Professional Documents

Culture Documents

Consolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)

Uploaded by

Maanvee Jaiswal0 ratings0% found this document useful (0 votes)

6 views2 pagesOriginal Title

69 72

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesConsolidated Balance Sheet: December 31, 2022 2021 (In Millions, Except Per Share Data)

Uploaded by

Maanvee JaiswalCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

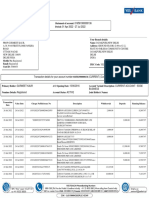

PART II

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Consolidated Balance Sheet

December 31,

2022 2021

(in millions, except per share data)

Assets

Current assets:

Cash and cash equivalents $ 7,008 $ 7,421

Restricted cash for litigation settlement 589 586

Investments 400 473

Accounts receivable 3,425 3,006

Settlement assets 1,270 1,319

Restricted security deposits held for customers 1,568 1,873

Prepaid expenses and other current assets 2,346 2,271

Total current assets 16,606 16,949

Property, equipment and right-of-use assets, net 2,006 1,907

Deferred income taxes 1,151 486

Goodwill 7,522 7,662

Other intangible assets, net 3,859 3,671

Other assets 7,580 6,994

Total Assets $ 38,724 $ 37,669

Liabilities, Redeemable Non-controlling Interests and Equity

Current liabilities:

Accounts payable $ 926 $ 738

Settlement obligations 1,111 913

Restricted security deposits held for customers 1,568 1,873

Accrued litigation 1,094 840

Accrued expenses 7,801 6,642

Short-term debt 274 792

Other current liabilities 1,397 1,364

Total current liabilities 14,171 13,162

Long-term debt 13,749 13,109

Deferred income taxes 393 395

Other liabilities 4,034 3,591

Total Liabilities 32,347 30,257

Commitments and Contingencies

Redeemable Non-controlling Interests 21 29

Stockholders’ Equity

Class A common stock, $0.0001 par value; authorized 3,000 shares, 1,399 and 1,397 shares

issued and 948 and 972 shares outstanding, respectively — —

Class B common stock, $0.0001 par value; authorized 1,200 shares, 8 shares issued and

outstanding — —

Additional paid-in-capital 5,298 5,061

Class A treasury stock, at cost, 451 and 425 shares, respectively (51,354) (42,588)

Retained earnings 53,607 45,648

Accumulated other comprehensive income (loss) (1,253) (809)

Mastercard Incorporated Stockholders' Equity 6,298 7,312

Non-controlling interests 58 71

Total Equity 6,356 7,383

Total Liabilities, Redeemable Non-controlling Interests and Equity $ 38,724 $ 37,669

The accompanying notes are an integral part of these consolidated financial statements.

MASTERCARD 2022 FORM 10-K 69

PART II

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Consolidated Statement of Cash Flows

For the Years Ended December 31,

2022 2021 2020

(in millions)

Operating Activities

Net income $ 9,930 $ 8,687 $ 6,411

Adjustments to reconcile net income to net cash provided by operating activities:

Amortization of customer and merchant incentives 1,586 1,371 1,072

Depreciation and amortization 750 726 580

(Gains) losses on equity investments, net 145 (645) (30)

Share-based compensation 295 273 254

Deferred income taxes (651) (69) 73

Other 44 36 14

Changes in operating assets and liabilities:

Accounts receivable (481) (397) (86)

Income taxes receivable 12 (87) (2)

Settlement assets 48 390 1,288

Prepaid expenses (2,175) (2,087) (1,552)

Accrued litigation and legal settlements 240 (1) (73)

Restricted security deposits held for customers (305) 177 326

Accounts payable 190 100 26

Settlement obligations 201 (568) (1,242)

Accrued expenses 1,188 1,355 (114)

Long-term taxes payable (121) (52) (37)

Net change in other assets and liabilities 299 254 316

Net cash provided by operating activities 11,195 9,463 7,224

Investing Activities

Purchases of investment securities available-for-sale (267) (389) (220)

Purchases of investments held-to-maturity (239) (294) (198)

Proceeds from sales of investment securities available-for-sale 54 83 361

Proceeds from maturities of investment securities available-for-sale 211 291 140

Proceeds from maturities of investments held-to-maturity 265 296 121

Purchases of property and equipment (442) (407) (339)

Capitalized software (655) (407) (369)

Purchases of equity investments (88) (228) (214)

Proceeds from sales of equity investments 7 186 —

Acquisition of businesses, net of cash acquired (313) (4,436) (989)

Settlement of interest rate derivative contracts — — (175)

Other investing activities (3) 33 3

Net cash used in investing activities (1,470) (5,272) (1,879)

Financing Activities

Purchases of treasury stock (8,753) (5,904) (4,473)

Dividends paid (1,903) (1,741) (1,605)

Proceeds from debt, net 1,123 2,024 3,959

Payment of debt (724) (650) —

Acquisition of redeemable non-controlling interests (4) — (49)

Acquisition of non-controlling interest — (133) —

Contingent consideration paid — (64) —

Tax withholdings related to share-based payments (141) (133) (150)

Cash proceeds from exercise of stock options 90 61 97

Other financing activities (16) (15) 69

Net cash used in financing activities (10,328) (6,555) (2,152)

Effect of exchange rate changes on cash, cash equivalents, restricted cash and restricted cash equivalents (103) (153) 257

Net increase (decrease) in cash, cash equivalents, restricted cash and restricted cash equivalents (706) (2,517) 3,450

Cash, cash equivalents, restricted cash and restricted cash equivalents - beginning of period 9,902 12,419 8,969

Cash, cash equivalents, restricted cash and restricted cash equivalents - end of period $ 9,196 $ 9,902 $ 12,419

The accompanying notes are an integral part of these consolidated financial statements.

72 MASTERCARD 2022 FORM 10-K

You might also like

- BS 2018Document1 pageBS 2018Maanvee JaiswalNo ratings yet

- Dell FY 2012 10 K Financial StatementsDocument4 pagesDell FY 2012 10 K Financial StatementsJuan Diego Vasquez BeraunNo ratings yet

- Appendix PfizerDocument2 pagesAppendix PfizerelatobouloNo ratings yet

- Pepsico Inc 2019 Annual ReportDocument1 pagePepsico Inc 2019 Annual ReportToodley DooNo ratings yet

- Financial Analysis Hewlett Packard Corporation 2007Document24 pagesFinancial Analysis Hewlett Packard Corporation 2007SAMNo ratings yet

- Tesla Balance Sheet AnalysisDocument10 pagesTesla Balance Sheet AnalysisAbhishek BatraNo ratings yet

- Nicole Irvin - ProjectDocument4 pagesNicole Irvin - Projectapi-581024555No ratings yet

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocument3 pagesAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303No ratings yet

- Kroger Financial Statement ExcerptsDocument9 pagesKroger Financial Statement ExcerptsAlexa WilcoxNo ratings yet

- Whirlpool Annual ReportDocument1 pageWhirlpool Annual ReportFakhre AlamNo ratings yet

- Balance SheetDocument25 pagesBalance SheetImran AhmedNo ratings yet

- 2022 Q4 Earnings Release (Ex-99.1) - Full Release Coca-ColaDocument1 page2022 Q4 Earnings Release (Ex-99.1) - Full Release Coca-ColakusshhalNo ratings yet

- DASH Q3 23 Earnings FinancialsDocument6 pagesDASH Q3 23 Earnings Financialsalpha.square.betaNo ratings yet

- Chapter 3 108-117Document10 pagesChapter 3 108-117Leony SantikaNo ratings yet

- Consolidated Balance Sheet As at June 30, 2021: AssetsDocument2 pagesConsolidated Balance Sheet As at June 30, 2021: Assetsshannia dcostaNo ratings yet

- Five Below 2018 Financial StatementsDocument4 pagesFive Below 2018 Financial StatementsElie GergesNo ratings yet

- Consolidated Balance Sheet: in Millions, Except Per Share Amounts, at December 31Document1 pageConsolidated Balance Sheet: in Millions, Except Per Share Amounts, at December 31Juan Jeronimo Marin ArevaloNo ratings yet

- Adani Ports & Special Economic Zone Ltd. (India) : SourceDocument9 pagesAdani Ports & Special Economic Zone Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Q1 2014 Financial ResultsDocument12 pagesQ1 2014 Financial ResultsJha YaNo ratings yet

- 2022 - Consolidated Financial StatementsDocument7 pages2022 - Consolidated Financial StatementscaarunjiNo ratings yet

- Zynga 2019 Annual Report - Excerpts - FinalDocument7 pagesZynga 2019 Annual Report - Excerpts - FinalAlexa WilcoxNo ratings yet

- KRR FS Q1 2023 15-May-2023Document19 pagesKRR FS Q1 2023 15-May-2023prenges prengesNo ratings yet

- 106 08 STLD Financial StatementsDocument3 pages106 08 STLD Financial StatementsRadit AdiNo ratings yet

- 3M - 2019 Annual Report ExcerptDocument7 pages3M - 2019 Annual Report ExcerptKumar AbhishekNo ratings yet

- Book 2Document3 pagesBook 2Tichaona NgomaNo ratings yet

- Unaudited Condensed Consolidated Financial ReportsDocument33 pagesUnaudited Condensed Consolidated Financial ReportsinforumdocsNo ratings yet

- Cosco Example PDFDocument4 pagesCosco Example PDFBeatrice BallabioNo ratings yet

- 2023 Half Year Balance SheetDocument2 pages2023 Half Year Balance SheetsrishtiladdhaNo ratings yet

- Marsh MC Lennan 2021-79-83Document5 pagesMarsh MC Lennan 2021-79-83socialsim07No ratings yet

- Marsh MC Lennan 2021-79-83-1-4Document4 pagesMarsh MC Lennan 2021-79-83-1-4socialsim07No ratings yet

- Ultratech Cement Ltd. (India) : SourceDocument6 pagesUltratech Cement Ltd. (India) : SourceDivyagarapatiNo ratings yet

- American Airlines Group IncDocument5 pagesAmerican Airlines Group IncMyka Mabs MagbanuaNo ratings yet

- 2014 AR Excel Financials For AR Web Site FINALDocument6 pages2014 AR Excel Financials For AR Web Site FINALPranjal SharmaNo ratings yet

- CHK_4Q_2023_FinancialsDocument10 pagesCHK_4Q_2023_FinancialsRanjan SaxenaNo ratings yet

- Consolidated Balance SheetsDocument3 pagesConsolidated Balance SheetsAninda RestikaNo ratings yet

- General Tyre Financial Statement AnalysisDocument29 pagesGeneral Tyre Financial Statement AnalysisasifNo ratings yet

- Samorita Hospital(Last 6 Month Financial Report)Document11 pagesSamorita Hospital(Last 6 Month Financial Report)Stalwart sheikhNo ratings yet

- Compilation of Raw Data - LBOBGDT Group 9Document165 pagesCompilation of Raw Data - LBOBGDT Group 9Romm SamsonNo ratings yet

- Sample 10KDocument29 pagesSample 10KabhishekNo ratings yet

- Financial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016Document5 pagesFinancial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016SSDNo ratings yet

- STAR FINANCIAL STATEMENTS REVENUE $62B NET INCOME $18.7BDocument38 pagesSTAR FINANCIAL STATEMENTS REVENUE $62B NET INCOME $18.7BAnnisa DewiNo ratings yet

- (In Millions, Except Par Values) Assets: The Kroger Co. C B SDocument1 page(In Millions, Except Par Values) Assets: The Kroger Co. C B ShashaamNo ratings yet

- Goodwill HandoutDocument14 pagesGoodwill HandoutCharudatta MundeNo ratings yet

- Bharat Petroleum Corporation Ltd. (India) : SourceDocument6 pagesBharat Petroleum Corporation Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Espresso Financial StatementsDocument38 pagesEspresso Financial StatementsAnwar AshrafNo ratings yet

- Financial Report 30 09 2019 ENDocument38 pagesFinancial Report 30 09 2019 ENVenture ConsultancyNo ratings yet

- Transportation Report Pfm4Document7 pagesTransportation Report Pfm4Lex Jeofrey SadsadNo ratings yet

- Review of Financial Statements: Professor Brian BusheeDocument13 pagesReview of Financial Statements: Professor Brian Busheeadan fadhilNo ratings yet

- Friendships Co. Financial Position StatementDocument3 pagesFriendships Co. Financial Position StatementMark James GarzonNo ratings yet

- DTCC Annual Financial Statements 2020 and 2019Document51 pagesDTCC Annual Financial Statements 2020 and 2019EvgeniyNo ratings yet

- Restatements of Bayer's Balance Sheet Due to PPA of MonsantoDocument8 pagesRestatements of Bayer's Balance Sheet Due to PPA of MonsantoAlvin LaquiNo ratings yet

- FA AssignmentDocument21 pagesFA AssignmentMuzammil khanNo ratings yet

- Particulars 2Document2 pagesParticulars 2AshwinNo ratings yet

- 2019 Cerner - Excerpts - FinalDocument10 pages2019 Cerner - Excerpts - FinalAlexa WilcoxNo ratings yet

- Divi's Laboratories Ltd. (India) : SourceDocument5 pagesDivi's Laboratories Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Garcia's Health Care Financial StatementsDocument3 pagesGarcia's Health Care Financial StatementsPamela PerezNo ratings yet

- FINC600 Week 4 DQ. Balance SheetDocument4 pagesFINC600 Week 4 DQ. Balance SheetashibhallauNo ratings yet

- UBA Ghana 2021 Q3 Financial StatementsDocument1 pageUBA Ghana 2021 Q3 Financial StatementsFuaad DodooNo ratings yet

- Accounting For Share CapitalDocument86 pagesAccounting For Share CapitalJPS JNo ratings yet

- 8 RTP Nov 21 1Document27 pages8 RTP Nov 21 1Bharath Krishna MVNo ratings yet

- Bfe 425 Assignment 3 2023Document3 pagesBfe 425 Assignment 3 2023Chikarakara LloydNo ratings yet

- Reading 17 Cost of Capital - Advanced Topics - AnswersDocument11 pagesReading 17 Cost of Capital - Advanced Topics - Answerstristan.riolsNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- CUET SQP Accountancy PaperDocument12 pagesCUET SQP Accountancy PaperShreyas BansalNo ratings yet

- ĐỀ THI NLKT - ĐỀ 3Document3 pagesĐỀ THI NLKT - ĐỀ 3Khánh LêNo ratings yet

- Walmart Inc. (WMT) Cash FlowDocument1 pageWalmart Inc. (WMT) Cash FlowinuNo ratings yet

- 04 Accounts Receivable - (PS)Document2 pages04 Accounts Receivable - (PS)kyle mandaresioNo ratings yet

- Lotus Bank Limited's Articles of IncorporationDocument9 pagesLotus Bank Limited's Articles of IncorporationSonam Peldon (Business) [Cohort2020 RTC]No ratings yet

- Ia Multiple ChoiceDocument3 pagesIa Multiple Choicecamilleescote562No ratings yet

- ALABANG PLUMBING IntroDocument1 pageALABANG PLUMBING IntroIsa NgNo ratings yet

- FINANCIAL REPORTING II ASSIGNMENTDocument7 pagesFINANCIAL REPORTING II ASSIGNMENTemeraldNo ratings yet

- Chapter 6 SOPL-SOFP-FormatDocument3 pagesChapter 6 SOPL-SOFP-FormatShowenah ThiruNo ratings yet

- Conceptual Framework Module 5Document3 pagesConceptual Framework Module 5Jaime LaronaNo ratings yet

- Business 6Document234 pagesBusiness 6dhanaraj patelNo ratings yet

- Consolidation (Annotated Part 1) PDFDocument6 pagesConsolidation (Annotated Part 1) PDFRaizah GaloNo ratings yet

- Financial Accounting and Reporting 1pngDocument19 pagesFinancial Accounting and Reporting 1pngJan Allyson BiagNo ratings yet

- Final 1111Document24 pagesFinal 1111COMPETITION PROJECTSNo ratings yet

- Shashank Black BookDocument40 pagesShashank Black Bookshashank PandeyNo ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetDocument24 pagesSafal Niveshak Stock Analysis Excel (Ver. 3.0) : How To Use This SpreadsheetVIGNESH RKNo ratings yet

- Materi Accounting AdvancedDocument12 pagesMateri Accounting AdvancedRianty AstaniaNo ratings yet

- 2021 Annual ReportDocument372 pages2021 Annual ReportfinanceconnoisseurngNo ratings yet

- Seatwork 2Document8 pagesSeatwork 2Nasiba M. AbdulcaderNo ratings yet

- Accounting+Worksheet+Mid-Term+2 2 PDFDocument3 pagesAccounting+Worksheet+Mid-Term+2 2 PDFالغيثيNo ratings yet

- Acct 101 CH 2Document15 pagesAcct 101 CH 2Nigussie BerhanuNo ratings yet

- ACC100.101 Analyzing Transactions - Practice QuestionsDocument7 pagesACC100.101 Analyzing Transactions - Practice QuestionsZACARIAS, Marc Nickson DG.No ratings yet

- Screenshot 2022-10-06 at 9.42.46 AMDocument20 pagesScreenshot 2022-10-06 at 9.42.46 AMUzer BagwanNo ratings yet

- PitchBook All Columns 2023 09 26 08 45 41Document61 pagesPitchBook All Columns 2023 09 26 08 45 41lilianasher2610No ratings yet

- Accounting Term 1 Revision Companies Financial StatementsDocument34 pagesAccounting Term 1 Revision Companies Financial StatementsRoseline SibekoNo ratings yet