Professional Documents

Culture Documents

New Excise Form

Uploaded by

Abdi Mucee Tube0 ratings0% found this document useful (0 votes)

53 views1 pageTax

Original Title

new Excise Form - Copy

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

53 views1 pageNew Excise Form

Uploaded by

Abdi Mucee TubeTax

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

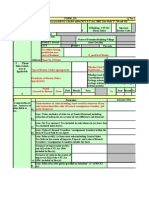

Federal Democratic Republic of Ethiopia Excise Tax Declaration Form The National Regional Government of Oromia

Ethiopia Revenues & Custom (To Be Filled Monthly) Bureau of Revenues

Authority

Section 1 – Taxpayer Information

1. Taxpayer’s Name (Company Name or Name, Father’s Name, Grandfather’s Name) 3. Taxpayer Identification Number 4. Tax Account Number 8. Tax Period

Month Year Page 1_ of_

2a. Region 2b. Zone/K-Ketema 5. Tax Center Document Number (Official use Only)

2c Woreda 2d Kebele/Farmers Association 2e. House Number 6. Telephone Number 7. Fax Number

Section 2 – Calculation of Tax Due

b) e) i)

d) g) h)

a)Seq Category of Product / Parent Product Monthly f) Unit Cost Tax to Pay

c) Product Details Measure Cost of Production Excise Tax

Num (See Reverse for Listing of Product Categories and Tax Production (Birr) (Column g x h)

ment (Column e x f) Rate

Rates) (units) (Birr)

Totals from Attached Continuation Sheets if used

Total Line 10 > Line 20>

Section 3 – Calculation of Tax due this Period For Official Use Only

Date of Payment Receipt Number

10 Total Cost Of Production Cheque Number Cheque Number

20 Total Excise Tax Payable (from column i above) Cashier Signature

Section 3 – Taxpayer Certification

Printed Name of Taxpayer or Authorized Officer Signature __________ Printed Name of Preparer: Signature_______

Taxpayer Seal

Date _______ Date __________

Oromia Bureau of Revenues OBR Form 2101 (5/2006)

You might also like

- GovTech Maturity Index: The State of Public Sector Digital TransformationFrom EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNo ratings yet

- 1105 Withholding On Payment Tax Declaration 1 2Document2 pages1105 Withholding On Payment Tax Declaration 1 2Maddahayota CollegeNo ratings yet

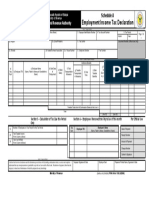

- Federal Employment Income Tax DeclarationDocument1 pageFederal Employment Income Tax DeclarationMaddahayota CollegeNo ratings yet

- Oromia Pension FormDocument3 pagesOromia Pension FormAboma Mekonnen86% (7)

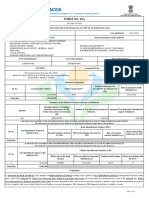

- GST RFD 01Document15 pagesGST RFD 01Rajdev AssociatesNo ratings yet

- Federal Pension Contribution Declaration FormDocument1 pageFederal Pension Contribution Declaration Formashe100% (1)

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- Schedule'C'Form With AnnexinstructionsDocument4 pagesSchedule'C'Form With AnnexinstructionsAmanuelNo ratings yet

- 1402 Gain On Transfer SharesDocument2 pages1402 Gain On Transfer SharesMaddahayota CollegeNo ratings yet

- US Internal Revenue Service: F1120icd - 2000Document6 pagesUS Internal Revenue Service: F1120icd - 2000IRSNo ratings yet

- (Name of Registered Business Entity) Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar/Fiscal YearDocument5 pages(Name of Registered Business Entity) Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar/Fiscal YearRoui Jean VillarNo ratings yet

- Useful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Document6 pagesUseful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Katherine OlidanNo ratings yet

- Bir For Private Poll Clerk and Third MemberDocument14 pagesBir For Private Poll Clerk and Third MemberDeanna TrinidadNo ratings yet

- SR0-218 Amendment in Jammu & Kashmir Value Added Tax Rules, 2005Document25 pagesSR0-218 Amendment in Jammu & Kashmir Value Added Tax Rules, 2005vinay dixitNo ratings yet

- US Internal Revenue Service: F1120icd - 1992Document6 pagesUS Internal Revenue Service: F1120icd - 1992IRSNo ratings yet

- 1201 Rental Tax Books of AcctDocument3 pages1201 Rental Tax Books of AcctMaddahayota College100% (1)

- (Attach Additional Sheet, If Necessary) : Useful Life or 60 Mos. (Whichever Is Shorter)Document2 pages(Attach Additional Sheet, If Necessary) : Useful Life or 60 Mos. (Whichever Is Shorter)Bianca LizardoNo ratings yet

- GH DepotDocument12 pagesGH DepotNormelita S. Dela CruzNo ratings yet

- Profit Tax FormatDocument10 pagesProfit Tax Formatnefassilk branchNo ratings yet

- Creditable Tax Withheld: Goods ManufacturedDocument3 pagesCreditable Tax Withheld: Goods ManufacturedJanua_Luca_as__4392No ratings yet

- GSTR9 09aaact9363l1zq 032023Document8 pagesGSTR9 09aaact9363l1zq 032023sachinkumar.rkcjNo ratings yet

- Useful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Document3 pagesUseful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Mark Alvin Tallongon100% (2)

- Abc Elementary School: Purchase OrderDocument16 pagesAbc Elementary School: Purchase OrderRexell MaybuenaNo ratings yet

- U.S. Income Tax Return For Cooperative AssociationsDocument5 pagesU.S. Income Tax Return For Cooperative AssociationsbhanuprakashbadriNo ratings yet

- Form 231Document14 pagesForm 231Jignesh Dinesh MewadaNo ratings yet

- GSTR 01Document9 pagesGSTR 01nisho tyagiNo ratings yet

- 27201451249V M1 1703 Hist PDFDocument6 pages27201451249V M1 1703 Hist PDFPriyanka AgrawalNo ratings yet

- Form 231 Sharp EnterprisesDocument8 pagesForm 231 Sharp Enterprisesqaid_duraiyaNo ratings yet

- 1702-MX Annual Income Tax Return: Part IV - Schedules InstructionsDocument2 pages1702-MX Annual Income Tax Return: Part IV - Schedules InstructionsVince Alvin DaquizNo ratings yet

- BIR Form 2307Document2 pagesBIR Form 2307Angelique MasupilNo ratings yet

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- Income Statement Report Form 11Document5 pagesIncome Statement Report Form 11mesfin eshete100% (13)

- 2017-2018 Associations Income Tax Return With Instructions - EnglishDocument18 pages2017-2018 Associations Income Tax Return With Instructions - EnglishAung Aung OoNo ratings yet

- 9 and 9C Print VersionDocument32 pages9 and 9C Print VersionTrending Via ViralNo ratings yet

- 2307 Jan 2018 ENCS v3.1Document90 pages2307 Jan 2018 ENCS v3.1Lex AmarieNo ratings yet

- US Internal Revenue Service: f8654 AccessibleDocument3 pagesUS Internal Revenue Service: f8654 AccessibleIRSNo ratings yet

- GSTR9 08aaafu3205h1zh 032022Document8 pagesGSTR9 08aaafu3205h1zh 032022Deepanshu AgarwalNo ratings yet

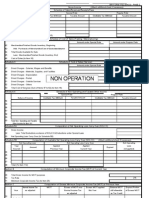

- Federal Ethiopia Turnover Tax DeclarationDocument3 pagesFederal Ethiopia Turnover Tax DeclarationMaddahayota CollegeNo ratings yet

- Adobe Scan Mar 25, 2022Document2 pagesAdobe Scan Mar 25, 2022GaneshNo ratings yet

- BIR Certificate of Creditable Tax WithheldDocument2 pagesBIR Certificate of Creditable Tax WithheldMark Patrics Comentan VerderaNo ratings yet

- GSTR9Document8 pagesGSTR9legendry007No ratings yet

- Service Tax - Form A1Document5 pagesService Tax - Form A1kuriakose_mv3653No ratings yet

- 1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnDocument6 pages1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnIRSNo ratings yet

- Creditable Tax Withheld: Goods ManufacturedDocument12 pagesCreditable Tax Withheld: Goods ManufacturedNino FrondozoNo ratings yet

- Form GST Rfd11Document63 pagesForm GST Rfd11forbooksNo ratings yet

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061No ratings yet

- GSTR - 1 Format 3 Jun 2017Document8 pagesGSTR - 1 Format 3 Jun 2017lokwaderNo ratings yet

- 18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionDocument2 pages18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionWUTYI THINNNo ratings yet

- Form 16A TDS CertificateDocument2 pagesForm 16A TDS CertificateRichardNoelFernandesNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- Sop Accounts Payables Axiom EasyDocument16 pagesSop Accounts Payables Axiom EasyRiskyKurniasih100% (1)

- PLDTDocument2 pagesPLDTdhimplesebro24No ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3SK GACAO PALO, LEYTENo ratings yet

- Taxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyFrom EverandTaxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyRating: 5 out of 5 stars5/5 (1)

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Modifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryFrom EverandModifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Inboard-Outdrive Boats World Summary: Market Sector Values & Financials by CountryFrom EverandInboard-Outdrive Boats World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Fa I Chapter 4 Accounting SystemDocument10 pagesFa I Chapter 4 Accounting SystemAbdi Mucee Tube100% (1)

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee TubeNo ratings yet

- 1 The Nature, Purpose and Scope of AuditingDocument12 pages1 The Nature, Purpose and Scope of Auditingyebegashet100% (1)

- Fa Ii Individual Assignment For Management StudentsDocument2 pagesFa Ii Individual Assignment For Management StudentsAbdi Mucee TubeNo ratings yet

- CHAPTER 15 Intermediate Acctng 1Document58 pagesCHAPTER 15 Intermediate Acctng 1Tessang OnongenNo ratings yet

- Abraham Beyene RESEARCHDocument46 pagesAbraham Beyene RESEARCHAbdi Mucee Tube0% (1)

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee Tube100% (1)

- PDF Afa CH 2 - CompressDocument60 pagesPDF Afa CH 2 - CompressAbdi Mucee TubeNo ratings yet

- Or-Section 2Document5 pagesOr-Section 2Dev TailorNo ratings yet

- Chapter 3 Current Liability PayrollDocument39 pagesChapter 3 Current Liability PayrollAbdi Mucee Tube100% (1)

- DanialDocument56 pagesDanialAbdi Mucee TubeNo ratings yet

- Fa Ii Chapter 1 InventoryDocument23 pagesFa Ii Chapter 1 InventoryAbdi Mucee TubeNo ratings yet

- Chapter 2, Accounting For Plant Assets and IntagiblesDocument20 pagesChapter 2, Accounting For Plant Assets and IntagiblesAbdi Mucee TubeNo ratings yet

- Chapter 3 PayrollDocument16 pagesChapter 3 PayrollAbdi Mucee TubeNo ratings yet

- TP ContentsDocument9 pagesTP ContentsAbdi Mucee TubeNo ratings yet

- Budgetary Control: Part A: TheoryDocument9 pagesBudgetary Control: Part A: TheoryAditi TNo ratings yet

- Accounting For Current Liabilities: Key Terms and Concepts To KnowDocument16 pagesAccounting For Current Liabilities: Key Terms and Concepts To KnowReverie SevillaNo ratings yet

- 4 5764766307975170385Document2 pages4 5764766307975170385Abdi Mucee TubeNo ratings yet

- Accounting and Finance Carriculum New (2021)Document172 pagesAccounting and Finance Carriculum New (2021)Abdi Mucee Tube67% (3)

- Cost Two IIDocument65 pagesCost Two IIAbdi Mucee TubeNo ratings yet

- Fa I Chapter 2Document4 pagesFa I Chapter 2Abdi Mucee TubeNo ratings yet

- Fundamentals of Accounting II Short Handout-1Document38 pagesFundamentals of Accounting II Short Handout-1Abdi Mucee TubeNo ratings yet

- Fund FinalDocument3 pagesFund FinalAbdi Mucee TubeNo ratings yet

- InventoryDocument65 pagesInventoryAbdi Mucee TubeNo ratings yet

- Fund TestDocument1 pageFund TestAbdi Mucee TubeNo ratings yet

- 1.1 Target and Minimum PricingDocument1 page1.1 Target and Minimum PricingAbdi Mucee Tube100% (2)

- Europass CV TemplateDocument2 pagesEuropass CV TemplateAbdi Mucee Tube0% (1)

- Jafar ResearchDocument52 pagesJafar ResearchAbdi Mucee TubeNo ratings yet

- Accounting For CorporationDocument19 pagesAccounting For CorporationAbdi Mucee TubeNo ratings yet

- Jafar ProposalDocument25 pagesJafar ProposalAbdi Mucee TubeNo ratings yet

- U.S. Tax Compliance - Foreign Grantor Trusts - Foreign GiftsDocument10 pagesU.S. Tax Compliance - Foreign Grantor Trusts - Foreign GiftsGary Wolfe100% (3)

- Quizl Tax IIDocument14 pagesQuizl Tax IITonyaNo ratings yet

- Annex "A": NA 01/01/17 12/31/2017 Rental NA 5%Document1 pageAnnex "A": NA 01/01/17 12/31/2017 Rental NA 5%KarlayaanNo ratings yet

- FORM NO. 16" (See Rule 31 (1) (A) : B) CGEGIS/Group Insurance: C) SpbyDocument6 pagesFORM NO. 16" (See Rule 31 (1) (A) : B) CGEGIS/Group Insurance: C) SpbyHem Ch DeuriNo ratings yet

- TPS - Tax Forms Done Tax ReturnDocument42 pagesTPS - Tax Forms Done Tax ReturnLuis Castro100% (1)

- MCTax GuideDocument1 pageMCTax Guidekhageshcode89No ratings yet

- Form PDFDocument1 pageForm PDFKanha SatyaranjanNo ratings yet

- Commissioner of Internal Revenue vs. PalancaDocument7 pagesCommissioner of Internal Revenue vs. PalancaVincent OngNo ratings yet

- BIR Ruling 103-99 - Asian Bank Ruling - FCDU To FCDUDocument2 pagesBIR Ruling 103-99 - Asian Bank Ruling - FCDU To FCDUCkey ArNo ratings yet

- SSPUSADVDocument1 pageSSPUSADVJamesNo ratings yet

- JBM PayslipDocument1 pageJBM PayslipROHIT RANJAN100% (1)

- Pay Slip January 2010 Phillips Kiln MumbaiDocument1 pagePay Slip January 2010 Phillips Kiln Mumbairitesh shrivastavNo ratings yet

- Fuel and Driver Reimb Logbook Format - For G1 LevelDocument2 pagesFuel and Driver Reimb Logbook Format - For G1 Levelsahil kumarNo ratings yet

- Receipt Template 4 WordDocument1 pageReceipt Template 4 Worddinepo3250No ratings yet

- Example Withholding TaxDocument2 pagesExample Withholding TaxRaudhatun Nisa'No ratings yet

- Commissioner of Internal Revenue v. Toda, Jr.Document1 pageCommissioner of Internal Revenue v. Toda, Jr.Mica ArceNo ratings yet

- 2628984Document1 page2628984Fuzzy PandaNo ratings yet

- Quiz On Taxation-Donor's TaxDocument2 pagesQuiz On Taxation-Donor's TaxRey PerosaNo ratings yet

- Automatic Salary Slip Generator Using ExcelDocument7 pagesAutomatic Salary Slip Generator Using ExcelkiuwmipNo ratings yet

- Form PDFDocument2 pagesForm PDFSuresh DoosaNo ratings yet

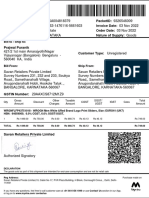

- Tax Invoice GST Details Housing Cavity ManufacturingDocument1 pageTax Invoice GST Details Housing Cavity ManufacturingSrishti GaurNo ratings yet

- True or False 1Document13 pagesTrue or False 1Mary DenizeNo ratings yet

- Abellano - STM - Midterm - ExamDocument3 pagesAbellano - STM - Midterm - ExamNelia AbellanoNo ratings yet

- 1022 2021Document15 pages1022 2021nfk roeNo ratings yet

- Solved Assume The Following Data For Oshkosh Company Before Its Year End PDFDocument1 pageSolved Assume The Following Data For Oshkosh Company Before Its Year End PDFAnbu jaromiaNo ratings yet

- Invoice INV 0035Document1 pageInvoice INV 0035Eggy PalangatNo ratings yet

- AutoInvoice Execution ReportDocument6 pagesAutoInvoice Execution ReportabduskhanNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoPrem ChanderNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPrajwal PuranikNo ratings yet

- Tax WorksheetDocument5 pagesTax WorksheetKim IrishNo ratings yet