Professional Documents

Culture Documents

05 - Activity - 1 - ARG 1

Uploaded by

Ivan CutiamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

05 - Activity - 1 - ARG 1

Uploaded by

Ivan CutiamCopyright:

Available Formats

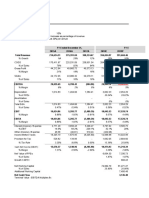

05 Activity 1 - ARG

CUTIAM, IVAN M. November 9, 2022

ABM 12 FABM

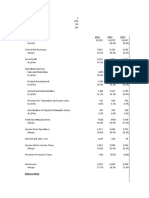

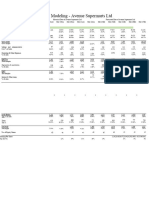

Horizontal Analysis

BALANCE SHEET

201B Vertical 201A Vertical Peso Change % Change

Analysis Analysis

Cash P 1,633 9.49% P 1396 9.26% 237 16.98%

Receivables 1,209 7.03% 1,074 7.12% 135 12.57%

Inventory 883 5.13% 707 4.69% 176 24.89%

Prepaid Expenses 1,139 6.62% 1,413 9.37% (274) (19.39%)

Total Current Assets 4,864 28.28% 4590 30.44% 274 5.97%

Other Assets 12,333 71.72% 10,491 69.56% 1706 17.56%

Total Assets 17,197 100% 15,081 100% 2116 14.03%

Total current liabilities 4,820 28.03% 5,645 37.43% (625) (14.61%)

Long-term liabilities 3,199 18.60% 2,528 16.76% 671 26.54%

Common Stock 4,379 25.46% 2,909 19.29% 1,470 50.53%

Retained Earnings 4,800 27.91% 4,000 26.52% 800 20%

Total Liabilities and 17,197 100% 15,081 100% 2116 14.03%

Equity

Horizontal Analysis

INCOME STATEMENT

201B Vertical 201A Vertical Peso Change % Change

Analysis Analysis

Sales P 2500 100% P 2100 100% 400 19.05%

Less: Cost of Goods Sold 1,800 72% 1,500 71.43% 300 20%

Gross Profit 700 28% 600 28.57% 100 16.67%

Less: Operating expenses 300 12% 250 11.90% 50 20%

Income from operations 400 16% 350 16.7% 50 14.19%

Less: Interest expense 180 7.2% 180 8.58% 0 0%

Income before taxes 220 8.8% 170 8.09% 50 29.41%

Less: Income tax 66 2.64% 59.5 2.83% 6.5 10.92%

Net Income 154 6.16% 110.5 5.26% 43.5 39.37%

You might also like

- 21414-3 Valves and Unit Injectors, AdjustDocument11 pages21414-3 Valves and Unit Injectors, AdjustTeguh Imam Adri100% (1)

- GTX 3XX Part 23: AML STC Installation ManualDocument367 pagesGTX 3XX Part 23: AML STC Installation ManuallocoboeingNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2Art Euphoria100% (1)

- 01 LC Vibratory Sifter 01Document2 pages01 LC Vibratory Sifter 01Ravi YadavNo ratings yet

- High Tire PerformanceDocument8 pagesHigh Tire PerformanceSofía MargaritaNo ratings yet

- TOA - Mock Compre - AnswersDocument12 pagesTOA - Mock Compre - AnswersChrissa Marie VienteNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Activity 07 CH14Document4 pagesActivity 07 CH14Dandreb SuaybaguioNo ratings yet

- Business Finance PeTa Shell Vs Petron FinalDocument5 pagesBusiness Finance PeTa Shell Vs Petron FinalFRANCIS IMMANUEL TAYAGNo ratings yet

- 05 - Activity - 1 - ARGCHANNN 1Document1 page05 - Activity - 1 - ARGCHANNN 1Ivan CutiamNo ratings yet

- Primo BenzinaDocument30 pagesPrimo BenzinaSofía MargaritaNo ratings yet

- Samsung Electronics: Earnings Release Q4 2020Document8 pagesSamsung Electronics: Earnings Release Q4 2020Aidə MəmmədzadəNo ratings yet

- JODY2 - 0 - Financial Statement Analysis - MC - CorrectedDocument6 pagesJODY2 - 0 - Financial Statement Analysis - MC - Correctedkunal bajajNo ratings yet

- DCF Trident 2Document20 pagesDCF Trident 2Jayant JainNo ratings yet

- Assignment 5 (APM Industries) by Anil Verma (EPGP-13D-010)Document3 pagesAssignment 5 (APM Industries) by Anil Verma (EPGP-13D-010)Anil VermaNo ratings yet

- 1996 Revenue Growth Rate Ebitda Margin Net Working Capital Percent of RevenueDocument14 pages1996 Revenue Growth Rate Ebitda Margin Net Working Capital Percent of RevenueRohith ThatchanNo ratings yet

- Ceres Gardening - Case (1) ProfesorDocument1 pageCeres Gardening - Case (1) Profesorpeta8805No ratings yet

- Financial Statement of The Gems Mfg. Corp. Are As Foll Vertically Horizontally 2015 2014 Amount PercentageDocument9 pagesFinancial Statement of The Gems Mfg. Corp. Are As Foll Vertically Horizontally 2015 2014 Amount PercentageCollen EsmaelNo ratings yet

- Income Statement For AAPLDocument1 pageIncome Statement For AAPLEzequiel FriossoNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Projections 2023Document8 pagesProjections 2023DHANAMNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- JanetDocument11 pagesJanetHassanNo ratings yet

- Infosys - Veritcal AnalysisDocument2 pagesInfosys - Veritcal AnalysisGhritachi PaulNo ratings yet

- Use 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsDocument3 pagesUse 2012 Annual Reports Woolworths Limited Metcash Limited: Pro Forma Financial StatementsgraceNo ratings yet

- Amazon DCF: Ticker Implied Share Price Date Current Share PriceDocument4 pagesAmazon DCF: Ticker Implied Share Price Date Current Share PriceFrancesco GliraNo ratings yet

- Beginner EBay DCFDocument14 pagesBeginner EBay DCFQazi Mohd TahaNo ratings yet

- Cigniti - Group 3 - BFBVDocument24 pagesCigniti - Group 3 - BFBVpgdm22srijanbNo ratings yet

- Quiz 1 Acco 204 - GonzagaDocument17 pagesQuiz 1 Acco 204 - GonzagaLalaine Keendra GonzagaNo ratings yet

- 2017 4Q Earnings Release Samsung ElectronicsDocument8 pages2017 4Q Earnings Release Samsung ElectronicsAlin RewaxisNo ratings yet

- Motherson Sumi Systems LTD Excel FinalDocument30 pagesMotherson Sumi Systems LTD Excel Finalwritik sahaNo ratings yet

- Lincoln Electric Itw - Cost Management ProjectDocument7 pagesLincoln Electric Itw - Cost Management Projectapi-451188446No ratings yet

- Axisbank Financial Statements Summary AJ WorksDocument12 pagesAxisbank Financial Statements Summary AJ WorksSoorajKrishnanNo ratings yet

- Apple Inc. AnalysisDocument15 pagesApple Inc. AnalysisDOWLA KHANNo ratings yet

- Statement For AAPLDocument1 pageStatement For AAPLEzequiel FriossoNo ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- Financial Model of Dmart - 5Document4 pagesFinancial Model of Dmart - 5Shivam DubeyNo ratings yet

- Data MixmrktDocument9 pagesData MixmrktRavi David UllahNo ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- DCF Calculation of Dabur India Ltd.Document6 pagesDCF Calculation of Dabur India Ltd.Radhika ChaudhryNo ratings yet

- 1Document1 page1Saray MorenoNo ratings yet

- Horizontal Analysis PDFDocument1 pageHorizontal Analysis PDFKhris Espinili AlgaraNo ratings yet

- Vertical Analysis: AssetsDocument10 pagesVertical Analysis: AssetstayyabasdNo ratings yet

- Investment GuideDocument2 pagesInvestment GuideMoises The Way of Water TubigNo ratings yet

- STORAENSO RESULTS Key Figures 2018Document11 pagesSTORAENSO RESULTS Key Figures 2018Paula Tapiero MorenoNo ratings yet

- DCF TVSDocument17 pagesDCF TVSSunilNo ratings yet

- Private Sector Banks Comparative Analysis 1HFY22Document12 pagesPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- Income Statement: Excess CashDocument9 pagesIncome Statement: Excess CashAlejandra San Roman AmadorNo ratings yet

- Add Dep Less Tax OCF Change in Capex Change in NWC FCFDocument5 pagesAdd Dep Less Tax OCF Change in Capex Change in NWC FCFGullible KhanNo ratings yet

- 4.1.1 - Dự Báo Dòng TiềnDocument5 pages4.1.1 - Dự Báo Dòng TiềnLê TiếnNo ratings yet

- Samyak Jain - IIM RanchiDocument2 pagesSamyak Jain - IIM RanchiNeha GuptaNo ratings yet

- Exhibit in ExcelDocument8 pagesExhibit in ExcelAdrian WyssNo ratings yet

- PHILEX - V and H AnalysisDocument8 pagesPHILEX - V and H AnalysisHilario, Jana Rizzette C.No ratings yet

- FIN Gilbert and Cash BudgetDocument9 pagesFIN Gilbert and Cash BudgetlmsmNo ratings yet

- FY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualDocument7 pagesFY 13-14 FY 14-15 FY 70-71 FY 71-72 FY 72-73 ActualramNo ratings yet

- Report of Alior Bank Group 31.03.2017 PDFDocument68 pagesReport of Alior Bank Group 31.03.2017 PDFParth PatelNo ratings yet

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- Balance SheetDocument14 pagesBalance SheetIbrahimNo ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- %sales Discount %yoy 18.5% 22.5% 1.8%Document2 pages%sales Discount %yoy 18.5% 22.5% 1.8%Linh NguyenNo ratings yet

- ColgateDocument32 pagesColgateapi-3702531No ratings yet

- Financial Statement Analysis of Yes BankDocument12 pagesFinancial Statement Analysis of Yes BankAjay Suthar100% (1)

- Ratio 2Document2 pagesRatio 2Mae ValenciaNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- My AutobiographyDocument2 pagesMy AutobiographyIvan CutiamNo ratings yet

- Abm 11Document1 pageAbm 11Ivan CutiamNo ratings yet

- Thingking It ThroughDocument2 pagesThingking It ThroughIvan CutiamNo ratings yet

- 03 Worksheet 1Document2 pages03 Worksheet 1Ivan CutiamNo ratings yet

- G12 W6 We Are All DifferentDocument1 pageG12 W6 We Are All DifferentIvan CutiamNo ratings yet

- 04 Writing A Concept PaperDocument1 page04 Writing A Concept PaperIvan CutiamNo ratings yet

- ILS Task Group 4 - Strawberry Ice CreamDocument4 pagesILS Task Group 4 - Strawberry Ice CreamIvan CutiamNo ratings yet

- Autobiography of A College StudentDocument2 pagesAutobiography of A College StudentIvan CutiamNo ratings yet

- 03 Activity 1 ARGDocument2 pages03 Activity 1 ARGIvan CutiamNo ratings yet

- Nature of ObDocument3 pagesNature of ObLords PorseenaNo ratings yet

- 1701075261076Document18 pages1701075261076rahulpavn01No ratings yet

- OpenSSH - 7.4 Multiple Vulnerabilities - Nessus - InfosecMatterDocument1 pageOpenSSH - 7.4 Multiple Vulnerabilities - Nessus - InfosecMatterdrgyyNo ratings yet

- Monitoring and Logging External Services in Kubernetes - HabrDocument3 pagesMonitoring and Logging External Services in Kubernetes - HabrmaxNo ratings yet

- EDPS - (Guidelines) On Processing PI in Whistleblowing Procedure A 17-12-19Document16 pagesEDPS - (Guidelines) On Processing PI in Whistleblowing Procedure A 17-12-19Mario Gomez100% (1)

- 1406441Document22 pages1406441sian017No ratings yet

- 9 Gitterstar LoadTable Autom TrucksDocument1 page9 Gitterstar LoadTable Autom TrucksSnaz_nedainNo ratings yet

- PFP Tutorial 8Document2 pagesPFP Tutorial 8stellaNo ratings yet

- Hot Mix Asphalt: Section 1: IdentificationDocument11 pagesHot Mix Asphalt: Section 1: Identificationfathul syaafNo ratings yet

- Midterm - Psychological StatisticsDocument6 pagesMidterm - Psychological StatisticsrieNo ratings yet

- See's Candy Order Form 2017Document1 pageSee's Candy Order Form 2017VanessaNo ratings yet

- Bpi V TrinidadDocument1 pageBpi V TrinidadangelusirideNo ratings yet

- NetBrain System Setup Guide Two-Server DeploymentDocument52 pagesNetBrain System Setup Guide Two-Server Deploymentajrob69_187428023No ratings yet

- Essay For Effects of ForceDocument1 pageEssay For Effects of ForceCheng NieNo ratings yet

- PCST - MODULE - 0.2 Process Control Systems Technician ProgramDocument15 pagesPCST - MODULE - 0.2 Process Control Systems Technician Programkali bangonNo ratings yet

- Microstructure & Mechanical Characterization of Modified Aluminium 6061Document14 pagesMicrostructure & Mechanical Characterization of Modified Aluminium 6061Dinesh DhaipulleNo ratings yet

- Exploring The Sysmaster Database: by Lester KnutsenDocument23 pagesExploring The Sysmaster Database: by Lester Knutsenabille01No ratings yet

- Open Hole Wireline LoggingDocument32 pagesOpen Hole Wireline Loggingsanjeet giriNo ratings yet

- Heckler & Kock - Mark-23 (Operators-Manual) 5-26-21Document36 pagesHeckler & Kock - Mark-23 (Operators-Manual) 5-26-21Ricardo C TorresNo ratings yet

- CP4123 - Chipping HammerDocument8 pagesCP4123 - Chipping HammerRigoberto RodriguezNo ratings yet

- A2093 18022 2018 ST01 Iss - WDDocument1 pageA2093 18022 2018 ST01 Iss - WDprompt consortiumNo ratings yet

- Parts List EUPOLO150 (JC150T)Document44 pagesParts List EUPOLO150 (JC150T)GARAGE PREMIUMNo ratings yet

- Mangayar Malar Recipes - 01-09-2013 - Tamil MagazinesDocument4 pagesMangayar Malar Recipes - 01-09-2013 - Tamil MagazinesiyappangokulNo ratings yet

- Chest Tubes Nursing CareDocument2 pagesChest Tubes Nursing CareYousef KhalifaNo ratings yet

- CWTSDocument2 pagesCWTSShakira Isabel ArtuzNo ratings yet

- Revised Stores Shield Criteria - Letter 12072023 - PCMM All Zonal RailwaysDocument7 pagesRevised Stores Shield Criteria - Letter 12072023 - PCMM All Zonal Railways1005 ABIRAME H.SNo ratings yet