Professional Documents

Culture Documents

Bsib 622 Homework 3

Bsib 622 Homework 3

Uploaded by

hamzaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bsib 622 Homework 3

Bsib 622 Homework 3

Uploaded by

hamzaCopyright:

Available Formats

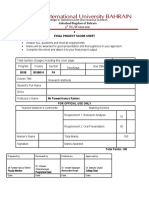

UNIVERSITY OF TECHNOLOGY BAHRAIN

Salmabad, Kingdom of Bahrain

COLLEGE OF ADMINISTRATIVE AND FINANCIAL SCIENCES

1st Trimester, AY 2021-2022

BSIB 622 – International Accounting

HOMEWORK 3

COURSE CODE BSIB 622 COURSE TITLE INTERNATIONAL ACCOUNTING

SECTION TIME DAYS ROOM

STUDENT NAME ID NO.

TEACHER’S NAME Mr. Emad Sadeq DATE

TOPIC

ACTIVITY TITLE

ACTIVITY

DIRECTION &

1. What are the main benefits of international harmonization of auditing

REQUIREMENT/S standards sure to cite any sources using proper APA? (10 Marks)

2. Do auditing and reporting standards affect firms ethical Behaviours the

moderating role of national culture?(10 Marks)

Rubric for 10 Marks:

9-10 = Details are fully complete and demonstrate deep understanding of content

7-8 = Answer is acceptable but lacks minor details

6-5 = Answer is responsive but not fully complete

3-4 = Major details are missing and shows low level of understanding of the content

1-2 = Answer is lacking multiple major details

0 = Question in not answered or answer given is inappropriate

ACTIVITY

OUTPUT

1. The purpose of accounting is to communicate the organization’s financial

position to company managers, investors, banks, and the government.

Accounting standards provide a system of rules and principles that

prescribe the format and content of financial statements. Through this

consistent reporting, a firm’s managers and investors can assess the

financial health of the firm. Accounting standards cover topics such as

how to account for inventories, depreciation, research and development

costs, income taxes, investments, intangible assets, and employee

benefits. Investors and banks use these financial statements to

determine whether to invest in or loan capital to the firm, while

governments use the statements to ensure that the companies are

paying their fair share of taxes.

As countries developed different cultures, languages, and social and

economic traditions, they developed different accounting practices as

well. In an increasingly globalized world, however, these differences are

not optimal for the smooth functioning of international business.\

2. The International Accounting Standards Board (IASB) is the major entity

proposing international standards of accounting. Originally formed in

1973 as the International Accounting Standards Committee (IASC) and

renamed the International Accounting Standards Board in 2001, the IASB

is an independent agency that develops accounting standards known as

international financial reporting standards (IFRS).“History,” International

Accounting Standards Board, accessed November 26, 2010,

http://www.ifrs.org/Home.htm.

The IASB is composed of fifteen representatives from professional

accounting firms from many countries.“About the IFRS Foundation and

the IASB,” IFRS Foundation, accessed November 25, 2010,

http://www.ifrs.org/The+organisation/IASCF+and+IASB.htm. These

board members formulate the international reporting standards. For a

standard to be approved, 75 percent of the board members must agree.

Often, getting agreement is difficult given the social, economic, legal, and

cultural differences among countries. As a result, most IASB statements

provide two acceptable alternatives. Two alternatives aren’t as solid or

straightforward as one, but it’s better than having a dozen different

options.

Adherence to the IASB’s standards is voluntary, but many countries have

mandated use of IFRS. For example, all companies listed on EU stock

exchanges are required to use IFRS.European Commission, “Report to the

European Securities Committee and to the European Parliament,” April 6,

2010, accessed November 26, 2010,

http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?

uri=com:2010:0292:fin:en:html. The same is true for all companies listed

on South Africa’s Johannesburg Stock Exchange and Turkey’s Istanbul

Stock Exchange. In all, over one hundred nations have adopted or

permitted companies to use the IASB’s standards to report their financial

results.Neil Baker, “IFAC Calls for Crucial Reporting Roadmap,”

Compliance Week, July 27, 2009, accessed November 26, 2010,

http://www.complianceweek.com/blog/glimpses/2009/07/27/ifac-calls-

for-reporting-roadmap.

The United States doesn’t mandate using the IFRS. Instead, the United

States has the Financial Accounting Standards Board (FASB), which

issues standards known as generally accepted accounting principles

(GAAP). The US currently mandates following GAAP. However, the

FASB and IASB are working on harmonizing the accounting standards;

many IASB standards are similar to FASB ones. The United States is

moving toward adopting the IFRS but hasn’t committed to a specific time

frame.Marie Leone, “Harvey Goldschmid Named IASB Trustee,” CFO,

December 11, 2009, accessed November 26, 2010,

http://www.cfo.com/printable/article.cfm/14461503.

The primary reason for adopting one standard internationally is that if

different accounting standards are used, it’s difficult for investors or

lenders to compare the financial health of two companies. In addition, if a

single international standard is used, multinational firms won’t have to

prepare different reports for the different countries in which they operate.

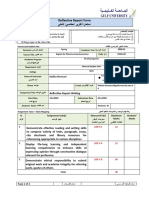

FACULTY

FEEDBACK

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BSIB 621 Final ProjectDocument5 pagesBSIB 621 Final ProjecthamzaNo ratings yet

- Bsib 621-Hwac 2Document4 pagesBsib 621-Hwac 2hamzaNo ratings yet

- Bsib 621-Fma 3Document3 pagesBsib 621-Fma 3hamzaNo ratings yet

- Bsib 621-Fa 4Document2 pagesBsib 621-Fa 4hamzaNo ratings yet

- Bsib514 HW 3 - 1ST Tri - 2020-2021Document6 pagesBsib514 HW 3 - 1ST Tri - 2020-2021hamzaNo ratings yet

- Bsib 621-Fa 1Document3 pagesBsib 621-Fa 1hamzaNo ratings yet

- BSIB 621 HWAC2 Case 2Document3 pagesBSIB 621 HWAC2 Case 2hamzaNo ratings yet

- BSIB 616 Research Methods - Final Project ADocument15 pagesBSIB 616 Research Methods - Final Project AhamzaNo ratings yet

- Bsib514 HW 3 - 1ST Tri - 2020-2021Document4 pagesBsib514 HW 3 - 1ST Tri - 2020-2021hamzaNo ratings yet

- Bsib 622 Homework 2Document3 pagesBsib 622 Homework 2hamzaNo ratings yet

- Bsib 621-Test 1Document10 pagesBsib 621-Test 1hamzaNo ratings yet

- College of Administrative & Financial Sciences: COMP643 - Accounting Information Systems Laboratory Report 1Document2 pagesCollege of Administrative & Financial Sciences: COMP643 - Accounting Information Systems Laboratory Report 1hamzaNo ratings yet

- MGT 315 Assignment Summer 2022Document7 pagesMGT 315 Assignment Summer 2022hamzaNo ratings yet

- BSIB 621 Case 1Document3 pagesBSIB 621 Case 1hamzaNo ratings yet

- Bsib421 - Final Project Set ADocument11 pagesBsib421 - Final Project Set AhamzaNo ratings yet

- Bsi525 IcpDocument10 pagesBsi525 IcphamzaNo ratings yet

- ENGG522 - HWAC1 ManuscriptDocument2 pagesENGG522 - HWAC1 ManuscripthamzaNo ratings yet

- CH 5 Assignment 4Document4 pagesCH 5 Assignment 4hamzaNo ratings yet

- ACC416 - Case Study - Answer SheetDocument6 pagesACC416 - Case Study - Answer SheethamzaNo ratings yet

- Lecture Graded Assigiment 2: Topics Assignment Direction & Requirement/ SDocument5 pagesLecture Graded Assigiment 2: Topics Assignment Direction & Requirement/ ShamzaNo ratings yet

- Assignment 5 - MGT230 Mock Final Exam.Document6 pagesAssignment 5 - MGT230 Mock Final Exam.hamzaNo ratings yet

- 118-Reflective Report Final (2) Ali FuadDocument13 pages118-Reflective Report Final (2) Ali FuadhamzaNo ratings yet

- Assignment FintechDocument5 pagesAssignment FintechhamzaNo ratings yet

- Final Project: BSBI 422 - Financial AccountingDocument4 pagesFinal Project: BSBI 422 - Financial AccountinghamzaNo ratings yet

- MGT 504 - MidtermDocument12 pagesMGT 504 - MidtermhamzaNo ratings yet

- COMP512Final Project-20212Document6 pagesCOMP512Final Project-20212hamzaNo ratings yet

- Ans-Assignment QM 204.editedDocument9 pagesAns-Assignment QM 204.editedhamzaNo ratings yet

- Negotiation and Conflict Resolution HUR382 Midterm ExamDocument5 pagesNegotiation and Conflict Resolution HUR382 Midterm ExamhamzaNo ratings yet

- MGT 202 OB Assignment 2022Document8 pagesMGT 202 OB Assignment 2022hamzaNo ratings yet

- Comp643 Final Lecture ProjectDocument7 pagesComp643 Final Lecture ProjecthamzaNo ratings yet