Professional Documents

Culture Documents

HRD Gist Dhan Va

Uploaded by

SunilCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HRD Gist Dhan Va

Uploaded by

SunilCopyright:

Available Formats

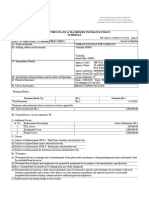

Table No. 866: Dhan Varsha (UIN) 512N349V01 ONLY up-to 31st March, 2023.

This is Guaranteed Addition, Non-Linked, Non-Participating, Individual, Savings, Single Premium Life Insurance plan. The policy holder

has an option to buy the plan with any of the option given below.

Option 1: 1.25 times of Tabular Premium for the chosen Basic Sum Assured

Option 2: 10 times of Tabular Premium for the chosen Basic Sum Assured

BENEFITS:

A. Maturity Benefit: “Basic Sum Assured” along with accrued Guaranteed Additions

B. Death benefit:

1. Risk Period: “Sum Assured on Death” along with accrued Guaranteed Additions.

2. Before Risk period: (applicable for Minor lives) refund of premium(s) paid (excluding taxes and extra

premium(s), if any) without interest.

Guaranteed Additions (per Rs 1000 Basic Sum Assured)

Option 1 Option 2

Basic Sum Assured

Policy Term 10 years Policy Term 15 years Policy Term 10 years Policy Term15 years

Rs. 1,25,000 to Rs. 2,45,000 60 65 25 30

Rs. 2,50,000 to Rs. 6,95,000 65 70 30 35

Rs. 7,00,000 and above

70 75 35 40

FEATURES:

Mini Entry Age 3 years (Term 15 years)

8 years (Term 10 years)

Maxi Entry Age Option 1: 60 years (NBD)

Option 2: 40 yrs Term 10 years

35 yrs Term 15 years

Policy Term 10 & 15 years

Mini Maturity Age 18 years (completed)

Maximum Cover till age: - 75 Years.

Minimum S.A. - Rs. 125,000

Maximum S.A. - No limit.

ASA SUM assured on Death minus premium paid. + TR SA if any.

Modes Allowed - Single Only.

Age Proof: - Both proof allowed.( Student & Minor Only Std Age proof.)

Female: - All Categories eligible. (even to pregnant female A-1 category)

Non-medical scheme. All Non-Medical applicable. Exclusive SP NM also

Forms to be used: - 300 ,or 360

Policy Loan: - available after 3 months of DOC

Surrender Any time during policy term.

Assignment allowed.

NRI and FNIO: - Allowed. Option 1 Gr 1 to 5 countries.

Option 2 Gr 3 to 5 countries.

(Mail order also allowed to gr 5 with OCI proof)

Key man and partnership: - Not allowed

Employee Employer: - Allowed. Form 300 or 340 can be used.

Back Dating: - Allowed. Not beyond Date of launch

Cooling off: - Allowed as per IRDAI rules.30 days.

Taxes: - Govt Taxes as applicable from time to time.

Optional rider benefits Accidental Death and Disability Benefit

only inception of the policy. Till age 70 or policy term which is earlier.

New Term Assurance

Settlement Option Death or Maturity: 5 years period

Prepared by: Harishkumar R Desai. Mumbai: Strictly for private circulation and only for the internal training purpose for LIC Marketing force. For detailed

version please refer to relevant circulars issued by the Corporation which shall be final and abiding for any interpretation.

You might also like

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- Safe Money First: Your Guidebook to Annuities and Safe Retirement Financial Planning StrategiesFrom EverandSafe Money First: Your Guidebook to Annuities and Safe Retirement Financial Planning StrategiesNo ratings yet

- Plan 869 - Dhan Vriddhi V02Document3 pagesPlan 869 - Dhan Vriddhi V02amalmca08No ratings yet

- LIC Jeevan Utsav PlanDocument3 pagesLIC Jeevan Utsav PlanphotonxcomNo ratings yet

- LIC BIMA Plan 848 - Bima ShreeDocument2 pagesLIC BIMA Plan 848 - Bima ShreeSubhendu KhantuaNo ratings yet

- Max Life CIDR ProspectusDocument40 pagesMax Life CIDR ProspectusGautam GogadaNo ratings yet

- Protect Your Family From A Life of CompromisesDocument8 pagesProtect Your Family From A Life of Compromisessumit_22inNo ratings yet

- Plan 845 - Jeevan UmangDocument6 pagesPlan 845 - Jeevan UmangSRIDHAR REDDYNo ratings yet

- Max Life CIDR ProspectusDocument35 pagesMax Life CIDR ProspectusRoshanPurandharNo ratings yet

- LIC Market Plus 1 Was Launched On July 5Document3 pagesLIC Market Plus 1 Was Launched On July 5JAAYARAMA ASSOCIATESNo ratings yet

- 874 - AmritbaalDocument1 page874 - AmritbaalShalini PuttaNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha+: FeaturesDocument6 pagesTata AIA Life Insurance Sampoorna Raksha+: Featuressenthilkumar.sNo ratings yet

- HDFC Life Click 2 Protect Life - Product Brochure PDFDocument24 pagesHDFC Life Click 2 Protect Life - Product Brochure PDFvaibhav kumar KhokharNo ratings yet

- PNB MetLife AajeevanSuraksha - Website Product Presentation - tcm47-71865Document13 pagesPNB MetLife AajeevanSuraksha - Website Product Presentation - tcm47-71865Vandita KhudiaNo ratings yet

- Jeevan Sathi PlusDocument6 pagesJeevan Sathi Plusap87No ratings yet

- SBI Life - Unit Plus III Pension, A Flexible Plan That Lets You Take Control of Your Golden Years AheadDocument16 pagesSBI Life - Unit Plus III Pension, A Flexible Plan That Lets You Take Control of Your Golden Years Aheadrgt18No ratings yet

- Benefit Illustration 6124175786Document4 pagesBenefit Illustration 6124175786Rajesh DommetiNo ratings yet

- Secure Your Family Against Uncertainties, With A Plan That Adjusts To Your NeedsDocument25 pagesSecure Your Family Against Uncertainties, With A Plan That Adjusts To Your Needsroxcox216No ratings yet

- HDFC Click2protectlife BrochureDocument25 pagesHDFC Click2protectlife BrochureaaaNo ratings yet

- Product Summary:: Jeevan Shree-IDocument4 pagesProduct Summary:: Jeevan Shree-IPinakin PatelNo ratings yet

- Aegon Lifei Term Prime BrochureDocument9 pagesAegon Lifei Term Prime Brochuredaskaran3141No ratings yet

- Max Life Flexi Wealth Plus - ProspectusDocument32 pagesMax Life Flexi Wealth Plus - ProspectusavisekgNo ratings yet

- Secure Your Family Against Uncertainties, With A Plan That Adjusts To Your NeedsDocument25 pagesSecure Your Family Against Uncertainties, With A Plan That Adjusts To Your NeedsAdityakaleyNo ratings yet

- Live A Life Full of Fulfilled Promises and Zero WorriesDocument28 pagesLive A Life Full of Fulfilled Promises and Zero WorriesSorin DobreNo ratings yet

- Life Secure Brochure - 1Document13 pagesLife Secure Brochure - 1spikysanchitNo ratings yet

- Wealth Ultima - Live-2017-1-16 - 9-4-53-120 PDFDocument18 pagesWealth Ultima - Live-2017-1-16 - 9-4-53-120 PDFBrijesh SrivastavaNo ratings yet

- 10 Pay With Return of Premium of MR SrinivasDocument4 pages10 Pay With Return of Premium of MR SrinivasvasuNo ratings yet

- Dhan Vriddhi English Sales BrochureDocument16 pagesDhan Vriddhi English Sales BrochureNimesh PrakashNo ratings yet

- Exide Life Smart Term PlanDocument10 pagesExide Life Smart Term PlanMaunilShethNo ratings yet

- Kotak Classic Endowment Plan Brochure1Document12 pagesKotak Classic Endowment Plan Brochure1Kranthi Kumar ReddyNo ratings yet

- Smart Suraksha Plan Brochure PDFDocument6 pagesSmart Suraksha Plan Brochure PDFmahendraNo ratings yet

- GPP Brochure 2Document36 pagesGPP Brochure 2Sandeep KolliNo ratings yet

- Dhan Varsha Sales BrochureDocument12 pagesDhan Varsha Sales BrochureCyril PilligrinNo ratings yet

- Term Plan - SPG - SL - BrochureDocument23 pagesTerm Plan - SPG - SL - BrochureAnkit SinghNo ratings yet

- YSI One Pager Version 1.0 Feb 21Document2 pagesYSI One Pager Version 1.0 Feb 21Prasad.MNo ratings yet

- Get Insured Today in 3 Simple Steps!: Beware of Spurious Phone Calls and Fictitious / Fraudulent OffersDocument1 pageGet Insured Today in 3 Simple Steps!: Beware of Spurious Phone Calls and Fictitious / Fraudulent OffersDhaval ParmarNo ratings yet

- Etouch One-Pager-SHIELD 13 02 2021Document2 pagesEtouch One-Pager-SHIELD 13 02 2021hiren1079No ratings yet

- HDFC Life Brochure-15Document16 pagesHDFC Life Brochure-15nayaksaismritiNo ratings yet

- 50 Lax Pa and Term Pay Till 60fine Illustration of Bajaj LifeDocument4 pages50 Lax Pa and Term Pay Till 60fine Illustration of Bajaj LifevasuNo ratings yet

- Non Medical Revision For Group I Plans: Sum Under ConsiderationDocument46 pagesNon Medical Revision For Group I Plans: Sum Under ConsiderationJc Duke M EliyasarNo ratings yet

- Lic Ki SipDocument15 pagesLic Ki Siparpitnigam21No ratings yet

- For Those, Who Aim For Excellence at Every Front: Life CoverDocument20 pagesFor Those, Who Aim For Excellence at Every Front: Life CoverVaibhav NagarNo ratings yet

- Young Star - One Pager - Version 1.2 - August 2021Document1 pageYoung Star - One Pager - Version 1.2 - August 2021Satya ArchangelNo ratings yet

- Digishield Plan BrochureDocument48 pagesDigishield Plan BrochureSuraj GawandeNo ratings yet

- Saral Jeevan Bima: Bajaj Allianz LifeDocument8 pagesSaral Jeevan Bima: Bajaj Allianz LifeSuresh MouryaNo ratings yet

- Features of ICICI Pru Saral Jeevan BimaDocument2 pagesFeatures of ICICI Pru Saral Jeevan BimaAshok GNo ratings yet

- 50 Lax Pa and Term Pay Till 75Document4 pages50 Lax Pa and Term Pay Till 75vasuNo ratings yet

- Young Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Document1 pageYoung Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Manjunatha GayakwadNo ratings yet

- YSI One Pager Version 1.0 Oct 2020Document1 pageYSI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- Iraksha Trop: Protection SolutionsDocument5 pagesIraksha Trop: Protection SolutionsPradeep ShastryNo ratings yet

- Com Par Is IonDocument9 pagesCom Par Is Ionnikunj_shahNo ratings yet

- Jeevan SaralDocument1 pageJeevan SarallicarvindNo ratings yet

- Et Uch: Key Feature DocumentDocument4 pagesEt Uch: Key Feature Documentabdulk1432No ratings yet

- Family Comes First.: Secure Them WithDocument2 pagesFamily Comes First.: Secure Them WithAmol RangariNo ratings yet

- LIC - Jeevan TarunDocument1 pageLIC - Jeevan TarunPraveen Kumar KNo ratings yet

- PlanDocument2 pagesPlanshital agaleNo ratings yet

- G JR Z: G Gmyz: X G NM Z: People: Process: PerformanceDocument31 pagesG JR Z: G Gmyz: X G NM Z: People: Process: PerformancelicarvindNo ratings yet

- HDFC Life Click 2 Wealth - Brochure - Retail - V3Document16 pagesHDFC Life Click 2 Wealth - Brochure - Retail - V3a26geniusNo ratings yet

- Brochure Shriram Assured Income Plus OnlineDocument12 pagesBrochure Shriram Assured Income Plus OnlineSivaramakrishna Davuluri100% (1)

- Till 23.08.2023. TATA HITACHIDocument20 pagesTill 23.08.2023. TATA HITACHIRaj Kumar LodhaNo ratings yet

- Aia Nafas 2021-4Document17 pagesAia Nafas 2021-4AKMAL HELMINo ratings yet

- College of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Document4 pagesCollege of St. John - Roxas: Member: Association of LASSSAI Accredited Superschools (ALAS)Miles SantosNo ratings yet

- The Nature of Credit Instruments - A Credit InstrumentDocument2 pagesThe Nature of Credit Instruments - A Credit Instrumentjoshua aguirreNo ratings yet

- Dishonour of Negotiable Instruments PDFDocument33 pagesDishonour of Negotiable Instruments PDFabhisheknnd312100% (3)

- Etica Capitulo II III IVDocument60 pagesEtica Capitulo II III IVValeria AlexandraNo ratings yet

- FarazDocument3 pagesFarazSai SholinganallurNo ratings yet

- Franchising in The UAEDocument3 pagesFranchising in The UAEMohamed SulimanNo ratings yet

- Cost Report February'2022Document28 pagesCost Report February'2022Sabbir AhmedNo ratings yet

- Equity Derivatives NCFM PDFDocument148 pagesEquity Derivatives NCFM PDFsarankumararamco100% (2)

- 34 City State Savings Bank Vs Teresita Tobias 3 7 18 G.R. No. 227990Document4 pages34 City State Savings Bank Vs Teresita Tobias 3 7 18 G.R. No. 227990RubenNo ratings yet

- Midterm Exam Answer Key UIDocument2 pagesMidterm Exam Answer Key UIJay Raphael Trio100% (1)

- Unit 3 Negotiable InstrumentDocument37 pagesUnit 3 Negotiable InstrumentsourabhdangarhNo ratings yet

- Void Agreement: Void Agreements (Ss. 11, 20 To 30, 32, 36, 56-57 + 65) ... 50 Agreements Against Public Policy... 54Document8 pagesVoid Agreement: Void Agreements (Ss. 11, 20 To 30, 32, 36, 56-57 + 65) ... 50 Agreements Against Public Policy... 54Deepti GajelliNo ratings yet

- RFBT MCQ Class No. 3172Document51 pagesRFBT MCQ Class No. 3172hyunsuk fhebieNo ratings yet

- Kinds of Contract of SaleDocument8 pagesKinds of Contract of SaleJoyceNo ratings yet

- Contracts in Roman LawDocument23 pagesContracts in Roman LawValeriaNo ratings yet

- Joint Ventures: in ConstructionDocument55 pagesJoint Ventures: in Constructiondirunraj3269No ratings yet

- 1 - Pearl & Dean v. ShoemartDocument3 pages1 - Pearl & Dean v. ShoemartPaulo SalanguitNo ratings yet

- Partnership Agreement PDFDocument4 pagesPartnership Agreement PDFNeon TasmanNo ratings yet

- Statement Bulan 2Document15 pagesStatement Bulan 2aedy garageNo ratings yet

- 2-Assign Interest in InstrumentDocument2 pages2-Assign Interest in InstrumentMichael Kovach100% (1)

- Mortgage Loan BasicsDocument11 pagesMortgage Loan BasicsBittu DesignsNo ratings yet

- Chapter 4 Insurance ClaimDocument22 pagesChapter 4 Insurance ClaimSuku Thomas Samuel100% (1)

- Elements of Marine Insurance ContractDocument6 pagesElements of Marine Insurance ContractSucharitaNo ratings yet

- 3MonthWaiver Poster 01Document1 page3MonthWaiver Poster 01Thanaraj SanmughamNo ratings yet

- AML and KYC BookDocument10 pagesAML and KYC BookAmitNo ratings yet

- Law Bachawat Scanner ICADocument100 pagesLaw Bachawat Scanner ICAgvramani51233No ratings yet

- Navalur Kuttapattu, Srirangam (TK), Tiruchirappalli - 620 009, Tamil NaduDocument16 pagesNavalur Kuttapattu, Srirangam (TK), Tiruchirappalli - 620 009, Tamil NaduNarayanaNo ratings yet

- Memorandum of Associations & Article of Associations: The DifferenceDocument12 pagesMemorandum of Associations & Article of Associations: The Differenceadv_animeshkumar67% (3)