Professional Documents

Culture Documents

20KVAS

Uploaded by

ManishSharma0 ratings0% found this document useful (0 votes)

0 views1 pageVAS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVAS

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

0 views1 page20KVAS

Uploaded by

ManishSharmaVAS

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

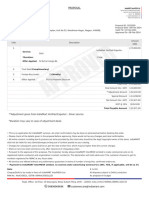

(Segment: Equity - Cash and Futures & Options)

Value Added Subscription Plan Client Code:_____________________

Brand Name 20KVAS

Value Added Subscription Rs. (a) 20000

Goods and Service Tax (b) As per Current Applicable Rates

Total Prepaid amount including GST (c) (a) + (b)

Reversal (c)

Validity 6 Month

Delivery 0.2%, 0.04MIN

Intraday - each leg 0.005%, 0.04MIN

Futures - each leg 0.005%, 0.04MIN

T2T - each leg 0.75%, 0.04MIN

Option trading brokerage - each leg Rs. 20 per lot flat

Note: All other charges are extra

NB: *Non refundable; ** Subject to the terms and conditions mentioned below

Terms and Conditions

Subscription fees are non-refundable • Default Plans have no validity • All trades will be charged as per charges mentioned in

each plan • Opening of accounts under Default plan will attract account opening fee of Rs 750/- inclusive of GST • All value

added services to continue irrespective of trading volume or brokerage paid by the customer • The plan is inclusive of rebate

on brokerage (inclusive of GST) paid to the extent of subscription fee during the validity of the plan. • The brokerage plan

opted will be valid till end of tenure and cannot be changed during that period. Upgrade of the plan during the validity period

will require the customer to pay the entire value of the new selected plan • Brokerage levied over and above the said fees

within the tenure of the plan will have to be paid additionally by the client at the same rate quoted above. • The plan may be

subject to regulatory norms in force and may discontinue under any regulatory directions or for any other reasons,

without giving prior intimation to the client • For new clients the validity period will commence from the date of account

activation • On expiry of the tenure, if the customer does not subscribe to the fee based plan, the default plan would be

applicable • To discontinue the fee based plan, the client can call customer service. • Irrespective of any plan, risk policies

will continue to be same as per KYC or amended from time to time. All statutory/ regulatory levies and other charges including

but not limited to Securities Transaction Tax, SEBI Turnover Fees, Exchange Transaction Charges, Stamp duty and GST shall be

charged separately over and above the brokerage rate • Two or more plans cannot be clubbed together• This subscription plan

is integral part of the KYC documents executed by the client • GST, STT and other Statutory charges as per current rate and

any revision in the rate then same will be applicable.

I/We wish to avail the_________subscription fee Rs ______plan offered by you. I/We have understood the plan details

as given above and agree to abide by the same.

I/We agree that subscription fee is non-refundable.

I__________________________, hereby authorize IIFL Securities Limited to debit a sum of Rs from my trading account

towards subscription plan.

I,__________________________, enclose demand draft/payorder/cheque of Rs favouring IIFL Securities

Limited to avail this subscription plan Client Name _________ClientCode*/FormNo#_______PaymentMode _

________ Cheque No . Cheque Date Bank Name ______

Amount_______Date: Place RM Name/ FAN _____

CLIENT SIGNATURE (Seal, If applicable)

(Sign should match with the KYC) * Existing client #New Client

Disclaimer: IIFL does not accept subscription fee or any other fee/ payments in cash. Please do not make any payment in cash.

FOR ANY ASSISTANCE CONTACT US: Customer Care: (022) 4007 1000/ Call & Trade: (022) 3944 0000

IIFL Securities Limited (Formerly India Infoline Limited)

Stock Broker SEBI Registration No.:-INZ000164132.

MEMBER: National Stock Exchange of India Ltd, Bombay Stock Exchange Ltd, Multi Commodity Exchange of India Ltd, National Commodity & Derivatives Exchange Ltd.

SEBI Registration No. DP: IN-DP-185-2016

Regd. Off.: IIFL House, Sun Infotech Park, Road No. 16V, Plot No. B-23, MIDC, Thane Industrial Area, Wagle Estate, Thane- 400604.

Tel: (91-22) 3929 4000/ 4103 5000 • Fax: (91-22) 2580 6654

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PD Sam I MT Q Property FinancingDocument10 pagesPD Sam I MT Q Property FinancingMichael TanNo ratings yet

- InvestDirect Subscription Plans and Value Added ServicesDocument2 pagesInvestDirect Subscription Plans and Value Added ServicesSoumyakanta SahaniNo ratings yet

- Miscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- PE_RO_PRICE_CIRCULAR_12.04.2024Document115 pagesPE_RO_PRICE_CIRCULAR_12.04.2024Prathamesh SinghNo ratings yet

- Ril Pe Price DT.01.02.2019Document89 pagesRil Pe Price DT.01.02.2019Akshat JainNo ratings yet

- Everything About ArtDocument88 pagesEverything About ArtRavinder SInghNo ratings yet

- Ril Pe Price DT.16.01.2019 PDFDocument86 pagesRil Pe Price DT.16.01.2019 PDFAkshat JainNo ratings yet

- Kotak Advance Fee-OnlineDocument1 pageKotak Advance Fee-Onlinejay.kumNo ratings yet

- PE RO Price Circular Wef 1st Aug 2022Document103 pagesPE RO Price Circular Wef 1st Aug 2022DEEKSHA GUPTANo ratings yet

- Reliance PE Pricing Policy UpdateDocument91 pagesReliance PE Pricing Policy UpdateAkshat JainNo ratings yet

- Ril Pe Price Dt. 10.01.2019 PDFDocument89 pagesRil Pe Price Dt. 10.01.2019 PDFAkshat JainNo ratings yet

- Pe-Price-Dt - 12 08 2021Document93 pagesPe-Price-Dt - 12 08 2021akshatjain3001No ratings yet

- Reliance Industries Limited PE Business Group: Page 1 of 93Document93 pagesReliance Industries Limited PE Business Group: Page 1 of 93Surya Kant SharmaNo ratings yet

- Pe Price Dt. 01.03.2019Document89 pagesPe Price Dt. 01.03.2019mohdNo ratings yet

- ABS - All Capital PlansDocument1 pageABS - All Capital Plansaisolamaddy86No ratings yet

- Pe Price DT.06.08.2020Document91 pagesPe Price DT.06.08.2020Akshat JainNo ratings yet

- Final Project Reports SBI POSDocument83 pagesFinal Project Reports SBI POSManishNo ratings yet

- Pe Resin Price As On 01 Feb 2021Document93 pagesPe Resin Price As On 01 Feb 2021Akshat JainNo ratings yet

- A r MedilineDocument3 pagesA r Medilinekishandadhich05No ratings yet

- PD Sam I MT Q Home FinancingDocument10 pagesPD Sam I MT Q Home FinancingMichael TanNo ratings yet

- ASB Fin PDS ENG June 2020-2Document4 pagesASB Fin PDS ENG June 2020-2holaNo ratings yet

- Pe Price 26 Nov 2020Document93 pagesPe Price 26 Nov 2020akshatjain3001No ratings yet

- Collection - C - SalesforceDocument2 pagesCollection - C - SalesforceDay by day fit fitnessNo ratings yet

- TermLoanASBProductDisclosureSheet IDocument8 pagesTermLoanASBProductDisclosureSheet IamirulNo ratings yet

- Vendor Program 001 - Cooperation Program With VIMIDDocument3 pagesVendor Program 001 - Cooperation Program With VIMIDBach TruongNo ratings yet

- Subscription Plans GuideDocument4 pagesSubscription Plans GuideB.S. RawatNo ratings yet

- Value Added Subscription PlansDocument1 pageValue Added Subscription PlansChetna SharmaNo ratings yet

- HBL CreditCard – Key Fact SheetDocument2 pagesHBL CreditCard – Key Fact SheetAbdul Rehman IlahiNo ratings yet

- Universal Pay With Points TnCsDocument4 pagesUniversal Pay With Points TnCschowdaryNo ratings yet

- Offer Terms and Conditions:: January 2022. Sample Illustration of Transactions Done Between 07-08 Oct'21Document4 pagesOffer Terms and Conditions:: January 2022. Sample Illustration of Transactions Done Between 07-08 Oct'21Sanjay VaswaniNo ratings yet

- IDFCDocument2 pagesIDFCRohit Sisodiya100% (1)

- Key Facts Document - Deposits: Stanbic Bank UgandaDocument2 pagesKey Facts Document - Deposits: Stanbic Bank UgandaKisDanNo ratings yet

- Renewal ReceiptDocument1 pageRenewal ReceiptLalit Kumar SunariNo ratings yet

- PDS Equity Home Financing IDocument10 pagesPDS Equity Home Financing IsyahnooraimanNo ratings yet

- TCS Overview Solution Implementation QueriesDocument13 pagesTCS Overview Solution Implementation QueriesAmit Shinde100% (1)

- Ril PVC Price Dt. 23.05.2018Document12 pagesRil PVC Price Dt. 23.05.2018Akshat JainNo ratings yet

- 2020 2 ListDocument3 pages2020 2 Listbunty aliNo ratings yet

- BillingStatement 315028328217Document2 pagesBillingStatement 315028328217Renier Palma CruzNo ratings yet

- BillingStatement 364024053214Document2 pagesBillingStatement 364024053214MARY JERICA OCUPENo ratings yet

- Active Money Semi EditableDocument1 pageActive Money Semi Editablevishwajeetkumar3232No ratings yet

- Edel PlansDocument4 pagesEdel PlansSubhas ChilumulaNo ratings yet

- Testbook - Offer Letter (Rahul Singh) - Rhlsingh545@gmailDocument2 pagesTestbook - Offer Letter (Rahul Singh) - Rhlsingh545@gmailAniket SinghNo ratings yet

- PDFFile AspxDocument2 pagesPDFFile AspxJane Carpio MedinaNo ratings yet

- 1 Tikonna Apr 20Document2 pages1 Tikonna Apr 20vignesh sNo ratings yet

- Ril Pe Price Dt. 22.03.2018Document97 pagesRil Pe Price Dt. 22.03.2018Akshat JainNo ratings yet

- KFD - UGX - Fixed DepositDocument2 pagesKFD - UGX - Fixed Depositokwir daniel chrispusNo ratings yet

- RHB BankDocument4 pagesRHB BankSyamil ImanNo ratings yet

- Circular W.E.F 19th May'22Document224 pagesCircular W.E.F 19th May'22Mohit MohataNo ratings yet

- SBI Life Insurance receipt for Rs. 100,000 premium paymentDocument1 pageSBI Life Insurance receipt for Rs. 100,000 premium paymentmanish sharmaNo ratings yet

- SWATI SBI - OrganizedDocument5 pagesSWATI SBI - OrganizedVinod MNo ratings yet

- C Syed Wajih 10kW Hybrid ESSDocument5 pagesC Syed Wajih 10kW Hybrid ESSChaudhary Muhammad Suban TasirNo ratings yet

- Tikona PDFDocument2 pagesTikona PDFSurvey S100% (1)

- Star PlansDocument13 pagesStar PlansgmcrswNo ratings yet

- NRE PIS Cum Demat Account Document Check List DetailsDocument1 pageNRE PIS Cum Demat Account Document Check List DetailsShamsuddeen PkNo ratings yet

- Testbook - Offer LetterDocument2 pagesTestbook - Offer LetterAayan TripathiNo ratings yet

- Global LaunchDocument11 pagesGlobal LaunchNicole De GuzmanNo ratings yet

- HBL CreditCard – Key Fact Sheet (Summary BoxDocument5 pagesHBL CreditCard – Key Fact Sheet (Summary Boxpakistan jobsNo ratings yet

- ProcessNote SmallcaseDocument22 pagesProcessNote SmallcaseManishSharmaNo ratings yet

- Open CasesDocument64 pagesOpen CasesManishSharmaNo ratings yet

- 0ec4Document1 page0ec4ManishSharmaNo ratings yet

- Small Case and Wealth BasketDocument27 pagesSmall Case and Wealth BasketManishSharmaNo ratings yet

- 20KVASDocument1 page20KVASManishSharmaNo ratings yet

- 20KVASDocument1 page20KVASManishSharmaNo ratings yet

- 20KVASDocument1 page20KVASManishSharmaNo ratings yet

- Project ReportDocument1 pageProject ReportManishSharmaNo ratings yet

- Bank DetailsDocument1 pageBank DetailsManishSharmaNo ratings yet

- The Role of Financial Markets and Institutions in Supporting The Global Economy During The COVID 19 PandemicDocument60 pagesThe Role of Financial Markets and Institutions in Supporting The Global Economy During The COVID 19 PandemicHanaSuhanaNo ratings yet

- Audit Planning and Procedures <40Document32 pagesAudit Planning and Procedures <40Minie KimNo ratings yet

- M&T Residences - Income & Expence Document DHT ZNDocument2 pagesM&T Residences - Income & Expence Document DHT ZNZuko NdodanaNo ratings yet

- Tamam Finance Company Financial Statements for 2020Document27 pagesTamam Finance Company Financial Statements for 2020Dhanviper NavidadNo ratings yet

- Home InsuranceDocument16 pagesHome InsuranceShashank TiwariNo ratings yet

- Monetary Policy: Name: Avinash Roll No. 2K18Bfs04Document18 pagesMonetary Policy: Name: Avinash Roll No. 2K18Bfs04Avinash Gogu100% (1)

- Acctg7 - CH 8Document22 pagesAcctg7 - CH 8Jao FloresNo ratings yet

- Amendments to the Philippine Deposit Insurance Corporation ActDocument3 pagesAmendments to the Philippine Deposit Insurance Corporation ActSchool FilesNo ratings yet

- CordsfagDocument1 pageCordsfagpavlosmakridakis2525No ratings yet

- SHS GenMath Q4 W3 4 PDFDocument22 pagesSHS GenMath Q4 W3 4 PDFJhie GacotNo ratings yet

- Mortgage Key Facts SheetDocument2 pagesMortgage Key Facts Sheetpeter_martin9335No ratings yet

- IFRS 11 Joint ArrangementsDocument5 pagesIFRS 11 Joint Arrangementsvicent laurianNo ratings yet

- Project Report On PNB Home LoanDocument43 pagesProject Report On PNB Home Loangunpriya75% (4)

- ICRA Press Release - NBFC - July 20th 2023Document3 pagesICRA Press Release - NBFC - July 20th 2023RajNo ratings yet

- Risk Management: Case Study On AIGDocument8 pagesRisk Management: Case Study On AIGPatrick ChauNo ratings yet

- CH 8 Interest and DepreciationDocument32 pagesCH 8 Interest and DepreciationHarry White100% (1)

- TOPIC 2 NOTES and LOANS PAYABLEDocument4 pagesTOPIC 2 NOTES and LOANS PAYABLEDustinEarth Buyo MontebonNo ratings yet

- S N Ne C Las Es L: Quantitative AptitudeDocument33 pagesS N Ne C Las Es L: Quantitative AptitudeanuragNo ratings yet

- Ch. 1 - Business CombinationDocument40 pagesCh. 1 - Business CombinationKadal BurikNo ratings yet

- TaichinhdoanhngiepDocument3 pagesTaichinhdoanhngiepLê KhánhNo ratings yet

- (499148095) DR MLC SolutionsDocument29 pages(499148095) DR MLC SolutionskvnnunzNo ratings yet

- Annual Financial Report of Philippine GOCCsDocument479 pagesAnnual Financial Report of Philippine GOCCsRomel TorresNo ratings yet

- Ass Aud1Document4 pagesAss Aud1Taehyungiiee KimNo ratings yet

- Untitled DocumentDocument7 pagesUntitled Documentlilieth shayNo ratings yet

- "Financing Start-Ups in and After The Crisis. Factors of Start-Ups and Financiers Credit Exhaustion or Private Equity As Future ModelsDocument6 pages"Financing Start-Ups in and After The Crisis. Factors of Start-Ups and Financiers Credit Exhaustion or Private Equity As Future ModelsODIPLEXNo ratings yet

- Quizzes - Topic 2 - Xem L I Bài LàmDocument6 pagesQuizzes - Topic 2 - Xem L I Bài Làmnhunghuyen159No ratings yet

- Ethical Issues in AccountingDocument20 pagesEthical Issues in AccountingKarina AyuNo ratings yet

- Politically-Exposed Person Survey Questionaire: Philippine Coast Guard Savings and Loan Association, IncDocument1 pagePolitically-Exposed Person Survey Questionaire: Philippine Coast Guard Savings and Loan Association, IncDok-ey AymoksixtyNo ratings yet

- Electronic Payment System: Presented byDocument43 pagesElectronic Payment System: Presented bysheetal28svNo ratings yet

- p1 Quiz With TheoryDocument16 pagesp1 Quiz With TheoryRica RegorisNo ratings yet