Professional Documents

Culture Documents

PC - India Growth Story 2 - Nov 2022 20221121131637

Uploaded by

Aryan AgarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PC - India Growth Story 2 - Nov 2022 20221121131637

Uploaded by

Aryan AgarwalCopyright:

Available Formats

INSTITUTIONAL EQUITY RESEARCH

India Growth Story 2.0

Multiple growth triggers = Flying Elephant 2.0

21 November 2022

INDIA | STRATEGY/MACRO | THEMATIC

Anjali Verma, Research Analyst

(+ 9122 6246 4115) anverma@phillipcapital.in;

Navaneeth Vijayan, Research Associate

nvijayan@phillipcapital.in

During covid times, we had said ‘’Public-capex push to be followed by private-capex push;

manufacturing, exports, GFCF will contribute higher delta to GDP – read our reports:

November2020, March 2021, titled Time for India’s Outperformance. From there to ‘’actual

rise seen in corporate + public capex and exports’’ has not been a long journey. While some

of the data is still not showing a clear uptrend, we believe there are newer structural factors

like PLIs, FTAs, alternate technologies/fuels, domestic demand, favourable government

policies, healthy balance sheets (BS) of consumers, corporates and banks – which will

continue to drive GDP higher (agri + industry + services; GFCF + NX + GFCE + PFCE) for years

to come. We are cognizant of the adverse impact of higher interest cost and global economic

slowdown in the near-term, but we believe any consequent correction in equities will be an

investment opportunity, considering India Growth Story 2.0 has started – many engines

firing simultaneously. We had written “A Flying Elephant Report in 2006” – Our long

journey!

Investment and exports, core growth drivers – the focal points of this report: After a long-

gap, the investment expansion cycle began in specialty chemicals, led by environmental curbs

in China, followed by demand-driven expansion in metals, cement, and capital goods. PLIs are

supporting consumer electronics, automobiles, pharmaceuticals, textiles, and

semiconductors sectors, while indigenization of defence has begun. 5G investments from

telecom and allied infrastructure are coming in while climate-change related investments

have kicked off. Meanwhile, infrastructure-related investment in logistics, supply-chain, ports,

and railways are ongoing, with expansion in e-commerce and data centres. Manufacturing-

expansion-led exports growth (to be tangibly boosted by FTAs) will push GDP to a sustainable

solid trajectory. All this shows that the India Growth Story 2.0 has begun and will continue to

see its next leg of structural evolution – to a developed economy from a developing one.

PC-Long-term Estimates: Combining centre+IEBR Capex, states capex, and Capex by 120

companies (RIL/Adani excluded) under our coverage, we estimate investment of Rs 65-75tn+

in FY23 and FY24; Rs 110tn in FY21-FY24 vs. Rs 75tn invested in previous 4-years (FY17-FY20).

Hereon, Real GFCF is expected to rise by 55tn+/annum vs. earlier trajectory of Rs

40tn+/annum. Annual Indian exports are estimated to touch US$ 500bn+ by FY26 vs. US$

300bn+ in FY18; US$ 380bn/440bn in FY23/24. Global slowdown in FY23 and FY24 will

adversely impact Indian exports for these years, post which we expect higher trends on

account of fuller benefits of PLIs and FTAs. We expect GDP to grow by 7-7.5 in the next 5-

years; FY24 around 6% assuming higher interest rates and global slowdown.

Page | 1 | PHILLIPCAPITAL INDIA RESEARCH

Please see penultimate page for additional important disclosures. PhillipCapital (India) Private Limited. (“PHILLIPCAP”) is a foreign broker-dealer unregistered in the USA. PHILLIPCAP research

is prepared by research analysts who are not registered in the USA. PHILLIPCAP research is distributed in the USA pursuant to Rule 15a-6 of the Securities Exchange Act of 1934 solely by Rosenblatt

Securities Inc, an SEC registered and FINRA-member broker-dealer.

STRATEGY/MACRO THEMATIC

Government policy and capex push – persisting and valuable growth triggers: The

Indian government has been on the capex path to support the economy through

conducive policies and spending. We expect this trend to prevail in the short, long, and

very-long terms. Incrementally, we have been expecting railways, ports, and defence

sectors to receive greater funds – and it is panning out just as expected. Asset

monetization and robust tax revenues will continue to support public capital

expenditure, in the long-run.

Private-sector capex expanding since FY22 and will progress: In line with our

expectations, with initial support from public capex during the recovery period from

covid, and appropriate government policies, private-sector capex picked up in FY22.

•Based on our analysis of 118 companies under our coverage, capex should grow 49%

in FY23 in addition to the 44% growth in FY22. Telecom, EPC, consumer durables,

cement, metals, oil & gas, and FMCG sectors are likely to be the key capex drivers in

FY23. Based on current projections for FY24, capex should be stronger in capital goods,

FMCG, pharmaceuticals, consumer durables and logistics; telecom will cool-off in FY24

as initial phase of 5G Capex tapers; Rs 5-6tn is likely to be invested in FY23-24. •Capex

for 289 NIFTY-500 companies is witnessing and estimated to register cumulative capex

of Rs 17tn in FY22-24E vs. Rs 12tn in FY17-FY19. •Combined orderbook of infra+capital

goods should grow 13%/9% in FY23/24. •CMIE capex data indicates that private share

in new capex has shot up to 93% in 1HFY23 vs. 74% in FY22 and 56% in FY21. • The 35%

peak rate of real GDP came from GFCF in Q1FY23.

PLIs – a crucial policy development: With an estimated outlay of around Rs 2.7tn over

the next few years, PLIs to 15 sectors are the perfect nudge that the government can

offer to induce capex, manufacturing, and exports, along with a reduction in import

dependency. PLI-driven projected private capex is Rs 4.9tn in the next 2-3 years, with

an employment opportunity for +2mn. The government may announce more PLIs in

the upcoming budget. With skilled manpower availability and improving infrastructure

and logistics, India can become a global manufacturing hub soon. To illustrate, PLI

incentives in mobile-phone manufacturing have substantially boosted production,

growth at 126% in FY22, 281% growth in exports, trade surplus at US$ 3.3bn in FY22

vs. marginal deficit in FY19.

PLI and FTAs – key catalysts for Indian exports: Currently, India contributes to only 2%

of global exports; China/US/Germany are at 15%/8%/7%. The Indian government’s

focus on promoting exports is evident through the extensive range of PLIs and FTAs

under negotiations. Historically, manufacturing and exports never received public

policy attention. Between 1998 and 2011, India signed 9 FTAs; after a lull of 10 years,

it has signed 3 FTAs (since 2021) while 4 are under discussion with large economies.

We believe that key exporting commodities will gain more momentum as PLI benefits

set in, and countries abide by treaties. Electronics, engineering goods, chemicals,

automobiles, textiles, food products (along with refinery products and iron & steel)

sectors can see renewed demand from exports in coming years; semi-conductors and

hydrogen will be new exporting segments, but there is a long way to go for that.

Risks: Prolonged global and Indian slowdown/recession, elevated interest rates in

India, government policy stagnation, domestic political instability, geo-political risks.

Stocks (Long-term beneficiaries of India Growth Story 2.0): L&T, ABB, Siemens, HAL,

BEL, Ultratech, ACC, Ambuja, HDFC Bank, ICICI Bank, Axis Bank, SBI, HDFC AMC, SBI

Life, Bajaj Finance, Chola, Tata Motors, TVS, Sona Comstar, Asian paints, Titan, HUL,

Trent, Shopper Stop, Jubilant Foodworks, Bharti, Divis, Sun Pharma, SRF, Praj

industries, Mahindra Logistics, Bajaj Electricals, KEI Industries, PGEL, Syrma, Tata

Power (NR), Power grid (NR), RIL (NR), Welspun India (NR), Adani Enterprise (NR).

Page | 2 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

India to outperform for a very long time…

According to IMF’s World Economic Outlook, global GDP growth will average 3.3%

during 2024-2027 from 2.7% in 2023 (monetary policy tightening). It estimates growth

in EMDEs (Emerging Markets and Developing Economies) at 4.3% during 2024-27 vs.

3.7% in 2023. India will be the bright spot among major economies with 6.1% growth

in 2023 followed by an average 6.6% growth during 2024-2027, but much higher than

growth in major developing countries, including China.

GDP growth: Select developing countries (%) GDP growth: Select developed countries (%)

EMDEs India China South Africa Russia World AE EU Japan UK US

Estimates

Estimates

20

10

15

5

10

5 0

0 -5

-5

-10

-10

-15

-15

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

2018

2020

2022

2024

2026

1992

2006

1990

1994

1996

1998

2000

2002

2004

2008

2010

2012

2014

2016

2018

2020

2022

2024

2026

Source: IMF WEO October, PhillipCapital India Research

We estimate GDP growth of 7%-7.5% for FY23-FY27, (barring a dip in FY24 on account

of tight monetary policy), boosted by all the segments – agriculture, manufacturing,

financials and other services; GFCF, GFCE, exports, and consumption.

Trends in GDP and PC Estimates FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23PCE FY24PCE FY25PCE FY26PCE FY27PCE

Agriculture -0.2 0.6 6.8 6.6 2.1 5.5 3.3 3.0 2.7 3.5 4.0 4.0 4.0

Industry 8.1 11.9 8.4 6.1 4.9 -2.2 -1.8 9.8 4.2 4.5 6.6 7.0 7.9

Mining and Quarrying 9.7 10.1 9.8 -5.6 -0.8 -1.5 -8.6 11.5 4.4 5.0 6.0 6.0 7.0

Manufacturing 7.9 13.1 7.9 7.5 5.4 -2.9 -0.6 9.9 3.5 4.0 6.5 7.0 8.0

Electricity, gas and water supply 7.2 4.7 10.0 10.6 7.9 2.2 -3.6 7.5 8.5 7.0 8.0 8.0 8.0

Services 9.0 8.6 8.1 6.2 7.1 5.7 -7.8 8.9 9.4 7.5 8.0 8.4 8.4

Construction 4.3 3.6 5.9 5.2 6.5 1.2 -7.3 11.5 4.0 6.0 8.0 8.0 8.0

Trade, hotels, Transport & Communication 9.4 10.2 7.7 10.3 7.2 5.9 -20.2 11.1 11.4 8.0 8.0 9.0 9.0

Financing, Insurance, Real Estate & professional services 11.0 10.7 8.6 1.8 7.0 6.7 2.2 4.2 9.8 8.2 8.5 9.0 9.0

Public Admin, defense, other services 8.3 6.1 9.3 8.3 7.5 6.3 -5.5 12.6 9.1 6.5 7.0 7.0 7.0

GVA at Basic Price 7.2 8.0 8.0 6.2 5.8 3.8 -4.8 8.1 7.2 6.2 7.0 7.4 7.6

Source: PhillipCapital India Research, CSO

Page | 3 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

…to be supported by manufacturing…

While ongoing trends show positive momentum, these will get stronger ahead

• PMI – Strong Manufacturing PMI at 55+ and sustaining.

• FDI – Strong FDI flows in automobiles, chemicals, drugs & pharma, construction,

computer software & hardware; additionally, sectors like telecom, consumer

durables, etc., to pick up pace.

• IIP – Historically peak production in food products, chemicals, pharmaceuticals,

metals, and non-metallic mineral products, intermediate and infrastructure

goods.

• PLI – Incentives across 15 sectors (worth Rs 2.7tn) to attract capex of Rs 5tn.

• Corporate earnings – We estimate earnings of listed manufacturing companies

(220-odd) in FY25 is estimated to be 130%, higher than FY19; 6-year CAGR at 15%

vs. 7% in the previous six years. For a wider base (Indian listed companies:

1,300/1,800), 4-year earnings CAGR for FY18-22 at 14% vs. 9% for the previous 4

years.

Annual IIP growth (yoy, %) India PMI trend

15 PMI Composite Index Manufacturing Services

70

10

60

50

5

40

0 30

20

-5 10

0

-10

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22

Source: CSO, IHS Markit, PhillipCapital India Research

…and exports

While exports will soften in the near term due to price adjustments and slowdown in

global economies, the long-term exports outlook is extremely bright for India,

considering a smaller base and steps taken by the government to induce Indian exports

– PLI and Free Trade Agreements (FTAs).

Global trade: Indian exports currently account for only 2% of global exports, while

countries like Vietnam, Indonesia, and Thailand, are slightly below India. Meanwhile,

China accounts for 15% of global exports, US 8%, and Germany 7%. This indicates that

there is huge potential for India, especially with the conducive policies that the

government is prioritizing in the last couple of years.

IMF estimates: IMF forecasts third-highest exports volume growth for India for the

next five years; Vietnam is on top, followed by Bangladesh. All other sizeable

economies are likely to record lower growth. These estimates are in line with our

expectations and thesis – that India has huge growth potential in exports, which will

be the incremental contributor to the country’s GDP.

Exports trends and estimates: Annual Indian exports are likely to touch US$ 500bn+

by FY26 vs. US$ 300bn+ in FY18; US$ 380/440bn in FY23/24. Global slowdown in FY23

and FY24 will adversely impact Indian exports for these years, post which we expect

higher export trends on account of fuller benefits of PLIs and FTAs.

Page | 4 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

PLI-induced exports: The government estimates US$ 30-40bn/annum additional

exports because of PLIs until 2027-30. Even assuming targets are not fully achieved in

the next couple of years, we believe PLI incentivization and schemes will add at least

US$ 10-20bn/annum.

FTAs – a new decade, new developments: In the last two decades, Free Trade

Agreements (FTAs) signed by India were with smaller Asian countries, accounting for

1-3% of India’s total exports. Empirically, it is evident that FTAs have boosted exports

with signatory partners (UAE – 3rd largest trading partner for India, Bangladesh – 4th

rank, Singapore – 6th rank, Nepal – 10th rank). The US, China, and EU nations are largest

exporting partners for India. PLI incentives and new FTAs with larger economies, like

the ones recently signed with UAE and Australia, and the ones under discussion with

the UK and EU, will be meaningful ones to propel manufacturing and export progress

in India. Additionally, PLI incentives will aid exports momentum with existing trading

partners. Combining PLI incentives and likely sectors that can gain from FTAs, we

expect electronics, engineering goods, chemicals, automobiles, textiles, food products,

refinery products, and iron & steel to see renewed demand from exports in coming

years; semi-conductors and hydrogen will also gain.

Indian annual exports, imports & trade balance (USD mn) IMF – global trade projections

China India United States

Trade Balance Exports Imports

Vietnam Bangladesh World

700000

Estimates

600000 40

500000

400000 30

300000 20

200000

100000 10

0 0

-100000

-200000 -10

-300000 -20

FY90

FY92

FY94

FY96

FY98

FY00

FY02

FY04

FY06

FY08

FY10

FY12

FY14

FY16

FY18

FY20

FY22

2016

2018

2020

2022

2010

2011

2012

2013

2014

2015

2017

2019

2021

2023

2024

2025

2026

2027

Source: Ministry of Commerce & Industry, IMF WEO, PhillipCapital India Research

Page | 5 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

Green shoots in the Indian investment pattern

GFCF at its peak!!

Investment is an essential aspect for the long-term economic prospects of a country.

For the last couple of years, we have been of the view that incremental contribution

to GDP in coming years will be from GFCF, exports, and manufacturing (Click here,

March 2021).

Share of GFCF (investments) to GDP increased to 32.5% in FY22 from 30.5% in FY21 (a

covid-driven low). While GFCF saw significant decline in FY21 due to the pandemic, the

positive investment sentiment prevalent at present should lead to much better

contribution to real GDP. This is evident from the highest-ever 35% share of GFCF in

GDP in Q1FY23.

Impact of higher interest rates on GFCF is adverse, and comes with a lag. Thus, if

interest rates in India remain elevated for long, capex expansion will be adversely

affected in the medium-term, but the long-term prospects remain positive and

expansionary. Additionally, at present, as we also do not expect elevated interest rates

to prevail in the long-run, we remain positive on India’s capex-expansion cycle.

GFCF and 10-year yield Share of GFCF in GDP (in constant prices, %)

Incremental GFCF (Rs Bn) GFCF YoY (%) GFCF (Rs Bn) GFCF as % of Real GDP

10 Yr G-Sec Yield (%) 60000 40

7000 23 50000 35

5000 18

40000

13 30

3000

8 30000

1000 25

3 20000

-1000

-2 20

10000

-3000 -7

-5000 -12 0 15

FY90

FY92

FY94

FY96

FY98

FY00

FY02

FY04

FY06

FY08

FY10

FY12

FY14

FY16

FY18

FY20

FY22

Source: RBI, CSO, Bloomberg, PhillipCapital India Research

Government capex push – to remain undoubtedly buoyant

The government had allocated 25% higher capex in FY23 over the 27%/39% capex

growth seen in FY21/22; 4-year CAGR was at 30% vs. 7% for the previous four years;

capex more than doubled from pre-covid levels. The government’s core focus is on

infrastructure development and economic progress through the multiplier effect.

Fiscal deficit is targeted at 4.5% by FY26, implying government capex will continue to

expand, and they are not in a hurry to tighten strings. Buoyant revenues, along with

asset monetisation, will offer substantial support to the government’s expansionary

capex plans. Public capex sets the tone for private capex as well, which also registered

buoyant growth after many years of stagnation.

• Capex allocation for FY23 was the highest in road transport (25%) followed by

defence capex (20%) and railways (18%).

• Road transport registered a 66% higher allocation in FY23 with defence and

railways at 10%/17% yoy growth.

• Defence capex allocations were the highest in FY20/21/22 at 33%/32%/23% share

while railways capex was second highest in FY21 and 22.

• Telecommunication share surged in FY23 due to BSNL’s capital infusion plans.

Page | 6 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

• Housing/atomic energy capex shared 4%/2% of the total capex in FY23, with lesser

spending on atomic energy.

• Focussed spend on infrastructure ministries like road and railways and higher

defence capex, with indigenisation plans, will help infrastructure and domestic

defence manufacturing companies.

Till September FYTD23, capex was at 46% of BE vs. 41% in the last year, registering

50% yoy growth. Among major capex-oriented ministries, road transport (65% of BE)

and railways (65%) saw strong capex spend in the first half of FY23 with 65%/91% yoy

growth. Atomic energy (43%) saw decent spend while defence capex (39%) and

housing (33%) were weaker. Housing capex was also weaker by 32% yoy.

Government capital expenditure (Rs bn, % of GDP)

Capital Expenditure (Rs Bn) Capital Exp (% of GDP)

8000 3.5

7000

3.0

6000

5000 2.5

4000

3000 2.0

2000

1.5

1000

0 1.0

FY17 FY18 FY19 FY20 FY21 FY22 FY23BE

Source: Union Budget Documents, CSO, PhillipCapital India Research

Annual capex of select ministries (Rs bn) Select ministries capex till September of respective FY (% of BE)

FY21 FY22 FY23 FY21 FY22 FY21 FY22 FY23

2000 80%

1800 70%

1600

60%

1400

1200 50%

1000 40%

800 30%

600

20%

400

200 10%

0 0%

Atomic Defence Road Railways Housing Atomic Defence Road Railways Housing Total Capex

energy transport energy transport

Source: Union Budget Documents, CGA, PhillipCapital India Research

Page | 7 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

State government capex: Following the central government capex trends, state

government also saw similar strong capex spend with 17%/28% yoy growth in FY21/22.

As per FY22BE, Uttar Pradesh (14%) saw the highest state share in capex, followed by

Maharashtra (10%), West Bengal (6%) and Telangana (6%). Increase capex was noted

from FY19-22 for Madhya Pradesh, Maharashtra, Kerala, Tamil Nadu and Delhi.

IEBR spending strengthened by 5% in FY22 while 7% decline was noted in FY23BE as

dependence on NHAI borrowing for roads capex was brought down to zero. IEBR was

highest for petroleum ministry (24%) followed by railways and PDS. IEBR in railways

should increase by 11% in FY23, while power sector saw 4%/5% growth in FY22/23BE

and renewable energy saw 100%/51% hike during the same period.

Combining Centre capex + IEBR + State Capex, Rs 7tn will be invested between FY22-

FY24 vs. Rs 4.3tn in FY17-19.

Cumulative state capex trend (Rs bn) IEBR expenditure trend (Rs bn)

State Capex YoY (%, RHS) 7000

12000 100.0 6000

10000 80.0 5000

60.0

8000 4000

40.0

6000 3000

20.0

4000 2000

0.0

2000 -20.0 1000

0 -40.0

0

FY00

FY02

FY04

FY06

FY08

FY10

FY12

FY14

FY16

FY18

FY20

FY22

FY17 FY18 FY19 FY20 FY21 FY22 FY23BE

Source: RBI, Union Budget Documents, PhillipCapital India Research

Total government capex trend- Centre+IEBR+State (Rs bn)

30000

25000

20000

15000

10000

5000

0

FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23BE FY24E

Source: PhillipCapital India Research

Page | 8 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

PLIs– just the beginning; execution under way

The government has announced Production Linked Incentive (PLI) schemes for 15

sectors, with certain schemes already in the production phase. Each scheme has a

different tenure. India should start reaping the benefits of these starting FY23 via

capex, employment opportunities, incremental production, and exports. With a total

government outlay of Rs 2.66tn, it expects capex to the tune of Rs 4.96tn in the initial

years of the project. More sector-based schemes are in the pipeline, which could

possibly be announced in the upcoming Union Budget in February.

PLI schemes announced and total outlay (Rs bn)

Sl No Sector Government Outlay Tenure Projected Capex

1 Semi-Conductor 760 FY23-28 1538

2 Electronics 386 FY21-26 110

3 Automobiles 259 FY23-27 749

4 Solar modules 240 FY22-27 1112

5 ACC Battery 181 FY23-28 450

6 Pharma drugs 150 FY21-29 150

7 Telecom 122 FY21-27 33

8 Food products 109 FY22-27 61

9 Textile 149 FY23-29 190

10 IT Hardware Products 73 FY22-25 25

11 Pharma APIs 69 FY21-30 37

12 Specialty Steel 63 FY24-31 396

13 White Goods 62 FY22-29 46

14 Medical devices 34 FY21-28 11

15 Drones 1 FY22-25 50

Total 2,660 4958

Source: PIB, Relevant ministries, PhillipCapital India Research

Looking at sector allocation, PLI for semiconductors and solar modules are forward

looking. Semi-conductors are critical for new-age electronics manufacturing and the

automobiles sector. Achieving self-sufficiency in manufacturing of these components

will help India to support production in associated sectors in a better way, and thus

aim to increase exports. Private-sector investment interest seen in most PLI scheme

applications indicate the initial success of the scheme.

Mobile phone trade (USD mn) Mobile phone production in India (Rs mn)

Export Import Net Exports 60000

8000 50000

6000

4000 40000

2000 30000

0

-2000 20000

-4000

10000

-6000

-8000 0

FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23TD FY20 FY21 FY22

Source: MOCI, MEITY, PhillipCapital India Research

One of the key success stories of PLI in India is evident in mobile phone manufacturing.

Production of mobile phones surged 126% in FY22, indicating that the PLI scheme has

already started contributing to Indian electronics manufacturing targets. With

increased production, trade also saw similar trends. Import dependence for mobile

phones declined by 33% in FY22, while exports saw a sharp 54% growth over weak

numbers in FY21. Trade surplus at US$ 3.3bn in FY22 vs. marginal deficit in FY19.This

stands as a clear indicator of the success that PLI schemes could deliver for the Indian

economy – via reduction in import dependence, by making India a hub for global

manufacturing, and supporting export-led growth.

Page | 9 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

PRIVATE CAPEX: Upturn!!!!

CMIE capex – private-sector clearly heading new capex from FY22

We have seen the private sector taking the lead in new project announcements even

in the past. However, from Q2FY21, the private sector has consistently outpaced the

government’s new projects – with an average 74% of the total new project value in

FY22. Private-sector new projects were at Rs 14tn in FY22, up 182% yoy, while

government projects saw a much lower 27% growth. We attribute softer government

capex trends to the fact that the government doesn’t invest in the sectors/segments

where incremental investment is being made – like renewables, chemicals, electronics,

metals, etc. As we know, public capex is also trending higher.

In FY22, out of Rs 19tn new capex projects, power generation projects (23%; renewable

at 19%, conventional at 4%) held a major share, followed by electronics manufacturing

(19%) and metals (14%). Renewable power projects by Reliance New Energy Solar,

SJVN Ltd, Arcerlormittal Nippon Steel, and JSW Energy were the major power

generation projects while semi-conductor fab manufacturing by Volcan Investments

and Reliance Industries were major projects in electronics manufacturing. Major

projects in the metals sector were led by steel plant projects from Bhushan Power &

Steel, Adani Enterprises, and two projects by Arcerlormittal Nippon Steel.

Out of the new projects announced in H1FY23, 38% were chemicals manufacturing

with key projects by Acme Cleantech Solutions and Indosol Solar Pvt Ltd. Power

generation came in second highest (renewables at 36%, conventional at 1%) led by

projects announced by Adani Green and Renew Power.

Private-sector capex has also seen an uptick in under-implementation and

announcements leading to a rising share in outstanding projects.

New projects by government and private sector (Rs bn) Share of government and private sector (outstanding projects)

7,000 Government Private Sector

Government Private sector

80

6,000

70

5,000 60

4,000 50

3,000 40

30

2,000

20

1,000

10

0

0

Mar-18

Mar-11

Mar-12

Mar-13

Mar-14

Mar-15

Mar-16

Mar-17

Mar-19

Mar-20

Mar-21

Mar-22

Sep-11

Sep-12

Sep-13

Sep-14

Sep-15

Sep-16

Sep-17

Sep-18

Sep-19

Sep-20

Sep-21

Sep-22

Mar-15

Mar-00

Dec-03

Mar-05

Jun-06

Dec-08

Mar-10

Dec-13

Dec-18

Mar-20

Jun-01

Sep-02

Sep-07

Jun-11

Sep-12

Jun-16

Sep-17

Jun-21

Sep-22

Source: CMIE, PhillipCapital India Research

Page | 10 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

Projects under implementation by government Projects announced by government and private sector (Rs bn)

and private sector (Rs bn)

Government Central Government Government Central Government

1,00,000

Government State Private Sector 60,000 Government State Private Sector

90,000

80,000 50,000

70,000

40,000

60,000

50,000 30,000

40,000

20,000

30,000

20,000 10,000

10,000

0

0

Dec-97

Mar-00

Dec-06

Mar-09

Jun-11

Sep-13

Dec-15

Mar-18

Sep-95

Jun-02

Sep-04

Jun-20

Sep-22

Dec-97

Mar-00

Dec-06

Mar-09

Dec-15

Mar-18

Sep-95

Jun-02

Sep-04

Jun-11

Sep-13

Jun-20

Sep-22

Source: CMIE, PhillipCapital India Research

Break-up of outstanding projects (industry-wise): Transport New capex as % of GFCF: Private new capex has been inching

services, electricity generation, and real-estate construction up from Q2FY21 and attained 29% of GFCF in Q4FY22 while

sectors have a major chunk of outstanding projects as on government new capex was lower at 10%, indicating strong

Q2FY23 private-sector contribution to the Indian growth story

Irrigation, Agro

Total New capex Private new capex

5.8% products, Chemicals, Government new capex

Real estate 0.4% 8.5% Cons.

materials, 90

cons., 10.4%

0.9% 80

Miscellaneous

, 4.8% Metals, 7.5% 70

IT, 1.2% Machinery, 60

2.0% 50

Communication Transport,

, 0.6% 40

1.6%

Mining, 3.8% 30

20

Electricity, 10

Transport 19.4% 0

Q1FY12

Q3FY12

Q1FY13

Q3FY13

Q1FY14

Q3FY14

Q1FY15

Q3FY15

Q1FY16

Q3FY16

Q1FY17

Q3FY17

Q1FY18

Q3FY18

Q1FY19

Q3FY19

Q1FY20

Q3FY20

Q1FY21

Q3FY21

Q1FY22

Q3FY22

Q1FY23

serv, 30.6% Retail

trading, 1.4%

Source: CMIE, PhillipCapital India Research Source: CMIE, MoSPI, PhillipCapital India Research

Page | 11 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

New projects announced: Sector-wise summary

(Rs bn) FY18 FY19 FY20 FY21 FY22 H1FY23

Conventional power 592 482 1,357 234 674 63

Renewable power 2,282 2,419 2,632 1,337 3,596 2,774

Power generation 2,874 2,901 3,989 1,572 4,269 2,837

Power transmission 109 260 97 19 427 7

Power distribution 48 8 3 0 0 0

Power T&D 157 268 100 19 427 7

Power 3,031 3,169 4,089 1,590 4,697 2,844

Coal & lignite 50 74 97 128 196 0

Crude oil & natural gas 922 184 74 20 0 21

Petroleum products 471 1,459 775 44 250 56

Natural gas distribution 96 299 14 19 48 1

Oil & gas 1,489 1,941 863 83 298 78

Roads 2,652 1,890 945 811 1,168 58

Railways 1,707 484 2,453 18 282 10

Airport Infra 178 123 41 3 0 1

Ports 204 192 59 103 556 10

Water & irrigation 579 837 378 368 314 53

Infrastructure 5321 3526 3876 1303 2319 131

Housing construction 1171 1386 1604 314 224 12

Commercial complexes 701 854 1613 372 255 1

Real estate 1872 2240 3217 687 479 13

Hotels, hospitals, education etc 677 725 611 470 435 90

Metals 500 755 591 1561 2673 267

Cement 208 281 171 69 163 38

Electronics 173 208 151 214 3,545 125

Chemicals 599 905 354 243 1344 2929

Auto 268 314 285 241 400 40

F&B 216 184 104 144 199 81

Textiles 206 110 62 54 192 47

Pharma 132 73 475 371 89 42

Fertilisers 4 7 1 29 122 73

Telecom 44 36 11 0 19 12

IT 61 319 409 493 448 157

Others 1,309 705 696 1,182 621 686

Total ex-Air transport 16160 15574 16062 8861 18238 7654

Air transport services 345 1528 2343 0 669 0

Total 16505 17102 18405 8861 18907 7654

Source: CMIE, PhillipCapital India Research

PC coverage: Uptick in most sectoral capex in FY23; buoyant

in FY24

Capex to remain strong for the 118 companies under our coverage

For FY23, capex is likely to trend higher with 49% yoy growth. Telecom/metals/auto &

anc. will contribute 41%/24%/15% to total capex. Capex growth will be stronger for

infrastructure (116%), followed by telecom (94%), metals (75%), consumer durables

(56%), cement (39%), oil & gas (31%) and FMCG (26%). Additionally, our forecast

indicates that all nine infrastructure companies under coverage are likely to see growth

in capex in FY23. Sectors like specialty chemicals (13%), capital goods (7%) and auto &

anc. (2%) are likely to see relatively lower growth. Pharma (-31%), logistics (-27%), agri

(-10%) will decline. Auto & anc. (Hero, MSIL), FMCG (HUL, BRIT), agri (Coromandel, PI),

capital goods (Cochin Shipyard, BDL, KEC), cement (Dalmia, JK Lakshmi, Ambuja,

Shree), infrastructure (HG Infra, Ashoka), pharma (Dr Reddys, Zydus), specialty

chemicals (SRF, Vinati), metals (Tata, Hindalco), consumer durables (Havells, KEI,

Orient Electric), logistics (Transport Corporation, Container Corporation, Gateway

Distriparks), and oil & gas (Petronet, Indraprastha) saw the strongest increase in capex.

Both telecom service providers, Bharti Airtel and VIL will ramp up their capex in FY23

for 5G connectivity infrastructure.

For FY24, we estimate capex growth to decline from the highs in FY23 led by lumpy

investments in metals, cement, and telecom in FY23. Increased capex expected in

sectors like capital goods (29%), pharma (20%) and logistics (30%).

Page | 12 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

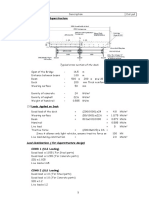

Capex of select companies under PCI coverage

Capex (Rs mn) Annual growth

Sectors FY20 FY21 FY22 FY23E FY24E FY21 FY22 FY23E FY24E

FMCG 69,609 55,719 65,570 82,548 1,00,915 -20% 18% 26% 22%

Agri 62,023 18,291 42,444 38,160 35,656 -71% 132% -10% -7%

Auto 5,93,206 3,30,549 4,60,643 4,71,543 4,69,067 -44% 39% 2% -1%

Capital Goods 73,652 49,825 63,936 68,244 87,898 -32% 28% 7% 29%

Cement 1,83,741 96,675 1,60,454 2,23,073 1,52,277 -47% 66% 39% -32%

Infra -31,609 24,515 20,369 44,021 44,477 -178% -17% 116% 1%

Pharma 94,845 1,10,818 1,28,644 88,511 1,05,976 17% 16% -31% 20%

Specialty Chem 35,287 30,532 41,410 46,624 45,501 -13% 36% 13% -2%

Metals 4,69,193 4,32,238 4,35,329 7,60,037 6,82,290 -8% 1% 75% -10%

Consumer durables 12,610 10,315 14,920 23,310 25,154 -18% 45% 56% 8%

Logistics 23,414 13,584 20,506 14,889 19,339 -42% 51% -27% 30%

Oil & Gas 14,415 12,957 24,500 32,000 29,500 -10% 89% 31% -8%

Telecom 7,85,944 2,98,329 6,65,935 12,93,302 3,03,400 -62% 123% 94% -77%

Total 23,86,329 14,84,345 21,44,661 31,86,261 21,01,448 -38% 44% 49% -34%

Source: Companies, PhillipCapital India Research

NIFTY500 capex: Healthy capex line-up

Among the 289 companies for which data is available evenly till FY24 (excluding financials

and IT) under the NIFTY500, capex should grow by 25% in FY23 over the 18% growth

registered in FY22. Slight decline of 8% in FY24 over a significantly higher base. Energy

(35%), materials (18%) and utilities (15%) should be the highest contributors to capex in

FY23. Capex undertaken by energy companies is likely to grow by 7% in FY23 and see a

minuscule 4% decline in FY24. Communication services capex will see 71% yoy growth,

mainly due to implementation of 5G by VIL and Bharti Airtel. Stronger capex will also be

visible for industrials (54%), consumer discretionary (46%), materials (44%) and real

estate (44%). Capex growth will be decent for other categories at 13-17%.

Dip in Industrials capex in FY24 is largely owing to lower capex by Adani Enterprises,

Indigo, IRCTC, Concor, Havells, and HEG.

Capex of select NIFTY500 companies

Capex (Rs mn) Annual growth

Sectors FY20 FY21 FY22 FY23E FY24E FY21 FY22 FY23E FY24E

Health Care 1,58,678 1,51,543 1,86,664 2,20,893 2,02,577 -4% 23% 18% -8%

Materials 7,33,506 5,90,056 8,08,318 11,61,403 10,83,030 -20% 37% 44% -7%

Consumer Discretionary 4,17,353 3,03,061 3,57,445 5,21,523 5,24,848 -27% 18% 46% 1%

Industrials 2,53,752 1,53,842 2,79,016 4,28,731 2,93,014 -39% 81% 54% -32%

Consumer Staples 78,067 68,383 95,429 1,06,811 1,08,352 -12% 40% 12% 1%

Utilities 5,72,429 6,13,540 8,45,977 9,59,959 9,22,308 7% 38% 13% -4%

Communication Services 3,06,985 3,36,835 3,94,788 6,75,128 5,34,351 10% 17% 71% -21%

Real Estate 38,712 29,278 41,016 59,146 48,762 -24% 40% 44% -18%

Energy 19,91,353 20,73,374 20,75,575 22,11,481 21,22,934 4% 0% 7% -4%

Total 45,50,834 43,19,913 50,84,228 63,45,074 58,40,173 -5% 18% 25% -8%

Source: Bloomberg, PhillipCapital India Research

Page | 13 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

Infrastructure and capital goods companies’ order book: Robust

expectations for FY23-24

We analysed the order inflows and outstanding order books of infra and capital goods

companies (9 + 13 = 22) to gauge the capex execution in coming years. Current analysis

is based on our analyst’s estimates:

Order inflows to rise:

FY23-24 ordering should be far stronger for infrastructure and capital goods companies

compared to FY17-22. Total order inflows for these sectors are likely to rise to Rs

4.9/5.2tn in FY23/24 with 28%/5% yoy growth.

• Infra companies are likely to record order inflow growth of 50% in FY23 with

significantly higher orders for GR Infra, HG Infra, Ahluwalia Contracts, NCC, and

PNC. Relatively higher orders also expected for ITD Cementation and IRB. Ashoka

and KNR are likely to see lower orders.

• NHAI awarded 6,306 kms of road construction orders in FY22, registering strong

32% yoy growth vs. 4,788/3,211 kms in FY21/20. Continuing with the trend, we

expect roads awarded to further increase in FY23.

• Within the capital-goods space, infrastructure/power/defence/hydrocarbon will

continue to be the largest sectors in terms of order inflows, with

15%/13%/37%/8% growth in FY23. These sectors are likely to further grow by

11%/2%/10%/6% in FY24.

• Total order inflows are likely to register 24%/8% growth in FY23/24 after 10%

growth in FY22. ABB, BDL, BEL, BHEL, Cochin Shipyard, KEC, and L&T will receive

strong orders in FY23 while BEL will see strong growth also in FY24 along with GE.

BDL and Cochin Shipyard to see a significant fall in order inflows in FY24.

• Order book (infra + capital goods): We expect order book for infra and capital

goods companies to grow by an average 11% in FY23-24 vs. 8% in FY22. It should

stand at Rs 13tn in FY23, Rs 9tn in FY24, vs. Rs 8tn in FY22.

Order inflows and order book for infra and capital-goods companies

Order Inflows (Rs Bn) FY17 FY18 FY19 FY20 FY21 FY22 FY23E FY24E

Infra 355 494 583 284 598 566 850 785

Capital goods 2628 2707 2982 2892 3005 3297 4088 4414

Total 2982 3201 3564 3176 3603 3863 4938 5199

Growth rate (yoy, %)

Infra 16.2 39.2 18.0 -51.3 110.5 -5.2 50.1 -7.6

Capital goods 4.5 3.0 10.1 -3.0 3.9 9.7 24.0 8.0

Total 5.8 7.3 11.4 -10.9 13.4 7.2 27.8 5.3

Order Book (Rs Bn) FY17 FY18 FY19 FY20 FY21 FY22 FY23E FY24E

Infra 666 901 1109 1020 1248 1353 1621 1770

Capital goods 5577 5618 5990 6077 6477 6979 7831 8559

Total 6243 6520 7099 7097 7725 8332 9452 10329

Incremental 450 277 579 -2 629 607 1120 877

Growth rate (yoy, %)

Infra 18.0 35.4 23.0 -8.0 22.4 8.4 19.8 9.2

Capital goods 6.7 0.7 6.6 1.4 6.6 7.8 12.2 9.3

Total 7.8 4.4 8.9 0.0 8.9 7.9 13.4 9.3

Source: Companies, PhillipCapital India Research

Page | 14 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

Credit trends: Double-digit growth indicates sound

economic activity

Credit growth is quite strong currently at 16% yoy; double-digit credit growth has

sustained since April 2022. Industrial credit has been witnessing a gradual uptick from

January 2022 and is currently at 13% yoy growth, indicating buoyancy in manufacturing

operations. Going ahead, capex expansion will keep credit growth supportive and

lower prices will soften working capital demand. Corporates have stronger BS and

bond markets to support capex expansion plans. That said, higher interest rate is a

near-term negative for any sort of borrowing and expansion plans.

Credit/GDP ratio shot up from a low base in FY00 at 20% to touch 53% in FY12; this was

the period of double-digit GFCF growth). It stagnated around these levels for the last 8

years.

Credit growth (yoy, %) Credit to nominal GDP ratio (%)

18 60

16

50

14

12 40

10

8 30

6

20

4

2 10

0

0

Jul-19

Jul-20

Jul-21

Jul-22

Oct-19

Oct-20

Oct-21

Oct-22

Jan-19

Apr-19

Jan-20

Apr-20

Jan-21

Apr-21

Jan-22

Apr-22

FY90

FY92

FY94

FY96

FY98

FY00

FY02

FY04

FY06

FY08

FY10

FY12

FY14

FY16

FY18

FY20

FY22

Source: RBI, CSO, PhillipCapital India Research

Looking at the credit disbursal pattern among the industries, it is clear that the

infrastructure sector – that includes power, telecommunication, roads, airports, ports,

railways and other infrastructure – leads, with a major share of around 38% as of

September 2022. This is followed by metals (10%), textiles (7%), chemicals (7%), food

processing (5%) and engineering industries (5%).

Following the headline industrial credit growth, most industries have also seen uptick

in availing credit. Notable industries currently recording healthy credit growth are-

petroleum & fuels (123%), chemicals (18%), infrastructure (12%), engineering (17%)

and food processing (10%). Credit intake was softer for textiles (8%), metals (7%), auto

& ancillary (7%), and cement (6%).

Page | 15 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

Sectoral credit growth (yoy, %)

Agri & Allied Activities Industry Services Personal Loans

25

20

15

10

-5

May-19

Jul-19

May-20

Jul-20

May-21

Jul-21

May-22

Jul-22

Jan-19

Mar-19

Nov-19

Jan-20

Mar-20

Sep-20

Nov-20

Jan-21

Mar-21

Nov-21

Jan-22

Mar-22

Sep-19

Sep-21

Sep-22

Source: RBI, CSO, PhillipCapital India Research

Major industry-wise credit share (%) Major industry-wise credit share (%)

Food Processing Basic Metal & Metal Product

Textiles Engineering

Petroleum, Coal Products & Nuclear Fuels Vehicles, Vehicle Parts & Transport Equipment

Chemicals & Chemical Products Construction

Cement & Cement Products Infrastructure (RHS)

9 40

12

7 38

5 36

7

3 34

1 2 32

May-19

Jul-19

May-20

Jul-20

May-21

Jul-21

May-22

Jul-22

Jan-19

Mar-19

Nov-19

Jan-20

Mar-20

Nov-20

Jan-21

Mar-21

Nov-21

Jan-22

Mar-22

Sep-19

Sep-20

Sep-21

Sep-22

Mar-19

May-19

Jul-19

Nov-19

Mar-20

May-20

Jul-20

Nov-20

Mar-21

May-21

Jul-21

Nov-21

Mar-22

May-22

Jul-22

Jan-19

Sep-19

Jan-20

Sep-20

Jan-21

Sep-21

Jan-22

Sep-22

Source: RBI, PhillipCapital India Research

Major industry-wise credit growth (yoy, %) Major industry-wise credit growth (yoy, %)

Food Processing Basic Metal & Metal Product

Textiles Engineering

Chemicals & Chemical Products Vehicles, Vehicle Parts & Transport Equipment

Cement & Cement Products Infrastructure

Petroleum, Coal & Nuclear Fuels (RHS) Construction (RHS)

40 150 30 40

20 30

20 100

20

10

0 50 10

0

0

-20 0

-10 -10

-40 -50 -20 -20

May-19

Jul-19

May-20

Jul-20

May-21

Jul-21

May-22

Jul-22

Mar-19

May-19

Jul-19

May-20

Jul-20

May-21

Jul-21

May-22

Jul-22

Jan-19

Mar-19

Nov-19

Jan-20

Mar-20

Nov-20

Jan-21

Mar-21

Nov-21

Jan-22

Mar-22

Jan-19

Sep-19

Nov-19

Jan-20

Mar-20

Nov-20

Jan-21

Mar-21

Nov-21

Jan-22

Mar-22

Sep-19

Sep-20

Sep-21

Sep-22

Sep-20

Sep-21

Sep-22

Source: RBI, PhillipCapital India Research

Page | 16 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

Realizing the export potential to drive growth

Export-led growth opportunities

Indian merchandise exports share was very low at less than 1% of world exports till

2005. After attaining 1.6% in 2011, the share was relatively stagnant at 1.6-1.7%, until

covid hit the world. However, in 2021, the share of exports rose to 1.8%. Exports

remained strong above US$ 30bn from March 2021, and peaked in March 2022.

With a relatively lower share in world merchandise exports, India has abundant

potential to expand its presence, as compared to other countries, which have captured

substantial market share (mentioned above). India aims to become a manufacturing

hub. As such, with government support to private players via incentives such as PLI,

the country can become an important player in world exports. Along with conducive

domestic policies and incentives to encourage exports, the Indian government is also

focusing on signing FTAs with sizeable nations; existing FTAs are a decade old, and with

smaller nations. FTAs with large economies can open tremendous opportunities for

Indian exports.

Share of Indian exports to world exports (yoy, %) Monthly Indian exports, imports, and trade balance

India Exports (US$ Bn) India Exports as % of World Exports Export Import Trade Balance

450 2.0

1.8 80000

400

350 1.6 60000

1.4

300

1.2 40000

250

1.0 20000

200

0.8

150 0

0.6

100 0.4 -20000

50 0.2

0 0.0 -40000

Apr-16

Dec-16

Apr-17

Dec-17

Apr-18

Apr-19

Dec-19

Apr-20

Dec-20

Apr-21

Dec-21

Apr-22

Aug-16

Aug-17

Aug-18

Dec-18

Aug-19

Aug-20

Aug-21

Aug-22

2003

2017

2002

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2018

2019

2020

2021

Source: WTO, PhillipCapital India Research Source: Ministry of Commerce & Industry, PhillipCapital India Research

The US contributed 18% of total Indian exports, followed by China + Hong Kong (8%),

UAE (7%), Bangladesh (4%), and Netherlands (3%) in FY22.

US exports: 19% of exports to the US were gems & jewellery, followed by

pharmaceutical products (9%), machinery (8%), petroleum products (7%) and

electronics equipment (5%). Textiles, organic chemicals and automobiles & ancillary

sectors saw around 4% share of total exports, while it is also notable that exports of

these commodities have seen decent growth over the years.

China + Hong kong (leading global exporter with 18% share in world exports, EU ranks

highest) is the second highest exports partner for India – with key commodities

exported being gems and jewellery (30%) followed by iron ore (8%), organic chemicals

(8%), and petroleum products (6%). Exports of machinery and electrical equipment,

even if it is just 4% each, has seen growth over the years.

Page | 17 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

India’s top-5 exports partners as of FY22 (USD mn) India’s next-5 exports partners as of FY22 (in USD mn)

80000 FY19 FY20 FY21 FY22 14000 FY19 FY20 FY21 FY22

70000

12000

60000

10000

50000

8000

40000

6000

30000

20000 4000

10000 2000

0 0

US CHINA+HONG UAE BANGLADESH NETHERLAND SINGAPORE UK BELGIUM GERMANY NEPAL

KONG

Source: Ministry of Commerce & Industry, PhillipCapital India Research

Exports growth: Volume and Value driven

While there is a clear indication that the value of India’s exports is rising recently, the

concern is whether this increase is due to price pressures. Incremental increase in

exports volumes would suggest better production capabilities in the economy.

• Both by volume and value, petroleum products were the highest exported

commodity from India. Looking at the detailed exports volume over the years,

automotive diesel, motor gasoline, and high-speed diesel grew stronger in FY22.

• Iron-ore pellets were the second-highest exports in quantity, which saw

tremendous growth in FY22. Till FY21, exports of this commodity were minimal.

• Other key commodities exported were limestone which saw a 571% rise in

volumes exported in FY22 over the 77% growth registered in FY21, but its exports

were 85% weaker in FY23 until September.

• Cereals export from India also saw strong growth in FY21, continued the same

trend in FY22, and similar strength was visible in FY23 till date. Key cereals

exported were rice and wheat – which saw higher exports in FY21/22.

• The manufacturing sector also fared well in exports in FY22.

o In electrical appliances and related accessories, key exports from India are

electrical accessories like capacitors, winding wires, resistors, conductors,

etc., which have all seen higher exports in FY22.

o Exports of mobile phones initially happened in FY21, which grew by 25% in

FY22.

• Machinery, mechanical appliances, and parts also saw robust growth in FY22 and

till FYTD23, except for the exports of some machinery parts & spares which were

slightly weak FYTD. Air conditioning machines and its parts, except certain specific

categories, saw higher exports in FY22 and continued the trend in FYTD23 as well.

With better production supported by PLI, exports of these commodities can surge.

Page | 18 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

• Another key commodity where India could shine is automobiles & ancillary. While

auto parts exports have been driving this segment by volume (up in FY22), data

also indicated higher exports of cars, scooters, three-wheelers and two-wheelers

in various categories in the year. Exports of two-wheelers below 250cc and three-

wheelers in FTYD23 were lower. However, exports of cars, scooters, and motor

cycles above 250cc were stronger in FYTD23.

• Pharmaceutical and medical equipment saw stronger exports in FY22 and also in

FYTD23, except for slight weakness in specific commodities.

Overall, trade volumes also saw higher exports of late, which show improved

production capacity and a wider market for Indian goods. While some of the surge

could be due to pent-up post-covid demand, increase in volume reassures how FTAs

and PLIs can improve Indian exports volumes over the years.

Free Trade Agreements (FTAs) are vital to tap the wider exports market. With lesser

trade restrictions and tariffs between signatories, trade can be enhanced with these

partner countries. India is currently signatory to 13 FTAs and 6 Preferential Trade

Agreements (PTAs) – with its FTAs with UAE and Australia being the most recently

announced trade agreements.

New foreign trade policy to be announced soon will steer Indian trade-led growth in

the right direction.

Out of the top-20 exports partners, India has bilateral FTAs with seven countries. As

part of multilateral FTAs, India has favourable trade terms with Bangladesh, Indonesia,

and Vietnam.

List of Free Trade Agreements (FTAs) currently active

Free Trade Agreements & Comprehensive Economic Cooperation

Sl No Signed on Countries

Agreement (CECA)

1 Indo Sri Lanka Free Trade Agreement 28-Dec-98

2 India – Thailand Comprehensive Economic Cooperation Agreement 09-Oct-03

Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan

3 South Asia Free Trade Agreement (SAFTA) 06-Jan-04

and Sri Lanka

4 India-Singapore Comprehensive Economic Cooperation Agreement 29-Jun-05

5 India – Korea CEPA 07-Aug-09

India-ASEAN CECA - Trade in Goods, Services and Investment Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar,

6 13-Aug-09

Agreement Philippines, Singapore, Thailand and Vietnam

7 India -Nepal Treaty of Trade 27-Oct-09

8 India – Japan CEPA 16-Feb-11

9 India - Malaysia CECA 18-Feb-11

10 India-Bhutan Agreement on Trade, Commerce and Transit 29-Jul-17

India-Mauritius Comprehensive Economic Cooperation and

11 22-Feb-21

Partnership Agreement

12 India UAE CEPA 18-Feb-22

13 India-Australia Comprehensive Economic Cooperation Agreement * 02-Apr-22

*- Signed, but yet to be implemented

Source: Ministry of Commerce & Industry, PhillipCapital India Research

Page | 19 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

Detailed analysis of FTAs

FTA with ASEAN has seen healthy pick-up over the years, with total exports to its

member countries accounting for 10% of India’s total exports. Exports to Singapore

(26%) stood tall among ASEAN members, followed by Indonesia (20%), Malaysia (17%),

Vietnam (16%), and Thailand (14%).

• Key exports to Singapore: Petroleum products (55%), machinery (9%), and gems

& jewellery (6%). Organic chemicals and electrical machinery share in total exports

was 3-4%.

• Key exports to Indonesia: Petroleum products (28%), sugar confectionary (11%)

and iron & steel (8%). Exports of organic chemicals, automobiles and machinery

accounted between 4%-6% of exports to Indonesia.

• Key exports to Malaysia: Petroleum products (32%), organic chemicals (6%) and

machinery (5%).

• Key exports to Vietnam: Iron & steel products (22%), cotton (8%) and cereals (8%).

Automobile & ancillary, machinery and electrical equipment comprise around 4%

each of exports to the country.

• Key exports to Thailand: Gems & jewellery (20%), machinery (19%) and iron & steel

products (7%). Automobile, organic chemicals, electrical equipment and

pharmaceuticals account for 3%-5% of exports.

A similar multilateral agreement, SAFTA signed early 2004 has helped with sustainable

improvement of Indian exports over the years, touching 8% of total Indian exports. The

main driver for this was trade with Bangladesh, which comprised 47% of exports with

SAFTA while Nepal saw 28%.

• Bangladesh: Cotton (28%) was the highest exported commodity to Bangladesh in

FY22/21 followed by cereals (14%). Significant improvement was also seen in

exports of automobiles and machinery with 5-6% share. Organic chemicals and

electrical equipment were among the top-10 commodities exported.

• Nepal: Petroleum products comprised 26% of total exports to Nepal followed by

iron & steel products (14%). Automobile and ancillary (8%) and machinery (7%)

exports were significant while electrical equipment and pharmaceutical were also

among the top 10 products exported with 3-4% share.

FTA with Korea saw slight enhancement over the years without much changes in its

share of Indian exports. In FY22, exports to Korea increased to 2% from around 1.4%

in FY14, with major commodities exported being petroleum products (32%), followed

by aluminium (19%), and iron & steel products (8%). Machinery, gems & jewellery,

automobile & ancillary, and electrical equipment were among the top-11 commodities

exported to Korea with 2-3% share.

FTA with Japan helped with a quick pick-up in exports after its signing in FY11, but its

share in India’s total exports has not improved as one would expect from a developed

economy. The key commodity exported to Japan was petroleum products (16%),

organic chemicals (11%), electrical equipment (8%) and machinery (8%). Gems &

jewellery and automobile & ancillary are also among the top exported commodities

with 5-6% share.

Exports to UAE have also seen healthy 68% yoy growth in FY22 and 27% in FYTD23.

Benefits of the recently signed UAE FTA – via incremental exports – will be seen in

products like gems and jewellery, textiles, leather, footwear, sports goods, plastics,

furniture, agricultural and wood products, engineering products, pharmaceuticals,

medical devices and automobiles. Apart from mineral fuels, which are 22% of the total

exports to UAE in FY22 in value, jewellery (18%) and electrical machinery (10%) were

the next highest exported commodities.

Page | 20 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

India could also find significant export potential to Australia – with whom it signed the

agreement in April 2022 is now India’s 14th-highest export partner. Trade agreement is

yet to be implemented as both the economies as finalising on the ratification. Key

commodities that could find advantage in Australia are pharmaceuticals, agricultural

products, textiles, engineering products, gems & jewellery and leather & footwear.

India is already exporting petroleum products (56% of its exports to Australia),

pharmaceuticals (4%), gems & jewellery (4%), machinery (3%), electrical equipment

(2%) and automobile and ancillary (2%) to Australia.

FTAs under negotiation: India is currently in negotiation with UK, Canada, and the EU

to finalize FTAs. Trade agreement with the UK got delayed, and is now expected to be

finalized by March 2023. UK is India’s eight-highest exports partner – with cement,

electrical machinery, textiles, leather, and food products among the key commodities

exported by volume. Trade agreements are also under negotiation with the EU and

Canada, and will soon be launched with GCC nations. Exports to Netherlands, Belgium,

Germany, Italy, and France, which are all among India’s top-20 exports partners, will

see substantial improvement, as the EU trade deal is finalized. Textiles, leather,

agriculture, and food products are the key sectors to gain.

Other FTAs that India is currently part of are mostly with smaller developing economies

and have thus not seen much momentum in the past years, as their share in India’s

total exports is minimal.

Conclusion: After analysing Indian export constituents, FTAs, and PLIs, we are

confident that India has substantial scope and levers to expand its exports share

globally. Currently, we are below 2% global exports’ share as compared to China’s 15%.

We expect the share of all the currently exporting key commodities (petroleum

products, gems & jewellery, textiles, machinery, electrical equipment,

pharmaceuticals, chemicals, automobiles, iron & steel products, and food products) to

rise due to the above-mentioned levers. Additionally, consumer electronics, semi-

conductors, and hydrogen will contribute to a rise in Indian exports in the long-term.

Page | 21 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

Disclosures and Disclaimers

PhillipCapital (India) Pvt. Ltd. has three independent equity research groups: Institutional Equities, Institutional Equity Derivatives, and Private Client Group. This

report has been prepared by Institutional Equities Group. The views and opinions expressed in this document may, may not match, or may be contrary at times

with the views, estimates, rating, and target price of the other equity research groups of PhillipCapital (India) Pvt. Ltd.

This report is issued by PhillipCapital (India) Pvt. Ltd., which is regulated by the SEBI. PhillipCapital (India) Pvt. Ltd. is a subsidiary of Phillip (Mauritius) Pvt. Ltd.

References to "PCIPL" in this report shall mean PhillipCapital (India) Pvt. Ltd unless otherwise stated. This report is prepared and distributed by PCIPL for

information purposes only, and neither the information contained herein, nor any opinion expressed should be construed or deemed to be construed as

solicitation or as offering advice for the purposes of the purchase or sale of any security, investment, or derivatives. The information and opinions contained in

the report were considered by PCIPL to be valid when published. The report also contains information provided to PCIPL by third parties. The source of such

information will usually be disclosed in the report. Whilst PCIPL has taken all reasonable steps to ensure that this information is correct, PCIPL does not offer any

warranty as to the accuracy or completeness of such information. Any person placing reliance on the report to undertake trading does so entirely at his or her

own risk and PCIPL does not accept any liability as a result. Securities and Derivatives markets may be subject to rapid and unexpected price movements and

past performance is not necessarily an indication of future performance.

This report does not regard the specific investment objectives, financial situation, and the particular needs of any specific person who may receive this report.

Investors must undertake independent analysis with their own legal, tax, and financial advisors and reach their own conclusions regarding the appropriateness

of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future

prospects may not be realised. Under no circumstances can it be used or considered as an offer to sell or as a solicitation of any offer to buy or sell the securities

mentioned within it. The information contained in the research reports may have been taken from trade and statistical services and other sources, which PCIL

believe is reliable. PhillipCapital (India) Pvt. Ltd. or any of its group/associate/affiliate companies do not guarantee that such information is accurate or complete

and it should not be relied upon as such. Any opinions expressed reflect judgments at this date and are subject to change without notice.

Important: These disclosures and disclaimers must be read in conjunction with the research report of which it forms part. Receipt and use of the research report

is subject to all aspects of these disclosures and disclaimers. Additional information about the issuers and securities discussed in this research report is available

on request.

Certifications: The research analyst(s) who prepared this research report hereby certifies that the views expressed in this research report accurately reflect the

research analyst’s personal views about all of the subject issuers and/or securities, that the analyst(s) have no known conflict of interest and no part of the

research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific views or recommendations contained in this research report.

Additional Disclosures of Interest:

Unless specifically mentioned in Point No. 9 below:

1. The Research Analyst(s), PCIL, or its associates or relatives of the Research Analyst does not have any financial interest in the company(ies) covered in this

report.

2. The Research Analyst, PCIL or its associates or relatives of the Research Analyst affiliates collectively do not hold more than 1% of the securities of the

company (ies)covered in this report as of the end of the month immediately preceding the distribution of the research report.

3. The Research Analyst, his/her associate, his/her relative, and PCIL, do not have any other material conflict of interest at the time of publication of this

research report.

4. The Research Analyst, PCIL, and its associates have not received compensation for investment banking or merchant banking or brokerage services or for

any other products or services from the company(ies) covered in this report, in the past twelve months.

5. The Research Analyst, PCIL or its associates have not managed or co-managed in the previous twelve months, a private or public offering of securities for

the company (ies) covered in this report.

6. PCIL or its associates have not received compensation or other benefits from the company(ies) covered in this report or from any third party, in connection

with the research report.

7. The Research Analyst has not served as an Officer, Director, or employee of the company (ies) covered in the Research report.

8. The Research Analyst and PCIL has not been engaged in market making activity for the company(ies) covered in the Research report.

9. Details of PCIL, Research Analyst and its associates pertaining to the companies covered in the Research report:

Sr. Particulars Yes/No

no.

1 Whether compensation has been received from the company(ies) covered in the Research report in the past 12 months for No

investment banking transaction by PCIL

2 Whether Research Analyst, PCIL or its associates or relatives of the Research Analyst affiliates collectively hold more than 1% of No

the company(ies) covered in the Research report

3 Whether compensation has been received by PCIL or its associates from the company(ies) covered in the Research report No

4 PCIL or its affiliates have managed or co-managed in the previous twelve months a private or public offering of securities for the No

company(ies) covered in the Research report

5 Research Analyst, his associate, PCIL or its associates have received compensation for investment banking or merchant banking or No

brokerage services or for any other products or services from the company(ies) covered in the Research report, in the last twelve

months

Independence: PhillipCapital (India) Pvt. Ltd. has not had an investment banking relationship with, and has not received any compensation for investment banking

services from, the subject issuers in the past twelve (12) months, and PhillipCapital (India) Pvt. Ltd does not anticipate receiving or intend to seek compensation

for investment banking services from the subject issuers in the next three (3) months. PhillipCapital (India) Pvt. Ltd is not a market maker in the securities

mentioned in this research report, although it, or its affiliates/employees, may have positions in, purchase or sell, or be materially interested in any of the

securities covered in the report.

Suitability and Risks: This research report is for informational purposes only and is not tailored to the specific investment objectives, financial situation or

particular requirements of any individual recipient hereof. Certain securities may give rise to substantial risks and may not be suitable for certain investors. Each

investor must make its own determination as to the appropriateness of any securities referred to in this research report based upon the legal, tax and accounting

considerations applicable to such investor and its own investment objectives or strategy, its financial situation and its investing experience. The value of any

security may be positively or adversely affected by changes in foreign exchange or interest rates, as well as by other financial, economic, or political factors. Past

performance is not necessarily indicative of future performance or results.

Page | 22 | PHILLIPCAPITAL INDIA RESEARCH

STRATEGY/MACRO THEMATIC

Sources, Completeness and Accuracy: The material herein is based upon information obtained from sources that PCIPL and the research analyst believe to be

reliable, but neither PCIPL nor the research analyst represents or guarantees that the information contained herein is accurate or complete and it should not be

relied upon as such. Opinions expressed herein are current opinions as of the date appearing on this material, and are subject to change without notice.

Furthermore, PCIPL is under no obligation to update or keep the information current. Without limiting any of the foregoing, in no event shall PCIL, any of its

affiliates/employees or any third party involved in, or related to computing or compiling the information have any liability for any damages of any kind including

but not limited to any direct or consequential loss or damage, however arising, from the use of this document.

Copyright: The copyright in this research report belongs exclusively to PCIPL. All rights are reserved. Any unauthorised use or disclosure is prohibited. No

reprinting or reproduction, in whole or in part, is permitted without the PCIPL’s prior consent, except that a recipient may reprint it for internal circulation only

and only if it is reprinted in its entirety.

Caution: Risk of loss in trading/investment can be substantial and even more than the amount / margin given by you. Investment in securities market are subject

to market risks, you are requested to read all the related documents carefully before investing. You should carefully consider whether trading/investment is

appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances. PhillipCapital and any of its employees, directors,

associates, group entities, or affiliates shall not be liable for losses, if any, incurred by you. You are further cautioned that trading/investments in financial markets

are subject to market risks and are advised to seek independent third party trading/investment advice outside

PhillipCapital/group/associates/affiliates/directors/employees before and during your trading/investment. There is no guarantee/assurance as to returns or

profits or capital protection or appreciation. PhillipCapital and any of its employees, directors, associates, and/or employees, directors, associates of

PhillipCapital’s group entities or affiliates is not inducing you for trading/investing in the financial market(s). Trading/Investment decision is your sole

responsibility. You must also read the Risk Disclosure Document and Do’s and Don’ts before investing.

Kindly note that past performance is not necessarily a guide to future performance.

For Detailed Disclaimer: Please visit our website www.phillipcapital.in

IMPORTANT DISCLOSURES FOR U.S. PERSONS

This research report is a product of PhillipCapital (India) Pvt. Ltd. which is the employer of the research analyst(s) who has prepared the research report.

PhillipCapital (India) Pvt Ltd. is authorized to engage in securities activities in India. PHILLIPCAP is not a registered broker-dealer in the United States and,

therefore, is not subject to U.S. rules regarding the preparation of research reports and the independence of research analysts. This research report is provided

for distribution to “major U.S. institutional investors” in reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act

of 1934, as amended (the “Exchange Act”). If the recipient of this report is not a Major Institutional Investor as specified above, then it should not act upon this

report and return the same to the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any U.S. person, which is not a Major

Institutional Investor.

Any U.S. recipient of this research report wishing to effect any transaction to buy or sell securities or related financial instruments based on the information

provided in this research report should do so only through Rosenblatt Securities Inc, 40 Wall Street 59th Floor, New York NY 10005, a registered broker dealer

in the United States. Under no circumstances should any recipient of this research report effect any transaction to buy or sell securities or related financial

instruments through PHILLIPCAP. Rosenblatt Securities Inc. accepts responsibility for the contents of this research report, subject to the terms set out below, to

the extent that it is delivered to a U.S. person other than a major U.S. institutional investor.

The analyst whose name appears in this research report is not registered or qualified as a research analyst with the Financial Industry Regulatory Authority

(“FINRA”) and may not be an associated person of Rosenblatt Securities Inc. and, therefore, may not be subject to applicable restrictions under FINRA Rules on

communications with a subject company, public appearances and trading securities held by a research analyst account.

Ownership and Material Conflicts of Interest

Rosenblatt Securities Inc. or its affiliates does not ‘beneficially own,’ as determined in accordance with Section 13(d) of the Exchange Act, 1% or more of any of

the equity securities mentioned in the report. Rosenblatt Securities Inc, its affiliates and/or their respective officers, directors or employees may have interests,

or long or short positions, and may at any time make purchases or sales as a principal or agent of the securities referred to herein. Rosenblatt Securities Inc. is

not aware of any material conflict of interest as of the date of this publication

Compensation and Investment Banking Activities

Rosenblatt Securities Inc. or any affiliate has not managed or co-managed a public offering of securities for the subject company in the past 12 months, nor

received compensation for investment banking services from the subject company in the past 12 months, neither does it or any affiliate expect to receive, or

intends to seek compensation for investment banking services from the subject company in the next 3 months.

Additional Disclosures

This research report is for distribution only under such circumstances as may be permitted by applicable law. This research report has no regard to the specific

investment objectives, financial situation or particular needs of any specific recipient, even if sent only to a single recipient. This research report is not guaranteed

to be a complete statement or summary of any securities, markets, reports or developments referred to in this research report. Neither PHILLIPCAP nor any of

its directors, officers, employees or agents shall have any liability, however arising, for any error, inaccuracy or incompleteness of fact or opinion in this research

report or lack of care in this research report’s preparation or publication, or any losses or damages which may arise from the use of this research report.

PHILLIPCAP may rely on information barriers, such as “Chinese Walls” to control the flow of information within the areas, units, divisions, groups, or affiliates of

PHILLIPCAP.

Investing in any non-U.S. securities or related financial instruments (including ADRs) discussed in this research report may present certain risks. The securities

of non-U.S. issuers may not be registered with, or be subject to the regulations of, the U.S. Securities and Exchange Commission. Information on such non-U.S.

securities or related financial instruments may be limited. Foreign companies may not be subject to audit and reporting standards and regulatory requirements

comparable to those in effect within the United States.

The value of any investment or income from any securities or related financial instruments discussed in this research report denominated in a currency other

than U.S. dollars is subject to exchange rate fluctuations that may have a positive or adverse effect on the value of or income from such securities or related

financial instruments.

Past performance is not necessarily a guide to future performance and no representation or warranty, express or implied, is made by PHILLIPCAP with respect

to future performance. Income from investments may fluctuate. The price or value of the investments to which this research report relates, either directly or