Professional Documents

Culture Documents

Internasional 3

Uploaded by

Lusiana KanjiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internasional 3

Uploaded by

Lusiana KanjiCopyright:

Available Formats

International Journal of Zakat Vol.

4(2) 2019 page 101-110

A Maqasid and Shariah Enterprises Theory-Based Performance

Measurement for Zakat Institution

Ataina Hudayati and Achmad Tohirin

Universitas Islam Indonesia

ABSTRACT

This study aims to develop a performance measurement system for zakat institutions from

the perspective of maqashid al-Shariah and Islamic enterprise theory. This study embarks

from previous studies focusing on the performance measurement methods applied to the

zakat institutions. The understanding of maqashid al-Shariah in this paper refers to the

concept formulated by Al Ghazali and Ibn Ashur. The basis of selecting so is their widely

known concept in the contemporary research. This paper concludes that the performance

measurement based on maqashid al-Shariah for Islamic bank can be adopted in zakat

institution by making various adjustments according to the characteristics of the

institution. In addition, this study also designed a performance scorecard to assess the

performance of zakat institutions based on maqashid al-Sharia and Islamic enterprises

theory. This scorecard method can calculate the index of zakat management of the related

institution from a broader perspective.

Keywords: performance, measurement, maqashid al-Shariah, enterprise theory

INTRODUCTION for 2017 period, only reached 2.9 percent

from its potential of Rp. 217 trillion

Poverty is a classic problem that (BAZNAS, 2018). Aibak (2015) argued

massively occurs in developing country. that one of the reasons for the low

Poverty is a complex problem. Poverty concern of the community in paying

and its implications can involve all zakat formally to the institution is

aspects of human life. To reduce the because the institution’s method of

problem of poverty, Islam offers zakat as collection. In some cases, the zakat

a comprehensive solution. That is, one of management institution seems to be

the reasons for establishing zakat passive in collecting zakat.

institution is to improve the effectiveness In order zakat can achieve its

of zakat management. In Indonesia, such objectives, the institution must be in

government institution is called as the accordance with the objectives of

National Boar of Zakat, Republic of Shariah or maqashid al-Shariah.

Indonesia (BAZNAS), while those the Maqashid al-Shariah is the basic

private ones called Lembaga Amil Zakat paradigm of Islamic economics

(LAZ). Both are governed under the low (Muzlifah, 2013). The importance of

No. 23 of 2011. maqashid al-Shariah concept has been

According to National Zakat addressed by some researchers. In the

Statistics 2017 published by BAZNAS, context of zakat institution, Hapsari and

the number of zakat institution in Abidin (2016) examined the distribution

Indonesia reaches to 603 institutions. of zakat based on the maqashid al-

However, the overall percentage of zakat Shariah framework. The same attempt

collection in the nationwide of Indonesia was also done Mardiah and Jamil (2016)

102 International Journal of Zakat Vol. 4(2) 2019

who reviewed the effectiveness of the to be a muzakki, even to achieve so

distribution of zakat at the Dompet requires an extensive work. Thus, it is

Dhuafa (DD) Palembang. The results of interesting to assess the degree to which

the study show that through various a zakat institution has been endorsing the

programs, DD Palembang has been able concept of maqashid al-Shariah,

to promote maqashid al-Shariah in the particularly in the context of Indonesia.

local context. In the next section, the theoretical

Furthermore, Fitria (2018) explanation is discussed further covering

examined the conformity of social the concept of maqashid al-Shariah, the

entrepreneurship programs in zakat innovation in the management of zakat

institutions using maqashid al-Shariah and the understanding of stakeholder

and sampled DD for a case study. The theory. Further, the discussion also

work highlighted the significance of the mainly reviewed some relevant previous

concept to be employed when analysing studies. The main part of this paper

the performance of Zakat institution. In establishes the design of performance

like manner, Nugroho & Wahyuni measurement for zakat management.

(2019) elaborated upon the necessity of Finally, this paper provides conclusions,

maqashid al-Shariah to develop a implications and suggestions.

framework for designing and

implementing performance

measurement. They tested their method LITERATURE REVIEW

by measuring the performance of the al-

Haromain zakat institution in Malang Maqashid al-Shariah

based on the concept of the balanced According to al-Syathibi as quoted by

scorecard and the perspective of Aibak (2015), the Shariah actually aims

maqashid al-Shariah. These reviewed to realize the welfare of humans in the

studies indicated the importance of world and the hereafter. From this basis,

considering maqashid al-Shariah when it is clear that in fact the laws were not

analysing the performance of Zakat made for the law itself but were made for

institution. the purpose of all human being.

As elaborated in the above text, Muhammad Abu Zahrah asserted that

this study aims to expand the previous the welfare for all human being should

studies by constructing more be achieved through individual

comprehensive model of performance education, the realization of justice and

measurement for zakat institution based welfare of the community (Mohammed

on maqashid al-Shariah and Islamic et al. 2008).

enterprise theory. This study integrates Al-Ghazali as mentioned in the

these concepts for a comprehensive study of Syofyan (2017), stated that the

method of measurement. primary purpose of Shariah is to promote

Measuring the performance of human welfare, which lies in protecting

zakat institutions is important. This is the followings;

because in general, the need to assess the a. faith (din),

effectiveness and the efficiency of zakat b. life (nafs),

institutions is vital for their c. intellectual (aql),

improvement. The simplest way to d. progeny (nasl), and

evaluate the effectiveness of zakat e. wealth (maal).

institutions is by looking at the speed of

transformation of converting a mustahik

A Maqasid and Shariah Enterprises Theory-Based Performance… 103

Further, Mulyana (2017) c. traditional productive and

concluded the concept of welfare in d. creative productive.

Islam, which is rooted from Al Ghazali’s Traditional consumptive is the

notion of maqashid al-Shariah. In the distribution of zakat to be used directly

study, maqashid al-Shariah is believed to by the mustahik, to meet their daily

be the most comprehensive concept of

needs. The creative consumptive is the

welfare. That is because the concept not distribution of zakat which is manifested

only covers the elements of material in other forms of the original goods, but

needs but also moral and spiritual still in the consumptive category, for

aspects. Thus, it what differs from the example zakat is distributed in the form

concept of welfare which is promoted by of school tools or scholarships.

the western concept, which only focuses Furthermore, traditional

on the material aspects. productive zakat is the distribution of

Based on the above explanation, zakat given in the form of productive

it is clear that maqashid al-Shariah has

goods such as buying goats, cows,

not only the dimension of the worldly commercial equipment and so on.

aspect but also the hereafter. Finally, creative productive zakat, which

is the distribution of zakat which is made

Innovation in zakat management

in the form of business capital.

Komariyah (2013) explained the main According to Muhammad &

purpose of zakat is to realize justice. Mas’ud (2005) as quoted in Ningrum

Therefore, zakat is required in narrowing (2016), productive zakat is the giving of

economic inequality in the society, by zakat enabling the recipients to sustain

distributing it specifically to certain the property from the received zakat. In

groups who we call them as Mustahiks other word, productive zakat is zakat

(zakat recipients). As prescribed in al- where the assets or zakat funds given to

Qur'an, zakat is distributed to eight Mustahik are not directly spent but it

ashnafs, which are; converts into a capital like asset. This is

a. Fakir (the poor), done to strengthen their businesses

b. Amil (now can be described as capacity and capability. By musthaik

those who work in Zakat being enhanced their capacity and

institution), capability, their business will be able to

c. Muallaf (those who revert to generate more income and profit.

Islam) Finally, they can fulfil their needs

d. Slaves, sustainably.

e. People who are in debt, There are four models of

f. Fisabilillah and productive zakat distribution

g. The wayfarer. (Muhammad, & Mas’ud, 2005). First,

budget surplus model. In this model,

There are many innovations in

zakat is partly distributed and the rest is

management of zakat to increase the

used for productive projects. Second, in

benefit of zakat to the society. One of

kind model. It is a system of zakat

them is the concept of productive zakat.

distribution where zakat funds are not

According to Aibak (2015), zakat

distributed in the form of money but are

distribution can be classified into four;

given in the form of production

a. Zakat distributed traditionally for

equipment. Third, the revolving fund

consumption,

b. reative consumptive, model. This model provides loans to the

mustahik in the form of qardhul hasan

104 International Journal of Zakat Vol. 4(2) 2019

financing. The mustahik is to return the Based on the Abu Zahrah

initial amount of loan. concept, Mohammed et al. (2008)

designed a technical performance

Shariah enterprises theory measures for Islamic banks. The work

done by Mohammed et al. (2008) has

This theory was developed by

significantly influenced scholarly

Triyuwono (2001). The idea that profit-

discussion on measuring the

oriented or stockholders-oriented in

performance of Islamic banks. For

conventional companies are seen to be

example; the recent study done by

not the right orientation for Islamic

Hudaefi & Noordin (2019); Kholid and

companies. To replace the concept of

Bachtiar (2015), and among others, are

stockholders-oriented, the author

the example of how the work of

suggested the use of Shariah enterprises

Mohammed et al. (2008) has credited the

theory which is oriented to zakat (zakat-

novelty to the general discourse of

oriented), oriented to preservation of

Islamic economics.

nature (natural environment) and

oriented to stakeholders. Furthermore, Mohammed et al.

(2015) developed further the

Furthermore Triyuwono (2001)

performance measurement for Islamic

explained that the orientation of zakat

banks with employing the five elements

means that the company will strive to

of al-Ghazali’s maqashid al-Shariah.

achieve the optimum realization of zakat

These including preserving;

(both material and value). Then the

a. Religion,

environment and stakeholder-oriented

b. Life,

has the implication that Shariah

c. Intellect,

organizations must have a concern to

d. Progeny, and

distribute the “welfare” (added value)

e. Wealth.

that has been successfully created to

nature and stakeholders. This Shariah In designing performance ratios,

enterprises theory has been used by Mohammed et al. (2015) employed the

Hermawan & Rini (2016) to analyze the concept of maqashid of Al Ghazali with

effectiveness of the management of the concept of maqashid of Ibn Ashur as

zakat institutions. In their research, explained in Table 1.

Hermawan & Rini (2016) claimed that Thus, from the above

the sampled zakat institution had elaboration, it is rationale to develop the

performed its obligations to God, and to performance measurement based on

stakeholders. However, for obligations maqashid al-Shariah in the context of

to nature and employees have not been zakat institution.

fully met.

Maqashid al-Sharia on Management of

Maqashid-Based Performance Zakat

Measurement Model for Islamic Banks Mardiah and Jamil (2016) examined the

Mohammed, et al. (2008) developed suitability of zakat distribution program

performance measurements based on of DD Palembang with the concept of al-

Abu Zahrah’s maqashid al-Shariah. Ghazali’s maqashid al-Shariah.

These include; The results of the studycan be

a. individual education, seen in Table 2. The researchers

b. establishing justice, and concluded that with the programs

c. public interest. implemented, DD Palembang has been

A Maqasid and Shariah Enterprises Theory-Based Performance… 105

able to promote the five objectives of a. Economy;

Shariah. b. Social and humanity;

c. Health;

d. Education; and

MAQASHID AL-SHARIAH-BASED e. Preaching.

METHOD OF MEASUREMENTS

The distribution of zakat in

FOR ZAKAT INSTITUTIONS

BAZNAS must be considered in

accordance with the maqashid al-

Benefit of Zakat for Mustahik

Shariah.

The first stakeholder of zakat institution

is mustahik. Mustahik will receive great Benefit of zakat for Muzaki

benefits from zakat institutions

For muzaki, zakat is the implementation

depending on the quality of zakat

of one of the pillars of Islam. Therefore,

distribution system.

by carrying out the obligation of zakat,

Rahmawati (2011) argued that in

the view of Islamic economics, the muzaki has performed the first goal of

maqashid al-Shariah, which is to

distribution system is part of economic

preserve religion. In addition, zakat

activity that has a strong influence on the

serves to purify property. Therefore, by

distribution of people's welfare.

paying zakat, muzaki has achieved the

Distribution system according to Islam is

fifth element of maqashid al-Shariah,

a rule that cannot be separated from the

which is to preserve property. On this

provisions of maqashid al-Shariah.

point, it can be understood that zakat

Therefore, there are two things that must

institution has assisted muzaki in

be considered in an effort to improve

achieving two objectives of Shariah,

welfare, they are;

which are preserving religion and

a. Reducing the gap between

preserving wealth.

community groups by opening

Zakat institution must help

jobs, and

muzaki to pay zakat correctly and

b. Providing direct assistance to the

properly. Therefore, the zakat needs to

poor, so that they can improve

be socialized with Shariah rules to

their quality of life.

determine the amount of assets that are

According to Shariah, mustahiks zakat-able. Knowledge and

who are staying around zakat institutions understanding of the assets owned such

must get first priority to receive zakat. as income, living expenses, debts owned,

Once all the designated mustahik receive primary and non-primary needs must be

zakat, then the remaining zakat can be known and considered. In addition,

allocated to other regions. In addition, socializing zakat to muzaki, the benefits

zakat managers also need to consider the received by muzaki may enhance the

form of zakat distribution whether zakat muzaki easiness for paying their zakat.

will be distributed in the form of Aibak, (2016) in a study

traditional consumptive, creative conducted at BAZNAS Tulungagung,

consumptive, traditional productive or provided an explanation on how zakat

creative productive. institutions can improve services to

Amymie (2017) explained the muzaki so that muzaki will be easier,

programs carried out by BAZNAS can comfortable and willing, to pay zakat.

be classified based on sectoral grouping, Zakat paid by employee in Tulungagung

namely; regency is collected by the zakat unit

106 International Journal of Zakat Vol. 4(2) 2019

which is usually called as Unit Penerima payment system of zakat institution

Zakat (UPT). Following this, UPT complies with Shariah rules, it will be

proceeds the collected zakat to possible for amil to obtain the five

BAZNAS. maqashid al-Shariah as explained before.

The benefits received by amil

Benefit for Amil from zakat institutions are greatly

influenced by the level of public trust on

Amil has the responsibility to manage

the zakat institutions. One important

zakat. With this responsibility, amil has

aspect affecting the level of public trust

sacrificed his time and energy to manage

on zakat institutions is the accountability

zakat institutions. Through their

of zakat institutions. This is part of the

expertise, which requires formal and

findings of study done by Ikhwanda &

informal education, amil has worked for

Hudayati (2019).

a significant contribution to the success

The findings of the study imply

of the zakat institution. Because of the

that zakat institutions need to improve

contributions they have made, amil has

the right to receive rewards for what they their accountability to gain trust from the

public. By enhancing trust from the

give.

public, zakat institutions will be able to

In addition, most amil zakat

develop and continue functioning

working in zakat institutions are

effectively as a trusted institution. In

employees of zakat institutions. Perhaps

addition to accountability, public trust is

the income from the zakat management

also influenced by the degree of

organization is the only salary they

transparency, professionalism and

receive. Therefore, the welfare of amil

competency of zakat institutions in

needs further attention, so that amil will

managing zakat.

get benefits, especially to get the fifth

element of Maqashid al-Shariah;

Benefit for nature/environment

increase prosperity through wealth

improvement. Shariah enterprises theory of Triyuwono

Nevertheless, improving (2001) stated that organizations based on

prosperity is not the only amil objective. Islamic principles must provide benefits

Amil also has the right to get other to all stakeholders, both direct and

maqashid al-Shariah elements that are indirect stakeholders, and provide

preserved for their religion, life, intellect benefits to nature. Nevertheless, the

and descent. To preserve religion, zakat results of a study conducted by

institutions may design programs such as Hermawan & Rini (2016) stated that

religious lectures, congregational zakat institutions have not fully been

prayers and various other activities. To able to provide benefits to nature even

protect amils’ children, the scholarship though responsibilities to other

program is an appropriate alternative. stakeholders have been fulfilled.

Provision of amil salaries needs to be

considered carefully, because Shariah Performance measurement system for

rules limit amil rights to a maximum of zakat institution

1/8 of the amount of zakat received. Developing a quantitative performance

Accordingly, amil welfare improvement measurement system is critical, so that

can be attained by taking funds from an index can be produced to measure the

other sources, for example unrestricted performance of zakat institutions. This

infaq or funding assistance from the state study suggests zakat institution to adopt

budget or regional budget. If salary

A Maqasid and Shariah Enterprises Theory-Based Performance… 107

the performance measurement financial statements of zakat institutions

scorecard. This method is designed as a whole. It is important to be noted

following Mohammed et al. (2008) with that the weakness of the performance

some adjustments and contextualisation measurement is not considering whether

to the nature of zakat institution. the zakat institution has fulfilled its

The authors of this paper are of obligations to all stakeholders.

the view that the performance To make practical contributions

measurements proposed by Mohammed to zakat institutions, this study designed

et al. (2008) are more appropriate for a more comprehensive performance

measuring performance at the overall measurement scorecard that can be

organizational level. This is due to the applied at the organizational level as well

data used to measure performance ratios as the organizational unit level described

are taken from the annual reports and in Table 3.

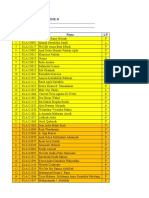

Table 1. Al-Ghazali and Ibn Ashur Maqashid al-Shariah

Maqashid Sharia Al Ghazali Maqashid Sharia Ibn Ashur

Preservation of religion/faith Freedom of faith.

Preservation of life/soul Preservation of human dignity.

Protection of human right.

Preservation of intellect/mind Propagation of scientific thinking.

Avoidance of brain drain.

Preservation of progeny Care of family.

Preservation of wealth Wellbeing of society.

Minimising income and wealth disparity.

Source: Adapted from Mohammed et al. (2015)

Table 2. Maqashid Sharia and Type of Program in Dompet Dhuafa

Maqashid Sharia Al Ghazali Program/Activities

Preservation of religion/faith Amazing Muslimah.

Ramadhan.

Preservation of life/soul Health Services

Mustahik Empowerment

Home based clinic

Preservation of intellect/mind Educational Scholarship

Preservation of progeny Indonesia Creative Orphans

Preservation of wealth Farmer Empowerment

Livestock’s Empowerment and Beneficiaries

Incubator

Source: Mardiah & Jamil (2016).

108 International Journal of Zakat Vol. 4(2) 2019

Table 3. Performance Measurement Scorecard for Zakat Institution

Program Maqashid al-Shariah Index/ Financial Benefit Index/

Activitiy MS1 MS2 MS3 MS4 MS5 Item Muzaki Mustahik Amil Nature Society Item

1 A 1 1 0 1 1 0.8 1 0 1 0 0 0.4

2 B 0 1 1 1 1 0.8 0 1 0 0 1 0.4

3 C 1 1 0 0 1 0.6 1 1 1 1 1 1

4 D 0 0 1 1 1 0.6 1 0 1 0 0 0.4

5 E 1 1 0 1 1 0.8 1 0 0 0 0 0.2

Index/Item

0.60 0.80 0.40 0.80 1.00

Maqashid Index

0.72

Benefit Index 0.48

Performance Index 0.6

Source: computed by Authors.

CONCLUSION 3) Performance measures that

integrate the concepts of

This study has discussed previous maqashid al-Shariah, and Shariah

research related to performance enterprises theory (SET) as

measurement based on maqashid al- exhibited in Table 3, that

Shariah in general context of Islamic identifies the programs carried out

banking and linking it to the context of by zakat institutions to meet

zakat institutions. The results of the maqashid al-Shariah and fulfilled

existing scholarly works were found that their obligations to all interested

significant efforts have been made to parties and stakeholders.

develop the concept of performance

The performance measurement

measurement, including for zakat based on maqasid al-Shariah as

institutions. To complement what has developed in this study is relevant to

been designed by previous research, this zakat stakeholders. Zakat institutions

study designed a performance may employ the developed benchmark to

measurement scorecard which function

communicate their performance on

is to complement the existing

maqasid al-Shariah, so that their efforts

performance measurements. The in actualising so is measurable.

discussion in this paper leads to conclude

that, the performance measurement

techniques in zakat institutions consist of REFERENCES

at least:

1) Performance measurements that Aibak, K. (2015). Zakat dalam perspektif

identify the allocation of maqashid al-syariah. Ahkam:

resources for each element of the Jurnal Hukum Islam, 3(2), 199-

maqashid al-Sharia; 218.

2) Performance measurement that Aibak, K. (2016). Pengelolaan zakat

identifies the allocation of dalam perspektif maqashid al-

resources to each stakeholder;

A Maqasid and Shariah Enterprises Theory-Based Performance… 109

syariah: Studi kasus di badan amil implementasi maqashid syariah

zakat Kabupaten Tulungagung. pada lembaga pengelola zakat

Ahkam: Jurnal Hukum Islam 4(2), dalam membangun konsep

247-288. pemberdayaan

Amymie, F. (2017). Optimalisasi masyarakat. ISLAMINOMICS, 4(1

pendistribusian dan ).

pendayagunaan dana zakat dalam Mardiah, S., & Jamil, M. A. (2016).

pelaksanaan tujuan program Efisiensi alokasi berdasarkan

pembangunan berkelanjutan maqoshid syariah: Studi kasus

(SDGs). Anida:Aktualisasi terhadap pola distribusi LAZ. I-

Nuansa Ilmu Dakwah, 17(1), 1-18. Finance: a Research Journal on

Fitria, A. (2018). Social Islamic Finance, 2(2), 21-33.

entrepreneurship dalam perspektif Mohammed, M. O., Razak, D.A. &

maqashid al-syariah. Iqtisad, 4(1). Taib., F.M. (2008). The

Hapsari, M. I., & Abidin, Z. (2016). performance of islamic banking

Zakat distribution in maqasid al- based on the maqasid syariah.

shariah framework. Journal of IIUM International Accounting

Islamic Financial Studies, 2(02). Conference (INTAC IV). Putra

Hudaefi, F. & Noordin, K. (2019). Jaya Marriott, 25 June 2008.

Harmonizing and constructing an Mohammed, M. O., Tarique, K. M., &

integrated maqāṣid al- Islam, R. (2015). Measuring the

Sharīʿah index for measuring the performance of islamic banks

performance of Islamic using maqasid-based model.

banks, ISRA International Journal Intellectual Discourse, 23, Special

of Islamic Finance, Vol. 11 (2), Issue, 401–424.

282-302. Muhammad, & Mas’ud, R. (2005). Zakat

https://doi.org/10.1108/IJIF-01- dan Kemiskinan: Instrumen

2018-0003 Pemberdayaan Ekonomi Umat.

Hermawan, S., & Rini, R. W. (2016). Yogyakarta: UII Press.

Pengelolaan dana zakat, infaq, dan Mulyana, R. A. (2017). Peran negara

shadaqah perspektif Shariah untuk mewujudkan kesejahteraan

Enterprise Theory. Riset Akuntansi dalam kerangka maqashidus

dan Keuangan Indonesia, 1(1), 12- syariah. Al-Urban: Jurnal

24. Ekonomi Syariah dan Filantropi

Ikhwanda, M.F., & Hudayati, A. (2019). Islam, 1(2), 155-175.

The influence of accountability, Muzlifah, E. (2013). Maqashid syariah

transparency, and affective and sebagai paradigma dasar ekonomi

cognitive trusts on interest in Islam. Economic: Journal of

paying zakat. Jurnal Akuntansi Economic and Islamic Law, 4(2),

dan Auditing Indonesia 23(1), 39- 73-93.

51. Ningrum, R. T. P. (2016). Penerapan

Kholid, M. N., & Bachtiar, A. (2015). manajemen zakat dengan sistem

Good corporate governance dan revolving fund models sebagai

kinerja maqasid syariah bank upaya efektifitas penyaluran zakat

syariah di Indonesia. Jurnal produktif: Studi pada lembaga

Akuntansi dan Auditing manajemen infaq Madiun. El-

Indonesia, 19(2), 126-136. Wasathiya: Jurnal Studi

Komariyah, O. (2013). Analisis Agama, 4(1), 1-21.

110 International Journal of Zakat Vol. 4(2) 2019

Nugroho, A., & Wahyuni, N. (2019). Ataina Hudayati

Pengukuran kinerja dengan Universitas Islam Indonesia

menggunakan balance scorecard ataina.hudayati@uii.ac.id

dan pemahaman maqashid syariah.

El Muhasaba: Jurnal Achmad Tohirin

Akuntansi, 10(1), 90-104. Universitas Islam Indonesia

Rahmawati, Y. (2011). Refleksi sistem

distribusi syariah pada lembaga

zakat dan wakaf dalam

perekonomian Indonesia. Al-

Iqtishad: Jurnal Ilmu Ekonomi

Syariah, 3(1).

Rusydiana, A. S., & Firmansyah, I.

(2018). Efficiency versus

maqashid sharia index: An

application on Indonesian Islamic

Banks. Shirkah: Journal of

Economics and Business, 2(2),

2503-4243.

Setiawan, I. (2019). Inovasi penyaluran

dana zakat pada program

pemberdayaan di lembaga amil

zakat. Asy-Syari'ah, 21(1), 55-68.

Syofyan, A. (2017). Analisis kinerja

bank syariah dengan metode

indeks maqasid syariah di

Indonesia. Al-Masraf: Jurnal

Lembaga Keuangan dan

Perbankan, 2(2), 145-158.

Triyuwono, I. S. (2001). Metafora zakat

dan shari'ah enterprise theory

sebagai konsep dasar dalam

membentuk akuntansi syari'ah.

Indonesian Journal of Accounting

and Auditing, 5(2), 131-145.

Toriquddin, M. (2015). Pengelolaan

zakat produktif di rumah zakat

kota Malang perspektif maqashid

al-syariah Ibnu ‘Asyur. Ulul

Albab: Jurnal Studi Islam, 16(1),

62-79

You might also like

- 10 1108 - Jiabr 06 2023 0188Document24 pages10 1108 - Jiabr 06 2023 0188fayyasin99No ratings yet

- 5915-Article Text-26060-1-4-20230131Document10 pages5915-Article Text-26060-1-4-20230131Mohamad Soleh NurzamanNo ratings yet

- Heikal Khaddafi 2014Document9 pagesHeikal Khaddafi 2014yeni latipahNo ratings yet

- Analysis of Islamic Accountability and Islamic GovDocument12 pagesAnalysis of Islamic Accountability and Islamic Govusama gujjarNo ratings yet

- Islamic Accountability Framework in The Zakat Funds ManagementDocument8 pagesIslamic Accountability Framework in The Zakat Funds ManagementNada Aulia RahmanNo ratings yet

- Mustafida, DKK (2020) The Implementation of Maqashid Shariah in Zakat Institution Comparison Between Indonesia & Malaysia - UnlockedDocument23 pagesMustafida, DKK (2020) The Implementation of Maqashid Shariah in Zakat Institution Comparison Between Indonesia & Malaysia - Unlockedbaehaqi17No ratings yet

- Kismawadi - Jurnal Internasional 1Document10 pagesKismawadi - Jurnal Internasional 1Maskat0012No ratings yet

- The Performance and Efficiency of Zakat Institutions in JambiDocument12 pagesThe Performance and Efficiency of Zakat Institutions in JambiNada Aulia RahmanNo ratings yet

- Utilization and Accounting of Zakat For Productive Purposes in Indonesia: A ReviewDocument5 pagesUtilization and Accounting of Zakat For Productive Purposes in Indonesia: A ReviewHendra PoltakNo ratings yet

- 2022 Optimizing Disbursement of Zakat Funds For Asnaf EntrepreneursDocument7 pages2022 Optimizing Disbursement of Zakat Funds For Asnaf EntrepreneursSisilia MarsheilaNo ratings yet

- The Relationship Among Zakat Maal, Altruism and Work Life Quality: A Quantitative AnalysisDocument24 pagesThe Relationship Among Zakat Maal, Altruism and Work Life Quality: A Quantitative AnalysisMuhammad Fakhri ArsyiNo ratings yet

- Sawmar & Mohammed (2021) Enhancing Zakat Compliance Through Good Governance A Conceptual FrameworkDocument19 pagesSawmar & Mohammed (2021) Enhancing Zakat Compliance Through Good Governance A Conceptual Frameworkbaehaqi17No ratings yet

- Daftar Isi: ISSN 2460-1896 Vol. 2, No. 1, Juli 2016Document18 pagesDaftar Isi: ISSN 2460-1896 Vol. 2, No. 1, Juli 2016ham 21No ratings yet

- Zakat and DEADocument20 pagesZakat and DEAAli FaycalNo ratings yet

- Implementasi Metode Cibest Center of Isl 94623210Document15 pagesImplementasi Metode Cibest Center of Isl 94623210UlfahNo ratings yet

- PUB NiswatinDocument16 pagesPUB NiswatinArzal SyahNo ratings yet

- Wahab & Rahman (2011) A Framework To Analyse The Efficiency and Governance of ZakatDocument21 pagesWahab & Rahman (2011) A Framework To Analyse The Efficiency and Governance of Zakatbaehaqi17No ratings yet

- Dadang 61-72Document12 pagesDadang 61-72Daan Dini KhairunidaNo ratings yet

- Uas Pak AscaryaDocument20 pagesUas Pak Ascaryamusic accousticNo ratings yet

- Utilisation of Holt-Winters Forecasting Model in Lembaga Zakat Selangor (LZS) For Zakat CollectionDocument8 pagesUtilisation of Holt-Winters Forecasting Model in Lembaga Zakat Selangor (LZS) For Zakat Collectionnurul hamizah yang hamzahNo ratings yet

- Efficiency of Management of Zakat Funds in Indonesian National Zakat Management Organizations (OPZ)Document8 pagesEfficiency of Management of Zakat Funds in Indonesian National Zakat Management Organizations (OPZ)Ijbmm JournalNo ratings yet

- Pengelolaan Dana Zakat Infaq Dan Shadaqah PerspektDocument14 pagesPengelolaan Dana Zakat Infaq Dan Shadaqah PerspektJania UlfaNo ratings yet

- Accounting Treatment For Corporate ZakatDocument14 pagesAccounting Treatment For Corporate ZakatCheng CheongNo ratings yet

- Analisis Faktor-Faktor Yang Mepengaruhi Muzakki Membayar Zakat Di BAZNAS YogyakartaDocument19 pagesAnalisis Faktor-Faktor Yang Mepengaruhi Muzakki Membayar Zakat Di BAZNAS YogyakartaHakim FadhliNo ratings yet

- The Influence of Maqashid Syariah Toward Mustahik's Empowerment & Welfare (Study Baznas Riau) - E. Armas Pailis, DKKDocument11 pagesThe Influence of Maqashid Syariah Toward Mustahik's Empowerment & Welfare (Study Baznas Riau) - E. Armas Pailis, DKKJuru KetikNo ratings yet

- TOWARDS ZAKAhDocument11 pagesTOWARDS ZAKAhJenny IslamNo ratings yet

- Performance Measurement and Accountability of WAQFDocument15 pagesPerformance Measurement and Accountability of WAQFterryNo ratings yet

- Construction Waqf CorporateDocument15 pagesConstruction Waqf CorporateLukman Santoso AzNo ratings yet

- Islamic Microfinance Models and Their Viability in Pakistan - World's Largest Interest Free Micro-Finance OrganizationDocument12 pagesIslamic Microfinance Models and Their Viability in Pakistan - World's Largest Interest Free Micro-Finance OrganizationAli Zain ParharNo ratings yet

- Toward The Adoption of A Governance Model in Zakat Foundations The Case of The Algerian Zakat FundDocument15 pagesToward The Adoption of A Governance Model in Zakat Foundations The Case of The Algerian Zakat FundFaizal RaffaliNo ratings yet

- Does Trust in Zakat Institution Enhance Entrepreneurs Zakat Compliance - 2021 - Emerald Group Holdings LTDDocument23 pagesDoes Trust in Zakat Institution Enhance Entrepreneurs Zakat Compliance - 2021 - Emerald Group Holdings LTDmaximillian kenasNo ratings yet

- Islamic Social Finance Instruments: Yusuf Haji-Othman Mohammadtahir CheumarDocument11 pagesIslamic Social Finance Instruments: Yusuf Haji-Othman Mohammadtahir CheumarNur Amirah HusnaNo ratings yet

- Zakat Produktif Sebagai Modal Kerja Usaha Mikro: Reni Oktaviani, Efri Syamsul BahriDocument20 pagesZakat Produktif Sebagai Modal Kerja Usaha Mikro: Reni Oktaviani, Efri Syamsul BahriGAMING NEWSNo ratings yet

- Maqasid Al-Shariah and Performance of Zakah InstitutionsDocument23 pagesMaqasid Al-Shariah and Performance of Zakah InstitutionsSyedNo ratings yet

- A Combination of Audit Opinion and Sharia ComplianceDocument13 pagesA Combination of Audit Opinion and Sharia CompliancemochammadfadhilabdullahNo ratings yet

- IDP - in IslamDocument30 pagesIDP - in IslamAyudya Puti RamadhantyNo ratings yet

- Dea PDFDocument36 pagesDea PDFhanifa sumadiNo ratings yet

- JETIR2311335Document10 pagesJETIR2311335Momo ChanNo ratings yet

- Analisis Zakat Produktif Dan Dampaknya T C7e041a3Document14 pagesAnalisis Zakat Produktif Dan Dampaknya T C7e041a3Irfan SyamdaNo ratings yet

- Ulema Viewpoints On Corporate Waqf As Legal EntityDocument9 pagesUlema Viewpoints On Corporate Waqf As Legal EntityLukman Santoso AzNo ratings yet

- Compliance Behaviour On Zakat Donation: A Qualitative ApproachDocument9 pagesCompliance Behaviour On Zakat Donation: A Qualitative ApproachsitilaelarahayuNo ratings yet

- 4792 11992 1 PBDocument20 pages4792 11992 1 PBArif AshsidiqiNo ratings yet

- Productive Zakat As A Financial Instrument in Economic Empowerment in Indonesia: A Literature StudyDocument11 pagesProductive Zakat As A Financial Instrument in Economic Empowerment in Indonesia: A Literature StudyindriNo ratings yet

- Interestfree Microfinance in India A Case Study of The AlKhair Cooperative Credit SocietyJournal of King Abdulaziz University Islamic EconomicsDocument20 pagesInterestfree Microfinance in India A Case Study of The AlKhair Cooperative Credit SocietyJournal of King Abdulaziz University Islamic EconomicsBHARATHITHASAN S 20PHD0413No ratings yet

- Mauquf'alaih As A Waqf Accountability Center (Prophetic Social Approach)Document26 pagesMauquf'alaih As A Waqf Accountability Center (Prophetic Social Approach)baehaqi17No ratings yet

- Journal - Zakat Management Information SystemDocument32 pagesJournal - Zakat Management Information SystemAsfa AsfiaNo ratings yet

- Manajemen Pendistribusian Dana Tahun 2019 Dalam Pemberdayaan MustahikDocument19 pagesManajemen Pendistribusian Dana Tahun 2019 Dalam Pemberdayaan MustahikPetty PheNo ratings yet

- Katmas. 2020. Tanggung Jawab Sosial Bank Syariah Di IndonesiaDocument11 pagesKatmas. 2020. Tanggung Jawab Sosial Bank Syariah Di IndonesiaHeru HermawanNo ratings yet

- Artikel EkiDocument22 pagesArtikel EkiSaifan NurNo ratings yet

- Evaluasi Penyaluran Dana Zakat Pada Program Pendidikan Baznas PusatDocument20 pagesEvaluasi Penyaluran Dana Zakat Pada Program Pendidikan Baznas PusatUmar suneNo ratings yet

- Reputation, Satisfaction of Zakat Distribution, and Service Quality As Determinant of Stakeholder Trust in Zakat InstitutionsDocument5 pagesReputation, Satisfaction of Zakat Distribution, and Service Quality As Determinant of Stakeholder Trust in Zakat InstitutionsArief Dwi PrasetyoNo ratings yet

- 2021 A Conceptual Framework On The SuccessDocument25 pages2021 A Conceptual Framework On The SuccessSisilia MarsheilaNo ratings yet

- LKBNsDocument7 pagesLKBNsannisa hariyaniNo ratings yet

- Muslim Society Perspective On Islamic BankingDocument25 pagesMuslim Society Perspective On Islamic BankingCh ShehzadNo ratings yet

- The Preliminary Investigation of How Barakah WorksDocument7 pagesThe Preliminary Investigation of How Barakah Worksiefa nimnNo ratings yet

- Jurnal Asing PDFDocument5 pagesJurnal Asing PDFWulan TrisnaNo ratings yet

- Identifying Disclosure Items For Zakat InstitutionsDocument9 pagesIdentifying Disclosure Items For Zakat InstitutionsmohamedNo ratings yet

- Bank Infaq: Tinjauan Kritis Perspektif Fiqh Muamalah: Erwandi Tarmizi, Muhammad Maulana HamzahDocument17 pagesBank Infaq: Tinjauan Kritis Perspektif Fiqh Muamalah: Erwandi Tarmizi, Muhammad Maulana HamzahMohammad Zainus SubkhanNo ratings yet

- Accounting Treatment For Corporate Zakat: A Critical Review: Imefm 2,1Document15 pagesAccounting Treatment For Corporate Zakat: A Critical Review: Imefm 2,1delimasalbutNo ratings yet

- Toward Creating Organizational Organization: Linking Organization: Vision, Mission, Values, Strategy, and Objectives with Performance ManagementFrom EverandToward Creating Organizational Organization: Linking Organization: Vision, Mission, Values, Strategy, and Objectives with Performance ManagementNo ratings yet

- Maranaoo TribeDocument2 pagesMaranaoo TribeIntangible Beauty Called ScentNo ratings yet

- Personal Lessons From The Qur'anDocument66 pagesPersonal Lessons From The Qur'an2cekal100% (5)

- Bacaan SholatDocument5 pagesBacaan SholatAndi Faizal Sofyan HasdamNo ratings yet

- Women Mystics Et CouvertureDocument14 pagesWomen Mystics Et CouvertureAllMoravideNo ratings yet

- Aqidah AhlakDocument5 pagesAqidah AhlakROSYID OCITNo ratings yet

- A Discussion On The Illah For Riba GharaDocument15 pagesA Discussion On The Illah For Riba GharaWan Muhammad ZamyrNo ratings yet

- Slave To Religion A Pegging Religious Humiliation EroticaDocument8 pagesSlave To Religion A Pegging Religious Humiliation EroticaWilma PurwaniNo ratings yet

- 4 - Sir Syed Ahmad Khan PAKISTAN STUDIESDocument4 pages4 - Sir Syed Ahmad Khan PAKISTAN STUDIESSam ManNo ratings yet

- Doa Setelah SholatDocument3 pagesDoa Setelah Sholatirvan syahmilNo ratings yet

- Story of ProphetsDocument15 pagesStory of ProphetsMD MagundacanNo ratings yet

- The Dialogue Between The Sunnis and The KharijitesDocument49 pagesThe Dialogue Between The Sunnis and The KharijitesateebaminNo ratings yet

- The Five Percent Nation of Gods and EartDocument7 pagesThe Five Percent Nation of Gods and EartCamilo SorianoNo ratings yet

- Final Anth 140 ReportDocument11 pagesFinal Anth 140 Reportapi-549149450No ratings yet

- Contributions of Allama Iqbal in The Independence of Pakistan 1Document2 pagesContributions of Allama Iqbal in The Independence of Pakistan 1AbdulBasitBilalSheikh100% (3)

- Toaz - Info Difference Between Deen and Mazhab PR - PDFDocument15 pagesToaz - Info Difference Between Deen and Mazhab PR - PDFDanish ShoukatNo ratings yet

- This Content Downloaded From 192.87.31.155 On Thu, 23 Feb 2023 22:13:07 UTCDocument26 pagesThis Content Downloaded From 192.87.31.155 On Thu, 23 Feb 2023 22:13:07 UTCEmre KayaNo ratings yet

- Pembagian Kelompok AnatomiDocument17 pagesPembagian Kelompok AnatomiRochnald PigaiNo ratings yet

- Daily Attendence DATE: 08-01-2021: CLUSTER NAME: - GOVT. GIRLS HIGH SCHOOL FEROZABAD GUJRAT.Document3 pagesDaily Attendence DATE: 08-01-2021: CLUSTER NAME: - GOVT. GIRLS HIGH SCHOOL FEROZABAD GUJRAT.ferozabad schoolNo ratings yet

- Umrah RitualsDocument21 pagesUmrah RitualsSiraj KuvakkattayilNo ratings yet

- ISLAMDocument26 pagesISLAMSeunda DeogratiasNo ratings yet

- Abu Yusuf, Yaqub Ibn IbrahimDocument9 pagesAbu Yusuf, Yaqub Ibn IbrahimUsaama AbdilaahiNo ratings yet

- Jurnal Implementasi Metode TikrarDocument24 pagesJurnal Implementasi Metode TikrarMuhammad Ardian UIN MataramNo ratings yet

- Kalender Masehi 2021 PDFDocument12 pagesKalender Masehi 2021 PDFBudiNo ratings yet

- Cambridge O Level: ISLAMIYAT 2058/22Document16 pagesCambridge O Level: ISLAMIYAT 2058/22Shaheer MubashirNo ratings yet

- Indah Permata Sari CVDocument1 pageIndah Permata Sari CVMuhammad RamadhaniNo ratings yet

- Kalender Indonesia 2021Document12 pagesKalender Indonesia 2021Mukhammad SalimNo ratings yet

- Bismilllahhirrohmannirohim, Assalammu'alaikum Warrahmatullahi Wabarakatuh Good Evening Ladies and Gentle MenDocument2 pagesBismilllahhirrohmannirohim, Assalammu'alaikum Warrahmatullahi Wabarakatuh Good Evening Ladies and Gentle MenPutri NgawirabayaNo ratings yet

- Globalization Diversity Geography of A Changing World 5th Edition Rowntree Test BankDocument39 pagesGlobalization Diversity Geography of A Changing World 5th Edition Rowntree Test Bankpionsower0n100% (28)

- Appointment Chart: Oc/Bc PositionDocument1 pageAppointment Chart: Oc/Bc PositionBlue Eye'sNo ratings yet

- TESBIHAT - BookletDocument143 pagesTESBIHAT - Bookletibrahim100% (1)