Professional Documents

Culture Documents

Answere Key - Fundamentals of Abm

Uploaded by

Angelique HernandezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answere Key - Fundamentals of Abm

Uploaded by

Angelique HernandezCopyright:

Available Formats

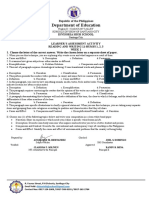

1.

A financial statement that reports the assets, liabilities, and equity of a

company on a given date.

a. strategy of financial position b. Statement of financial position

c. Solution of freedom position d. Solution of finance position

2. Their balances in this account remain intact from one accounting period to

another.

a. Permanent Accounts b. Temporary Accounts c. Provisional

d. Conditional account

3. These are presented under the assets portion of the SFP but are balances

remain intact from one accounting period to another.

Permanent Accounts – as n name

suggest, these accounts are permanent

in the sense that

their balances remain intact from one

accounting period to anothe

Permanent Accounts – as n name

suggest, these accounts are permanent

in the sense that

their balances remain intact from one

accounting period to anothe

Permanent Accounts – as n name

suggest, these accounts are permanent

in the sense that

their balances remain intact from one

accounting period to another.

Permanent Accounts – as n name

suggest, these accounts are permanent

in the sense that

their balances remain intact from one

accounting period to another

Permanent Accounts – as n name

suggest, these accounts are permanent

in the sense that

their balances remain intact from one

accounting period to another

Permanent Accounts – as n name

suggest, these accounts are permanent

in the sense that

their balances remain intact from one

accounting period to another

a. Free Assets b. Permanent Accounts c. Accessible Assets

d. Contra Assets

4. This is a resource controlled by the entity as a result of past events and from which future

economic benefits are expected to flow to the entity.

a. Asset b. Liability c. Equity d. Justice

5. This is the present obligation of the enterprise arising from past events,

the settlement of which is expected to result in an outflow from the

enterprise of resources embodying economic benefits.

a. Equity b. Asset c. Liability d. Benefit

6. This is the residual interest in the assets of the entity after deducting all

the liabilities.

a. Equity b. Value c. Asset d. Liability

7. An increase in the net assets of the entity during an accounting period except for

such increases caused by the contributions from owners.

a. Expenses b. Income c. Cost d. Rate

8. A decrease in the net assets of the entity over an accounting period except for

such decreases caused by the distributions to the owners.

a. Revenue b. Returns c. Profits d. Expense

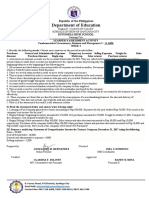

Direction: Identify the following statement if they are under Current Liabilities or

Non-current Liabilities.

1. Trade Accounts Payable- are open accounts relating to purchase of goods and/or

raw materials. - Current Liabilities

2. Long-term Debt - these accounts represent bank loans as a source of financing

for the entity, long term debt can be span from 5 years to almost 25 years, it also

includes mortgage payable if certain properties are held as collateral for such loans.

Non-current Liabilities.

3. Notes- payable- are evidence by a promissory note, notes payable will have

principal amount, maturity date and interest rate. - Current Liabilities

4. Bonds Payable- are contracts of indebtedness sold to certain individuals. - Non-

current Liabilities.

5. Income tax Payable- is computed at 30% of the corporate income, for sole

proprietors, however, their taxable income is subjected to the graduated tax rates. -

Current Liabilities

You might also like

- Vallix QuestionnairesDocument14 pagesVallix QuestionnairesKathleen LucasNo ratings yet

- Intermediate Accounting 2 Theory ReviewerDocument62 pagesIntermediate Accounting 2 Theory ReviewerDip Per100% (1)

- Intermediate Accounting 2 THEORIESDocument68 pagesIntermediate Accounting 2 THEORIESLedelyn MaullonNo ratings yet

- Chap 8, UnfinishedDocument11 pagesChap 8, UnfinishedGuiana WacasNo ratings yet

- Shareholders Equity PDF FreeDocument111 pagesShareholders Equity PDF FreeJoseph Asis100% (1)

- CF FS and Reporting EntityDocument5 pagesCF FS and Reporting Entitypanda 1No ratings yet

- DocumentDocument7 pagesDocumentMae Ann AvenidoNo ratings yet

- Activity 2 Quiz QuestionsDocument2 pagesActivity 2 Quiz QuestionsRowena RogadoNo ratings yet

- 3 - Activities For ULO 7, 8, 9, 10 & 11Document8 pages3 - Activities For ULO 7, 8, 9, 10 & 11RJ 1No ratings yet

- LiabilitiesDocument11 pagesLiabilitiesJayson Manalo GañaNo ratings yet

- FAR Review Course Pre-Board - Answer KeyDocument17 pagesFAR Review Course Pre-Board - Answer KeyROMAR A. PIGANo ratings yet

- SLM Module in Fabm2 Q1Document53 pagesSLM Module in Fabm2 Q1Fredgy R BanicoNo ratings yet

- Ia2 Examination 1 Theories Liabilities and Provisions - CompressDocument3 pagesIa2 Examination 1 Theories Liabilities and Provisions - CompressTRECIA AMOR PAMILARNo ratings yet

- Acctg Assignment Sep 5 DeadlineDocument3 pagesAcctg Assignment Sep 5 Deadlinechristine nelmidaNo ratings yet

- Fabm 2 Edited Lesson 1 SFPDocument16 pagesFabm 2 Edited Lesson 1 SFPJhon Jhon100% (1)

- Chapter 13 Intermediate AccoutingDocument8 pagesChapter 13 Intermediate AccoutingMarlind3No ratings yet

- Fundamentals of Accountancy, Business & Management 2: Quarter 1 - SLM 1 Statement of Financial PositionDocument9 pagesFundamentals of Accountancy, Business & Management 2: Quarter 1 - SLM 1 Statement of Financial PositionJhon Michael GambongNo ratings yet

- Fabm1 Lesson 2Document21 pagesFabm1 Lesson 2JoshuaNo ratings yet

- Chapter 8 - Current Liabilities and The Time Value of MoneyDocument4 pagesChapter 8 - Current Liabilities and The Time Value of MoneyAlice LiddellNo ratings yet

- Audit of Receivables-1Document16 pagesAudit of Receivables-1jennyMBNo ratings yet

- FAR Review Course Pre-Board - FinalDocument17 pagesFAR Review Course Pre-Board - FinalROMAR A. PIGA100% (1)

- ACC 111 - SimulativeDocument13 pagesACC 111 - SimulativePrecious Anne CantarosNo ratings yet

- 06-Receivables TheoryDocument2 pages06-Receivables TheoryRegenLudevese100% (4)

- Day 1 Note (Accounting Concepts, Principles and Merchandising Accounting)Document11 pagesDay 1 Note (Accounting Concepts, Principles and Merchandising Accounting)Janette AngligenNo ratings yet

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of Accountschristine anglaNo ratings yet

- C. Both Statements Are FalseDocument12 pagesC. Both Statements Are FalseShaira Bagunas ObiasNo ratings yet

- Problem 1-5 Multiple Choice (IAA)Document2 pagesProblem 1-5 Multiple Choice (IAA)jayNo ratings yet

- Lesson 1 Statement of Financial PositionDocument22 pagesLesson 1 Statement of Financial PositionMylene SantiagoNo ratings yet

- Accounting Terns and DefitionDocument10 pagesAccounting Terns and DefitionReign MontejoNo ratings yet

- Intermediate Accouting Testbank ch13Document23 pagesIntermediate Accouting Testbank ch13cthunder_192% (12)

- 02 - Cash & Cash EquivalentDocument5 pages02 - Cash & Cash EquivalentEmmanuelNo ratings yet

- Accounting For LawyersDocument51 pagesAccounting For Lawyersnamratha minupuri100% (2)

- Exercise For Current LiabilitiesDocument5 pagesExercise For Current LiabilitiesAsyraf AzharNo ratings yet

- Statement of Financial Position - TheoryDocument2 pagesStatement of Financial Position - Theoryricamae saladagaNo ratings yet

- Chapter 04 - Conceptual FrameworkDocument4 pagesChapter 04 - Conceptual FrameworkKimberly Claire AtienzaNo ratings yet

- QUESTION 4-12 Multiple Choice (Conceptual Framework)Document4 pagesQUESTION 4-12 Multiple Choice (Conceptual Framework)Janine CamachoNo ratings yet

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGANo ratings yet

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of AccountsKathleen PardoNo ratings yet

- D3Document13 pagesD3neo14No ratings yet

- Quiz 4 - Accounts Receivable & Notes ReceivableDocument4 pagesQuiz 4 - Accounts Receivable & Notes ReceivableCaila Nicole ReyesNo ratings yet

- CFASDocument17 pagesCFASKie Magracia BustillosNo ratings yet

- Pra Acc Quizzer 2016Document5 pagesPra Acc Quizzer 2016Kim DavilloNo ratings yet

- FABM 2 Module 1Document16 pagesFABM 2 Module 1Rene Castillo JrNo ratings yet

- Audit of ReceivablesDocument15 pagesAudit of ReceivablesLouie De La Torre75% (4)

- Jamolod - Unit 1 - General Features of Financial StatementDocument8 pagesJamolod - Unit 1 - General Features of Financial StatementJatha JamolodNo ratings yet

- NIOS Class 12 ACC Most Important QuestionDocument8 pagesNIOS Class 12 ACC Most Important QuestionKaushil SolankiNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Financial Control Blueprint: Building a Path to Growth and SuccessFrom EverandFinancial Control Blueprint: Building a Path to Growth and SuccessNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Business Free Talk: Lesson 2 Copy and PrintDocument9 pagesBusiness Free Talk: Lesson 2 Copy and PrintAngelique HernandezNo ratings yet

- WHLP Business Mathematics 2Document1 pageWHLP Business Mathematics 2Angelique HernandezNo ratings yet

- WHLP Fundamentals of Abm 2Document1 pageWHLP Fundamentals of Abm 2Angelique HernandezNo ratings yet

- WHLP Reading and Writing 2Document2 pagesWHLP Reading and Writing 2Angelique HernandezNo ratings yet

- Reading and Writing LAA 2Document1 pageReading and Writing LAA 2Angelique HernandezNo ratings yet

- Fund. of ABM LAA KEYDocument2 pagesFund. of ABM LAA KEYAngelique HernandezNo ratings yet

- May 17-21, 2021Document2 pagesMay 17-21, 2021Angelique HernandezNo ratings yet

- Students RecordDocument11 pagesStudents RecordAngelique HernandezNo ratings yet

- May 11-14, 2021Document6 pagesMay 11-14, 2021Angelique HernandezNo ratings yet

- Fund. of ABM LAA 2Document1 pageFund. of ABM LAA 2Angelique HernandezNo ratings yet

- Weekly Home Learning Plan Business MathematicsDocument1 pageWeekly Home Learning Plan Business MathematicsAngelique HernandezNo ratings yet

- Weekly Home Learning Plan Fundamentals of AbmDocument1 pageWeekly Home Learning Plan Fundamentals of AbmAngelique HernandezNo ratings yet

- Group ABMDocument2 pagesGroup ABMAngelique HernandezNo ratings yet

- Weekly Home Learning Plan Reading and WritingDocument1 pageWeekly Home Learning Plan Reading and WritingAngelique HernandezNo ratings yet

- Reading and Writing LAADocument1 pageReading and Writing LAAAngelique HernandezNo ratings yet

- Unit 2 Lesson 1: The Amazing Journey: You're Explorers Now!Document21 pagesUnit 2 Lesson 1: The Amazing Journey: You're Explorers Now!Angelique HernandezNo ratings yet

- IwarDocument5 pagesIwarAngelique HernandezNo ratings yet

- DK - English - For - Everyone - Course Book - Level - 1 - Beginner PDFDocument184 pagesDK - English - For - Everyone - Course Book - Level - 1 - Beginner PDFMariana Calin92% (78)

- Iwp Angelique M. Hernandez May 10-14, 2021Document1 pageIwp Angelique M. Hernandez May 10-14, 2021Angelique HernandezNo ratings yet

- Business Mathematics LAADocument2 pagesBusiness Mathematics LAAAngelique HernandezNo ratings yet

- Fundamentals of ABM LAADocument2 pagesFundamentals of ABM LAAAngelique HernandezNo ratings yet

- Unit 1 Lesson 3: Stative VerbsDocument13 pagesUnit 1 Lesson 3: Stative VerbsAngelique HernandezNo ratings yet

- This Material Is For Students' After-Class Use. If You're Using, Please Go To: Cloud Disk Authorized ResourcesDocument17 pagesThis Material Is For Students' After-Class Use. If You're Using, Please Go To: Cloud Disk Authorized ResourcesAngelique HernandezNo ratings yet

- Unit 2 Lesson 1: Teenagers' Time: An Amazing StoryDocument11 pagesUnit 2 Lesson 1: Teenagers' Time: An Amazing StoryAngelique HernandezNo ratings yet

- Unit 2 Lesson 1: Teenagers' Time: An Amazing StoryDocument12 pagesUnit 2 Lesson 1: Teenagers' Time: An Amazing StoryAngelique HernandezNo ratings yet

- InventionsDocument49 pagesInventionsChrislet VaelNo ratings yet

- This Material Is For Students' After-Class Use. If You're Using, Please Go To: Cloud Disk Authorized Resources If You're Using, Please Go To: A-Classroom Courseware LibraryDocument33 pagesThis Material Is For Students' After-Class Use. If You're Using, Please Go To: Cloud Disk Authorized Resources If You're Using, Please Go To: A-Classroom Courseware LibraryAngelique HernandezNo ratings yet

- This Material Is For Students' After-Class Use. If You're Using, Please Go To: Cloud Disk Authorized ResourcesDocument23 pagesThis Material Is For Students' After-Class Use. If You're Using, Please Go To: Cloud Disk Authorized ResourcesAngelique HernandezNo ratings yet

- This Material Is For: Lesson Planning (For T) After-Class Use (For S) - If You Are Using Classin, Please Go ToDocument14 pagesThis Material Is For: Lesson Planning (For T) After-Class Use (For S) - If You Are Using Classin, Please Go ToAngelique HernandezNo ratings yet

- 2012 General EnglishDocument12 pages2012 General EnglishHari rajNo ratings yet

- Oracle Absence ManagementDocument26 pagesOracle Absence ManagementSai Narayan88% (16)

- Company Secretarial Practice in BangladeshDocument7 pagesCompany Secretarial Practice in BangladeshMohammadOmarFaruq0% (1)

- Internship Report - 20bee305Document32 pagesInternship Report - 20bee305YOKESH BNo ratings yet

- An Overview of Association Rule Mining & Its Application: by Abhinav RaiDocument22 pagesAn Overview of Association Rule Mining & Its Application: by Abhinav RaiBheng AvilaNo ratings yet

- Customers' Attitude Towards Green Packaging: A Case of Sapphire, PakistanDocument28 pagesCustomers' Attitude Towards Green Packaging: A Case of Sapphire, PakistanErwin MedinaNo ratings yet

- English For Business EassayDocument4 pagesEnglish For Business EassayEma ZulkiffliNo ratings yet

- FSSC 22000 GUIDELINE - FSSC CertificationDocument14 pagesFSSC 22000 GUIDELINE - FSSC CertificationFelix MwandukaNo ratings yet

- AssignmentDocument2 pagesAssignmentYahya TariqNo ratings yet

- Vertical Pumps Repairs Standards VPRSDocument44 pagesVertical Pumps Repairs Standards VPRSAlvialvarez100% (1)

- Imron Sahid NugrohoDocument7 pagesImron Sahid NugrohoAnanda LukmanNo ratings yet

- Mba08226 - Sangeethanair - Roadmap - Sangeetha NairDocument1 pageMba08226 - Sangeethanair - Roadmap - Sangeetha NairKAMAL NAYANNo ratings yet

- A FrAmework For Successful Hotel DevelopmentsDocument16 pagesA FrAmework For Successful Hotel DevelopmentsMurat KaraNo ratings yet

- CV and Cover Letter Guide: Career Development CentreDocument26 pagesCV and Cover Letter Guide: Career Development CentreAbdul RohhimNo ratings yet

- Specifications: PartsDocument1 pageSpecifications: PartsReza RezaNo ratings yet

- Chaoter 4 AnswersDocument45 pagesChaoter 4 Answersmorgan.bertone100% (2)

- Project Report On-Marketing Strategies of VodafoneDocument109 pagesProject Report On-Marketing Strategies of Vodafoneridhsi61% (23)

- "Barcode" Web Service: ManualDocument64 pages"Barcode" Web Service: ManualЕгон ЧарнојевићNo ratings yet

- Himanshu AroraDocument3 pagesHimanshu AroraKiran Kumar PNo ratings yet

- Engineering Management Masters Thesis TopicsDocument5 pagesEngineering Management Masters Thesis Topicsgbtrjrap100% (2)

- BusplanDocument38 pagesBusplanCrissa MorescaNo ratings yet

- PPTXDocument26 pagesPPTXmohsinziaNo ratings yet

- SatisfactionDocument17 pagesSatisfactionPhio MarviNo ratings yet

- Bhavnath Temple: Case AnalysisDocument2 pagesBhavnath Temple: Case Analysismanvi singhNo ratings yet

- 6 Mark Grade Boundary:: MarkschemeDocument22 pages6 Mark Grade Boundary:: Markschemeqi huangNo ratings yet

- Mother of Perpetual Help School, Inc.: Quarter 1 - Module 1/ Week 1-2Document14 pagesMother of Perpetual Help School, Inc.: Quarter 1 - Module 1/ Week 1-2Lunilyn Ortega100% (1)

- Project Management Processes Methodologies and Economics 2nd Edition Shtub Solutions ManualDocument11 pagesProject Management Processes Methodologies and Economics 2nd Edition Shtub Solutions Manualashleygonzalezcqyxzgwdsa100% (10)

- The Coca-Cola Company Analysis 1. Company Overview 1.1 Executive SummaryDocument35 pagesThe Coca-Cola Company Analysis 1. Company Overview 1.1 Executive SummaryASAD ULLAHNo ratings yet

- Unit-3: Project SelectionDocument101 pagesUnit-3: Project SelectionMandeep Singh BhatiaNo ratings yet

- Demerger of BajajDocument30 pagesDemerger of BajajNikhil100% (1)