Professional Documents

Culture Documents

Dharshini R Dna

Dharshini R Dna

Uploaded by

Punitha K0 ratings0% found this document useful (0 votes)

7 views3 pagesGeo-tagging of payment system touch points refers to capturing the geographical coordinates of locations where merchants accept payments from customers, such as POS terminals and QR codes. The RBI's new framework mandates that banks and non-bank payment system operators maintain a registry with accurate location details of all touch points. This will help banks monitor infrastructure penetration across regions and identify areas for additional deployment, while also providing the RBI insights to guide policy. All payment institutions must begin reporting touch point information through the RBI's system, though a timeline for implementation has not been set yet.

Original Description:

Original Title

DHARSHINI R DNA

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGeo-tagging of payment system touch points refers to capturing the geographical coordinates of locations where merchants accept payments from customers, such as POS terminals and QR codes. The RBI's new framework mandates that banks and non-bank payment system operators maintain a registry with accurate location details of all touch points. This will help banks monitor infrastructure penetration across regions and identify areas for additional deployment, while also providing the RBI insights to guide policy. All payment institutions must begin reporting touch point information through the RBI's system, though a timeline for implementation has not been set yet.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesDharshini R Dna

Dharshini R Dna

Uploaded by

Punitha KGeo-tagging of payment system touch points refers to capturing the geographical coordinates of locations where merchants accept payments from customers, such as POS terminals and QR codes. The RBI's new framework mandates that banks and non-bank payment system operators maintain a registry with accurate location details of all touch points. This will help banks monitor infrastructure penetration across regions and identify areas for additional deployment, while also providing the RBI insights to guide policy. All payment institutions must begin reporting touch point information through the RBI's system, though a timeline for implementation has not been set yet.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

GEOTAGGING OF PAYMENT SYSTEM

TOUCH POINTS AND ITS BENEFITS

RBI’s geo-tagging framework focusses on deepening digital payments and providing

inclusive access to all citizens

What is Geo-tagging of payment system touch points?

Geo-tagging refers to the process of adding geographical identification to a media

based on the location of smart phones or GPS-enabled electronic devices. Geo-tags

can be applied to media such as photos, videos, websites, text messages and QR

codes. Last week, the Reserve Bank of India issued a framework for geo-tagging of

payment system touch points, which simply means capturing the geographical

coordinates (latitude and longitude) of various touch points deployed by merchants to

receive payments from their customers.

Why is it important?

From cash as the primary mode of payment and usage of debit/ credit cards at

merchant locations, the Indian payments ecosystem has rapidly evolved in recent

years with widespread adoption of multiple payment products and systems, including

Point of Sale (PoS) terminals, Quick Response (QR) codes, prepaid payment

instruments (PPIs), net banking transfers, Immediate Payment Service (IMPS),

Unified Payment Interface (UPI) and Aadhar-enabled Payment Service (AePS).

Smartphone and internet penetration has led to proliferation of digital payments in the

country. According to data from the National Payments Corporation of India (NPCI),

UPI-led digital transactions crossed the highest-ever value of Rs 81-lakh crore with

5.42 billion transactions in FY22. However, a large number of people, especially in

the rural parts of the country, continue to use cash as the primary mode of transaction.

RBI’s geo-tagging framework focusses on deepening digital payments and providing

inclusive access to all citizens, irrespective of their location or digital literacy.

How does it work?

The central bank has categorized ‘Banking infrastructure’ and ‘Payment acceptance

infrastructure’ as two categories of physical infrastructure through which digital

payment transactions are carried out. Banking infrastructure covers payment

transactions made through bank branches, counters, ATMs and Cash Recycle

Machines (CRMs), among others. While PoS terminals, QR codes deployed by

banks / non-bank Payment System Operators (PSOs) come under payment acceptance

infrastructure. The RBI framework mandates that banks and non-bank PSOs should

maintain a registry with accurate location of all payment touch points across the

country. The registry must contain merchant-related information such as the merchant

name, ID, type, category, contact details as well as location details such as address

and state, district. Banks and non-bank PSOs must also report payment acceptance

infrastructure details such as the terminal type, terminal ID, terminal address, state,

district and geo-coordinates.

How will it benefit banks and players in the payment ecosystem?

By capturing the accurate location of various payment system touchpoints, banks can

get insights on regional penetration of digital payments, monitor infrastructure density

across different locations, identify the scope for deploying additional payment touch

points, and facilitate focused digital literacy programmes. The data collected through

geo-tagging will also help the central bank bring suitable policy interventions

wherever required.

When will it be implemented?

All banks and non-bank PSOs are required to report information on payment system

touch points through the RBI’s Centralized Information Management System (CIMS).

However, the central bank is yet to communicate the timeline for commencement of

reporting. For now, the RBI has asked banks and non-bank PSOs to submit the contact

details of the nodal officer for this activity by March 31, 2022.

You might also like

- Etrade Bank-StatementDocument5 pagesEtrade Bank-StatementMark Galanty100% (4)

- Report & Analysis About The Market of Payment Gateway Industry in Indonesia and A Strategic Plan On How To Survive The Market.Document15 pagesReport & Analysis About The Market of Payment Gateway Industry in Indonesia and A Strategic Plan On How To Survive The Market.Ario Wibisono100% (1)

- Research Proposal - Digital Payment System (BHIM UPI)Document13 pagesResearch Proposal - Digital Payment System (BHIM UPI)pooja joshi67% (3)

- New Balance $53.52 Minimum Payment Due $40.00 Payment Due Date 10/21/21Document7 pagesNew Balance $53.52 Minimum Payment Due $40.00 Payment Due Date 10/21/21DavidNo ratings yet

- Modelo SBLCDocument1 pageModelo SBLCCohen Consultor100% (1)

- Electronic Payment MediaDocument31 pagesElectronic Payment MediaAnubha100% (1)

- Digital Payments in IndiaDocument10 pagesDigital Payments in IndiaPrajwal KottawarNo ratings yet

- The Birth Certificate InfoDocument1 pageThe Birth Certificate InfoexousiallcNo ratings yet

- Cash Shortage Computation: SolutionDocument4 pagesCash Shortage Computation: SolutionCJ alandyNo ratings yet

- Wattal Committee ReportDocument2 pagesWattal Committee ReportKunwarbir Singh lohatNo ratings yet

- Luh Putu Listya Dewi Anindhita - Paper Dan Sitasi EFSPDocument11 pagesLuh Putu Listya Dewi Anindhita - Paper Dan Sitasi EFSPLuh Putu Listya Dewi Anindhita1067No ratings yet

- POS Machines SBIDocument52 pagesPOS Machines SBISakshi SinhaNo ratings yet

- Full Fledge CP Project Work-In-Progress-1Document50 pagesFull Fledge CP Project Work-In-Progress-1Eldorado OSNo ratings yet

- (2018) An Assessment of Digital Payment Method After Demonitisation in India (Lexipedia)Document8 pages(2018) An Assessment of Digital Payment Method After Demonitisation in India (Lexipedia)s.husain.bhuNo ratings yet

- Unified Payments Interface: Current QR Code-Based PaymentsDocument5 pagesUnified Payments Interface: Current QR Code-Based Paymentschaudhary harisNo ratings yet

- PSR Briefingjun2019Document14 pagesPSR Briefingjun2019goalangiaNo ratings yet

- Factors Affecting Customers' Adoption of Electronic Payment: An Empirical AnalysisDocument15 pagesFactors Affecting Customers' Adoption of Electronic Payment: An Empirical Analysisprabin ghimireNo ratings yet

- Digital Banking UpdatesDocument46 pagesDigital Banking Updatesvivek_anandNo ratings yet

- Bharat Bill Payments SystemDocument2 pagesBharat Bill Payments SystemAditya MishraNo ratings yet

- Introduction To Financial InclusionDocument9 pagesIntroduction To Financial Inclusionmahaseth2008100% (1)

- Introduction UpiDocument4 pagesIntroduction UpiSiddhant BoradeNo ratings yet

- Transformation of E-Payment & It's Impact On BanksDocument36 pagesTransformation of E-Payment & It's Impact On BanksPinky Gupta100% (3)

- Current Digital Payments Method in India: Submitted By: - Vidit Mittal (317/2020)Document4 pagesCurrent Digital Payments Method in India: Submitted By: - Vidit Mittal (317/2020)Pro BroNo ratings yet

- High-Tech Banking: Unit VDocument24 pagesHigh-Tech Banking: Unit VtkashvinNo ratings yet

- Institute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingDocument5 pagesInstitute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingSNo ratings yet

- PM Challenge Case Study: Problem DefinitionDocument6 pagesPM Challenge Case Study: Problem DefinitionBhavenParakhNo ratings yet

- Consumer Perception Towards Digital Payment ModeDocument8 pagesConsumer Perception Towards Digital Payment ModeSibiCk100% (1)

- Payment & Settlement Systems in India: Vision-2021: Banking PresentationDocument17 pagesPayment & Settlement Systems in India: Vision-2021: Banking PresentationShilpi KumariNo ratings yet

- Factors Affecting Customers' Adoption of Electronic Payment: An Empirical AnalysisDocument17 pagesFactors Affecting Customers' Adoption of Electronic Payment: An Empirical AnalysisOsama AhmadNo ratings yet

- Swathika Final PG ProjectDocument62 pagesSwathika Final PG Projectprabhakaranprabhakaran662No ratings yet

- Mis at Axis BankDocument8 pagesMis at Axis BankankitasankitaNo ratings yet

- Project On UPIDocument17 pagesProject On UPIpallavimishra1109No ratings yet

- CHAPTER2Document19 pagesCHAPTER2Monika VermaNo ratings yet

- Increase-The Government's Encouragement To Use Electronic Wallets Has Contributed Much ToDocument3 pagesIncrease-The Government's Encouragement To Use Electronic Wallets Has Contributed Much ToMahima SharmaNo ratings yet

- CN - 9 - Digital PaymentsDocument24 pagesCN - 9 - Digital PaymentsAbhishek KashyapNo ratings yet

- Chapter 1: Introduction To Digital BankingDocument9 pagesChapter 1: Introduction To Digital BankingPriyanka JNo ratings yet

- 27 04 20 SPA Instant Payment Card Initiative v1 FinalDocument14 pages27 04 20 SPA Instant Payment Card Initiative v1 FinalRobin MooreNo ratings yet

- 3 RDDocument4 pages3 RDBeneath B MathewNo ratings yet

- Dr. K V R Satya Kumar Assoc Professor Dept of Management Studies, VJIT & Dr. Seema Nazneen Assoc Professor Som, AuDocument26 pagesDr. K V R Satya Kumar Assoc Professor Dept of Management Studies, VJIT & Dr. Seema Nazneen Assoc Professor Som, AuSatya KumarNo ratings yet

- Digital Payment (PAYTM)Document35 pagesDigital Payment (PAYTM)Ankit PashteNo ratings yet

- Ruchi Finance LabDocument35 pagesRuchi Finance LabNitish BhardwajNo ratings yet

- BAHAN RESEARCH GAP - TRUST - Analysis of Factors Affecting Use Behavior of QRIS PaymentDocument20 pagesBAHAN RESEARCH GAP - TRUST - Analysis of Factors Affecting Use Behavior of QRIS PaymentNathaniel Felix Syailendra PrasetyoNo ratings yet

- Digital Payment IndustryDocument6 pagesDigital Payment Industrywubetie SewunetNo ratings yet

- Techdevelopmentsinbanking 120509205806 Phpapp01Document43 pagesTechdevelopmentsinbanking 120509205806 Phpapp01PatelMayurNo ratings yet

- E-Banking: Submitted By:-Aditi Mangal Harsha Srivastava Nakul AgarwalDocument45 pagesE-Banking: Submitted By:-Aditi Mangal Harsha Srivastava Nakul AgarwalAditi MangalNo ratings yet

- BharatQRCode AnInsightDocument3 pagesBharatQRCode AnInsightnairvasuk4No ratings yet

- Mini Project On CARDLESS ATM SERVICES by Komal Preet KaurDocument36 pagesMini Project On CARDLESS ATM SERVICES by Komal Preet KaurAkash KatiyarNo ratings yet

- Information Technology in Banking Services - Trends, Issues and ChallengesDocument9 pagesInformation Technology in Banking Services - Trends, Issues and ChallengesSneha ChavanNo ratings yet

- EpaymentsDocument35 pagesEpaymentsHarshikaa SatyaNo ratings yet

- Digital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz TajDocument6 pagesDigital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz Tajnilofer shallyNo ratings yet

- Chapter - 3 Theoretical FrameworkDocument9 pagesChapter - 3 Theoretical FrameworkSalim ShaNo ratings yet

- Asynchronous Assignment Bank Management: Submitted byDocument6 pagesAsynchronous Assignment Bank Management: Submitted bytanyaNo ratings yet

- Presented By: Ipsa Bhan (A006) Shweta Dawar (A012) Vaibhav Kapoor (A025) Bhumika Keswani (A026) Abhishek Patel (A039) Gurpreet Singh (A046)Document35 pagesPresented By: Ipsa Bhan (A006) Shweta Dawar (A012) Vaibhav Kapoor (A025) Bhumika Keswani (A026) Abhishek Patel (A039) Gurpreet Singh (A046)Abhishek Raj PatelNo ratings yet

- RBI Circular E-KYCDocument4 pagesRBI Circular E-KYCadmiralninjaNo ratings yet

- Principles of Marketing Da 3Document6 pagesPrinciples of Marketing Da 3Jayagokul SaravananNo ratings yet

- 3rd Quarrterly Review FY12 13Document5 pages3rd Quarrterly Review FY12 13Sibtain JiwaniNo ratings yet

- QPAY - ConsultingDocument14 pagesQPAY - ConsultingmayurNo ratings yet

- Pathak Commitee ReportDocument2 pagesPathak Commitee ReportKunwarbir Singh lohatNo ratings yet

- Real-Time Payment System IMPS - Future & ChallengesDocument27 pagesReal-Time Payment System IMPS - Future & ChallengesRahul AminNo ratings yet

- Secure Ciphering Based QR Pay System For Mobile DevicesDocument8 pagesSecure Ciphering Based QR Pay System For Mobile DevicesTrần Cẩm NhungNo ratings yet

- RBI Vision 2019-2021: The Way Forward: August 2019Document17 pagesRBI Vision 2019-2021: The Way Forward: August 2019hitesh ganvirNo ratings yet

- Payment and Settlement Systems in India-Major Developments: SAARC Payments Council MeetingDocument14 pagesPayment and Settlement Systems in India-Major Developments: SAARC Payments Council MeetingLalit ShahNo ratings yet

- Distribution Flow V 1.0Document8 pagesDistribution Flow V 1.0moazzambaigNo ratings yet

- Need For A Payment System ActDocument4 pagesNeed For A Payment System ActMohammad Shahjahan SiddiquiNo ratings yet

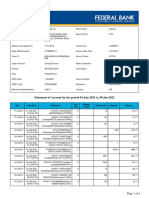

- Statement of Account For The Period 01-Jun-2021 To 30-Jun-2021Document4 pagesStatement of Account For The Period 01-Jun-2021 To 30-Jun-2021Vicky GunaNo ratings yet

- Application For Provident LoanDocument3 pagesApplication For Provident LoanJerexNo ratings yet

- Areza v. Express Savings BankDocument9 pagesAreza v. Express Savings BankMonicaSumangaNo ratings yet

- FileHandler Ashx PDFDocument1 pageFileHandler Ashx PDFneyi tumalNo ratings yet

- Maybank DeclarationDocument2 pagesMaybank DeclarationNova BitesNo ratings yet

- ConfirmationDocument2 pagesConfirmationsunny singhNo ratings yet

- Ps1 AnswerDocument6 pagesPs1 AnswerChan Kong Yan AnnieNo ratings yet

- Banking Co Final AccountDocument14 pagesBanking Co Final AccountRISHAB NANGIANo ratings yet

- Számlakivonat 20221102 180854Document2 pagesSzámlakivonat 20221102 180854cristina kerekesNo ratings yet

- Du 1NoTvuFPBsnn5D7OBtMcho1n-chargeback Issuer evidence-VPhkdSTHfelrNtp8DjIoC79FQWQ2Pp-SdUHmFmq5Ws4Document2 pagesDu 1NoTvuFPBsnn5D7OBtMcho1n-chargeback Issuer evidence-VPhkdSTHfelrNtp8DjIoC79FQWQ2Pp-SdUHmFmq5Ws4Nguyen LyNo ratings yet

- Chapter-4: E-Banking and M-BankingDocument9 pagesChapter-4: E-Banking and M-Bankinghasan alNo ratings yet

- MT103 CMTDocument2 pagesMT103 CMTchakrounifatimazohra86No ratings yet

- C4 SIand CIDocument11 pagesC4 SIand CISonu SagarNo ratings yet

- PWC TP Discontinuance of LiborDocument3 pagesPWC TP Discontinuance of LiborArpanNo ratings yet

- Unusual Currencies: Money MattersDocument2 pagesUnusual Currencies: Money MattersNatalia ValentiniNo ratings yet

- Datatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 351Document12 pagesDatatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 351Justia.comNo ratings yet

- Globe BillDocument4 pagesGlobe BillLenny Joy Elemento SardidoNo ratings yet

- Commercial Bank of Ethiopia Hawassa District Digital Channel Business Service Active New Customers Recruited by BranchDocument30 pagesCommercial Bank of Ethiopia Hawassa District Digital Channel Business Service Active New Customers Recruited by BranchWondwossen GebeyehuNo ratings yet

- Kra FormDocument1 pageKra FormMary Joy ClarNo ratings yet

- 1579221808448drMLsyEUj3DzHZPx PDFDocument13 pages1579221808448drMLsyEUj3DzHZPx PDFVuddemarri SivaprasadNo ratings yet

- Cash Discount: What Is A Cash Discount? Definition of Cash DiscountDocument12 pagesCash Discount: What Is A Cash Discount? Definition of Cash DiscountHumanityNo ratings yet

- Pananchery Service Cooperative BankDocument58 pagesPananchery Service Cooperative Bankvinu666No ratings yet

- Jagmeet Singh StatementDocument6 pagesJagmeet Singh StatementBALKAR SINGHNo ratings yet

- United States v. MorganDocument2 pagesUnited States v. MorganKeith KnightNo ratings yet