Professional Documents

Culture Documents

Rajeev Kumar Sharma2122

Rajeev Kumar Sharma2122

Uploaded by

Vaibhav PandeyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rajeev Kumar Sharma2122

Rajeev Kumar Sharma2122

Uploaded by

Vaibhav PandeyCopyright:

Available Formats

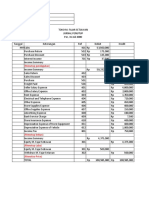

INDIAN INCOME TAX RETURN VERIFICATION FORM

Assessment

FORM [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, Year

ITR-V ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically] 2021-22

(Please see Rule 12 of the Income-tax Rules, 1962)

Name RAJEEV KUMAR SHARMA

PAN DUBPS8587J Form Number ITR-4

139(4) Belated- Return filed after due date e-Filing Acknowledgement

Filed u/s 408116950230322

Number

VERIFICATION

I, RAJEEV KUMAR SHARMA son/ daughter of BHAIYALAL SHARMA , solemnly declare that to the best of my knowledge

and belief, the information given in the return which has been submitted by me vide acknowledgement number

408116950230322 is correct and complete and is in accordance with the provisions of the Income-tax Act, 1961. I further

declare that I am making this return in my capacity as Self and I am also competent to make make this return and verify it. I

am holding permanent account number DUBPS8587J

Signature >

Date of

submission 23-Mar-2022 Source IP address 10.1.36.245

System

Generated

Barcode/QR Code DUBPS8587J044081169502303226BE35E8C5D7B8891B541EBD66B1953D766DA9D94

Instructions:

1. Please send the duly signed (preferably in blue ink) Form ITR-V to "Centralized Processing Centre, Income Tax

Department, Bengaluru 560500", by ORDINARY POST OR SPEED POST ONLY, so as to reach within 120 days from

date of submission of ITR. Alternately, you may e-verify the electronic transmitted return data using Aadhaar OTP or Login

to e-Filing account through Net-Banking login or EVC obtained generated using Pre-Validated Bank Account/Demat

Account or EVC generated through Bank ATM.

2. If Form ITR-V is received beyond the 120th day of electronic transmission of the return data or e-Verified beyond the 120th

day of electronic transmission of the return data, then the day on which the return is e-Verified or the Form ITR-V is

received at Centralized Processing Centre, Income Tax Department, Bengaluru would be treated as the date of filing the

Income Tax Return and all consequences of Income Tax Act, 1961, shall accordingly will be applicable.

3. Form ITR-V shall not be received in any other office of the Income Tax Department or in any other manner. The

confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail Id registered in the e-Filing account.

On successful verification, the return filing acknowledgement can be downloaded from e-Filing portal as a proof of

completion of process of filing the return of Income.

1 of 1

You might also like

- Disputes Assessment TestDocument21 pagesDisputes Assessment Testshakg0% (1)

- KPLC 22Document1 pageKPLC 22Document Maker Documentmaker100% (1)

- Authorization FormDocument1 pageAuthorization Formam911No ratings yet

- Lim - Tax Reviewer PDFDocument217 pagesLim - Tax Reviewer PDFHarris Camposano100% (4)

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearaccount patnaNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearBilalNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearShraddha JagadNo ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearGoutham Kumar'sNo ratings yet

- Form Itr-V Indian Income Tax Return Verification Form 2021-22Document1 pageForm Itr-V Indian Income Tax Return Verification Form 2021-22Chetanya VigNo ratings yet

- ITRVDocument1 pageITRVcaprajwalshettyNo ratings yet

- Indian Income Tax Return Verification Form 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Verification Form 2021-22: Assessment YearHarsha vardhan ReddyNo ratings yet

- PDF 579203040271223Document1 pagePDF 579203040271223Manivannan VNo ratings yet

- PDF 201380090050524Document1 pagePDF 201380090050524nirlepenterprises411No ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearAnil kadamNo ratings yet

- Form Itr-V Indian Income Tax Return Verification Form 2021-22Document1 pageForm Itr-V Indian Income Tax Return Verification Form 2021-22Arihant SatpathyNo ratings yet

- Indian Income Tax Return Verification FormDocument1 pageIndian Income Tax Return Verification FormRahul BhanNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearL ROMANANDA SINGHNo ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- PDF 334657210280923Document1 pagePDF 334657210280923Manish NirwanNo ratings yet

- Income Tax ReturnDocument1 pageIncome Tax ReturnalharamislamicfoundationNo ratings yet

- PDF 994551360250722Document1 pagePDF 994551360250722ca.bhagirathbariNo ratings yet

- Itrv EnglishDocument1 pageItrv Englishniko belicNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVivek BajajNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMurari AgarwalNo ratings yet

- Itr-V Elkpd1794p 2024-25 188420870250424Document1 pageItr-V Elkpd1794p 2024-25 188420870250424taxindia610No ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearVikas CheedellaNo ratings yet

- PDF 147397690310723Document1 pagePDF 147397690310723Rashi SrivastavaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormShyamala SubramanianNo ratings yet

- PDF 297442290260623Document1 pagePDF 297442290260623TAX INDIANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNikhil SinghNo ratings yet

- PDF 895015630200722Document1 pagePDF 895015630200722sukanta mitraNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearsandhya dollyekkaNo ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearTechwiser services and engineeringNo ratings yet

- Itr-V Adyps7344c 2023-24 149225400310723Document1 pageItr-V Adyps7344c 2023-24 149225400310723taxindia610No ratings yet

- Itr-V Asnpp1028l 2023-24 448120190130723Document1 pageItr-V Asnpp1028l 2023-24 448120190130723harsh sethiNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormDevesh Singh SenwalNo ratings yet

- PDF 919198870310723Document1 pagePDF 919198870310723sunil jadhavNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Sunita RanaDocument1 pageSunita RanaVIKASH KUMARNo ratings yet

- PDF 523510460230922Document1 pagePDF 523510460230922Vikash KumarNo ratings yet

- Mohit ShuklaDocument1 pageMohit ShuklaVaibhav PandeyNo ratings yet

- Itr-V Aygpk1992d 2023-24 206400380070623Document1 pageItr-V Aygpk1992d 2023-24 206400380070623muraliswayambuNo ratings yet

- 2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvDocument1 page2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvRohan KapurNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormBaby MazumdarNo ratings yet

- PDF 676646680170622Document1 pagePDF 676646680170622CE30 Sanket BadadeNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- PDF 878054160291222Document1 pagePDF 878054160291222Barun DasNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMahendra PatilNo ratings yet

- 2020 12 30 13 13 43 919 - 1609314223919 - XXXPP0183X - ItrvDocument1 page2020 12 30 13 13 43 919 - 1609314223919 - XXXPP0183X - Itrvtushar guptaNo ratings yet

- PDF 994808580250722Document1 pagePDF 994808580250722ca.bhagirathbariNo ratings yet

- 2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2Document1 page2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2sunny.likescatNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment Year 2021-22Document1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Year 2021-22Mayank JoshiNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formravi rajaNo ratings yet

- Itr-V MXFPK0148F 2023-24 454963440281023Document1 pageItr-V MXFPK0148F 2023-24 454963440281023prakashdebleyNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormHarishNo ratings yet

- J Itr 2022-23Document1 pageJ Itr 2022-23prabhjeet singh antalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbhavya gowdaNo ratings yet

- Itr-V Acwps3168b 2023-24 129905930310723Document1 pageItr-V Acwps3168b 2023-24 129905930310723aruncaoffice1979No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMadhan Kumar BobbalaNo ratings yet

- Itr-V Amypm5266g 2023-24 151362850310723Document1 pageItr-V Amypm5266g 2023-24 151362850310723sunil jadhavNo ratings yet

- Global Strategic Management (GSM)Document3 pagesGlobal Strategic Management (GSM)keval limbasiyaNo ratings yet

- GSM Assignment MayurDocument8 pagesGSM Assignment Mayurkeval limbasiyaNo ratings yet

- EXIM - 1 SEM - 3 Presentatioln 2022Document8 pagesEXIM - 1 SEM - 3 Presentatioln 2022keval limbasiyaNo ratings yet

- Graduate School of Management Studies: PreambleDocument2 pagesGraduate School of Management Studies: Preamblekeval limbasiyaNo ratings yet

- Introduction of The CompanyDocument6 pagesIntroduction of The Companykeval limbasiyaNo ratings yet

- Gujarat Technological University: Project Scheduling and TechniquesDocument7 pagesGujarat Technological University: Project Scheduling and Techniqueskeval limbasiyaNo ratings yet

- Summer Internship Project Report OnDocument54 pagesSummer Internship Project Report Onkeval limbasiyaNo ratings yet

- Pre-Authorized Debit (": PAD") Terms and Conditions (The "Terms")Document2 pagesPre-Authorized Debit (": PAD") Terms and Conditions (The "Terms")SepehrNo ratings yet

- CBK Power LTD Vs Cir CDDocument3 pagesCBK Power LTD Vs Cir CDJennylyn Biltz AlbanoNo ratings yet

- Account Summary Contact UsDocument2 pagesAccount Summary Contact UsJesse ReevesNo ratings yet

- File 2 First Final Bill130707Document2 pagesFile 2 First Final Bill130707Pranab GangulyNo ratings yet

- InvoiceDocument1 pageInvoiceRohankant TateluNo ratings yet

- Web Generated Bill: Lahore Electric Supply Company - Electricity Consumer Bill (Mdi)Document2 pagesWeb Generated Bill: Lahore Electric Supply Company - Electricity Consumer Bill (Mdi)Mian EjazNo ratings yet

- Branch V Subsidiary CorporationDocument4 pagesBranch V Subsidiary CorporationKristian AguilarNo ratings yet

- Sample ComputationDocument16 pagesSample ComputationMarkwin QuadxNo ratings yet

- Jurnal Penutup M. Fajar SetiawanDocument1 pageJurnal Penutup M. Fajar SetiawanecjebNo ratings yet

- Card Issuer Response CodesDocument3 pagesCard Issuer Response CodesDoutor NefariusNo ratings yet

- Tax Invoice TS1212203 BD26615Document1 pageTax Invoice TS1212203 BD26615Tejasvi ParamkusamNo ratings yet

- Quizzer TAX-Percentage-TAX Quizzer TAX - Percentage-TAXDocument15 pagesQuizzer TAX-Percentage-TAX Quizzer TAX - Percentage-TAX?????100% (6)

- Manual Esales ReportDocument394 pagesManual Esales ReportStephanie CruzNo ratings yet

- CROMA Invoice - UpdatedDocument3 pagesCROMA Invoice - UpdatedSaravanan ThavamaniNo ratings yet

- Https Indiapostgdsonline - in Gdsonlinec3p1 Reg Print - AspxDocument1 pageHttps Indiapostgdsonline - in Gdsonlinec3p1 Reg Print - AspxMurugan ANo ratings yet

- Jio FiberDocument1 pageJio FibernykbswNo ratings yet

- US Internal Revenue Service: p1546Document24 pagesUS Internal Revenue Service: p1546IRSNo ratings yet

- Final Income Taxation: Catch-All For Item of Gross Income Not Subject To Final Tax and Capital Gains TaxDocument2 pagesFinal Income Taxation: Catch-All For Item of Gross Income Not Subject To Final Tax and Capital Gains Taxdaenielle reyesNo ratings yet

- Numericals On National Income Accounting 2019-20Document2 pagesNumericals On National Income Accounting 2019-20NIKITA SONINo ratings yet

- CIBSE Membership Fees Form PDFDocument2 pagesCIBSE Membership Fees Form PDFAnonymous TlYmhkNo ratings yet

- Invoice (59 PDFDocument1 pageInvoice (59 PDFHaan 7No ratings yet

- Dollar Stretchers International Hire Purchase Agreement: HirerDocument2 pagesDollar Stretchers International Hire Purchase Agreement: HirerLàtishà PuràñNo ratings yet

- Theory and Basis of TaxationDocument20 pagesTheory and Basis of TaxationOliverDeleonSyNo ratings yet

- (Circular E), Employer's Tax Guide: Future DevelopmentsDocument48 pages(Circular E), Employer's Tax Guide: Future DevelopmentsradhakrishnaNo ratings yet

- GAARDocument20 pagesGAARXMBA 24 ITM VashiNo ratings yet

- Payment ConfirmationDocument4 pagesPayment ConfirmationPiyushNo ratings yet