Professional Documents

Culture Documents

ZWS ISO 9001:2008 QUALITY MANAGEMENT SYSTEM PAYE TAX TABLES

Uploaded by

Tinovimba Mawoyo0 ratings0% found this document useful (0 votes)

188 views1 pageRTGS Tax tables Zimbabwe

Original Title

RTGS 2022 August-December 2022 Tax Tables

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRTGS Tax tables Zimbabwe

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

188 views1 pageZWS ISO 9001:2008 QUALITY MANAGEMENT SYSTEM PAYE TAX TABLES

Uploaded by

Tinovimba MawoyoRTGS Tax tables Zimbabwe

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

ZWS ISO 9001:2008 QUALITY MANAGEMENT SYSTEM

ZIMBABWE REVENUE AUTHORITY

PAY AS YOU EARN ( PAYE) TABLES FOR AUGUST TO DECEMBER 2022

DAILY TABLE Example

Rates If an employee earns

from - to 1,633.99 multiply by 0% Deduct - $2000 per day

from 1,634.00 to 3,921.57 multiply by 20% Deduct 326.80 The tax will be calculated thus:

from 3,921.58 to 7,843.14 multiply by 25% Deduct 522.88

from 7,843.15 to 15,686.27 multiply by 30% Deduct 915.03 $2000 x 20% -$326.80 =

from 15,686.28 to 32,679.74 multiply by 35% Deduct 1,699.35 $73.20

from 32,679.75 and above multiply by 40% Deduct 3,333.33

WEEKLY TABLE Example

Rates If an employee earns

from - to 11,363.64 multiply by 0% Deduct - $15000 per week

from 11,363.65 to 27,272.73 multiply by 20% Deduct 2,272.73 The tax will be calculated thus:

from 27,272.74 to 54,545.45 multiply by 25% Deduct 3,636.36

from 54,545.46 to 109,090.91 multiply by 30% Deduct 6,363.64 $15000 x 20% -$2272.73 =

from 109,090.92 to 227,272.73 multiply by 35% Deduct 11,818.18 $727.27 per week

from 227,272.74 and above multiply by 40% Deduct 23,181.82

FORTNIGHTLY TABLE Example

Rates If an employee earns

from - to 22,727.27 multiply by 0% Deduct - $50 800 per fortnight

from 22,727.28 to 54,545.45 multiply by 20% Deduct 4,545.45 The tax will be calculated thus:

from 54,545.46 to 109,090.91 multiply by 25% Deduct 7,272.73

from 109,090.92 to 218,181.82 multiply by 30% Deduct 12,727.27 $50 800 x 20%-$4545.45

from 218,181.83 to 454,545.45 multiply by 35% Deduct 23,636.36 $2887.27 per fortnight

from 454,545.46 and above multiply by 40% Deduct 46,363.64

MONTHLY TABLE Example

Rates If an employee earns

from - to 50,000.00 multiply by 0% - $220 000 per month

from 50,000.01 to 120,000.00 multiply by 20% Deduct 10,000.00 The tax will be calculated thus:

from 120,000.01 to 240,000.00 multiply by 25% Deduct 16,000.00

from 240,000.01 to 480,000.00 multiply by 30% Deduct 28,000.00 $220 000 x 25% - $16 000.00 =

from 480,000.01 to 1,000,000.00 multiply by 35% Deduct 52,000.00 $27 000.00 per month

from 1,000,000.01 and above multiply by 40% Deduct 102,000.00

ANNUAL TABLE Example

Rates If an employee earns

from 0 to 250,000.00 multiply by 0% Deduct - $5 800 000 per year

from 250,001 to 600,000.00 multiply by 20% Deduct 50,000 The tax will be calculated thus:

from 600,001 to 1,200,000.00 multiply by 25% Deduct 80,000

from 1,200,001 to 2,400,000.00 multiply by 30% Deduct 140,000 $5 800 000 x 40%-$510 000

from 2,400,001 to 5,000,000.00 multiply by 35% Deduct 260,000 $1 810 000 per annum

from 5,000,001 and above multiply by 40% Deduct 510,000

Aids Levy is 3% of the Individuals' Tax payable

CONTACT YOUR NEAREST ZIMRA OFFICE FOR QUERIES

TAX TABLES Research Development Issue No.1 Version: 1 Issue Date: 22/12/2017

You might also like

- Aug To Dec 2022 Tax TablesDocument1 pageAug To Dec 2022 Tax TablesGodfrey MakurumureNo ratings yet

- ZWS ISO 9001:2008 QUALITY MANAGEMENT SYSTEM PAYE TAX TABLESDocument1 pageZWS ISO 9001:2008 QUALITY MANAGEMENT SYSTEM PAYE TAX TABLESGodfrey MakurumureNo ratings yet

- Jan To Jul 2022 Tax TablesDocument1 pageJan To Jul 2022 Tax Tablesgracia murevanemweNo ratings yet

- Zimbabwe Revenue Authority PAYE Tax Tables 2022Document1 pageZimbabwe Revenue Authority PAYE Tax Tables 2022Godfrey MakurumureNo ratings yet

- Tax Tables RTGS 2021 Jan - DecDocument1 pageTax Tables RTGS 2021 Jan - DecTanaka MachanaNo ratings yet

- Aug - Dec 2020 Tax Tables RTGSDocument1 pageAug - Dec 2020 Tax Tables RTGSTanaka MachanaNo ratings yet

- Tax Tables RTGS 2020Document1 pageTax Tables RTGS 2020Mai CarolNo ratings yet

- Jan-July 2023 ZWL Tax TablesDocument1 pageJan-July 2023 ZWL Tax TablesTawanda BlackwatchNo ratings yet

- August To December 2019 RTGS Tax TablesDocument1 pageAugust To December 2019 RTGS Tax TablesAlton MadyaraNo ratings yet

- Zimbabwe Revenue Authority: Pay As You Earn (Paye) Forex Tables For January To December 2018Document2 pagesZimbabwe Revenue Authority: Pay As You Earn (Paye) Forex Tables For January To December 2018Nyasha ChihungwaNo ratings yet

- JANUARY To DECEMBER 2022 USD Tax TablesDocument1 pageJANUARY To DECEMBER 2022 USD Tax TablesAndrew MusarurwaNo ratings yet

- USD Tax Tables 2022Document1 pageUSD Tax Tables 2022Godfrey MakurumureNo ratings yet

- Tax Tables 2021 Jan - DecDocument1 pageTax Tables 2021 Jan - DecGeanie TawodzeraNo ratings yet

- 2014 Tax TablesDocument1 page2014 Tax Tableszimbo2No ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- Income TAX: Particular Case 1 Case 2Document15 pagesIncome TAX: Particular Case 1 Case 2Shekh SalmanNo ratings yet

- Self Employed Tax ContributionDocument4 pagesSelf Employed Tax ContributionLe-Noi AndersonNo ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

- House Bill 5636 - Package 1Document63 pagesHouse Bill 5636 - Package 1Denise MarambaNo ratings yet

- Wake Up and Smell The CoffeeDocument6 pagesWake Up and Smell The CoffeeAeyNo ratings yet

- Gonzales CompanyDocument1 pageGonzales CompanyLako Lako FindsNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- Graduated Income Tax Rates: Effective January 1, 2018 Until December 31, 2022Document3 pagesGraduated Income Tax Rates: Effective January 1, 2018 Until December 31, 2022Jecah May R. RiegoNo ratings yet

- Cat Module 1 Answer KeysDocument27 pagesCat Module 1 Answer KeysLexden MendozaNo ratings yet

- Akuntansi Keuangan Lanjutan IIDocument6 pagesAkuntansi Keuangan Lanjutan IIlistianiNo ratings yet

- Finals Exam SolutionsDocument6 pagesFinals Exam SolutionsZhengzhou CalNo ratings yet

- SamplePayroll Processing and Withholding Tax On CompensationDocument2 pagesSamplePayroll Processing and Withholding Tax On CompensationReinalyn De VeraNo ratings yet

- Mart Manalo Tax Calculator for 1M IncomeDocument2 pagesMart Manalo Tax Calculator for 1M IncomeMart ManaloNo ratings yet

- Department of Finance and Administration: Withholding TaxDocument3 pagesDepartment of Finance and Administration: Withholding TaxJuan Daniel Garcia VeigaNo ratings yet

- FIT-Percentage Method ChartsDocument4 pagesFIT-Percentage Method ChartsMary67% (3)

- Tax Final Exam Practice Material - CompressDocument10 pagesTax Final Exam Practice Material - CompressNovemae CollamatNo ratings yet

- Taxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Document15 pagesTaxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Harold Dan AcebedoNo ratings yet

- 1.1.1 Tax On Income From Employment / Personal Income Tax: Direct TaxesDocument6 pages1.1.1 Tax On Income From Employment / Personal Income Tax: Direct TaxesGetu WeyessaNo ratings yet

- TAX RATE PowerpointDocument8 pagesTAX RATE PowerpointAngelo Gade LeysaNo ratings yet

- Principles of Taxation M. Khalid Petiwala: Income Tax Rates, Rebates & DeductionsDocument15 pagesPrinciples of Taxation M. Khalid Petiwala: Income Tax Rates, Rebates & DeductionsosamaNo ratings yet

- ES _GROUP 8Document4 pagesES _GROUP 8Papa NketsiahNo ratings yet

- Provided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDocument5 pagesProvided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDebolina DasNo ratings yet

- Month Net Taxable Income Tax Slabs Tax RateDocument2 pagesMonth Net Taxable Income Tax Slabs Tax RateBhargav ChintalapatiNo ratings yet

- S. No. Target - Per Month Commission (%) On MRP Amount Commission (%) On Discount AmountDocument1 pageS. No. Target - Per Month Commission (%) On MRP Amount Commission (%) On Discount AmountwawecorNo ratings yet

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- PRTC - TAX-Final PB - May 2022Document16 pagesPRTC - TAX-Final PB - May 2022Luna VNo ratings yet

- Pakistan Salary Tax Calculator FY 2019-20Document2 pagesPakistan Salary Tax Calculator FY 2019-20Usman HabibNo ratings yet

- Income Tax Rates, Rebates & DeductionsDocument35 pagesIncome Tax Rates, Rebates & DeductionsMaryam IkhlaqeNo ratings yet

- Standard Pay CalculationDocument16 pagesStandard Pay Calculationnaresh86chNo ratings yet

- Assignment 4 - SolutionsDocument2 pagesAssignment 4 - SolutionsstoryNo ratings yet

- What is TDS? Advance Tax and ProblemsDocument8 pagesWhat is TDS? Advance Tax and ProblemsNishantNo ratings yet

- Alison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateDocument7 pagesAlison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateNichole TumulakNo ratings yet

- Philippine Income Tax Rates GuideDocument17 pagesPhilippine Income Tax Rates GuideCharie Mae YdNo ratings yet

- How To Save Tax For Salary Above 20 LakhsDocument12 pagesHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNo ratings yet

- ExtraTaxProblem-TY2020 Student - SUSANDocument6 pagesExtraTaxProblem-TY2020 Student - SUSANhhunter530No ratings yet

- TAX LIABILITY PDF) OkDocument7 pagesTAX LIABILITY PDF) OksaeNo ratings yet

- Train by SGV ColorDocument32 pagesTrain by SGV ColorFlorenz AmbasNo ratings yet

- Chapter 08 Test BankDocument158 pagesChapter 08 Test BankBrandon LeeNo ratings yet

- Support-Department Cost AllocationDocument5 pagesSupport-Department Cost AllocationNABILA SARINo ratings yet

- Budget Updates 2023 PDFDocument4 pagesBudget Updates 2023 PDFmohit PathakNo ratings yet

- Australian tax rates for individuals and companies 2022Document4 pagesAustralian tax rates for individuals and companies 2022Crystal CheahNo ratings yet

- Assingment 1 Payroll TheoryDocument15 pagesAssingment 1 Payroll TheoryJenmark John JacolbeNo ratings yet

- HyderabadDocument2 pagesHyderabadChisty MoinNo ratings yet

- International and High Value PaymentsDocument6 pagesInternational and High Value PaymentszardarwaseemNo ratings yet

- Last 6 Months Bank StatementDocument8 pagesLast 6 Months Bank StatementGajanandNo ratings yet

- RFID at MetroDocument5 pagesRFID at MetroSreekanth PS100% (1)

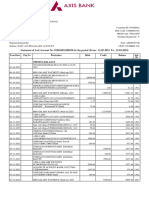

- Account Statement For Account:6572000100011504Document3 pagesAccount Statement For Account:6572000100011504RiseNo ratings yet

- Ms. Rebecca Ledda Jacinto: 1065 New Antipolo Street Interior 27 Tondo North, Manila City 1013Document1 pageMs. Rebecca Ledda Jacinto: 1065 New Antipolo Street Interior 27 Tondo North, Manila City 1013Joemark JacintoNo ratings yet

- Cash Basis To Accrual Basis of AccountingDocument3 pagesCash Basis To Accrual Basis of AccountingAlex OngNo ratings yet

- RR No. 26-2018Document3 pagesRR No. 26-2018Dianne EvardoneNo ratings yet

- Bill of LadingDocument1 pageBill of Ladingbiviana niñoNo ratings yet

- Travel BillsDocument3 pagesTravel BillsSaket Raut0% (1)

- Bill 071153222Document1 pageBill 071153222parantapkayalNo ratings yet

- Documents & Records Guide AccountingDocument4 pagesDocuments & Records Guide AccountingAllen KateNo ratings yet

- UNIT 2 Income From SalaryDocument146 pagesUNIT 2 Income From Salaryeasy mailNo ratings yet

- Jan 2022 Bir Tax CalendarDocument1 pageJan 2022 Bir Tax Calendarmypinoy taxNo ratings yet

- UPI - Product SolutionsDocument8 pagesUPI - Product SolutionsAmit SinghNo ratings yet

- Receipt For Rhomar Dimayuga Malicse: FailedDocument1 pageReceipt For Rhomar Dimayuga Malicse: FailedVelaNo ratings yet

- Galileo Quick Reference GuideDocument34 pagesGalileo Quick Reference GuideAbdullah AlHashimi100% (3)

- UBL Internship Report InsightsDocument38 pagesUBL Internship Report InsightsshakeelNo ratings yet

- Balance StatementDocument5 pagesBalance Statementmichael anthonyNo ratings yet

- Chapter 3 ReviewDocument6 pagesChapter 3 Reviewmy miNo ratings yet

- Tax Invoice For: Your Telstra BillDocument2 pagesTax Invoice For: Your Telstra BillGaro KhatcherianNo ratings yet

- RRS-Formulir Pendaftaran Fiber Broadband-Rev 1.0Document1 pageRRS-Formulir Pendaftaran Fiber Broadband-Rev 1.0dipponugroz100% (1)

- Certificate of Clearance for Ciano Glitz Clarence AdiwangDocument2 pagesCertificate of Clearance for Ciano Glitz Clarence Adiwangkorean languageNo ratings yet

- A, B, C - Specialised Accounting - 2Document15 pagesA, B, C - Specialised Accounting - 2محمود احمدNo ratings yet

- Bus Routes & Timings: Academic Year 2011 - 2012Document22 pagesBus Routes & Timings: Academic Year 2011 - 2012arshadmohammed23No ratings yet

- Removal/Qualifying ExaminationDocument12 pagesRemoval/Qualifying ExaminationMiljane PerdizoNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument14 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureShaikh AmjadNo ratings yet

- GST - A Game Changer: 2. Review of LiteratureDocument3 pagesGST - A Game Changer: 2. Review of LiteratureInternational Journal in Management Research and Social ScienceNo ratings yet

- Account STMT XX8258 12032024Document5 pagesAccount STMT XX8258 12032024adas27380No ratings yet

- Booking ConfirmationDocument4 pagesBooking ConfirmationCAROLINA CORTESNo ratings yet

- Faq For The Mastercard Identity Check "-ProcedureDocument2 pagesFaq For The Mastercard Identity Check "-ProcedureКалоян АспаруховNo ratings yet