Professional Documents

Culture Documents

Bharat Electronics LTD: Guidance Achievement Wards Off Near-Term Growth Concerns

Uploaded by

coureOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bharat Electronics LTD: Guidance Achievement Wards Off Near-Term Growth Concerns

Uploaded by

coureCopyright:

Available Formats

Stock Update

Bharat Electronics Ltd

Guidance achievement wards off near-term growth concerns

Powered by the Sharekhan 3R Research Philosophy Capital Goods Sharekhan code: BEL

Reco/View: Buy CMP: Rs. 97 Price Target: Rs. 120

Company Update

3R MATRIX + = -

Right Sector (RS) ü

á Upgrade Maintain â Downgrade

Right Quality (RQ) ü Summary

FY23 performance on revenue (up 15% y-o-y) and order inflow (Rs. 20,000 crore) front as per the provisional

Right Valuation (RV) ü numbers has been in line with guidance. Gross margins and OPM are also expected to achieve the guidance

of 40%/~22-24% in FY23.

+ Positive = Neutral – Negative Order backlog stands strong at ~Rs. 60,500 crore (~3.5x FY23 sales). Near to medium-term order pipeline is

healthy at Rs. 60,000-70,000 crore.

What has changed in 3R MATRIX Bharat Electronics Ltd (BEL) is expediting efforts to increase non-defence revenue to diversify its business.

Further, any breakthrough on export front (currently ~2% of sales) would provide a fillip to its growth.

Old New BEL has a promising order inflow pipeline, large order book and healthy balance sheet. We retain a Buy on BEL

with an unchanged PT of Rs. 120, valuing it on FY2025E EPS.

RS

Provisional revenue numbers and order inflow for FY23 were in-line with its guidance. This allayed concerns on

RQ tepid order inflow for FY23. The company registered sales growth of ~15% y-o-y to Rs. 17,300 crore. Its export

revenue for FY23 stood at $ 46.5 million, which was up 40% y-o-y, but lower than its guidance of US$ 70 mn.

Currently, exports comprise of merely ~2% of its total revenues. Based on FY23 provisional numbers, Q4FY23

RV revenue are expected to be flat at ~Rs. 6,240 crore (+0.5% y-o-y). Order inflow for FY23 was Rs. 20,200 crore, in

line with company’s guidance. BEL has acquired export orders worth US$ 75.66 mn during FY23. As the company

received bulk orders towards the end of FY23, its order book has jumped to Rs. 60,500 crore (3.5x FY23 sales),

growing by 5% y-o-y. Hence, growing order book indicates strong revenue and earnings growth growing forward.

ESG Disclosure Score NEW We believe BEL is a formidable play on India’s defence story, given its indigenisation capabilities, healthy order

book, promising order inflow pipeline of Rs. 60,000- 70,000 crore in the medium term and strong execution

capabilities.

ESG RISK RATING

Updated Mar 08, 2023

34.56 Provisional revenue numbers meet guidance

BEL’s provisional revenue numbers were in-line with its guidance of ~15% y-o-y growth to Rs. 17,300 crore. Its export

High Risk revenue for FY23 stood at US$ 46.5 million which was up 40% y-o-y, but lower than its guidance of US$ 70 mn.

Currently, exports comprise of merely ~2% of its total revenue. Some major projects executed during FY23 were

long-range surface-to-air missile (LRSAM) systems, Akash missile systems, SATCOM network, command & control

NEGL LOW MED HIGH SEVERE systems, various radars, electronic warfare systems, communication equipment, coastal surveillance system,

electro-optic systems, fire control systems, home land security systems, Smart City projects etc. Major products

0-10 10-20 20-30 30-40 40+

exported include transmit & receive (TR) modules, radar warning receiver (RWR), control cards, Link-II systems,

Source: Morningstar compact multi-purpose advanced stabilization system (CoMPASS), low band receivers (LBREC) and medical

electronics. The company targets ~20% y-o-y sales growth in FY24/FY25. BEL has also been focusing on exploring

exports (primarily non-defence currently) potential of defence electronics products and systems, which bodes well

Company details for revenue diversification. The company targets 10-15% revenue contribution from exports in the long term.

Order inflow guidance achieved towards FY23 end; strong order book

Market cap: Rs. 70,905 cr

BEL achieved its order inflow guidance by bagging orders worth Rs. 20,200 crore in FY23 which was primarily driven

52-week high/low: Rs. 115/69 by several large order awards by ministry of defence (MoD) towards the end of FY23. Some of the major orders

acquired during the year were Himashakti, Medium Power Radar (Arudhra) for Rs. 2,800 crore, Air Defence Control

& Reporting System (Akashteer) for Rs. 2,000 crore, Lynx U2 systems, EW Suite for MLH Upgrade, DR118 for Su-30,

NSE volume: Weapon Locating Radar (WLR), SARANG ESM etc. BEL has acquired export orders worth $75.66 million during FY23.

157.1 lakh

(No of shares) BEL’s order book now stands at Rs. 60,500 crore; providing revenue visibility of ~3.5 years. Going forward, the order

pipeline in the near to medium term is Rs. 60,000-70,000 crore, which bodes well for its growth.

BSE code: 500049 Margin guidance likely to be achieved, WCC to be stable

BEL has guided for gross margins at 40% levels for FY23 and EBITDA margin could be between 22-24% for FY23.

NSE code: BEL BEL has been focused on cost-control measures and extensive indigenisation efforts to improve profitability and that

shall lead to the company achieving its margin guidance as well. We expect BEL to meet its entire working capital

Free float: needs through internal accruals. Cash flow from operations has grown significantly in the last five years and we

357.2 cr expect growth in FY23 as well. Further, despite significant topline growth, its inventory and receivables days are

(No of shares) also expected to be stable in FY23.

Revision in estimates – We have broadly maintained our estimates as per the company’s guidance for FY2023-

Shareholding (%) FY2025E.

Our Call

Promoters 51.1 Valuation – Maintain Buy with an unchanged PT of Rs. 120: BEL’s achievement of order inflow guidance towards

the end of FY23 allays concerns over the company missing its mark in terms of order inflows. Further, meeting

FII 17.3 its revenue guidance despite supply-side constraints is also positive. Based on provisional revenue figures, we

expect strong operating performance in Q4FY23 as operating leverage would also kick in; as the company typically

DII 25.1 achieves highest revenue in its 4th quarter. On the broader perspective, BEL would play a significant role in the

successful implementation of the government’s Make in India and AtmaNirbhar Bharat initiatives as it is one of

Others 6.5 the key defence and aerospace players. Further, global defence companies are tying up with indigenous players,

as there is a tremendous export potential for engineering services and components sourcing from India, which

bodes well for BEL. BEL has strong manufacturing and R&D base, a robust order book, healthy order prospects,

Price chart diversifying revenue stream, and strong balance sheet with improving return ratios. We retain a Buy on the stock with

120 an unchanged price target (PT) of Rs. 120, valuing it on FY2025E EPS.

110 Key Risks

100 Delayed order execution and slower pace of fresh orders can affect revenue growth.

90 Higher raw-material prices and shortage of some key components could affect margins going forward.

80

70

60 Valuation (Consolidated) Rs cr

50 Particulars FY22 FY23E FY24E FY25E

Apr-22

Apr-23

Aug-22

Dec-22

Net Sales 15,368 17,629 20,653 23,586

OPM (%) 21.7 21.8 22.5 22.8

Price performance PAT 2,399 2,778 3,267 3,793

YoY growth 14.3 15.8 17.6 16.1

(%) 1m 3m 6m 12m

EPS (Rs.) 3.3 3.8 4.5 5.2

Absolute 3.1 -2.4 -3.4 38.8 P/E (x) 29.6 25.5 21.7 18.7

Relative to EV/EBITDA (x) 22.5 19.5 16.4 14.1

3.0 0.6 -6.1 38.1 RoCE (%) 17.8 19.1 19.9 20.1

Sensex

Sharekhan Research, Bloomberg RoE (%) 20.6 21.2 21.8 22.0

Source: Company; Sharekhan estimates

April 03, 2023 1

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Provisional revenue numbers in-line with guidance despite supply side challenges

BEL’s provisional revenue numbers were in-line with its guidance of ~15% y-o-y growth to Rs. 17,300 crore. Its

export revenue for FY23 stood at US$ 46.5 million which was up 40% y-o-y, but lower than its guidance of

US$ 70 mn. Currently, exports comprise of merely ~2% of its total revenue. Some major projects executed

during FY23 were long-range surface-to-air missile (LRSAM) systems, Akash missile systems, SATCOM

network, command & control systems, various radars, electronic warfare systems, communication equipment,

coastal surveillance system, electro-optic systems, fire control systems, home land security systems, Smart

City projects etc. Major products exported include transmit & receive (TR) modules, radar warning receiver

(RWR), control cards, Link-II systems, compact multi-purpose advanced stabilization system (CoMPASS), low

band receivers (LBREC) and medical electronics. The company targets a ~20% y-o-y sales growth in FY24/

FY25. BEL has also been focusing on exploring exports (primarily non-defence currently) potential of defence

electronics products and systems, which bodes well for revenue diversification. The company targets 10-15%

revenue contribution from exports (currently ~2%) in the long term. Moreover, the company aims to increase

share of non-defence verticals like civil, railways and metro rail in total revenues. BEL is trying to get a

breakthrough in the exports with countries like Egypt, Malaysia; etc and is hopeful of increasing its export

share in total revenue.

Order inflow of Rs. 20,000 crore takes order book to Rs. 60,500 crore

BEL achieved its order inflow guidance by bagging orders worth Rs. 20,200 crore in FY23 which was driven

by several large order awards by MoD towards the end of FY23. Some major orders acquired during the year

were Himashakti, Medium Power Radar (Arudhra) for Rs. 2,800 crore, Air Defence Control & Reporting System

(Akashteer) for Rs. 2,000 crore, Lynx U2 systems, EW Suite for MLH Upgrade, DR118 for Su-30, Weapon

Locating Radar (WLR), SARANG ESM, etc. BEL has acquired export orders worth US$ 75.66 mn. BEL’s order

book now stands at Rs. 60,500 crore. This provides revenue visibility of 3.5 years. Going forward, the order

pipeline in the near to medium term is Rs. 60,000-70,000 crore which bodes well for its growth.

Margin guidance likely to be achieved, WCC to be stable

BEL has guided for gross margin at 40% levels for FY23 and EBITDA margin could be between 22-24%

for FY23. BEL has been focused on cost-control measures and extensive indigenization efforts to improve

profitability and that shall lead to the company achieving its margin guidance as well. We expect BEL to meet

its working capital needs wholly through internal accruals. Cash flow from operations has grown significantly

in the last five years and we expect strong growth in FY23 as well. Further, despite significant topline growth,

its inventory and receivables days are also expected to be stable in FY23.

Capex guidance of Rs. 600-800 crore for the next two years

BEL is likely to incur a capex of Rs 600-800 crore in FY2023/FY2024. Apart from regular capex, the company

is developing a defence system integration complex in Nagpur. It is building an arms & ammunition facility for

Rs. 200 crore in Hyderabad. It is also building advanced night vision factory at Nimmaluru, Andhra Pradesh

for ~ Rs. 340 crore.

April 03, 2023 2

Stock Update

Powered by the Sharekhan

3R Research Philosophy

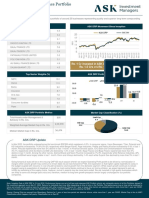

Financials in charts

Order book growth trend Revenue growth trend

80,000 9.2 9.5 10.0 25,000 20.0

70,000 17.2

7.7 8.0 20,000 14.7

60,000 15.0

14.2

50,000 6.0 15,000

40,000 5.1 8.8 10.0

10,000 8.9

30,000 4.0

2.8 6.6 5.0

20,000 5,000

2.0

10,000

- 0.3 - - -

FY20 FY21 FY22 FY23 FY24E FY25E FY20 FY21 FY22 FY23E FY24E FY25E

Order Book (Rs cr) Growth (%) Total Revenue from operations (Rs cr) Growth (%)

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

Order Book to Revenue ratio Operating profit and margin trend

4.5 4.0 6,000 24.0

4.0 3.8 3.7

3.4 5,000 22.8 22.5

3.5 3.2 3.1 22.8

4,000 21.7 22.0

3.0

21.8

2.5 3,000 21.2

2.0 2,000 20.0

1.5

1,000

1.0

0.5 - 18.0

0.0 FY20 FY21 FY22 FY23E FY24E FY25E

FY20 FY21 FY22 FY23E FY24E FY25E Operating Profit (Rs cr) Margin (%)

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

Net profit growth trend Return ratios trend (%)

4,000 17.6 20.0 23.0

21.8

15.1 21.2 22.0

16.1 15.0

3,000 15.8 21.0 20.6

14.3 19.9

10.0 20.1

18.9 19.9

2,000 19.0 18.6 19.1

5.0

18.0 17.8

1,000 17.0

-

(3.3)

- (5.0) 15.0

FY20 FY21 FY22 FY23E FY24E FY25E FY20 FY21 FY22 FY23E FY24E FY25E

Adjusted Net Profit (Rs cr) Growth (%) ROE (%) ROCE (%)

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

April 03, 2023 3

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Outlook and Valuation

n Sector view - AatmaNirbhar Bharat initiative to boost defence manufacturing in India

The government is emphasising on creating an environment to boost the AatmaNirbhar Bharat programme

in the defence sector and create a level-playing field for private players, including MSMEs. Completion of

defence projects takes longer than envisaged earlier and, hence, the government is planning to incorporate

cost-escalation clauses and provide incentives to vendors based on enhanced productivity and performance.

Further, hike in foreign direct investment (FDI) to 74% through the automatic route would boost investments

in the sector. This is likely to boost investments in the space, as foreign players in the defence sector would

look at setting up joint ventures to establish defence manufacturing bases in India, considering the large

opportunity with the opening up of the defence sector. The government has also established defence corridors

in Tamil Nadu and Uttar Pradesh, which have helped in reducing the dependency on imports.

n Company outlook - diversification and strong order pipeline would boost growth

BEL has been continuously focusing on sustainable growth plans and has taken various initiatives such

as i) Focusing on enhancing its R&D capability; ii) Enhancing manufacturing capabilities through timely

modernisation and expansion of facilities; and iii) Entering into joint ventures in existing and emerging

businesses to enhance business visibility. Order pipeline includes orders for Medium Range Surface - To -

Air Missile (MRSAM)- Rs. 20,000 crore, Quick Reaction Surface-to-Air Missile (QRSAM) – Rs. 20,000 crore,

Akash Prime Rs. 4,000 crore; etc. In addition, BEL has been focusing on exploring the export (primarily non-

defence currently) potential of defence electronics products and systems, which bodes well for revenue

diversification. The company targets 10-15% revenue contribution from exports (currently ~2%).

n Valuation - Maintain Buy with an unchanged PT of Rs. 120

BEL’s achievement of order inflow guidance towards the end of FY23 allays concerns over the company missing

its mark in terms of order inflows. Further, meeting its revenue guidance despite supply-side constraints is

also positive. Based on provisional revenue figures, we expect strong operating performance in Q4FY23 as

operating leverage would also kick in; as the company typically achieves highest revenue in its 4th quarter.

On the broader perspective, BEL would play a significant role in the successful implementation of the

government’s Make in India and AtmaNirbhar Bharat initiatives as it is one of the key defence and aerospace

players. Further, global defence companies are tying up with indigenous players, as there is a tremendous

export potential for engineering services and components sourcing from India, which bodes well for BEL. BEL

has strong manufacturing and R&D base, a robust order book, healthy order prospects, diversifying revenue

stream, and strong balance sheet with improving return ratios. We retain a Buy on the stock with an unchanged

price target (PT) of Rs. 120, valuing it on FY2025E EPS.

One-year forward P/E (x) band

30.0

25.0

20.0

15.0

10.0

5.0

-

Apr-19 Oct-19 Apr-20 Oct-20 Apr-21 Oct-21 Apr-22 Oct-22 Apr-23

1yr Fwd PE(x) Avg 1yr fwd PE Peak Trough

Source: Sharekhan Research

April 03, 2023 4

Stock Update

Powered by the Sharekhan

3R Research Philosophy

About company

BEL is a PSU with strong manufacturing and R&D capabilities and robust cost-control measures. The company

manufactures electronics, communication, and defence equipment and stands to benefit from enhanced

budgetary outlay for strengthening and modernising India’s security.

Investment theme

The government’s Make in India and AatmaNirbhar Bharat initiatives along with rising spends for modernizing

defence equipment will support earnings growth in the coming years, as BEL is one of the key players with

strong research and manufacturing capabilities in the defence space in the country. A robust order book

provides strong revenue and earnings visibility. BEL is a good play on the defence sector on account of its

strong manufacturing and R&D base, good margin trajectory, cost efficiency, growing indigenisation, and

strong balance sheet.

Key Risks

Delayed order execution and slower pace of fresh orders can affect revenue growth.

Higher raw-material prices and shortage of some key components such as semi-conductors could affect

execution and earnings going forward.

Additional Data

Key management personnel

Mr. Bhanu Prakash Srivastava Executive Director-Chairperson-MD

Mr. Vinay Kumar Katyal Executive Director

Mr. Damodar S Bhattad Director (Finance) & Chief Financial Officer (CFO)

Source: Company

Top 10 shareholders

Sr. No. Holder Name Holding (%)

1 Nippon Asset Life India Management Ltd 4.04

2 Kotak Mahindra Asset Management Co Ltd 3.51

3 HDFC Asset Management Co Ltd 3.22

4 Vanguard Group Inc 1.74

5 Blackrock Inc 1.58

6 FMR LLC 1.31

7 Canara Robeco Asset Management Co Ltd 1.24

8 MIRAE Asset Global Investments Co Ltd 1.03

9 DSP Investment Managers Pvt Ltd 1.02

10 ICICI Prudential Asset Management Co Ltd 0.85

Source: Bloomberg

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

April 03, 2023 5

Understanding the Sharekhan 3R Matrix

Right Sector

Positive Strong industry fundamentals (favorable demand-supply scenario, consistent

industry growth), increasing investments, higher entry barrier, and favorable

government policies

Neutral Stagnancy in the industry growth due to macro factors and lower incremental

investments by Government/private companies

Negative Unable to recover from low in the stable economic environment, adverse

government policies affecting the business fundamentals and global challenges

(currency headwinds and unfavorable policies implemented by global industrial

institutions) and any significant increase in commodity prices affecting profitability.

Right Quality

Positive Sector leader, Strong management bandwidth, Strong financial track-record,

Healthy Balance sheet/cash flows, differentiated product/service portfolio and

Good corporate governance.

Neutral Macro slowdown affecting near term growth profile, Untoward events such as

natural calamities resulting in near term uncertainty, Company specific events

such as factory shutdown, lack of positive triggers/events in near term, raw

material price movement turning unfavourable

Negative Weakening growth trend led by led by external/internal factors, reshuffling of

key management personal, questionable corporate governance, high commodity

prices/weak realisation environment resulting in margin pressure and detoriating

balance sheet

Right Valuation

Positive Strong earnings growth expectation and improving return ratios but valuations

are trading at discount to industry leaders/historical average multiples, Expansion

in valuation multiple due to expected outperformance amongst its peers and

Industry up-cycle with conducive business environment.

Neutral Trading at par to historical valuations and having limited scope of expansion in

valuation multiples.

Negative Trading at premium valuations but earnings outlook are weak; Emergence of

roadblocks such as corporate governance issue, adverse government policies

and bleak global macro environment etc warranting for lower than historical

valuation multiple.

Source: Sharekhan Research

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may receive

this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved) and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the views

expressed in this document accurately reflect his or her personal views about the subject company or companies and its or their

securities and do not necessarily reflect those of SHAREKHAN. The analyst and SHAREKHAN further certifies that neither he or his

relatives or Sharekhan associates has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in

the securities of the company at the end of the month immediately preceding the date of publication of the research report nor have

any material conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company.

Further, the analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and

no part of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in

this document. Sharekhan Limited or its associates or analysts have not received any compensation for investment banking, merchant

banking, brokerage services or any compensation or other benefits from the subject company or from third party in the past twelve

months in connection with the research report.

Either, SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Ms. Binkle Oza; Tel: 022-61169602; email id: complianceofficer@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com.

Registered Office: Sharekhan Limited, The Ruby, 18th Floor, 29 Senapati Bapat Marg, Dadar (West), Mumbai – 400 028,

Maharashtra, INDIA, Tel: 022 - 67502000/ Fax: 022 - 24327343. Sharekhan Ltd.: SEBI Regn. Nos.: BSE / NSE / MSEI (CASH / F&O/

CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786; Mutual Fund: ARN 20669;

Research Analyst: INH000006183.

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- SupremeInd 3R Apr29 2022Document7 pagesSupremeInd 3R Apr29 2022bdacNo ratings yet

- PNC Infratech LTD: ESG Disclosure ScoreDocument5 pagesPNC Infratech LTD: ESG Disclosure ScoredarshanmaldeNo ratings yet

- Pidilite 3R Aug11 2022Document8 pagesPidilite 3R Aug11 2022Arka MitraNo ratings yet

- Gati Q1 Result UpdateDocument7 pagesGati Q1 Result UpdateAryan SharmaNo ratings yet

- Ashoka Buidcon 3R Aug11 2022Document7 pagesAshoka Buidcon 3R Aug11 2022Arka MitraNo ratings yet

- PNC - Infra Q1 Result UpdateDocument7 pagesPNC - Infra Q1 Result UpdateAryan SharmaNo ratings yet

- 26july2023 India Daily 230726 084131Document105 pages26july2023 India Daily 230726 084131Mahaveer BadalNo ratings yet

- Atul LTD: ESG Disclosure ScoreDocument7 pagesAtul LTD: ESG Disclosure ScoreGrim ReaperNo ratings yet

- CuminsIndia 3R Aug11 2022Document7 pagesCuminsIndia 3R Aug11 2022Arka MitraNo ratings yet

- Macrotech Developers 3R Oct06 2022Document7 pagesMacrotech Developers 3R Oct06 2022Kdp03No ratings yet

- Investoreye (10) - 4Document43 pagesInvestoreye (10) - 4Harry AndersonNo ratings yet

- Insecticides Q1 Result UpdateDocument7 pagesInsecticides Q1 Result UpdateAryan SharmaNo ratings yet

- Greenlam Q1 Result UpdateDocument7 pagesGreenlam Q1 Result UpdateshrikantbodkeNo ratings yet

- Supreme Industries LTD: ESG Disclosure ScoreDocument7 pagesSupreme Industries LTD: ESG Disclosure ScoreGrim ReaperNo ratings yet

- BP Wealth On Hikal - 06.11.2020Document7 pagesBP Wealth On Hikal - 06.11.2020VM ONo ratings yet

- Ratnamani Metals & Tubes: Rising Order Inflow Boosts Growth ProspectsDocument8 pagesRatnamani Metals & Tubes: Rising Order Inflow Boosts Growth ProspectsraguramrNo ratings yet

- Larsen & Toubro: Bottoming Out Order Pick-Up Awaited BUYDocument10 pagesLarsen & Toubro: Bottoming Out Order Pick-Up Awaited BUYVikas AggarwalNo ratings yet

- V-Guard Industries: Operationally Strong QuarterDocument5 pagesV-Guard Industries: Operationally Strong QuarterUmesh ThawareNo ratings yet

- PSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10Document8 pagesPSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10samraatjadhavNo ratings yet

- Power Grid-Feb09 2024Document7 pagesPower Grid-Feb09 2024shashankNo ratings yet

- RITES LTD - Management Meeting Note June 2023 - 19!06!2023 - 09Document7 pagesRITES LTD - Management Meeting Note June 2023 - 19!06!2023 - 09Sanjeedeep Mishra , 315No ratings yet

- Polycab India Limited: Business Dynamics Strong, Retain BuyDocument8 pagesPolycab India Limited: Business Dynamics Strong, Retain Buyshankar alkotiNo ratings yet

- L&T Finance Holdings LTD: ESG Disclosure ScoreDocument6 pagesL&T Finance Holdings LTD: ESG Disclosure ScoreAshwet JadhavNo ratings yet

- Investoreye - 2022-10-07T052922.838Document9 pagesInvestoreye - 2022-10-07T052922.838Harry AndersonNo ratings yet

- JMC Projects (India) Limited: Strong Execution Continues To Propel Net Earnings GrowthDocument6 pagesJMC Projects (India) Limited: Strong Execution Continues To Propel Net Earnings GrowthdarshanmadeNo ratings yet

- TCI Express SharekhanDocument7 pagesTCI Express SharekhanAniket DhanukaNo ratings yet

- Bharti - Airtel Q1 Result UpdateDocument10 pagesBharti - Airtel Q1 Result UpdateRatan PalankiNo ratings yet

- Britannia Industries: Steady Performance in Tough EnvironmentDocument6 pagesBritannia Industries: Steady Performance in Tough EnvironmentdarshanmadeNo ratings yet

- KEI Q1 Result UpdateDocument7 pagesKEI Q1 Result UpdateAryan SharmaNo ratings yet

- KRChoksey CreditAccess Grameen LTD ReportDocument25 pagesKRChoksey CreditAccess Grameen LTD ReportspryaaNo ratings yet

- Asian Paints 26-07-2023 KhanDocument7 pagesAsian Paints 26-07-2023 Khangaurav24021990No ratings yet

- Mahindra Logistics Ltd-1Document4 pagesMahindra Logistics Ltd-1Ashish GowdaNo ratings yet

- SHAREKHANDocument11 pagesSHAREKHANRajesh SharmaNo ratings yet

- Elgi Equipments (ELEQ IN) 2Q24 - HaitongDocument14 pagesElgi Equipments (ELEQ IN) 2Q24 - Haitonglong-shortNo ratings yet

- Sobha 3R Aug11 - 2022Document7 pagesSobha 3R Aug11 - 2022Arka MitraNo ratings yet

- Aarti 3R Aug11 - 2022Document7 pagesAarti 3R Aug11 - 2022Arka MitraNo ratings yet

- Kalpataru Power - 1QFY20 Result - EdelDocument14 pagesKalpataru Power - 1QFY20 Result - EdeldarshanmadeNo ratings yet

- MarutiSuzuki 3R Oct27 - 2023Document7 pagesMarutiSuzuki 3R Oct27 - 2023ajoy14091981No ratings yet

- Kirloskar 3R Feb10 2023Document7 pagesKirloskar 3R Feb10 2023sushant panditaNo ratings yet

- Subros 3R Jan31 - 2024Document8 pagesSubros 3R Jan31 - 2024h40280890No ratings yet

- Motilal Oswal Sees 6% DOWNSIDE in Bajaj Auto in Line 3Q DemandDocument12 pagesMotilal Oswal Sees 6% DOWNSIDE in Bajaj Auto in Line 3Q DemandDhaval MailNo ratings yet

- Maruti Suzuki India LTD: ESG Disclosure ScoreDocument7 pagesMaruti Suzuki India LTD: ESG Disclosure ScorebdacNo ratings yet

- Avenue Supermarts: CMP: INR5,360 TP: INR4,900 (-9%) Continuing To Deliver On GrowthDocument10 pagesAvenue Supermarts: CMP: INR5,360 TP: INR4,900 (-9%) Continuing To Deliver On GrowthLucifer GamerzNo ratings yet

- Trent Feb07 - 2020 202002102024105183431 PDFDocument5 pagesTrent Feb07 - 2020 202002102024105183431 PDFdarshanmadeNo ratings yet

- Bajaj Electricals - HaitongDocument12 pagesBajaj Electricals - HaitongGurjeevNo ratings yet

- Britannia Industries 01 01 2023 KhanDocument7 pagesBritannia Industries 01 01 2023 Khansaran21No ratings yet

- Ashok Leyland LTD: ESG Disclosure ScoreDocument8 pagesAshok Leyland LTD: ESG Disclosure ScoreRomelu MartialNo ratings yet

- TPMA - All The Right MovesDocument4 pagesTPMA - All The Right MovesanekalogamkonstruksiNo ratings yet

- Voltamp Transformers LTD: Invest ResearchDocument8 pagesVoltamp Transformers LTD: Invest ResearchDarwish MammiNo ratings yet

- BGR Upside Buy RecoDocument11 pagesBGR Upside Buy RecomittleNo ratings yet

- HDFC ReportDocument8 pagesHDFC ReportPreet JainNo ratings yet

- Titan Company 01 01 2023 KhanDocument8 pagesTitan Company 01 01 2023 Khansaran21No ratings yet

- Aarti Ind. SharekhanDocument8 pagesAarti Ind. SharekhanAniket DhanukaNo ratings yet

- L&T Finance Holding LTD: ESG Disclosure ScoreDocument6 pagesL&T Finance Holding LTD: ESG Disclosure ScoreQUALITY12No ratings yet

- Affle Stock PricingDocument8 pagesAffle Stock PricingSandyNo ratings yet

- LT 26 7 23 PLDocument9 pagesLT 26 7 23 PLIbrahimNo ratings yet

- Axis Bank - 03 - 03 - 2023 - Khan030323Document7 pagesAxis Bank - 03 - 03 - 2023 - Khan030323Ranjan SharmaNo ratings yet

- TVS Motor Company LTD: ESG Disclosure ScoreDocument7 pagesTVS Motor Company LTD: ESG Disclosure ScorePiyush ParagNo ratings yet

- MNM Finance-Mar03 2023Document7 pagesMNM Finance-Mar03 2023Rajavel GanesanNo ratings yet

- Heet - Mar 23Document2 pagesHeet - Mar 23coureNo ratings yet

- T - Mar 23Document1 pageT - Mar 23coureNo ratings yet

- Et - Mar 23Document2 pagesEt - Mar 23coureNo ratings yet

- GlobalDocument5 pagesGlobalcoureNo ratings yet

- Mar 23Document2 pagesMar 23coureNo ratings yet

- Mar 23Document2 pagesMar 23coureNo ratings yet

- Mar 23Document2 pagesMar 23coureNo ratings yet

- Apr03 2023Document4 pagesApr03 2023coureNo ratings yet

- NUVAMADocument11 pagesNUVAMAcoureNo ratings yet

- Back To The Future: Margins Still Matter: ThematicDocument247 pagesBack To The Future: Margins Still Matter: ThematiccoureNo ratings yet

- Automobile-Apr03 2023Document7 pagesAutomobile-Apr03 2023coureNo ratings yet

- Yahoo Finance Stocks Excel Formula Reference - User Guide - Excel Price FeedDocument7 pagesYahoo Finance Stocks Excel Formula Reference - User Guide - Excel Price FeedShakeel AhmedNo ratings yet

- Scmo 0029Document1 pageScmo 0029ssvivekanandhNo ratings yet

- Pilot Study - Financial Ratio Benchmarks For Real Estate Companies of The G.C.C. - Mahesh N ButaniDocument173 pagesPilot Study - Financial Ratio Benchmarks For Real Estate Companies of The G.C.C. - Mahesh N ButaniMahesh Butani100% (3)

- Lihle Zamantimande Shongwe CVDocument4 pagesLihle Zamantimande Shongwe CVLihle ShongweNo ratings yet

- Orange and Black Virtual Assistant ResumeDocument6 pagesOrange and Black Virtual Assistant ResumeCj VillaverdeNo ratings yet

- 2 Part Financial AnalysisDocument20 pages2 Part Financial AnalysisAbebe TilahunNo ratings yet

- Solution Manual For Financial Statement Analysis 10th Edition by SubramanyamDocument36 pagesSolution Manual For Financial Statement Analysis 10th Edition by SubramanyamJenniferPalmerdqwf100% (38)

- Insecticides India IC 080415Document13 pagesInsecticides India IC 080415frenz4punit6024No ratings yet

- Assignment Case Study - 7BSP1350-0901-2023 - Project Risk and Commercial ManagementDocument6 pagesAssignment Case Study - 7BSP1350-0901-2023 - Project Risk and Commercial ManagementUsama NawazNo ratings yet

- CLSA India Strategy (Taking Stock June 2023) 06072023Document19 pagesCLSA India Strategy (Taking Stock June 2023) 06072023botoy26No ratings yet

- Report On Angel BrokingDocument102 pagesReport On Angel BrokingRashid SiddiquiNo ratings yet

- JPM CPI Preview - Keep Calm and Carry On TighteningDocument11 pagesJPM CPI Preview - Keep Calm and Carry On TighteningWyllian CapucciNo ratings yet

- Dot Com CrashDocument4 pagesDot Com CrashBeatriz MenaNo ratings yet

- Ferrari IPO Case Study - VFDocument33 pagesFerrari IPO Case Study - VFfabriNo ratings yet

- A Studyon Financial Statement Analysis of HDFCDocument63 pagesA Studyon Financial Statement Analysis of HDFCmandeepjasonNo ratings yet

- DB Realty Limited: Another Mumbai-Based PlayerDocument8 pagesDB Realty Limited: Another Mumbai-Based PlayerVahni SinghNo ratings yet

- Accounting Textbook Solutions - 34Document19 pagesAccounting Textbook Solutions - 34acc-expertNo ratings yet

- CV InglesDocument3 pagesCV InglesHernan PNo ratings yet

- Escorts (Hold) - ICICI DirectDocument5 pagesEscorts (Hold) - ICICI DirectdarshanmadeNo ratings yet

- Highlights of The Union Budget 2022 - 2023Document12 pagesHighlights of The Union Budget 2022 - 2023Robin WadhwaNo ratings yet

- Michael Page Salary Guide 2021 enDocument40 pagesMichael Page Salary Guide 2021 enBogdan-Gabriel SchiopuNo ratings yet

- 02 Standards of Professional Conduct & Guidance Professionalism PDFDocument20 pages02 Standards of Professional Conduct & Guidance Professionalism PDFSardonna FongNo ratings yet

- Wlcon - PS Wlcon PMDocument10 pagesWlcon - PS Wlcon PMP RosenbergNo ratings yet

- ManpowerGroup Thailand Salary Guide Year 2021-2022Document101 pagesManpowerGroup Thailand Salary Guide Year 2021-2022Phuvit JaruratkitNo ratings yet

- Develo 1Document265 pagesDevelo 1Amare SimachewNo ratings yet

- Pedro Acosta Valenzuela: Education Princeton UniversityDocument12 pagesPedro Acosta Valenzuela: Education Princeton UniversityJ. Fernando G. R.No ratings yet

- Sun Pharma - Motilal Oswal - Detailed ReportDocument10 pagesSun Pharma - Motilal Oswal - Detailed ReportHemal DaniNo ratings yet

- 75 - Largerhinoliverecommendation - DLF LTDDocument5 pages75 - Largerhinoliverecommendation - DLF LTDamit ghoshNo ratings yet

- BBA - BUS 310 - Kings - Sharifzadeh - Quantitative - 191009Document27 pagesBBA - BUS 310 - Kings - Sharifzadeh - Quantitative - 191009Samar RamiresZNo ratings yet

- JPM Brazil Real EstateDocument286 pagesJPM Brazil Real EstatePedro FerreiraNo ratings yet