Professional Documents

Culture Documents

2nd Grading Gen Math 2017-2018

Uploaded by

Mariel VillanuevaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2nd Grading Gen Math 2017-2018

Uploaded by

Mariel VillanuevaCopyright:

Available Formats

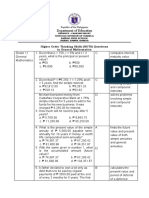

COLON NATIONAL HIGH SCHOOL

Colon, Maasim, Sarangani Province

Integrated Senior High School

SHS ID: 341635

Second Quarter Examinations (General Mathematics)

Name Grade & Section

Subject Teacher Mariel G. Villanueva Score

DIRECTION. Write the letter of the correct answer in the space provided. You are allowed to use calculator.

_____1. P 8,000 is invested at 12% single interest. _____11. The original amount of money that

What is the amount at the end of 2 years? people save or invest is known as

a. P9,600 b. P8,960 a. Interest b. Principal

c. P8,240 d. P9,920 c. Compound interest d. Seed money

_____2. At what rate of interest should P2, 400 be _____12. The amount an investment will be worth

invested so that it will earn P880 in 8 after one or more periods of time is called

months?

a. future value b. present value

a. 6 ½% b. 5 ½% c. principal value d. discounted value

c. 5% d. 6%

_____13. When the term is 3 years and 6

_____3. How much would be paid on a bank months and money is compounded

loan of P30, 000 a year at 12% annual semi – annually, the total number of

interest? conversion periods is

a. P3, 240 b. P33,600 a. 3 b. 7

c. P2, 800 d. P3, 600 c. 9 d. 18

_____4. How long will an amount of money double _____14. When money is compounded monthly,

at a simple interest rate of 2%? the frequency of conversion is

a. 20 years b. 30 years a. 2 b. 4

c. 40 years d. 50 years c. 6 d. 12

_____5. At what simple interest rate will an _____15. When the total number of conversion

amount of money double itself in 10 years? periods is 12 and the term is 6 years, then

the money is compounded

a. 5% b. 10%

c. 15% d. 20% a. annually b. semi – annually

c. quarterly d. monthly

For items 6 to 10, refer to the choices below.

_____16. Annie deposited P 100,000 in a bank that

a. Time money is borrowed. pays 12% compounded interest annually.

How much money she will have after 3

b. Percentage of increase of investment years?

c. Amount of money borrowed or invested a. P 140,492.00 b. P100,404.00

c. P 68,147.00 d. P 60,000.00

d. Amount added by the lender, to be

received on repayment date _____17. Thirty years ago, your father invested

11,000. Today, that investment is worth

e. Amount received on repayment date. 287, 047. What is the average annual

rate of return of your father earned on his

_____6. Principal interest?

_____7. Term a. 11.14% b. 11.27%

c. 11.387% d. 11.49%

_____8. Interest

_____9. Maturity value

_____10. Interest rate

_____18. Gloria deposited P6000 at 8% c. Depositing P1,000 monthly in a fund that

compounded annually interest for 4 years. pays 6% compounded quarterly.

What is total amount?

d. Monthly payments of P2,000 for 5 years

a. P2, 162. 93 b. P7, 558.27 with interest rate of 12% compounded

c. P1, 558.27 d. P8, 162.93 monthly

_____19. How long would it take for P 5000 ______27. An annuity where the length of the

invested at 5% compounded annually payment interval is the same as the length

to double in value? of the interest compounding period

a. 5 years b. 7 years a. general annuity b. ordinary annuity

c. 10 years d. 14 years c. deferred annuity d. general ordinary

_____20. What present value, compounded ______28. Muaz will need P 130, 000 in 4 years to

quarterly at 6%, will become P 59, 780.91 in buy a piece of property. He plan to save

3 years? money by making equal quarterly deposits

into an account earning 6.1% compounded

a. 49,780.91 b. 50,780.19 quarterly. What is Muaz’s quarterly

c. 49,984.04 d. 50,000.76 deposit?

For items 21 to 25, refer to the choices below. a. P 7, 235.51 b. P 9, 218.01

c. P 871.18 d. P 1, 110.69

a. a sequence of payments made at

equal (fixed) intervals or periods of _____27. What is the future value of $2,400 a year

time for three years at an 8 percent rate of

interest?

b. time between the first payment interval

and last payment interval a. $6,185.03 b. $6,847.26

c. $7,134.16 d. $7,791.36

c. the amount of each payment

_____28. You would like to have $1,000 one year

d. sum of future values of all the payments (365 days) from now and you find that the

to be made during the entire term of the bank is paying 7% compounded daily. How

annuity much will you have to deposit with the bank

today to be able to have the $1,000?

e. sum of future values of all the payments

to be made during the entire term of the a. $ 934.58 b. $ 933.51

annuity c. $ 932.40 d. $ 934.50

_____21. Annuity _____29. A young couple buys their dream house.

After paying their down payment and

_____22. Term closing costs, the couple has borrowed

$400,000 from the bank. The terms of the

_____23. Regular Payment mortgage are 30 years of monthly payments

of 6% with monthly compounding. What

_____24. Future Value is the monthly payment for the

couple?

_____25. Present Value

a. $2,398.20 b. $2,421.63

_____26. Which of the following illustrates ordinary c. $2,697.98 d. $2,700.00

annuity?

_____30. Uncle Fester puts $50,000 into a bank

a. Monthly installment payment of a car, lot, account earning 6%. You can't withdraw the money

or house with an interest rate that is until the balance has doubled. How long will you

compounded annually have to leave the money in the account?

b. Paying a debt semi-annually when the a. 9 years b. 10 years

interest is compounded monthly c. 11 years d. 12 years

End of the Test

Good Luck and God Bless

“The best way to predict the future is to invent it”

Prepared by

MARIEL G. VILLANUEVA

Subject Teacher

You might also like

- 2nd Grading Gen Math 2017-2018 EditedDocument2 pages2nd Grading Gen Math 2017-2018 EditedMariel VillanuevaNo ratings yet

- MathDocument5 pagesMathAgnes Ramo100% (1)

- Gen. Math SummativeDocument2 pagesGen. Math SummativeMarlon DespoyNo ratings yet

- 2nd Grading General Mathematics 2016-2017Document4 pages2nd Grading General Mathematics 2016-2017Mariel VillanuevaNo ratings yet

- Quuuuiiiizzzz Sa MathDocument1 pageQuuuuiiiizzzz Sa MathLanie O. GasatanNo ratings yet

- Test Question For Math 12Document5 pagesTest Question For Math 12Ernie Lahaylahay100% (1)

- Quiz 3Document2 pagesQuiz 3shaylieeeNo ratings yet

- Summative Test Week 1-4Document1 pageSummative Test Week 1-4Aguila AlvinNo ratings yet

- Time Value of Money QuestionsDocument8 pagesTime Value of Money QuestionswanNo ratings yet

- Time Value of Money Quiz ReviewerDocument3 pagesTime Value of Money Quiz ReviewerAra FloresNo ratings yet

- Final Exam Gen Math 3Document4 pagesFinal Exam Gen Math 3Angel ParaguisonNo ratings yet

- MC ReviewDocument7 pagesMC ReviewIqtidar Khan100% (1)

- Gen Math 2nd Quarter - 1Document4 pagesGen Math 2nd Quarter - 1Adriano Jay-Jay Lloren Pocbit Jr.No ratings yet

- Hots Gen MathDocument3 pagesHots Gen MathDenver Pol FernandezNo ratings yet

- 01prelim FIN 103 Answer KeyDocument7 pages01prelim FIN 103 Answer KeyevaNo ratings yet

- Direction: Read and Examine Each Question Carefully. Write Only The Letter of The Correct Answer. If The Answer Is Not in The Choices, Write WDocument3 pagesDirection: Read and Examine Each Question Carefully. Write Only The Letter of The Correct Answer. If The Answer Is Not in The Choices, Write WRevanVilladozNo ratings yet

- Summative Test 1-Q2Document2 pagesSummative Test 1-Q2Dina Jean Sombrio0% (1)

- Chapter 7 1 TaskDocument3 pagesChapter 7 1 Taskapi-3506421800% (1)

- Summative Test For Genmath Quarter 2 Final PrintDocument3 pagesSummative Test For Genmath Quarter 2 Final PrintClemente Ace Burce Macorol100% (2)

- 1st Quiz Calculus 8-15-2018 (Time Value of Money)Document2 pages1st Quiz Calculus 8-15-2018 (Time Value of Money)Gletzmar IgcasamaNo ratings yet

- Maths FinalDocument5 pagesMaths FinalYared BitewNo ratings yet

- GENERAL MATHEMATICS 11 2nd Quarter ExamDocument3 pagesGENERAL MATHEMATICS 11 2nd Quarter ExamPOTENCIANO JR TUNAY100% (1)

- Quarter 2 Test in Gen MathDocument2 pagesQuarter 2 Test in Gen MathDong Min100% (2)

- Assignment - Time ValueDocument8 pagesAssignment - Time ValueOssama FatehyNo ratings yet

- Tg26 Mat 152 Lesson Exam Pg3Document6 pagesTg26 Mat 152 Lesson Exam Pg3ECE CAPILINo ratings yet

- Apznzabaqearpefkn Hcmj5ev6iwe5rx70g7mkdovnxe3pa7ta Twqnbcpgkx4b8dlsvvuwlxldgtqnnnqekvmueiigzpewgmueffbhywd04ecgaai7ix5awzmbplwwtae0rnugdk8gtkxol Nklc3ed2ezepg8ddmblahyt Wjxrwsqgbuaesk6c0cejurkay6 Ukwgyls DnuqhpzDocument2 pagesApznzabaqearpefkn Hcmj5ev6iwe5rx70g7mkdovnxe3pa7ta Twqnbcpgkx4b8dlsvvuwlxldgtqnnnqekvmueiigzpewgmueffbhywd04ecgaai7ix5awzmbplwwtae0rnugdk8gtkxol Nklc3ed2ezepg8ddmblahyt Wjxrwsqgbuaesk6c0cejurkay6 Ukwgyls DnuqhpzHaise SasakiNo ratings yet

- Fom 12 Midterm Review of AwesomenessDocument38 pagesFom 12 Midterm Review of AwesomenessSauel snyderNo ratings yet

- EE1Document22 pagesEE1Jeiel ValenciaNo ratings yet

- TVM Practice Questions Fall 2018Document4 pagesTVM Practice Questions Fall 2018ZarakKhanNo ratings yet

- General Mathematics Final Term Written Test IDocument4 pagesGeneral Mathematics Final Term Written Test IcykenNo ratings yet

- Lat Soal Time Value of MoneyDocument3 pagesLat Soal Time Value of MoneyHendra G. AngjayaNo ratings yet

- Gen. Math. Periodical Exam. 2nd QuarterDocument4 pagesGen. Math. Periodical Exam. 2nd Quarterhogmc media100% (1)

- Fin302 MCQs PDFDocument13 pagesFin302 MCQs PDFkhushi mishaNo ratings yet

- 2nd Quarter Exam Gen MathDocument5 pages2nd Quarter Exam Gen MathroniloNo ratings yet

- A. October 1, 2018 B. September 30, 2018Document3 pagesA. October 1, 2018 B. September 30, 2018Danilo CumpioNo ratings yet

- Don Eulogio de Guzman Memorial National High School: La Union Schools Division OfficeDocument2 pagesDon Eulogio de Guzman Memorial National High School: La Union Schools Division OfficeMary Joy ColasitoNo ratings yet

- Extra Credits For Q2Document1 pageExtra Credits For Q2Noe ZalamedaNo ratings yet

- MathDocument2 pagesMathJessel Ann MontecilloNo ratings yet

- General Mathematics Final ExamDocument8 pagesGeneral Mathematics Final ExamMarisa Canada ApliseNo ratings yet

- 1 MultiDocument1 page1 MultiFaba, Froi Jastine T.No ratings yet

- Chapter 2+3-MCQDocument2 pagesChapter 2+3-MCQNguyễn Việt LêNo ratings yet

- Calculus For Business Part 2 Time Value of MoneyDocument2 pagesCalculus For Business Part 2 Time Value of MoneyGletzmar IgcasamaNo ratings yet

- 2nd Q Exam Sta Moincs HSDocument3 pages2nd Q Exam Sta Moincs HSJettCortez Alolod100% (1)

- General Mathematics Final Term Written Test IDocument4 pagesGeneral Mathematics Final Term Written Test IcykenNo ratings yet

- Gen Math Quarter 2 Summative TestDocument6 pagesGen Math Quarter 2 Summative TestAngelie ButalidNo ratings yet

- Time Value of MoneyDocument8 pagesTime Value of MoneyChethan KumarNo ratings yet

- CFA Quant Level 1Document81 pagesCFA Quant Level 1Sophy ThweNo ratings yet

- Prelim Problem Set #3: Interests, Inflation, Escalation, AnnuityDocument1 pagePrelim Problem Set #3: Interests, Inflation, Escalation, AnnuityHane Minasalbas0% (1)

- Seatwork6 Withanswer Final PDFDocument2 pagesSeatwork6 Withanswer Final PDFLester John PrecillasNo ratings yet

- Time Value of Money ProblemsDocument24 pagesTime Value of Money ProblemsMahidhara Davangere100% (1)

- Fundamentals of Corporate Finance, 2nd Edition, Selt Test Ch06 PDFDocument7 pagesFundamentals of Corporate Finance, 2nd Edition, Selt Test Ch06 PDFmacseuNo ratings yet

- Week 3 PDFDocument2 pagesWeek 3 PDFyogeshgharpureNo ratings yet

- General Mathematics Quarter 2 ExaminationDocument6 pagesGeneral Mathematics Quarter 2 ExaminationDina Jean Sombrio100% (1)

- 2nd Periodical Test 2023Document3 pages2nd Periodical Test 2023Gideon CayogNo ratings yet

- 2nd Summative Test in General MathDocument2 pages2nd Summative Test in General MathPOTENCIANO JR TUNAYNo ratings yet

- Local Media7735387659572366861Document3 pagesLocal Media7735387659572366861heynuhh gNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- General Mathematics Summative Test 3 2022-2023Document2 pagesGeneral Mathematics Summative Test 3 2022-2023Mariel VillanuevaNo ratings yet

- 3rd Grading Stat and Prob 2017-2018Document3 pages3rd Grading Stat and Prob 2017-2018Mariel VillanuevaNo ratings yet

- General Mathematics Summative Test 3 2022-2023 - Version 2Document2 pagesGeneral Mathematics Summative Test 3 2022-2023 - Version 2Mariel VillanuevaNo ratings yet

- Action Research Theme 2 (Child Protection) Oral - Colon NHS 2022Document10 pagesAction Research Theme 2 (Child Protection) Oral - Colon NHS 2022Mariel VillanuevaNo ratings yet

- 4th Grading Gen Physics 2 2017-2018Document2 pages4th Grading Gen Physics 2 2017-2018Mariel VillanuevaNo ratings yet

- 1st Grading Gen Physics 1 2017-2018Document3 pages1st Grading Gen Physics 1 2017-2018Mariel VillanuevaNo ratings yet

- 2nd Grading Gen Physics 1 2017-2018Document3 pages2nd Grading Gen Physics 1 2017-2018Mariel VillanuevaNo ratings yet

- Colon Student-Led School Watching and Hazard MappingDocument9 pagesColon Student-Led School Watching and Hazard MappingMariel VillanuevaNo ratings yet

- 2nd Grading Gen Physics 2017-2018 EditedDocument3 pages2nd Grading Gen Physics 2017-2018 EditedMariel VillanuevaNo ratings yet

- 1st Grading Gen Math 2017-2018Document3 pages1st Grading Gen Math 2017-2018Mariel VillanuevaNo ratings yet

- 4th Grading Exam Basic Calculus 2017-2018Document16 pages4th Grading Exam Basic Calculus 2017-2018Mariel VillanuevaNo ratings yet

- 4th Grading Gen Physics 2 2017-2018Document2 pages4th Grading Gen Physics 2 2017-2018Mariel VillanuevaNo ratings yet

- 3rd Grading Gen Physics 2017-2018Document3 pages3rd Grading Gen Physics 2017-2018Mariel VillanuevaNo ratings yet

- 3rd Grading Stat and Prob 2017-2018Document3 pages3rd Grading Stat and Prob 2017-2018Mariel VillanuevaNo ratings yet

- 2nd Grading Gen Physics 2017-2018 EditedDocument3 pages2nd Grading Gen Physics 2017-2018 EditedMariel VillanuevaNo ratings yet

- 2nd Grading Gen Physics 2017-2018Document2 pages2nd Grading Gen Physics 2017-2018Mariel VillanuevaNo ratings yet

- 4th Grading General Chemistry 2016-2017Document1 page4th Grading General Chemistry 2016-2017Mariel VillanuevaNo ratings yet

- G8 and G9 Math OlympicsDocument9 pagesG8 and G9 Math OlympicsMariel VillanuevaNo ratings yet

- Philosophy Summative Test 4th 2020 2021Document2 pagesPhilosophy Summative Test 4th 2020 2021Mariel VillanuevaNo ratings yet

- 3rd Grading Basic Calculus 2019 2020Document3 pages3rd Grading Basic Calculus 2019 2020Mariel VillanuevaNo ratings yet

- 2nd Grading Earth and Life Science 2016-2017Document3 pages2nd Grading Earth and Life Science 2016-2017Mariel VillanuevaNo ratings yet

- 3rd Grading General Chemistry 1 2016-2017Document4 pages3rd Grading General Chemistry 1 2016-2017Mariel VillanuevaNo ratings yet

- 3rd Grading Basic Calculus 2016-2017Document4 pages3rd Grading Basic Calculus 2016-2017Mariel VillanuevaNo ratings yet

- 3rd Grading Disaster Risk Reduction 2019 2020Document3 pages3rd Grading Disaster Risk Reduction 2019 2020Mariel VillanuevaNo ratings yet

- Philosophy Summative Test 3rd 2020 2021Document2 pagesPhilosophy Summative Test 3rd 2020 2021Mariel VillanuevaNo ratings yet

- 1st Grading Earth and Life Science 2016-2017Document5 pages1st Grading Earth and Life Science 2016-2017Mariel VillanuevaNo ratings yet

- 1st Grading Gen Math 2016-2017Document4 pages1st Grading Gen Math 2016-2017Mariel VillanuevaNo ratings yet

- 3rd Grading Gen Physics 2 2019-2020Document2 pages3rd Grading Gen Physics 2 2019-2020Mariel VillanuevaNo ratings yet

- Pavlishchuck Addison - 2000 - Electrochemical PotentialsDocument6 pagesPavlishchuck Addison - 2000 - Electrochemical PotentialscomsianNo ratings yet

- The Journeyto Learning Throughthe Learning StylesDocument93 pagesThe Journeyto Learning Throughthe Learning Stylesastria alosNo ratings yet

- Stamp 07 eDocument6 pagesStamp 07 eDumitru TuiNo ratings yet

- Bo Sanchez-Turtle Always Wins Bo SanchezDocument31 pagesBo Sanchez-Turtle Always Wins Bo SanchezCristy Louela Pagapular88% (8)

- A B&C - List of Residents - VKRWA 12Document10 pagesA B&C - List of Residents - VKRWA 12blr.visheshNo ratings yet

- CN Blue Love Rigt Lyrics (Romanized)Document3 pagesCN Blue Love Rigt Lyrics (Romanized)Dhika Halet NinridarNo ratings yet

- English Lesson Plan Form 4 (Literature: "The Living Photograph")Document2 pagesEnglish Lesson Plan Form 4 (Literature: "The Living Photograph")Maisarah Mohamad100% (3)

- Text Descriptive Tentang HewanDocument15 pagesText Descriptive Tentang HewanHAPPY ARIFIANTONo ratings yet

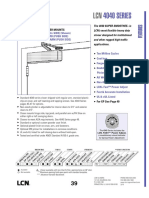

- 4040 SERIES: Hinge (Pull Side) (Shown) Top Jamb (Push Side) Parallel Arm (Push Side)Document11 pages4040 SERIES: Hinge (Pull Side) (Shown) Top Jamb (Push Side) Parallel Arm (Push Side)Melrose FabianNo ratings yet

- Mother Tongue Based Instruction in The Newly Implemented K To 12 Curriculum of The PhilippinesDocument16 pagesMother Tongue Based Instruction in The Newly Implemented K To 12 Curriculum of The PhilippinesEi JayNo ratings yet

- LEARNING ACTIVITY SHEET in Oral CommDocument4 pagesLEARNING ACTIVITY SHEET in Oral CommTinTin100% (1)

- KRPL Shahjahanpur Check List For Arc Welding MachineDocument1 pageKRPL Shahjahanpur Check List For Arc Welding MachineA S YadavNo ratings yet

- AA-SM-010 Stress Due To Interference Fit Bushing Installation - Rev BDocument3 pagesAA-SM-010 Stress Due To Interference Fit Bushing Installation - Rev BMaicon PiontcoskiNo ratings yet

- Metro Depot: (Aar 422) Pre-Thesis SeminarDocument3 pagesMetro Depot: (Aar 422) Pre-Thesis SeminarSri VirimchiNo ratings yet

- Electrostatics Practice ProblemsDocument4 pagesElectrostatics Practice ProblemsMohammed Aftab AhmedNo ratings yet

- Ericsson Private 5G Solution BriefDocument5 pagesEricsson Private 5G Solution BriefTanesan WyotNo ratings yet

- SBU PlanningDocument13 pagesSBU PlanningMohammad Raihanul HasanNo ratings yet

- 2 MercaptoEthanolDocument8 pages2 MercaptoEthanolMuhamad ZakyNo ratings yet

- This Study Resource Was: MCV4U Exam ReviewDocument9 pagesThis Study Resource Was: MCV4U Exam ReviewNathan WaltonNo ratings yet

- Revised LabDocument18 pagesRevised LabAbu AyemanNo ratings yet

- Cesars WayDocument20 pagesCesars WayToni TursićNo ratings yet

- Ericsson AXE 810: Switch (ROTD)Document4 pagesEricsson AXE 810: Switch (ROTD)Kao Sun HoNo ratings yet

- Maharishi Language of Gravity - SoS 27Document3 pagesMaharishi Language of Gravity - SoS 27Prof. MadhavanNo ratings yet

- California Academy For Lilminius (Cal) : Lesson PlanDocument4 pagesCalifornia Academy For Lilminius (Cal) : Lesson Plandarryl franciscoNo ratings yet

- Ofsaai Ic 72 E22351 01Document312 pagesOfsaai Ic 72 E22351 01Mohamed AbrarNo ratings yet

- Thermal ComfortDocument50 pagesThermal ComfortSSNo ratings yet

- Course Information2009 2010Document4 pagesCourse Information2009 2010shihabnittNo ratings yet

- Self-Actualization in Robert Luketic'S: Legally Blonde: A HumanisticDocument10 pagesSelf-Actualization in Robert Luketic'S: Legally Blonde: A HumanisticAyeshia FréyNo ratings yet

- Using The Words in The Box, Fill in All The GapsDocument23 pagesUsing The Words in The Box, Fill in All The GapsMo NoNo ratings yet

- Unit 4 ADocument10 pagesUnit 4 AChetan p ShirahattiNo ratings yet