Professional Documents

Culture Documents

CementosPacasmayoSAABVLCPACASC1 PublicCompany

Uploaded by

Mayra MarinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CementosPacasmayoSAABVLCPACASC1 PublicCompany

Uploaded by

Mayra MarinCopyright:

Available Formats

Cementos Pacasmayo S.A.A.

(BVL:CPACASC1)

S&P Issuer Credit Rating FC LT:

Construction Materials Employees: 1,698 Incorporated: 1949 in PE

BB+

Calle La Colonia 150

Cementos Pacasmayo S.A.A., a cement company, produces, distributes, and sells cement and cement-related materials in Peru.

UrbanizaciOn El Vivero

The company operates through three segments: Cement, Concrete and Precast; Quicklime; and Sales of Construction Supplies. It

Surco

produces cement for various uses, such as residential and commercial construction, and civil engineering; ready-mix concrete used in

Lima, Lima

construction sites; concrete precast, such as paving units or paver stones for pedestrian walkways, as well as other bricks for partition

Peru

walls and concrete precast for structural and non-structural uses; and cement-based products. The company also produces and

Phone: 511 317 6000

distributes quicklime for use in steel, food, fishing, chemical, mining, agriculture, and other industries. In...

www.cementospacasmayo.com.pe

Key Statistics

12 Months 12 Months 12 Months 12 Months 12 Months EPS Estimate (PEN)

Dec-31-2020A Dec-31-2021A Sep-30-2022A Dec-31-2022E Dec-31-2023E

Total Revenue 1,296.33 1,937.77 2,106.72 2,084.02 2,113.92

Growth Over Prior Year (6.9%) 49.5% 11.6% 7.5% 1.4%

Gross Profit Margin % 28.9% 28.9% 30.9% 30.8% 31.4%

EBITDA Margin % 23.9% 23.0% 24.0% 22.9% 23.9%

EBIT Margin % 13.6% 16.3% 17.8% 16.8% 17.6%

Net Income Margin % 4.5% 7.9% 9.0% 8.1% 8.5% Estimates

Diluted EPS Excl. Extra Items 0.14 0.36 0.44 0.35 0.38

Recommendation Outperform(2.20)

Diluted EPS Excl. Extra Items... (56.2%) 164.6% 27.1% (2.8%) 8.6%

Target Price 5.10167000

Revenue by Business and Geographic Segments (PEN, mm) Forward Multiples

FY2022 FY0

P/E 12.86x 11.84x

TEV/REV 1.56x 1.54x

TEV/EBITDA 6.83x 6.46x

P/BV 1.21x

Competitors - NTM TEV/Fwd EBITDA

* Segments with negative values, such as corporate eliminations, are excluded from the total and percentage

calculations and do not appear on the charts

Top Holders

Common Stock % of Total Shares Market Value

Holder

Equivalent Held Outstanding (PEN in mm)

Farragut Holdings Inc. 211,976,611 49.51 941.2

PRIMA AFP S.A. 42,286,500 9.88 187.8

Profuturo AFP S.A. 38,791,800 9.06 172.2 Capitalization

AFP Integra 25,217,100 5.89 112.0 Share Price as of Nov-07-2022 4.41

Brown Brothers Harriman & Co., Investment 14,423,080 3.37 64.0 Shares Out. 428.11

Arm

Holders as of Tuesday, November 08, 2022 Market Capitalization 1,885.37

- Cash & Short Term Investments 211.65

Market Data Share Price & Volume (PEN) + Total Debt 1,544.95

Last (Delayed) 4.50 Market Cap (mm) 1,923.5 + Pref. Equity -

Open 4.50 Shares Out. (mm) 428.1 + Total Minority Interest -

Previous Close 4.50 Float % 50.5% = Total Enterprise Value (TEV) 3,218.67

Change on Day 0.04 Shares Sold... - Impl.Shares Out -

Change % on Day 0.9% Dividend Yield % 9.5% Impl.Market Cap -

Day High/Low 4.50/4.50 Diluted EPS 0.44 Book Value of Common Equity 1,334.87

52 wk High/Low 5.50/3.54 Excl....

P/Diluted EPS... 10.17x + Pref. Equity -

Volume (mm) 0.00 Avg 3M Dly Vlm... 0.08 + Total Minority Interest -

Beta 5Y 0.40

Key Executives and Board Members

Hochschild Beeck, Chairman of the Board Events

Eduardo

Reynaldo Nadal Del... CEO & Director Date/Time Event

Morales Dasso, Jose... Vice Chairman of the Board Nov-16-2022 Ex-Div Date (Regular)

Ferreyros Peña, Manuel... VP of Administration & Finance and CFO Feb-10-2023 Estimated Earnings Release Date (S&P Global Derived)

Castillo, Hugo Villanueva Central Manager of Operations

Date Created: Nov-08-2022 Copyright © 2022 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved.

Historical Equity Pricing Data supplied by Interactive Data Pricing

and Reference Data LLCs

Credit Default Swaps data provided by ICE CMA

You might also like

- EmperadorIncPSEEMI PublicCompanyDocument1 pageEmperadorIncPSEEMI PublicCompanyLester FarewellNo ratings yet

- ShimanoIncTSE7309 PublicCompanyDocument1 pageShimanoIncTSE7309 PublicCompanyss xNo ratings yet

- AC Penetration Accross CountriesDocument21 pagesAC Penetration Accross Countrieshh.deepakNo ratings yet

- B D E (BDE) : LUE ART XpressDocument18 pagesB D E (BDE) : LUE ART XpresshemantNo ratings yet

- Blue Star LTD: Key Financial IndicatorsDocument4 pagesBlue Star LTD: Key Financial IndicatorsSaurav ShridharNo ratings yet

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadeNo ratings yet

- VA Tech Wabag-KotakDocument9 pagesVA Tech Wabag-KotakADNo ratings yet

- Vidrala SA (OTCPK:VDRFF) Vidrala SA (OTCPK:VDRFF) : CurrentDocument13 pagesVidrala SA (OTCPK:VDRFF) Vidrala SA (OTCPK:VDRFF) : CurrentcarminatNo ratings yet

- Cekd Ipo 20210914Document10 pagesCekd Ipo 20210914FazliJaafarNo ratings yet

- RoyalBankofCanadaTSXRY PublicCompanyDocument1 pageRoyalBankofCanadaTSXRY PublicCompanyGDoingThings YTNo ratings yet

- BAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTDocument1 pageBAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTVivek NambiarNo ratings yet

- S&P500 Complete List PDFDocument3,401 pagesS&P500 Complete List PDFMacera FelipeNo ratings yet

- BD FinanceDocument5 pagesBD Financesibgat ullahNo ratings yet

- UnionBankofthePhilippinesPSEUBP PublicCompanyDocument1 pageUnionBankofthePhilippinesPSEUBP PublicCompanyLester FarewellNo ratings yet

- ITC Analyst Meet Key TakeawaysDocument19 pagesITC Analyst Meet Key TakeawaysTatsam VipulNo ratings yet

- Airtel AnalysisDocument15 pagesAirtel AnalysisPriyanshi JainNo ratings yet

- UGRO19 Oct 21Document32 pagesUGRO19 Oct 21zhreniNo ratings yet

- LKP Moldtek 01feb08Document2 pagesLKP Moldtek 01feb08nillchopraNo ratings yet

- Quantamental Research - ITC LTDDocument1 pageQuantamental Research - ITC LTDsadaf hashmiNo ratings yet

- Datasonic Trading Buy Maintained on Recovery HopesDocument4 pagesDatasonic Trading Buy Maintained on Recovery HopesGiddy YupNo ratings yet

- Semen Indonesia Persero TBK PT: at A GlanceDocument3 pagesSemen Indonesia Persero TBK PT: at A GlanceRendy SentosaNo ratings yet

- Singapore Exchange Limited: Firing On All CylindersDocument6 pagesSingapore Exchange Limited: Firing On All CylindersCalebNo ratings yet

- Dolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Document6 pagesDolat Capital Market - Vinati Organics - Q2FY20 Result Update - 1Bhaveek OstwalNo ratings yet

- PVR Q3FY18 - Result Update - Axis Direct - 06022018 - 06-02-2018 - 14Document6 pagesPVR Q3FY18 - Result Update - Axis Direct - 06022018 - 06-02-2018 - 14Shubham siddhpuriaNo ratings yet

- India - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadDocument13 pagesIndia - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadVrajesh ChitaliaNo ratings yet

- Avenue - Super Dolat 211020 PDFDocument10 pagesAvenue - Super Dolat 211020 PDFnani reddyNo ratings yet

- VS Industry Berhad: FY10 Core Net Profit Grew 197.6% YoY - 30/09/2010Document3 pagesVS Industry Berhad: FY10 Core Net Profit Grew 197.6% YoY - 30/09/2010Rhb InvestNo ratings yet

- Foodothe 20090319Document12 pagesFoodothe 20090319nareshsbcNo ratings yet

- Adi Sarana Armada: Anteraja's Collaboration With Grab and GojekDocument7 pagesAdi Sarana Armada: Anteraja's Collaboration With Grab and Gojekbobby prayogoNo ratings yet

- Deepak Fertilizers and ChemicalsDocument17 pagesDeepak Fertilizers and ChemicalsnakilNo ratings yet

- Balkrishna Industries Investor PresentationDocument34 pagesBalkrishna Industries Investor PresentationAnand SNo ratings yet

- GuruFocus Report 0P000002ACDocument16 pagesGuruFocus Report 0P000002ACsilva.mathew29No ratings yet

- Bhel-3qfy11 Ru-210111Document12 pagesBhel-3qfy11 Ru-210111kshintlNo ratings yet

- Axiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Document5 pagesAxiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Rhb InvestNo ratings yet

- Jamna Auto Jamna Auto: India I EquitiesDocument16 pagesJamna Auto Jamna Auto: India I Equitiesrishab agarwalNo ratings yet

- CB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Document3 pagesCB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Rhb InvestNo ratings yet

- Notion Vtec Berhad: Worse Than Feared - 06/08/2010Document3 pagesNotion Vtec Berhad: Worse Than Feared - 06/08/2010Rhb InvestNo ratings yet

- JBM Auto (Q2FY21 Result Update)Document7 pagesJBM Auto (Q2FY21 Result Update)krippuNo ratings yet

- Pidilite Industries: ReduceDocument9 pagesPidilite Industries: ReduceIS group 7No ratings yet

- Homepage: o o o o o o o o o o o o o o o oDocument5 pagesHomepage: o o o o o o o o o o o o o o o oReynel BringasNo ratings yet

- BKT InvestorPresentation March2020Document34 pagesBKT InvestorPresentation March2020Rina JageNo ratings yet

- APM Automotive Holdings Berhad: Riding On Motor Sector's Growth Cycle - 29/7/2010Document7 pagesAPM Automotive Holdings Berhad: Riding On Motor Sector's Growth Cycle - 29/7/2010Rhb InvestNo ratings yet

- Balkrishna Industries LTD: Investor Presentation February 2020Document30 pagesBalkrishna Industries LTD: Investor Presentation February 2020PIBM MBA-FINANCENo ratings yet

- Dipawali ReportDocument16 pagesDipawali ReportKeval ShahNo ratings yet

- Uol Group Fy2020 Results 26 FEBRUARY 2021Document33 pagesUol Group Fy2020 Results 26 FEBRUARY 2021Pat KwekNo ratings yet

- 29 Apr 03 INCODocument8 pages29 Apr 03 INCOpd98004No ratings yet

- Enil 25 8 08 PLDocument12 pagesEnil 25 8 08 PLapi-3862995No ratings yet

- BDOLeasingandFinanceIncPSEBLFI PublicCompanyDocument1 pageBDOLeasingandFinanceIncPSEBLFI PublicCompanyLester FarewellNo ratings yet

- MOIL 07feb20 Kotak PCG 00210 PDFDocument6 pagesMOIL 07feb20 Kotak PCG 00210 PDFdarshanmadeNo ratings yet

- AboitizEquityVenturesIncPSEAEV_PublicCompanyDocument1 pageAboitizEquityVenturesIncPSEAEV_PublicCompanyKaranNo ratings yet

- Astral delivers 73% revenue growth, 332% PBT growth in Q1Document5 pagesAstral delivers 73% revenue growth, 332% PBT growth in Q1Namrata ShahNo ratings yet

- Repco Home Finance Ltd. (Repco) : Background Stock Performance DetailsDocument7 pagesRepco Home Finance Ltd. (Repco) : Background Stock Performance DetailstsrupenNo ratings yet

- Zomato IPO NoteDocument9 pagesZomato IPO NoteCrest WolfNo ratings yet

- Bajaj Auto Project TestDocument61 pagesBajaj Auto Project TestSauhard Sachan0% (1)

- Bharat Forge: Performance HighlightsDocument13 pagesBharat Forge: Performance HighlightsarikuldeepNo ratings yet

- Equity Note - Aftab Automobiles Limited - March 2017Document2 pagesEquity Note - Aftab Automobiles Limited - March 2017Sarwar IqbalNo ratings yet

- enDocument65 pagesenYassine Alami TahiriNo ratings yet

- Hero-MotoCorp - Annual ReportDocument40 pagesHero-MotoCorp - Annual ReportAdarsh DhakaNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- RPC 2 Page 21 CasesDocument49 pagesRPC 2 Page 21 CasesCarlo Paul Castro SanaNo ratings yet

- General TermsDocument8 pagesGeneral TermsSyahmi GhazaliNo ratings yet

- Things Fall Apart Reading GuideDocument8 pagesThings Fall Apart Reading GuideJordan GriffinNo ratings yet

- An Interview With Composer Shahrokh YadegariDocument2 pagesAn Interview With Composer Shahrokh YadegarimagnesmuseumNo ratings yet

- Aurengzeb The Throne or The GraveDocument10 pagesAurengzeb The Throne or The GravevstrohmeNo ratings yet

- Acca Timetable June 2024Document13 pagesAcca Timetable June 2024Anish SinghNo ratings yet

- MandwaDocument4 pagesMandwaMadhu KumarNo ratings yet

- Summary Report Family Code of The Pihilippines E.O. 209Document41 pagesSummary Report Family Code of The Pihilippines E.O. 209Cejay Deleon100% (3)

- Moulana Innamul Hasan SabDocument6 pagesMoulana Innamul Hasan SabsyedNo ratings yet

- Novartis Hyderabad: Job Application FormDocument5 pagesNovartis Hyderabad: Job Application FormjustindianNo ratings yet

- Labor dispute and illegal dismissal caseDocument5 pagesLabor dispute and illegal dismissal caseRene ValentosNo ratings yet

- Lease and HPDocument27 pagesLease and HPpreetimaurya100% (1)

- Yongqiang - Dealing With Non-Market Stakeholders in The International MarketDocument15 pagesYongqiang - Dealing With Non-Market Stakeholders in The International Marketisabelle100% (1)

- Punjab National Bank Punjab National Bank Punjab National BankDocument1 pagePunjab National Bank Punjab National Bank Punjab National BankHarsh ChaudharyNo ratings yet

- Income Tax Appeals: Taxpayers Facilitation GuideDocument18 pagesIncome Tax Appeals: Taxpayers Facilitation GuideAqeel ZahidNo ratings yet

- A Disaster Recovery Plan PDFDocument12 pagesA Disaster Recovery Plan PDFtekebaNo ratings yet

- INDIAN WAR OF INDEPENDENCE 1857 - ORIGINAL PUBLISHERs NoteDocument19 pagesINDIAN WAR OF INDEPENDENCE 1857 - ORIGINAL PUBLISHERs NoteBISWAJIT MOHANTYNo ratings yet

- Nord Pool - The Nordic Power MarketDocument30 pagesNord Pool - The Nordic Power MarketVanádio Yakovlev FaindaNo ratings yet

- G47.591 Musical Instrument Retailers in The UK Industry Report PDFDocument32 pagesG47.591 Musical Instrument Retailers in The UK Industry Report PDFSam AikNo ratings yet

- Rimi Khanuja Vs S P Mehra Ors On 24 August 2022Document4 pagesRimi Khanuja Vs S P Mehra Ors On 24 August 2022Prakhar SinghNo ratings yet

- SY 2020-2021 Region IV-A (Visually Impairment)Document67 pagesSY 2020-2021 Region IV-A (Visually Impairment)Kristian Erick BautistaNo ratings yet

- CHAPTER 2 AnalysisDocument7 pagesCHAPTER 2 AnalysisJv Seberias100% (1)

- KEILMUAN DAN SENI DALM KEBIDANANDocument18 pagesKEILMUAN DAN SENI DALM KEBIDANANRizky Putri AndriantiNo ratings yet

- Brainy kl8 Short Tests Unit 5 Lesson 5Document1 pageBrainy kl8 Short Tests Unit 5 Lesson 5wb4sqbrnd2No ratings yet

- The Illumined Man Knows Worldly Enjoyment Is UnrealDocument4 pagesThe Illumined Man Knows Worldly Enjoyment Is UnrealMadhulika Vishwanathan100% (1)

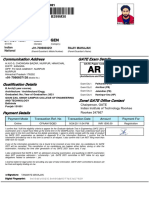

- 24 Nov 1997 Male GEN: Communication Address GATE Exam DetailsDocument1 page24 Nov 1997 Male GEN: Communication Address GATE Exam DetailsAr Tanmaye MahajanNo ratings yet

- Multi Q!Document112 pagesMulti Q!collinmandersonNo ratings yet

- The Pretense of Knowledge (Hayek 1973)Document5 pagesThe Pretense of Knowledge (Hayek 1973)Adnan KhanNo ratings yet

- Sentinel Boom: Ensuring An Effective Solution To Your Oil Spill Requirements!Document2 pagesSentinel Boom: Ensuring An Effective Solution To Your Oil Spill Requirements!Adrian GomezNo ratings yet

- Unit 4 - CSDocument32 pagesUnit 4 - CSyuydokostaNo ratings yet