Professional Documents

Culture Documents

Radar Answers

Uploaded by

Balayya Pattapu0 ratings0% found this document useful (0 votes)

5 views6 pagesOriginal Title

radar answers

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views6 pagesRadar Answers

Uploaded by

Balayya PattapuCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

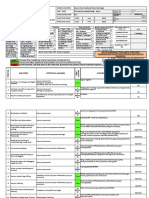

1. RADAR score has impact on which among the following?

A) RFIA ratings B) Oultier score

C) CDS D) OTMS E) WEBCAS

2. Regular CRA is applicable for Exposure more than ___? D. 5 Crore

3. A branch has secured 70% in RFIA before RADAR score integration under CRM. RADAR

average score in CRM for the audit period is 80%. Considering no exposure scrutinized

under WBCAS/ ERS, what will be effective CRM score of the Branch in RFIA after RADAR

score integration? A. 71.5

4. In Offsite RADAR EBCT, the RADAR compliances are verified by ___? Choose the best

option B. Branches has to upload evidences which will be verified by controllers and

finally scrutinized at CAOs

5. In Home loans sanctioned for construction of property where existing land is in the name of

the Borrowers, CERSAI registration must be __ C. Along with EM creation based on sale

deed before disbursement

6. What can be the max CRM score from Offsite Audits (RADAR,ERS, WBCAS) considering

exposure scrutinised under ERS, WBCAS during the audit review period? C.410

7. What is the max score of Problem loan management under CRM in RADAR? B.30

8. The scores received from ERS and WBCAS are integrated in ___along with RADAR during

RFIA? C. Pre sanction under CRM

9. What is the term used in RADAR to show non adherence to controls? B. Value

statement.

10. An account where deviations are shown in RADAR has been closed in CBS. However

deviations are still showing in RADAR Application . What might be the reason? Choose the

best option. A. The branch has not sent mail to RADAR, IAD with screen shots sas

prof of closure.

11. Under RADAR, ____ records are being scrutinized ? A. Sample basis

12. CRILC module in RADAR is under ___sub parameter? D. Pre sanction , CRM

13. A branch has secured 75% in RFIA before RADAR score integration under ORM. RADAR

average score for the audit period in ORM is 78%. What will be effective ORM score of the

Branch in RFIA after RADAR score integration? A. 75.8

14. Under RADAR EBCT the penalty of false compliances to be levied on___? A. RADAR

score before integration

15. RADAR deviation reports are available at what frequency to operating units?

B. Fortnightly

16. RADAR score of a branch depends on which among the following ___in a value statement?

Choose the best option. A. Deviation Percentage

17. Which among the following is not a RADAR EBCT type? B. Spot

18. In CRM under RADAR, which of the following has got highest weightage?

B. Post sanction

19. How do an issue in RADAR to be raised for resolution? B. Raising S core ticket with

Special Project-II

20. Which Department in LHO is the Nodal office for RADAR related issues? A. BOPM

21. Which among the following is not correct? B. RADAR is a Hybrid....

22. What is the full form of RADAR?

B. Remote application for Dynamicf Assessment of Risk

23. In Onsite RADAR EBCT, the RADAR compliances are verified by ___? Choose the best

option. B. Internal Auditor and CAO officials

24. What is the role of RBOs/AOs in RADAR application? C. AO/RBOs can view the

exceptions pertaining to their branches under CRM and ORM and follow up for

rectification

25. What is RADAR average Score in ORM for the auditee unit? C. Average of monthly

RADAR ORM scores from last RFIA to current RFIA

26. During the RFIA, it was observed that Branch has already been subjected to offsite RADAR

, EBCT during review period. Choose the best option. A. Between two RFIAs there

will be only one RADAR EBCT, …..

27. Value statements in RADAR show deviations based on the data points available in ___?

Choose the best option. C. Source Systems like CBS, LOS etc.

28. What is the Max score for a medium risk value statement? C. 2

Critical- 6 : high risk -4 ;Medium risk – 2 : Low risk 1

29. RADAR scores are generated at what frequency? D. monthly

30. The branch has secured very good score in RFIA, but final integrated score is very less.

Which of the following audit scores could have impacted the RFIA score? A) WEBCAS B)

CVS C) ERS D) LITMAS E) RADAR C. A,C & E

31. which among the following is/are the core parameter(s) in RADAR? C. Both CRM & ORM

32. What is the max score of post sanction under CRM in RADAR? A. 75

33. I have been recently transferred to a new Branch but my RADAR login shows my previous

Branch records. What needs to be done? Choose the best option. B. HRMS to be

transferred to new Branch....

34. While raising S core request for a value statement which among the following must be

mentioned/ attached? A) Value statement Name B) Screen shot from the source system/

Screen shot from RADAR C) Brief description of the issue D) Approval from controllers

D. All of the above

35. In order to rectify the deviations in RADAR a branch official updated source system with

congruent data without actual compliance. The false compliance will be detected and

penalty will be imposed for such act. The process is called___? A. RADAR EBCT

36. Which of he following is true about RADAR? A. Controllers Visit system related value

statements are in ORM under RADAR

37. When there is no applicable records in a value statement in RADAR, how it will impact the

overall score? Choose the best option. C. Improves the score as the score will be

normalised

38. “ Accounts where Inspection not scheduled in System.” Choose the best option for

rectification of deviations for this value statement. B. Rectification path is

:CBS>Common Processing>Inspections>.....

39. Applicability of CUE rating for an account is based on ___?Choose the best option.

A. Customer's Bank level exposure

40. What is the maximum % penalty for false compliance in RADAR? C.25%

41. “NPA> Rs.20 lacs not transferred to SARB/SAMG”. Choose the best option for rectification

of deviations for this value statement. B. All NPA >20 Lacs should be migrated to

SARB. Mainiteanance code/Home Br.....

42. A branch has secured 80% in RFIA before RADAR score integration under CRM. RADAR

average score in CRM for the audit period is 75%. Considering no exposure scrutinized

under WBCAS/ ERS, what will be effective CRM score of the Branch in RFIA after RADAR

score integration? B. 79.3

43. “Home loan account where EM not Created/ not recorded in CBS after 18 months from date

of sanction”. Choose the best option for rectification of deviations for this value statement.

C. EM to be created in A/C level. The updations done in CBS will be....

44. How to rectify the deviation “ Low Risk Customer opened as High/Medium Risk “?

A. The deviations are shown to Branches for the month only. The branch officials …..

45. “Gold Loan LTV> 75% and upto 100 “. Choose the best option for rectification of deviations

for this value statement A. Recovery to be done to keep LTV within 75%

46. Which of the following is not correct about offsite RADAR EBCT? D. Offsite RADAR EBCT

is conducted along with RFIA

47. A branch has total Advances (FB+NFB) of Rs. 200 Crores as on date of RFIA. Credit

Auditable A/cs exposure os Rs. 30 Crores. Exposure scrutinized under ERS is Rs. 30

Cores. What will be the maximum score for pre sanction under CRM for the branch during

RFIA? A. 87 offsites, 218 RFIA

48. The max presanction score under CRM from offsite audits (RADAR, ERS, WBCAS)

depends on which among the following ?A) Branch Net Exposure as on the Audit date of

RFIA B) Exposure Scrutinised under WBCAS/ERS during audit review period D) RADAR.

C. A&B

49. Probable ineligible savings bank- Govt. Accounts, Deviations are shown for an A/c in a

Branch where the Branch has obtained permission letters from appropriate Authority.

Choose the best option for rectification. C. Where SB accounts are opened after

obtaining permission letters from ….........001002/001003 in SWO ID

50. What is the range of max score of pre-sanciton under CRM considering all offsite audits

(ERS/WBCAS/ RADAR) B. 40-305

51. In Credit CPCs which of the RADAR score is/are applicable? B. CRM only

52. Security Audits will be carried out in High Risk branches, with min,and max gap as___?

(Normal Times) D. min -9 , max-15

53. ERS- Large Loans covers all sanctions (New/renewal/Enhancement) involving exposure of

above Rs. ___ Crore for Domestic Branches. C.20

54. The rectifications of RADAR deviations shown under PVC (Preventive Vigilance Committee)

, CRP (Customer relation Programme) , CSC (Customer Service Committee) meetings , are

to be done in ____? C. BCSBI

55. In offsite RADAR EBCT, the RADAR compliances are verified by ___? Choose the best

option. B. Branches has to upload evidences which will be verified by

Controllers and finally scrutinized at CAO s

56. Banks shall make it mandatory for Corporate Borrowers having aggregate fund-based and

non- fund based exposure of Rs.___Crores and above from any Bank, to obtain Legal

Entity Identifier (LEI) in a phased manner and capture the same in the Central Respiratory

of Information to Large Credits (CRILC) C. 50

57. What is RADAR FOA? D. RADAR Foreign Office Audit

58. What is the path to access help Documents related to RADAR? B. RADAR>> Manuals &

Help documents

59. In offsite RADAR EBCT, if the no. of false compliances is more than 30, what will be the

____ % of disincentive score/ D.25

60. In which menu, Branch Official can see the RADAR score in value statement/ module/sub

sub parameter etc. and analyze the RADAR score of the Branch. A. Offsite scores

month/level wise under reports

61. A branch has secured 85% in RFIA before RADAR score integration under ORM, RADAR

average score for the audit period in ORM is 90%. What will be effective ORM Score of the

Branch in RFIA after RADAR score integration? 86.3

62. RADAR reported dated 31.07.2022 is populated on 12.08.2022. The report will show

updations in source system upto ___B. 31-Jul-22

63. ERS – small loans covers all sanctions (New/ Renewal/ Enhancement ) involving exposure

of above Rs. _____ crore and upto Rs. ____ crore. Rs. 1 Crore and upto 20 crores

64. What is the main objective of RADAR?

65. Concurrent Audit (WBCAS) & Early Review of Sanction (ERS) scores along with RADAR

scores are integrated in CRM pre sanction score of RFIA, in proportion to the exposure

scrutinized by those audits. What type of ERS loans are considered under ERS for

integration mentioned above? C. Both ERS-Small & Large Loans

66. Which of the following is not correct about RADAR ? B. Sum of total of Scores obtained

in each value statement under CRM is the total CRM score in the branch

67. In Onsite RADAR EBCT, penal score is levied by____. ? Choose the best option

A. Moderating the RADAR average score as per.....

68. which of the following is not true about RADAR ? C Problem loan management is a

module in RADAR.

69. RADAR comes under which department in IAD? C. OMA (Offsite Monitoring Audit)

70. “ Accounts with Insufficient Primary Security Amount” Deviations are shown for Recalled

Assets for a Branch. Choose the best option for rectification of deviations in this value

statement. B. A/Cs are to be upgraded/closed through recovery or write off ensuring

proper provisions

71. A branch has secured 85% in RFIA before RADAR score integration under ORM, RADAR

average score for the audit period in ORM is 80 %. What will be effective ORM Score of the

Branch in RFIA after RADAR score integration? C. 83.7

72. “Insurance expired but renewal details not updated in system”. A Branch observed

deviations related to auto loans in this value statement and could not understand as for auto

loans insurance need not be insisted from customer from 2nd year onwards as per bank's

circular instruction. Which among the following are the reasons for such deviations.

B. Outstanding is more than 20 lakhs

73. What can be the max CRM score in RADAR where no exposure is scrutinized under ERS,

WBCAS during the audit review period? A.145

74. “PBBU – Quick Mortality – A/C turned NPA within 2 years from the Date of Sanction “.

Choose the best option for rectification of deviations in this value statement.

C. Branches to upgrade/close by recovery or arrange for write off of the accounts

75. Onsite RADAR EBCT is carried out___? B. Along with RFIA

76. In Offsite RADAR EBCT, penal score is levied by____. ? Choose the best option. C. By

deducting penal score from monthly RADAR CRM/ORM score, …..

77. “PBBU – Registration Number /Registration Date/ RC details not recorded in CBS for Auto

Loans etc.”Choose best option for rectification of deviations in the value statement.

A. All important details e.g., Registration_Number field, Register_date......

78. Score obtained in value statement level in RADAR application is normalized to Core Level.

What is the correct flow of the Score? C. Value statement> Module> Sub Sub

parameters> Sub parameters> core

79. which of the following is not true about RADAR ? B. RADAR score is being generated

every fortnight

80. Which of the following is not a sub parameters in CRM under RADAR? B. APPRISAL,

ASSESSEMENT AND SANCTION

81. In which menu under RADAR Application the score for WBCAS & ERS can be checked?

B. Offsite Average Score under Reports

82. A branch has total Advances (FB+NFB) of Rs. 200 Crores as on date of RFIA. Credit

Auditable A/cs exposure os Rs.80 Crores. Exposure scrutinised under ERS is Rs.20

Crores. What will be the maximum score for pre sanction under CRM for the branch during

RFIA? B. 84 Offsite, 221 RFIA

83. What is the percentage share of Offsite Audits (RADAR, ERS, WBCAS) in RFIA under

CRM? C. 14.5-30.5

84. A Branch is not under the current year Audit plan. Under which type of RADAR EBCT it will

fall into? Choose the best option. B. If the Branch is identified as TBA, it will be

subjected to TBA/EBCT, else offsite RADAR EBCT.

85. How to obtain RADAR login credentials for Users? C. No need for separate login

credentials as it is mapped to SSO

86. How deviations are corrected in RADAR? A) In the source system as well as S core request

for back end deletion of deviations B) In the source system only C) Back up papers to be

collected & compliance can be done late on D) Actual compliance is a must before

rectification is done in the source systems. B. B&D

87. What is the Max score for a High risk value statement? 4

88. A branch has secured 90% in RFIA before RADAR score integration under CRM. RADAR

average score in CRM for the audit period is 80%. Considering no exposure scrutinized

under WBCAS/ ERS, what will be effective CRM score of the Branch in RFIA after RADAR

score integration? A. 88.6

89. For Security Officers visit related deviations rectifications are to be done in ___ application?

A. Online Security Officer visit Audit

90. As per the latest RBI guidelines while undertaking RTGS/NEFT transaction above 50 core,

LEI code is mandatory , which among the following options is not correct. C. Where both

remitter and beneficiary are non individuals, only sender LEI to be provided in the

transaction.

91. CUE rating is applicable for exposure more than ____ and upto ___?

A. 10 lakh , 50 lakhs

92. A branch has secured 85% in RFIA before RADAR score integration under CRM. RADAR

average score for the audit period in CRM is 78%. Considering no expuosure uner

WBCAS/ERS,What will be effective ORM score of the Branch in RFIA after RADAR score

integration? B.83

93. There are some value statements in RADAR related to deviations in LOS. Choose the best

option for rectification. D. Both 2 & 3

94. Which of the following audit score are considered for integration with RFIA in Pre sanction.

CRM during RFIA? A) WBCAS B)Legal Audit C) ERS D) IS Audit E) RADAR. A,C,E

95. “Insurance details not captured to CBS system”. A branch has an A/C where the waiver of

Insurance is approached . The branch however gets the deviation in RADAR. Choose the

best option for rectification of deviations in this value statement. B. Mark Insurance

required flag as “No”.....

96. “ Multiple Cash transactions of > Rs. 50000 in Customer Accounts categorized as Low

Risk”. Choose the best option for rectification of deviations in this value statement.

B. The risk categorization of the customer is to be suitably ammended

97. Personal Segment Gold Loans should be auctioned within ___days/ months from the date

of NPA. B. 2 months

98. An account where deviations are shown in RADAR is of a deceased customer. Balance is

available in the A/c but any further rectification is not being possible. Choose the best option

for rectification of deviations in the RADAR. A. mark CIF as deceased

99. “Inland Bank Lcs expired but not closed”. Choose the best option for rectification of

deviations in this value statement. A. Inland bank Lcs which are expired and

without having any outstanding Bills, to be closed in Exim Bills/ Trade Finance

100. Which of the following is not correct about RADAR ? B. RADAR ORM score gets

integrated with RFIA score in CRM presanction only

101. Which among the following is not a level in RADAR Architecture? D. Key

parameters

102. “Home loan account where EM not Created/ not recorded in CBS after 18 months

from date of sanction”. The branch has done correction in CBS. However deviations are still

in RADAR Application. What might be the reason?Choose the best option. D. All of

the above

103. “CUE Rating (additional Internal Rating Code) is not updated in CBS”. Choose the

best option for rectification of deviations in this value statement. C. In account level

CISLA screen 67154 in CBS, CUE rating fields …....

104. Unit Inspection module in RADAR is under ___ sub parameter. D. Post sanction

,CRM

105. What is the Max score for a Critical value statement? 6

106. A branch has total Advances (FB+NFB) of Rs. 300 Crores as on date of RFIA. Credit

Auditable A/cs exposure os Rs.100 Crores. Exposure scrutinized under ERS is Rs.40

Cores and WECAS is 60 Crores. Branch has scored 80 in WBCAS and 70% in ERS for the

audit review period. RADAR average score in CRM-Pre sanction for the audit period is

80%. The onsite RFIA score given for Pre sanction CRM by IA is 80%. What is the Final pre

sanction CRM score of the branch in RFIA after integration? B. 78.26

107. “Delay in submission of Account opening forms to LCPC (Greater than 10 days)”.

Choose the best option for deviations in this value statement. D. Both 1 &3

108. “Monitoring of Mobile Numbers changed during the Month (Alert purpose), Customer

request form (CRF-2) and OVD to be kept on Record”.Choose the best option for deviations

in this value statement. B. This is a very sensitive and fraud prone are. Branches to

ensure availability of CFT-2 & OVD for verification during Audit

109. A branch has secured 70% in RFIA before RADAR score integration under ORM.

RADAR average score for the audit period in ORM is 90%. What will be effective ORM

Score of the Branch in RFIA after RADAR score integration? 75.2

110. What is the expected date of populations of RADAR month end deviations? A. 12th of

the succeeding month

111. A branch has total Advances (FB+NFB) of Rs. 100 Crore as on date of RFIA. Out of

which Credit Auditable A/cs Exposure is Rs. 50 Crore. Exposure scrutinized under ERS is

Rs. 20 crore. What will be the Max Score for Pre sanction under CRM for the Branch during

RFIA? B. 40 RADAR , 106ERS,159RFIA

112. A branch has total Advances (FB+NFB) of Rs. 300 Crore as on date of

RFIA. Credit Auditable A/cs Exposure is Rs. 100 Crore. Exposure scrutinised under ERS is

Rs. 70 crore and WBCAS is 60 Crore. What will be the max Score for Pre sanction under

CRM for the Branch during RFIA? D. 212 offsites, 93 RFIA

113. In what frequency corrections made in source systems are updated in radar? choose

the best option A. Monthly

114. Inland bills discounted outstanding beyond due date of maturity. one branch

observed that deviations are reported in radar under this value statement affecting the

score. on analysis the branch manager observed that these entries initiated in trade finance

stood unreconciled as inadvertently the outstanding entries have been reversed in CBS

directly without routing through trade finance. the branch has requested IAD through email

with the copy of approval from controller for deletion of deviations from the back

end. choose the best option along the following. A. all rectification should be done

in the source systems only . so the branch should have arranged for reconciling the

entries in trade finance.

115. SMEBU accounts with L&B as collateral security where valuation date is not

recorded in CBS/or valuation date is more than 3 years old. choose the best

option for rectification of deviations in this value statement. B. Rectification is to be done

in CBS screen 67041 and the date of valuation to be updated. all eligible active

collateral should have proper valuation date entered in CBS.

116. Which of the following is not true about onsite RADAR EBCT? B. The disagreed

items by Branch Manager will be further confirmed by controllers at RBO

117. which among the following is not correct/ A) RADAR average score for the

audit period under CRM is always the average of monthly CRM score B) RADAR

average score for the audit period is derived separately for presanction, Post

sanction and problem loan under CRM. C) RADAR average score for the audit

period for pre sanction CRM depends on exposure scrutinised under WBCAS

only. D) RADAR average score for the audit period at pre sanction CRM depends

on exposure scrutinised under WBCAS and ERS. A. A&C

118. Which of the following is not correct about RADAR? C. CRM Problem Loan

Management max score is 120

119. “Manual Credit Interest Adjustments made in loan accounts.” choose the best

option for dealing with such deviations under this value statement. A) Deviation is shown for

the month only and it will be loaded with new applicable records in next loading cycle. B)

The transactions are to be mandatorily reversed. C)Branch to ensure that proper approval

has been obtained from competent authority for such transactions. the same might be

sought during RADAR EBCT. D. All of the above

120. In what frequency corrections are made In source systems are updated in RADAR?

Choose the best option. D. Fortnightly

121. What is the max score of Problem Loan Management under CRM in RADAR? B. 30

122. RADAR first fortnight report is generated as on ___ A. Nearest Friday to 15the of

the month

123. a

124. f

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Auditing TheoryDocument27 pagesAuditing Theorysharielles /No ratings yet

- Offering Memorandum For Non-Qualifying Issuers: No External Agent Has Been Appointed at This TimeDocument36 pagesOffering Memorandum For Non-Qualifying Issuers: No External Agent Has Been Appointed at This TimeAlex100% (1)

- Super Favourite Football SystemDocument21 pagesSuper Favourite Football SystemOghoghorie Clever100% (8)

- కళ్యాణ సంస్కృతిDocument102 pagesకళ్యాణ సంస్కృతిBalayya PattapuNo ratings yet

- 2015 394905 Mahatyagi-MadduriDocument72 pages2015 394905 Mahatyagi-MadduriBalayya PattapuNo ratings yet

- 2015 371346 Gaandhito-OkaDocument143 pages2015 371346 Gaandhito-OkaBalayya PattapuNo ratings yet

- Social LogicDocument262 pagesSocial LogicBalayya PattapuNo ratings yet

- Human LogicDocument186 pagesHuman LogicBalayya PattapuNo ratings yet

- Brain LogicDocument74 pagesBrain LogicBalayya PattapuNo ratings yet

- MatsuoipediaDocument21 pagesMatsuoipediaBalayya PattapuNo ratings yet

- DharmanandmbiDocument15 pagesDharmanandmbiBalayya PattapuNo ratings yet

- 2015 395357 Rasaba-VilasamuDocument17 pages2015 395357 Rasaba-VilasamuBalayya PattapuNo ratings yet

- 2015.372707.pattaabhiraama VilaasamuDocument163 pages2015.372707.pattaabhiraama VilaasamuBalayya PattapuNo ratings yet

- Seneca LTTRDocument4 pagesSeneca LTTRBalayya PattapuNo ratings yet

- Ore - 20220923201401Document3 pagesOre - 20220923201401Balayya PattapuNo ratings yet

- Radar Solu)Document34 pagesRadar Solu)Balayya PattapuNo ratings yet

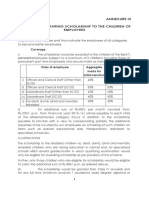

- Scholarships To Wards OfidelinesDocument10 pagesScholarships To Wards OfidelinesBalayya PattapuNo ratings yet

- He Accounting Year 01-2022Document3 pagesHe Accounting Year 01-2022Balayya PattapuNo ratings yet

- 20220920Document27 pages20220920Balayya PattapuNo ratings yet

- TDM335782 111022101613 InvoiceDocument1 pageTDM335782 111022101613 InvoiceBalayya PattapuNo ratings yet

- R9723093 Balaiah P 130622195556Document1 pageR9723093 Balaiah P 130622195556Balayya PattapuNo ratings yet

- Business&Working HourDocument2 pagesBusiness&Working HourBalayya PattapuNo ratings yet

- R9723093 Balaiah P 130622195556Document1 pageR9723093 Balaiah P 130622195556Balayya PattapuNo ratings yet

- 2015 371613 MadhumaavatiiDocument196 pages2015 371613 MadhumaavatiiBalayya PattapuNo ratings yet

- Clinical Examination of The AnimalDocument25 pagesClinical Examination of The AnimalAbdul RehmanNo ratings yet

- Various Elements That May Be Exposed To Hazards Environmental, Social and EconomicDocument27 pagesVarious Elements That May Be Exposed To Hazards Environmental, Social and EconomicTommy PascuaNo ratings yet

- CWTSDocument1 pageCWTSHammiya LachaonaNo ratings yet

- Management PlanDocument75 pagesManagement PlantaqiiftikharNo ratings yet

- Finance Chapter RSM330Document11 pagesFinance Chapter RSM330JhonGodtoNo ratings yet

- Police Critical Incident ManagementDocument22 pagesPolice Critical Incident ManagementRica EncelaNo ratings yet

- Bridging Document CIL - JEL Rev 01 Drilling 06 07 2017Document55 pagesBridging Document CIL - JEL Rev 01 Drilling 06 07 2017Ershad AkhtarNo ratings yet

- Training and Development in Max Newyork Life InsuranceDocument51 pagesTraining and Development in Max Newyork Life Insuranceneonradhika100% (8)

- Natf TPL 001 4 Reference DocumentDocument42 pagesNatf TPL 001 4 Reference Document陆华林No ratings yet

- Financial System and Financial MarketDocument10 pagesFinancial System and Financial MarketPulkit PareekNo ratings yet

- SSRN Id3596245 PDFDocument64 pagesSSRN Id3596245 PDFAkil LawyerNo ratings yet

- Liminal Business and Entity Verification Market and Buyers Guide - 12122023Document53 pagesLiminal Business and Entity Verification Market and Buyers Guide - 12122023rand808No ratings yet

- Safety Oil and GasDocument105 pagesSafety Oil and GasAmiibah100% (2)

- Reflective Case Study Report: Project Management in BusinessDocument14 pagesReflective Case Study Report: Project Management in BusinessBursuc MariusNo ratings yet

- Privacy 27701 RMISCDocument41 pagesPrivacy 27701 RMISCerick.rinconNo ratings yet

- ADVANCED-FINANCIAL-MANAGEMENT-may 2016 Icag PDFDocument21 pagesADVANCED-FINANCIAL-MANAGEMENT-may 2016 Icag PDFmohedNo ratings yet

- Centrica Annual Report-2015Document206 pagesCentrica Annual Report-2015realm1902mNo ratings yet

- JHA Dryer Hot CommissioningDocument5 pagesJHA Dryer Hot CommissioningJowel MercadoNo ratings yet

- Health and Medical Monitoring Group ProcedureDocument14 pagesHealth and Medical Monitoring Group ProcedurenickNo ratings yet

- Balanced Score Card For Insurance - MyPF - MyDocument9 pagesBalanced Score Card For Insurance - MyPF - MyAbdullah Abdul RashidNo ratings yet

- Risk ManagementDocument11 pagesRisk ManagementShamoil ShaikhNo ratings yet

- Risk Assessment and Control Template Checklist - SafetyCultureDocument4 pagesRisk Assessment and Control Template Checklist - SafetyCulturepattysaborio520No ratings yet

- CiiiDocument19 pagesCiiimikelNo ratings yet

- Internal Factory AuditsDocument3 pagesInternal Factory AuditsAntoniNo ratings yet

- Leadership and Management of Health and SafetyDocument20 pagesLeadership and Management of Health and SafetyitapiazNo ratings yet

- Grro 11 ADocument10 pagesGrro 11 AApriadi Budi RaharjaNo ratings yet

- Mercer eIPEDocument24 pagesMercer eIPEjehaniaNo ratings yet