Fi card incorporating the transmitter and

While not a manufacturer of complete communications receiver functions for IEEE 802.11a, b and g operation in the

systems, Endwave, founded in 1992, evolved as a supplier of 2.4 GHz and 5.8 GHz bands!

microwave and millimeterwave subsystems to systems The subject of enabling technology deserves much more

manufacturers in different bands ranging from about 3 GHz detailed coverage which, unfortunately, is not feasible within

to 65 GHz. Outdoor units represent the highest level of the limited scope of this paper.

integration among the company’s current products.

The above historical summaries reveal a notable outcome.

V. NEW DIRECTIONS

Attempted competition with Farinon/Harris MCD and/or

DMC/Stratex in their main markets turned out to be A. “Wireless” Systems

unsustainable. Subsequent pursuits of alternative sustainable

business opportunities proceeded in two main directions: Substantial industrial activities in this systems category

into the “wireless” market below 6 GHz, and into the started in the Bay Area in the 1990s, stimulated by

millimeterwave market. apparently attractive potential business opportunities in the

2.5 GHz multichannel multipoint distribution service

(MMDS) band and in the 2.4 GHz and 5.8GHz license B. Millimeterwave Systems

exempt bands. In the following years, the number of

“wireless” spin-offs and start-ups exceeded by far the The emergence of multi-Gigabit fiber optic systems and

number of all past microwave systems suppliers in the Bay their inroads into the broadband access market provided

Area, but most of the entrants over the past decade or so attractive new opportunities for complementary or

have in the meantime exited in one way or another. Covering competitive millimeterwave systems that are particularly

them in the same way as those covered in Sections III and well suited for multi-Gigabit access. The first Bay Area

IV would therefore greatly exceed the scope of this historical entrant into this market was BridgeWave with a 60 GHz

overview. It is also not necessary because this is well known product line mentioned in Section III.b. In 2003 the FCC

recent history of a new industry segment transitioning from substantially enhanced the mm-wave systems prospects by

proprietary to standardized systems based on the IEEE approving use of the bands 71-76 GHz, 81-86 GHz and 92-

802.11 (“Wi-Fi”) and IEEE 802.16 (“WiMAX”) standards. 95 GHz. GigaBeam, founded in 2004, entered this market in

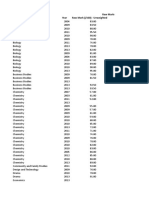

The following listing of existing “wireless” systems 2005 with a 1 Gb/s product in the 70/80 GHz bands and

suppliers headquartered in the Bay Area or with local announced a 10 Gb/s product for 2006. BridgeWave is also

engineering and/or manufacturing activities is the result of a planning products for these bands.

“best effort” search. Listed in chronological order (start-up

year in parentheses): Arraycom (1992), Alvarion (1992),

Gigabit Wireless (1998, changed name to Iospan in 2000, VI. CONCLUSION

and acquired by Intel in 2002), Aperto Networks (1999), The highlighted 50-year history portrays the emergence of

TeleCIS (2000), Tropos Networks (2000), Airespace (2001, an industry sector in the Bay Area that thrives on

acquired by Cisco in 2005), Aruba Networks (2002), Meru entrepreneurship and technological innovation. Two early

Networks (2002), Trapeze Networks (2002), Beceem start-ups successfully established themselves among the

Communications (2003), Firetide (2003), and PacketHop world’s major suppliers of point-to-point systems in the 4

(2003). The companies in this group already covered in GHz to 38 GHz range for use in telecom and cellular

Section III are Proxim/Terabeam, P-Com/Wave Wireless, infrastructures, and private networks.

and Netro/SR Telecom. Apologies for any inadvertent The broadband wireless access (BWA) market that started

omissions! growing substantially in the 1990s stimulated an increasing

Significantly, 11 of the 16 listed companies were founded number of Bay Area start-ups that successfully advance new

or acquired after the year 2000, which best exemplifies the systems development and greatly contribute to IEEE 802.11

accelerating technological progress and market dynamics. and IEEE 802.16 standardization and to FCC initiatives for

The notable acquisitions are by Intel and Cisco, industry opening new frequency bands for BWA applications.

leaders with strong leverage in the wireless systems market. The two apparently most promising BWA pursuits in the

Intel’s Centrino is apparently the best known favorable Bay Area are toward complementarity and competition with

example of such leverage in the Wi-Fi market. The company 3G and Beyond 3G cellular systems through mobile

shows intent to add a WiMAX version, which can be extensions of Wi-Fi and WiMAX applications in frequency

expected to have a similarly favorable market impact. And bands below 6 GHz, and toward complementarity and

the list of big-name companies expanding the wireless competition with fiber optic access systems through the use

market for their own purposes is much longer, recently of millimeterwave systems above 50 GHz.

including Google, for example. Nevertheless, big-name These activities are intensifying in an increasingly

wireless initiatives are not necessarily successful – dynamic entrepreneurial environment that continuously

remember Cometa? challenges all parties involved. Fortunately, however, the

The greatest challenge to independent wireless systems overall most favorable environment of this kind is in the San

suppliers in the Bay Area is therefore in their pursuits of Francisco Bay Area.

sustainable business by incorporating competitive

proprietary features into standardized systems and

developing advantageous applications. A major trend in ACKNOWLEDGEMENT

progress is toward mobility in Wi-Fi and WiMAX networks.

If, and when, mobility in such networks lives up to its This overview was made possible by information kindly

apparent promise, market requirements could greatly exceed provided by the following executive and expert participants

what the currently available frequency bands can in the reported developments, in alphabetical order: George

accommodate, because plans for Beyond 3G systems aim at Badger, George Bechtel, Carlos Belfiore, Mark Byington,

100 Mb/s mobile subscriber throughput and 1 Gb/s nomadic Walter Day, Berin Fank, Wes Fischer, Robert Friess, James

throughput. This issue is already being addressed in the ITU- Gibbons, Eugene Guthrie, Tim Heyboer, Edward Karkar,

R, and requires timely attention among competing Bay Area Richard Laine, David Leeson, Gregg Levin, Douglas Lockie,

wireless systems suppliers using the IEEE 802.16 standard. Ross Lunan, Douglas Morais, Masahiro Omori, Mita

IMS 2006 Focused Session WE3G “4 GHz for 4G?” Postich, George Roberts, Lou Salinas, Jodi Sherman Jahic,

addresses one particular aspect of the issue. Edwin Taylor. Many thanks to all! Additional information

was collected from company web sites.

You might also like

- History of Microwave in The Bay AreaDocument4 pagesHistory of Microwave in The Bay Areaahmad.buNo ratings yet

- Essential 4G Guide: Learn 4G Wireless In One DayFrom EverandEssential 4G Guide: Learn 4G Wireless In One DayRating: 4.5 out of 5 stars4.5/5 (12)

- Communication 76 Signals SuccessDocument1 pageCommunication 76 Signals Success何天啸No ratings yet

- Rappaport PDFDocument14 pagesRappaport PDFPushpendra KumarNo ratings yet

- SlidesDocument69 pagesSlidesAmmuBooNo ratings yet

- 26-07-23, 0813 Microsoft LensDocument5 pages26-07-23, 0813 Microsoft LensCésar CastilloNo ratings yet

- SeminarDocument19 pagesSeminarpushpayandrapati97No ratings yet

- Technology Evolution For Mobile and Personal CommunicationsDocument23 pagesTechnology Evolution For Mobile and Personal CommunicationsLester GarciaNo ratings yet

- Technology Evolution For Mobile and Personal CommunicationsDocument23 pagesTechnology Evolution For Mobile and Personal CommunicationsMatias ForeroNo ratings yet

- Cellular Mobile CommunicationsDocument55 pagesCellular Mobile CommunicationsRezwan Mohammad SayeedNo ratings yet

- Wireless Communications: Advantages and DisadvantagesDocument235 pagesWireless Communications: Advantages and Disadvantagessk abdullahNo ratings yet

- ADL High Throughput Satellites-Main ReportDocument20 pagesADL High Throughput Satellites-Main ReportSiapaajaNo ratings yet

- Features and Limitations of Mobile GenerationsDocument5 pagesFeatures and Limitations of Mobile GenerationsPepe Jr AlonsoNo ratings yet

- Mobile Communications 4G and 5G Effect On Coronavirus Covid 19 and Other DiseasesDocument6 pagesMobile Communications 4G and 5G Effect On Coronavirus Covid 19 and Other DiseasesEditor IJTSRDNo ratings yet

- Evolution of Mobile Generation Technology: M.Benisha, R.Thandaiah Prabu, Thulasi BaiDocument6 pagesEvolution of Mobile Generation Technology: M.Benisha, R.Thandaiah Prabu, Thulasi BaiNebiye SolomonNo ratings yet

- Telecommunication Lecture (Forkan Uddin)Document94 pagesTelecommunication Lecture (Forkan Uddin)desigandNo ratings yet

- ITT575 - Introduction to Wireless and Mobile ComputingDocument13 pagesITT575 - Introduction to Wireless and Mobile ComputingZizan HakimNo ratings yet

- Mobile Radio Evolution: Advances in NetworksDocument6 pagesMobile Radio Evolution: Advances in Networksashutosh199625No ratings yet

- Slide 1.IDocument109 pagesSlide 1.IEfoy TechNo ratings yet

- MCA-104 Unit-I-INFORMATION TECHNOLOGY NOTESDocument73 pagesMCA-104 Unit-I-INFORMATION TECHNOLOGY NOTESsai project75% (8)

- Wire Less CommunicationDocument30 pagesWire Less CommunicationVishwaraj BhagwatNo ratings yet

- Intro to Wireless & Mobile ComputingDocument35 pagesIntro to Wireless & Mobile ComputingROB JAMESNo ratings yet

- The Radio Armateur Microwave Communications HandbookDocument192 pagesThe Radio Armateur Microwave Communications HandbookRapee Dev100% (1)

- Wireless Communications-1-NewDocument145 pagesWireless Communications-1-NewMoataz BelkhairNo ratings yet

- Spectrum Privatization:: R B T CDocument31 pagesSpectrum Privatization:: R B T CreasonorgNo ratings yet

- Cellular Mobile CommunicationDocument28 pagesCellular Mobile CommunicationCyber MagicNo ratings yet

- Cellular Networks An Evolution From 1G To 4GDocument9 pagesCellular Networks An Evolution From 1G To 4GjosetumachoNo ratings yet

- Newnes Guide to Radio and Communications TechnologyFrom EverandNewnes Guide to Radio and Communications TechnologyRating: 3.5 out of 5 stars3.5/5 (2)

- ECS455 - 1 - 1 - Mobile IntroDocument41 pagesECS455 - 1 - 1 - Mobile Introvectorvc999No ratings yet

- GSM Paper Presentation On Frequency PlanningDocument5 pagesGSM Paper Presentation On Frequency PlanningphalanetraNo ratings yet

- Introduction To Wireless Communication SystemsDocument25 pagesIntroduction To Wireless Communication SystemsGashaw GetanehNo ratings yet

- 5G Mobile CompressedDocument49 pages5G Mobile CompressedMuhammad Arifatul TriyonoNo ratings yet

- Mobile Phone Research ReportDocument46 pagesMobile Phone Research ReportRaj KumarNo ratings yet

- A Study of Mobile Generations from 1G to 5GDocument12 pagesA Study of Mobile Generations from 1G to 5Gkaran singh khohkarNo ratings yet

- Wireless Communication Course Outline and HistoryDocument75 pagesWireless Communication Course Outline and HistoryIrum Nausheen Lecturer - FETNo ratings yet

- Chapter 1Document26 pagesChapter 1anon_494993240No ratings yet

- Abhishek Sharma - Generations - of - Wireless - Communication - FRDocument9 pagesAbhishek Sharma - Generations - of - Wireless - Communication - FRscheeleNo ratings yet

- Adapted From Wireless Communications Principles & PracticeDocument20 pagesAdapted From Wireless Communications Principles & PracticeAkshay SNo ratings yet

- Wireless Communication Systems Course OverviewDocument28 pagesWireless Communication Systems Course Overviewannapoorna c kNo ratings yet

- WL Chap1Document20 pagesWL Chap1chiranjibaviNo ratings yet

- Evolution of Mobile Wireless Communication NetworksDocument5 pagesEvolution of Mobile Wireless Communication NetworksFarhan Bin KhalidNo ratings yet

- Final AirtelDocument143 pagesFinal Airtelonly leds (Only LED's)No ratings yet

- Wireless Communication Systems For Underground Mines - A Critical AppraisalDocument5 pagesWireless Communication Systems For Underground Mines - A Critical AppraisalseventhsensegroupNo ratings yet

- Future of ElectronicsDocument4 pagesFuture of ElectronicsPrad DingariNo ratings yet

- Mobile CommunicationDocument43 pagesMobile CommunicationChinmayFouzdarNo ratings yet

- Souma Badombena Wanta, Cognitive Radios - Technical Report - Research PaperDocument17 pagesSouma Badombena Wanta, Cognitive Radios - Technical Report - Research Paperslinc_a82No ratings yet

- An Overview On Evolution of Mobile Wirel-Edited FinalDocument6 pagesAn Overview On Evolution of Mobile Wirel-Edited FinalAhmad Zahin Mohd RosliNo ratings yet

- Development of Telecommunication: Telephone, Mobile, and Cellular NetworkDocument6 pagesDevelopment of Telecommunication: Telephone, Mobile, and Cellular NetworkAman Singh KushwahaNo ratings yet

- Wolaita Sodo University College of Engineering Department of Electrical and Computer EngineeringDocument7 pagesWolaita Sodo University College of Engineering Department of Electrical and Computer EngineeringSimachew TemesgenNo ratings yet

- Wireless Networks: Book: (1st Chapter) T. S. Rappaport, Wireless Communications, 2nd Edition, PearsonDocument33 pagesWireless Networks: Book: (1st Chapter) T. S. Rappaport, Wireless Communications, 2nd Edition, PearsonMd Shamim HossainNo ratings yet

- ADocument24 pagesARock AsmighouseNo ratings yet

- Trends in Microwave CommunicationDocument16 pagesTrends in Microwave CommunicationZaheer AhmedNo ratings yet

- WC Unit1 PDFDocument112 pagesWC Unit1 PDFPramod RoyNo ratings yet

- Comparison of Different Mobile Sets Companies ServicesDocument64 pagesComparison of Different Mobile Sets Companies Servicesrehan_brarNo ratings yet

- Customer Satisfaction of AircelDocument40 pagesCustomer Satisfaction of AircelSumanth PatelNo ratings yet

- Microwave and Wireless Communications TechnologyFrom EverandMicrowave and Wireless Communications TechnologyRating: 5 out of 5 stars5/5 (1)

- Innovations in Telecommunications Part AFrom EverandInnovations in Telecommunications Part AJamal ManassahNo ratings yet

- 3-5 Support Document - Phase IDocument38 pages3-5 Support Document - Phase Iapi-290854496No ratings yet

- MCE 244 Course OutlineDocument1 pageMCE 244 Course OutlineKaren DavisNo ratings yet

- Humour and IdentityDocument12 pagesHumour and IdentityLyann MartinezNo ratings yet

- Nederhoff Kees MSC ThesisDocument188 pagesNederhoff Kees MSC ThesisSiddhant AgarwalNo ratings yet

- Fly 10 Your Super FutureDocument3 pagesFly 10 Your Super FutureRichard Colón67% (3)

- KidzeeDocument16 pagesKidzeeXLS OfficeNo ratings yet

- Raw To Scaled Mark DatabaseDocument10 pagesRaw To Scaled Mark DatabaseKelly ChuNo ratings yet

- Grades - MMM132 - Management - CloudDeakinDocument2 pagesGrades - MMM132 - Management - CloudDeakinpsana99gmailcomNo ratings yet

- Eco Industrial DevelopmentDocument16 pagesEco Industrial DevelopmentSrinivas ThimmaiahNo ratings yet

- Of For of or Or: The Professional School of Psychology San Francisco, CaliforniaDocument9 pagesOf For of or Or: The Professional School of Psychology San Francisco, CaliforniaSamiMolinaNo ratings yet

- Ficha Tecnica SpikaDocument2 pagesFicha Tecnica SpikaJosé Luis RubioNo ratings yet

- VMI Quality ManualDocument8 pagesVMI Quality ManualkarthickmthNo ratings yet

- Pakistan Exams Cie o A Reg Form Oct09Document13 pagesPakistan Exams Cie o A Reg Form Oct09shamsulzamanNo ratings yet

- Urban Form FactorsDocument56 pagesUrban Form FactorsEarl Schervin CalaguiNo ratings yet

- Fluxus F/G722: Non-Intrusive Ultrasonic Flow Meter For Highly Dynamic FlowsDocument2 pagesFluxus F/G722: Non-Intrusive Ultrasonic Flow Meter For Highly Dynamic FlowslossaladosNo ratings yet

- Acer LCD x193hq Sm080904v1 Model Id Ra19waanuDocument36 pagesAcer LCD x193hq Sm080904v1 Model Id Ra19waanuFrancis Gilbey Joson ArnaizNo ratings yet

- Big Data Maturity ModelDocument6 pagesBig Data Maturity Modelkatherine976No ratings yet

- "Ff15Af" Series Fan Filters Description: Fan Filter 115/230 Va.cDocument1 page"Ff15Af" Series Fan Filters Description: Fan Filter 115/230 Va.cGoranNo ratings yet

- Analysis of Morphogenesis in Hyphomycetes New CharDocument27 pagesAnalysis of Morphogenesis in Hyphomycetes New Charestefaniacb1305No ratings yet

- VCS Test01Document27 pagesVCS Test01GyanNo ratings yet

- Science: Locating Places On Earth Using Coordinate SystemDocument29 pagesScience: Locating Places On Earth Using Coordinate Systemlawrence maputolNo ratings yet

- Study PDFDocument10 pagesStudy PDFDaniel Cano QuinteroNo ratings yet

- Kenyan Iron Ore Mining and Prospects of PDFDocument11 pagesKenyan Iron Ore Mining and Prospects of PDFAlex NgureNo ratings yet

- 4EA1 01R Que 20180606Document20 pages4EA1 01R Que 20180606Shriyans GadnisNo ratings yet

- Theosophical Quarterly v23 1925-1926Document424 pagesTheosophical Quarterly v23 1925-1926Joma SipeNo ratings yet

- HD 9 Manual 5900123 Rev F 10 1 13Document60 pagesHD 9 Manual 5900123 Rev F 10 1 13Karito NicoleNo ratings yet

- Colibri Arm Som Pxa270 Technical Reference ManualDocument1,246 pagesColibri Arm Som Pxa270 Technical Reference ManualАртемNo ratings yet

- Interview Presentations: Steps For Interview Presentation SuccessDocument3 pagesInterview Presentations: Steps For Interview Presentation SuccessAditya SharmaNo ratings yet

- Alice Through The Looking Glass Movie Review (Great Books)Document2 pagesAlice Through The Looking Glass Movie Review (Great Books)Maria Kara Alexir CalambaNo ratings yet

- Helve Tic ADocument9 pagesHelve Tic AwemeihNo ratings yet