Professional Documents

Culture Documents

ACC 402 - Problem 28

ACC 402 - Problem 28

Uploaded by

Maria Pia0 ratings0% found this document useful (0 votes)

5 views2 pagesThe document records journal entries for an investment in Kinman Company from 2017 to 2018. It records the initial investment, dividends received, equity in earnings and losses of the investee, amortization of excess payments, and deferral of intra-entity profits until inventory is sold to outside parties. Schedules are provided to calculate amortization and deferred intra-entity profits for 2017 and 2018.

Original Description:

Advanced Financial Accounting, Chapter 1, Question 28

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document records journal entries for an investment in Kinman Company from 2017 to 2018. It records the initial investment, dividends received, equity in earnings and losses of the investee, amortization of excess payments, and deferral of intra-entity profits until inventory is sold to outside parties. Schedules are provided to calculate amortization and deferred intra-entity profits for 2017 and 2018.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesACC 402 - Problem 28

ACC 402 - Problem 28

Uploaded by

Maria PiaThe document records journal entries for an investment in Kinman Company from 2017 to 2018. It records the initial investment, dividends received, equity in earnings and losses of the investee, amortization of excess payments, and deferral of intra-entity profits until inventory is sold to outside parties. Schedules are provided to calculate amortization and deferred intra-entity profits for 2017 and 2018.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

ACC 402 - Problem 28 Maria Pia Velasquez

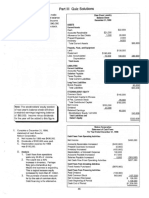

Journal entries:

DATE ACCOUNT DEBIT CREDIT

January 1, 2017 Investment in Kinman Company $210,000

Cash $210,000

To record acquisition of 40 percent of the

outstanding shares of Kinman Company.

2017 Dividend receivable $4,000

Investment in Kinman Company $4,000

To record a dividend declaration by Kinman

Company ($10,000 x 40%).

2017 Cash $4,000

Dividend receivable $4,000

To record collection of the cash dividend.

December 31, 2017 Equity in investee income $16,000

Other comprehensive loss 8,000

Investment in Kinman Company $24,000

To accrue 40 percent of the 2017 reported

losses of investee ($40,000 + $20,000 x 40%).

December 31, 2017 Equity in investee income $3,300

Investment in Kinman Company $3,300

To record amortization of excess payment

allocated to building and royalty (schedule 1).

December 31, 2017 Equity in investee income $2,000

Investment in Kinman Company $2,000

To defer recognition of intra-entity gross profit

until inventory is sold to outside parties

(schedule 2).

2018 Dividend Receivable $4,800

Investment in Kinman Company $4,800

To record a dividend declaration by Kinman

Company ($12,000 x 40%).

2018 Cash $4,800

Dividend receivable $4,800

To record collection of the cash dividend.

December 31, 2018 Investment in Kinman Company $16,000

Equity in investee income $16,000

To accrue 40 percent of the 2018 reported

income of investee ($40,000 x 40%).

December 31, 2018 Equity in investee income $3,300

Investment in Kinman Company $3,300

ACC 402 - Problem 28 Maria Pia Velasquez

To record amortization of excess payment

allocated to building and royalty (schedule 1).

December 31, 2018 Investment in Kinman Company $2,000

Equity in investee income $2,000

To record income on intra-entity sale that now

can be recognized after sales to outsiders.

December 31, 2018 Equity in investee income $3,600

Investment in Kinman Company $3,600

To defer recognition of intra-entity gross profit

until inventory is sold to outside parties

(schedule 3).

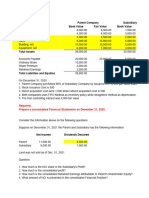

Schedule 1: Amortization calculations

Payment by investor $210,000

Percentage of book value acquired ($400,000 x 40%) 160,000

Payment in excess of book value $50,000

Excess payment identified with specific assets:

Building ($40,000 undervaluation x 40%) $16,000

Royalty ($85,000 undervaluation x 40%) 34,000 50,000

Excess payment not identified with specific assets $ -- 0 --

ASSET ATTRIBUTED COST REMAINING USEFUL LIFE ANNUAL AMORTIZATION

BUILDING $16,000 10 years $1,600

ROYALTY 34,000 20 years 1,700

Total $3,300

Schedule 2: Deferral of intra-entity gross profits in inventory calculations for 2017

REMAINING GROSS GROSS PROFIT IN INVESTOR DEFERRED INTRA-

ENDING PROFIT ENDING OWNERSHIP ENTITY GROSS

INVENTORY PERCENTAGE INVENTORY PERCENTAGE PROFIT

$15,000 33⅓% $5,000 40% $2,000

Schedule 3: Deferral of intra-entity gross profits in inventory calculations for 2018

REMAINING GROSS GROSS PROFIT IN INVESTOR DEFERRED INTRA-

ENDING PROFIT ENDING OWNERSHIP ENTITY GROSS

INVENTORY PERCENTAGE INVENTORY PERCENTAGE PROFIT

$24,000 37.5% $9,000 40% $3,600

You might also like

- Aug 2017 PDFDocument4 pagesAug 2017 PDFfurqan yaseenNo ratings yet

- 50 Financial Analyst Interview Questions and AnswersDocument19 pages50 Financial Analyst Interview Questions and AnswerskahladimayahlaNo ratings yet

- QUIZ 2-Mid.-Problems On Statement of Cash FlowsDocument2 pagesQUIZ 2-Mid.-Problems On Statement of Cash FlowsMonica GeronaNo ratings yet

- Chapter 6 ADVAC (Excel +Document43 pagesChapter 6 ADVAC (Excel +Christine Jane RamosNo ratings yet

- May 2017Document7 pagesMay 2017Patrick Arazo0% (1)

- Cash Flow Statements Study GuideDocument37 pagesCash Flow Statements Study GuideAshekin MahadiNo ratings yet

- QUIZ 2-Mid.-Problems On Statement of Cash FlowsDocument2 pagesQUIZ 2-Mid.-Problems On Statement of Cash FlowsMonica GeronaNo ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- Interview Material @SAP - 07..3.22 - With YouDocument270 pagesInterview Material @SAP - 07..3.22 - With YouAjit K. Panigrahi100% (1)

- Final RequirementDocument18 pagesFinal RequirementZandra GonzalesNo ratings yet

- Organigrama CredicorpDocument7 pagesOrganigrama CredicorpCarlos RamosNo ratings yet

- ASSIGNMENTSDocument13 pagesASSIGNMENTSJpzelleNo ratings yet

- IA Quiz ImadeDocument4 pagesIA Quiz ImadeKuro ZetsuNo ratings yet

- Lab 3 Stock InvestmentDocument4 pagesLab 3 Stock InvestmentAlvira FajriNo ratings yet

- FS Consolidation at The Date of Acquisition v2Document16 pagesFS Consolidation at The Date of Acquisition v2Pagatpat, Apple Grace C.No ratings yet

- CH 04Document9 pagesCH 04Antonios FahedNo ratings yet

- Intermediate Accounting Unit4 - Topic4Document8 pagesIntermediate Accounting Unit4 - Topic4Lea Polinar100% (1)

- CH 4 In-Class ExerciseDocument4 pagesCH 4 In-Class ExerciseAbdullah alhamaadNo ratings yet

- Service Business Accounting CycleDocument6 pagesService Business Accounting CycleMarie Kairish Damag Vivar100% (1)

- CH 12 - SolutionDocument50 pagesCH 12 - SolutionMuhammad RehmanNo ratings yet

- GEN4Document7 pagesGEN4Mylene HeragaNo ratings yet

- Solutions For Notes and Loans ReceivableDocument4 pagesSolutions For Notes and Loans ReceivableKenaniah SanchezNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- Warner Company Statement of Cash FlowsDocument2 pagesWarner Company Statement of Cash FlowsKailash KumarNo ratings yet

- Chapter 7 Inclass Problems Day 1 SOLUTIONSDocument3 pagesChapter 7 Inclass Problems Day 1 SOLUTIONSAbdullah alhamaadNo ratings yet

- Angelo Fernando - 01012190021 - Tugas Akuntansi Menengah 2 - Pertemuan 5Document4 pagesAngelo Fernando - 01012190021 - Tugas Akuntansi Menengah 2 - Pertemuan 5ANGELOXAK202No ratings yet

- Tax Quiz 1Document3 pagesTax Quiz 1KimbabNo ratings yet

- Investment in AssociatesDocument6 pagesInvestment in Associates2022104429No ratings yet

- ACC 203 Ch05 SolutionDocument11 pagesACC 203 Ch05 Solutionomaritani2005No ratings yet

- Recording Adjustments For Revenues & Recording EquityDocument7 pagesRecording Adjustments For Revenues & Recording Equitypratibha jaggan martinNo ratings yet

- Problem 1 ReqDocument5 pagesProblem 1 ReqAgent348No ratings yet

- Intermediate Accounting 1 (Chap 17)Document10 pagesIntermediate Accounting 1 (Chap 17)Natalie Anne Bambico MercadoNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- Online Ass Advance Acc NEWDocument6 pagesOnline Ass Advance Acc NEWRara Rarara30No ratings yet

- Ch04 Consolidation TechniquesDocument54 pagesCh04 Consolidation TechniquesRizqita Putri Ramadhani0% (1)

- Materi Lab 3 - Stock Investment PDFDocument4 pagesMateri Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Introduction To Accounting and Business: Discussion QuestionsDocument46 pagesIntroduction To Accounting and Business: Discussion QuestionsCyyyNo ratings yet

- Sole Trader Accounting Handout 3Document5 pagesSole Trader Accounting Handout 3DenishNo ratings yet

- FCR Final With SignaturesDocument18 pagesFCR Final With SignaturesSeguros, pensiones y fianzas SIMON RODRIGUEZNo ratings yet

- Acg5205 Solutions Ch.08 - SL - Christensen 12eDocument15 pagesAcg5205 Solutions Ch.08 - SL - Christensen 12eRyan NguyenNo ratings yet

- FS AnalysisDocument1 pageFS AnalysisLark WarNo ratings yet

- Chapter 6: Consolidated Financial Statements (Part 3) : Compilation of ReportsDocument43 pagesChapter 6: Consolidated Financial Statements (Part 3) : Compilation of ReportsKriz TanNo ratings yet

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDocument12 pagesGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Fin 4500 sAMPLE Midterm Questions and AnswersDocument6 pagesFin 4500 sAMPLE Midterm Questions and AnswersmohamedNo ratings yet

- Tugas Aklan TM7Document7 pagesTugas Aklan TM7AdnanNo ratings yet

- Accounting Cycle 2Document6 pagesAccounting Cycle 2Ahmer NaeemNo ratings yet

- FABULAR Intercompany DividendsDocument6 pagesFABULAR Intercompany DividendsRico, Jalaica B.No ratings yet

- Ch23 StatementofCashFlowExamples Zeke and ZoeDocument4 pagesCh23 StatementofCashFlowExamples Zeke and ZoeHossein ParvardehNo ratings yet

- Problem 2.19Document3 pagesProblem 2.19CNo ratings yet

- ch12 Problem Set CDocument2 pagesch12 Problem Set CMutiara TenriNo ratings yet

- Ch02 SolutionDocument6 pagesCh02 SolutionMalekNo ratings yet

- Suggested Single EntryDocument5 pagesSuggested Single Entrya73512463No ratings yet

- DUAZO - 6th EXAM SIM ANSWERSDocument7 pagesDUAZO - 6th EXAM SIM ANSWERSJeric TorionNo ratings yet

- Good InformationDocument3 pagesGood InformationHoshen MollaNo ratings yet

- Guided Exercises Investment in AssociateDocument2 pagesGuided Exercises Investment in AssociateMireya YueNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Chapter 5 - Selected SolutionsDocument13 pagesChapter 5 - Selected SolutionsNouh Al-SayyedNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's CheckDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's CheckJunzen Ralph Yap100% (1)

- Solutions Ch08Document19 pagesSolutions Ch08KyleNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- May 2017 PDF FreeDocument7 pagesMay 2017 PDF FreeJorenz UndagNo ratings yet

- Reporting Financial Results: Practice Session and Revision LectureDocument53 pagesReporting Financial Results: Practice Session and Revision LectureNurt TurdNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Advanced Accounting Chapter 3 AnswersDocument2 pagesAdvanced Accounting Chapter 3 AnswersMaria PiaNo ratings yet

- Chapter 2 Questions-AnswersDocument20 pagesChapter 2 Questions-AnswersMaria PiaNo ratings yet

- ACC 402 - Question 33Document3 pagesACC 402 - Question 33Maria PiaNo ratings yet

- Chapter 6 QuizDocument3 pagesChapter 6 QuizMaria PiaNo ratings yet

- Chapter 5 QuizDocument5 pagesChapter 5 QuizMaria Pia100% (1)

- Chapter 4 QuizDocument5 pagesChapter 4 QuizMaria PiaNo ratings yet

- Chapter 3 QuizDocument7 pagesChapter 3 QuizMaria PiaNo ratings yet

- Chapter 2 QuizDocument4 pagesChapter 2 QuizMaria PiaNo ratings yet

- PWC-UIAS 29 Practical ExampleDocument51 pagesPWC-UIAS 29 Practical ExampleCem SamurcayNo ratings yet

- REO - AFAR - PreWeek - 3rd BatchDocument18 pagesREO - AFAR - PreWeek - 3rd BatchLeocadia GalnayonNo ratings yet

- Assignmnet 5.5Document2 pagesAssignmnet 5.5chrislupinjrNo ratings yet

- Indian Unicorn ReportDocument10 pagesIndian Unicorn ReportV KeshavdevNo ratings yet

- Paymore Products Places Orders For Goods Equal To 75 ofDocument1 pagePaymore Products Places Orders For Goods Equal To 75 ofAmit PandeyNo ratings yet

- fcs340 Document HousingmarketassignmentDocument9 pagesfcs340 Document Housingmarketassignmentapi-468161460No ratings yet

- Chattel Mortgage Without Separate Promissory NoteDocument2 pagesChattel Mortgage Without Separate Promissory NoteJson GalvezNo ratings yet

- Part II: Discussion QuestionsDocument8 pagesPart II: Discussion Questionssamuel39No ratings yet

- Group7 ZA BLKL PaperDocument14 pagesGroup7 ZA BLKL PaperAudrey ArivianaNo ratings yet

- Inet Account Statement: Nadeeem Jamshed 117,044.40Document4 pagesInet Account Statement: Nadeeem Jamshed 117,044.40mubeen khanNo ratings yet

- LIC Jeevan Labh Plan (836) DetailsDocument12 pagesLIC Jeevan Labh Plan (836) DetailsMuthukrishnan SankaranNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisJumain B SaideNo ratings yet

- Account AssignmentDocument7 pagesAccount AssignmentPororoTix Jie GNo ratings yet

- Opening Balance As Of: 47,889.36: Description Reference Value Date Debit Credit DateDocument1 pageOpening Balance As Of: 47,889.36: Description Reference Value Date Debit Credit DateSayed Rasully SadatNo ratings yet

- GST ChallanDocument2 pagesGST ChallanArun KumarNo ratings yet

- Chapter 3 Cost of CapitalDocument15 pagesChapter 3 Cost of Capitalfirst breakNo ratings yet

- Assignment 4 Class XI Accounting Eq 20230704163852515Document4 pagesAssignment 4 Class XI Accounting Eq 20230704163852515saumya guptaNo ratings yet

- Literature Review CompletedDocument19 pagesLiterature Review CompletedRana Tahir100% (1)

- Arul SPF 2000Document13 pagesArul SPF 2000ADLFVNRNo ratings yet

- Key-Facts-Statement-Signature-Priority-Account UBLDocument4 pagesKey-Facts-Statement-Signature-Priority-Account UBLMuhammadDanialNo ratings yet

- Module 4Document10 pagesModule 4ANSLEY CATE C. GUEVARRANo ratings yet

- Deposit Guarantee Scheme - : Depositor Information SheetDocument2 pagesDeposit Guarantee Scheme - : Depositor Information SheetdeepakaggairbnbNo ratings yet

- 1 SPDocument22 pages1 SPnxshadetyNo ratings yet

- MTBSL: MTB Securities LimitedDocument2 pagesMTBSL: MTB Securities LimitedMuhammad Ziaul HaqueNo ratings yet

- Investment Company Association of The PhilippinesDocument3 pagesInvestment Company Association of The PhilippinesHeinson R. VariasNo ratings yet