Professional Documents

Culture Documents

Suggested Solution CMAC-NA Test#1

Uploaded by

Shahaer Mumtaz0 ratings0% found this document useful (0 votes)

11 views2 pages1. The document provides an inventory ledger card using the weighted average method to track inventory levels and costs for SCH Limited over time as inventory is received, issued, and has adjustments. It includes details of inventory receipts, issues, and balances on various dates.

2. It also provides cost breakdowns for two inventory purchases.

3. The second question provides cost breakdowns for Rusty Limited between variable and fixed costs. It includes workings to show how various costs were calculated and allocated as variable or fixed.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document provides an inventory ledger card using the weighted average method to track inventory levels and costs for SCH Limited over time as inventory is received, issued, and has adjustments. It includes details of inventory receipts, issues, and balances on various dates.

2. It also provides cost breakdowns for two inventory purchases.

3. The second question provides cost breakdowns for Rusty Limited between variable and fixed costs. It includes workings to show how various costs were calculated and allocated as variable or fixed.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesSuggested Solution CMAC-NA Test#1

Uploaded by

Shahaer Mumtaz1. The document provides an inventory ledger card using the weighted average method to track inventory levels and costs for SCH Limited over time as inventory is received, issued, and has adjustments. It includes details of inventory receipts, issues, and balances on various dates.

2. It also provides cost breakdowns for two inventory purchases.

3. The second question provides cost breakdowns for Rusty Limited between variable and fixed costs. It includes workings to show how various costs were calculated and allocated as variable or fixed.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Suggested Solution CMAC-NA Test 1

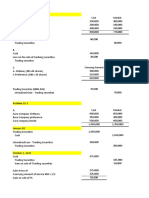

Question - 1 SCH Limited

Inventory ledger card (Weighted average method) Marking

Date Particulars Receipts Issue Balance

Units Rate Amount Units Rate Amount Units Rate Amount

1-Mar Opening balance 1,000 452.00 452,000 1.00

9-Mar Purchases 8,000 581.00 4,648,000 9,000 566.67 5,100,000 3.50

(W-1)

10-Mar Issue to production 3,500 566.67 1,983,345 5,500 566.67 3,116,655 1.00

15-Mar Sale of damaged units 1,000 566.67 566,670 4,500 566.67 2,549,985 1.00

20-Mar Purchases 4,500 630.44 2,837,000 9,000 598.55 5,386,985 3.50

(W - 2)

22-Mar Issue to production 2,000 598.55 1,197,100 7,000 598.55 4,189,885 1.00

25-Mar Issue return (500) (567) (283,335) 7,500 596.43 4,473,220 1.00

30-Mar Issue to production 2,800 596.43 1,670,004 4,700 596.43 2,803,216 1.00

31-Mar Loss due to shortage 200 596.43 119,286 4,500 596.43 2,683,930 1.00

14.00

W-1 Purchase Cost of 1st Shipment W-2 Purchase cost of 2nd shipment

Purchase price 4,160,000 Purchase price 2,520,000

Import duties (4160000 x 25% x 40%) 416,000 Import duties (2,520,000 x 10%) 252,000

Transport & handling charges 60,000 Transport & handling charges 60,000

Transit insurance 12,000 Transit storage 5,000

4,648,000 2,837,000

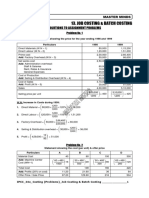

Question 2 Rusty Limited

Marking

Variable Cost Fixed Cost

Scheme

Insurance premium 50,000 0.5

Electricity charges (W-1) 100,000 20,000 1

Repairs and maintenance (W-2) 24,000 70,000 1.5

Salaries and wages (W-3) 1,200,000 300,000 1

Depreciation (W-4) 600,000 800,000 1

Direct material cost 2,000,000 0.5

Rent 1,200,000 0.5

Other factory overheads (W-5) 750,000 250,000 1

Total 4,674,000 2,690,000

7

Workings:

W-1 Electricity charges

Variable charges (8 X 12,500) 100,000

Fixed annual charges (bal.) 20,000

Total 120,000

W-2 Repair and Maintainance

Part replacement (8000 X 6000/2000) 24,000

Annual overheads (bal.) 70,000

Total 94,000

W-3 Salaries

Production wages (80 X 15000) 1,200,000

Permanent staff salaries (bal.) 300,000

Total 1,500,000

W-4 Depreciation

Variable depreciation (100 X 6000) 600,000

Fixed depreciation (bal.) 800,000

Total 1,400,000

W-5 Other factory overheads

Variable overheads (50 X15000) 750,000

Fixed overheads 250,000

Total 1,000,000

You might also like

- Caf-03 Cma Sir Nasir Sp-23Document48 pagesCaf-03 Cma Sir Nasir Sp-23Riot Skin0% (1)

- Intermediate Accounting Chapter 12 Lower of Cost and Net Realizable ValueDocument11 pagesIntermediate Accounting Chapter 12 Lower of Cost and Net Realizable ValueBlue SkyNo ratings yet

- CTA LEVEL 2 FT - Financial Accounting Test 2 2021 - SolutionDocument3 pagesCTA LEVEL 2 FT - Financial Accounting Test 2 2021 - SolutioncuthbertNo ratings yet

- CH 27Document4 pagesCH 27Alona MeladNo ratings yet

- Solution Test 1 AAFR Final PDFDocument4 pagesSolution Test 1 AAFR Final PDFMuhammad Abid QaziNo ratings yet

- SW3 PertubalDocument3 pagesSW3 PertubalNatividad, Kered ZilyoNo ratings yet

- CH 4 Comprehensive ProblemDocument5 pagesCH 4 Comprehensive ProblemLNo ratings yet

- ANSWER KEY - FM - Mcom Sem 4 - June 2023Document5 pagesANSWER KEY - FM - Mcom Sem 4 - June 2023Faheem KwtNo ratings yet

- October 27 - Special DeductionsDocument3 pagesOctober 27 - Special DeductionsDarius DelacruzNo ratings yet

- Far1 Artt Ias 36 Test SolDocument2 pagesFar1 Artt Ias 36 Test SolHassan TanveerNo ratings yet

- Tut 8 - Management AccountingDocument29 pagesTut 8 - Management AccountingTao LoheNo ratings yet

- CVP, AVC, BudgetingDocument8 pagesCVP, AVC, BudgetingLeoreyn Faye MedinaNo ratings yet

- Far1 SDocument8 pagesFar1 Shaziq farooqNo ratings yet

- Final Accounting (ENG)Document19 pagesFinal Accounting (ENG)lika rukhadzeNo ratings yet

- Ilanchelian (P121958) - ZCMC6122 - Individual Assignment 2Document24 pagesIlanchelian (P121958) - ZCMC6122 - Individual Assignment 2Ilanchelian ChandranNo ratings yet

- IA Chapter 15Document12 pagesIA Chapter 15Blue Sky100% (1)

- 13.4 IAS 21 - SolutionsDocument21 pages13.4 IAS 21 - SolutionsStaid LynxNo ratings yet

- 4 HW On Gov't Grant, Depreciation, Revaluation and Impairment T3 Answer KeyDocument9 pages4 HW On Gov't Grant, Depreciation, Revaluation and Impairment T3 Answer KeyJessica Mikah Lim AgbayaniNo ratings yet

- Bio Coal EstimateDocument1 pageBio Coal EstimateDhananjay KulkarniNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- RUNNING HEAD: Accounting Questions 1Document6 pagesRUNNING HEAD: Accounting Questions 1Chirayu ThapaNo ratings yet

- Mystic SportsDocument34 pagesMystic SportshelloNo ratings yet

- Discontinued Operations, Segment and Interim Reporting, Biological AssetsDocument5 pagesDiscontinued Operations, Segment and Interim Reporting, Biological AssetsElaine Joyce GarciaNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- Ch8 PDFDocument11 pagesCh8 PDFGiang NguyenNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- Finals Quiz and ActivityDocument4 pagesFinals Quiz and ActivityHello PMNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Initial Cash Flows Terminal Cash FlowsDocument5 pagesInitial Cash Flows Terminal Cash FlowshannahNo ratings yet

- SW3 Natividad BSA 2-13Document4 pagesSW3 Natividad BSA 2-13Natividad, Kered ZilyoNo ratings yet

- Acccob3 HW9Document33 pagesAcccob3 HW9Reshawn Kimi SantosNo ratings yet

- Joint Product & By-Product ExamplesDocument15 pagesJoint Product & By-Product ExamplesMuhammad azeemNo ratings yet

- Problems On Total IncomeDocument12 pagesProblems On Total IncomedipakNo ratings yet

- 01 Financial Investments Overview SolutionsDocument5 pages01 Financial Investments Overview Solutionscristinelarita18No ratings yet

- Midterms I Answer KeyDocument5 pagesMidterms I Answer Keyaldric taclanNo ratings yet

- MA hw6Document5 pagesMA hw6Caleb BuddNo ratings yet

- Answer 4Document7 pagesAnswer 4Sinclair faith galarioNo ratings yet

- 9 Job Costing & Batch Costing PDFDocument7 pages9 Job Costing & Batch Costing PDFgracel angela tolejano100% (1)

- Master Question (Mixed With Process Costing) - Q ADocument3 pagesMaster Question (Mixed With Process Costing) - Q AMuaaz NayyarNo ratings yet

- Star Engineering CompanyDocument5 pagesStar Engineering CompanyChleo Espera100% (1)

- Depreciation Allowance (Parts 1 & 2) Tutorial Questions 1Document4 pagesDepreciation Allowance (Parts 1 & 2) Tutorial Questions 1ting ting shihNo ratings yet

- Prctice SetDocument9 pagesPrctice SetAdam CuencaNo ratings yet

- Chap 12 - Inventory (Prob 24-32)Document10 pagesChap 12 - Inventory (Prob 24-32)Kloie SanoriaNo ratings yet

- Materi Untuk Tugas Topik 2Document11 pagesMateri Untuk Tugas Topik 2Violen AmeliaNo ratings yet

- Sir Mac Book SolmanDocument10 pagesSir Mac Book SolmanJAY AUBREY PINEDANo ratings yet

- Tutorial 6 - Solutions Consolidated Statement of Financial Position (Csofp) - Part 2 SolutionsDocument8 pagesTutorial 6 - Solutions Consolidated Statement of Financial Position (Csofp) - Part 2 Solutionscynthiama7777No ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- 3 Departmental AccountsDocument13 pages3 Departmental AccountsJayesh VyasNo ratings yet

- FAR Problem Quiz 1 SolDocument3 pagesFAR Problem Quiz 1 SolEdnalyn CruzNo ratings yet

- Sample Muscovado CTMDDocument29 pagesSample Muscovado CTMDJan ryanNo ratings yet

- Intangible Assets QuizDocument3 pagesIntangible Assets QuizKarlo PalerNo ratings yet

- Fixed Overhead Incurred (REAL)Document5 pagesFixed Overhead Incurred (REAL)Anny ChainNo ratings yet

- 7 2006 Jun ADocument9 pages7 2006 Jun Aapi-19836745No ratings yet

- DeceVid Company Final Worksheet PDFDocument1 pageDeceVid Company Final Worksheet PDFAngel Nhova Pepito OmalayNo ratings yet

- Error and Corrections Solutionpa CheckDocument5 pagesError and Corrections Solutionpa Checkmartinfaith958No ratings yet

- Cash Flow Statement AssignmentDocument2 pagesCash Flow Statement AssignmentYoungsonya JubeckingNo ratings yet

- Rkv302 Test 2 Suggested Solution - 2023Document3 pagesRkv302 Test 2 Suggested Solution - 2023sibambonotheteleloNo ratings yet

- A Hierarchy of Turing Degrees: A Transfinite Hierarchy of Lowness Notions in the Computably Enumerable Degrees, Unifying Classes, and Natural Definability (AMS-206)From EverandA Hierarchy of Turing Degrees: A Transfinite Hierarchy of Lowness Notions in the Computably Enumerable Degrees, Unifying Classes, and Natural Definability (AMS-206)No ratings yet

- Cost Flow in Production - Chap-6Document4 pagesCost Flow in Production - Chap-6Shahaer MumtazNo ratings yet

- CAF 08 Chapter 4 MindMapDocument3 pagesCAF 08 Chapter 4 MindMapShahaer MumtazNo ratings yet

- ResultofCAFExamination Autumn2022Document267 pagesResultofCAFExamination Autumn2022Shahaer MumtazNo ratings yet

- Chapter 12 Cost of Capital Mind MapDocument2 pagesChapter 12 Cost of Capital Mind MapShahaer MumtazNo ratings yet

- MFA Made Easy - Volume 1 (By Atif Abidi)Document64 pagesMFA Made Easy - Volume 1 (By Atif Abidi)Shahaer MumtazNo ratings yet

- Bizedge - PK: Units in Hand UnitsDocument5 pagesBizedge - PK: Units in Hand UnitsShahaer MumtazNo ratings yet

- Q-6 Aut-14Document1 pageQ-6 Aut-14Shahaer MumtazNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Q-2 Aut-20 Amended - Q ADocument2 pagesQ-2 Aut-20 Amended - Q AShahaer MumtazNo ratings yet

- Designing Substantive Procedures: ©2019 John Wiley & Sons Australia LTDDocument42 pagesDesigning Substantive Procedures: ©2019 John Wiley & Sons Australia LTDPooja KumarNo ratings yet

- Conceptual Framework ProcurementDocument218 pagesConceptual Framework ProcurementTerry Gunduza0% (1)

- UniLever Foods Project CharterDocument15 pagesUniLever Foods Project ChartersirfanalizaidiNo ratings yet

- Sales Research: Dr. Chitranshi VermaDocument25 pagesSales Research: Dr. Chitranshi VermachitranshiNo ratings yet

- Project 1: Blackmores Case StudyDocument1 pageProject 1: Blackmores Case StudyrenatolzNo ratings yet

- 4Ms PDFDocument4 pages4Ms PDFRedkylle敬.No ratings yet

- Outcome of Board Meeting - Buy-Back of Equity Shares of The Company (Board Meeting)Document2 pagesOutcome of Board Meeting - Buy-Back of Equity Shares of The Company (Board Meeting)Shyam SunderNo ratings yet

- Rangapriya (Priya) Kannan-Narasimhan: EducationDocument6 pagesRangapriya (Priya) Kannan-Narasimhan: Educationsubhashini sureshNo ratings yet

- Spencer Case PDFDocument18 pagesSpencer Case PDFMuskan singlaNo ratings yet

- Lumpsum LDocument20 pagesLumpsum LCharles LaspiñasNo ratings yet

- Report Sample SssDocument20 pagesReport Sample Sssuser nameNo ratings yet

- Have Mercy On Us AutosavedDocument11 pagesHave Mercy On Us AutosavedMyrel Cedron TucioNo ratings yet

- ACC 413 Adv Cost Accounting Class Material 3Document6 pagesACC 413 Adv Cost Accounting Class Material 3Samia AkterNo ratings yet

- Define The Following TermsDocument4 pagesDefine The Following TermsKeshawn McBrideNo ratings yet

- MKTG201 Fundamentals of MarketingDocument10 pagesMKTG201 Fundamentals of MarketingG JhaNo ratings yet

- Identification of Critical Success Factors For Total Quality Management Implementation in Organizations: A Critical ReviewDocument7 pagesIdentification of Critical Success Factors For Total Quality Management Implementation in Organizations: A Critical ReviewRashid JehangiriNo ratings yet

- Topic 1.1 Cost BehaviorDocument51 pagesTopic 1.1 Cost BehaviorGaleli PascualNo ratings yet

- Unit 15 Kazi Abdul Mannan GBS Hospitality Marketing EssentialsDocument16 pagesUnit 15 Kazi Abdul Mannan GBS Hospitality Marketing EssentialsshakibNo ratings yet

- MCQ Accounts With AnswersDocument70 pagesMCQ Accounts With AnswersPrashant Nayyar100% (1)

- Extra Assessment Material: BusinessDocument14 pagesExtra Assessment Material: BusinessFatema Waleed Mohammed Alnaw AlhebsiNo ratings yet

- IFRS Trainer ProfileDocument7 pagesIFRS Trainer ProfileRafay IkramNo ratings yet

- Role of Advertising in Brand BuildingDocument8 pagesRole of Advertising in Brand Buildingapi-291598576100% (1)

- Case Analysis - Dr. Pepper Snapple Group, Inc.Document18 pagesCase Analysis - Dr. Pepper Snapple Group, Inc.greddyteg100% (1)

- Coca ColaDocument12 pagesCoca ColaMukesh SinhaNo ratings yet

- Marketing Management 14Th Edition Kotler Solutions Manual Full Chapter PDFDocument36 pagesMarketing Management 14Th Edition Kotler Solutions Manual Full Chapter PDFmalabarhumane088100% (11)

- GRJ 3319Document8 pagesGRJ 3319Devendra RaiNo ratings yet

- Capital Structure Decision: An Overview: Kennedy Prince ModuguDocument14 pagesCapital Structure Decision: An Overview: Kennedy Prince ModuguChaitanya PrasadNo ratings yet

- Private Credit in Asia PacificDocument22 pagesPrivate Credit in Asia PacifictamlqNo ratings yet

- IAS 12 - Income TaxesDocument7 pagesIAS 12 - Income TaxesNdila mangalisoNo ratings yet

- Body of Jamuna GroupDocument33 pagesBody of Jamuna GroupSharifMahmud100% (1)