Professional Documents

Culture Documents

Homework 4 - 5th Ed

Uploaded by

Nandini Goyal0 ratings0% found this document useful (0 votes)

6 views4 pagesThis document provides instructions for Homework 4 in the ACCT101 Financial Accounting course. It includes 3 bond valuation exercises to complete using journal entries. Exercise 9-7 has students journalize the issuance and semi-annual interest payments on bonds issued at face value. Exercise 9-8 asks students to calculate interest expense and changes to the carrying value of bonds issued at a discount. Exercise 9-18 requires using present value tables to calculate bond prices when issued at a premium, face value, and discount.

Original Description:

Financial Accounting Homework 4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides instructions for Homework 4 in the ACCT101 Financial Accounting course. It includes 3 bond valuation exercises to complete using journal entries. Exercise 9-7 has students journalize the issuance and semi-annual interest payments on bonds issued at face value. Exercise 9-8 asks students to calculate interest expense and changes to the carrying value of bonds issued at a discount. Exercise 9-18 requires using present value tables to calculate bond prices when issued at a premium, face value, and discount.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pagesHomework 4 - 5th Ed

Uploaded by

Nandini GoyalThis document provides instructions for Homework 4 in the ACCT101 Financial Accounting course. It includes 3 bond valuation exercises to complete using journal entries. Exercise 9-7 has students journalize the issuance and semi-annual interest payments on bonds issued at face value. Exercise 9-8 asks students to calculate interest expense and changes to the carrying value of bonds issued at a discount. Exercise 9-18 requires using present value tables to calculate bond prices when issued at a premium, face value, and discount.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

ACCT101 Financial Accounting Homework 4: E9-7, E9-8, E9-18 5th Edition

Homework 4 – Chapter 9

Name: Section: G5 Grade:

Edition of textbook: 5th Edition

Submission due date: before 3:30 pm on Thursday 20 October

Please follow this example to journalize the transactions in the exercises

where journal entries are asked.

Date Debit Credit

Account Name 200

Account Name 200

(Description of transaction)

ACCT101 Financial Accounting Homework 4: E9-7, E9-8, E9-18 5th Edition

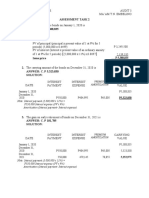

Exercise 9-7 (LO 9-5)

January 1, 2021 Debit Credit

Cash 500,000

Bonds Payable 500,000

(Issue bonds at face amount)

June 30, 2021

Interest expense 22,500

Cash 22,500

(Pay semi-annual interest)

($22,500= $500,000 x 9% x 1/2

December 31, 2021

Interest expense 22,500

Cash 22,500

(Pay semi-annual interest)

ACCT101 Financial Accounting Homework 4: E9-7, E9-8, E9-18 5th Edition

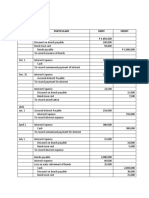

Exercise 9-8 (LO 9-5)

Requirement 1

(1) (2) (3) (4) (5)

Increase in

Cash Interest Carrying Carrying

Date Paid Expense Value Value

Face Carrying Value Prior

Amount x 5% Market (3) – (2) Carrying

x 4.5% Rate Value + (4)

Stated Rate

1/ 1 /2021 457,102

6/30/2021 22,500 22,855 355 457,457

12/31/2021 22,500 22,873 373 457,830

Requirement 2

January 1, 2021 Debit Credit

Cash 457,102

Discount on Bonds Payable 42,898

Bonds Payable 500,000

(Issue bonds at a discount)

June 30, 2021

Interest Expense 22,855

Discount on Bonds Payable 355

(difference)

Cash 22,500

(Pay semi-annual interest)

December 31, 2021

Interest Expense 22,873

Discount on Bonds Payable 373

(difference)

Cash 22,500

(Pay semi-annual interest)

ACCT101 Financial Accounting Homework 4: E9-7, E9-8, E9-18 5th Edition

Exercise 9-18 (LO 9-7) Please use the Present Value Tables (i.e., Table 2 and Table 4

on page P-2 and P-4 in the textbook) at the end of the textbook to calculate the bond price.

Requirement 1

Bond is issued at a premium.

PV of principal $41,000,000 x 0.20829 = 8,539,890

PV of interest payments $1,845,000 x 19.79277 = 36,517,661

Issue price of bonds = $45,057,551

Requirement 2

Bond is issued at face amount.

PV of principal $41,000,000 x 0.17193 = 7,049,130

PV of interest payments $1,845,000 x 18.40158 = 33,950,915

Issue price of bonds = $41,000,045

Requirement 3

Bond is issued at a discount.

PV of principal $41,000,000 x 0.14205 = 5,824,050

PV of interest payments $1,845,000 x 17.15909 = 31,658521

Issue price of bonds = $37,482,571

You might also like

- Client Information Sheet: Company'S Information::: Signatory'S InformationDocument4 pagesClient Information Sheet: Company'S Information::: Signatory'S InformationGarbo BentleyNo ratings yet

- Case 3Document13 pagesCase 3Prezi Toli100% (1)

- Introduction To Budgets and Preparing The Master Budget Coverage of Learning ObjectivesDocument44 pagesIntroduction To Budgets and Preparing The Master Budget Coverage of Learning Objectivesahmed100% (1)

- B7AF102 Financial Accounting May 2023Document11 pagesB7AF102 Financial Accounting May 2023gerlaniamelgacoNo ratings yet

- Introduction To Budgets and Preparing The Master Budget: Coverage of Learning ObjectivesDocument45 pagesIntroduction To Budgets and Preparing The Master Budget: Coverage of Learning ObjectivesReyansh SharmaNo ratings yet

- Lobrigas Unit3 Topic2 AssessmentDocument6 pagesLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Ia 3 ZZZZDocument4 pagesIa 3 ZZZZPRE GNNo ratings yet

- Chapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Document66 pagesChapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Never Letting GoNo ratings yet

- AP-LIABS-3 (With Answers)Document4 pagesAP-LIABS-3 (With Answers)Kendrew SujideNo ratings yet

- Quiz 2 BP With Answers PDFDocument4 pagesQuiz 2 BP With Answers PDFspur iousNo ratings yet

- Revised FAR PROBLEMS (PART 2) With AnswersDocument17 pagesRevised FAR PROBLEMS (PART 2) With AnswersBergNo ratings yet

- Bonds Payable Bond - Is A Formal Unconditional Promise, Made Under Seal, To Pay A Specified Sum of Money at ADocument8 pagesBonds Payable Bond - Is A Formal Unconditional Promise, Made Under Seal, To Pay A Specified Sum of Money at ACamille BacaresNo ratings yet

- Quiz 2 BPDocument4 pagesQuiz 2 BPspur iousNo ratings yet

- Mary Joy Otic Test 1Document10 pagesMary Joy Otic Test 1norman mandoNo ratings yet

- 3.3.1 Notes and Loans Receivable Receivable FinancingDocument14 pages3.3.1 Notes and Loans Receivable Receivable FinancingJan Nelson BayanganNo ratings yet

- IA2Document9 pagesIA2Claire BarbaNo ratings yet

- Quiz 2 BP With AnswersDocument4 pagesQuiz 2 BP With Answersspur iousNo ratings yet

- Accounting 1Document10 pagesAccounting 1Jay EbuenNo ratings yet

- Liabilities QuizDocument5 pagesLiabilities QuizVanshee 11No ratings yet

- Take-Home Exam 1Document9 pagesTake-Home Exam 1Okuhle MqoboliNo ratings yet

- Fra 3Document7 pagesFra 3Subhajyoti MukhopadhyayNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Problems Bonds-PayableDocument8 pagesProblems Bonds-PayableKezNo ratings yet

- Tugas Ch.14Document6 pagesTugas Ch.14Chupa HesNo ratings yet

- Module 7 - Notes ReceivableDocument5 pagesModule 7 - Notes Receivablejustine cabanaNo ratings yet

- Chapter 5 - Ia3Document3 pagesChapter 5 - Ia3Xynith Nicole RamosNo ratings yet

- Module - IA Chapter 6Document10 pagesModule - IA Chapter 6Kathleen EbuenNo ratings yet

- CH 4: Apply Your Knowledge Decision Case 4-1: Accounting 9/e Solutions Manual 392Document15 pagesCH 4: Apply Your Knowledge Decision Case 4-1: Accounting 9/e Solutions Manual 392Loany Martinez100% (1)

- IAIIASI05&ACT05 - For StudentsDocument22 pagesIAIIASI05&ACT05 - For StudentsLovely Anne Dela CruzNo ratings yet

- Quiz 4 With SolutionDocument5 pagesQuiz 4 With SolutionKarl Lincoln TemporosaNo ratings yet

- 2 - Accounting For Note ReceivableDocument10 pages2 - Accounting For Note ReceivableReese AyessaNo ratings yet

- Renton Effective Am21Document5 pagesRenton Effective Am21Kris Hazel RentonNo ratings yet

- Bonds Payable Issued at A PremiumDocument6 pagesBonds Payable Issued at A PremiumCris Ann Marie ESPAnOLANo ratings yet

- Assurance SP Reviewer PremidDocument14 pagesAssurance SP Reviewer PremidMica Bengson TolentinoNo ratings yet

- Problem 6-5 & 6Document2 pagesProblem 6-5 & 6Micah April SabularseNo ratings yet

- Chapter 14 AKM Kieso - Jawab SoalDocument6 pagesChapter 14 AKM Kieso - Jawab SoalNABILAH KHANSA 1911000089No ratings yet

- Chapter 20Document74 pagesChapter 20astherille caxxNo ratings yet

- Combinepdf 1 PDFDocument16 pagesCombinepdf 1 PDFandrea arapocNo ratings yet

- 2020 Spring Midterm II A AnsKey PDFDocument12 pages2020 Spring Midterm II A AnsKey PDFEunice GuoNo ratings yet

- Ia PPT 6Document20 pagesIa PPT 6lorriejaneNo ratings yet

- Summary Bonds Payable PDFDocument6 pagesSummary Bonds Payable PDFRovi PatinoNo ratings yet

- Note Payable Irrevocably Designated As at Fair Value Through Profit or LossDocument4 pagesNote Payable Irrevocably Designated As at Fair Value Through Profit or Lossnot funny didn't laughNo ratings yet

- Chapter 3 - Bonds PayableDocument6 pagesChapter 3 - Bonds PayablePatricia EsplagoNo ratings yet

- Note Payable: Feu - IabfDocument5 pagesNote Payable: Feu - IabfDonise Ronadel SantosNo ratings yet

- January 1, 2020 P5,388,835 December 31, 2020 P550,000 P484,995 P65,005Document7 pagesJanuary 1, 2020 P5,388,835 December 31, 2020 P550,000 P484,995 P65,005gazer beamNo ratings yet

- Accounting Revision SheetDocument6 pagesAccounting Revision SheetjaiinaniNo ratings yet

- 21 Problems - and - Answers - Reclassification - of - Financial - AssetDocument30 pages21 Problems - and - Answers - Reclassification - of - Financial - AssetSheila Grace BajaNo ratings yet

- Investments in Debt SecuritiesDocument34 pagesInvestments in Debt SecuritiesNobu NobuNo ratings yet

- Acctg Lab 7Document8 pagesAcctg Lab 7AngieNo ratings yet

- Midterm Test - Code 37 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 37 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Module 2 - Topic 3 (Notes Receivable)Document7 pagesModule 2 - Topic 3 (Notes Receivable)GRACE ANN BERGONIONo ratings yet

- Debt Financing SolutionsDocument3 pagesDebt Financing SolutionsSleepy marshmallowNo ratings yet

- Quiz 2 DeliveryDocument20 pagesQuiz 2 DeliveryAli Zain ParharNo ratings yet

- Garcia Unit3 AssessmentTopic1Document5 pagesGarcia Unit3 AssessmentTopic1jaychristiangarcia18No ratings yet

- Problem 1 Investment in Equity SecuritiesDocument6 pagesProblem 1 Investment in Equity SecuritiesGabriel OrolfoNo ratings yet

- Acctg Lab 4Document3 pagesAcctg Lab 4AngieNo ratings yet

- Name: Solution Problem: P14-2, Issuance and Retirement of Bonds Course: DateDocument8 pagesName: Solution Problem: P14-2, Issuance and Retirement of Bonds Course: DateRegina PutriNo ratings yet

- Date Particulars Debit CreditDocument5 pagesDate Particulars Debit CreditToun MyNo ratings yet

- Assessment Task 3Document5 pagesAssessment Task 3Christian N MagsinoNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- COR1100 Assessment 1Document5 pagesCOR1100 Assessment 1Nandini GoyalNo ratings yet

- Midterm Cheat SheetDocument2 pagesMidterm Cheat SheetNandini GoyalNo ratings yet

- EOG Final NotesDocument18 pagesEOG Final NotesNandini GoyalNo ratings yet

- COR2100 Cheat SheetDocument2 pagesCOR2100 Cheat SheetNandini GoyalNo ratings yet

- Willingdon College, Sangli. Willingdon College, Sangli. Willingdon College, Sangli. Willingdon College, SangliDocument1 pageWillingdon College, Sangli. Willingdon College, Sangli. Willingdon College, Sangli. Willingdon College, SangliTik tok & Funny videoNo ratings yet

- The Banking Regulation Review - Edition 11Document11 pagesThe Banking Regulation Review - Edition 11Mylene Orain SevillaNo ratings yet

- Tanggal Uraian Transaksi Nominal Transaksi SaldoDocument4 pagesTanggal Uraian Transaksi Nominal Transaksi SaldoAdnan JafarNo ratings yet

- Axis BankDocument20 pagesAxis BankXYZ909No ratings yet

- New Card Application Form & Stop Notice: Given Name/s Surname Cif KeyDocument1 pageNew Card Application Form & Stop Notice: Given Name/s Surname Cif KeyGerald SaiguyauNo ratings yet

- Axis Bank Statement 916020016900949 PDFDocument6 pagesAxis Bank Statement 916020016900949 PDFAnonymous iN6XHHANo ratings yet

- Unit Test 4Document12 pagesUnit Test 4Tin Nguyen0% (1)

- Financial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyDocument8 pagesFinancial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyJamhel MarquezNo ratings yet

- My ProjectDocument159 pagesMy ProjectVijay KumarNo ratings yet

- Capital Adequacy Ratio - Wikipedia, The Free EncyclopediaDocument4 pagesCapital Adequacy Ratio - Wikipedia, The Free EncyclopediaTrần Kim ChungNo ratings yet

- SCInterestDocument6 pagesSCInterestJamaica MoralejaNo ratings yet

- Overview of The Philippine Financial & Banking Legal Framework (Part I)Document111 pagesOverview of The Philippine Financial & Banking Legal Framework (Part I)Saint AliaNo ratings yet

- Hayman July 07Document5 pagesHayman July 07grumpyfeckerNo ratings yet

- MR - Sanjay Kumar Bhardwaj Visit Dial Your Bank: Page 1 of 2 M-76543125-1Document2 pagesMR - Sanjay Kumar Bhardwaj Visit Dial Your Bank: Page 1 of 2 M-76543125-1Sanjay BhardwajNo ratings yet

- Aman Kapoor - Col. KS Mohan Sir - Priority BankingDocument69 pagesAman Kapoor - Col. KS Mohan Sir - Priority Bankingbond11111No ratings yet

- Hdssdas 7878Document3 pagesHdssdas 7878vamshiyerrawarNo ratings yet

- Tanggal Uraian Transaksi Nominal Transaksi SaldoDocument4 pagesTanggal Uraian Transaksi Nominal Transaksi SaldoPipit NurfitrohNo ratings yet

- Api H2HDocument5 pagesApi H2HShree GuptaNo ratings yet

- Credit & CollectionsDocument4 pagesCredit & CollectionsMercury2012No ratings yet

- SCB Supervalue Titanium.Document2 pagesSCB Supervalue Titanium.sanket shahNo ratings yet

- DNL Use of Proceeds Annual Progress As of 12.31.14Document6 pagesDNL Use of Proceeds Annual Progress As of 12.31.14WrLw7pcufeGUNo ratings yet

- Finacle MenusDocument6 pagesFinacle MenusDeepjyoti SarmaNo ratings yet

- Project Report On Customer Preference For Current Account Services at ING VYSYA BankDocument71 pagesProject Report On Customer Preference For Current Account Services at ING VYSYA BankAnil Makvana0% (1)

- BKI MM Aug2022 ReportDocument25 pagesBKI MM Aug2022 ReportZerohedgeNo ratings yet

- Acct Statement XX0012 25052023Document5 pagesAcct Statement XX0012 25052023JunoonNo ratings yet

- SOP PF Withdrawal Claim FormsDocument4 pagesSOP PF Withdrawal Claim FormsAastikUdeniaNo ratings yet

- Management Comparision of Private and Public BankDocument24 pagesManagement Comparision of Private and Public BankআশরাফুলহকNo ratings yet

- Stockquotes 12012020 PDFDocument9 pagesStockquotes 12012020 PDFXander 4thNo ratings yet

- Business Guide - Direct Debit v2.0Document43 pagesBusiness Guide - Direct Debit v2.0Dimitrios PloutarchosNo ratings yet