Professional Documents

Culture Documents

eEN1ZXRDVVllM214T0dqM1QxcjZjQT09 Invoice

Uploaded by

Asad ShakilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

eEN1ZXRDVVllM214T0dqM1QxcjZjQT09 Invoice

Uploaded by

Asad ShakilCopyright:

Available Formats

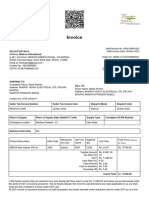

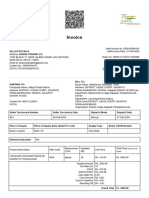

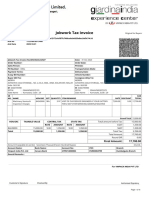

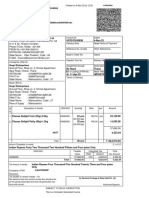

Invoice

GeM Invoice No: GEM-34676135

GeM Invoice Date: 19-Sep-2023

SELLER DETAILS:

Address: SHREE SHYAM ENTERPRISES

Order No: GEMC-511687764561862

180A, BHUPALPURA, Udaipur, RAJASTHAN, 313001

Order Date: 08-Sep-2023

Email Id: sse.udr@gmail.com

Contact No : 09414167113

GSTIN: 08ABIPB9204C1Z4

Click here to download seller invoice

BILL TO:

Buyer Name: Bhagchand Narania , Manager

SHIPPING TO: Address: INDIAN OIL CORPORATION LIMITED, LPG BP

Consignee Name: Bhagchand Narania -Gorakhpur, Gorakhpur Industrial Area, Sector 15, Near Village

Address: INDIAN OIL CORPORATION LIMITED, LPG BP Judian, Tahshil Sahjanwa, Gorakhpur Gorakhpur UTTAR

-Gorakhpur, Gorakhpur Industrial Area, Sector 15, Near Village PRADESH 273209 INDIAN OIL CORPORATION LIMITED

Judian, Tahshil Sahjanwa, Gorakhpur GORAKHPUR INDIAN OIL Corporation Limited

UTTAR PRADESH 273209 Department: INDIAN OIL CORPORATION LIMITED

Office Zone:GORAKHPUR BOTTLING PLANT

Organisation: INDIAN OIL Corporation Limited

Ministry: Ministry of Petroleum and Natural Gas

Seller Tax Invoice Number Seller Tax Invoice Date Dispatch Mode Dispatch Date

SSE/23-24/273 18-Sep-2023 Courier 18-Sep-2023

Type of Transport Tracking No Tracking URL Type & No of Packages

- SSE/23-24/273 Click here for tracking Box 4

Place of Supply Place of Supply State (State/UT Code) Supply Type Consignee GSTIN Number

Consignee Location Uttar Pradesh / 09 Inter-State

Delivery Instruction Please deliver material as soon as possible(within 15 days) due to requirement at location.

Measuremen Supplied Total Price inclusive all

Product Description HSN Code Unit Price

t Unit Qty Taxes

hp Intel Core i5 10400 8 GB/ 500 GB

84715000 pieces 2 Rs. 51890.00 Rs. 103780.00

HDD/ Windows 10 Professional

Taxable Amount Rs. 87949.15

Tax Rate (%) 18

IGST Rs. 15830.85

Cess Rate (%) 0.00

Cess Amount Rs. 0.00

Cess in Quantum Rs. 0.00

Rounding Off Rs. 0.00

Grand Total Rs. 103780.00

I/We hereby declare that we are covered under the ambit of GST e-invoicing provisions and therefore the invoices, debit notes,

credit notes or any other prescribed document under e-invoicing issued/raised by us duly complies with the notified e-invoicing

provisions

Further, any invoice or document issued by us shall be properly and timely reported under respective returns under GST by us in

line with the notified provisions and the applicable tax collected from Buyer shall be timely and correctly paid to the respective

Government by us.

In case the Input Tax Credit of GST is denied or demand is recovered from Buyer on account of any act/omission of us in this

regard, we shall be liable in respect of all claims of tax, penalty and/or interest, loss, damages, costs, expenses and liability that

may arise due to such non-compliance. Buyer shall have the right to recover such amount from any payments due to us or from

Performance Security, or any other legal recourse from us.

INK SIGNED SIGNATURES ARE NOT REQUIRED IN SYSTEM GENERATED DOCUMENTS

You might also like

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- AThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceDocument2 pagesAThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceRobin singhNo ratings yet

- Canon Printer InvoiceDocument2 pagesCanon Printer InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- RzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceDocument2 pagesRzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceInclusive Education BranchNo ratings yet

- Gem InvoiceDocument2 pagesGem InvoicenimaygabaNo ratings yet

- GEMC-511687720852142 Invoice PDFDocument2 pagesGEMC-511687720852142 Invoice PDFrip111176No ratings yet

- GEM Invoice for Signage BoardsDocument2 pagesGEM Invoice for Signage BoardsInclusive Education BranchNo ratings yet

- InvoiceDocument1 pageInvoicerajesh sNo ratings yet

- NXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceDocument2 pagesNXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceInclusive Education BranchNo ratings yet

- TldEdURCaElod0FGVE12NldQL2l6Zz09 InvoiceDocument2 pagesTldEdURCaElod0FGVE12NldQL2l6Zz09 InvoicePratyush kumar NayakNo ratings yet

- eWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceDocument2 pageseWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceRuskin S. KhadirahNo ratings yet

- OVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceDocument2 pagesOVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceLakshaya EnterprisesNo ratings yet

- PASTDocument2 pagesPASTpatel harshadNo ratings yet

- Invoice for 10 HP laptops under Rs. 428,000Document2 pagesInvoice for 10 HP laptops under Rs. 428,000aryandjNo ratings yet

- Complition of Various DeliveryDocument22 pagesComplition of Various Deliverydipak kambleNo ratings yet

- Vvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceDocument2 pagesVvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- dkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceDocument2 pagesdkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceAkash ChoudharyNo ratings yet

- Eshwar Tradesr..Document1 pageEshwar Tradesr..ANAND KAGALENo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Tax Invoice for Godown FumigationDocument1 pageTax Invoice for Godown FumigationAnonymous rNqW9p3No ratings yet

- GeM InvoiceDocument2 pagesGeM Invoicemankari.kamal.18022963No ratings yet

- InvoiceDocument2 pagesInvoiceMukesh ChoudharyNo ratings yet

- Tax Invoice Footwear SaleDocument1 pageTax Invoice Footwear SaleRashid KhanNo ratings yet

- Print Invoice Old - PHPDocument1 pagePrint Invoice Old - PHPDishank RastogiNo ratings yet

- CG04NH9088 EndorsementDocument2 pagesCG04NH9088 EndorsementSiddhantNo ratings yet

- Tax Invoice DetailsDocument1 pageTax Invoice DetailsSANJAY PRAKASHNo ratings yet

- Tax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraDocument1 pageTax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraSHANTANU PATHAKNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)KamakshiNo ratings yet

- Excise Invoice 213Document4 pagesExcise Invoice 213Anonymous rNqW9p3No ratings yet

- Gemc 511687709712217 21052022Document3 pagesGemc 511687709712217 21052022Robin singhNo ratings yet

- Tax Invoice: RD Service - 1 998314 1 375.00 375.00 0.00 375.00 CGST 9% SGST 9% 33.75 33.75Document1 pageTax Invoice: RD Service - 1 998314 1 375.00 375.00 0.00 375.00 CGST 9% SGST 9% 33.75 33.75Abdul mobeenNo ratings yet

- 5500004155Document4 pages5500004155arvind.tiwariNo ratings yet

- Modular Kitchen InvoiceDocument1 pageModular Kitchen InvoiceShubham MishraNo ratings yet

- Morph Ser202324027 31102023 277Document6 pagesMorph Ser202324027 31102023 277gokulpics1No ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherDIPL MUMBAINo ratings yet

- Ramesh Verma PDFDocument2 pagesRamesh Verma PDFPankajNo ratings yet

- 9.refund VoucherDocument18 pages9.refund VoucherSamrat ManchekarNo ratings yet

- Securitas Engineers: Buyer: ConsigneeDocument1 pageSecuritas Engineers: Buyer: Consigneesvarn groupNo ratings yet

- Byers Bill ProcessDocument3 pagesByers Bill Processtarun pandeyNo ratings yet

- Purchase OrderDocument6 pagesPurchase OrderMANGAL MUNSHINo ratings yet

- Painting Buck - SPM Tech PDFDocument2 pagesPainting Buck - SPM Tech PDFmanoprasath1989No ratings yet

- Tax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacDocument1 pageTax Invoice: Description of Goods Amount Per Rate Quantity Hsn/Sacanshagrawal0000No ratings yet

- ZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoiceDocument2 pagesZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoicePratyush kumar NayakNo ratings yet

- Sudev Podder 084Document1 pageSudev Podder 084ssd dNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherAvijitSinharoyNo ratings yet

- Dashmesh Tractors and Farm EquipmentsDocument2 pagesDashmesh Tractors and Farm EquipmentsdashmeshNo ratings yet

- SmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceDocument2 pagesSmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceJitender NarulaNo ratings yet

- Tax Invoice: Pest Kare (India) PVT - LTDDocument1 pageTax Invoice: Pest Kare (India) PVT - LTDAnonymous rNqW9p3No ratings yet

- Description of Goods Amount Per Rate Quantity Hsn/Sac: Authorised SignatoryDocument2 pagesDescription of Goods Amount Per Rate Quantity Hsn/Sac: Authorised Signatorygaurav tanwarNo ratings yet

- InvoiceDocument1 pageInvoiceAɓʜɩ's Fɭʌsʜ GʌɱɩŋgNo ratings yet

- Invoice No.62 BBM (Foundation Bolts)Document2 pagesInvoice No.62 BBM (Foundation Bolts)sales.saimedhaNo ratings yet

- InvoiceDocument1 pageInvoiceChora SinghNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Abhisek KumarNo ratings yet

- PowerbankDocument1 pagePowerbankMynameis lakhanNo ratings yet

- Dans & DehorsDocument1 pageDans & DehorsBhavin MehtaNo ratings yet

- Gemc 511687704270302 02082022Document4 pagesGemc 511687704270302 02082022sdfgdfsgdNo ratings yet

- Gemc 511687707603277 19102022Document3 pagesGemc 511687707603277 19102022abhay 247No ratings yet

- GOGRIDocument1 pageGOGRIvineetNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Analysis of Financial Products & Its Distribution Channels inDocument4 pagesAnalysis of Financial Products & Its Distribution Channels inrajiv937No ratings yet

- ImitatingDocument2 pagesImitatingعبد القادر عماد100% (2)

- Change Management in Hewlett Packard & Role of Carly FiorinaDocument38 pagesChange Management in Hewlett Packard & Role of Carly FiorinaSunil KatalNo ratings yet

- Lean Manufacturing Just-In-TimeDocument26 pagesLean Manufacturing Just-In-TimeTạ Ngọc HuyNo ratings yet

- CO CPTD JPN Perform Template Allocation-CollectiveDocument20 pagesCO CPTD JPN Perform Template Allocation-Collectivenguyencaohuy0% (1)

- GB921-B Business Process Framework 7-0 - V7-1 (63 Pages)Document63 pagesGB921-B Business Process Framework 7-0 - V7-1 (63 Pages)Eric YANKAMNo ratings yet

- Soal + JawabDocument4 pagesSoal + JawabNaim Kharima Saraswati100% (1)

- Indian Labour Law - Wikipedia, The Free EncyclopediaDocument13 pagesIndian Labour Law - Wikipedia, The Free EncyclopediaKailash DhirwaniNo ratings yet

- Housing.comDocument5 pagesHousing.comSrikant SharmaNo ratings yet

- Process Audit ChecklistDocument15 pagesProcess Audit Checklistmulachu100% (1)

- Vegan Meat Sales and Profit Analysis 2021Document13 pagesVegan Meat Sales and Profit Analysis 2021kavya guptaNo ratings yet

- MuhammadFasieh - KIWI ShoeDocument6 pagesMuhammadFasieh - KIWI ShoeErfan MirxaNo ratings yet

- Intangible AssetsDocument32 pagesIntangible AssetsRichard RajaNo ratings yet

- Travel Agent HandbookDocument380 pagesTravel Agent HandbookDDLRVNo ratings yet

- Certification in Business Data Analytics Handbook: The Iiba® Guide To Pursuing The Iiba®-CbdaDocument7 pagesCertification in Business Data Analytics Handbook: The Iiba® Guide To Pursuing The Iiba®-CbdaJeezNo ratings yet

- Financial Leasing RegulationsDocument30 pagesFinancial Leasing RegulationsZaminNo ratings yet

- Synopsis Consumer Perception Towards Amul ProductsDocument10 pagesSynopsis Consumer Perception Towards Amul ProductsMansha BhatNo ratings yet

- Marketing Team Goals and ObjectivesDocument3 pagesMarketing Team Goals and Objectivesankitshah21No ratings yet

- Worksheet - 1 Unit 1 - Accounting For Partnership Firm Chapter 4 - Admission of A PartnerDocument14 pagesWorksheet - 1 Unit 1 - Accounting For Partnership Firm Chapter 4 - Admission of A PartnerRica Jane LlorenNo ratings yet

- IDIC CRM Model Stages ExplainedDocument12 pagesIDIC CRM Model Stages ExplainedBhosx KimNo ratings yet

- ASCROMDocument2 pagesASCROMbinalamitNo ratings yet

- Living Goods Advert Project ManagerDocument4 pagesLiving Goods Advert Project ManagerSANDRA NAMAROMENo ratings yet

- Ventum Announces Series A Funding, New HQ in Utah, & Plans To ExpandDocument2 pagesVentum Announces Series A Funding, New HQ in Utah, & Plans To ExpandPR.comNo ratings yet

- Hany Mekky Finance Manager NewDocument4 pagesHany Mekky Finance Manager NewHany Ahmed MakyNo ratings yet

- Shruti OberoiDocument4 pagesShruti OberoiManuj OberoiNo ratings yet

- Banking Regulations in The PhilippinesDocument36 pagesBanking Regulations in The PhilippinesEmerlyn Charlotte Fonte100% (1)

- LIC Project ReportDocument76 pagesLIC Project ReportAkhilesh Badola100% (1)

- BPO KPO Guide Explaining Business Process and Knowledge Process OutsourcingDocument19 pagesBPO KPO Guide Explaining Business Process and Knowledge Process OutsourcingRuchita MehtaNo ratings yet

- Kotler CPT1 14e RevisedDocument36 pagesKotler CPT1 14e RevisedAsif ZicoNo ratings yet

- ArmaniDocument5 pagesArmanichinmaya.parija100% (2)