Professional Documents

Culture Documents

Fancy Phone Trust - Trust - Financial Statements

Uploaded by

jerry dela cruzCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fancy Phone Trust - Trust - Financial Statements

Uploaded by

jerry dela cruzCopyright:

Available Formats

Trust - Financial Statements

Fancy Phone Trust

ABN 26 933 478 496

For the year ended 30 June 2022

Prepared by FP Advisory Unit Trust

Contents

3 Trust Income Distribution

4 Beneficiary Accounts

5 Balance Sheet - Summarised

6 Notes to the Financial Statements

9 Director's Declaration of the Trustee Company

10 Compilation Report

11 Trading Statement

12 Income Statement

13 Balance Sheet

14 Depreciation Schedule

15 Tax Reconciliation

Trust - Financial Statements Fancy Phone Trust Page 2 of 15

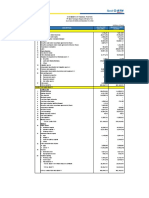

Trust Income Distribution

Fancy Phone Trust

For the year ended 30 June 2022

2022 2021

Trust Income Distribution

Current Year Earnings 171,539 154,383

Net Trust Income for Distribution 171,539 154,383

Distributions to Beneficiaries 171,539 154,383

Undistributed Trust Income - -

The accompanying notes form part of these financial statements. These statements should be read in conjunction with the attached

compilation report.

Trust - Financial Statements Fancy Phone Trust Page 3 of 15

Beneficiary Accounts

Fancy Phone Trust

For the year ended 30 June 2022

2022 2021

Beneficiary Accounts

Beneficiaries Accounts Summary

Profit Distributed 171,539 154,383

Physical Distribution (171,539) (154,383)

Detailed Beneficiary Accounts

Kerryn Jenkinson

Share of profit 106,932 93,013

Physical distribution (106,932) (93,013)

Total Kerryn Jenkinson - -

Sudarat Hatthasan

Share of profit 64,607 61,371

Physical distribution (64,607) (61,371)

Total Sudarat Hatthasan - -

Total Detailed Beneficiary Accounts - -

The accompanying notes form part of these financial statements. These statements should be read in conjunction with the attached

compilation report.

Trust - Financial Statements Fancy Phone Trust Page 4 of 15

Balance Sheet - Summarised

Fancy Phone Trust

As at 30 June 2022

NOTES 30 JUN 2022 30 JUN 2021

Assets

Current Assets

Cash and Cash Equivalents 2 8,050 37,354

Borrowing Costs 841 391

Accumulated amortisation (269) (149)

Total Current Assets 8,622 37,596

Non-Current Assets

Property, Plant and Equipment 3 41,565 -

Total Non-Current Assets 41,565 -

Total Assets 50,187 37,596

Liabilities

Current Liabilities

Payables 4 2,153 6,526

GST 4,667 3,851

Hire Purchase - Capital Finance (Cruiser) CL 8,711 -

Unexpired Interest - Capital Finance (Cruiser) CL (2,022) -

Total Current Liabilities 13,508 10,377

Non-Current Liabilities

Hire Purchase - Capital Finance (Cruiser) NCL 41,376 -

Unexpired Interest - Capital Finance (Cruiser) NCL (3,447) -

Beneficiary/Shareholder Accounts 5 (11,235) 17,232

Payables 4 9,887 9,887

Total Non-Current Liabilities 36,580 27,119

Total Liabilities 50,087 37,496

Net Assets 100 100

Equity

Retained Earnings 100 100

Total Equity 100 100

The accompanying notes form part of these financial statements. These statements should be read in conjunction with the attached

compilation report.

Trust - Financial Statements Fancy Phone Trust Page 5 of 15

Notes to the Financial Statements

Fancy Phone Trust

For the year ended 30 June 2022

1. Statement of Significant Accounting Policies

The director of the trustee company has prepared the financial statements of the trust on the basis that the trust is a

non-reporting entity because there are no users dependent on general purpose financial statements. The financial statements

are therefore special purpose financial statements that have been prepared in order to meet the requirements of the trust deed,

the information needs of stakeholders and for the basis of preparation of the income tax return. The financial statements have

been prepared in accordance with the significant accounting policies disclosed below, which the director has determined is

appropriate to meet the purposes of preparation. Such accounting policies are consistent with the previous period unless stated

otherwise. The financial statements have been prepared on an accruals basis and are based on historical costs unless otherwise

stated in the notes. The financial statements were authorised for issue on 3 November 2022 by the director of the trustee

company.

Property, Plant and Equipment

Property, plant and equipment is initially recorded at the cost of acquisition or fair value less, if applicable, any accumulated

depreciation and impairment losses. Plant and equipment that has been contributed at no cost, or for nominal cost, is valued

and recognised at the fair value of the asset at the date it is acquired. The plant and equipment is reviewed annually by directors

to ensure that the carrying amount is not in excess of the recoverable amount from these assets. The recoverable amount is

assessed on the basis of the expected net cash flows that will be received from the utilisation of the assets and the subsequent

disposal. The expected net cash flows have been discounted to their present values in estimating recoverable amounts.

Freehold land and buildings are measured at their fair value, based on periodic, but at least triennial, valuations by independent

external valuers, less subsequent depreciation for buildings.

Increases in the carrying amount of land and buildings arising on revaluation are credited in equity to a revaluation surplus.

Decreases against previous increases of the same asset are charged against fair value reserves in equity. All other decreases are

charged to profit or loss.

Any accumulated depreciation at the date of revaluation is offset against the gross carrying amount of the asset and the net

amount is restated to the revalued amount of the asset.

Trade and Other Payables

Trade and other payables represent the liabilities for goods and services received by the trust that remain unpaid at 30 June

2022. Trade payables are recognised at their transaction price. They are subject to normal credit terms and do not bear interest.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, deposits held on call with banks, other short-term highly liquid investments

with original maturities of three months or less, and bank overdrafts.

Revenue Recognition

Revenue from the sale of goods is recognised upon the delivery of goods to customers.

Revenue from the rendering of services is recognised upon the delivery of the services to customers.

Revenue from commissions is recognised upon delivery of services to customers.

Revenue from interest is recognised using the effective interest rate method.

Revenue from dividends is recognised when the entity has a right to receive the dividend.

All revenue is stated net of the amount of goods and services tax (GST).

Goods and Services Tax

These notes should be read in conjunction with the attached compilation report.

Trust - Financial Statements Fancy Phone Trust Page 6 of 15

Notes to the Financial Statements

Transactions are recognised net of GST, except where the amount of GST incurred is not recoverable from the Australian

Taxation Office (ATO).

Receivables and payables are stated inclusive of the amount of GST receivable or payable. The net amount of GST recoverable

from, or payable to, the ATO is included with other receivables or payables in the balance sheet.

2022 2021

2. Cash and Cash Equivalents

Bank Accounts

Business Cheque Account 7,950 37,254

Total Bank Accounts 7,950 37,254

Other Cash Items

Cash on Hand 100 100

Total Other Cash Items 100 100

Total Cash and Cash Equivalents 8,050 37,354

2022 2021

3. Property Plant and Equipment

Plant and Equipment

Plant and Equipment at Cost 1,585 -

Accumulated Depreciation of Plant and Equipment (1,585) -

Total Plant and Equipment - -

Motor Vehicles

Motor Vehicles at Cost 68,432 23,974

Accumulated Depreciation of Motor Vehicles (26,867) (23,974)

Total Motor Vehicles 41,565 -

Total Property Plant and Equipment 41,565 -

2022 2021

4. Payables

Current

Hire Purchase - Toyota Finance (Mazda 3) CL - 7,271

PAYG Withholdings Payable 798 -

Superannuation Payable 1,355 -

Unexpired Interest - Toyota Finance (Mazda 3) CL - (745)

Total Current 2,153 6,526

Non Current

Hire Purchase - Toyota Finance (Mazda 3) NCL 10,300 10,300

Unexpired Interest - Toyota Finance (Mazda 3) NCL (414) (414)

Total Non Current 9,887 9,887

Total Payables 12,039 16,412

5. Beneficiary Accounts

These notes should be read in conjunction with the attached compilation report.

Trust - Financial Statements Fancy Phone Trust Page 7 of 15

Notes to the Financial Statements

Please see report titled "Beneficiary Accounts" for breakdown of beneficiary activity.

These notes should be read in conjunction with the attached compilation report.

Trust - Financial Statements Fancy Phone Trust Page 8 of 15

Director's Declaration of the Trustee Company

Fancy Phone Trust

For the year ended 30 June 2022

The director of the trustee company, Fancy Phone Pty Ltd, declares that the trust is not a reporting entity and that this special

purpose financial report should be prepared in accordance with the accounting policies outlined in Note 1 of the financial

statements.

The director of the company declares that:

1. The financial statements and notes present fairly the company's financial position as at 30 June 2022 and its performance

for the year ended on that date in accordance with the accounting policies described in Note 1 of the financial statements.

2. In the director's opinion there are reasonable grounds to believe that the company will be able to pay its debts as and

when they become due and payable.

This declaration is made in accordance with a resolution of Board of Director.

Director: Kerryn Jenkinson

Sign date:

Trust - Financial Statements Fancy Phone Trust Page 9 of 15

Compilation Report

Fancy Phone Trust

For the year ended 30 June 2022

Compilation report to Fancy Phone Trust

We have compiled the accompanying special purpose financial statements of Fancy Phone Trust, which comprise the balance

sheet as at 30 June 2022, the income statement, the statement of cash flows, a summary of significant accounting policies and

other explanatory notes. The specific purpose for which the special purpose financial statements have been prepared is set out

in Note 1.

The Responsibility of the Directors

The director of Fancy Phone Pty Ltd is solely responsible for the information contained in the special purpose financial

statements, the reliability, accuracy and completeness of the information and for the determination that the basis of

accounting used is appropriate to meet their needs and for the purpose that financial statements were prepared.

Our Responsibility

On the basis of information provided by the director we have compiled the accompanying special purpose financial statements

in accordance with the basis of accounting as described in Note 1 to the financial statements and APES 315 Compilation of

Financial Information.

We have applied our expertise in accounting and financial reporting to compile these financial statements in accordance with

the basis of accounting described in Note 1 to the financial statements. We have complied with the relevant ethical

requirements of APES 110 Code of Ethics for Professional Accountants.

Assurance Disclaimer

Since a compilation engagement is not an assurance engagement, we are not required to verify the reliability, accuracy or

completeness of the information provided to us by management to compile these financial statements. Accordingly, we do not

express an audit opinion or a review conclusion on these financial statements.

The special purpose financial statements were compiled exclusively for the benefit of the directors who are responsible for the

reliability, accuracy and completeness of the information used to compile them. We do not accept responsibility for the contents

of the special purpose financial statements.

Frank Palermo

FP Advisory

1/148 Arthurton Road, Northcote VIC 3070

Dated: 3 November 2022

Trust - Financial Statements Fancy Phone Trust Page 10 of 15

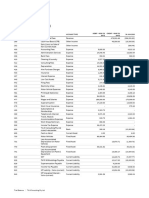

Trading Statement

Fancy Phone Trust

For the year ended 30 June 2022

NOTES 2022 2021

Trading Income

Sales

Revenue 38,400 5,000

Sale of Goods 305,603 272,495

Total Sales 344,003 277,495

Cost of Sales

Purchases 70,735 63,566

Direct Costs 19 -

Total Cost of Sales 70,754 63,566

Gross Profit 273,249 213,929

Gross Profit (%) 79 77

The accompanying notes form part of these financial statements. These statements should be read in conjunction with the attached

compilation report.

Trust - Financial Statements Fancy Phone Trust Page 11 of 15

Income Statement

Fancy Phone Trust

For the year ended 30 June 2022

NOTES 2022 2021

Income

Trading Profit 234,849 208,929

Total Income 234,849 208,929

Other Income

Government Grant 38,400 5,000

Subsidies Received - Jobkeeper - 21,900

Total Other Income 38,400 26,900

Total Income 273,249 235,829

Expenses

Accounting Fees 4,332 3,450

Advertising & Marketing 14 -

Bank Fees 2,767 2,400

Borrowing expense 120 98

Cleaning 74 279

Consulting Fees - 1,800

Depreciation 4,478 -

Filing Fees 276 273

Freight & Courier - 619

General Expenses 621 5

Hire purchase charges 1,317 1,096

Insurance - 529

Legal expenses 487 487

Light, Power, Heating 818 988

Motor Vehicle Expenses 6,609 4,284

Office Expenses 90 233

Postage 116 215

Printing & Stationery 742 98

Rent 59,411 60,794

Shop Expense 113 141

Subscriptions & Memberships - 706

Superannuation 1,355 -

Telephone & Internet 3,928 2,950

Travel and Accommodation 270 -

Wages and Salaries 13,545 -

Workcover 225 -

Total Expenses 101,710 81,445

Profit / (Loss) Before Distribution 171,539 154,383

Undistributed Income 171,539 154,383

The accompanying notes form part of these financial statements. These statements should be read in conjunction with the attached

compilation report.

Trust - Financial Statements Fancy Phone Trust Page 12 of 15

Balance Sheet

Fancy Phone Trust

As at 30 June 2022

NOTES 30 JUN 2022 30 JUN 2021

Assets

Current Assets

Bank Accounts

Business Cheque Account 7,950 37,254

Total Bank Accounts 7,950 37,254

Cash on Hand 100 100

Borrowing Costs 841 391

Accumulated amortisation (269) (149)

Total Current Assets 8,622 37,596

Non-Current Assets

Property, Plant and Equipment 3 41,565 -

Total Non-Current Assets 41,565 -

Total Assets 50,187 37,596

Liabilities

Current Liabilities

GST 4,667 3,851

PAYG Withholdings Payable 798 -

Superannuation Payable 1,355 -

Hire Purchase Agreements

Hire Purchase Agreements 8,711 7,271

Unexpired Interest (2,022) (745)

Total Hire Purchase Agreements 6,688 6,526

Total Current Liabilities 13,508 10,377

Non-Current Liabilities

Beneficiaries' Accounts 5 (11,235) 17,232

Hire Purchase Agreements

Hire Purchase Agreements 51,676 10,300

Unexpired Interest (3,861) (414)

Total Hire Purchase Agreements 47,815 9,887

Total Non-Current Liabilities 36,580 27,119

Total Liabilities 50,087 37,496

Net Assets 100 100

Equity

Undistributed Income 171,539 154,383

Retained Earnings (171,439) (154,283)

Total Equity 100 100

The accompanying notes form part of these financial statements. These statements should be read in conjunction with the attached

compilation report.

Trust - Financial Statements Fancy Phone Trust Page 13 of 15

Depreciation Schedule

Fancy Phone Trust

For the year ended 30 June 2022

NAME COST OPENING VALUE PURCHASES DISPOSALS DEPRECIATION CLOSING VALUE

Motor Vehicles

Mazda 1NY4HH 23,974 - - - - -

Toyota Cruiser 44,458 - 44,458 - 2,893 41,565

Total Motor Vehicles 68,432 - 44,458 - 2,893 41,565

Office Equipment

Computer 1,227 - 1,227 - 1,227 -

Keyboard 18 - 18 - 18 -

Modem 91 - 91 - 91 -

Printer 249 - 249 - 249 -

Total Office Equipment 1,585 - 1,585 - 1,585 -

Total 70,017 - 46,043 - 4,478 41,565

The accompanying notes form part of these financial statements. These statements should be read in conjunction with the attached

compilation report.

Trust - Financial Statements Fancy Phone Trust Page 14 of 15

Tax Reconciliation

Fancy Phone Trust

For the year ended 30 June 2022

2022

Tax Reconciliation

Accounting Profit for Period

Profit for period -

Carried Forward Losses Applied -

Total Accounting Profit for Period -

Addbacks

Prior Year Debtors -

Current Year Creditors -

Entertainment -

Fines -

Superannuation Expense -

Other Addbacks -

Total Addbacks -

Deductions

Current Year Debtors -

Prior Year Creditors -

Superannuation Paid -

Other Deductions -

Total Deductions -

Taxable Profit for Beneficiaries -

Tax Distribution per Beneficiary

Beneficiary 1 -

Beneficiary 2 -

Beneficiary 3 -

Beneficiary 4 -

Beneficiary 5 -

Beneficiary 6 -

Beneficiary 7 -

Beneficiary 8 -

Beneficiary 9 -

Beneficiary 10 -

Total Tax Distribution per Beneficiary -

Trust - Financial Statements Fancy Phone Trust Page 15 of 15

You might also like

- Unaudited Condensed Consolidated Financial ReportsDocument33 pagesUnaudited Condensed Consolidated Financial ReportsinforumdocsNo ratings yet

- Management Accounts For The Year 2022Document6 pagesManagement Accounts For The Year 2022Clyton MusipaNo ratings yet

- Cashflow Analysis - Beta - GammaDocument14 pagesCashflow Analysis - Beta - Gammashahin selkarNo ratings yet

- Lii Hen - Q1 (2017) 1Document15 pagesLii Hen - Q1 (2017) 1Jordan YiiNo ratings yet

- Bitfarms Q4 2021 FS FinalDocument46 pagesBitfarms Q4 2021 FS FinalAlexandru IonescuNo ratings yet

- DTCC Annual Financial Statements 2020 and 2019Document51 pagesDTCC Annual Financial Statements 2020 and 2019EvgeniyNo ratings yet

- AlMeezan AnnualReport2023 MIIFDocument9 pagesAlMeezan AnnualReport2023 MIIFmrordinaryNo ratings yet

- Practice Exercise - Springbok - SolutionDocument3 pagesPractice Exercise - Springbok - Solution155- Salsabila GadingNo ratings yet

- Comparative FSDocument4 pagesComparative FSSuper GenerationNo ratings yet

- Wings of Hope Equitherapy 7-31-2021 Audited Financial StatementsDocument16 pagesWings of Hope Equitherapy 7-31-2021 Audited Financial StatementsWings of Hope EquitherapyNo ratings yet

- 1 30062010 StatementDocument1 page1 30062010 StatementChee Heng KingNo ratings yet

- Sample 10KDocument29 pagesSample 10KabhishekNo ratings yet

- PT Matahari Department Store TBK Dan Entitas Anak/And Subsidiaries Laporan Keuangan KonsolidasianDocument103 pagesPT Matahari Department Store TBK Dan Entitas Anak/And Subsidiaries Laporan Keuangan KonsolidasianStevi MujonoNo ratings yet

- Practice Exercise - Springbok - BlankDocument3 pagesPractice Exercise - Springbok - Blank155- Salsabila GadingNo ratings yet

- PIOCORE 2022 - ThousandDocument7 pagesPIOCORE 2022 - ThousandAbhishek RaiNo ratings yet

- Psaf Revision Day 3 May 2023Document8 pagesPsaf Revision Day 3 May 2023Esther AkpanNo ratings yet

- Long-Lived Assets HandoutDocument13 pagesLong-Lived Assets HandoutCharudatta MundeNo ratings yet

- 2021 Summarised Financial Statement 1 Pager Final SignedDocument1 page2021 Summarised Financial Statement 1 Pager Final SignedFuaad DodooNo ratings yet

- Marsh MC Lennan 2021-79-83Document5 pagesMarsh MC Lennan 2021-79-83socialsim07No ratings yet

- Marsh MC Lennan 2021-79-83-1-4Document4 pagesMarsh MC Lennan 2021-79-83-1-4socialsim07No ratings yet

- Dell Financial Data Mid Course Quiz 1668627324062Document10 pagesDell Financial Data Mid Course Quiz 1668627324062rohit goyalNo ratings yet

- Magellan Financial Group Limited 2018 AGM Presentation: Brett Cairns - Executive ChairmanDocument8 pagesMagellan Financial Group Limited 2018 AGM Presentation: Brett Cairns - Executive Chairmanfrenz17No ratings yet

- Announcement of Annual Results For The Year Ended 30 September 2021 2021120601652Document23 pagesAnnouncement of Annual Results For The Year Ended 30 September 2021 2021120601652l chanNo ratings yet

- Consolidated Financial Highlights: - Amortized Cost: Investment SecuritiesDocument2 pagesConsolidated Financial Highlights: - Amortized Cost: Investment SecuritiesRimsha SiafNo ratings yet

- Financial Statements For The Financial Year 2022Document6 pagesFinancial Statements For The Financial Year 2022Clyton MusipaNo ratings yet

- Quarterly FS Sept 30, 2021-BoardDocument12 pagesQuarterly FS Sept 30, 2021-BoardkamrangulNo ratings yet

- 2017 Year End FinancialsDocument37 pages2017 Year End FinancialsFryan GreenhousegasNo ratings yet

- Financial Analysis Hewlett Packard Corporation 2007Document24 pagesFinancial Analysis Hewlett Packard Corporation 2007SAMNo ratings yet

- Consolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)Document2 pagesConsolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)Maanvee JaiswalNo ratings yet

- Unaudited - Quarterly - Result - Q4 - 2076-77 NIBLDocument23 pagesUnaudited - Quarterly - Result - Q4 - 2076-77 NIBLManish BhandariNo ratings yet

- Way Finders Brands Limited: Balance Sheet As at 31 March 2017Document2 pagesWay Finders Brands Limited: Balance Sheet As at 31 March 2017Shoaib ShaikhNo ratings yet

- The Boeing Company and Subsidiaries Consolidated Statements of Cash FlowsDocument1 pageThe Boeing Company and Subsidiaries Consolidated Statements of Cash Flowsdivineyang05No ratings yet

- PJSC Zakat Calculation - Fy2018Document1 pagePJSC Zakat Calculation - Fy2018Jameel KhanNo ratings yet

- AlMeezan AnnualReport2023 MSFDocument9 pagesAlMeezan AnnualReport2023 MSFmrordinaryNo ratings yet

- IMCC 31.12.2023 FS - FinalDocument77 pagesIMCC 31.12.2023 FS - FinalBrian ManyauNo ratings yet

- 2021-11 Financial Statement - LMS0729sDocument5 pages2021-11 Financial Statement - LMS0729salexgambrel0No ratings yet

- Afaa InsuranceDocument9 pagesAfaa InsuranceARAIB TAJINo ratings yet

- Enterprise GroupDocument8 pagesEnterprise GroupFuaad DodooNo ratings yet

- Samorita Hospital (Last 6 Month Financial Report)Document11 pagesSamorita Hospital (Last 6 Month Financial Report)Stalwart sheikhNo ratings yet

- Untitled 1Document7 pagesUntitled 1Shafeeq GigyaniNo ratings yet

- Trust CFDocument1 pageTrust CFShaira May Dela CruzNo ratings yet

- UntitledDocument288 pagesUntitledOlamide AjiboyeNo ratings yet

- Appendix PfizerDocument2 pagesAppendix PfizerelatobouloNo ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- Receipts and Payments AccountDocument2 pagesReceipts and Payments AccountUmapathi MNo ratings yet

- Group Limited Interim Condensed Consolidated Financial StatementsDocument21 pagesGroup Limited Interim Condensed Consolidated Financial StatementsАлексейNo ratings yet

- Consolidated Balance Sheet Metapower International, IncDocument12 pagesConsolidated Balance Sheet Metapower International, IncJha YaNo ratings yet

- Transportation Report Pfm4Document7 pagesTransportation Report Pfm4Lex Jeofrey SadsadNo ratings yet

- FY2009 Financial StatementsDocument21 pagesFY2009 Financial StatementsmontalvoartsNo ratings yet

- RHB Group Soci SofpDocument3 pagesRHB Group Soci SofpAnis SuhailaNo ratings yet

- H1 Consolidated FS 2023 FinalDocument21 pagesH1 Consolidated FS 2023 FinalHussein BoffuNo ratings yet

- 2 NGCI BalanceSheet 07032022 8Document2 pages2 NGCI BalanceSheet 07032022 8Hussna Al-Habsi حُسنى الحبسيNo ratings yet

- Annual-Report-FML-30-June-2020-23 Vol 2Document1 pageAnnual-Report-FML-30-June-2020-23 Vol 2Bluish FlameNo ratings yet

- Vitrox q42011Document10 pagesVitrox q42011Dennis AngNo ratings yet

- PSA-NAM App CGA SubDocument3 pagesPSA-NAM App CGA SubMuhammad TariqNo ratings yet

- Financial Statement SingerDocument13 pagesFinancial Statement SingerAnuja PasandulNo ratings yet

- Lapkeu TW II 2023 EngDocument21 pagesLapkeu TW II 2023 EngNur Arif Setya HendraNo ratings yet

- Nama: Ariyadi Kelas: Manajemen A NIM: B1021181029 Makul: Pengantar BisnisDocument2 pagesNama: Ariyadi Kelas: Manajemen A NIM: B1021181029 Makul: Pengantar BisnisariyadiNo ratings yet

- Managing County Assets and Liabilities in Kenya: Postdevolution Challenges and ResponsesFrom EverandManaging County Assets and Liabilities in Kenya: Postdevolution Challenges and ResponsesNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Delacruz, Jazka L.: Work ExperienceDocument1 pageDelacruz, Jazka L.: Work Experiencejerry dela cruzNo ratings yet

- T H Consulting Pty LTD - Trial BalanceDocument2 pagesT H Consulting Pty LTD - Trial Balancejerry dela cruzNo ratings yet

- Blue and Green Simple Teacher ResumeDocument1 pageBlue and Green Simple Teacher Resumejerry dela cruzNo ratings yet

- Be 20221018Document6 pagesBe 20221018jerry dela cruzNo ratings yet

- Fancy Phone Trust - Minutes - Corporate TrusteeDocument3 pagesFancy Phone Trust - Minutes - Corporate Trusteejerry dela cruzNo ratings yet

- Di Simone Plumbing Drainage - Disposal ScheduleDocument1 pageDi Simone Plumbing Drainage - Disposal Schedulejerry dela cruzNo ratings yet

- Di Simone Plumbing Drainage - Depreciation ScheduleDocument1 pageDi Simone Plumbing Drainage - Depreciation Schedulejerry dela cruzNo ratings yet

- Letter of Credit Bank Contracts Guarantees Trade Financing Export RefinanceDocument68 pagesLetter of Credit Bank Contracts Guarantees Trade Financing Export RefinanceMuhammad SaeedNo ratings yet

- Public RevenueDocument17 pagesPublic RevenueNamrata More100% (1)

- The Venus ProjectDocument27 pagesThe Venus Projectapi-252242159100% (1)

- Income Statement FormatDocument2 pagesIncome Statement FormatShruti MohanNo ratings yet

- Financial Markets and OperationsDocument27 pagesFinancial Markets and OperationsSakshi SharmaNo ratings yet

- Book 1Document10 pagesBook 1Gunjan ChoureNo ratings yet

- James Scott Credit ReportDocument26 pagesJames Scott Credit Reportjamess07100% (1)

- Week 4 IBTDocument12 pagesWeek 4 IBTThamuz LunoxNo ratings yet

- Mission of Pubali Bank LTDDocument8 pagesMission of Pubali Bank LTDTalha_Adil_3097No ratings yet

- MS-4 Dec 2012 PDFDocument4 pagesMS-4 Dec 2012 PDFAnonymous Uqrw8OwFWuNo ratings yet

- FundaTech 7Document111 pagesFundaTech 7Foru FormeNo ratings yet

- Merchant Banking Is A Combination of Banking and Consultancy ServicesDocument3 pagesMerchant Banking Is A Combination of Banking and Consultancy ServicessynayakNo ratings yet

- Pal VS CaDocument2 pagesPal VS CaJesa Formaran100% (1)

- Accounting For Banking Institutions PDFDocument45 pagesAccounting For Banking Institutions PDFNchendeh ChristianNo ratings yet

- Bahan Uas English Definisi WadiahDocument3 pagesBahan Uas English Definisi WadiahVarul EfandiNo ratings yet

- Brief Notes National Income and Related AggregatesDocument1 pageBrief Notes National Income and Related AggregatesKeshvi AggarwalNo ratings yet

- Complete POA SummaryDocument38 pagesComplete POA SummaryZara HazirahNo ratings yet

- Lock Box in SAP ARDocument4 pagesLock Box in SAP ARNaveen KumarNo ratings yet

- Fulton Iron Works v. ChinaBankDocument6 pagesFulton Iron Works v. ChinaBankmisterdodiNo ratings yet

- Invoice 1922Document1 pageInvoice 1922miroljubNo ratings yet

- Ch10 PPTDocument62 pagesCh10 PPTmuhammad Adeel0% (1)

- AAA Mock C - Answers S22Document26 pagesAAA Mock C - Answers S22AwaiZ zahidNo ratings yet

- CF MBA S23 Ch2 (B2) QsDocument6 pagesCF MBA S23 Ch2 (B2) QsWaris 3478-FBAS/BSCS/F16No ratings yet

- TAX May2021 1st Preboard Questions PDFDocument7 pagesTAX May2021 1st Preboard Questions PDFGoze, Cassandra Jane0% (1)

- Capital Market V/s Money MarketDocument23 pagesCapital Market V/s Money Marketsaurabh kumarNo ratings yet

- Ivrcl Indore Toll Ways NCLTDocument15 pagesIvrcl Indore Toll Ways NCLTveeruNo ratings yet

- 6EC02 01R Que 20140521 PDFDocument32 pages6EC02 01R Que 20140521 PDFJaneNo ratings yet

- The IPO of Saudi Aramco Some Fundamental Questions OIES Energy InsightDocument10 pagesThe IPO of Saudi Aramco Some Fundamental Questions OIES Energy InsightsamNo ratings yet

- Passbook ST MTDocument3 pagesPassbook ST MTRao Samarth0% (1)

- Econ 231, Chapter 15: GDP and National IncomeDocument8 pagesEcon 231, Chapter 15: GDP and National IncomeTienNo ratings yet