Professional Documents

Culture Documents

TldEdURCaElod0FGVE12NldQL2l6Zz09 Invoice

Uploaded by

Pratyush kumar NayakOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TldEdURCaElod0FGVE12NldQL2l6Zz09 Invoice

Uploaded by

Pratyush kumar NayakCopyright:

Available Formats

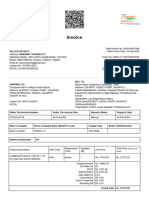

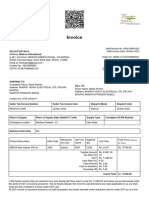

Invoice

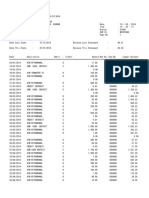

GeM Invoice No: GEM-40589162

SELLER DETAILS: GeM Invoice Date: 27-Feb-2024

Address: KARAN TRADING CO.

17/87 BLOCK-17, NEAR JALEBI CHOWK, KALYAN PURI, Order No: GEMC-511687717203899

NEW DELHI, DELHI, 110091 Order Date: 23-Feb-2024

Email Id: karantrading003@gmail.com

Contact No : 09958164150

GSTIN: 07CHOPK0407N1Z3 Click here to download seller invoice

BILL TO:

SHIPPING TO: Buyer Name: Hatakishore Dandapat , Nazir

Consignee Name: Aditya Prasad Sahoo Address: DISTRICT JUDGE COURT, GAJAPATI,

Address: DISTRICT JUDGE COURT, GAJAPATI, PARALAKHEMUNDI, ODISHA. Gajapati ODISHA 761200 Law

PARALAKHEMUNDI, ODISHA. GAJAPATI Department Odisha District Judge,Gajapati, Paralakhemundi,

ODISHA 761200 GSTIN:

Department: Law Department Odisha

Contact No: 06815-222824- Office Zone:DISTRICT JUDGE COURT GAJAPATI

GSTIN: PARALAKHEMUNDI

Organisation: District Judge,Gajapati, Paralakhemundi,

Seller Tax Invoice Number Seller Tax Invoice Date Dispatch Mode Dispatch Date

823 26-Feb-2024 Manual 27-Feb-2024

Place of Supply Place of Supply State (State/UT Code) Supply Type Buyer GSTIN Number

Buyer Location Delhi / 07 Intra-State

Delivery Instruction NA

Measuremen Supplied Total Price inclusive all

Product Description HSN Code Unit Price

t Unit Qty Taxes

Unbranded Unbranded Pasting file

4820 pieces 30 Rs. 120.00 Rs. 3600.00

suitable for Foolscap paper

Taxable Amount Rs. 3050.85

Tax Rate (%) 18

CGST Rs. 274.58

SGST/UTGST Rs. 274.58

Cess Rate (%) 0.00

Cess Amount Rs. 0.00

Cess in Quantum Rs. 0.00

Rounding Off Rs. -0.01

Grand Total Rs. 3600.00

I /We hereby declare that our firm/company has been specifically excluded from the requirement to comply with GST e-invoicing

provisions vide Notification number 13/2020-Central Tax dated 21 March 2020, as amended up to date. Accordingly, at present,

we are not covered under the ambit of GST e-invoicing provisions. We do hereby declare that once the said provisions are made

applicable to us, we shall issue the duly complied e-Invoice under GST Law.

All GST invoice or document issued by us shall be properly and timely reported under respective returns under GST by us in line

with the notified provisions and the applicable tax collected from Buyer shall be timely and correctly paid to the respective

Government by us.

In case the Input Tax Credit of GST is denied or demand is recovered from Buyer on account of any act/ omission of us in this

regard, we shall be liable in respect of all claims of tax, penalty and/or interest, loss, damages, costs, expenses and liability that

may arise due to such non-compliance. Buyer shall have the right to recover such amount from any payments due to us or from

Performance Security, or any other legal recourse from us.

INK SIGNED SIGNATURES ARE NOT REQUIRED IN SYSTEM GENERATED DOCUMENTS

You might also like

- ZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoiceDocument2 pagesZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoicePratyush kumar NayakNo ratings yet

- Gem InvoiceDocument2 pagesGem InvoicenimaygabaNo ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- InvoiceDocument1 pageInvoicerajesh sNo ratings yet

- OVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceDocument2 pagesOVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceLakshaya EnterprisesNo ratings yet

- L0JJYm1iUlAzNDUvRE1tektJQnlqZz09 InvoiceDocument2 pagesL0JJYm1iUlAzNDUvRE1tektJQnlqZz09 Invoicemankari.kamal.18022963No ratings yet

- PASTDocument2 pagesPASTpatel harshadNo ratings yet

- Canon Printer InvoiceDocument2 pagesCanon Printer InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- AThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceDocument2 pagesAThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceRobin singhNo ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- dkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceDocument2 pagesdkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceAkash ChoudharyNo ratings yet

- eWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceDocument2 pageseWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceRuskin S. KhadirahNo ratings yet

- Sudev Podder 084Document1 pageSudev Podder 084ssd dNo ratings yet

- MnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceDocument2 pagesMnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceInclusive Education BranchNo ratings yet

- RzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceDocument2 pagesRzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceInclusive Education BranchNo ratings yet

- eEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceDocument2 pageseEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceAsad ShakilNo ratings yet

- V3NHaGM2NCtsTm5kNmpwQnhBekVzQT09 InvoiceDocument2 pagesV3NHaGM2NCtsTm5kNmpwQnhBekVzQT09 InvoiceOmkar DaveNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Abhisek KumarNo ratings yet

- NXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceDocument2 pagesNXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceInclusive Education BranchNo ratings yet

- XELNZJYE8JLNDocument1 pageXELNZJYE8JLNAkshayNo ratings yet

- RSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceDocument2 pagesRSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceRavi Kant RohillaNo ratings yet

- Bom 487Document1 pageBom 487Roop HariaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)KamakshiNo ratings yet

- Invoice - 282 EnHDocument4 pagesInvoice - 282 EnHPriyank PawarNo ratings yet

- Output CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionDocument1 pageOutput CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionmadhurNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Screenshot 2022-08-24 at 8.11.05 PMDocument2 pagesScreenshot 2022-08-24 at 8.11.05 PMutkarshNo ratings yet

- Invoice: Seller Details: Private LimitedDocument2 pagesInvoice: Seller Details: Private LimitedHusain KanchwalaNo ratings yet

- 1 PDFDocument1 page1 PDFAkshay Kumar swamiNo ratings yet

- FingerprintDocument1 pageFingerprintatulkumar72960No ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnjani KumariNo ratings yet

- SmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceDocument2 pagesSmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceJitender NarulaNo ratings yet

- MST 1295Document1 pageMST 1295digital lifeNo ratings yet

- InvoiceDocument1 pageInvoicelatest updateNo ratings yet

- Dans & DehorsDocument1 pageDans & DehorsBhavin MehtaNo ratings yet

- Tax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Document1 pageTax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Abhinaya JoNo ratings yet

- Vvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceDocument2 pagesVvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherUttam PurohitNo ratings yet

- 8476 Art Street NewDocument1 page8476 Art Street Newf4m0uqb2riNo ratings yet

- Securitas Engineers: Buyer: ConsigneeDocument1 pageSecuritas Engineers: Buyer: Consigneesvarn groupNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnil KumarNo ratings yet

- Invoice - No - 1146 - DT - 27102022 Original For RecipientDocument1 pageInvoice - No - 1146 - DT - 27102022 Original For RecipientAshwani SharmaNo ratings yet

- Tax Invoice: Rebel Enterprise 1325/18-19 4-Jan-2019Document2 pagesTax Invoice: Rebel Enterprise 1325/18-19 4-Jan-2019HARDIK PATELNo ratings yet

- Bill Format Gypusm BoardDocument8 pagesBill Format Gypusm BoardRamachandra SahuNo ratings yet

- GEMC-511687720852142 Invoice PDFDocument2 pagesGEMC-511687720852142 Invoice PDFrip111176No ratings yet

- Tax Invoice: United Squares PVT - Ltd. (Hyd) From 1-Apr-2017Document1 pageTax Invoice: United Squares PVT - Ltd. (Hyd) From 1-Apr-2017AthahNo ratings yet

- Shree Chenaramjee Fancy Electric & Hardware Store: CGST SGSTDocument1 pageShree Chenaramjee Fancy Electric & Hardware Store: CGST SGSTDr. Shashank RkNo ratings yet

- Taco 231231PF01010312Document1 pageTaco 231231PF01010312aanchalpatelNo ratings yet

- Book IpmDocument1 pageBook Ipmoscar sicomNo ratings yet

- RzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoiceDocument1 pageRzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoicePratyush kumar NayakNo ratings yet

- Ruby Hall InvoiceDocument3 pagesRuby Hall InvoiceRanvir RajputNo ratings yet

- Tax Invoice: State Name: Uttarakhand, Code: 05 Place of Supply: UttarakhandDocument1 pageTax Invoice: State Name: Uttarakhand, Code: 05 Place of Supply: UttarakhandSANJAY PRAKASHNo ratings yet

- Tax Invoice: State Name: Maharashtra, Code: 27Document1 pageTax Invoice: State Name: Maharashtra, Code: 27Kunj KariaNo ratings yet

- Hindustan HardwareDocument1 pageHindustan HardwareKunj KariaNo ratings yet

- Tax Invoice: State Name: Maharashtra, Code: 27Document1 pageTax Invoice: State Name: Maharashtra, Code: 27Kunj KariaNo ratings yet

- Rajender ShopDocument1 pageRajender ShopKunj KariaNo ratings yet

- Tax Invoice: State Name: Maharashtra, Code: 27Document1 pageTax Invoice: State Name: Maharashtra, Code: 27Kunj KariaNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherAvijitSinharoyNo ratings yet

- UBITX V6 MainDocument15 pagesUBITX V6 MainEngaf ProcurementNo ratings yet

- LT1256X1 - Revg - FB1300, FB1400 Series - EnglishDocument58 pagesLT1256X1 - Revg - FB1300, FB1400 Series - EnglishRahma NaharinNo ratings yet

- TP1743 - Kertas 1 Dan 2 Peperiksaan Percubaan SPM Sains 2023-20243Document12 pagesTP1743 - Kertas 1 Dan 2 Peperiksaan Percubaan SPM Sains 2023-20243Felix ChewNo ratings yet

- Business Testimony 3Document14 pagesBusiness Testimony 3Sapan BanerjeeNo ratings yet

- Lenskart SheetDocument1 pageLenskart SheetThink School libraryNo ratings yet

- Tendernotice 1Document42 pagesTendernotice 1Hanu MittalNo ratings yet

- Majalah Remaja Islam Drise #09 by Majalah Drise - Issuu PDFDocument1 pageMajalah Remaja Islam Drise #09 by Majalah Drise - Issuu PDFBalqis Ar-Rubayyi' Binti HasanNo ratings yet

- Heat TreatmentsDocument14 pagesHeat Treatmentsravishankar100% (1)

- Document 3Document3 pagesDocument 3AdeleNo ratings yet

- Assessment 21GES1475Document4 pagesAssessment 21GES1475kavindupunsara02No ratings yet

- C Sharp Logical TestDocument6 pagesC Sharp Logical TestBogor0251No ratings yet

- SemiDocument252 pagesSemiGNo ratings yet

- QG To AIS 2017 PDFDocument135 pagesQG To AIS 2017 PDFMangoStarr Aibelle VegasNo ratings yet

- MCS Valve: Minimizes Body Washout Problems and Provides Reliable Low-Pressure SealingDocument4 pagesMCS Valve: Minimizes Body Washout Problems and Provides Reliable Low-Pressure SealingTerry SmithNo ratings yet

- Digital Documentation Class 10 NotesDocument8 pagesDigital Documentation Class 10 NotesRuby Khatoon86% (7)

- Bank Statement SampleDocument6 pagesBank Statement SampleRovern Keith Oro CuencaNo ratings yet

- Dreamweaver Lure v. Heyne - ComplaintDocument27 pagesDreamweaver Lure v. Heyne - ComplaintSarah BursteinNo ratings yet

- Purchases + Carriage Inwards + Other Expenses Incurred On Purchase of Materials - Closing Inventory of MaterialsDocument4 pagesPurchases + Carriage Inwards + Other Expenses Incurred On Purchase of Materials - Closing Inventory of MaterialsSiva SankariNo ratings yet

- MEMORANDUMDocument8 pagesMEMORANDUMAdee JocsonNo ratings yet

- Health, Safety & Environment: Refer NumberDocument2 pagesHealth, Safety & Environment: Refer NumbergilNo ratings yet

- QuizDocument11 pagesQuizDanica RamosNo ratings yet

- GATE General Aptitude GA Syllabus Common To AllDocument2 pagesGATE General Aptitude GA Syllabus Common To AllAbiramiAbiNo ratings yet

- Ramp Footing "RF" Wall Footing-1 Detail: Blow-Up Detail "B"Document2 pagesRamp Footing "RF" Wall Footing-1 Detail: Blow-Up Detail "B"Genevieve GayosoNo ratings yet

- Capsule Research ProposalDocument4 pagesCapsule Research ProposalAilyn Ursal80% (5)

- Guidelines Use of The Word AnzacDocument28 pagesGuidelines Use of The Word AnzacMichael SmithNo ratings yet

- Bea Form 7 - Natg6 PMDocument2 pagesBea Form 7 - Natg6 PMgoeb72100% (1)

- Paul Milgran - A Taxonomy of Mixed Reality Visual DisplaysDocument11 pagesPaul Milgran - A Taxonomy of Mixed Reality Visual DisplaysPresencaVirtual100% (1)

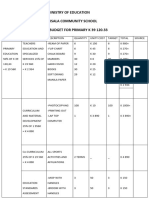

- Ministry of Education Musala SCHDocument5 pagesMinistry of Education Musala SCHlaonimosesNo ratings yet

- Soneri Bank Compensation PolicyDocument20 pagesSoneri Bank Compensation PolicySapii Mandhan100% (1)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (98)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersFrom EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersNo ratings yet

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooFrom EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooRating: 5 out of 5 stars5/5 (2)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Secrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global EliteFrom EverandSecrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global EliteRating: 4.5 out of 5 stars4.5/5 (6)

- International Business Law: Cases and MaterialsFrom EverandInternational Business Law: Cases and MaterialsRating: 5 out of 5 stars5/5 (1)

- Contract Law in America: A Social and Economic Case StudyFrom EverandContract Law in America: A Social and Economic Case StudyNo ratings yet

- The Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomFrom EverandThe Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomRating: 4.5 out of 5 stars4.5/5 (2)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Side Hustles for Dummies: The Key to Unlocking Extra Income and Entrepreneurial Success through Side HustlesFrom EverandSide Hustles for Dummies: The Key to Unlocking Extra Income and Entrepreneurial Success through Side HustlesNo ratings yet

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (34)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)