Professional Documents

Culture Documents

UBI Brochure

Uploaded by

DEEPAKOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBI Brochure

Uploaded by

DEEPAKCopyright:

Available Formats

UNION SOLAR Financing Scheme

Your step towards Greener,

Cleaner & Sustainable Energy!

KEY ATTRACTIONS

Exclusive discounted

Project up to 2 MW

interest rates

Collateral free

Flexible tenure Pan-India

options available

WHY CHOOSE TATA POWER

India's No. 1* 35,000+ Happy Rooftop &

Solar Rooftop Open Access

Company Customers solar solutions

*Source: Industry trusted research body: Bridge To India

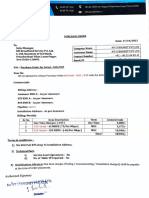

TERM SHEET

• Project Capacity: Up to 2 MW • On grid captive projects

• Loan Amount: `0.1- `8 Cr • Interest Rates:

- MSME: 8.95- 9.70% p.a

• Down payment: 15- 20%

- Non-MSME: 8.15- 8.90% p.a

• Collateral: (EMI/ Lakh `1221- `2110)

- ETB Customer: Nil

• Tenure: ≤ 10 yrs.

- NTB Customer: Case to case basis (incl. moratorium of 3 months)

ELIGIBILITY CRITERIA

• Segment: All business enterprises including Trusts/ Associations (exl. HUF)

• Units on leased premises subject to:

- Right to Access

- Unexpired Lease period >= Loan tenure

MANDATORY DOCUMENTS

Pre-sanction Documents Post sanction/

Pre-disbursement documents:

• Promoter- Related: • Unit-related:

- KYC Docs.: - PAN & UDYAM Certificate - NOC from existing

✧ ID Proof- PAN

- GST Certificate & bank (if applicable)

✧ Address Proof- - Advance payment

12 month GST return

AADHAR/ Passport/

- Partnership Deed receipt

Driving License (if applicable) - ESCOM/ Net metering

- Last 3 years' ITR - Certificate of Inc. arrangement

- Trust Deed (if applicable) - Approval for site

• Project-related documents:

- MoA/ AoA feasibility from

- Detailed techno-commercial - Ownership/ lease doc. Jurisdictional

proposal - PCB Certificate DISCOM/ CEIG

- Electricity bill of (Pollution Control Board)

previous 3 months - 3 yrs. audited

- CMA data financials, ITR & CA

certified provisional

(also of associate/ group

companies if any)

- Bank statement for

12 months

To avail scheme, contact your authorised Tata Power channel partner for more details.

TOLL FREE NO. 1800 25 77777 solaroof.tatapower.com

You might also like

- Proposal 12.5 KW AFOHSDocument12 pagesProposal 12.5 KW AFOHSFaisal IqbalNo ratings yet

- S dt.16.05.2023 - Ms Duttcon Consultant Engrs P Ltd. KolkataDocument4 pagesS dt.16.05.2023 - Ms Duttcon Consultant Engrs P Ltd. Kolkataduttcon engineeringNo ratings yet

- GeM-Bidding-3905752 - NITDocument13 pagesGeM-Bidding-3905752 - NITAmbrish KumarNo ratings yet

- GeM Bidding 1979713Document3 pagesGeM Bidding 1979713neha vatsNo ratings yet

- GeM Bidding 4074027Document5 pagesGeM Bidding 4074027bharatiya technologyNo ratings yet

- B2B Rental Sale Checklist - LGEP - 5 - ReviewedDocument5 pagesB2B Rental Sale Checklist - LGEP - 5 - Reviewedsunlife zeoilenNo ratings yet

- GeM Bidding 4158897Document4 pagesGeM Bidding 4158897Raj TenderNo ratings yet

- Mazagon Dock Shipbuilders Limited Floats Tender for Supply of Electrical ItemsDocument12 pagesMazagon Dock Shipbuilders Limited Floats Tender for Supply of Electrical ItemsANKUR ELECTRONICSNo ratings yet

- GeM Bidding 4195280Document7 pagesGeM Bidding 4195280Rinki JainNo ratings yet

- An accelerated dealer finance platformDocument2 pagesAn accelerated dealer finance platformneeraj guptaNo ratings yet

- Enquiry Information: Commercial Credit Information ReportDocument9 pagesEnquiry Information: Commercial Credit Information ReportSurajit DoraNo ratings yet

- Details of Rooftop Solar - Dec'20Document3 pagesDetails of Rooftop Solar - Dec'20shahnawaz1709No ratings yet

- Reliance Industries PE Pricing and Payment PolicyDocument47 pagesReliance Industries PE Pricing and Payment PolicyAkshat JainNo ratings yet

- Central Bank of India Bangalore City Branch: Santosh Complex, K G Road, Bangalore-560009Document3 pagesCentral Bank of India Bangalore City Branch: Santosh Complex, K G Road, Bangalore-560009DeepakNo ratings yet

- GEM/2022/B/2718130 - Bid for Pest and Rodent Control ServicesDocument5 pagesGEM/2022/B/2718130 - Bid for Pest and Rodent Control ServicesMohan Subhash PNo ratings yet

- GeM Bidding 3214809Document22 pagesGeM Bidding 3214809masoodNo ratings yet

- GeM Bidding 3659823Document7 pagesGeM Bidding 3659823Lp BatNo ratings yet

- 1 Gig p2p FasutonettoDocument4 pages1 Gig p2p Fasutonettokanishkakhanna.inboxNo ratings yet

- GeM Bidding 3357050Document4 pagesGeM Bidding 3357050Ashwet JadhavNo ratings yet

- GEM Bid for Synchronization Panel SupplyDocument3 pagesGEM Bid for Synchronization Panel SupplyTarun MondalNo ratings yet

- JLR Special Scheme For Salaried CustomersDocument5 pagesJLR Special Scheme For Salaried CustomersJay ShahNo ratings yet

- GeM Bidding 4157315Document6 pagesGeM Bidding 4157315Priyanka DevghareNo ratings yet

- Second Hand Empty Gunny Bags Bid for 10000 PiecesDocument5 pagesSecond Hand Empty Gunny Bags Bid for 10000 PiecesRahul RawatNo ratings yet

- GeM Bidding 3987275Document6 pagesGeM Bidding 3987275Kartik RajputNo ratings yet

- Bayview Terraces Amc Service CompDocument2 pagesBayview Terraces Amc Service CompAishwarya ShetNo ratings yet

- Ani Purchase Order 45, 155 NLDDocument3 pagesAni Purchase Order 45, 155 NLDkanishkakhanna.inboxNo ratings yet

- Credit Processing For CVDocument5 pagesCredit Processing For CVBhaskar GarimellaNo ratings yet

- Ril Pe Price Dt. 10.01.2019 PDFDocument89 pagesRil Pe Price Dt. 10.01.2019 PDFAkshat JainNo ratings yet

- Your Account Details Segment'S RegisteredDocument2 pagesYour Account Details Segment'S Registeredarnav kumarNo ratings yet

- Canara BankDocument2 pagesCanara Banklinsonjohny34No ratings yet

- Gmail - Unlimited Tender Information Services - WWW - Classictenders.com - Call - 7574002108Document3 pagesGmail - Unlimited Tender Information Services - WWW - Classictenders.com - Call - 7574002108jenul.classictendersNo ratings yet

- GeM Bidding 3926982Document4 pagesGeM Bidding 3926982MIHIR RANJANNo ratings yet

- GeM Bidding 4180525Document12 pagesGeM Bidding 4180525Indranil BanerjeeNo ratings yet

- China HD-SDI PTZ Camera Rugged 36X Optical Zoom Weather-Resistant PTZ Cameras For Cars & Ships On Global Sources PDFDocument7 pagesChina HD-SDI PTZ Camera Rugged 36X Optical Zoom Weather-Resistant PTZ Cameras For Cars & Ships On Global Sources PDFLa PedroNo ratings yet

- Ril Pe Price Dt. 22.03.2018Document97 pagesRil Pe Price Dt. 22.03.2018Akshat JainNo ratings yet

- GeM Bidding 3706104Document5 pagesGeM Bidding 3706104NE-II Circle Electrical Division - DimapurNo ratings yet

- Procurement of Ermeto Fittings for MRLC ProjectDocument13 pagesProcurement of Ermeto Fittings for MRLC ProjectShubham ChouhanNo ratings yet

- Fibre Cable BidDocument4 pagesFibre Cable BidRadha GNo ratings yet

- GeM Bidding 2834097Document4 pagesGeM Bidding 2834097TENDER AWADH GROUPNo ratings yet

- Solar Rebate App 4-6-10Document13 pagesSolar Rebate App 4-6-10sandyolkowskiNo ratings yet

- GeM Bidding 4044502Document9 pagesGeM Bidding 4044502LOGAVARMANNo ratings yet

- GeM Bidding 3482736Document4 pagesGeM Bidding 3482736mogijo11dffdfgdfgNo ratings yet

- Sanction letter for vehicle loan approvalDocument2 pagesSanction letter for vehicle loan approvalAmit KumarNo ratings yet

- Electricity Facts LabelDocument16 pagesElectricity Facts LabelTiffany 'Lowden' KoopNo ratings yet

- Mobile Digital Radiography Systems BidDocument8 pagesMobile Digital Radiography Systems Bidasdd sNo ratings yet

- GeM Bidding 3899105Document6 pagesGeM Bidding 3899105Tumbin DilseNo ratings yet

- IProp Membership FormDocument1 pageIProp Membership FormrarahimNo ratings yet

- Ril Pe Price DT.16.01.2019 PDFDocument86 pagesRil Pe Price DT.16.01.2019 PDFAkshat JainNo ratings yet

- GeM Bidding 3267051Document7 pagesGeM Bidding 3267051Lakshmana Rao NNo ratings yet

- GeM Bidding 3705605Document5 pagesGeM Bidding 3705605NE-II Circle Electrical Division - DimapurNo ratings yet

- PMC Application - MAY08Document17 pagesPMC Application - MAY08Nathan WilliamsNo ratings yet

- Gujarat State Electricity Corporation Limited invites bids for supply of consumable itemsDocument55 pagesGujarat State Electricity Corporation Limited invites bids for supply of consumable itemsSunil BajpaiNo ratings yet

- GeM Bidding 2273581Document4 pagesGeM Bidding 2273581MKumarNo ratings yet

- SandipaniDocument163 pagesSandipaniabhinavsharma2558750% (2)

- EOI Brigade Oasis Revised EOI Form LatestDocument5 pagesEOI Brigade Oasis Revised EOI Form LatestParchuri PraveenNo ratings yet

- Pe Price Dt. 01.03.2019Document89 pagesPe Price Dt. 01.03.2019mohdNo ratings yet

- Gem 2021 B 1704791Document8 pagesGem 2021 B 1704791aadilnayazNo ratings yet

- Everything About ArtDocument88 pagesEverything About ArtRavinder SInghNo ratings yet

- GeM Bidding 4094343Document5 pagesGeM Bidding 4094343AnilNo ratings yet

- I. Important Instructions: 1. Candidates To Ensure Their Eligibility For The PostDocument33 pagesI. Important Instructions: 1. Candidates To Ensure Their Eligibility For The PostannnoyynnmussNo ratings yet

- Eligible ProgramsDocument1 pageEligible ProgramsDEEPAKNo ratings yet

- Cybercrimes in India: A Toothless Legal FrameworkDocument27 pagesCybercrimes in India: A Toothless Legal FrameworkDEEPAKNo ratings yet

- 202004021930365160sanjana Mittal Law Cyber LawDocument20 pages202004021930365160sanjana Mittal Law Cyber LawDEEPAKNo ratings yet

- Cyber Laws Overview 17888 PDFDocument111 pagesCyber Laws Overview 17888 PDFVardhaman PandeyNo ratings yet

- Online Dispute ResolutionDocument15 pagesOnline Dispute ResolutionDEEPAK100% (1)

- Cyber Law MCQDocument5 pagesCyber Law MCQharshNo ratings yet

- 8.4.3 Alien Genetics LabDocument2 pages8.4.3 Alien Genetics LabCharles KnightNo ratings yet

- SummaryDocument3 pagesSummaryОля ВласійчукNo ratings yet

- Revit Quiz 1 ReviewerDocument13 pagesRevit Quiz 1 ReviewerLanz RamosNo ratings yet

- P90X2 Les Mills PUMP HybridDocument7 pagesP90X2 Les Mills PUMP HybridRamonBeltranNo ratings yet

- Analysis of Wood Bending PropertiesDocument11 pagesAnalysis of Wood Bending Propertiesprasanna020391100% (1)

- ESDIS05161 DMP For DPs Template PDFDocument15 pagesESDIS05161 DMP For DPs Template PDFneerajshukla246829No ratings yet

- Defibrelator ch1Document31 pagesDefibrelator ch1د.محمد عبد المنعم الشحاتNo ratings yet

- Human Rights Law IntroductionDocument8 pagesHuman Rights Law IntroductionXander ZingapanNo ratings yet

- TSSA Fuels Safety High Pressure Piping Code, TSSA HPP-2017 November 2017Document7 pagesTSSA Fuels Safety High Pressure Piping Code, TSSA HPP-2017 November 2017Manoj SaralayaNo ratings yet

- MyITLab Access Grader Real Estate Case SolutionDocument3 pagesMyITLab Access Grader Real Estate Case SolutionShivaani Aggarwal0% (1)

- CAD32M7 Data SheetDocument2 pagesCAD32M7 Data SheetMehmet EngürNo ratings yet

- Redmi 9 Power Blazing Blue, 64 GB: Adilaxmi E-Commerce Private LimitedDocument1 pageRedmi 9 Power Blazing Blue, 64 GB: Adilaxmi E-Commerce Private Limitedask meNo ratings yet

- SD Card Formatter 5.01 User's Manual: July 15, 2021Document11 pagesSD Card Formatter 5.01 User's Manual: July 15, 2021Alexis GutierrezNo ratings yet

- Challenges of Deep Excavation for KVMRT StationsDocument85 pagesChallenges of Deep Excavation for KVMRT StationsAlwin AntonyNo ratings yet

- MSC - Nastran 2014 Linear Static Analysis User's Guide PDFDocument762 pagesMSC - Nastran 2014 Linear Static Analysis User's Guide PDFFeiNo ratings yet

- Kollmorgen S300 Servo Drive ManualDocument134 pagesKollmorgen S300 Servo Drive ManualCarlos SalazarNo ratings yet

- Responses to Empiricism and Structuralism in Social SciencesDocument13 pagesResponses to Empiricism and Structuralism in Social Sciencesphils_skoreaNo ratings yet

- ComplexDocument35 pagesComplexKetso MolapoNo ratings yet

- TS4F01-1 Unit 4 - Document ControlDocument66 pagesTS4F01-1 Unit 4 - Document ControlLuki1233332No ratings yet

- Film Crew: ProductionDocument15 pagesFilm Crew: ProductionDarkshine_THNo ratings yet

- LP Fuel Gas SystemDocument6 pagesLP Fuel Gas SystemAnonymous QSfDsVxjZNo ratings yet

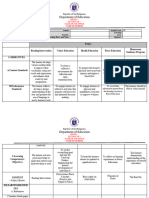

- DLL Catch Up Friday Grade 4 Jan 19Document7 pagesDLL Catch Up Friday Grade 4 Jan 19reyannmolinacruz21100% (30)

- Prof. Hanumant Pawar: GeomorphologyDocument15 pagesProf. Hanumant Pawar: GeomorphologySHAIK CHAND PASHANo ratings yet

- Ilang - Ilang LP g7Document6 pagesIlang - Ilang LP g7custodiokeizelNo ratings yet

- Clare Foster CVDocument2 pagesClare Foster CVfostressNo ratings yet

- Profile Shakeel Carpentry Joinery WorksDocument46 pagesProfile Shakeel Carpentry Joinery WorksShakeel Ahmad100% (1)

- EN 1090 White Paper17 119019 PDFDocument24 pagesEN 1090 White Paper17 119019 PDFZaza PokumbaNo ratings yet

- Chapter Arithmetic and Geometric Progressions 024005Document14 pagesChapter Arithmetic and Geometric Progressions 024005ravichandran_brNo ratings yet

- Bank Automation ProjectDocument75 pagesBank Automation Projectyathsih24885No ratings yet

- Castro DW 32Document3 pagesCastro DW 32Jeetu GosaiNo ratings yet