Professional Documents

Culture Documents

HW3

Uploaded by

Vianna NgCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HW3

Uploaded by

Vianna NgCopyright:

Available Formats

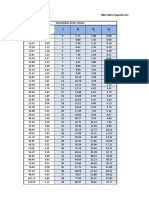

All the returns are monthly and in %. So 0.56 means 0.56% in that month.

Month Mkt-RF RF Apple return Apple return -RF Answer

1 -4.74 0.41 0.91 0.50 From the regression, we can find that the beta is 0.

2 2.45 0.43 10.48 10.05

3 5.2 0.47 18.48 18.01 Market risk premium

4 -6.4 0.46 -8.65 -9.11 0.330

5 -4.42 0.5 -32.29 -32.79

6 4.64 0.4 24.70 24.30 CAPM forecast

7 -2.51 0.48 -2.98 -3.46 Expected return

8 7.03 0.5 19.93 19.43

9 -5.45 0.51 -57.74 -58.25

10 -2.76 0.56 -24.03 -24.59

11 -10.72 0.51 -15.65 -16.16

12 1.19 0.5 -9.85 -10.35

13 3.13 0.54 45.38 44.84

14 -10.05 0.38 -15.61 -15.99

15 -7.26 0.42 20.93 20.51

16 7.94 0.39 15.50 15.11

17 0.72 0.32 -21.73 -22.05

18 -1.94 0.28 16.54 16.26

19 -2.13 0.3 -19.18 -19.48

20 -6.46 0.31 -1.28 -1.59

21 -9.25 0.28 -16.39 -16.67

22 2.46 0.22 13.22 13.00

23 7.54 0.17 21.30 21.13

24 1.61 0.15 2.82 2.67

25 -1.44 0.14 12.88 12.74

26 -2.29 0.13 -12.22 -12.35

27 4.24 0.13 9.08 8.95

28 -5.2 0.15 2.53 2.38

29 -1.38 0.14 -4.00 -4.14

30 -7.21 0.13 -23.95 -24.08

31 -8.18 0.15 -13.88 -14.03

32 0.5 0.14 -3.34 -3.48

33 -10.35 0.14 -1.69 -1.83

34 7.84 0.14 10.83 10.69

35 5.96 0.12 -3.55 -3.67

36 -5.76 0.11 -7.55 -7.66

37 -2.57 0.1 0.21 0.11

38 -1.88 0.09 4.53 4.44

39 1.09 0.1 -5.80 -5.90

40 8.22 0.1 0.57 0.47

41 6.05 0.09 26.23 26.14

42 1.42 0.1 6.18 6.08

43 2.35 0.07 10.60 10.53

44 2.34 0.07 7.26 7.19

45 -1.24 0.08 -8.36 -8.44

46 6.08 0.07 10.47 10.40

47 1.35 0.07 -8.65 -8.72

48 4.29 0.08 2.20 2.12

49 2.15 0.07 5.57 5.50

50 1.4 0.06 6.03 5.97

51 -1.32 0.09 13.04 12.95

52 -1.83 0.08 -4.66 -4.74

53 1.17 0.06 8.84 8.78

54 1.86 0.08 15.97 15.89

55 -4.06 0.1 -0.61 -0.71

56 0.08 0.11 6.65 6.54

57 1.6 0.11 12.35 12.24

58 1.43 0.11 35.23 35.12

59 4.54 0.15 27.96 27.81

60 3.43 0.16 -3.95 -4.11

61 -2.76 0.16 19.41 19.25

62 1.89 0.16 16.67 16.51

63 -1.97 0.21 -7.11 -7.32

64 -2.61 0.21 -13.46 -13.67

65 3.65 0.24 10.26 10.02

66 0.57 0.23 -7.42 -7.65

67 3.92 0.24 15.87 15.63

68 -1.22 0.3 9.94 9.64

69 0.49 0.29 14.33 14.04

70 -2.02 0.27 7.42 7.15

71 3.61 0.31 17.76 17.45

72 -0.25 0.32 6.00 5.68

73 3.04 0.35 5.04 4.69

74 -0.3 0.34 -9.30 -9.64

75 1.46 0.37 -8.42 -8.79

76 0.73 0.36 12.23 11.87

77 -3.57 0.43 -15.09 -15.52

78 -0.35 0.4 -4.18 -4.58

79 -0.78 0.4 18.67 18.27

80 2.03 0.42 -0.16 -0.58

81 1.84 0.41 13.46 13.05

82 3.23 0.41 5.33 4.92

83 1.71 0.42 13.05 12.63

84 0.87 0.4 -7.44 -7.84

85 1.4 0.44 1.05 0.61

86 -1.96 0.38 -1.31 -1.69

87 0.68 0.43 9.81 9.38

88 3.49 0.44 7.42 6.98

89 3.24 0.41 21.43 21.02

90 -1.96 0.4 0.70 0.30

91 -3.73 0.4 7.96 7.56

92 0.92 0.42 5.10 4.68

93 3.22 0.32 10.82 10.50

94 1.8 0.32 23.77 23.45

95 -4.83 0.34 -4.07 -4.41

96 -0.87 0.27 8.70 8.43

97 -6.36 0.21 -31.66 -31.87

98 -3.09 0.13 -7.64 -7.77

99 -0.93 0.17 14.78 14.61

100 4.6 0.18 21.22 21.04

101 1.86 0.18 8.51 8.33

102 -8.44 0.17 -11.29 -11.46

103 -0.77 0.15 -5.07 -5.22

104 1.53 0.13 6.66 6.53

105 -9.24 0.15 -32.96 -33.11

106 -17.23 0.08 -5.34 -5.42

107 -7.86 0.03 -13.87 -13.90

108 1.74 0 -7.90 -7.90

109 -8.12 0 5.60 5.60

110 -10.1 0.01 -0.91 -0.92

111 8.95 0.02 17.70 17.68

112 10.19 0.01 19.70 19.69

113 5.21 0 7.93 7.93

114 0.43 0.01 4.87 4.86

115 7.72 0.01 14.72 14.71

116 3.33 0.01 2.95 2.94

117 4.08 0.01 10.19 10.18

118 -2.59 0 1.70 1.70

119 5.56 0 6.05 6.05

120 2.75 0.01 5.41 5.40

121 -3.36 0 -8.86 -8.86

122 3.4 0 6.54 6.54

123 6.31 0.01 14.85 14.84

124 2 0.01 11.10 11.09

125 -7.89 0.01 -1.61 -1.62

126 -5.56 0.01 -2.08 -2.09

127 6.93 0.01 2.27 2.26

128 -4.77 0.01 -5.50 -5.51

129 9.54 0.01 16.72 16.71

130 3.88 0.01 6.07 6.06

131 0.6 0.01 3.38 3.37

132 6.82 0.01 3.67 3.66

133 1.99 0.01 5.20 5.19

134 3.49 0.01 4.09 4.08

135 0.45 0.01 -1.33 -1.34

136 2.9 0 0.46 0.46

137 -1.27 0 -0.66 -0.66

138 -1.75 0 -3.50 -3.50

139 -2.36 0 16.33 16.33

140 -5.99 0.01 -1.45 -1.46

141 -7.59 0 -0.91 -0.91

142 11.35 0 6.15 6.15

143 -0.28 0 -5.58 -5.58

144 0.74 0 5.97 5.97

145 5.05 0 12.71 12.71

146 4.42 0 18.83 18.83

147 3.11 0 10.53 10.53

148 -0.85 0 -2.60 -2.60

149 -6.19 0.01 -1.07 -1.08

150 3.89 0 1.09 1.09

151 0.79 0 4.58 4.58

152 2.55 0.01 9.39 9.38

153 2.73 0.01 0.28 0.27

154 -1.76 0.01 -10.76 -10.77

155 0.78 0.01 -1.24 -1.25

156 1.18 0.01 -9.07 -9.08

157 5.57 0 -14.41 -14.41

158 1.29 0 -2.53 -2.53

159 4.03 0 0.29 0.29

160 1.56 0 0.03 0.03

161 2.8 0 2.24 2.24

162 -1.2 0 -11.83 -11.83

163 5.65 0 14.12 14.12

164 -2.71 0 8.38 8.38

165 3.77 0 -2.15 -2.15

166 4.18 0 9.64 9.64

167 3.12 0 7.01 7.01

168 2.81 0 0.89 0.89

169 -3.32 0 -10.77 -10.77

170 4.65 0 5.75 5.75

171 0.43 0 2.00 2.00

172 -0.19 0 9.94 9.94

173 2.06 0 7.87 7.87

174 2.61 0 2.77 2.77

175 -2.04 0 2.87 2.87

176 4.23 0 7.75 7.75

177 -1.97 0 -1.71 -1.71

178 2.52 0 7.20 7.20

179 2.55 0 10.60 10.60

180 -0.06 0 -7.19 -7.19

181 -3.11 0 6.14 6.14

182 6.13 0 10.08 10.08

183 -1.12 0 -3.14 -3.14

184 0.59 0 0.58 0.58

185 1.36 0 4.53 4.53

186 -1.53 0 -3.72 -3.72

187 1.54 0 -3.29 -3.29

188 -6.04 0 -6.62 -6.62

189 -3.08 0 -2.18 -2.18

190 7.75 0 8.34 8.34

191 0.56 0.01 -0.58 -0.59

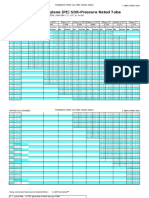

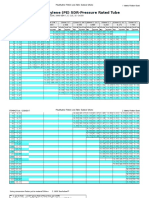

gression, we can find that the beta is 0.19233 and alpha is -0.16241.

Risk-free rate (Taking the average of RF)

0.144

(Under CAPM, alpha is assumed as 0)

20.695%

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.527112

R Square 0.277847

Adjusted R 0.274027

Standard E 3.858514

Observatio 191

ANOVA

df SS MS F Significance F

Regression 1 1082.629 1082.629 72.71756 4.74E-15

Residual 189 2813.857 14.88813

Total 190 3896.486

Coefficients

Standard Error t Stat P-value Lower 95%Upper 95%

Lower 95.0%

Upper 95.0%

Intercept -0.162409 0.285098 -0.569663 0.569583 -0.724791 0.399973 -0.724791 0.399973

X Variable 0.19233 0.022554 8.527459 4.74E-15 0.14784 0.23682 0.14784 0.23682

You might also like

- Andreessen Horowitz Case Study: Evaluating the VC Firm's ModelDocument3 pagesAndreessen Horowitz Case Study: Evaluating the VC Firm's ModelPaco Colín50% (4)

- Moles and Equations - Worksheets 2.1-2.11 1 AnsDocument19 pagesMoles and Equations - Worksheets 2.1-2.11 1 Ansash2568% (24)

- AmazonDocument28 pagesAmazonVianna NgNo ratings yet

- Airbnb IPODocument64 pagesAirbnb IPOVianna NgNo ratings yet

- Vibrational Behaviour of The Turbo Generator Stator End Winding in CaseDocument12 pagesVibrational Behaviour of The Turbo Generator Stator End Winding in Casekoohestani_afshin50% (2)

- Ayurveda Fact Sheet AustraliaDocument2 pagesAyurveda Fact Sheet AustraliaRaviNo ratings yet

- A History of The Methodist Episcopal Church Volume I (Nathan D.D.bangs)Document244 pagesA History of The Methodist Episcopal Church Volume I (Nathan D.D.bangs)Jaguar777xNo ratings yet

- R448A PRESSURE TEMPERATURE CHARTDocument2 pagesR448A PRESSURE TEMPERATURE CHARTCesar VillarNo ratings yet

- Design of Typical Community HallDocument52 pagesDesign of Typical Community HallD.V.Srinivasa Rao0% (1)

- Practical Salinity ScaleDocument53 pagesPractical Salinity ScalesreeramNo ratings yet

- UntitledDocument442 pagesUntitledArmando MendietaNo ratings yet

- ESTUDIANTE: Flores Cayllahua Yonatan CÓDIGO: 201522000 Ejercicio 1Document7 pagesESTUDIANTE: Flores Cayllahua Yonatan CÓDIGO: 201522000 Ejercicio 1yonatan flores cayllahuaNo ratings yet

- Design of Structure: Construction of F.C.O Lab Building at T.P.GudemDocument17 pagesDesign of Structure: Construction of F.C.O Lab Building at T.P.GudemD.V.Srinivasa RaoNo ratings yet

- PerformanceMeasures GradedQuiz SolutionsDocument3 pagesPerformanceMeasures GradedQuiz Solutionsphuongdungnguyen2412No ratings yet

- Accelerograma Vrancea 1977 EastWestDocument51 pagesAccelerograma Vrancea 1977 EastWestPaul Ionescu IINo ratings yet

- Re Acci OnesDocument9 pagesRe Acci OnesCres P. BaldeonNo ratings yet

- Sine Wavefor FormulaDocument158 pagesSine Wavefor FormulanmguravNo ratings yet

- Design GP Office PedapaduDocument21 pagesDesign GP Office PedapaduD.V.Srinivasa RaoNo ratings yet

- 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Total Selama 18 TahunDocument3 pages2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Total Selama 18 Tahunchristal panjaitanNo ratings yet

- Control Room Report PDFDocument38 pagesControl Room Report PDFAbhishek ChappaNo ratings yet

- Nilai Faktor Kapasitas Dukung Terzaghi Keruntuhan Geser Umum α f K N N NDocument12 pagesNilai Faktor Kapasitas Dukung Terzaghi Keruntuhan Geser Umum α f K N N Nkamil sNo ratings yet

- BreakdownDocument103 pagesBreakdownhandiNo ratings yet

- FSAE Stab Rig DataDocument37 pagesFSAE Stab Rig DataahmadNo ratings yet

- Polyethylene (PE) SDR-Pressure Rated Tube: Friction Loss CharacteristicsDocument24 pagesPolyethylene (PE) SDR-Pressure Rated Tube: Friction Loss CharacteristicsqastroqNo ratings yet

- BombeoDocument17 pagesBombeoNicolas Cediel LopezNo ratings yet

- R717 (Ammonia) Pressure Temperature ChartDocument2 pagesR717 (Ammonia) Pressure Temperature ChartNeoZeruelNo ratings yet

- r717 PT Chart PDFDocument2 pagesr717 PT Chart PDFTechnos GuruNo ratings yet

- r717 PT ChartDocument2 pagesr717 PT ChartYogesh NarkarNo ratings yet

- r717 PT Chart PDFDocument2 pagesr717 PT Chart PDFAlexander Cordero GomezNo ratings yet

- Temperature/Pressure (Kpa) Chart: Temp Refrigerant/Pressure Kpa Temp Refrigerant/Pressure KpaDocument1 pageTemperature/Pressure (Kpa) Chart: Temp Refrigerant/Pressure Kpa Temp Refrigerant/Pressure KpaMohamed AghilaNo ratings yet

- 4-Petra - 770 South HarborDocument302 pages4-Petra - 770 South HarborJNo ratings yet

- FOGRA52 MW3 SubsetDocument2 pagesFOGRA52 MW3 Subsetana1correiaNo ratings yet

- Report 29 September 2022Document1 pageReport 29 September 2022Muhammad Rabi SafderNo ratings yet

- Simulating A M/M/1 Queueing System: Results From One Run: Arrival Rate (Customers/sec) Departure Rate (Custutomers/sec)Document44 pagesSimulating A M/M/1 Queueing System: Results From One Run: Arrival Rate (Customers/sec) Departure Rate (Custutomers/sec)Dr. Ir. R. Didin Kusdian, MT.No ratings yet

- Interest TablesDocument1 pageInterest Tablesnindidavid628No ratings yet

- JULIAN - BALLEN - Funciones MatemáticasDocument21 pagesJULIAN - BALLEN - Funciones Matemáticasjulian ballenNo ratings yet

- Copia de CanalDocument33 pagesCopia de CanalPO Roussell MaicolNo ratings yet

- Eading Biquitous Rontier Eading Biquitous Rontier: PCB Antenna Design GuideDocument5 pagesEading Biquitous Rontier Eading Biquitous Rontier: PCB Antenna Design GuideJuan Camilo GuarnizoNo ratings yet

- Polyethylene friction loss chartDocument18 pagesPolyethylene friction loss chartprasadnn2001No ratings yet

- B.1.Pipe - Design - Koltadi Main LineDocument27 pagesB.1.Pipe - Design - Koltadi Main LineCivil EngineeringNo ratings yet

- FOGRA1SDocument17 pagesFOGRA1SM. PopovaNo ratings yet

- P WC Cat Ed 10 Page 172 2Document1 pageP WC Cat Ed 10 Page 172 2Satisfying VdoNo ratings yet

- Mantis Pistol Rifle Target Ring Guide 20 Yd 1 Yd IncDocument1 pageMantis Pistol Rifle Target Ring Guide 20 Yd 1 Yd IncTanis TruittNo ratings yet

- Book 2Document386 pagesBook 2huzefasakriwalaNo ratings yet

- Fogra51 Mw3 SubsetDocument2 pagesFogra51 Mw3 Subsetana1correiaNo ratings yet

- R134a PT ChartDocument2 pagesR134a PT ChartsameerNo ratings yet

- R134a PT ChartDocument2 pagesR134a PT ChartAttila JonesNo ratings yet

- R134a PT Chart PDFDocument2 pagesR134a PT Chart PDFSathish NNo ratings yet

- South North 2Document4 pagesSouth North 2Pedro PaulinoNo ratings yet

- K8L WalkingDocument124 pagesK8L WalkingKimkimNo ratings yet

- Engsolutions RCB: P-Delta Analysis-Support ReactionsDocument2 pagesEngsolutions RCB: P-Delta Analysis-Support ReactionsWilliam CifuentesNo ratings yet

- Total Force GraphDocument3 pagesTotal Force GraphSyafiq DanielNo ratings yet

- Analysis of Prod HBB NPC TSB INF INT TUP RDI DIP dataDocument13 pagesAnalysis of Prod HBB NPC TSB INF INT TUP RDI DIP dataTaufik Hidayat B TNo ratings yet

- Book 2Document13 pagesBook 2Taufik Hidayat B TNo ratings yet

- Prod HBB NPC TSB INF INT TUP RDI DIPDocument13 pagesProd HBB NPC TSB INF INT TUP RDI DIPTaufik Hidayat B TNo ratings yet

- Design GP Office NallajerlaDocument9 pagesDesign GP Office NallajerlaD.V.Srinivasa RaoNo ratings yet

- Polyethylene (PE) SDR-Pressure Rated Tube: Frictional Head Loss ChartDocument1 pagePolyethylene (PE) SDR-Pressure Rated Tube: Frictional Head Loss CharthumphrangoNo ratings yet

- HYDPRO - Drilling Hydraulics Model: Computational ResultsDocument7 pagesHYDPRO - Drilling Hydraulics Model: Computational ResultsjimmyvargasarteagaNo ratings yet

- Areva DLF Limited Bharti Airtel Tata Motors Siemens SBIDocument13 pagesAreva DLF Limited Bharti Airtel Tata Motors Siemens SBIilovetrouble780No ratings yet

- Engsolutions RCB: P-Delta Analysis-Support ReactionsDocument3 pagesEngsolutions RCB: P-Delta Analysis-Support ReactionsProyectos Constrwctor sasNo ratings yet

- Manual Sounding Table No2 HfoDocument15 pagesManual Sounding Table No2 HfoAndhityas Piscessandhy PutraNo ratings yet

- FOGRA56 MW3 SubsetDocument2 pagesFOGRA56 MW3 Subsetana1correiaNo ratings yet

- 10 Portfolios Prior 12 2Document98 pages10 Portfolios Prior 12 2Alexey VinokurovNo ratings yet

- Alcantarillado SanitarioDocument1,162 pagesAlcantarillado SanitarioSheyla Iridian Cuadros PortugalNo ratings yet

- Ewalker Consulting JDDocument2 pagesEwalker Consulting JDVianna NgNo ratings yet

- Review For HUMA2101 Final Exam Fall 2022 (1) - TaggedDocument2 pagesReview For HUMA2101 Final Exam Fall 2022 (1) - TaggedVianna NgNo ratings yet

- Airbnb SimulationDocument5 pagesAirbnb SimulationVianna NgNo ratings yet

- Citic JDDocument1 pageCitic JDVianna NgNo ratings yet

- Performance Descriptors - Oral Presentation 1Document3 pagesPerformance Descriptors - Oral Presentation 1Vianna NgNo ratings yet

- Final Exam L3 - 4 AppendixDocument6 pagesFinal Exam L3 - 4 AppendixVianna NgNo ratings yet

- Friedman's Argument That Business's Only Responsibility Is To Increase ProfitsDocument8 pagesFriedman's Argument That Business's Only Responsibility Is To Increase ProfitsFatima YauderNo ratings yet

- Choosing The Right Valuation ModelDocument7 pagesChoosing The Right Valuation ModelSubscription 126No ratings yet

- Importance of Bilingual Communication in Civil Service: Hon Ip Lau Suk-Yee, Regina 20 December 2012Document11 pagesImportance of Bilingual Communication in Civil Service: Hon Ip Lau Suk-Yee, Regina 20 December 2012Vianna NgNo ratings yet

- Case Analysis Report (Individual) AnishaDocument6 pagesCase Analysis Report (Individual) AnishaVianna NgNo ratings yet

- HUMA1000B Fall 2021-22 SyllabusDocument5 pagesHUMA1000B Fall 2021-22 SyllabusVianna NgNo ratings yet

- Column1 Price of One Orange Wah Kee Fresh HK$3.00 Yau Ma Tei FR HK$2.80 Category 3 3.5 Category 4 4.5Document1 pageColumn1 Price of One Orange Wah Kee Fresh HK$3.00 Yau Ma Tei FR HK$2.80 Category 3 3.5 Category 4 4.5Vianna NgNo ratings yet

- NYSF Walmart Solutionv2Document41 pagesNYSF Walmart Solutionv2Vianna NgNo ratings yet

- K I Am Comfortable To Consume Imperfect Fruits (I.e. Odd Shapes or With Scars) Which Is Safe To Eat 1 5 2 9 3 17 4 44 5 75Document2 pagesK I Am Comfortable To Consume Imperfect Fruits (I.e. Odd Shapes or With Scars) Which Is Safe To Eat 1 5 2 9 3 17 4 44 5 75Vianna NgNo ratings yet

- Column1 What Do You Think About The Fruit Price in Hong Kong Low 0 Reasonable 7 Quite High 25 Unaffordable 68Document1 pageColumn1 What Do You Think About The Fruit Price in Hong Kong Low 0 Reasonable 7 Quite High 25 Unaffordable 68Vianna NgNo ratings yet

- Different Type of Transportation: Figure 1 Emission of Carbon Dioxide in Hong Kong in 2016Document2 pagesDifferent Type of Transportation: Figure 1 Emission of Carbon Dioxide in Hong Kong in 2016Vianna NgNo ratings yet

- Survey 1Document2 pagesSurvey 1Vianna NgNo ratings yet

- Predicted Income Statement: Sales RevenueDocument15 pagesPredicted Income Statement: Sales RevenueVianna NgNo ratings yet

- Importance of psychological safety in delivering quality careDocument6 pagesImportance of psychological safety in delivering quality careVianna NgNo ratings yet

- 2123 Online Final Exam Rules and InstructionsDocument6 pages2123 Online Final Exam Rules and InstructionsVianna NgNo ratings yet

- ADASDocument20 pagesADASVianna NgNo ratings yet

- Year # of Hkust Freshmen Price (Tuition: HK$) Nominal GDP Real GDP (In 1990 $) Real GDP (In 2000 $)Document4 pagesYear # of Hkust Freshmen Price (Tuition: HK$) Nominal GDP Real GDP (In 1990 $) Real GDP (In 2000 $)Vianna NgNo ratings yet

- FinaDocument8 pagesFinaVianna NgNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2Vianna NgNo ratings yet

- AtomCompsData - Airbnb CompsDocument9 pagesAtomCompsData - Airbnb CompsVianna NgNo ratings yet

- Course Information: Methods. Volume, and ProfitDocument4 pagesCourse Information: Methods. Volume, and ProfitVianna NgNo ratings yet

- A Nurse's StoryDocument13 pagesA Nurse's StoryPeachee SolimanNo ratings yet

- The Future of The Past: The Contemporary Significance of The Nouvelle ThéologieDocument15 pagesThe Future of The Past: The Contemporary Significance of The Nouvelle ThéologiefesousacostaNo ratings yet

- Talent ManagementDocument8 pagesTalent Managementyared haftuNo ratings yet

- English Profesional Nursering Book 2 PDFDocument35 pagesEnglish Profesional Nursering Book 2 PDFRed Millennium50% (2)

- TLE W3 EdwinlucinaDocument25 pagesTLE W3 Edwinlucinarhodora d. tamayoNo ratings yet

- Theories of LearningDocument19 pagesTheories of LearningIndu GuptaNo ratings yet

- English 3-Q4-L7 ModuleDocument19 pagesEnglish 3-Q4-L7 ModuleZosima Abalos100% (1)

- Macroeconomics Dde PDFDocument253 pagesMacroeconomics Dde PDFPankaj GahlautNo ratings yet

- Advocate - Conflict of InterestDocument7 pagesAdvocate - Conflict of InterestZaminNo ratings yet

- Forbidden Psalm V1.1Document47 pagesForbidden Psalm V1.1Tenoch Carmona YáñezNo ratings yet

- Republic Planters Bank Vs CADocument2 pagesRepublic Planters Bank Vs CAMohammad Yusof Mauna MacalandapNo ratings yet

- 07Document30 pages07David MontoyaNo ratings yet

- Skema Pppa Kimia k2 2014 (Set 1)Document10 pagesSkema Pppa Kimia k2 2014 (Set 1)Siva Guru0% (1)

- Derrida Large DeviationsDocument13 pagesDerrida Large Deviationsanurag sahayNo ratings yet

- Supreme Court Ruling on Missing Court RecordsDocument7 pagesSupreme Court Ruling on Missing Court RecordsApr CelestialNo ratings yet

- InequalitiesDocument6 pagesInequalitiesapi-235135985No ratings yet

- What is a Mineral? Characteristics and Common TypesDocument9 pagesWhat is a Mineral? Characteristics and Common TypesSoleh SundavaNo ratings yet

- Connectors of Addition and ContrastDocument2 pagesConnectors of Addition and Contrastmmaarr100% (2)

- Workshop Francisco (Guardado Automaticamente)Document12 pagesWorkshop Francisco (Guardado Automaticamente)Helena AlmeidaNo ratings yet

- Youth Stroke Education: 60min & 40min Lesson PlansDocument18 pagesYouth Stroke Education: 60min & 40min Lesson PlansShrishail ShreeNo ratings yet

- The Impact of Cultural Intelligence On Global BusinessDocument5 pagesThe Impact of Cultural Intelligence On Global BusinessAna Mihaela IstrateNo ratings yet

- 3 Pehlke. Observations On The Historical Reliability of OT. SJT 56.1 (2013)Document22 pages3 Pehlke. Observations On The Historical Reliability of OT. SJT 56.1 (2013)Cordova Llacsahuache Leif100% (1)

- Ms. Irish Lyn T. Alolod Vi-AdviserDocument17 pagesMs. Irish Lyn T. Alolod Vi-AdviserIrish Lyn Alolod Cabilogan100% (1)

- 01 Lezione 1 Working LifeDocument18 pages01 Lezione 1 Working LifeVincenzo Di PintoNo ratings yet

- The Role and Capabilities of The Executive SponsorDocument8 pagesThe Role and Capabilities of The Executive Sponsorkatty_domínguez_8No ratings yet

- Document 2Document7 pagesDocument 2rNo ratings yet