Professional Documents

Culture Documents

Fsa

Fsa

Uploaded by

Sundar0 ratings0% found this document useful (0 votes)

6 views18 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views18 pagesFsa

Fsa

Uploaded by

SundarCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 18

Welcome Approach to Financial Reporting and Financial

tatement Analysis For SEM VI(Honours)

period. Thus, it is a statement which shows the movement of cash between two balance sheet dates by

enlisting the different sources from where cash is generated and the different uses where it spends and thereby

shows the changes in cash balances. Moreover, this statement generally reflects the liquidity position of the

business. As per Ind AS 7 the components of Cash Flow Statement is as follows:

(i) Cash Flows from Operating Activities: Operating Activities of the business mean the production

sales, and delivery of finished goods and collection of dues from debtors. In this component of cash

flow statement, cash inflows consist of collection from sales of goods and services and refund of

taxes, while cash outflows consist of purchasing of materials, advertising and cost of shipping the

product. This also includes payment to suppliers and employees and payment of taxes

(ji) Cash Flows from Investing Activities: It refers to investments and it consists of purchase of

assets, gains or losses through investments in the financial market or in subsidiaries. and other

related items.

(iii) Cash Flows from Financing Activities: It refers to activities of business entity which enable them

to mobilize funds and repayment of investors. Cash flows from financing activities might include

cash dividends, adding or changing loans or issue of shares’stocks. It generally reveals the financial

health of a business entity. Financial activities that involve positive cash inflows include cash from

issue of shares, debentures and stocks while negative cash inflows under this activity include payment

of interest or dividends, repayment of loans, buy back of shares and redemption of preference

shares.

5.4 Meaning of Financial Statement Analysis:

Primarily the financial statements are prepared for the purpose of making various economic decisions,

Ithough the financial statements contain information relating to financial results but they are not readily

usuable for making effective decision making. As such, they need to be analysed, scrutinised, evaluated and

interpreted.

Financial statement analysis is basically a process of identifying the strength and weakness of the concem

by truely setting up the relationship between the items that are usually contained in the financial statements

Itprovides assistance to the analysis in assessing the past performance on the basis of which they can predict

about the future performance and the risk of the firm. In this context two important definitions can be

forwarded.

According to Myer, “Financial statement analysis is largely a study of relationships among the various

financial factors in a business, as disclosed by a single set of statements and a study of trends of these

factors, as shown in a series of statements.”

Again in the words of Kennedy and Muller, “The analysis and interpretation of financial statements

are an attempt to determine the significance and meaning of financial statements data so that the forecast

may be made of the prospects for future eamings, ability to pay interest and debt maturities (both current

and long term and profitability and sound dividend policy.”

From the understanding and analysis of these two definitions, itis observed that to ascertain the significance

of the information contained in the financial statements with the view to understanding the liquidity, solvency,

leverage effect and the profitability of the enterprises.

The analysis and interpretation of financial statements depict four steps, out of which the first three are

related to the works of accountants which contain the accumulation and summarisation of financial and

operation data as well the preparation of financial statements. Thus, the process includes the following

steps—

‘Step 1 : Ascertainment of debit and credit along with the determination of amounts involved by analysis

Nts & Introduction to Financial Statement Analysis

and evaluation of all transactions.

Step 2 : Recording and summarisation of information develop from step 1 in the books of account and

preparation of a work sheet

Step 3 : Drafting of financial statements.

The fourth step of this process involves the analysis and interpretation of financial statements with a view

to provide information that assists business management, investors and other interested outside parties.

‘Such process can be adopted by the management and the other interested parties like the owners, creditors,

investors, long term loan providers and others

Thus financial statements analysis is basically learnt about the relationship among the various financial

factors in a business as revealed by a single set of statements and a study of the trends of these factors as

reflected in a series of statements.

With reference to the analysis and interpretation of financial statements the users may come to the

conclusion about the strength and weakness of the firm, make anticipation about the future and recommend

the course of action to be adopted for the overall improvement.

The area of modern financial statements analysis is not merely restricted to financial statements but it

also covers the studies of environment—both external and internal, in which the firm is functioning.

Thus at present, the process of financial statements analysis means the analysis of relevant financial ano

operational data derived from the financial statements along with the non-financial factors affecting the firm

such as competative and regulatory environment, employees’ morale, customers relation, risk involved, attitude

of the rivals etc.

The financial statement analysis involves the following steps

(a) Lear about the surrounding environment in which the firm is operating.

(b) Extraction of relevant information from the financial statements.

(c) Classification of information derived from financial statements in such a manner so as to build up a

significant relationship.

(d) Drawing conclusion on the basis of evidence by applying various measuring devices of financial analysis

such as ratio, preentage, trend ete

5.5 Need For Financial Statement Analysis:

Itis beyond saying that the objective of the financial statement is to provide information regarding the

financial result and financial position of the firm to the different users of these statements. The stakeholders

may take various economic decisions on the basis of the valuable information contained in the financial

statemnents. But such information is not readily usable for decision making, Ithas to be analysed, scrutinised

and interpreted in proper view to make it useful for decision making, Analysis of financial statements assists

the analyst to familiar with the information extracted from the financial data contained in the financial

statements and to evaluate the financial health of the firm. This analysis also assists us to predict for the

future and which in turn also assists us in the preparation of budgets and estimates. Thus analysis of

financial statements has been done for numbers of reason. These are noted below :

1. Investment Decision : Different categories of investors may be foundin a firm. They make investment

with different expections. The equity investors expecting reasonable return more or less regularly and also

expect its steady growth. Long term debt providers expect to receive interest and repayment of principal

amount when they fall due. Although, the expectations of different types of investors are different, but both

of them feel risk in receiving their return. Therefore, here lies the need for financial statement analysis to

Predict their expected returns and along with this evaluate the risk involved with those return. Accordingly

they can make appropriate investment decisions.

A Welcome Approach to Financial Reporting and Financial

tement Analysis For SEM Vi(Honours)

me, a

Seo i.

Limitations :

It is needless to mention that the modern approach to financial statement analysis has given @ new

dimension to the analysis but still itis not free from certain limitations. These are stated below aorta

(i) Problem of Measurement : This approach takes into account the non-financial informa fon along

with the financial information. But it is quite impracticable to assign monetary value to such non

factors, al statement analysis, it

(ii) Problem of Utilisation : For the adoption of modern approach to financial state ie bon int

needs sophisticated and logical statistical tools and techniques, which are quite impractical v

analysts to collect. :

uy Piecemeal Development : Modem approach to financial statement is developed by adopting the

piecemeal method. No isolated tool of this approach can analyse the whole picture of an enterprise, Bi

traditional tools are useful in this regard. For instance with the assistance of traditional tools like ratio

analysis, we can analyse all the aspects of financial position and operating performance of an enterprise.

5.8 Traditional Vs. Modern Approach to Financial Statement Analysis:

be highlighted below

The major sae traditional and modem approaches to financial statement analysis can

Points of Traditional Approach Modern Approach

Difference

(i) Scope This analysis is based only on financial | This analysis is not restricted to the

information, reported in the financial statement. | financial informatioin only, but it also

takes into account the relevant non-

financial information.

ii) Focus | As the analysis is confined to only financial| The main argument of the modern

information, obtained from historical records it

is past oriented. Estimation of the future of the

firm can not be made with the assistance of

traditional approach.

approach to financial statement

analysis is that, it is future looking

approach. It processes both the

historical as well as present data and

on the basis of that makes estimation

about the future.

(ii) Approach to

the Analysis

(iv) Measures of

Decision rules are made by setting a standard

or norms. Market testing is ignored to the |

principle developed.

This analysis is basically done on the basis of

Decision rules are framed after adopting

emperical verification.

Advance and sophisticated statistical

Analysis ratio analysis, common size analysis, inter-firm | and mathematical tools have been

comparison. No advance statistical or | adopted in this analysis

mathematical measure is usually considered in

e this analysis.

(v) Users

Bankers and other financial institutions usually

conduct financial statement analysis by

adopting the well popular traditional techniques.

Recently, all the stakeholders of the business

also decide to conduct their financial statement

analysis by applying the said traditional techniques.

It satisfies the information need of

multiple stakeholders. That is why it is

more broad based compared to

traditional financial statement analysis

which is primarily adopted to satisfy

the interest of the borrowers.

Introduction to Financial Statement Analysis

@

Points of Traditional Appracch Modern Approach

Difference

(Wi) Relationship | This analysis is mainly done on the basis of | This approach attempts to integrate the

with other | financial reports. It has not integrated the | financial statement analysis with other

branches of | financial statement analysis with other| branches of studies specifically with

knowledge | disciplines. It implies that the analysis is| reference to economics and advanced

basically done in isolation of other branches | financial theories.

of knowledge.

(vil) Vision This analysis puts special importance on| This approach puts special importance

profitability, liquidity, solvency, and overall | on profitability, solvency, liquidity and

financial position of the firm from the angle | overall financial position of the firm

of short term point of view. both from the short term and long tem

point of view.

(viii) Merger and | Amalgamation and absorption are basically | Merger and acquisitions are done as

Acquisitions | done on the basis of historical data and it is | per Accounting Standard 14 and most

a static concept. modem concepts ate synergy concepts

of merger.

(ix) Pictorial Pictorial representations through charts, graphs | Pictorial representations through charts,

Representation | and diagrams are not practised in static| graphs and diagrams are compulsory

concept for every large-sized companies

(®) Stages of | This approach conveys the firm to prepare | This approach conveys, the company,

Income multiple steps income statement. even a listed jont stock company, to

Statement prepare single step income statement

including disbursement of income.

(x) Inflationary | The inflationary effects are not acknowledged | Few large-size companies disclose the

Effect in this approach inflationary effect in financial

statements, even though it represents

a hopeless picture, in reporting annual

reports.

5.9 Parties to Financial Statement Analysi

The primary objectives towards the preparation of financial statements are to provide information which

js useful to the internal as well as external use* The different users who are interested in financial statements

analysis are stated below:

(i) Management : Management needs financial information for ensuring survival and growth of the

firm, On the basis of such information they formulate plans, make policies, select strategy, allocate financial

resources and initiate control. Management also needs financial and operating information for the porpose

pinpointing the loopholes ofthe business and making effective investing, financing, operating and strateaic

business decisions

(ii) Proprietors) Shareholders! Partners : They_are interested to know the rate of return on the

investment of long term solvency ofthe firm, the profit earning capacity ofthe firm and the growth potential

Accordingly, they can make sensible and judicial decision regarding the investment or withdrawal of capital

‘by way of acquiring or disposing shares on the basis of information available from the financial staternents

(iii) Creditors, Bankers and other Lenders : Bankers, creditors and other lenders are interested t©

know the ultimate solvency, liquidity position and the coverage of interest. As such they need information for

‘AWelcome Approach to Financial Reporting and Financial oie a

Statement Analysis For SEM VI(Honours) \N

ascertaining existing and proposed debt and interest paying capacity. Financial statement analysis helps

them to collect information in this regard.

(iv) Government : Government is interested to know about the resource allocation, profit earning

capacity and the activities of the firm. For this purpose, whatever information is needed by the firm

supplied by the financial statements. Accordingly, it will assist the government in ascertaining tax liability andl

the economic development of the country. Again the Government needs information for formulating plans

for effective economic development and growth of the different sectors of economy.

(v) Customers : Customers are interested to know whether the firm is able to supply quality products

over the long period of time at reasonable price. As such, the customers may go through the financial

statements of the firm to know their efficiency and financial validity for long term association with the

business firm.

(vi) Rivals : Rivals are interested to study financial statements to compare the relative performance of

the firms

(oii) Employees : They need information to evaluate the ability oftheir employer regarding remuneration,

retirement benefits and employment opportunities. Accordingly, they are interested to study the financial

statements to know about the profitability and economic stability of the firm.

(vlli) Research Scholars : They are interested to use the accounting information for their research

work. Financial statement analysis is of great help to the research scholers to a great extent. They analyse the

financial information and evaluate their requirement to satisfy the information need of the users If the

existing accounting and reporting system appear to be inadequate or it fails to help the users in making

decision, then they must highlight the same and provide suggestion for their development. That is why, the

research scholars depend heavily on the financial statement analysis for their research work.

(bx) General Public : Business concem can influence the general public both individually and collectively

They have substantial contribution to the society in many ways. Such as providing job opportunities,

infrastructure development, patronage of local suppliers etc. Financial statement anaiysis may help the

general public by supplying information in studying the trend and current development in the sphere of

prosperty of the firm and the span of its activities.

(x) Auditors : Financial statement analysis assists the auditors in determining the field of work which

needs special care during the course of performing their duties.

(xi) Merger and Acquisition Analysts : They need information for the purpose of determining the

economic value and evaluating the financial health of potential merger firms.

(xil) Trade Union : Financial statement analysis assists the trade unions by providing information in

respect of the following causes :-—

(a) Increase in wages, (b) Evaluation of working condition, (c) Evaluation of faimess of wages presently

active, pension plan etc.

Beyond that, analysis of financial statement is socially desirable and the signals of social desirability

are.

(a) Capital output ratio, (b) Cost-benefit ratio; (c) Value added Per rupee of capital, (d) lc

Potential, () area development, (f) foreign exchange benefit to country, (g) value adcled a sia a

5.10 Comparative Statement:

Comparative Statements or Comparative Financial Statements refers to a comparative study of

components or elements or items of financial statements (I.e., Balance Sheet and Income Statement) for

two or more years or with that of other entities. It is a historical summary of the same item or group of items

of consecutive Income Statements or Balance Sheets of an entity.

Introduction to Financial Statement Analysis 69)

The comparative Statement is prepared to reveal:

(i) Absolute Figures/Data- in rupee amount.

(ii) Increase or decrease in absolute amounts.

(if) Increase or decrease in absolute figure in percentage

(iv) Comparisons expressed in ratios.

(v) Percentage of total amounts.

5.10.1 Advantages of Comparative Statemen'

(a) For Evaluation of Financial Performance: It is a useful tool for evaluation and analysis of

financial performance of an entity over a period of two or more years or with respect to other entities.

(b) Earmarked Changes: Itis helpful in indicating the changes either in terms of absolute amount or

in terms of percentage.

(c) Highlighting nature of changes: It provides information regarding changes in the financial position

to measures the influences of such changes.

(a) Indicating, Strength and Weakness: It provides information regarding strengths and weaknesses

about the liquidity, solvency and profitability of the business entity.

(e) Comparison with other entities and Industry Performance: It reveals the comparative position

of an entity's performance with that of the average performance of similar entities and also that of

with the industry.

(f) Helps to make Forecasting and Planning: It ensure analysis of past multi- year financial data.

This will in turn helps the management in forecasting and planning.

(g) Key Financial Statistics: It act as a guide to the movement of Key financial statistics.

(h) Key Help in Decision Making: It provides information regarding financial health of the enterprises

to help them to make decisions pertaining to various important and crucial financial matters.

(i) Trend Analysis: Financial statements provide information regarding changes in the financial

performance and financial position of the business enterprises. It indicates the trends in respect of

various components of financial items and thereby helps the analyst to evaluate the performance of

the entity and thus helps in forecasting.

5.10.2. Weakness of Comparative Statements:

(a) Historical records: It enables analysis of past data i.e. analysis of past financial statements. Thus,

it reveals the trends of those happening that are occurred in the past. It is not reflective of future,

which is more relevant.

(b) Price Level Changes: As data and transactions are recorded in the financial statement at historical

cost, thus Inter-period comparison on the basis of comparative statement produce misleading results.

Because when comparison is made the value of money does remain same due to change in price

level. As such, whatever comparison is made are meaningless.

(©) Difficult to make Inter-firm Comparison: Intr-firm comparison on the basis of comparative

statement produce erroneous conclusion particularly when the firms under comparison differ in sizes

and adopting different accounting policies

(4) Difficult to make detailed analysis: Comparative statements reveals the changes in liquidity,

solvency and profitability of the entity but it failed to indicate the causes of such changes.

(e) Chance of Providing Misleading Information: Sometimes comparative statement failed to

provide meaningful information. For instance, when in respect of an item a negative amount appears

‘AWelcome Approach to Financial Reporting and Financial e = A

Statement Analysis For SEM VI(Honours)

in the base year and positive amount appears in the current year, then itis dificult to make meaningful

percentage change. Moreover, if there is no figure in the base year then it is also very difficult to

compute percentage change.

A. Types of Comparative Statements:

(a) Comparative Balance Sheet;

(b) Comparative Income Statement;

(c) Comparative Fund Flow Statement;

(d) Comparative Cash Flow Statement.

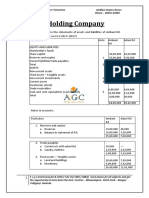

(a) Comparative Balance Sheet: Comparative Balance Sheet refers to a statement of assets and

liabilities which shows the position of assets and liabilities of two or more balance sheet dates or two or more

business enterprises. It studies the trend of same items or group of items between two or more balance sheets

dates or two or more business enterprises. According to Foulke, “Comparative Balance Sheet Analysis is

the study of the trend of the same items. Group of items and computed items in two or more Balance Sheets

of the same business enterprise on different dates.”

Purpose for preparation of Comparative Balance Sheet:

(a) To study the trend of short-term financial position;

(b) To study the trend of long-term solvency position;

(c) To study the growth of the business enterprise.

Advantages of Comparative Balance Sheet:

(a) Acomparative study of balance sheets of two or more years focus on the changes that have prevailed

in the figures of different components of assets and liabilities.

(b) The increase or decrease in the figures of different assets and liabilities (both in absolute terms as well

in percentage term) can easily be noticed which helps in forming an opinion about the progress made

by the business enterprises.

(c) Asingle Balance Sheet throws light on status while the Comparative Balance Sheet throws light is

on changes.

(d) A Comparative Balance Sheet is a more useful statement than single balance because it provides

the scope of understanding the trend in the business enterprises.

(¢) Itreveals the effect of business operation on assets, liabilities and equity and create a link between

the Balance Sheet and Statement of Profit and Loss.

Preparation of Comparative Balance Sheet:

Generally following five columns are drawn in Comparative Balance Sheet which contains the following

information:

Column 1: The details of components or items or elements of Balance Sheet are recorded in this

column;

Column 2: The data or amount pertaining to components of previous year is recorded inthis column;

Column 3: The data or amount pertaining to components of current year is recorded in this column:

Column 4: The differences (i.e., either increase or decrease) in amount betwe

current year are recorded in this column;

Column 5: The percentage of above changes taking previous year as base are recorded in this column.

(b) Comparative Income Sheet: Comparative Income Statement refers to that statement which

reveals the operating results of two or more accounting periods so that the changes in the data or amount

both in terms of absolute amount and percentage can be known. From this statement ‘we can understand the

en the previous year and

a i 4

“Yast & Introduction to Financial Statement Analysis

trend of financial performance over two or more accounting periods. It helps to identify financial trends and

measure performance over time. It may also use to compare the items of revenue income and expenses of

one company with other companies and depict the trend thereof.

Purpose for preparation of Comparative Income Statement:

(a) To analyses the change in income and expenditure for two or more accounting periods or between

two or more enterprises.

(b) To analyse the increase or decrease in the items of income or expenditure in terms of rupees and also

in terms of percentage.

(c) To understand the overall profitability of the business enterprise by taking into consideration the

changes in the net profit in the given accounting period.

(a) To review the operating performance of the past year and its likely effect on the current year.

Advantages of Comparative Income Statement:

(a) It makes analyses simple and fast as past figures can easily be compared with the current figures

without the need for referring to separate past Income Statement.

(b) Itmakes comparison across different companies also easy and helps in analyzing the efficiency both

at Gross Profit Level and Net Profit Level.

(c)_ Itshows percentage in all line items of the Income Statement which makes analysis and Interpretation

of Top Line (Sales) and Bottom Line (Net Profit) easy and more informative.

Preparation of Comparative Income Statement:

Generally following five columns are drawn in Comparative Income Statement which contains the following

information:

Column 1: The details of items of Statement of Profit & Loss or Income statement (i.e., Sales, other

Income, Cost of Materials consumed, Purchase of stock-in-trade, change in inventories of Finished Goods,

Work-in-progress and Stock-in-trade, Employee Benefits Expenses, Depreciation and amortization, Finance

Cost etc.) are recorded in this column;

Column 2: The data or amount pertaining to items of previous year is recorded in this ‘column;

Column 3: The data or amount pertaining to components of current year is recorded in this column;

Column 4: The differences (ie., either increase or decrease) in amount between the previous year and

current year are recorded in this column;

Column 5: The percentage of above changes taking previous year as base are recorded in this column.

5.11 Common-size Statement

Common size statements refers to those statements in which figures reported are converted into percentage

tosome common base. Common-size may prepare for two or more years. Common-size statements provides

vertical analysis. In this type of statement, the comparisons are made vertically from top to bottom for an

analysis of component changes that occur with certain common base. In this form every items of financial

statement are in percentage on the basis of a common base (viz. In case of Common-size Income Statement

on the basis of sales and in case of Balance Sheet on the basis of total assets or total ‘equities. Thus, analysis

financial statements aftr they ave common. based is generally known as Common-size Financial Statement

is. According to Kohler, “Common-size statements are : c

game ibace rather than rupees” ‘accounting statements expressed in percentages

‘Common-size Statement is prepared to reveal:

(@) Items of common-size financial statement are evaluat.

; ‘ed from top tc te

(b) Itreveals the trend in different items of incomes and »P to bottom or bottom to top.

expenditures.

‘AWelcome Approach to Financial Reporting and Financial 3

Statement Analysis For SEM VI( Honours) 4 in.

(c) It reveals the change in individual items of Income Statement in percentage with reference to a

common base.

5.11.1, Advantages of Common-size Statement:

(a) Itreveals Sources and Application of Funds in a nutshell which help in taking decision.

(b} If common size statements of two or more years are compared it indicate the trends of various

components of Assets, Liabilities, Cost, Net Sale & Profit.

(c) When Inter-firm Comparison is made with the help of Common size statement it helps in doing

corporate evaluation and ranking.

(d) It facilitates cross-sectional analysis because under this analysis size of the concern is not bar.

(e) Ithighlights the difference in corporate strategies.

() The purpose of common-size financial statements is to eliminate those financial differences between

concems that have nothing to do their primary operations

5.11.2 Disadvantages of Common-size Statement:

(a) Common-size statements becomes useless if consistency is not maintained in accounting policies,

concepts and conventions.

() Common-size Statement is prepared on the basis of historical data, so it does not consider the time

value of money i.e. change in price levels,

(c) The common-size statement ignores the qualitative elements of the firm.

(2) Common-size failed to ascertain different ratios like Current ratio, Liquid ratio, Debt-equity ratio,

Capital Gearing Ratio etc. which are essential for ascertaining the liquidity and solvency ratio of a

concem.

(e) Common Size Statements are regarded as useless as there is no established standard proportion of

an asset to the total asset or an item of expense to net sales.

(| Iffinancial statement of a certain business concem is not prepared year after year on consistent basis,

comparative study of common-size statement will be misleading,

‘Types of Common-size Statements:

(2) Common-size Balance Sheet;

(b) Common-size Income Statement.

(a) Common-Size Balance Sheet: ’

The common-size Balance Sheet shows the relation between each elements of assets with total assets

and each element of liabilities to total equity and liabilities in terms of percentages. In common-size Balance

Sheet all total assets and total equity and liabilities is considered as 100 and all the figures are expressed as

a percentage of total. Comparative Balance Sheet of two or more years help to observe the trends in different

items. Moreover, if it is prepared for different concerns in an industry, it facilitates to judge the relative

soundness and helps to understand their financial strategy.

Objectives of Preparation of Common-size Balance Sheet:

(2) To analyze the changes of different items of Balance Sheet.

(b) To establish a relationship between different items of Balance Sheet.

(c) To reveals the trends of different items of assets, liabilities and equity.

(€) To judge the relative financial position of different concerns under the same industry common-size

balance sheet of two or more years may be prepared.

(e) Toevaluate the financial strategy adopted by different enterprises in an industry.

ey & Introduction to Financial Statement Analysis 3

Advantages of Common-size Balance Sheet:

(a) pe to clearly understand the percentage of each individual item of asset as a percentage of total

assets.

(0) It helps to clearly understand the percentage of each individual item of liability and equity as a

percentage of total equity and liability.

(©) Ithelps a user to ascertain the trend related to the percentage share of each item of the assets part

and percentage share of each item of the liability and equity part.

(@) A financial user can also use it to compare the financial performance of different entities at a glance

since each item is expressed in terms of percentage of total assets and the user can determine any

required ratio quite easily.

Disadvantages of Common-size Balance Sheet:

(a) As there is no approved standard proportion of each item to the total asset so a common-size

balance sheet is considered as impracticable and it does not aid any decision-making process.

(b) Incase the balance sheet of a concern is not prepared year after year on a consistent basis, then it

is misleading to cary on any comparative study of a common -size Balance Sheet.

(c) If there is inconsistency in preparing Financial Statements due to change in accounting principles,

concepts and conventions, then preparation of common-size balance sheet becomes a meaningless

exercise.

(d) During the period of seasonal fluctuations in different components of assets and liabilities a common

size balance sheet does not convey proper records. As such, it fails to provide the actual information

to the users of financial statements.

(e) Acommon-size balance sheet fails to detect the ill effects of window dressing of balance sheet to

provide the true positions of assets and liabilities.

() Acommon-size balance sheet fails to detect the qualitative elements while gauging the performance

‘of a company, although it is not a good practice to ignore it. Examples of qualitative elements are

customer relations, efficiency and talent of workers, quality of products, quality of after sales services,

etc.

(@) It also fails to ascertain the solvency and liquidity position of a company. It just measures the

percentage changes in various components of assets, liabilities and equity. Moreover, it fails to

ascertain the different balance sheet ratios like current ratio, acid test ratio, debt equity ratio, proprietary

ratio, capital gearing ratio etc. which are essential for determining the solvency and liquidity position

of a company.

Preparation of Common-size Balance Sheet:

Generally following five columns are drawn in Common-size Balance Sheet which contains the following

information:

Column 1; The details of components or items or elements of Balance Sheet are recorded in this

column; :

Column 2: The data or amount pertaining to components of previous year is recorded in this column;

Column 3: The data or amount pertaining to components of current year is recorded in this column;

Column 4: Ascertain and enter the percentage relation of different components of previous year’s

Balance Sheet to total equity and liabilities/ total assets, which are considered as 100, in this column;

Column 5: Ascertain and enter the percentage relation of different components of the current yeat’s

Balance Sheet to total equity and liabilities/ total assets, which are considered as 100, in this column.

(b) Common-size Income Statement:

Common-size income statement refers othe statement which expresses all tems of income statement a5

‘A Welcome Approach to Financial Reporting and Financial Sk a/

Statement Analysis For SEM VI(Honours) x oo

a percentage of revenue from operations. In other words, itis that statement in which revenue from operations

is considered as 100 and all other items income statement are expressed as a percentage of revenue from

operations. Common-size Income staternent for different period helps to reveals the efficiency or inefficiency,

Moreover, ifitis prepared for two or more companies at a time it reveals the relative efficiency of cost items

of them.

Objective of preparation of Common-size Income Statement:

(a) To analyses the change in individual item of Income Statement.

(b) To study the trend in various items of Incomes and Expenses.

() To consider a common base for comparison.

Advantages of Common-size Income Statement:

(a) Itbecomes easy to compares companies as the size does not matters L.e., cross sectional analysis.

(b)_Itis useful in time series analysis.

{c)_ Itsnapshots the variation in the corporate strategies.

Disadvantages of Common-size Income Statement:

(a) Ifconsistency is not maintained in accounting principles, concepts and conventions, then preparation

of common size income statement becomes misleading.

(b) Asitis prepared on the basis of historical data, so it does not recognize the change in the price level.

() The common-size income statement fails to provide data for ascertaining the different ratio like

Gross Profit Ratio, Net Profit Ratio, Operating Ratio and Operating Profit Ratio etc. to ascertain the

profitability of a company or companies.

Preparation of Common-size Income Statement:

Generally following five columns are drawn in Common-size Income Statement which contains the

following information

Column 1; The details of items of Statement of Profit & Loss or Income statement (i.e., Sales, other

Income, Cost of Materials consumed, Purchase of stock-in-trade, change in inventories of Finished Goods,

Work-in-progress and Stock-in-trade, Employee Benefits Expenses, Depreciation and amortization, Finance

Cost etc.) are recorded in this column;

Column 2: The data or amount pertaining to different items (ie., Income/Expenses) of the Income

Statement of previous year is recorded in this column;

Column 3: The data or amount pertaining to different items (i.e., Income/Expenses) of the Income

Statement of current year is recorded in this column;

Column 4: Ascertain and enter the percentage relation of different items of Income Statement for the

previous year to revenue from operations (which are considered as 100) in this column;

Column 5: Ascertain and enter the percentage relation of different items of Income Statement for the

previous year to revenue from operations (which are considered as 100) in this column.

5.12 Trend analysis:

The word ‘trend’ signifies future possibilities. It is the smooth, regular and long-term movement of data

showing the basic tendency to expansion, diminution or stagnation over a period of time. An efficient and

effective management tries to know the actual performance and also discovers future prospect of the business.

‘The trend analysis acquaints us with the profitability and the short term as well as long term liquidity of the

business. Moreover, it also discovers the future prospects of the business in terms of profitability, operational

efficiency and financial soundness of the enterprise. It indicates the ‘increasing trend’ or ‘decreasing trend’ of

Introduction to Financial Statement Analysis

any particular series of data. The essential features of trend analysis are its smooth pattern of movement,

‘end analysis is generally done when data are available for a series of accounting period. More specifically,

itisa statistical method of identifying direction, speed and extent of trends in individual components in the

financial statements over a longer period of time of 5 years or even 10 years. It highlights how prime financial

numbers say sales, profits, current assets, current liabilities etc. moved in the past and this in turn guides the

financial analysts how they could behave in the future. This analysis is also named as Intra-firm analysis and

horizontal analysis,

5.12.1. Various Tools of Trend Analysis:

Following are the different methods that are generally used for trend analysis:

(a) Percentage Change Method: Under this method accounting figures are converted into percentage

over a series of accounting period. The figures in the base year is considered as 100. The main drawback of

this method is that it ignores the effect of price level changes.

(b) Graphical Method: Under this method financial data of the period of study may be presented

graphically with the help of line diagram. The main merit of this method is that it helps the financial analyst

tounderstand the trends of data at a glance. Graphical presentation helps to understand the trends of sales,

net profit etc. quickly,

(c) Trend Ratios: Trend radios indicates the direction of change of a specific component over the period

ofstudy. It shows the indication of how the results over a series of accounting year are compared and show

the general direction of trend. Generally, trend ratios include — current ratio, acid test ratio, gross profit ratio,

net profit ratio, net income to proprietor fund ratio, fixed assets to proprietor fund ratio, equity ratio, proprietary

ratio, capital ratio, earning per ratio etc. Generally, trend ratio is calculated with the help of the following

formula:

Trend Ratio = Absolute value of a particular item in the vear of comparison x 100

Absolute value of that item in the base year

The following steps are generally followed for ascertain the trend ratios and executing trend analysis:

Step 1: Selection of Base Year: One specific yearis selected as base year on the basis of which comparison

isto be made. In any case, it must be normal year i.e. the year which is free from any abnormal activities and

may have minimum fluctuations. The figures of base year are considered as 100.

Step 2: For each individual item trend percentage is to be calculated on the basis of above stated

formula.

Step 3: In the final step, conclusion is to be drawn logically and meaningfully by considering the patter

of trend values or trend ratios. »

Objectives : Trae

(i) Indicating the profitability of the enterprise.

(ii) Showing operational efficiency of the business.

(iii) Indicating actual and prospective performance of the business.

(iv) Assisting in decision making regarding future course of action.

(v) Manifesting short term and long term financial soundness of the enterprise.

Advantages of Trend Analysis:

(a) Prompt Understanding of the Progress: The progress of the business can be expeditiously

evaluated by determining the trend of sales, production, profit, capital employed etc.

AWelcome Approach to Financial Reporting and Financial

‘Statement Analysis For SEM VI(Honours)

(b) Possibility of making inter-firm Comparison: Comparative trend data of the given business

and its rivals enable inter-firm comparison for evaluating the strength and weakness of the given

business.

(c) Ensure control and Decision Making; Comparison of trend ratios in related items enable

management to ensure control and decision making. For instance, the hike of trend ratio of cost of

sales over the hike of trend ratio of sales give indication to the management for further investigation

and necessity to take corrective action.

(d) Investment Decision: On the basis of trend analysis, an investor can make investment decisions

more rationally and judicially.

{e) Forecasting of Future: It enables the analyst to make forecasts about the future growth and

prospects,

() Measuring the Liquidity and Solvency: Trend analysis helps management and the analyst to

understand the short-term solvency and liquidity position of a business concem over a period of time

with the help of related trend ratios.

(g) Useful for Comparative Study: Trend analysis is very effective for making comparative analysis

of data to measures the financial performance of the business concern over time period and which

helps management to make decisions for the future i.e. it helps to predict the future.

(h) Measuring Profitability Position: Trend Analysis also helps to measures the profitability position

of the business concer over the time on the basis of few related financial trend ratios (i.e. Operating

ratio, Net Profit Ratio, Gross Profit Ratio etc.)

Limitations of Trend Analysis:

{a) Inflationary Factor: Trend analysis data are generally influenced by inflationary factor i.e. by the

factors which cause a rise in the price level. Thus, it creates problems to identify the real growth by

the trend analysis. Occasionally, it is recommended to use price deflator to arrest inflationary effect

from the time series data. However, the selection of appropriate price index is another problem.

(b) Consistency of Business Factors: Trend analysis over a long period of time is not always meaningful

because the accounting policies followed by the entity may have changed over time. The environmental

and competitive conditions may have changed considerably.

(c) Problem in selection of base year: Selection of base year for trend analysis is also a very difficult

exercise. A base year should always be a normal year. It should be free from any abnormality.

(d) Useless in Inflationary Situation: Analysis of trend ratios is useless at the time of inflationary

period. Trends of data which are considered for comparison create misleading results.

5.13. Distinguish between Comfarative Statement Analysis and Common-

size Statement analysis:

Points of | Comparative Statement Analysis Common-size Statement Analysis

Difference

1, Definition | Comparative study of financial statement is the | Common size statement means the statement

‘comparison of the financial statement of the | which is prepared by expressing every itern of

business with the previous years ‘financial published financial statements in the form of

statement and with the performance of other _| percentage of its important heading

competitive enterprise, so that weakness and

shortcomings may be identified and remedial

measures applied.

‘stl 8

Introduction to Financial Statement Analysis

Points of

Difference

Comparative Statement Analysis

Common-size Statement Analysis

2. Base year

Under this statement analysis, previous year

's considered as the base year:

The normal year in which financial information

is analyzed, is considered as the base year. In

this statement analysis there is no other specific

base year.

3, Scope

Under this statement analysis information

of two or more years financial statements are

compared. Thus, its scope is wide.

Under this statement analysis information of

only one year’s financial statement is compared.

Thus, its scope is very narrow,

4, Analysis

As under Comparative Financial Statement,

we have to look after the analysis of a couple

of years’ financial statements, hence this

statement analysis is termed as Horizontal

Analysis or Dynamic Analysis,

Under Common size Financial Statement

Analysis, we have to make analysis of the

financial statement of only one year. Thus, itis

termed as Vertical Analysis or Static Analysis.

5, Comparison

Inter-firm comparison is difficult. Because the

firm differs with size, capital, turnover ete.

Inter-firm comparison can be made easily.

Because all the elements can be expressed in

the form of percentage

6. Importance of

each item

Under this analysis the relative importance of

financial statements is very low, Because all the

items of such statements are disclosed in

absolute figure.

Under this analysis all the figures of each item

are expressed in the form of percentages. As

such, the relative importance of each item of

financial statements is much more.

7. Basis of

Comparison

Under this system comparison is made in

terms of absolute figure.

Under this system comparison is made in terms

of percentage.

5.14 Distinguish between Comparative Fi

size Financial Statement:

ras

slg Statement and Common-

Points of Comparative Financial Statement Common-size Financial Statement

Difference

1.Nature of | Comparative statement analysis is a horizontal. | Common-size statement analysis is a vertical

Analysis analysis. It is also a dynamic analysis. analysis Its also a structural analysis

2. Base of Data | In this analysis, the figures of previous year are_| In this analysis the total figures i.e, sales, total

taken as base assets etc.are taken as the base.

3. Contents Both absolute change and percentage change | Only percentage of the elements in respect to

are reflected through this analysis. total figure are expressed through this analysis.

4. Nature of __| In this analysis inter-firm comparison is very _| In this analysis both intra-firm and inter-firm

Comparison | difficult. So, only intra-firm comparison is, comparison are possible because these are

possible expressed in percentage =

5. Importance | This analysis does not disclose the relative This analysis can clearly disclose the relative

Relative importance of the component items. importance of component items.

-_ a

Accounting Ratios for Financial Statement Analysis |

vi ia :

6.1 Introduction:

“The Financial Statements are the end products of financial accounting, Traditionally financial statements

consist of (a) Income Statement (i.e. Profit & Loss account/Statement of profit & Loss ~ in case of company)

and (b) Position Statement (i.e. Balance Sheet). While, the Income Statement reflects the financial performance

of the entity for a defined period of time, the Balance Sheet exhibits the financial position of the firm at a

point of time ending that period. The absolute figure included in the conventional financial statements failed

to serve the information needs of various stakeholders directly or indirectly associated with the business. But

itis very difficult to deduce any meaningful inference on the basis of absolute figures of the financial statements,

In order to gauge accurately the financial health of a business concern accounting figure must be related to

some other relevant accounting figure. Here arises the need of ratio analysis.

6.2 Meaning Rati

The term ratio refers to the numerical or quantitative relationship between two items or variable. It is

calculated by dividing one item of the relationship with the others. For instance, there are 50 teachers ina

degree college having 2,000 students. Thus, the teachers-students ratio of that college is 50: 2000= 1:40.

6.3 Meaning of Accounting Rati

Accounting ratio refers to the quantitative relationship between the relevant accounting figures. It is

calculated by dividing one item of the relationship with the others. Itset up a causal relationship between two

accounting figures. It indicates the mathematical relationship between two or more accounting data used in

the financial statements of a firm. It can be expressed as

(a) Pure Ratio e.g. ratio between current assets and current liabilities say 2:1.

(b) Rates ie. ratio with reference to time period e.g. Fixed Assets Turnover ratio say 2 times in a year

(©) Percentage e.g. Gross Profit Ratio say 30%.

6.4 Meaning of Ratio Analysis a

Ratio analysis is the process of analyzing the performance of a concei i

help of different ratios of relevant accounting figures available in the franc sui dine — abi I 7

an altemative method of expressing items which are related to each other for the purpose of finencial

analysis. Ratio is the numerical or quantitative expression of relationship that exist between two iterre or

variables and the expression may be either in the form of percentage or rates or pure ratio. But mere

formulation of different accounting ratios will not serve any useful purpose unless itis purely analyzed and

interpreted. Basically, accounting ratios are the symptom, by the analysis of which the financial analyst may

| OORT na

“Sf it & ‘Accounting Ratios for Financial Statement Analysis

al

anived at the conclusion about the profitability, solvency, liquidity and the managerial efficiency of the

| concem.

6.5 Ob%ectives of Ratio Analysi:

The objectives of ratio analysis are:

{a) To simplify the accounting information.

(b) To assess the operating efficiency of the business.

(c) To analyze the profitability of the business

(d) To help in inter-form and intracfirm comparison.

(e) To assess the performance of the business entity and improve the management functions i. planning

coordination and control.

(0) Toascertain the financial strength and weakness of the business entity,

(@) Todetermine the liquidity or short-term solvency and long-term solvency. Short-term solvency refers

to the ability of the firm to meet its short-term financial obligations. Whereas, the long-term solvency

refers to the ability of the firm to meet its long-term financial obligations.

(h) To find out the deviationibyicomparing the actual with the standards so that corrective action can be

taken on time "ym

6.6 Advantages of Ratio Analysis: we Sh

Following are the few important advantages of ratio analysis:

(a) Forecasting and Planning: The trend in costs, sales, profits and other related matters can «

known by the management by computing different accounting ratios of relevant accounting figures

of the last few years. This trend analysis with the help of ratios may be useful for forecasting and

planning future business activities.

(b) Budgeting: Budget is an estimate of future activities on the basis of past experience, Accounting

ratios help to estimate budgeted figures. For example, with the help of last year's stock turnover ratio,

current year’s production budget can be prepared with respect to forecasted sales.

(c) Communication: Pertinent information regarding financial strength, earning capacity, liquidity,

solvency, production capacity, sales capacity, collection capacity can be meaningfully communicated

to outsiders with the help of ratios.

(d) Measurement of Efficiency: The technique of ratio analysis provides sufficient data and information

by which the efficiency of management or the managerial ability can be clearly measured in the

utilization of various assets. It indicates the degree of efficiency in the management and utilization of

assets.

(c) Control of Performance and Cost: Ratios may also be used for control of performances of

different divisions or departments of an entity along with control of cost.

(9 Inter-firm Comparison: Inter-firm comparison with the help of relevant ratios with those of

competitors or with the average ratios of the industry reveals efficient and inefficient firms, thereby

Gnabling the inefficient firms to adopt proper measures for improving their efficiency

(@) Indication of Liquidity Position: Ratio analysis helps to assess the liquidity position i., the

short-term debt repayment ability of the entity. Itreveals the debt repayment ability of the entity and

helps in credit analysis by creditors, banks and other suppliers of short-term loans.

(h) Decision Making: The techniques of ratio analysis provides sufficient information to the management

to assist them in making decisions like whether to supply goods on credit to a firm, whether bank

A Welcome Approach to Financial Reporting and Financial &, y

Statement Analysis For SEM VI(Honours) Se fi”

loans will be made available etc.

(i) Indication of Long-term Solvency Position: The technique of ratio analysis is also used to

assess the long-term debt paying capacity of a firm. Long-term solvency position of a borrower is a

prime concem to the long-term creditors, security analysts and the present and potential owners of

the business. It is ascertained by the leverage/capital structure and profitability ratios which reveals

the earning ability and operating efficiency. It indicates the strength and weakness of the firm in

respect of determination of long-term solvency position.

(%) Signal of Corporate Sickness: The extent of corporate sickness can be known well in advance

with the help of the technique of ratio analysis. It provides signal in this respect at the proper time,

so that corrective measures can be undertaken to prevent the occurrence of such eventualities.

(\) Simplification of Financial Statements: Ratio analysis makes it easy to grasp the relationship

between different items and helps the analyst to understand the financial statements.

() Indication of Overall Profitability: The management of an entity always want to know the

overall profitability of the firm. They may also want to know the short-term and long-term solvency

position of the firm to judge the debt repayment capacity. This is possible only when all the ratios are

considered together.

6.7 Limitations of Ratio Analysis: te

Accounting ratios are nof free from limitations. These are stated below:

(2) Incomparability: Inter-firm comparison is possible only when the firm in question adopt the same

accounting principles and procedures. Butit is quite absurd, that the two firms will follow the same

accounting principles and procedures. As such, in such cases itis quite impossible to make inter-firm

comparison and if done it will give misleading results.

() Dependence on Current Data: The efficiency of ratio analysis is relied on the reliability of the

accounting data. Ifthe accounting data fabricated, the ratio analysis will provide misleading conclusion.

(c) Lack of Standard: Fixation of standard is not a very easy task. Apart from this, the standard ratio

of two related items may vary from industry to industry. In reality, it is quite impossible to calculate

universally applicable standard ratios for the purpose of making comparisons with the actual ratios,

and assess.

(a) Historical Data: Ratios do not provide definite answers because financial statements are historical

in nature based on estimated data such as provision for bad debt and are subject to arithmetical

accuracy.

(e) Solution of Problem Remain Unsolved: Ratio analysis only snapshot the problem but failed to

provide any solution for such problem. Identification of problem is not enough. It is just at the

doorstep. Further investigation is essential for the solution of this problem.

() Defect of Single Ratio: A single ratio, whatever important it may be, cannot be considered as the

prime indicator of a particular affair of a concern. As such, a bunch of co-related accounting ratios

must be calculated from the different angle for the purpose of making unambiguous and healthy

diagnosis of an affairs and for providing meaningful information.

(@) Misuse of Multiple Ratios: Use of too many ratios for the purpose of drawing a conclusion about

an affair of a concem is also very dangerous. Instead of giving better diagnosis, it will distort the

result, because the use of too many ratios may create confusion in the mind of analyst to come to

a clear conclusion and making a decision.

(h) Change in the Price Level: Frequent change in the price level very often distort the trend analysis

done through ratio analysis.

‘oa B ‘Accounting Ratios for Financial Statement Analysis,

(i) Personal judgementand Bias: Knowledge in selecting quality data with personal judgement are

attached to the significance and reliability to ratio,

(i) Presentation of Misleading Picture: Since ratios account for only one variable, hence they

cannot always give correct picture. As such, this cannot be used as a sole technique for decision

making. Other techniques of management accounting should also be applied parallelly along with

Tatio analysis for clear analysis and detailed investigation in a particular is essential for the purpose

of decision making

()

Analysis of Past Data: Since ratios are usually computed on the basis of past financial statement

hence these are not true indicators of the future. As such, forecasting and decision making cannot

always give sufficient and satisfactory result.

() Useful Phenomenon: Ratio analysis is said to be useless when it is not compared with the number

of years result.

6.8 Classification of Ratios:

Accounting Ratios may be classified in different ways. However the most widely used classification of

ratios are as follows

Classification of Ratios

We

According to Source According to Function

Aspects of Firm's Operation Economic Aspects of the Firm

Balance Sheet / Position Statement Ratios

Profit & Loss Account or Income Statement Ratios

Balance Sheet and Profit & Loss

Account Ratios or Mixed Ratios or Position Statement.

Cum Income Staement Ratios

Liquidity Ratios

Long term Solvency Ratios

Efficiency or Turnover Ratios

Profitability Ratios

RENE

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Working Capital ManagementDocument2 pagesWorking Capital ManagementSundarNo ratings yet

- Capital Expenditure DecisionsDocument2 pagesCapital Expenditure DecisionsSundarNo ratings yet

- According StandardDocument5 pagesAccording StandardSundarNo ratings yet

- Holding CompanyDocument3 pagesHolding CompanySundarNo ratings yet

- Accounting Ratios For FSADocument4 pagesAccounting Ratios For FSASundarNo ratings yet

- LeverageDocument2 pagesLeverageSundarNo ratings yet

- Cost of CapitalDocument2 pagesCost of CapitalSundarNo ratings yet

- Aswina Mango From Malda Adv Booking OpenDocument3 pagesAswina Mango From Malda Adv Booking OpenSundarNo ratings yet

- Qmin Kolkata Taj Bengal 2Document21 pagesQmin Kolkata Taj Bengal 2SundarNo ratings yet

- Dividend PolicyDocument15 pagesDividend PolicySundarNo ratings yet

- Financial Management SuggestionsDocument7 pagesFinancial Management SuggestionsSundarNo ratings yet

- Last Time Tips by CA Ankit PatwariDocument41 pagesLast Time Tips by CA Ankit PatwariSundarNo ratings yet

- FM Theory 2Document14 pagesFM Theory 2SundarNo ratings yet

- Fr&Fsa TheoryDocument30 pagesFr&Fsa TheorySundarNo ratings yet

- FM TheoryDocument17 pagesFM TheorySundarNo ratings yet