Professional Documents

Culture Documents

dkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 Invoice

Uploaded by

Akash ChoudharyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

dkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 Invoice

Uploaded by

Akash ChoudharyCopyright:

Available Formats

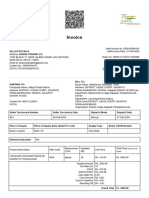

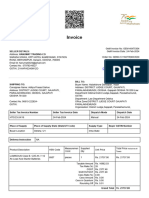

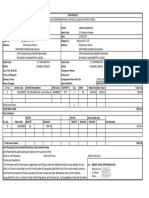

Invoice

GeM Invoice No: GEM-22603997

SELLER DETAILS: GeM Invoice Date: 02-Sep-2022

Address: PARAS TRADING CO.

INDUSTRIAL FOCAL POINT, DERABASSI, PLOT NO E-41P, Order No: GEMC-511687730069179

FIRST FLOOR, PUNJAB, 140507 Order Date: 29-Aug-2022

Email Id: parastrading711@gmail.com

Contact No : 08146808011

GSTIN: 03AEZPK0265L1Z4 Click here to download seller invoice

BILL TO:

SHIPPING TO: Buyer Name: Yogendra Pal Singh , Principal

Consignee Name: Yogendra Pal Singh Address: Jawahar Navodaya Vidyalaya Kherasain Satpuli Pauri

Address: Jawahar Navodaya Vidyalaya Kherasain Satpuli Garhwal UTTARAKHAND 246172 Department of School

PAURI GARHWAL Education and Literacy Navodaya Vidyalaya Samiti (NVS)

UTTARAKHAND 246172 GSTIN:

Department: Department of School Education and Literacy

Contact No: 01386-246139- Office Zone:Regional Office Lucknow

GSTIN: Organisation: Navodaya Vidyalaya Samiti (NVS)

Ministry: Ministry of Education

Seller Tax Invoice Number Seller Tax Invoice Date Dispatch Mode Dispatch Date

PTC154 01-Sep-2022 Courier 01-Sep-2022

Type of Transport Tracking No Tracking URL Type & No of Packages

- 217103824 Click here for tracking Box 5

Place of Supply Place of Supply State (State/UT Code) Supply Type Consignee GSTIN Number

Consignee Location Uttarakhand / 05 Inter-State

Measurem GST UQ Supplied Total Price inclusive

Product Description HSN Code Unit Price

ent Unit Name Qty all Taxes

khaitan 400 millimeter Bracket NUMBE

8414 pieces 5 Rs. 2185.37 Rs. 10926.85

mounted fan for Wall mounting RS

Taxable Amount Rs. 9260.05

Tax Rate (%) 18

IGST Rs. 1666.81

Cess Rate (%) 0.000

Cess Amount Rs. 0.00

Cess in Quantum Rs. 0.00

Rounding Off Rs. -0.01

Grand Total Rs. 10926.85

I /We hereby declare that our maximum turn over during last three years is only Rs. 15912514 and hence we arenotcovered under

the ambit of GST e-invoicing provisions. We do hereby declare that once the said provisions are made applicable to us, we shall

issue the duly complied e-Invoice under GST Law.

All GST invoice or document issued by us shall be properly and timely reported under respective returns under GST by us in line

with the notified provisions and the applicable tax collected from Buyer shall be timely and correctly paid to the respective

Government by us.

In case the Input Tax Credit of GST is denied or demand is recovered from Buyer on account of any act/ omission of us in this

regard, we shallbe liable in respect of all claims of tax, penalty and/or interest, loss, damages, costs, expenses and liability that

may arise due to such non-compliance. Buyer shall have the right to recover such amount from any payments due to us or from

Performance Security, or any other legal recourse from us.

INK SIGNED SIGNATURES ARE NOT REQUIRED IN SYSTEM GENERATED DOCUMENTS

You might also like

- Basic Underwriting (ATG)Document402 pagesBasic Underwriting (ATG)dwrighte1No ratings yet

- InvoiceDocument1 pageInvoiceSaurav AgrawalNo ratings yet

- RSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceDocument2 pagesRSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceRavi Kant RohillaNo ratings yet

- L0JJYm1iUlAzNDUvRE1tektJQnlqZz09 InvoiceDocument2 pagesL0JJYm1iUlAzNDUvRE1tektJQnlqZz09 Invoicemankari.kamal.18022963No ratings yet

- RzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceDocument2 pagesRzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceInclusive Education BranchNo ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- AThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceDocument2 pagesAThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceRobin singhNo ratings yet

- MnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceDocument2 pagesMnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceInclusive Education BranchNo ratings yet

- OVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceDocument2 pagesOVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceLakshaya EnterprisesNo ratings yet

- TldEdURCaElod0FGVE12NldQL2l6Zz09 InvoiceDocument2 pagesTldEdURCaElod0FGVE12NldQL2l6Zz09 InvoicePratyush kumar NayakNo ratings yet

- NXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceDocument2 pagesNXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceInclusive Education BranchNo ratings yet

- NDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceDocument2 pagesNDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceInclusive Education BranchNo ratings yet

- N3JZZW1sTDhXRElyNnBUak9DcVJZZz09 InvoiceDocument2 pagesN3JZZW1sTDhXRElyNnBUak9DcVJZZz09 InvoiceJitender NarulaNo ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- SmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceDocument2 pagesSmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceJitender NarulaNo ratings yet

- eEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceDocument2 pageseEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceAsad ShakilNo ratings yet

- Canon Printer InvoiceDocument2 pagesCanon Printer InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- eWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceDocument2 pageseWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceRuskin S. KhadirahNo ratings yet

- aGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceDocument2 pagesaGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceSandeep KumarNo ratings yet

- PASTDocument2 pagesPASTpatel harshadNo ratings yet

- GEMC-511687720852142 Invoice PDFDocument2 pagesGEMC-511687720852142 Invoice PDFrip111176No ratings yet

- InvoiceDocument1 pageInvoicerajesh sNo ratings yet

- bkhWNWhJTzlTK0R4QkJwbmFvV1phZz09 InvoiceDocument2 pagesbkhWNWhJTzlTK0R4QkJwbmFvV1phZz09 InvoiceInclusive Education BranchNo ratings yet

- TSs4MDFuOXVOWFNGL3hMYzl2bGQvZz09 InvoiceDocument2 pagesTSs4MDFuOXVOWFNGL3hMYzl2bGQvZz09 InvoiceJitender NarulaNo ratings yet

- InvoiceDocument2 pagesInvoiceMukesh ChoudharyNo ratings yet

- Vvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceDocument2 pagesVvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- ZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoiceDocument2 pagesZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoicePratyush kumar NayakNo ratings yet

- Gem InvoiceDocument2 pagesGem InvoicenimaygabaNo ratings yet

- VP CQ55RQTZ InvoicesDocument2 pagesVP CQ55RQTZ Invoicesservice.anishhydraNo ratings yet

- V3NHaGM2NCtsTm5kNmpwQnhBekVzQT09 InvoiceDocument2 pagesV3NHaGM2NCtsTm5kNmpwQnhBekVzQT09 InvoiceOmkar DaveNo ratings yet

- Invoice: Click Here To Download Seller Tax InvoiceDocument2 pagesInvoice: Click Here To Download Seller Tax InvoiceRaghavendra Rao GNo ratings yet

- Ruby Hall InvoiceDocument3 pagesRuby Hall InvoiceRanvir RajputNo ratings yet

- Complition of Various DeliveryDocument22 pagesComplition of Various Deliverydipak kambleNo ratings yet

- NmNEK0JacjBpTStEQm9uN0JwS2ovdz09 InvoiceDocument2 pagesNmNEK0JacjBpTStEQm9uN0JwS2ovdz09 InvoiceJitender NarulaNo ratings yet

- Rakesh Pareek Aug22Document1 pageRakesh Pareek Aug22Raghvendra Singh JadounNo ratings yet

- Invoice 110945 SHIVAM JAISWALDocument1 pageInvoice 110945 SHIVAM JAISWALShivam JaiswalNo ratings yet

- Drill MachineDocument1 pageDrill Machineranjitghosh684No ratings yet

- Accounting Voucher 14Document1 pageAccounting Voucher 14Woven FabricNo ratings yet

- BooksDocument2 pagesBooksbarun1977No ratings yet

- NikhilDocument4 pagesNikhilAditya JoshiNo ratings yet

- CostumerInvoice PDFDocument1 pageCostumerInvoice PDFsangrur midlcpNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Invoice: Seller Details: Private LimitedDocument2 pagesInvoice: Seller Details: Private LimitedHusain KanchwalaNo ratings yet

- Invoice 2Document1 pageInvoice 2kiranrokade7337No ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnjani KumariNo ratings yet

- Tax Invoice: Rebel Enterprise 1325/18-19 4-Jan-2019Document2 pagesTax Invoice: Rebel Enterprise 1325/18-19 4-Jan-2019HARDIK PATELNo ratings yet

- Invoice E1123022411125001400Document1 pageInvoice E1123022411125001400Kakkar JatinNo ratings yet

- Invoice M112107253847639592Document1 pageInvoice M112107253847639592Harshal BhattNo ratings yet

- Invoice Cum Bill of Supply: FNP E Retail Private LimitedDocument1 pageInvoice Cum Bill of Supply: FNP E Retail Private LimitedVishNo ratings yet

- Order Confirmation - OC00001 - 2022-09-27Document1 pageOrder Confirmation - OC00001 - 2022-09-27Anil BiswalNo ratings yet

- Sidel DL 042Document1 pageSidel DL 042cnanda89No ratings yet

- Bom 487Document1 pageBom 487Roop HariaNo ratings yet

- UntitledDocument1 pageUntitledSanket JadhavNo ratings yet

- AuwmDocument1 pageAuwmNishanthNo ratings yet

- 4087219755Document1 page4087219755devta1111No ratings yet

- InvoiceDocument1 pageInvoiceMohit SharmaNo ratings yet

- InvertedDocument2 pagesInvertedShrikant KeskarNo ratings yet

- Modular Kitchen InvoiceDocument1 pageModular Kitchen InvoiceShubham MishraNo ratings yet

- Invoice M112401146424004498Document2 pagesInvoice M112401146424004498SubhajitNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFagam sai sidarNo ratings yet

- Handout 018Document1 pageHandout 018Caryl May Esparrago MiraNo ratings yet

- What Is Stablecoin?: A Survey On Its Mechanism and Potential As Decentralized Payment SystemsDocument18 pagesWhat Is Stablecoin?: A Survey On Its Mechanism and Potential As Decentralized Payment SystemsSAECTARNo ratings yet

- IPP Rating MethodologyDocument9 pagesIPP Rating MethodologyRana Naeem AhmedNo ratings yet

- Admission of A Partner: Namma KalviDocument15 pagesAdmission of A Partner: Namma KalviAakaash C.K.No ratings yet

- Chapter 1: Introduction To The Study of GlobalizationDocument80 pagesChapter 1: Introduction To The Study of GlobalizationAshton Travis HawksNo ratings yet

- AKL P6-2 Achmad Faizal AzmiDocument5 pagesAKL P6-2 Achmad Faizal AzmiTiara Eva Tresna100% (1)

- Introduction To Government AccountingDocument34 pagesIntroduction To Government AccountingAnnamae Teoxon100% (1)

- D. All of ThemDocument6 pagesD. All of ThemRyan CapistranoNo ratings yet

- Assignment 1Document2 pagesAssignment 1georgeNo ratings yet

- 1-Conceptual Framework SummaryDocument11 pages1-Conceptual Framework Summaryyen yenNo ratings yet

- BNIS Short Notes: TP: IDR 1,200Document5 pagesBNIS Short Notes: TP: IDR 1,200Tarisya PermatasariNo ratings yet

- General Growth Properties' Full PetitionDocument63 pagesGeneral Growth Properties' Full PetitionDealBook100% (2)

- ACT3110 - Accounting For Revenue and Expenses - Accounting Process Part II (S)Document34 pagesACT3110 - Accounting For Revenue and Expenses - Accounting Process Part II (S)amirah1999No ratings yet

- Ratio Analysis: Interpretation of Financial Statements: 1) Profitability RatiosDocument4 pagesRatio Analysis: Interpretation of Financial Statements: 1) Profitability RatiosCollen MahamboNo ratings yet

- Role of Merchant BanksDocument20 pagesRole of Merchant BanksSai Bhaskar Kannepalli100% (1)

- Sole Proprietorship Quiz Bee1Document5 pagesSole Proprietorship Quiz Bee1Dethzaida AsebuqueNo ratings yet

- Ketan Parekh ScamDocument2 pagesKetan Parekh Scamrehan husainNo ratings yet

- Week 3 SolutionsDocument7 pagesWeek 3 Solutionschi_nguyen_100No ratings yet

- Angelo - Chapter 10 Operating LeaseDocument8 pagesAngelo - Chapter 10 Operating LeaseAngelo Andro Suan100% (1)

- Course OtamDocument4 pagesCourse Otamkam456No ratings yet

- Research Proposal: Changes in Oil Prices and Their Impact On Emerging Markets ReturnsDocument11 pagesResearch Proposal: Changes in Oil Prices and Their Impact On Emerging Markets ReturnsMehran Arshad100% (1)

- List of Standard Reports in Oracle EBSDocument17 pagesList of Standard Reports in Oracle EBSJilani Shaik100% (1)

- FABM2 LESSON 3 Statement of Changes in EquityDocument4 pagesFABM2 LESSON 3 Statement of Changes in EquityArjay CorderoNo ratings yet

- Guidelines For TDS Deduction On Purchase of Immovable PropertyDocument4 pagesGuidelines For TDS Deduction On Purchase of Immovable Propertymib_santoshNo ratings yet

- Public Provident Fund Scheme 1968: Salient FeaturesDocument16 pagesPublic Provident Fund Scheme 1968: Salient FeaturesjyottsnaNo ratings yet

- BPS Research Paper On NordstromDocument17 pagesBPS Research Paper On NordstromelizabethvuNo ratings yet

- Pac App A0000839186 20191016024434 Gcc96syfcqjshlahqyxyzrcjkgsevds2xk5attrpqsDocument4 pagesPac App A0000839186 20191016024434 Gcc96syfcqjshlahqyxyzrcjkgsevds2xk5attrpqsJonas DanielNo ratings yet

- Presentation For AO IIDocument103 pagesPresentation For AO IIClerica Realingo100% (1)

- Islamic Indices: Oil and Gas Tradable Sector Index (OGTI)Document2 pagesIslamic Indices: Oil and Gas Tradable Sector Index (OGTI)Talha Iftekhar KhanNo ratings yet