Professional Documents

Culture Documents

Strong Q2 for Macrotech Developers despite lag in deleveraging

Uploaded by

Kdp03Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strong Q2 for Macrotech Developers despite lag in deleveraging

Uploaded by

Kdp03Copyright:

Available Formats

Viewpoint

Macrotech Developers Ltd

Strong Q2 barring deleveraging & repatriation

Powered by the Sharekhan 3R Research Philosophy Real Estate Sharekhan code: LODHA

3R MATRIX + = -

Reco/View: Positive CMP: Rs. 993 Upside potential: 36-38%

Company Update

Right Sector (RS) ü á Upgrade Maintain â Downgrade

Right Quality (RQ) ü Summary

Lodha continued to report strong pre-sales booking of Rs. 3148 crores for Q2FY2023, up 57% y-o-y

Right Valuation (RV) ü in a seasonally weak period. H1 pre-sales were up 101% y-o-y at Rs. 5962 crore, which is 52% of its

FY2023 target.

+ Positive = Neutral – Negative

The new project additions remained strong with GDV addition of Rs. 3100 crore for Q1FY2023 taking

GDV additions to Rs. 9300 crore for H1FY2023, which is 62% of its FY2023 target.

Net debt reduction was marginal at Rs. 60 crore for Q2. It would need Rs. 2800 crore reduction in H2

What has changed in 3R MATRIX to achieve Rs. 6000 crore net debt by FY2023 end. Repatriation of UK projects were muted although

obligations get paid up ahead of schedule.

Old New We stay positive on Macrotech Developers and expect a 36-38% upside given strong growth levers

for its residential portfolio and favourable risk-reward ratio.

RS

Macrotech Developers (Lodha) reported strong pre-sales of Rs. 3148 crore (up 57% y-o-y, up 12% q-o-q)

RQ for Q2FY2023. The H1FY2023 pre-sales stood at Rs. 5962 crore (up 101% y-o-y) which is 52% of its

pre-sales target of Rs. 11500 crore for FY2023. Strong pre-sales booking for Q2FY2023 was despite

RV the period being seasonally weak due to monsoon and an inauspicious period (Pitrupaksh/Shraadh).

Hence, collections were lower by 9% q-o-q at Rs. 2375 crore. The new project additions continued with

GDV addition of Rs. 3100 crore during Q2FY2023 taking GDV additions of Rs. 9300 crore for H1FY2023

(62% of full year guidance of Rs. 15000 crore. However, it lagged in terms of net debt reduction, which

was just Rs. 60 crore to Rs. 8796 crore. Consequently, it would need to reduce almost Rs. 2800 crore

Company details net debt reduction during H2FY2023. The repatriation of money from UK investments were just Rs. 100

crore during Q2FY2023 due to the weak UK economic environment. However, the company maintained

Market cap: Rs. 47,820 cr additional repatriation of Rs. 1000 crore in CY2023.

Pre-sales booking remained strong despite a seasonally weak quarter: The company continued its

52-week high/low: Rs. 1,539/815 strong performance in terms of pre-sales for Q2FY2023 with Rs. 3148 crore (up 57%/12% y-o-y/q-o-q)

pre-sales recorded during Q2FY2023. The strong pre-sales booking during Q2FY2023 was despite

NSE volume:

4.5 lakh it being a seasonally weak quarter of the year due to monsoon and inauspicious period (Pitrupaksh/

(No of shares) Shraadh). Further, rising home loan rates and increase in sales prices have not affected the underlying

housing demand for the company as underscored by its pre-sales booking for H1FY2023 (Rs. 5962

BSE code: 543287 crore, up 101% y-o-y). Hence, it has been able to achieve 52% of its yearly guidance of Rs. 11500 crore

during H1FY2023, which tends to be ~40-45% of full-year sales. However, collections during Q2FY2023

NSE code: LODHA

were lower by 9% q-o-q (up 24% y-o-y) at Rs. 2375 crore affected by seasonality.

Free float: New project additions continued: The company added four new projects having ~2.2msf of the

8.6 cr saleable area with GDV of ~Rs. 3100 crore across various micro-markets of MMR and Pune. The same

(No of shares)

leads to addition of seven new project additions having ~7.3msf of the saleable area with GDV of ~Rs.

9300 crore during H1FY2023. Consequently, it achieved 62% of its full-year guidance of Rs. 15000

crore of GDV addition for FY2023.

Net debt reduction and London repatriations lagged: In its UK investments, the company pre-paid

Shareholding (%) a balance $ 55mn in September 2022, fully repaying $225mn bonds six months ahead of schedule.

Consequently, there is no further obligation on Lodha’s balance sheet with respect to the London

Promoters 82.2 investments. The company repatriated ~Rs. 100 crore from UK to India during Q2FY2023 and expects

additional repatriation of ~Rs. 1000 crore in CY2023. The company was able to reduce its net debt

FII 14.5 marginally by Rs. 60 crore q-o-q to Rs. 8796 crore. It would have to pare net debt by almost Rs. 2800

crore during H2FY2023 in order to achieve its net debt target of Rs. 6000 crore by FY2023 end.

DII 1.9

Our Call

Others 1.4 Valuation – Stay Positive; expect 36-38% upside: Macrotech continues to be on track on achieving its

pre-sales and new project additions targets for FY2023 despite the continued rise in home loan rates and

increase in property prices. Further, the recent media articles suggest towards possibility of stamp duty

reduction on Property by the Maharashtra government which if implemented can provide a strong fillip

to pre-sales booking going ahead. However, repatriation of London investments and net debt reduction

Price chart need to be keenly monitored over the next one to two years. Additionally, rising home loan rates remain

a key headwind for the sector. Lodha’s leadership positioning in the Mumbai Metropolitan Region (MMR)

1,600

and an eye on newer geographies such as Pune and Bengaluru provide a distinct advantage in the sector.

1,400 Lodha has underperformed its listed peers providing a favourable risk-reward ratio to investors. Hence,

we retain a positive view of the stock and expect a potential upside of 36-38%.

1,200 Key Risks

1,000 Slowdown in real estate demand especially in MMR and Pune is a key risk to our call. Unfavorable macro-

economic indicators like a rise in interest rates can dampen demand.

800

Valuation (Consolidated) Rs cr

Oct-21

Oct-22

Jun-22

Feb-22

Particulars FY21 FY22 FY23E FY24E

Revenue 5449 9233 10356 12407

OPM (%) 25.2 23.0 23.0 24.0

Adjusted PAT 503 1202 1603 2163

Price performance % YoY growth -30.9 139.1 33.3 34.9

(%) 1m 3m 6m 12m Adjusted EPS (Rs.) 10.4 25.0 33.3 44.9

P/E (x) 95.1 39.8 29.8 22.1

Absolute -10.4 -10.1 -14.7 -11.6 P/B (x) 9.6 3.8 3.4 2.9

Relative to EV/EBITDA (x) 42.3 27.3 24.4 19.5

-9.1 -17.6 -13.4 -9.2

Sensex RoNW (%) 11.0 14.4 12.4 14.6

Sharekhan Research, Bloomberg RoCE (%) 5.9 8.1 8.6 11.1

Source: Company; Sharekhan estimates

October 06, 2022 1

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

Strong pre-sales in seasonally weak Q2

The company continued its strong performance in terms of pre-sales for Q2FY2023 with Rs. 3148 crore pre-

sales recorded during Q2FY2023, which was up 57% y-o-y and 12% q-o-q. Its H1FY2023 sales stood at Rs. 5962

crore, which was up 101% y-o-y. The company was able to achieve strong pre-sales booking during Q2FY2023

despite it being a seasonally weak quarter of the year due to monsoon and inauspicious period (Pitrupaksh/

Shraadh). Further, rising home loan rates and increase in sales prices have not affected the underlying housing

demand for the company as underscored by its pre-sales booking for H1FY2023. Hence, it has been able to

achieve 52% of its yearly guidance of Rs. 11500 crore during H1FY2023, which tends to be ~40-45% of full-

year sales. However, collections during Q2FY2023 were lower by 9% q-o-q (up 24% y-o-y) at Rs. 2375 crore.

The sequential dip in collections is attributable to seasonal factors such as lower construction activity during

monsoon and deferral of registrations during the 15-day inauspicious period (Pitrupaksh/Shraadh).

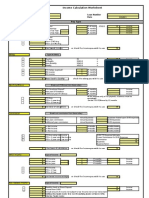

Pre-sales quarterly trend Quarterly trend in collections

4,000 3,000 2,843

3,456 2,616

3,500 3,148 2,375

2,500

2,814 2,089 2,127

3,000 2,608

2,531 1,912

2,000 1,714

2,500

2,003 1,472

1,862

2,000 1,500

1,107

1,500 1,066 957 1,000

1,000

509 384

500

500

0 0

Q1FY21

Q2FY21

Q3FY21

Q4FY21

Q1FY22

Q2FY22

Q3FY22

Q4FY22

Q1FY23

Q2FY23

Q1FY21

Q2FY21

Q3FY21

Q4FY21

Q1FY22

Q2FY22

Q3FY22

Q4FY22

Q1FY23

Q2FY23

Pre-Sales (Rs cr) Collections (R s cr)

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

Strong BD additions; net debt marginally down

The company added four new projects having ~2.2msf of saleable area with GDV of ~Rs. 3100 crore across

various micro-markets of MMR and Pune. The same leads to addition of seven new project additions having

~7.3msf of saleable area with GDV of ~Rs. 9300 crore during H1FY2023. Consequently, it achieved 62% of

its full year guidance of Rs. 15000 crore of GDV addition for FY2023. In its UK investments, the company

pre-paid balance $ 55mn in September 2022, fully repaying $225mn bonds six months ahead of schedule.

Consequently, there is no further obligation on Lodha’s balance sheet with respect to the London investments.

The company repatriated ~Rs. 100 crore from UK to India during Q2FY2023 and expects additional repatriation

of ~Rs. 1000 crore in CY2023. The company was able to reduce its net debt marginally by Rs. 60 crore q-o-q

to Rs. 8796 crore. It would have to pare net debt by almost Rs. 2800 crore during H2FY2023 in order to

achieve its net debt target of Rs. 6000 crore by FY2023 end.

India Net Debt Quarterly trend

18,000 16,625 16,075

15,000

12,435 12,477

12,000 9,896 9,310 8,856 8,796

9,000

6,000

3,000

0

Q3FY21 Q4FY21 Q1FY22 Q2FY22 Q3FY22 Q4FY22 Q1FY23 Q2FY23

India net debt (Rs cr)

Source: Company, Sharekhan Research

October 06, 2022 2

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

Financials in charts

Sales Trend Gross collections Trend

10,000 8.00 9.0 10,000 9,065

7.40 8,564 8,597

8.0 8,190

8,000 6.37 6.18 7.0 8,000

5.10 6.0

6,000 6,000

5.0 5,052

4.0

4,000 4,000

3.0

2,000 2.0

2,000

8,130

7,163

6,570

5,968

9,024

1.0

0 0.0 0

FY18 FY19 FY20 FY21 FY22 FY18 FY19 FY20 FY21 FY22

Sales (Rs cr) Sales (msf) Gross coll ections (Rs cr)

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

Completion Trend Revenue Trend

18 14,000

15.65 12,443 12,407

15 13.75 12,000

10,356

10,000 9,233

12

8,000

9

5,449

6.39 6,000

5.30

6

4,000

2.70

3 2,000

0 0

FY18 FY19 FY20 FY21 FY22 FY20 FY21 FY22 FY23E FY24E

Completed Developabl e Area (msf) Revenues (Rs cr)

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

OPM Trend Net Profit Trend

30 2,500

25.18 2,163

24.00

25 23.01 23.00

2,000

1,603

20

15.33 1,500

1,202

15

1,000

727

10

503

500

5

0 0

FY20 FY21 FY22 FY23E FY24E FY20 FY21 FY22 FY23E FY24E

OPM (%) Adjusted PAT (Rs cr)

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

October 06, 2022 3

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

Outlook and Valuation

n Sector View – Residential market on a growth trajectory

The real estate sector, especially the residential realty market, is expected to be in the limelight going ahead,

as it benefits from central and state governments’ favourable policies pertaining to the affordable housing

segment. Rising income levels and affordability levels are expected to drive sales for quality, organised

developers. Further, organised players are expected to benefit from ample inorganic opportunities in the

sector, which is leading to consolidation in the sector. The sector is also expected to benefit from low interest

rates, which provides the twin benefits in driving demand and lower funding costs. Overall, we are positive on

the residential segment of the real estate market for the reasons mentioned above.

n Company Outlook – Reaping benefits of scale as industry consolidates

Macrotech Developers (Lodha) has outpaced peers in terms of sales from FY2014 to FY2021 positioning itself in

the league of large residential property developers. The company has also been the second-largest in terms

of deliveries, showcasing strong execution capabilities on a larger scale. The company enjoys leadership

positioning in the lucrative MMR market. The management retained pre-sales guidance of Rs. 11,500 crore for

FY2023, a growth of 25% y-o-y. For sale projects would contribute Rs. 10,500 crore and a balance Rs. 1000

crore from sale of non-core assets, digital infrastructure etc. Net debt is expected to tread below Rs. 6000 crore

in FY2023 from Rs. 9300 crore in FY2022. The JDA target is Rs. 15,000 crores for FY2023. Over 3-5 years, it is

targeting pre-sales growth of 20% p.a. It targets debt to be not more than one-year operating cash flows.

n Valuation – Retain Positive view and upside potential of 36-38%

Macrotech continues to be on track on achieving its pre-sales and new project additions targets for FY2023

despite the continued rise in home loan rates and increase in property prices. Further, the recent media articles

suggest towards possibility of stamp duty reduction on Property by the Maharashtra government which if

implemented can provide a strong fillip to pre-sales booking going ahead. However, repatriation of London

investments and net debt reduction need to be keenly monitored over the next one to two years. Additionally,

rising home loan rates remain a key headwind for the sector. Lodha’s leadership positioning in the Mumbai

Metropolitan Region (MMR) and an eye on newer geographies such as Pune and Bengaluru provide a distinct

advantage in the sector. Lodha has underperformed its listed peers providing favourable risk-reward ratios to

investors. Hence, we retain a positive view of the stock and expect a potential upside of 36-38%.

Peer Comparison

P/E (x) EV/EBITDA (x) P/BV (x) RoE (%)

Particulars

FY23E FY24E FY23E FY24E FY23E FY24E FY23E FY24E

Macrotech Developers 29.8 22.1 24.4 19.5 3.4 2.9 12.4 14.6

Oberoi Realty 28.1 17.7 20.4 13.1 2.9 2.5 11.1 15.6

DLF 47.5 42.6 39.7 35.1 2.4 2.3 5.2 5.5

Prestige Estates 41.0 33.5 11.8 10.4 2.0 1.9 4.9 5.8

Source: Sharekhan Research

October 06, 2022 4

Viewpoint

Powered by the Sharekhan

3R Research Philosophy

About company

Lodha Group is among the largest real estate developer in India that delivers with scale since 1980s. The core

business of Lodha Group is residential real estate development with a focus on affordable and mid-income

housing. The group also has a growing industrial & logistics park business. Lodha Group has delivered more

than 81 million square feet of real estate and is currently developing ~93 million square feet under its ongoing

and planned portfolio. The Group has more than 4,400 acres of land beyond its ongoing and planned portfolio

which will be utilized in developing further Residential, Commercial and Industrial & Logistics spaces.

Investment theme

Lodha enjoys leadership positioning in the lucrative MMR region which has been recently showing strong

traction in residential sales which are expected to sustain going ahead. The industry consolidation is expected

to benefit the company owing to its scale of operations. The company is one of the leading players in both

sales and deliveries highlighting its in-house capabilities. The company’s large land reserves provide long-

term sustainable growth visibility. The company’s balance sheet is expected to improve materially led by

strong cashflows expected from residential projects.

Key Risks

A slowdown in the macro-economic environment percolating to the real estate sector slowdown.

A delay in execution, inability to maintain sales, rising interest rates, and rising commodity prices.

Additional Data

Key management personnel

Mr. Mukund Chitale Independent Director and Chairman

Mr. Abhishek Lodha Managing Director and CEO

Mr. Sushil Kumar Modi Chief Financial Officer

Source: Company Website

Top 10 shareholders

Sr. No. Holder Name Holding (%)

1 Sambhavnath Infrabuild 30.56

2 Sambhavnath trust 28.74

3 Hightown Cons Pvt 24.50

4 Homecraft Dev N Farms 4.70

5 Ivanhoe Op India Inc 1.57

6 Capital Group Cos Inc 0.65

7 Nippon Life India AMC 0.42

8 Nomura Holdings Inc 0.17

9 LivfoersaekringsABet Skandia Publ 0.10

10 Manulife Financial Corp 0.10

Source: Bloomberg

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

October 06, 2022 5

Understanding the Sharekhan 3R Matrix

Right Sector

Positive Strong industry fundamentals (favorable demand-supply scenario, consistent

industry growth), increasing investments, higher entry barrier, and favorable

government policies

Neutral Stagnancy in the industry growth due to macro factors and lower incremental

investments by Government/private companies

Negative Unable to recover from low in the stable economic environment, adverse

government policies affecting the business fundamentals and global challenges

(currency headwinds and unfavorable policies implemented by global industrial

institutions) and any significant increase in commodity prices affecting profitability.

Right Quality

Positive Sector leader, Strong management bandwidth, Strong financial track-record,

Healthy Balance sheet/cash flows, differentiated product/service portfolio and

Good corporate governance.

Neutral Macro slowdown affecting near term growth profile, Untoward events such as

natural calamities resulting in near term uncertainty, Company specific events

such as factory shutdown, lack of positive triggers/events in near term, raw

material price movement turning unfavourable

Negative Weakening growth trend led by led by external/internal factors, reshuffling of

key management personal, questionable corporate governance, high commodity

prices/weak realisation environment resulting in margin pressure and detoriating

balance sheet

Right Valuation

Positive Strong earnings growth expectation and improving return ratios but valuations

are trading at discount to industry leaders/historical average multiples, Expansion

in valuation multiple due to expected outperformance amongst its peers and

Industry up-cycle with conducive business environment.

Neutral Trading at par to historical valuations and having limited scope of expansion in

valuation multiples.

Negative Trading at premium valuations but earnings outlook are weak; Emergence of

roadblocks such as corporate governance issue, adverse government policies

and bleak global macro environment etc warranting for lower than historical

valuation multiple.

Source: Sharekhan Research

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he or its associates

or his relatives has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of

the company at the end of the month immediately preceding the date of publication of the research report nor have any material

conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company. Further, the

analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and no part

of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this

document. Sharekhan Limited or its associates or analysts have not received any compensation for investment banking, merchant

banking, brokerage services or any compensation or other benefits from the subject company or from third party in the past twelve

months in connection with the research report.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Ms. Binkle Oza; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar (West), Mumbai – 400 028,

Maharashtra, INDIA, Tel: 022 - 67502000/ Fax: 022 - 24327343. Sharekhan Ltd.: SEBI Regn. Nos.: BSE / NSE / MSEI (CASH /

F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786; Mutual Fund: ARN 20669;

Research Analyst: INH000006183.

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- Financial Reporting and Analysis Using Financial Accounting Information 13th Edition Ebook PDFDocument41 pagesFinancial Reporting and Analysis Using Financial Accounting Information 13th Edition Ebook PDFdon.anderson433100% (36)

- Regulatory Affairs Professionals GuideDocument14 pagesRegulatory Affairs Professionals GuideKdp03100% (4)

- HDFC Bank - BaseDocument613 pagesHDFC Bank - BasebysqqqdxNo ratings yet

- Income Calculation WorksheetDocument1 pageIncome Calculation Worksheetrush2serveNo ratings yet

- Prestige Estates - Initiating coverage-Oct-23-NUVAMADocument54 pagesPrestige Estates - Initiating coverage-Oct-23-NUVAMAalfaresearch1No ratings yet

- Ihg 2019ar PDFDocument257 pagesIhg 2019ar PDFJardan TatianaNo ratings yet

- Tax Deduction vs Credit for Senior DiscountsDocument7 pagesTax Deduction vs Credit for Senior DiscountsPatricia Bautista0% (1)

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Johnston Processors AdaptedDocument6 pagesJohnston Processors AdaptedVinayNo ratings yet

- Investoreye - 2022-10-07T052922.838Document9 pagesInvestoreye - 2022-10-07T052922.838Harry AndersonNo ratings yet

- Gati Q1 Result UpdateDocument7 pagesGati Q1 Result UpdateAryan SharmaNo ratings yet

- PNC - Infra Q1 Result UpdateDocument7 pagesPNC - Infra Q1 Result UpdateAryan SharmaNo ratings yet

- Sobha 3R Aug11 - 2022Document7 pagesSobha 3R Aug11 - 2022Arka MitraNo ratings yet

- PNC Infratech LTD: ESG Disclosure ScoreDocument5 pagesPNC Infratech LTD: ESG Disclosure ScoredarshanmaldeNo ratings yet

- DLF - Ara - Fy23 - Hsie-202307260810490672012Document13 pagesDLF - Ara - Fy23 - Hsie-202307260810490672012mahlawat.ajaykumarNo ratings yet

- InvestoreyeDocument21 pagesInvestoreyeAnkitNo ratings yet

- Subros 3R Jan31 - 2024Document8 pagesSubros 3R Jan31 - 2024h40280890No ratings yet

- Investoreye (10) - 4Document43 pagesInvestoreye (10) - 4Harry AndersonNo ratings yet

- Supreme Industries LTD: ESG Disclosure ScoreDocument7 pagesSupreme Industries LTD: ESG Disclosure ScoreGrim ReaperNo ratings yet

- Power Grid-Feb09 2024Document7 pagesPower Grid-Feb09 2024shashankNo ratings yet

- Greenlam Q1 Result UpdateDocument7 pagesGreenlam Q1 Result UpdateshrikantbodkeNo ratings yet

- PSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10Document8 pagesPSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10samraatjadhavNo ratings yet

- Bharat Electronics LTD: Guidance Achievement Wards Off Near-Term Growth ConcernsDocument7 pagesBharat Electronics LTD: Guidance Achievement Wards Off Near-Term Growth ConcernscoureNo ratings yet

- Gaursons India (P) LTDDocument7 pagesGaursons India (P) LTDlekid57996No ratings yet

- Power Mech Projects Ltd Strong Orderbook and Execution to Pick Up, Maintain BuyDocument5 pagesPower Mech Projects Ltd Strong Orderbook and Execution to Pick Up, Maintain BuyDhittbanda GamingNo ratings yet

- KNR Constructions Limited: A Strong Bounce BackDocument6 pagesKNR Constructions Limited: A Strong Bounce BackdarshanmadeNo ratings yet

- Gabriel India Investor Presentation Q3 2022Document49 pagesGabriel India Investor Presentation Q3 2022Renato AlvesNo ratings yet

- Mahindra Logistics Ltd-1Document4 pagesMahindra Logistics Ltd-1Ashish GowdaNo ratings yet

- Maruti Suzuki India LTD: ESG Disclosure ScoreDocument7 pagesMaruti Suzuki India LTD: ESG Disclosure ScorebdacNo ratings yet

- MNM Finance-Mar03 2023Document7 pagesMNM Finance-Mar03 2023Rajavel GanesanNo ratings yet

- Morning Market Report: SGX Nifty, Nykaa, Equitas UpdatesDocument2 pagesMorning Market Report: SGX Nifty, Nykaa, Equitas UpdatesAmit MittalNo ratings yet

- Godrej Properties LimitedDocument11 pagesGodrej Properties Limitedkitono5817No ratings yet

- Nirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Document11 pagesNirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Shinde Chaitanya Sharad C-DOT 5688No ratings yet

- Strong Q1 Results for Pidilite; Valuation Limits UpsideDocument8 pagesStrong Q1 Results for Pidilite; Valuation Limits UpsideArka MitraNo ratings yet

- Corporate PresentationDocument50 pagesCorporate PresentationAniket SabaleNo ratings yet

- JMC Projects (India) Limited: Strong Execution Continues To Propel Net Earnings GrowthDocument6 pagesJMC Projects (India) Limited: Strong Execution Continues To Propel Net Earnings GrowthdarshanmadeNo ratings yet

- 26july2023 India Daily 230726 084131Document105 pages26july2023 India Daily 230726 084131Mahaveer BadalNo ratings yet

- Ashoka Buidcon 3R Aug11 2022Document7 pagesAshoka Buidcon 3R Aug11 2022Arka MitraNo ratings yet

- ICICI Securities Tata Power Company UpdateDocument10 pagesICICI Securities Tata Power Company UpdateRojalin SwainNo ratings yet

- KRChoksey CreditAccess Grameen LTD ReportDocument25 pagesKRChoksey CreditAccess Grameen LTD ReportspryaaNo ratings yet

- Rali 23 7 20 PL PDFDocument8 pagesRali 23 7 20 PL PDFwhitenagarNo ratings yet

- AIA Engineering - Q4FY22 Result Update - 30 May 2022Document7 pagesAIA Engineering - Q4FY22 Result Update - 30 May 2022PavanNo ratings yet

- L&T Technology Services Clicking the Right DealsDocument21 pagesL&T Technology Services Clicking the Right DealsJuan Daniel Garcia VeigaNo ratings yet

- Supreme Industries reports Q4 results, maintains 15% volume growth outlookDocument7 pagesSupreme Industries reports Q4 results, maintains 15% volume growth outlookbdacNo ratings yet

- Blue Star (BLSTR In) 2QFY20 Result Update - RsecDocument9 pagesBlue Star (BLSTR In) 2QFY20 Result Update - RsecHardik ShahNo ratings yet

- Barbeque Nation Hospitality LimitedDocument7 pagesBarbeque Nation Hospitality Limitednayabrasul208No ratings yet

- H G Infra Engineering LTD - Q3FY22 Result Update - 07022021 - 07-02-2022 - 14Document9 pagesH G Infra Engineering LTD - Q3FY22 Result Update - 07022021 - 07-02-2022 - 14Rohan ChauhanNo ratings yet

- LT 26 7 23 PLDocument9 pagesLT 26 7 23 PLIbrahimNo ratings yet

- Tenda 4T23Document33 pagesTenda 4T23Flavya PereiraNo ratings yet

- SRF LTD Fundamental Monthly PickDocument3 pagesSRF LTD Fundamental Monthly PickAyushi ShahNo ratings yet

- Strong demand outlook for Polycab IndiaDocument8 pagesStrong demand outlook for Polycab Indiashankar alkotiNo ratings yet

- 21163011142022216coal India Limited - 20221116Document5 pages21163011142022216coal India Limited - 20221116Sandy SandyNo ratings yet

- Account Closer Form - 19022018Document13 pagesAccount Closer Form - 19022018RajeshNo ratings yet

- GNA Axles Q1 Result UpdateDocument8 pagesGNA Axles Q1 Result UpdateshrikantbodkeNo ratings yet

- PNB Housing Finance: IndiaDocument14 pagesPNB Housing Finance: IndiaMalolanRNo ratings yet

- SChand Analyst CoverageDocument7 pagesSChand Analyst CoverageMohan KNo ratings yet

- Wonderla Holidays - Monarch ReportsDocument9 pagesWonderla Holidays - Monarch ReportsSANDIP MISHRANo ratings yet

- Bajaj Finance q2 Investor Presentation Fy23pdfDocument66 pagesBajaj Finance q2 Investor Presentation Fy23pdfsachin kumarNo ratings yet

- Investor PresentationDocument65 pagesInvestor PresentationAniket SabaleNo ratings yet

- Gabriel India Investor Presentation Q3 2022 OfficialDocument55 pagesGabriel India Investor Presentation Q3 2022 OfficialRenato AlvesNo ratings yet

- Princpip 11 8 23 PLDocument6 pagesPrincpip 11 8 23 PLAnubhi Garg374No ratings yet

- V-Guard Q2FY20 Profit Rises 50% on Margin ExpansionDocument5 pagesV-Guard Q2FY20 Profit Rises 50% on Margin ExpansionUmesh ThawareNo ratings yet

- Sadbhav Engineering: A Weak Quarter Healthy Prospects AheadDocument6 pagesSadbhav Engineering: A Weak Quarter Healthy Prospects AheaddarshanmadeNo ratings yet

- Research ReportsDocument10 pagesResearch Reportssrinath kNo ratings yet

- Bajaj Electricals - HaitongDocument12 pagesBajaj Electricals - HaitongGurjeevNo ratings yet

- Mindtree - 141022 - Moti141022 PDFDocument10 pagesMindtree - 141022 - Moti141022 PDFSJ WealthNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Belladine Acidic Femiinine Douche ph4Document5 pagesBelladine Acidic Femiinine Douche ph4Kdp03No ratings yet

- CPP - External User ManualDocument21 pagesCPP - External User ManualKdp03No ratings yet

- Bridion 100 MG - ML Solution For Injection - Summary of Product Characteristics (SMPC) - Print Friendly - (Emc)Document14 pagesBridion 100 MG - ML Solution For Injection - Summary of Product Characteristics (SMPC) - Print Friendly - (Emc)Kdp03No ratings yet

- ChrHansen Human Health PortfolioDocument14 pagesChrHansen Human Health PortfolioKdp03No ratings yet

- Veterinary Product List 2021Document320 pagesVeterinary Product List 2021Kdp03No ratings yet

- LeafletDocument6 pagesLeafletKdp03No ratings yet

- Medical Presentation - Q2FY23Document26 pagesMedical Presentation - Q2FY23Kdp03No ratings yet

- Bridion 100 MG - ML Solution For Injection - Summary of Product Characteristics (SMPC) - Print Friendly - (Emc)Document14 pagesBridion 100 MG - ML Solution For Injection - Summary of Product Characteristics (SMPC) - Print Friendly - (Emc)Kdp03No ratings yet

- Pil 10299Document7 pagesPil 10299Kdp03No ratings yet

- Guide To Application For Registration of Medicinal Products - 4th EditiDocument142 pagesGuide To Application For Registration of Medicinal Products - 4th EditiKdp03No ratings yet

- Analytical Annexures Q2FY23Document24 pagesAnalytical Annexures Q2FY23Kdp03No ratings yet

- Orig 1 S 002Document4 pagesOrig 1 S 002Kdp03No ratings yet

- Infographic Registration of Pharmaceutical Product For General Sale 637828524496205508Document1 pageInfographic Registration of Pharmaceutical Product For General Sale 637828524496205508Kdp03No ratings yet

- ACCT 2200 - Chapter 11 P2 - With SolutionsDocument26 pagesACCT 2200 - Chapter 11 P2 - With Solutionsafsdasdf3qf4341f4asDNo ratings yet

- Accounting concepts, journal entries and financial statementsDocument3 pagesAccounting concepts, journal entries and financial statementsRNo ratings yet

- Panasonic Business Strategy Panasonic Business Strategy: Measures Taken So Far Measures Taken So FarDocument11 pagesPanasonic Business Strategy Panasonic Business Strategy: Measures Taken So Far Measures Taken So FarJubilleNo ratings yet

- Form 16A TDS CertificateDocument3 pagesForm 16A TDS Certificatejishna mathewNo ratings yet

- Cost-Volume-Profit AnalysisDocument12 pagesCost-Volume-Profit AnalysisdXXNo ratings yet

- Topic 1-Intro & Cost ClassificationDocument8 pagesTopic 1-Intro & Cost ClassificationMuhammad Alif100% (2)

- Accountancy, Business and Management Name: - ScoreDocument3 pagesAccountancy, Business and Management Name: - ScoreHLeigh Nietes-GabutanNo ratings yet

- Accounting System of Teletalk & GrameenphoneDocument17 pagesAccounting System of Teletalk & GrameenphoneFarhana Ahamed 1815237660No ratings yet

- Cost Terminology and Classification ExplainedDocument8 pagesCost Terminology and Classification ExplainedKanbiro Orkaido100% (1)

- Adjusting ProbsDocument6 pagesAdjusting ProbsJheriko MallariNo ratings yet

- INTRODUCTIONDocument79 pagesINTRODUCTIONdrkotianrajeshNo ratings yet

- Nature of Transactions in A Service BusinessDocument2 pagesNature of Transactions in A Service BusinessYanela YishaNo ratings yet

- Business Plan Super FinalDocument13 pagesBusiness Plan Super FinalJohanna Rose AngelitudNo ratings yet

- Outlook Business e Magazine PDFDocument60 pagesOutlook Business e Magazine PDFMadhura ChafleNo ratings yet

- Prepare and Process Financial DocsDocument47 pagesPrepare and Process Financial DocsEphraim PryceNo ratings yet

- Key Metrics: March 9, 2018Document31 pagesKey Metrics: March 9, 2018RenadNo ratings yet

- BCOM PM Unit 3Document11 pagesBCOM PM Unit 3Anujyadav MonuyadavNo ratings yet

- Intermediate Accounting ExamDocument6 pagesIntermediate Accounting ExamPISONANTA KRISETIANo ratings yet

- 250,000 300,000 400,000 500,000 Cash Flow: Year 1 2 3 4Document9 pages250,000 300,000 400,000 500,000 Cash Flow: Year 1 2 3 4Kai ZhaoNo ratings yet

- TameDocument24 pagesTameAbdi fatah BashirNo ratings yet

- CF Assignment Final SubmissionDocument52 pagesCF Assignment Final SubmissionnidhidNo ratings yet

- Comparative Statement Analysis of Select Paint PDFDocument8 pagesComparative Statement Analysis of Select Paint PDFMerajud DinNo ratings yet

- Chapter 1 Scope and Objectives of Financial Management 2Document19 pagesChapter 1 Scope and Objectives of Financial Management 2Pandit Niraj Dilip SharmaNo ratings yet

- Earnings Con Call-Q4 Fy 17 18Document24 pagesEarnings Con Call-Q4 Fy 17 18Sourav DuttaNo ratings yet