Professional Documents

Culture Documents

Niva HA SS v2

Uploaded by

Phunsukh WangduOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Niva HA SS v2

Uploaded by

Phunsukh WangduCopyright:

Available Formats

A comprehensive Personal Accident Cover

from Niva Bupa

AT NIVA BUPA. WE FEEL THAT ANY INSURANCE

YOU BUY SHOULD GIVE YOU PEACE OF MIND

IRRESPECTIVE OF YOUR AGE. PLAN OR ANY

OTHER FACTOR. HERE ARE THE KEY REASONS

ON WHY YOU SHOULD CHOOSE A NIVA BUPA

POLICY.

For your family’s health insurance, Call: 1860-500-8888

or visit www.nivabupa.com

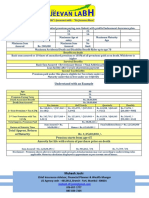

BENEFITS

PERSONAL ACCIDENTAL POLICY (All figures in Rs.)

Entry Age 18 years to 65 years & Dependent Children 2 - 21 yrs;

Max 2 children

Policy Tenure 1/2/3 Years

Premium Discount for 2 years and 3 years 12.5% & 15% Respectively

Sum Insured - 1 Adult 25 Lacs 30 Lacs 50 Lacs

Premium for 3 year (Inc. GST) 9,216 11,140 18,503

Premium for 3 year (Plus TTD) 10,238 12,162 19,525

Premium for 3 year (Plus TTD & AH) 11,936 14,200 22,582

Plan benefits and features (All figures in Rs.)

Accidental Death (100% Sum Insured) 2,500,000 3,000,000 5,000,000

Permanent Total Disability (125% Sum Insured) 3,125,000 3,750,000 6,250,000

Permanent Partial Disability (Upto 100% Sum Insured) 2,500,000 3,000,000 5,000,000

Child Education Benefit 5% of Sum 5% of Sum 5% of Sum

Insured Insured Insured

Funeral Expenses 5,000 50,000 50,000

Optional Benefits available under Accident Care# (All figures in Rs.)

Temporary Total Disability (TTD)* Sum Insured 1,000,000 2,000,000

available

TTD Benefits 1% of Sum Insured (SI) per week, Max upto 100 weeks

TTD Sum Insured (SI) not to exceed 2 times of annual income

Acidental Hospitalisation (In india only) 2% of Accident care Sum Insured

Surgical Operations

Nursing Care, Drugs and Surgical Dressing

Medical Practioner's/ Surgeon's Fee

Room Rent

Operation Theater Charges Covered Upto Accident Hospitalisation Limit

Anesthetics Fee (Including Administration)

X-Ray Examnination or Treatment's (Including CT)

Diagnostic's Procedures and Therapies

Prosthetic Implant

Emergency Ambulance Limited to Rs. 2,000 per claim

Physiotherapy Limited to 10% of Accidental Hospitalisation Limit

PREMIUM

Entry Age - 18 - 65 Years (All figures in Rs.)

PA 1 Adult 2 Adult 2A + 2C

Cover 1Y 2Y 3Y 1Y 2Y 3Y 1Y 2Y 3Y

25 Lacs 3,382 6,341 9,216 5,205 9,759 14,184 5,205 9,759 14,184

30 Lacs 4,088 7,665 11,140 6,040 11,325 16,459 6,040 11,325 16,459

50 Lacs 6,790 12,731 18,503 8,821 16,539 24,037 8,821 16,539 24,037

Disclaimer: : Insurance is a subject matter of solicitation. Niva Bupa Health Insurance Company Limited (formerly known as Max Bupa Health Insurance Company Limited) (IRDAI Registration No. 145).

‘Bupa’ and ‘HEARTBEAT’ logo are registered trademarks of their respective owners and are being used by Niva Bupa Health Insurance Company Limited under license. Registered office:- C-98, First Floor,

Lajpat Nagar, Part 1, New Delhi-110024; For more details on terms and conditions, exclusions, risk factors, waiting period & benefits, please read sales brochure carefully before concluding a sale. CIN No,

U66000DL2008PLC182918, Website: www.nivabupa.com. Fax: +91 11 30902010. Helpline: 1860- 500 -8888. Product Name : Health Assurance, Product UIN No.: IRDAI/HLT/MBHI/PH/V.II/175/2016-17, UIN No.:

NB/SS/CA/2021-22/373. Optional Benefits are available on payment ofadditional premium. *Source: Report published by Ministry of Road Transport & Highways Government of India. #This is a benefit in Health

Assure product.

You might also like

- Health Assurance BrochureDocument2 pagesHealth Assurance BrochureDhaval PatelNo ratings yet

- Comparison Quote - GPADocument7 pagesComparison Quote - GPAvisheshNo ratings yet

- Medicare BrochureDocument8 pagesMedicare Brochuresudhanshu RanjanNo ratings yet

- Koti Personal Accident Leaflet - Round3 - Final - Highraise - 221214 - 153052Document4 pagesKoti Personal Accident Leaflet - Round3 - Final - Highraise - 221214 - 153052nirav56No ratings yet

- CeylincoQuoteDocument3 pagesCeylincoQuotejulani pabasariNo ratings yet

- Complete The Puzzle of Your Family Health With: HDFC Ergo Group Health InsuranceDocument2 pagesComplete The Puzzle of Your Family Health With: HDFC Ergo Group Health InsuranceChiranjit SahaNo ratings yet

- ReportDocument5 pagesReportvinaykumar333777No ratings yet

- 7000054772Document18 pages7000054772binitasinha100No ratings yet

- Key Features and Benefits of ICICI Pru iProtect SmartDocument4 pagesKey Features and Benefits of ICICI Pru iProtect SmartQualityCare InternationalNo ratings yet

- Youngstar - One Pager PDFDocument1 pageYoungstar - One Pager PDFRickyNo ratings yet

- HEALTH INFINITY Plan ONE PagerDocument3 pagesHEALTH INFINITY Plan ONE PagerVikas SharmaNo ratings yet

- SBI General Arogya Top Up Policy ProspectusDocument64 pagesSBI General Arogya Top Up Policy Prospectusyashmpanchal333No ratings yet

- Yuva Bharat Health Policy-BrochureDocument8 pagesYuva Bharat Health Policy-Brochuresrias100% (1)

- Dear Uppuluri Venkata Sri Harsha: Congratulations!Document8 pagesDear Uppuluri Venkata Sri Harsha: Congratulations!Ravi PrakashNo ratings yet

- Youngstar - One PagerDocument1 pageYoungstar - One Pagersahilbajaj12No ratings yet

- Chola 230515 114142Document7 pagesChola 230515 114142Prashanth G.P.No ratings yet

- Young India Digi Heath BrochureDocument4 pagesYoung India Digi Heath BrochureAvijit HazraNo ratings yet

- Smart Suraksha Plan Brochure PDFDocument6 pagesSmart Suraksha Plan Brochure PDFmahendraNo ratings yet

- 0287764082 (1)Document8 pages0287764082 (1)rmohanNo ratings yet

- New Business Policy Summary for Accident Guard PlusDocument7 pagesNew Business Policy Summary for Accident Guard PlusSneha BhosaleNo ratings yet

- Screenshot 2024-03-22 at 12.59.42 PMDocument40 pagesScreenshot 2024-03-22 at 12.59.42 PMYash ChaudharyNo ratings yet

- Features and Benefits of ICICI Pru iProtect SmartDocument4 pagesFeatures and Benefits of ICICI Pru iProtect Smartdinesh tiwariNo ratings yet

- GMC Policy 22-23Document6 pagesGMC Policy 22-237gs7gnc48tNo ratings yet

- Divi Thilina: (Terms & Conditions Applied)Document1 pageDivi Thilina: (Terms & Conditions Applied)KetharanathanSaravananNo ratings yet

- Star Health Insurance Plans and Premium RatesDocument4 pagesStar Health Insurance Plans and Premium RatesYugandhar SalviNo ratings yet

- EndowmentDocument2 pagesEndowmentcryptomaxxtrade4No ratings yet

- Young Star Insurance Policy ParametersDocument1 pageYoung Star Insurance Policy ParametersVivek Sharma100% (1)

- Validity of 3dDocument4 pagesValidity of 3dVijayNo ratings yet

- NivaBupa 2023Document83 pagesNivaBupa 2023Aniket Yadav100% (1)

- TATA Medicare Premier 871b2dee42Document8 pagesTATA Medicare Premier 871b2dee42ramana reddy KotaNo ratings yet

- Policy Mr. Ullas PalDocument11 pagesPolicy Mr. Ullas Palullaspal30No ratings yet

- Benefit Illustration LIC's Amrit BaalDocument3 pagesBenefit Illustration LIC's Amrit BaalVENKATESHNo ratings yet

- PDF 17017375 1584486767998 PDFDocument6 pagesPDF 17017375 1584486767998 PDFLucky TraderNo ratings yet

- Asia Travel Guard Policy - Policy ScheduleDocument11 pagesAsia Travel Guard Policy - Policy SchedulePasha Shaikh MehboobNo ratings yet

- Young Star - One Pager - Version 1.2 - August 2021Document1 pageYoung Star - One Pager - Version 1.2 - August 2021Satya ArchangelNo ratings yet

- Features of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Document4 pagesFeatures of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Soumyaranjan SwainNo ratings yet

- Kaycee Tolentino 1 Year Old Child Educ Funding ProposalDocument2 pagesKaycee Tolentino 1 Year Old Child Educ Funding ProposalRheianne Dela IslaNo ratings yet

- Policy 2022-23Document6 pagesPolicy 2022-23paras INSURANCENo ratings yet

- OLDSTU PresentationDocument18 pagesOLDSTU Presentationkomla kofiNo ratings yet

- Get covered for more than just accidentsDocument8 pagesGet covered for more than just accidentsChin Mui LanNo ratings yet

- Features of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Document4 pagesFeatures of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Ck WilliumNo ratings yet

- TokioMarine-Bright Future Launching SlideDocument49 pagesTokioMarine-Bright Future Launching SlideKaviyarasiiNo ratings yet

- CHI - One Pager - Version 1.3 - September 2021Document1 pageCHI - One Pager - Version 1.3 - September 2021ShihbNo ratings yet

- 2021 MDRT Goals in India: Monthly Production Targets for Top Insurance Agent MembershipsDocument3 pages2021 MDRT Goals in India: Monthly Production Targets for Top Insurance Agent MembershipsVidhyaNo ratings yet

- CHI One PagerDocument1 pageCHI One PagerPOS-ADSR TrackingNo ratings yet

- PB Care Plus insurance plan detailsDocument6 pagesPB Care Plus insurance plan detailsAnne SaiNo ratings yet

- Param Rakshak III plan offers life cover, returns and wellnessDocument4 pagesParam Rakshak III plan offers life cover, returns and wellnessJignesh PatelNo ratings yet

- Virtusa Policy Benefit1Document1 pageVirtusa Policy Benefit1Venkatesh KumarNo ratings yet

- YSI One Pager Version 1.0 Oct 2020Document1 pageYSI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- Young Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Document1 pageYoung Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Manjunatha GayakwadNo ratings yet

- R10 - Medicare Premier Development - E-Brochure - 02 - 13-02-23Document10 pagesR10 - Medicare Premier Development - E-Brochure - 02 - 13-02-23Nirranjan JNo ratings yet

- Afyaimara BrochureDocument16 pagesAfyaimara BrochureJoenathan EbenezerNo ratings yet

- Buy Any One Business Starter Package: P A C K A G EDocument25 pagesBuy Any One Business Starter Package: P A C K A G Ea.n.singhNo ratings yet

- Aviva Life Insurance Company India LimitedDocument3 pagesAviva Life Insurance Company India Limitedvarun_chd86No ratings yet

- Upul 15 Yrs PDFDocument4 pagesUpul 15 Yrs PDFMadawa DasarathnaNo ratings yet

- Illustration - 2023-10-14T171945.641Document2 pagesIllustration - 2023-10-14T171945.641abinashsekharmishra1No ratings yet

- LIC Jeevan LabhDocument1 pageLIC Jeevan LabhMukesh JoshiNo ratings yet

- HDFC ERGO renews Optima Restore Floater Insurance Policy for Preeti BajpaiDocument4 pagesHDFC ERGO renews Optima Restore Floater Insurance Policy for Preeti BajpaiHoooooNo ratings yet

- Exide Life Assured Gain Plus1599746714499 PDFDocument5 pagesExide Life Assured Gain Plus1599746714499 PDFDarshan HNNo ratings yet

- Claims FormDocument16 pagesClaims FormPhunsukh WangduNo ratings yet

- Global Health Care Brochure FinalDocument44 pagesGlobal Health Care Brochure FinalPhunsukh WangduNo ratings yet

- Criticare Brochure SS v10Document2 pagesCriticare Brochure SS v10Phunsukh WangduNo ratings yet

- VedicReport 1640886229454Document1 pageVedicReport 1640886229454Phunsukh WangduNo ratings yet

- Compartivie Grmmer PrakritDocument450 pagesCompartivie Grmmer PrakritPhunsukh WangduNo ratings yet

- Prakrit LanguageDocument236 pagesPrakrit LanguagePhunsukh WangduNo ratings yet

- IADON Emergency MotionDocument63 pagesIADON Emergency MotionRiley SnyderNo ratings yet

- IFRA Comitment PDFDocument40 pagesIFRA Comitment PDFSiti fatimahNo ratings yet

- Namami Gange Programme by Smita SiriDocument7 pagesNamami Gange Programme by Smita Sirigemcap123No ratings yet

- SOP ProcurementDocument32 pagesSOP ProcurementErnest Jerome Malamion100% (1)

- Policy MemoDocument7 pagesPolicy Memoapi-407553737No ratings yet

- List of State Nursing Council Recognised Institutions in Andhra PradeshDocument123 pagesList of State Nursing Council Recognised Institutions in Andhra PradeshShubham PushpNo ratings yet

- The Tides of Agencification: Literature Development and Future DirectionsDocument27 pagesThe Tides of Agencification: Literature Development and Future Directionskhalil21No ratings yet

- Standard and Sample Contract For Consulting Services, Small Assignments Time-Based Payments DraftDocument15 pagesStandard and Sample Contract For Consulting Services, Small Assignments Time-Based Payments DraftSATRIONo ratings yet

- Deed of Extrajudicial Settlement and Special Power of AttorneyDocument5 pagesDeed of Extrajudicial Settlement and Special Power of AttorneyMegan HerreraNo ratings yet

- Collective Bargaining - ppt1Document15 pagesCollective Bargaining - ppt1Komal MadhanNo ratings yet

- Helicopter Operations With ExposureDocument10 pagesHelicopter Operations With Exposuresmr767No ratings yet

- Hope FoundationDocument19 pagesHope FoundationsalonishirwaikerNo ratings yet

- Gpo 36 ChronopherDocument16 pagesGpo 36 ChronopherTheodor EikeNo ratings yet

- DoE Agusan del Norte Division Promotion RequirementsDocument2 pagesDoE Agusan del Norte Division Promotion RequirementsJhong Floreta MontefalconNo ratings yet

- House Hearing, 113TH Congress - Departments of Labor, Health and Human Services, Education, and Related Agencies Appropriations For 2014Document542 pagesHouse Hearing, 113TH Congress - Departments of Labor, Health and Human Services, Education, and Related Agencies Appropriations For 2014Scribd Government Docs100% (1)

- Calendar of Events in The PhilippinesDocument40 pagesCalendar of Events in The PhilippinesAldrin SorianoNo ratings yet

- Itsci Joint Industry Traceability and Due Diligence ProgrammeDocument11 pagesItsci Joint Industry Traceability and Due Diligence ProgrammeCarlos MaroveNo ratings yet

- Rule: Air Pollutants, Hazardous National Emission Standards: Synthetic Organic Chemical Manufacturing IndustryDocument13 pagesRule: Air Pollutants, Hazardous National Emission Standards: Synthetic Organic Chemical Manufacturing IndustryJustia.comNo ratings yet

- Industry Code of Practice On Chemical Classification & Hazard Communication CLASS Regulations 2014Document2 pagesIndustry Code of Practice On Chemical Classification & Hazard Communication CLASS Regulations 2014Nurul AfizaNo ratings yet

- Acknowledgement32564178993.Doc Final1Document6 pagesAcknowledgement32564178993.Doc Final1Rashid AzmiNo ratings yet

- Guide To The Workplace Safety and Health (WSHO) Regulations 2007Document4 pagesGuide To The Workplace Safety and Health (WSHO) Regulations 2007Htin Lin AungNo ratings yet

- NSTP Training Program ModulesDocument3 pagesNSTP Training Program ModulesJoyce Respicio100% (2)

- ENV18 Aspects Register Procedure 2014 - UpdatedDocument5 pagesENV18 Aspects Register Procedure 2014 - UpdatedsametggtNo ratings yet

- Oman (Sultanate) : Goods Documents Required Customs Prescriptions RemarksDocument4 pagesOman (Sultanate) : Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- The Rise and Decline of Cannabis Prohibition.Document88 pagesThe Rise and Decline of Cannabis Prohibition.Descriminalización.orgNo ratings yet

- Report CapExecutiveSummaryDocument25 pagesReport CapExecutiveSummaryflashtronNo ratings yet

- Health Care Ch1Document10 pagesHealth Care Ch1david parker0% (1)

- Recruitment demand letter for Qatar construction workersDocument1 pageRecruitment demand letter for Qatar construction workersDinkar Joshi100% (3)

- FM 8-230 Medical Specialist PDFDocument720 pagesFM 8-230 Medical Specialist PDFJames100% (1)

- Market Entry Report SampleDocument37 pagesMarket Entry Report SampleMussaKanat50% (2)