Professional Documents

Culture Documents

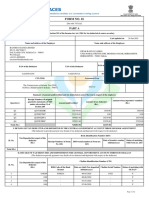

Annual Income Tax Return

Uploaded by

Queenel MabbayadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Income Tax Return

Uploaded by

Queenel MabbayadCopyright:

Available Formats

Annual Income Tax Return

When you submit a tax return to BIR, you're disclosing your earnings, spending, and

other important financial data. Returns for taxes are used to assess a taxpayer's tax

burden, schedule tax payments, or obtain a refund for an overpayment of tax. Tax returns

are required to be submitted on a yearly basis in the Philippines.

BIR Form No. 1701: Annual Income Tax Return For Individuals

(including MIXED Income Earner), Estates and Trusts

In line with Section 51 of the Code, as amended, people having mixed income (i.e., those

engaged in trade/business or profession but also receiving compensation income) must

submit BIR Form No. 1701. In order to file an annual income tax return, a taxpayer must

include all of their financial transactions for the previous calendar year.

The following people, regardless of their gross income, are required to complete this

form:

1. A Filipino citizen engaged in commerce, trade, or profession both within and outside

of the country.

2. Any foreign national or non-citizen resident working in the Philippines in the course

of his or her profession, whether as an employee or as a company owner.

3. A trustee of a trust, guardian of a minor, executor/administrator of an estate, or any

person acting in any fiduciary capacity for any person, where such trust, estate, minor, or

person is engaged in trade or business.

4. A person who is involved in a trade or company or profession and is also earning

compensation money.

Filing date: Taxpayers are required to submit this form on or before April 15 of

each year, which covers the preceding taxable year's income.

BIR Form No. 1701A: Annual Income Tax Return for Individuals Earning

Income PURELY from Business/Profession

Individuals using the flat 8 percent income tax rate and those who fall within the

graduated income tax rates with OSD as a method of deduction. Individuals who make

their money solely via trade, commerce, or the practice of the profession are required to

submit a tax return.

1. A resident citizen (within and without the Philippines)

2. A resident alien, non-resident citizen or non-resident alien (within the Philippines)

The return may only be utilized by the following individuals:

individuals whose subject to graduated income tax rates and who use the standard

deduction as a strategy of tax planning, whether or not they have any sales or receipts

or other non-operational revenue; OR

anybody earning less than Php 3 million in sales/receipts or other non-operating

income but who took advantage of the 8% flat income tax rate

Filing date: Taxpayers are required to submit this form on or before April 15 of

each year, which covers the preceding taxable year's income.

You might also like

- Case 2 - A Zero Wage Increase AgainDocument3 pagesCase 2 - A Zero Wage Increase AgainAlvaro Sierra75% (4)

- Ramchrisen H. Haveria, Petitioner, vs. Social Security System, Corazon de La Paz, and Leonora S. Nuque, RespondentsDocument2 pagesRamchrisen H. Haveria, Petitioner, vs. Social Security System, Corazon de La Paz, and Leonora S. Nuque, RespondentsViolet Blue100% (1)

- BIR FORMS.docxDocument6 pagesBIR FORMS.docxalfortegwenNo ratings yet

- Annual Income Tax Return For Individuals Earning Purely Compensation IncomeDocument2 pagesAnnual Income Tax Return For Individuals Earning Purely Compensation IncomeErikaNo ratings yet

- Assessment#2Document2 pagesAssessment#2Lai SinghNo ratings yet

- BIR Form No. 1700 1709Document5 pagesBIR Form No. 1700 1709FaithNo ratings yet

- Income Tax Return: Group MembersDocument12 pagesIncome Tax Return: Group MembersTophe ProvidoNo ratings yet

- What Is An Itr?Document12 pagesWhat Is An Itr?جاثية عبدالرحمنNo ratings yet

- Description: (Return To Index)Document27 pagesDescription: (Return To Index)Dura LexNo ratings yet

- BIR Form No GuidlineDocument11 pagesBIR Form No GuidlineFernando OrganoNo ratings yet

- BIR Ir TAXDocument37 pagesBIR Ir TAXMarky De AsisNo ratings yet

- Tax-on-Individuals PhilippinesDocument21 pagesTax-on-Individuals PhilippinesMaria Regina Javier100% (2)

- BIR Form No 1700 1701Document1 pageBIR Form No 1700 1701Joshua OuanoNo ratings yet

- O o o o o o O: IndividualsDocument17 pagesO o o o o o O: IndividualsDustin GonzalezNo ratings yet

- BIR FormsDocument5 pagesBIR FormsjoannalouisacgabawanNo ratings yet

- Returns and Payment of TaxDocument14 pagesReturns and Payment of TaxJanna Grace Dela CruzNo ratings yet

- Income Taxes For IndividualsDocument30 pagesIncome Taxes For IndividualsDarrr RumbinesNo ratings yet

- Filing ITR Guide (Group 10Document8 pagesFiling ITR Guide (Group 10ALAJID, KIM EMMANUELNo ratings yet

- The Bureau of Internal RevenueDocument2 pagesThe Bureau of Internal RevenueSamuel EviaNo ratings yet

- Income TaxDocument19 pagesIncome TaxJustine BartolomeNo ratings yet

- Income TaxDocument19 pagesIncome TaxKitch GamillaNo ratings yet

- Taxation of IndividualsDocument12 pagesTaxation of Individualsaj lopezNo ratings yet

- Income TaxDocument292 pagesIncome TaxynnadadenipNo ratings yet

- Individuals Required To File ITRDocument27 pagesIndividuals Required To File ITRDura LexNo ratings yet

- Income TaxationDocument32 pagesIncome Taxationblackphoenix303No ratings yet

- How To File Your Income Tax Return in The Philippines-COMPENSATIONDocument10 pagesHow To File Your Income Tax Return in The Philippines-COMPENSATIONmiles1280No ratings yet

- Income TaxationDocument13 pagesIncome TaxationKyzy LimsiacoNo ratings yet

- Index For Income TaxDocument20 pagesIndex For Income TaxMark Joseph BajaNo ratings yet

- Income TaxDocument15 pagesIncome TaxJessNo ratings yet

- Income TaxationDocument3 pagesIncome Taxationm.bagnas.488669No ratings yet

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.No ratings yet

- Name of Form Bir Form Filing and Payment DescriptionDocument4 pagesName of Form Bir Form Filing and Payment DescriptionMelrose Eugenio ErasgaNo ratings yet

- INCOME TAX - PDFDocument19 pagesINCOME TAX - PDFPhia CustodioNo ratings yet

- Income Tax Filing RequirementsDocument17 pagesIncome Tax Filing RequirementsMichael Olmedo NeneNo ratings yet

- Administrative Provisions For Individual Income TaxDocument20 pagesAdministrative Provisions For Individual Income Taxramosolaarni0No ratings yet

- From An Employee To A SelfDocument3 pagesFrom An Employee To A SelfChristine BobisNo ratings yet

- Business Income TaxDocument8 pagesBusiness Income TaxAngelica Orion PanchoNo ratings yet

- Unit 3 - Concepts of Income & Income TaxationDocument10 pagesUnit 3 - Concepts of Income & Income TaxationJoseph Anthony RomeroNo ratings yet

- Income Tax Description: IndividualsDocument13 pagesIncome Tax Description: IndividualsJAYAR MENDZNo ratings yet

- Returns and Payment of TaxDocument12 pagesReturns and Payment of TaxHelaena Bueno Delos SantosNo ratings yet

- Income Tax Guide for IndividualsDocument30 pagesIncome Tax Guide for IndividualsWAYNENo ratings yet

- Various Income Taxes & Income Tax Returns Forms: Group 3 Ortega Angel Duterte Dela Cruz Argonsola Marquez AgustinDocument26 pagesVarious Income Taxes & Income Tax Returns Forms: Group 3 Ortega Angel Duterte Dela Cruz Argonsola Marquez AgustinTophe ProvidoNo ratings yet

- INCOME TAX OF INDIVIDUALS Part 2 PDFDocument3 pagesINCOME TAX OF INDIVIDUALS Part 2 PDFADNo ratings yet

- Individual Income Tax GuideDocument8 pagesIndividual Income Tax GuideMai RuizNo ratings yet

- Individual CitizenDocument2 pagesIndividual CitizenSky LeeNo ratings yet

- income taxDocument32 pagesincome taxAeiaNo ratings yet

- Income and Business TaxationDocument44 pagesIncome and Business TaxationBeverly EroyNo ratings yet

- BIR 2019 Income Tax DescriptionDocument20 pagesBIR 2019 Income Tax DescriptionRiselle Ann SanchezNo ratings yet

- BIR Form 1700 filing guideDocument72 pagesBIR Form 1700 filing guidemiles1280No ratings yet

- TaxationDocument2 pagesTaxationJohn Dave JavaNo ratings yet

- Bacore 3 Course Packet 2Document15 pagesBacore 3 Course Packet 2Jenifer Borja BacayoNo ratings yet

- Individual Income Tax ReturnsDocument2 pagesIndividual Income Tax ReturnsZen1No ratings yet

- How Do You See Yourself 5 - 10 Years From Now?Document72 pagesHow Do You See Yourself 5 - 10 Years From Now?Army KamiNo ratings yet

- Calculate Income Tax DueDocument8 pagesCalculate Income Tax DueKhaira PeraltaNo ratings yet

- Javier Assignment 28Document9 pagesJavier Assignment 28Shamraj E. SunderamurthyNo ratings yet

- Week 3 Income Taxation Individual TaxpayersDocument58 pagesWeek 3 Income Taxation Individual TaxpayersJulienne Untalasco100% (1)

- Scope of Progressive TaxDocument3 pagesScope of Progressive TaxGeriel FajardoNo ratings yet

- BIR Form 1701 Filing GuideDocument4 pagesBIR Form 1701 Filing GuideJazz techNo ratings yet

- BIR Form 0605 UsesDocument4 pagesBIR Form 0605 UsesCykee Hanna Quizo LumongsodNo ratings yet

- Review of Income Tax Reporting For Individuals & Corporate TaxpayersDocument159 pagesReview of Income Tax Reporting For Individuals & Corporate TaxpayersRyan Christian BalanquitNo ratings yet

- Key takeaways on filing taxes as a self-employed individual in the PhilippinesDocument2 pagesKey takeaways on filing taxes as a self-employed individual in the PhilippinesJefferson AlingasaNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- BLR Discussion 10 8 2022Document16 pagesBLR Discussion 10 8 2022Queenel MabbayadNo ratings yet

- Filipino-Worksheet-1Document1 pageFilipino-Worksheet-1Queenel MabbayadNo ratings yet

- Acc 202 Acctg Special Transactions OutlineDocument5 pagesAcc 202 Acctg Special Transactions OutlineQueenel MabbayadNo ratings yet

- Partnership Ex1Document10 pagesPartnership Ex1Queenel MabbayadNo ratings yet

- Uts Socio and AnthroDocument24 pagesUts Socio and AnthroQueenel MabbayadNo ratings yet

- Pe ArnisDocument34 pagesPe ArnisQueenel MabbayadNo ratings yet

- Article 1410Document2 pagesArticle 1410Queenel MabbayadNo ratings yet

- SESSION 1 Simple InterestDocument21 pagesSESSION 1 Simple InterestQueenel MabbayadNo ratings yet

- Case BDocument1 pageCase BQueenel MabbayadNo ratings yet

- Graphing Linear Equations and InequalitiesDocument53 pagesGraphing Linear Equations and InequalitiesQueenel Mabbayad100% (1)

- 4 Multiplication and Conditional ProbabilityDocument21 pages4 Multiplication and Conditional ProbabilityQueenel MabbayadNo ratings yet

- MS MidtermsDocument10 pagesMS MidtermsQueenel MabbayadNo ratings yet

- How Philippine Is Philippine ArtDocument4 pagesHow Philippine Is Philippine ArtQueenel MabbayadNo ratings yet

- History & Concepts of Phil TaxationDocument5 pagesHistory & Concepts of Phil TaxationQueenel MabbayadNo ratings yet

- Cedula Seat WorkDocument1 pageCedula Seat WorkQueenel MabbayadNo ratings yet

- Kalo CompanyDocument1 pageKalo CompanyQueenel MabbayadNo ratings yet

- Psychology in Art Gestalt and ColorDocument36 pagesPsychology in Art Gestalt and ColorQueenel MabbayadNo ratings yet

- LS4 - Workers, Wages & BenefitsDocument9 pagesLS4 - Workers, Wages & BenefitsAlanie Grace Beron TrigoNo ratings yet

- FW-001-GC Fee Waiver Request - Child 1Document4 pagesFW-001-GC Fee Waiver Request - Child 1AlyssaMarie93No ratings yet

- Consumer Preference Towards Shriram Life Insurance CompanyDocument18 pagesConsumer Preference Towards Shriram Life Insurance Companyprava vamsiNo ratings yet

- Payroll Control Procedures For AuditingDocument4 pagesPayroll Control Procedures For AuditingSyed HasanNo ratings yet

- July 30, 2010 Strathmore TimesDocument20 pagesJuly 30, 2010 Strathmore TimesStrathmore TimesNo ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- Sap HR DefinitionsDocument13 pagesSap HR Definitionsravibabu1620No ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AMirza Aftab BaigNo ratings yet

- C1 - Mid-Course Test PracticeDocument13 pagesC1 - Mid-Course Test PracticeTerranova KarlovacNo ratings yet

- Personal Public Service Number: Your Own DetailsDocument2 pagesPersonal Public Service Number: Your Own DetailsPetru BurcaNo ratings yet

- Module 9 - Government Accounting ProcessDocument10 pagesModule 9 - Government Accounting ProcessJeeramel TorresNo ratings yet

- Budget Preparation Abm BDocument3 pagesBudget Preparation Abm BCHERIE MAY ANGEL QUITORIANONo ratings yet

- Traditional Mock ExamDocument9 pagesTraditional Mock Examgemma bayerNo ratings yet

- Solved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFDocument1 pageSolved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFAnbu jaromiaNo ratings yet

- Tradional& VULDocument5 pagesTradional& VULdocgilbertNo ratings yet

- Taking Your Money Out of NestDocument32 pagesTaking Your Money Out of Nestvincent wanNo ratings yet

- Estates and Trusts: Understanding Income TaxDocument9 pagesEstates and Trusts: Understanding Income TaxPawPaul Mccoy100% (1)

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementtaramaNo ratings yet

- Oberoi Hotels Case StudyDocument15 pagesOberoi Hotels Case Studyanon_54755050100% (3)

- Family Pension For LIC and General Insurance PensionersDocument1 pageFamily Pension For LIC and General Insurance PensionersParesh BorboruahNo ratings yet

- SAE Claim FormDocument5 pagesSAE Claim FormNovaPNo ratings yet

- Shareholder and Shareholder Activism: Class G - 19 Team 2Document12 pagesShareholder and Shareholder Activism: Class G - 19 Team 2ARNOLD SANDA LAYUKNo ratings yet

- 2.2 Module 2 Part 2Document12 pages2.2 Module 2 Part 2Arpita ArtaniNo ratings yet

- Aviva PLC Annual Report and Accounts 2019Document288 pagesAviva PLC Annual Report and Accounts 2019Tanveer AhmadNo ratings yet

- Pag-IBIG II enrollment form details savings program termsDocument2 pagesPag-IBIG II enrollment form details savings program termsJazziel Fortaliza100% (1)

- Jaybangla Application FormDocument3 pagesJaybangla Application Formgfh hfgdfsdgNo ratings yet

- Dawood Family Takaful LTDDocument2 pagesDawood Family Takaful LTDTaimoor AhmmedNo ratings yet

- Retirement Notification FormDocument2 pagesRetirement Notification FormAbongile PhinyanaNo ratings yet