Professional Documents

Culture Documents

Assessment Plan FAR

Uploaded by

Sebastian MlingwaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assessment Plan FAR

Uploaded by

Sebastian MlingwaCopyright:

Available Formats

COLLEGE OF BUSINESS EDUCATION

DAR ES SALAAM/DODOMA/MWANZA/MBEYA

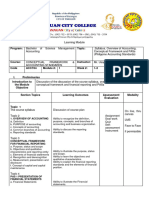

ASSESSMENT PLAN

Module Name: Financial Accounting and Reporting

Module Code: ACU 07131

Qualification: NTA Level 7 – BACHELOR OF ACCOUNTANCY and TAXATION

1.0 INTRODUCTION

This assessment plan has been prepared by the College of Business Education (CBE) for the module named

Financial Accounting and Reporting. The assessor is intending to assess learning outcomes stipulated within

the NTA Level 7 curriculum flexibly based on student’s ability to apply/show the competences involving

application of skills and knowledge in a broad range of activities, most of which are non-routine.

This assessment plan has been developed in September 2022 to be implemented in academic year 2022/2023 in

the implementation of Competence Based Education and Training (CBET) Curriculum.

2.0 PRINCIPLES LEARNING OUTCOMES AND ENABLING OUTCOME

PRINCIPAL LEARNING

OUTCOMES ENABLING LEARNING OUTCOMES

1.0 Apply accounting 1.1 Apply accounting principles in organization

information system in operations

organization operations. 1.2 Apply accounting rules in accounting transaction

1.3 Apply accounting standards in financial operations

3.0 ENABLING LEARNING OUTCOMES AND SUB ENABLING OUTCOMES

ENABLING LEARNING OUTCOMES SUB ENABLING OUTCOMES

1.1 Apply accounting principles in 1.1.1 Apply accounting theories in describing

organization operations nature of accounting

1.1.2 Use accounting procedures in

preparing books of accounts.

1.1.3 Apply IAS 1 in reporting business

financial information

1.1.4 Use financial analysis techniques in

interpreting financial information

2.0 SPECIFICATION OF COMPETENCES

Learning content and associated related tasks. Competences to be Number of tasks provided

assessed under continuous

assessmentand end of

semester examination are 38

CA SE

Wider attributes

(22 ) ( 16 )

Understand

Knowledge

Skills

Sub-enabling outcome:

1.1.1 Apply accounting theories in describing nature

of accounting

Related Tasks:

a) Explain Book keeping and accounting √ √

b) Describe nature and objectives of accounting

√ √

c) Explain purpose of maintaining accounting

√ √

records.

d) Describe users of financial information and

√ √

their respective information needs.

e) Explain the financial accounting, cost

√ √

accounting and management accounting.

f) Differentiate between financial accounting

√ √

and management accounting.

g) Differentiate between financial accounting

√ √

and cost accounting.

h) Define accounting policies, concepts and

√ √

principles

i) Describes principles of accounting √ √

j) Illustrate the contents of accounting

equation.

Sub enabling learning outcome:

1.1.2 Use accounting procedures in preparing books

of accounts.

Related Tasks:

a) Discuss main sources documents of

accounting information i.e Sales invoice, √ √ √

Purchases invoice, cash

b) Prepare primary books of accounts ie. Sales

Journal, Purchases Journal, Sales Returns √ √

Journal.

c) Discuss types of ledger books and their uses. √ √

d) Recording business transaction in double

√ √

entry.

e) Prepare two column cash book, Petty cash

√ √

book and one column cash book

f) Prepare bank reconciliation statements. √ √

g) Identify errors affecting and not affecting

√

Trial Balance

h) Prepare accounts for correction of errors. √ √

i) Prepare control accounts √ √

j) Prepare Trial Balance √ √

k) Perform year-end adjustments i.e. accruals,

prepayments, provision for depreciation, and √ √

provision for bad and doubtful debts

Sub-Enabling Outcome:

1.1.3 Apply IAS 1 in reporting business financial

information

Related Tasks:

a) Describe the contents of IAS 1.

√ √ √

b) Describe qualities of financial statement. √ √

c) Describe elements of financial statements i.e

Assets, Liability, Equity, Revenue, Expences √ √

and distribution to owners.

d) Prepare statement of income (statement of

√ √ √

profit or loss).

e) Prepare statement of financial position for

√ √ √

sole proprietorship.

f) Prepare a simple cash flow statement. √ √ √

g) Prepare financial statements from incomplete

√ √

record.

h) Post business transactions into respective

√ √

ledger accounts applying double entry rules.

Sub-Enabling Outcome:

1.1.4 Use financial analysis techniques in

interpreting financial information

Related Tasks:

a) Define the term interpretation of financial

statement. √ √ √

b) Describe various methods of analyzing

financial statements i.e. qualitative and √

quantitative.

c) Explain types of finnacial analysis i.e.

√ √ √

horizontal and vertical analysis.

d) Explain types of financial ratios i.e liquidity

ratios efficiency/asset/management/ activity

√ √ √ √

ratios, financial leverage/garage/capital

ratios, profitability ratios and market ratios.

e) Calculate all types of ratios i.e Liquidity

ratios, Efficiency /asset management/ activi

ty ratios, Financial leverage/gearing/c apital √ √

structure ratios, Profitability ratios and

Market value ratios.

f) Interpret all types of ratios i.e. Liquidity

ratios, Efficiency /asset management/ activi

ty ratios, Financial leverage/gearing/c apital √ √

structure ratios, Profitability ratios and

Market value ratios.

g) Explain limitations of ratios. √ √

3.0 EXAMINATIONS INSTRUCTIONS

3.1 Duration, number of questions, marks distribution, and sections.

a) The duration of the end of semester examination will be 3 hours.

b) The end of semester examination paper shall consist of five(5) questions covering eight

(16) related tasks and candidates will be required to answer five (05) questions, while for

the continuous assessment will cover 22 related tasks.

3.2 Overall assessment

- Individual assignments 10%

- Group assignments 05%

- Test 1 10%

- Test 2 15%

- End of semester Examination 60%

You might also like

- Paper GE-01 PDFDocument6 pagesPaper GE-01 PDFRefa- E- Alam 1110884030No ratings yet

- IE01-PAC Lecture Sheet 01 (Class 1-2)Document11 pagesIE01-PAC Lecture Sheet 01 (Class 1-2)WILD๛SHOTッ tanvirNo ratings yet

- Financial Accounting Syllabus PDFDocument6 pagesFinancial Accounting Syllabus PDFAzizul AviNo ratings yet

- Descriptions of Module - Financial AnalysisDocument8 pagesDescriptions of Module - Financial AnalysisSebastian MlingwaNo ratings yet

- Cost Accounting - IV Sem B.Com (Reg)Document11 pagesCost Accounting - IV Sem B.Com (Reg)Neha BajajNo ratings yet

- Outline ACC1023Document7 pagesOutline ACC1023nadiah noordinNo ratings yet

- Notes Cost Accounting CertificateDocument29 pagesNotes Cost Accounting CertificateNalugo LeilahNo ratings yet

- Accounting Fundamentals Course Outline (CUP) 1st Sem AY2022-2023Document2 pagesAccounting Fundamentals Course Outline (CUP) 1st Sem AY2022-2023Zia GuerreroNo ratings yet

- LP Chapter 7 The Basic Accounting EquationDocument4 pagesLP Chapter 7 The Basic Accounting EquationJopher NazarioNo ratings yet

- DW FMAAContentSpecificationOutlinesDocument7 pagesDW FMAAContentSpecificationOutlinesbahaasaffarino9No ratings yet

- UNEC FrlessonDocument22 pagesUNEC FrlessonTaKo TaKoNo ratings yet

- Part A: 1. Differentiate Among Financial Accounting, Cost Accounting & Management AccountingDocument5 pagesPart A: 1. Differentiate Among Financial Accounting, Cost Accounting & Management AccountingSisir AhammedNo ratings yet

- 9755 2018Document16 pages9755 2018Naseer SapNo ratings yet

- Difference Between FA, CA - MADocument9 pagesDifference Between FA, CA - MARishabh MehtaNo ratings yet

- FABM2 PreTest - 1stQtrDocument4 pagesFABM2 PreTest - 1stQtrRossano DavidNo ratings yet

- CPA Financial Accounting SyllabusDocument11 pagesCPA Financial Accounting SyllabusKasujja AidenNo ratings yet

- Accounting Sec 01Document11 pagesAccounting Sec 01tNo ratings yet

- Fundamentals of AccountingDocument257 pagesFundamentals of AccountingCeline MontefalcoNo ratings yet

- Fundamentals of AccountingDocument257 pagesFundamentals of Accountingamershareef337100% (4)

- Foundation Paper2 RevisedDocument5 pagesFoundation Paper2 RevisedMenu GargNo ratings yet

- 01) O1-FFA (Updated Syllabus)Document3 pages01) O1-FFA (Updated Syllabus)aonabbasabro786No ratings yet

- Cost Acco UntingDocument400 pagesCost Acco UntingRuchi Kashyap100% (2)

- Paper 2newDocument328 pagesPaper 2newAnonymous 1ClGHbiT0JNo ratings yet

- Paper 2 Study MaterialDocument328 pagesPaper 2 Study MaterialGF BF100% (1)

- Lesson Plan Double-Entry AccountingDocument4 pagesLesson Plan Double-Entry AccountingJuadjie ParbaNo ratings yet

- Accounts 1Document24 pagesAccounts 1laale dijaanNo ratings yet

- Icmab - Pac KL P-O1Document6 pagesIcmab - Pac KL P-O1আদনান স্বজনNo ratings yet

- Ae 14 Module 1Document32 pagesAe 14 Module 1Rizell Mae PruebasNo ratings yet

- 2E Studies (Sun - 29-10-2023) - Final Mid-TermDocument22 pages2E Studies (Sun - 29-10-2023) - Final Mid-TermahmedNo ratings yet

- New SyllabusDocument4 pagesNew SyllabusSiya ChughNo ratings yet

- Paper-8-Cost AC CMADocument424 pagesPaper-8-Cost AC CMAJanhavi Kadambande100% (1)

- Financial Accounting 1 OutlineDocument6 pagesFinancial Accounting 1 OutlineRasab AhmedNo ratings yet

- FA2 Syllabus and Study Guide 2021-22Document11 pagesFA2 Syllabus and Study Guide 2021-22Aleena MuhammadNo ratings yet

- Syllabus Akuntansi Manajemen (Management Accounting) ECAU 602103 Even Semester 2016/2017Document6 pagesSyllabus Akuntansi Manajemen (Management Accounting) ECAU 602103 Even Semester 2016/2017Zefanya Artha ValenciaNo ratings yet

- Review of Financial Statement Preparation, Analysis and InterpretationDocument37 pagesReview of Financial Statement Preparation, Analysis and InterpretationJC AppartelleNo ratings yet

- Paper 2 FDN Syl2016 PDFDocument289 pagesPaper 2 FDN Syl2016 PDFGovind Rathod100% (1)

- 6584financial Accounting 2021Document3 pages6584financial Accounting 2021Najia SalmanNo ratings yet

- Man SyllabusDocument4 pagesMan SyllabusFrederick GbliNo ratings yet

- Management Accounting: Course ContentsDocument2 pagesManagement Accounting: Course ContentsIbrahimGorgageNo ratings yet

- Pass Course Syllabus 202021 OnwardsDocument108 pagesPass Course Syllabus 202021 Onwardsowa senseiNo ratings yet

- Learning Mod 1 CfasDocument20 pagesLearning Mod 1 CfasKristine CamposNo ratings yet

- StudyScheme2018 Updated in 2023 (w.e.f.Fall2023forFeb.2024Exam)Document58 pagesStudyScheme2018 Updated in 2023 (w.e.f.Fall2023forFeb.2024Exam)Amir Ali LiaqatNo ratings yet

- 2022-23 - CFRA - IIMC Course Outline - SentDocument10 pages2022-23 - CFRA - IIMC Course Outline - SentAnanya DevNo ratings yet

- RPS Akuntansi Menengah IIDocument18 pagesRPS Akuntansi Menengah IIAnyaaNo ratings yet

- Lesson Plan Double-Entry AccountingDocument5 pagesLesson Plan Double-Entry AccountingIssa TimNo ratings yet

- Annual SyllabusDocument92 pagesAnnual Syllabusowa senseiNo ratings yet

- O1 FfaDocument3 pagesO1 Ffamuhammmad irfanNo ratings yet

- Unit 1 The Reporting Environment - CF - IAS 1 and IAS 8 - Handout and Tutorial QuestionDocument23 pagesUnit 1 The Reporting Environment - CF - IAS 1 and IAS 8 - Handout and Tutorial Questionasiphileamagiqwa25No ratings yet

- MA Study Notes and Question BankDocument410 pagesMA Study Notes and Question BankVăn Mạnh100% (2)

- Romney 15e Accessible Fullppt 18Document11 pagesRomney 15e Accessible Fullppt 18Liyana IzyanNo ratings yet

- CA Inter Costing Theory BookDocument60 pagesCA Inter Costing Theory Bookjj4223062003No ratings yet

- Paper 8Document400 pagesPaper 8krittika19No ratings yet

- Fsa 2021-23 PGDMDocument9 pagesFsa 2021-23 PGDMShaz BhuwanNo ratings yet

- Cost Accounting and Financial ManagementDocument496 pagesCost Accounting and Financial Managementgaurav dixit100% (1)

- Paper-8 Cma FullDocument443 pagesPaper-8 Cma FullCH NAIRNo ratings yet

- BA 99.1 Course Outline1st Sem - AY1819Document5 pagesBA 99.1 Course Outline1st Sem - AY1819JaviiiNo ratings yet

- Accounting For LeasesDocument4 pagesAccounting For LeasesSebastian MlingwaNo ratings yet

- Analysis of Financial StatementsDocument13 pagesAnalysis of Financial StatementsSebastian MlingwaNo ratings yet

- Assignment 2Document4 pagesAssignment 2Sebastian MlingwaNo ratings yet

- Apprenticeship Coordinator Office Budget 2022-23 - NgattaDocument4 pagesApprenticeship Coordinator Office Budget 2022-23 - NgattaSebastian MlingwaNo ratings yet

- Assessment Plan AFRDocument11 pagesAssessment Plan AFRSebastian MlingwaNo ratings yet

- IAS 16, IAS 36 IAS 38 QuestionsDocument1 pageIAS 16, IAS 36 IAS 38 QuestionsSebastian MlingwaNo ratings yet

- Stage TwoDocument34 pagesStage TwoThar LattNo ratings yet

- Raw Data:: Organizing and Summarizing DataDocument5 pagesRaw Data:: Organizing and Summarizing DataWalter Mazibuko100% (1)

- Liking Versus LovingDocument3 pagesLiking Versus LovingHazie GhazaliNo ratings yet

- Social Studies SBA QuestionnaireDocument22 pagesSocial Studies SBA QuestionnaireTheRagingBNo ratings yet

- Community Organizing Participatory Action ResearchDocument5 pagesCommunity Organizing Participatory Action ResearchRichard Ines Valino100% (6)

- BS 4301 Probability and StatisticsDocument2 pagesBS 4301 Probability and StatisticsAtul GautamNo ratings yet

- Edexcel English Literature Coursework A LevelDocument6 pagesEdexcel English Literature Coursework A Levelafjwocqdcjpvgy100% (2)

- The Research On Training Methodologies For AIDS Education and Counselling in Thailand (Phrase II)Document66 pagesThe Research On Training Methodologies For AIDS Education and Counselling in Thailand (Phrase II)adkittipongNo ratings yet

- Multiple Response Optimization of Heat Shock Process For Separation of Bovine Serum Albumin From PlasmaDocument11 pagesMultiple Response Optimization of Heat Shock Process For Separation of Bovine Serum Albumin From PlasmaJavier RigauNo ratings yet

- Agri-Crop Grade 10Document195 pagesAgri-Crop Grade 10Lea Cardinez100% (2)

- When Should You Adjust Standard Errors For Clustering?: Alberto Abadie, Susan Athey, Guido Imbens, & Jeffrey WooldridgeDocument33 pagesWhen Should You Adjust Standard Errors For Clustering?: Alberto Abadie, Susan Athey, Guido Imbens, & Jeffrey WooldridgesreedharbharathNo ratings yet

- Irony in British Newspapers of Various TypesDocument65 pagesIrony in British Newspapers of Various TypesZanda Mauriņa0% (1)

- THERBORN, GÃ Ran BEKKER, Simon. Power and Powerlessness - Capital Cities in AfricaDocument248 pagesTHERBORN, GÃ Ran BEKKER, Simon. Power and Powerlessness - Capital Cities in Africajoaquín arrosamena0% (1)

- Freshmen Student's Level of Self-Esteem and Academic and Social Adjustments in Southwestern University PHINMADocument4 pagesFreshmen Student's Level of Self-Esteem and Academic and Social Adjustments in Southwestern University PHINMAzeynNo ratings yet

- Ok ReportDocument66 pagesOk ReportSagar BishtNo ratings yet

- Joe 40 hoadley-FRAMINGDocument20 pagesJoe 40 hoadley-FRAMINGGuadalupe TenagliaNo ratings yet

- Minor Project Report On Adidas Vs Nike BbaDocument52 pagesMinor Project Report On Adidas Vs Nike BbaClaira BanikNo ratings yet

- Career CounselingDocument25 pagesCareer CounselingDebyNo ratings yet

- School Burnout, Perceived Stress Level and Online Disinhibition Among College Students of The University of The East - ManilaDocument13 pagesSchool Burnout, Perceived Stress Level and Online Disinhibition Among College Students of The University of The East - ManilaPsychology and Education: A Multidisciplinary JournalNo ratings yet

- UF0108N FDSC Nursing Associate Course SpecificationDocument6 pagesUF0108N FDSC Nursing Associate Course SpecificationZeeshan ShafqatNo ratings yet

- Stat 217 MidtermDocument7 pagesStat 217 MidtermAOIIYearbook0% (1)

- 4 How To Use Smart PLS Software StructurDocument48 pages4 How To Use Smart PLS Software StructurPhươngLêNo ratings yet

- Oil & Gas Project in LibyaDocument307 pagesOil & Gas Project in LibyaSUBRAMANAN NARAYANANNo ratings yet

- IME634 Statistics UnivariateDocument238 pagesIME634 Statistics UnivariateAbhishek aryaNo ratings yet

- QMT 3003 Assessment 3Document2 pagesQMT 3003 Assessment 3AqsaNo ratings yet

- Guidelines For Sem IV Dissertation Project ReportDocument9 pagesGuidelines For Sem IV Dissertation Project Reportdarshan shettyNo ratings yet

- Article Critique - Effects of Facebook Usage On English Learning BehaviorDocument5 pagesArticle Critique - Effects of Facebook Usage On English Learning BehaviorPauAngeliPonsaranBaloyo100% (1)

- Biostatistics Laboratory SAMPLINGDocument6 pagesBiostatistics Laboratory SAMPLINGTrisha Joy SicatNo ratings yet

- Jurnal - CASEL's Framework For Systemic Social and Emotional LearningDocument7 pagesJurnal - CASEL's Framework For Systemic Social and Emotional Learningsurya dianaNo ratings yet

- 11269-Article Text-14687-1-10-20150419Document6 pages11269-Article Text-14687-1-10-20150419Annisa KhairaNo ratings yet