Professional Documents

Culture Documents

1202 Second Details Rental Tax Books of Acct

Uploaded by

Maddahayota CollegeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1202 Second Details Rental Tax Books of Acct

Uploaded by

Maddahayota CollegeCopyright:

Available Formats

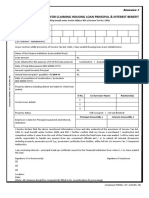

Federal Democratic Republic of Ethiopia

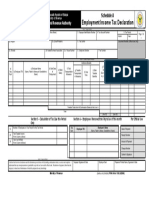

Schedule B

Ministry of Revenue

Federal Inland Revenue Rental Income Lessee

Authority Details Declaration

Section 1 – Taxpayer Information

1. Taxpayer’s Name (Company Name or Name, Father’s Name, Grandfather’s name) 2. Taxpayer Identification Number 3. For the Year of: Page 1 of

___

Section 2 – Declaration of Lessee Payments Made

d) Address of Property Being Leased e) End

g)

Total Rent i) If Sub-

a) b) Lessee c) Name of Lessee Organization or h)

Monthly f) Date of lease Enter

Seq TIN (If Person (Name, Father’s Name and Zone/ K- Kebel House For Year

Num Available) Region Woreda Rent Leased Contract Amount

Grandfather’s Name) Ketema e Number (Birr) Paid

(Birr) Date

Enter Totals From All Continuation Sheets Here if used >>

Gross Rental Income (Enter Totals Here and on Lines 1 and 2 of Rental Income Tax Declaration, Form 1201 )

Section 3 – Taxpayer Certification

I declare that the above declaration and all information provide here-with (including continuation sheets) is correct and

complete. I understand that any misrepresentation is punishable as per the tax Laws and the Penal code. Declaration of

preparer (other than the taxpayer) is based on all information of which the preparer has any knowledge

Signature of Taxpayer or Authorized Representative Date Signature of Preparer Date

Company

Printed Name of Taxpayer or Authorized Representative Seal Printed Name of

Preparer

Ministry of Revenue (Draft as of 465/2006) FIRA Form 1202 (5/2006)

You might also like

- Oromia Pension FormDocument3 pagesOromia Pension FormAboma Mekonnen86% (7)

- BIR Form 2307 PDFDocument1 pageBIR Form 2307 PDFAizhel Villegas ArcipeNo ratings yet

- 1203 First Details Rental Tax Books of AcctDocument2 pages1203 First Details Rental Tax Books of AcctMaddahayota CollegeNo ratings yet

- 1105 Withholding On Payment Tax Declaration 1 2Document2 pages1105 Withholding On Payment Tax Declaration 1 2Maddahayota CollegeNo ratings yet

- 2307Document16 pages2307Marjorie JotojotNo ratings yet

- GH DepotDocument12 pagesGH DepotNormelita S. Dela CruzNo ratings yet

- 2307 Jan 2018 ENCS v3 - GLOBEDocument11 pages2307 Jan 2018 ENCS v3 - GLOBEpearlanncasem12No ratings yet

- BIR Form 2307 PDFDocument1 pageBIR Form 2307 PDFAizhel Villegas ArcipeNo ratings yet

- BIR Form 2307Document1 pageBIR Form 2307Aizhel Villegas ArcipeNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasthekidthatcantNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument1 pageCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasMARJONNo ratings yet

- 2307 Jan 2018 ENCS v3 - L.U. MORNING STAR Oct2023 FGGFDocument11 pages2307 Jan 2018 ENCS v3 - L.U. MORNING STAR Oct2023 FGGFpearlanncasem12No ratings yet

- Deliverable Acceptance FormDocument1 pageDeliverable Acceptance FormRyan LincayNo ratings yet

- Vendor CA 587 - Non-ResidentDocument3 pagesVendor CA 587 - Non-ResidentЛена КиселеваNo ratings yet

- Form 2307Document18 pagesForm 2307Charlie Juliet Charlie HensonNo ratings yet

- 2307 - CTT Synergy - CorporationDocument2 pages2307 - CTT Synergy - CorporationRACHEL DAMALERIONo ratings yet

- US Internal Revenue Service: f1120fsc - 1992Document6 pagesUS Internal Revenue Service: f1120fsc - 1992IRSNo ratings yet

- 2307 - Rent My CarDocument10 pages2307 - Rent My CarSoeletraNo ratings yet

- 2307 Engrs'Document112 pages2307 Engrs'Kenneth Cyrus OlivarNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceRhecin Glenale BonalosNo ratings yet

- Republic of the Philippines CertificateDocument2 pagesRepublic of the Philippines CertificateLe Lhiin CariñoNo ratings yet

- FORM A 1-For Import Payments OnlyDocument6 pagesFORM A 1-For Import Payments OnlyAnonymous rPwwJGksANo ratings yet

- Finance Lease AgreementDocument6 pagesFinance Lease AgreementLister LastrellaNo ratings yet

- Serv Central 2307 November 2023Document1 pageServ Central 2307 November 2023andrea.begulbuilderscorpNo ratings yet

- 2307 Jan 2018 ENCS v3Document4 pages2307 Jan 2018 ENCS v3Jasmin Sheryl Fortin-CastroNo ratings yet

- Form No. 27B: (In Case Return Has Been Filed Earleer)Document1 pageForm No. 27B: (In Case Return Has Been Filed Earleer)anon-418665100% (1)

- Certificate of Creditable Tax WithheldDocument1 pageCertificate of Creditable Tax WithheldSheina Mae Asuncion Casem100% (1)

- 2022 04 25 15 00 40 TDS Declaration Form For F Y 2022 23Document2 pages2022 04 25 15 00 40 TDS Declaration Form For F Y 2022 23Mayank RanaNo ratings yet

- Housing Loan Self DeclarationDocument1 pageHousing Loan Self DeclarationSreenivasa RaoNo ratings yet

- Tarelco IIDocument1 pageTarelco IIJessica CrisostomoNo ratings yet

- US Internal Revenue Service: f1120fsc - 1994Document6 pagesUS Internal Revenue Service: f1120fsc - 1994IRSNo ratings yet

- New Excise FormDocument1 pageNew Excise FormAbdi Mucee TubeNo ratings yet

- Form DTE - DTE100EX - FI - 201406231430438077Document2 pagesForm DTE - DTE100EX - FI - 201406231430438077NaderNo ratings yet

- US Internal Revenue Service: f1120fsc - 1995Document6 pagesUS Internal Revenue Service: f1120fsc - 1995IRSNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document6 pagesAttention:: WWW - Irs.gov/form1099Trevor BurnettNo ratings yet

- December, 2021Document2 pagesDecember, 2021armand resquir jrNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument36 pagesCertificate of Creditable Tax Withheld at SourceProbinsyana KoNo ratings yet

- 2307 Jan 2018 ENCS v3.1Document90 pages2307 Jan 2018 ENCS v3.1Lex AmarieNo ratings yet

- BIR FORM 2307 SampleDocument6 pagesBIR FORM 2307 SampleEasyHear Philippines by NuGen Hearing Devices, Inc.No ratings yet

- BIR Form 2307 CertificateDocument37 pagesBIR Form 2307 Certificate175pauNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Cauayan Petron Service Center / Ferdinand GalopeDocument3 pagesCertificate of Creditable Tax Withheld at Source: Cauayan Petron Service Center / Ferdinand GalopeAnnalyn Gonzales ModeloNo ratings yet

- Form 2307Document12 pagesForm 2307Reycia Vic QuintanaNo ratings yet

- 1604-C Jan 2018 Final Annex A PDFDocument1 page1604-C Jan 2018 Final Annex A PDFAs Li NahNo ratings yet

- Bir05 PDFDocument3 pagesBir05 PDFBarangay LumbangNo ratings yet

- Bir Form 2307Document8 pagesBir Form 2307Alex CalannoNo ratings yet

- Realty Transfer Tax Statement of Value REV 183Document2 pagesRealty Transfer Tax Statement of Value REV 183maria-bellaNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- BIR Form 1601-E Monthly Remittance ReturnDocument3 pagesBIR Form 1601-E Monthly Remittance ReturnAlexa Reyes de GuzmanNo ratings yet

- BIR Form 2307Document2 pagesBIR Form 2307Angelique MasupilNo ratings yet

- 2307 NEW PLDTDocument2 pages2307 NEW PLDTdayneblazeNo ratings yet

- 1913 Final2 03.2023434341 2Document1 page1913 Final2 03.2023434341 2LandsNo ratings yet

- BIR Certificate of Creditable Tax WithheldDocument2 pagesBIR Certificate of Creditable Tax WithheldMark Patrics Comentan VerderaNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument3 pagesCertificate of Creditable Tax Withheld at SourceAnn Gladdys QuiocoNo ratings yet

- Federal Ethiopia Turnover Tax DeclarationDocument3 pagesFederal Ethiopia Turnover Tax DeclarationMaddahayota CollegeNo ratings yet

- Federal Democratic Republic of Ethiopia Casual Property Rental Tax DeclarationDocument2 pagesFederal Democratic Republic of Ethiopia Casual Property Rental Tax DeclarationMaddahayota CollegeNo ratings yet

- 1402 Gain On Transfer SharesDocument2 pages1402 Gain On Transfer SharesMaddahayota CollegeNo ratings yet

- 1201 Rental Tax Books of AcctDocument3 pages1201 Rental Tax Books of AcctMaddahayota College100% (1)

- Federal Employment Income Tax DeclarationDocument1 pageFederal Employment Income Tax DeclarationMaddahayota CollegeNo ratings yet

- Proc No 532 The Amended Electoral LawDocument59 pagesProc No 532 The Amended Electoral LawMaddahayota CollegeNo ratings yet

- Ifes Faqs Elections in Ethiopia 2021 General Elections June 2021Document12 pagesIfes Faqs Elections in Ethiopia 2021 General Elections June 2021Maddahayota CollegeNo ratings yet

- Proclamation No.1133.2019Document18 pagesProclamation No.1133.2019Maddahayota CollegeNo ratings yet

- CARPER Law Extends Philippine Agrarian Reform ProgramDocument1 pageCARPER Law Extends Philippine Agrarian Reform Programmegawhat115No ratings yet

- Reviewer CSCDocument149 pagesReviewer CSCjudy egarNo ratings yet

- Different Room Types in HotelsDocument21 pagesDifferent Room Types in HotelsYvonne Janet Cosico-Dela FuenteNo ratings yet

- Journal of Geographical Research - Vol.6, Iss.1 January 2023Document73 pagesJournal of Geographical Research - Vol.6, Iss.1 January 2023Bilingual PublishingNo ratings yet

- El Cerrito Plaza BART TOD - Holliday RFQ ResponseDocument134 pagesEl Cerrito Plaza BART TOD - Holliday RFQ ResponseElCerritoBARTNo ratings yet

- DSAllodialTitleAndLandPatents PDFDocument30 pagesDSAllodialTitleAndLandPatents PDFklg.consultant2366100% (1)

- SEC Form 17-A Annual ReportDocument172 pagesSEC Form 17-A Annual ReportFeds Gula Jr.No ratings yet

- Royalty Accounts: 9/5/21 Prof. Santosh MK 1Document8 pagesRoyalty Accounts: 9/5/21 Prof. Santosh MK 1Aparna ViswakumarNo ratings yet

- Building Permit FormsDocument2 pagesBuilding Permit FormsysvdaNo ratings yet

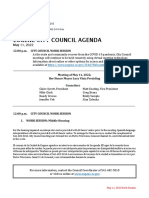

- Agenda Packet 5-11-2022 PostDocument227 pagesAgenda Packet 5-11-2022 PostSinclair Broadcast Group - EugeneNo ratings yet

- Commercial Lease AgreementDocument3 pagesCommercial Lease Agreementmalou ablazaNo ratings yet

- Prime City of London Investment OpportunityDocument27 pagesPrime City of London Investment Opportunitydicky bhaktiNo ratings yet

- Estoppel Assignment MeDocument5 pagesEstoppel Assignment MeSeemab MalikNo ratings yet

- Re RADocument29 pagesRe RAHARSHITA SHUKLA100% (1)

- Ebook 2Document43 pagesEbook 2溝辺 朋也No ratings yet

- Daclison vs. Baytion GR No. 219811, April 6, 2016: FactsDocument2 pagesDaclison vs. Baytion GR No. 219811, April 6, 2016: FactsChris Ronnel Cabrito CatubaoNo ratings yet

- HomeworkDocument4 pagesHomeworktuantai lêNo ratings yet

- HCDRD Report ScriptDocument3 pagesHCDRD Report ScriptValentin S. GaborNo ratings yet

- F A M Es Pi NT T W T U Di G S H: 1 To 7 Bedroom House PlansDocument2 pagesF A M Es Pi NT T W T U Di G S H: 1 To 7 Bedroom House PlansmsagaliwaNo ratings yet

- Bayano, Hazel M. Quiz 5Document2 pagesBayano, Hazel M. Quiz 5Liz Matarong BayanoNo ratings yet

- Affidavit of Title IldaDocument5 pagesAffidavit of Title IldaGERALDNo ratings yet

- Understanding Property Law and Its ApplicationDocument2 pagesUnderstanding Property Law and Its ApplicationFermin AbisNo ratings yet

- Activity - Estate Tax ComputationDocument2 pagesActivity - Estate Tax ComputationEki SunriseNo ratings yet

- JurisprudenceDocument6 pagesJurisprudencekhiiiyannnNo ratings yet

- Hacienda Luisita, Incorporated vs. Presidential Agrarian Reform CouncilDocument8 pagesHacienda Luisita, Incorporated vs. Presidential Agrarian Reform CouncilLaw2019upto2024No ratings yet

- Generate Rent Receipts OnlineDocument6 pagesGenerate Rent Receipts Onlinesatya prakashNo ratings yet

- PKS Sta Lucia Projects For CNCDocument42 pagesPKS Sta Lucia Projects For CNCBantay Amaro LibsNo ratings yet

- Avighna IX Final BrochureDocument30 pagesAvighna IX Final BrochurePrashant JadhavNo ratings yet

- Land Law in ZambiaDocument45 pagesLand Law in ZambiaAngel MoongaNo ratings yet

- Rishabh Cloud9 Skylish Towers ProjectDocument9 pagesRishabh Cloud9 Skylish Towers ProjectakashbhartiNo ratings yet