Professional Documents

Culture Documents

Capital Gains Tax

Uploaded by

HARSH RANJANOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Gains Tax

Uploaded by

HARSH RANJANCopyright:

Available Formats

Capital Gain Tax

Any profit or gain that arises from the sale of a ‘capital asset’ is a capital gain. This gain or profit

comes under the category of ‘income’.

Hence, the capital gain tax will be required to be paid for that amount in the year in which the

transfer of the capital asset takes place. This is called the capital gains tax, which can be both

short-term or long-term.

Long-term Capital Gains Tax: It is a levy on the profits from the sale of assets held for more

than a year. The rates are 0%, 15%, or 20%, depending on tax bracket.

Short-term Capital Gains Tax: It applies to assets held for a year or less and is taxed as

ordinary income.

Capital gains can be reduced by deducting the capital losses that occur when a taxable asset is

sold for less than the original purchase price. The total of capital gains minus any capital losses is

known as the "net capital gains".

Tax on capital gains is triggered only when an asset is sold, or "realized". Stock shares that

appreciate every year will not be taxed for capital gains until they are sold.

Capital Assets

Land, building, house property, vehicles, patents, trademarks, leasehold rights, machinery, and

jewellery are a few examples of capital assets. This includes having rights in or in relation to an

Indian company. It also includes the rights of management or control or any other legal right.

Realized Gain

It results from selling an asset at a price higher than the original purchase price. It occurs when an

asset is sold at a level that exceeds its book value cost.

While an asset may be carried on a balance sheet at a level far above cost, any gains while the

asset is still being held are considered unrealized as the asset is only being valued at fair market

value.

Inherited property

Capital gains are not applicable to an inherited property as there is no sale but only a transfer

of ownership.

The Income Tax Act has specifically exempted assets received as gifts by way of an inheritance or

will. However, if the person who inherited the asset decides to sell it, capital gains tax will be

applicable.

PDF Refernece URL: https://www.drishtiias.com/printpdf/capital-gain-tax

Powered by TCPDF (www.tcpdf.org)

You might also like

- Capital Gains Tax Ordinary Assets-Assets Used in BusinessDocument3 pagesCapital Gains Tax Ordinary Assets-Assets Used in Businessjoevitt delfinadoNo ratings yet

- Dealings in Properties and The Withholding Tax SystemDocument38 pagesDealings in Properties and The Withholding Tax SystemKenzel lawasNo ratings yet

- Chapter 12 Reviewer IncotaxDocument2 pagesChapter 12 Reviewer IncotaxJere Mae MarananNo ratings yet

- Capital GainDocument38 pagesCapital GainD. Naarayan NandanNo ratings yet

- M6 - Capital Gains TaxationDocument31 pagesM6 - Capital Gains TaxationTERRIUS AceNo ratings yet

- Topic: Captial Gains Tax Name: Radha Krishna Lankisetti ROLL - NO: 2016055Document1 pageTopic: Captial Gains Tax Name: Radha Krishna Lankisetti ROLL - NO: 2016055radhakrishnaNo ratings yet

- Note 3 Gross IncomeDocument7 pagesNote 3 Gross IncomeJason Robert MendozaNo ratings yet

- Chap 12 Dealings in PropertiesDocument11 pagesChap 12 Dealings in PropertiesyvonneNo ratings yet

- TAXATION - 6 Dealings in Cap. AssetsDocument2 pagesTAXATION - 6 Dealings in Cap. AssetsMIKAELA ANDREA LAYOGNo ratings yet

- Untitled DocumentDocument2 pagesUntitled DocumentMaria DubloisNo ratings yet

- Dealings in PropertiesDocument3 pagesDealings in Propertiesloonie tunesNo ratings yet

- Material 7 Capital Assets Gains LossesDocument3 pagesMaterial 7 Capital Assets Gains LossesKrista PerezNo ratings yet

- Cabria Cpa Review Center: Tel. Nos. (043) 980-6659Document10 pagesCabria Cpa Review Center: Tel. Nos. (043) 980-6659MaeNo ratings yet

- Aa TaxDocument22 pagesAa Taxnirshan rajNo ratings yet

- Capital GainDocument4 pagesCapital GainqwertyNo ratings yet

- Dealings in PropertiesDocument2 pagesDealings in PropertiesJamaica DavidNo ratings yet

- Capital GainsDocument25 pagesCapital GainsanonymousNo ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains TaxAii Lyssa UNo ratings yet

- Dealings in Properties: 2 Year Bs Accounting Informations SytemsDocument12 pagesDealings in Properties: 2 Year Bs Accounting Informations SytemsAiron BendañaNo ratings yet

- PFTP Capital Gain-1-2Document16 pagesPFTP Capital Gain-1-2SAGAR BALAGARNo ratings yet

- Material 7 Capital Assets Gains LossesDocument3 pagesMaterial 7 Capital Assets Gains LossesKrista PerezNo ratings yet

- Mergers and Acquisitions Country Report PhilippinesDocument12 pagesMergers and Acquisitions Country Report PhilippinesErika PinedaNo ratings yet

- Capital Gains Losses 1Document2 pagesCapital Gains Losses 1shai santiagoNo ratings yet

- Module 03 - Income Tax ConceptsDocument29 pagesModule 03 - Income Tax ConceptsTrixie OnglaoNo ratings yet

- RegulatoryDocument77 pagesRegulatoryAlican, JerhamelNo ratings yet

- Dealings in Property NotesDocument6 pagesDealings in Property NotesLinrhay RicohermosoNo ratings yet

- Taxation Macmod Capital Gains & LossesDocument2 pagesTaxation Macmod Capital Gains & LossesFaye Cecil Posadas CuramingNo ratings yet

- Investment in Equity Securities 2Document26 pagesInvestment in Equity Securities 2Mhelka Tiodianco0% (1)

- Dealings in PropertieDocument10 pagesDealings in PropertieAdmNo ratings yet

- CCH Federal Taxation Comprehensive Topics 2013 1st Edition Harmelink Solutions ManualDocument17 pagesCCH Federal Taxation Comprehensive Topics 2013 1st Edition Harmelink Solutions Manualbodiandoncella9j9to100% (24)

- Capital Asset and Capital Gains LossDocument4 pagesCapital Asset and Capital Gains LossAmy Olaes DulnuanNo ratings yet

- 7.0 Capital Gains TaxationDocument23 pages7.0 Capital Gains TaxationElle VernezNo ratings yet

- PrintDocument2 pagesPrintMariel AbionNo ratings yet

- Discussion On Dealings of PropertiesDocument2 pagesDiscussion On Dealings of PropertieshazeerkeedNo ratings yet

- Chapter 2Document4 pagesChapter 2Trisha Mae BoholNo ratings yet

- TAX-1101: Capital Assets, Capital Gains & Losses: - T R S ADocument3 pagesTAX-1101: Capital Assets, Capital Gains & Losses: - T R S AVaughn TheoNo ratings yet

- Morales Taxation Topic 7 Capital Gains and LossesDocument10 pagesMorales Taxation Topic 7 Capital Gains and LossesMary Joice Delos santosNo ratings yet

- Synthesis FAR2ndDayDocument5 pagesSynthesis FAR2ndDayJane DizonNo ratings yet

- Tax Capital Gain Mcom Project of 31 OagesDocument33 pagesTax Capital Gain Mcom Project of 31 Oageskarthika kounder50% (6)

- Investment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Document11 pagesInvestment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Richie BoomaNo ratings yet

- Income Taxation2020Document377 pagesIncome Taxation2020tine100% (1)

- Capital Gains TaxDocument8 pagesCapital Gains TaxRedfield GrahamNo ratings yet

- Module 03 - Income Tax ConceptsDocument34 pagesModule 03 - Income Tax ConceptsLEON JOAQUIN VALDEZNo ratings yet

- Chapter 7Document7 pagesChapter 7Chariess CasanovaNo ratings yet

- TAX Chapter 6Document4 pagesTAX Chapter 6Myz MessyNo ratings yet

- Chapter 12 Dealings in PropertiesDocument6 pagesChapter 12 Dealings in PropertiesAlyssa BerangberangNo ratings yet

- Income Taxation2020Document377 pagesIncome Taxation2020Libra SunNo ratings yet

- Module 6 CGT - 1Document3 pagesModule 6 CGT - 1Marklein DumangengNo ratings yet

- Tax Free Exchanges Exchanges Not Plainly For StocksDocument2 pagesTax Free Exchanges Exchanges Not Plainly For StocksALLIA LOPEZNo ratings yet

- Taxation LawDocument124 pagesTaxation Lawakshay yadavNo ratings yet

- Dealings in PropertyDocument62 pagesDealings in PropertyDonna May CacayorinNo ratings yet

- Income Tax 3Document11 pagesIncome Tax 3Ivy Loraine BangloyNo ratings yet

- Capital Gains Tax and Dealings in Property: Income TaxationDocument105 pagesCapital Gains Tax and Dealings in Property: Income TaxationRonna Mae DungogNo ratings yet

- Investment in Equity Securities 2Document6 pagesInvestment in Equity Securities 2RomeNo ratings yet

- 7 As 13 Accounting For InvestmentsDocument32 pages7 As 13 Accounting For Investmentscloudstorage567No ratings yet

- Chapter 2 - Classes of IncomeDocument12 pagesChapter 2 - Classes of IncomeRacky King PalacioNo ratings yet

- Acquisition: Capital Gains Tax Implications For Transfer of SharesDocument1 pageAcquisition: Capital Gains Tax Implications For Transfer of SharesJagruti RawalNo ratings yet

- Gains & Losses From Dealing in PropertyDocument72 pagesGains & Losses From Dealing in PropertyJoyce Nalzaro100% (2)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Times of Agriculture 2023 AugustDocument57 pagesTimes of Agriculture 2023 AugustHARSH RANJANNo ratings yet

- CBDCDocument9 pagesCBDCHARSH RANJANNo ratings yet

- Yojana September Magzine 2023Document51 pagesYojana September Magzine 2023HARSH RANJANNo ratings yet

- Agriculture Optional SyllabusDocument6 pagesAgriculture Optional SyllabusHARSH RANJANNo ratings yet

- Business Ethics by DC Kartikeyan PDFDocument293 pagesBusiness Ethics by DC Kartikeyan PDFHARSH RANJANNo ratings yet

- Benefits of Metro RailDocument76 pagesBenefits of Metro RailHARSH RANJANNo ratings yet

- Big DataDocument3 pagesBig DataHARSH RANJANNo ratings yet

- COP-15 Biodiversity FrameworkDocument4 pagesCOP-15 Biodiversity FrameworkHARSH RANJANNo ratings yet

- A World Transformed - ORFDocument4 pagesA World Transformed - ORFHARSH RANJANNo ratings yet

- Agnipath and Global PracticeDocument17 pagesAgnipath and Global PracticeHARSH RANJANNo ratings yet

- FINAL Design Thinking (Delivery Agents Problems)Document19 pagesFINAL Design Thinking (Delivery Agents Problems)HARSH RANJANNo ratings yet

- Exam Score Card GD210140597Document2 pagesExam Score Card GD210140597HARSH RANJANNo ratings yet

- 5G Auction - Who Bought What Bands, and WhyDocument14 pages5G Auction - Who Bought What Bands, and WhyHARSH RANJANNo ratings yet

- Corporate FinanceDocument7 pagesCorporate FinanceHARSH RANJANNo ratings yet

- Project ModelsDocument5 pagesProject ModelsHARSH RANJANNo ratings yet

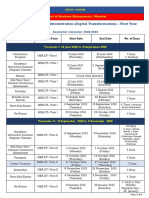

- Academic Calendar - MBA DT I YearDocument2 pagesAcademic Calendar - MBA DT I YearHARSH RANJANNo ratings yet

- DTEPDocument2 pagesDTEPHARSH RANJANNo ratings yet

- E 1340 - 96 - Rteznda - PDFDocument12 pagesE 1340 - 96 - Rteznda - PDFsandeepNo ratings yet

- 100kva DG Set - 100kva Koel GensetDocument3 pages100kva DG Set - 100kva Koel GensetMothilalNo ratings yet

- Grounding-101 IEEE IAS PDFDocument81 pagesGrounding-101 IEEE IAS PDFRoySnk100% (2)

- Week 3 Lecture SlidesDocument23 pagesWeek 3 Lecture SlidesMike AmukhumbaNo ratings yet

- Argumentative Essay Block PatternDocument3 pagesArgumentative Essay Block PatternNes Ghi NeNo ratings yet

- AVSEC Awareness Ground StaffDocument12 pagesAVSEC Awareness Ground Staffanon_823464996100% (2)

- Representing Inverse Functions Through Tables and GraphsDocument18 pagesRepresenting Inverse Functions Through Tables and GraphsJoseph BaclayoNo ratings yet

- Renr8131-01 C12Document2 pagesRenr8131-01 C12ait mimouneNo ratings yet

- Dissertation Fight ClubDocument5 pagesDissertation Fight ClubWriteMyPaperForMeCheapAlbuquerque100% (1)

- Price List PDFDocument269 pagesPrice List PDFsmartsaravanaNo ratings yet

- Negative Effects of Social Media AddictionDocument2 pagesNegative Effects of Social Media AddictionTubagus Fikih AriansyahNo ratings yet

- Ranjit SinghDocument8 pagesRanjit SinghRANJIT100% (1)

- 6th Grade Health Lesson Plan - Portfolio - BloomsDocument3 pages6th Grade Health Lesson Plan - Portfolio - Bloomsapi-475320683No ratings yet

- Aadi Amavasya SpecialDocument5 pagesAadi Amavasya SpecialjyoprasadNo ratings yet

- Summer Internship in JaipurDocument12 pagesSummer Internship in JaipurLinuxWorldIndiaNo ratings yet

- Aspects and Style in Technical WritingDocument14 pagesAspects and Style in Technical WritingRogelio Jerome Celeste100% (1)

- Antheil - Piano Sonata No 4Document29 pagesAntheil - Piano Sonata No 4TateCarson100% (1)

- EPR in Waste ManagementDocument11 pagesEPR in Waste Managementdorexp17No ratings yet

- Lab-Journal Compiler ConstructionDocument20 pagesLab-Journal Compiler ConstructionAbdullah ArshadNo ratings yet

- CSR ReportDocument13 pagesCSR Reportrishabh agarwalNo ratings yet

- 10 Must Read Books For Stock Market Investors in India - Trade BrainsDocument35 pages10 Must Read Books For Stock Market Investors in India - Trade BrainsCHANDRAKISHORE SINGHNo ratings yet

- Kuis ITSMDocument31 pagesKuis ITSMHariyanto HalimNo ratings yet

- Lab1 - Kali Linux Overview: 1. ReconnaissanceDocument6 pagesLab1 - Kali Linux Overview: 1. ReconnaissanceNguyễn Hữu VĩnhNo ratings yet

- Affiliate Marketing Step by StepDocument27 pagesAffiliate Marketing Step by StepJulia FawcettNo ratings yet

- P3A Taking Order BeveragesDocument2 pagesP3A Taking Order BeveragesRavi KshirsagerNo ratings yet

- Character MapDocument1 pageCharacter MapNikkieIrisAlbañoNovesNo ratings yet

- Examination of Foot and Ankle JointDocument58 pagesExamination of Foot and Ankle JointSantosh KumarNo ratings yet

- Block Chain Waste Management Using Secure Data Standard A Novel ApproachDocument30 pagesBlock Chain Waste Management Using Secure Data Standard A Novel Approachsakthi velNo ratings yet

- Maxillary Sinus Augmentation: Tarun Kumar A.B, Ullas AnandDocument13 pagesMaxillary Sinus Augmentation: Tarun Kumar A.B, Ullas Anandyuan.nisaratNo ratings yet

- Using Techniques On Seeking, Screening, and Seizing OpportunitiesDocument8 pagesUsing Techniques On Seeking, Screening, and Seizing OpportunitiesJustine Evasco RubiaNo ratings yet