Professional Documents

Culture Documents

Lesson 1 BANKING - Banking and Financial Institution

Uploaded by

Angela Magtibay0 ratings0% found this document useful (0 votes)

128 views4 pagesThe document discusses the Philippine banking system and financial institutions. It begins by classifying the main types of banks in the Philippines as rural and cooperative banks, thrift or savings banks, and universal or commercial banks. It then discusses the Bangko Sentral ng Pilipinas (BSP) as the central banking authority that supervises banks and provides monetary policy. The BSP took over central banking responsibilities from its predecessor in 1993. Key functions of the BSP include liquidity management, acting as lender of last resort, and currency issuance.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the Philippine banking system and financial institutions. It begins by classifying the main types of banks in the Philippines as rural and cooperative banks, thrift or savings banks, and universal or commercial banks. It then discusses the Bangko Sentral ng Pilipinas (BSP) as the central banking authority that supervises banks and provides monetary policy. The BSP took over central banking responsibilities from its predecessor in 1993. Key functions of the BSP include liquidity management, acting as lender of last resort, and currency issuance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

128 views4 pagesLesson 1 BANKING - Banking and Financial Institution

Uploaded by

Angela MagtibayThe document discusses the Philippine banking system and financial institutions. It begins by classifying the main types of banks in the Philippines as rural and cooperative banks, thrift or savings banks, and universal or commercial banks. It then discusses the Bangko Sentral ng Pilipinas (BSP) as the central banking authority that supervises banks and provides monetary policy. The BSP took over central banking responsibilities from its predecessor in 1993. Key functions of the BSP include liquidity management, acting as lender of last resort, and currency issuance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

BANKING - Banking and Financial Institution

Lesson1 Classification of Banks

Brief history of Banks in the Phil.

The Bangko Sentral ng Pilipinas acts as the central monetary authority of the Philippines

The country’s central bank was created in July 1993 in accordance with the provisions of the 1987

Philippine Constitution and the New Central Bank Act of 1993.

The BSP took over from Central Bank of Philippines, which was established on 3 January 1949, as

the country’s central monetary authority.

It supervises the operations of banks in the Philippines and provides policy directions in banking,

credit, and money matters.

3 Main Categories

1. Rural and Cooperative Banks

2. Thrift or Savings Bank

3. Universal or Commercial Banks

Offer the widest variety of banking services among financial institutions.

They also represent the largest single group, resource-wise, of financial institutions in the

country.

Universal banking can be defined as a banking system that offers a wide range of banking and

financial services (like insurance, development banking, investment banking, commercial

banking, and other financial services) in comparison to traditional banking institutions; in simple

terms, it can also be understood as a combination of all three services that is retail banking,

investment banking, and wholesale banking. This system offers asset management, deposits,

payment processing, investment advisory, underwriting, securities transactions, financial

analysis, merchant banking, factoring, mutual funds, credit cards, auto loans, insurance, housing

finance, retail loans, etc.

Under the General Banking Law of 2000 (GBL), a universal bank is defined as a commercial

bank with the additional authority to exercise the powers of an investment house and invest in

non-allied enterprises. An ordinary commercial bank does not have that authority.

All enterprises not otherwise specified as allied (whether financial or non-financial) would be

classifiable as non-allied. Thus, investments in mutual funds (as opposed to their management

companies) would be considered as non-allied.

What bank products and services are offered by BDO?

BDO is a full-service universal bank that provides a complete array of industry leading products and

services to the retail and corporate markets including Lending (corporate, middle market, SME, and

consumer), Deposit-taking, Foreign Exchange, Brokering, Trust and Investments, Credit Cards,

Corporate Cash Management and Remittances. Through its subsidiaries, the Bank offers Leasing and

Financing, Investment Banking, Private Banking, Bancassurance, Insurance Brokerage and Stock

Brokerage services.

BPI is a universal bank and together with its subsidiaries and affiliates, it offers a wide range of

financial products and solutions that serve both retail and corporate clients.

MetroBank, Established in 1962, the Metropolitan Bank & Trust Company has become the premier

universal bank and among the foremost financial institutions in the Philippines.

With a history spanning more than 50 years, it aims to deliver meaningful banking to Filipinos

everywhere.

It boasts diverse product portfolio including investment banking, thrift banking, leasing and

financing, bank assurance, and credit cards.

It offers a full range of services to large local and multinational corporations, middle-market and

SMEs, high net-worth individuals and retail segment.

Universal banks are advanced commercial banks that offer an exclusive range of services under one

roof. They are updated versions of commercial banks, but not all commercial banks are universal.

Circular No. 854

SERIES OF 2014

MORB - Manual of Regulation for banks

Minimum Capitalization of Banks

Bank Category Required Minimum Capitalization

UBs

Head Office P3.00 billion

Only Up to 10 branches 6.00 billion

11 to 100 branches 15.00 billion

More than 100 branches 20.00 billion

KBs

Head Office Only P2.00 billion

Up to 10 branches 4.00 billion

11 to 100 branches 10.00 billion

More than 100 branches 15.00 billion

Number of Banks Per Category

UB 20

KB 25

THRIFT BANKS 43

RURAL BANKS 381

COOP BANKS 24

The Philippine Financial System

Financial System

A complex structure and operation which every individual and business organization in a civilized

society are directly involved.

A set of institutions, such as banks, insurance companies, and stock exchanges, that permit the

exchange of funds.

Can be perceived on a company, regional, or global scale, which facilitates the practice of

exchanging funds between one entity to another.

Financial systems are regulated, as their processes influence and contribute to the growth of many

assets.

A network that facilitates the practice of exchanging funds between one entity to another.

Nature and Necessity of Finance

Financial System

- A network of various institutions, together with government agencies, laws and policies, which

generates, circulates and controls money credit.

Provides a link between the lenders and the borrowers of money.

Finances the socio economic programs of the country.

This is good for the whole economy.

Functions of Financial Institutions

To facilitate the transfer of funds from the savers to the users

Matching supply and demand for funds

Investigation and credit analysis

Provisions of liquidity

Provides payments system

It provides service as intermediaries of the capital and debt markets.

They are responsible for transferring funds from investors to companies, in need of those funds.

The presence of financial institutions facilitates the flow of cash through economy.

Basic Components of Financial System

1) Financial Institutions - Value financial assets whenever making loans to business and consumers.

Also called financial intermediaries. (Banks and other non-bank financial institutions)

2) Financial Markets - Markets in which financial instruments can be traded. (Stock Market, Bond

Market, Money Market)

3) Financial Instruments - Legal agreements that require one party to pay money or something else of

value or to promise to pay under stipulated conditions. (Stocks, bonds, financial loans, financial

contracts)

4) Financial Services - Economic services provided by the finance industry.

5) Money - medium of exchange and acts as store of value.

General Functions

1) Liability – Asset Transformation - they issue claims to their customers that have characteristics differ

from those of their own assets.

2) Size Transformation - They provide large volume of finance on the basis of small deposits or unit

capital.

3) Risk Transformation - They distribute risk through diversification and thereby reduce it for savers as

in the case of mutual funds.

4) Maturity Transformation - They offer savers alternate forms of deposit according to their liquidity

preferences, and provide borrowers with loans of requisite maturities.

Specific Functions

1) Investigation and Credit Analysis - Loan application is properly evaluated to ensure the efficient use

of credit and to protect the savings of individuals as well as to minimize the risk of non-payment of

loans.

2) Matching the Supply and Demand for Funds - Financial institutions are money brokers

3) Provision for Liquidity - Through their brokerage function, they provide an organized market, the

investor can find a buyer for his debt or ownership claims.

4) Provides payment system - The transfer of goods and services has become convenient, faster and

economical.

Structure of Philippine Financial System

Bangko Sentral Ng Pilipinas

The BSP actually started out as the Central bank of the Philippines established in January 3, 1949 as

the Philippines’ Central Monetary Authority.

In accordance with the pursuant of the 1987 constitution, the New Central Bank Act (R.A. 7653) was

signed in June 14, 1993, and took effect on July 3, 1993 and was renamed as the Bangko Sentral ng

Pilipinas.

Bangko Sentral ng Pilipinas supervises and regulates the financial system.

It provides policy directions in the areas of money, banks and exercise such regulatory powers and

other pertinent laws over the operation of finance companies and non-bank financial institutions

performing quasi-banking functions.

The BSP’s primary objective is to maintain price stability, financial stability and economic stability.

Current BSP Governor – Dr. Felipe M. Medalla

Main Functions of the BSP

Liquidity management.

- The BSP is responsible for liquidity management by formulating and implementing monetary policy

aimed to influence the supply of money. The BSP may decide to contract or expand the economy.

Consistent with its primary objective the BSP stands on its three pillars: price stability, financial

stability, and economic stability.

1) Lender of last resort - The BSP is also the lender of last resort to banks facing bankruptcy.

2) Currency Issue - The BSP has the exclusive power to issue the national currency.

3) Financial Supervision - The BSP supervises banks and exercises regulatory powers over non-bank

institutions performing quasi-banking functions.

4) Management of Foreign Currency Reserves - Maintain sufficient international reserves to meet any

foreseeable net demands for foreign currencies in order to preserve the international stability and

convertibility of PHP

5) Determination of the exchange rate policy - Being the banker, financial advisor and official

depository of the Government, its political subdivisions and instrumentalities and GOCCs.

In the Philippines settings, Financial System is composed of banking institutions and nonbank

financial intermediaries, including commercial banks, specialized government banks, thrift banks and rural

banks.

Banking Institutions

I. Private Banking Institutions

1. Expanded Commercial Banks/Universal Banks

2. Commercial Banks

3. Thrift Banks

Savings and Mortgage Banks

Private Development Banks

Stock Savings and Loan Associations

II. Private Banking Institutions

1. Rural Banks

2. Cooperative Banks

You might also like

- 201.06 Accounting For Insurance Companies (IAS-1, IfRS-4)Document6 pages201.06 Accounting For Insurance Companies (IAS-1, IfRS-4)Biplob K. SannyasiNo ratings yet

- Accounting For Insurance LiabilitiesDocument18 pagesAccounting For Insurance LiabilitiesDudenNo ratings yet

- Ascent Corporation: Business & ConsultancDocument7 pagesAscent Corporation: Business & ConsultancAscent CorporationNo ratings yet

- Basic Accounting Chapter 1-5 QuizzesDocument6 pagesBasic Accounting Chapter 1-5 QuizzesLuna Shi100% (1)

- Whitepaper Ifrs17 Accounting Turning Theory Into PracticeDocument10 pagesWhitepaper Ifrs17 Accounting Turning Theory Into PracticeVarian CitrajayaNo ratings yet

- Faii Chapter Vi - 0Document16 pagesFaii Chapter Vi - 0chuchuNo ratings yet

- Distinguish Between Cash Flow and Fund Flow StatementDocument3 pagesDistinguish Between Cash Flow and Fund Flow StatementSachin GodseNo ratings yet

- FAC1601 Assignment 5Document73 pagesFAC1601 Assignment 5Kgomotso RamodikeNo ratings yet

- Chapter 25 (Pension Fund Operation)Document20 pagesChapter 25 (Pension Fund Operation)Aguntuk ShawonNo ratings yet

- Accounting For Directors Loans Under FRS 102 FAQsDocument7 pagesAccounting For Directors Loans Under FRS 102 FAQswattersed1711No ratings yet

- Electricity Statement: Your New Balance Is 599.94Document4 pagesElectricity Statement: Your New Balance Is 599.94RakeshKumarSingh0% (1)

- Bill of LadingDocument1 pageBill of LadingboyNo ratings yet

- Business Finance: Key Concepts of FinanceDocument20 pagesBusiness Finance: Key Concepts of FinanceTrisha Nicole DumangonNo ratings yet

- FTFM Final PDFDocument548 pagesFTFM Final PDFPradeep Katiyar0% (1)

- Countingup Statement 2023 07Document1 pageCountingup Statement 2023 07SophiaNo ratings yet

- LESSON 8 PERDEV - Personality DevelopmentDocument3 pagesLESSON 8 PERDEV - Personality DevelopmentAngela MagtibayNo ratings yet

- The Suppy Chain Game WriteupDocument2 pagesThe Suppy Chain Game WriteupMuhammad Hasan Saeed67% (3)

- ABM FABM 2 Q1 Course Guide PDFDocument58 pagesABM FABM 2 Q1 Course Guide PDFEarl Christian BonaobraNo ratings yet

- Gelyn D. Baldriasmka22 The Philippine Financial System Structure Financial InstitutionsDocument15 pagesGelyn D. Baldriasmka22 The Philippine Financial System Structure Financial InstitutionsJackie Pearl AstudilloNo ratings yet

- Busfin 5 Financial-PlanningDocument14 pagesBusfin 5 Financial-PlanningHazel Cabrera100% (1)

- Financial Instrument: What Are Financial Instruments?Document8 pagesFinancial Instrument: What Are Financial Instruments?Sarvan KumarNo ratings yet

- FIN3483 - Chapter 1 - The Role and Scope of InvestmentDocument34 pagesFIN3483 - Chapter 1 - The Role and Scope of InvestmentDivya NandiniNo ratings yet

- Banking and Finance Theory MHVDocument70 pagesBanking and Finance Theory MHVMai Huỳnh VyNo ratings yet

- Lesson 1Document42 pagesLesson 1ShannahNo ratings yet

- Chapter - 8Document26 pagesChapter - 8Rathnakar SarmaNo ratings yet

- PATHFITDocument20 pagesPATHFITClint BalaNo ratings yet

- Ethical Dilemmas Case Studies ProfessionDocument20 pagesEthical Dilemmas Case Studies ProfessionKrizel rochaNo ratings yet

- Investment BankingDocument16 pagesInvestment BankingSudarshan DhavejiNo ratings yet

- Chap 2Document54 pagesChap 2Yeshiwork GirmaNo ratings yet

- NSTP Report Group 4Document3 pagesNSTP Report Group 4torno amielNo ratings yet

- FAR Prelim For Printing PDFDocument86 pagesFAR Prelim For Printing PDFMico Villegas BalbuenaNo ratings yet

- BDO Easy Investment PlanDocument12 pagesBDO Easy Investment Planannair_redNo ratings yet

- On Ind AS 7, 8 & 10 - CA. Alok GargDocument28 pagesOn Ind AS 7, 8 & 10 - CA. Alok GargrounakkrbansalNo ratings yet

- GR12 Business Finance Module 1-2Document7 pagesGR12 Business Finance Module 1-2Jean Diane JoveloNo ratings yet

- Answer in Purposive CommunicationDocument5 pagesAnswer in Purposive CommunicationMinnie MaculaNo ratings yet

- Ifrs 9Document42 pagesIfrs 9tariqNo ratings yet

- Semestral Accomplishment ReportDocument44 pagesSemestral Accomplishment ReportJulliena BakersNo ratings yet

- Nigeria Sas 10 and New Prudential Guidelines PDFDocument21 pagesNigeria Sas 10 and New Prudential Guidelines PDFiranadeNo ratings yet

- Course DescriptionDocument20 pagesCourse DescriptionJoseph ChristopherNo ratings yet

- Module 1Document18 pagesModule 1Rizwana BaigNo ratings yet

- Toulouse Business School: C O U R S E C O N T E N TDocument28 pagesToulouse Business School: C O U R S E C O N T E N TlocoNo ratings yet

- 01 Activity (The Self)Document2 pages01 Activity (The Self)Miles ArmonioNo ratings yet

- Overview of Investment BankingDocument3 pagesOverview of Investment BankingSamin SakibNo ratings yet

- Theories of EquityDocument1 pageTheories of EquityJavian Negrón100% (1)

- Module2 CWTS 2ndsemDocument4 pagesModule2 CWTS 2ndsemryujinNo ratings yet

- Kpi PDFDocument2 pagesKpi PDFmadelo2No ratings yet

- Chapter 2 of Principle of AccountingDocument75 pagesChapter 2 of Principle of AccountingNhật LinhNo ratings yet

- Financial InstitutionsDocument76 pagesFinancial InstitutionsGaurav Rathaur100% (1)

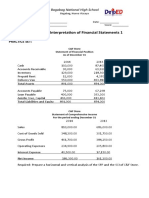

- Practice Set - Analysis of FS1Document1 pagePractice Set - Analysis of FS1marissa casareno almueteNo ratings yet

- MODULE 4 PPT GE 11 FacilitationDocument31 pagesMODULE 4 PPT GE 11 FacilitationMiaNo ratings yet

- Sustainable Development CanvaDocument5 pagesSustainable Development CanvaEllah MaeNo ratings yet

- Closed End VS Open End FundsDocument2 pagesClosed End VS Open End Fundspingu_513501No ratings yet

- UNIT II The Accounting Process Service and TradingDocument22 pagesUNIT II The Accounting Process Service and TradingAlezandra SantelicesNo ratings yet

- Beliefs SystemDocument27 pagesBeliefs SystemJackie Dela RosaNo ratings yet

- Introduction To AccountingDocument16 pagesIntroduction To AccountingJoselyn AmonNo ratings yet

- IFRS 17 in South AfricaDocument12 pagesIFRS 17 in South AfricaDanielNo ratings yet

- Module 6 EthicsDocument8 pagesModule 6 EthicsReychille AbianNo ratings yet

- 10 - Ch-7-Customer Driven Market Strategy Creating Value For Target CustDocument23 pages10 - Ch-7-Customer Driven Market Strategy Creating Value For Target Custمحمد حسنین رضا قادریNo ratings yet

- Dda 2 12Document7 pagesDda 2 12genius_blueNo ratings yet

- PeopleSoft GL PointsDocument14 pagesPeopleSoft GL PointsVenkateswara Rao Balla100% (1)

- Central Banking and Financial RegulationsDocument9 pagesCentral Banking and Financial RegulationsHasibul IslamNo ratings yet

- Financial Futures MarketsDocument48 pagesFinancial Futures MarketsAnthony KwoNo ratings yet

- GovernanceDocument13 pagesGovernancePixie CanaveralNo ratings yet

- Business Finance Handouts 04Document5 pagesBusiness Finance Handouts 04Shane VeiraNo ratings yet

- Financial Institutions, Instruments and MarketsDocument11 pagesFinancial Institutions, Instruments and MarketsBrozy24100% (1)

- Chapter 4 Financial InvestmentDocument53 pagesChapter 4 Financial InvestmentAngelica Joy ManaoisNo ratings yet

- AssignmentDocument7 pagesAssignmentHaziel LadananNo ratings yet

- Lesson 2Document26 pagesLesson 2Angela MagtibayNo ratings yet

- Lesson 4Document22 pagesLesson 4Angela MagtibayNo ratings yet

- Lesson 4 StatisticsDocument11 pagesLesson 4 StatisticsAngela MagtibayNo ratings yet

- Lesson 1 1Document13 pagesLesson 1 1Angela MagtibayNo ratings yet

- General Enterprise Data FlowDocument33 pagesGeneral Enterprise Data FlowAngela MagtibayNo ratings yet

- Lesson 2 2Document15 pagesLesson 2 2Angela MagtibayNo ratings yet

- Lesson 3Document50 pagesLesson 3Angela MagtibayNo ratings yet

- Data VisualizationDocument13 pagesData VisualizationAngela MagtibayNo ratings yet

- Lesson 3 Descriptive StatisticsDocument9 pagesLesson 3 Descriptive StatisticsAngela MagtibayNo ratings yet

- LESSON 7 PERDEV - Personality DevelopmentDocument3 pagesLESSON 7 PERDEV - Personality DevelopmentAngela MagtibayNo ratings yet

- Lesson 1 FL - Foreign LanguageDocument5 pagesLesson 1 FL - Foreign LanguageAngela MagtibayNo ratings yet

- Lesson 1 CREDIT - Credit and CollectionDocument4 pagesLesson 1 CREDIT - Credit and CollectionAngela MagtibayNo ratings yet

- Research Module 2 REVISEDDocument7 pagesResearch Module 2 REVISEDAngela MagtibayNo ratings yet

- Lesson 1 BPO 1 - ELEC 1Document3 pagesLesson 1 BPO 1 - ELEC 1Angela MagtibayNo ratings yet

- Hope Prelim Edited FinalDocument5 pagesHope Prelim Edited FinalAngela MagtibayNo ratings yet

- Pointers To Review E TechDocument2 pagesPointers To Review E TechAngela MagtibayNo ratings yet

- INVOICE BPK LTD CKM Drg. Rendhy .ADocument2 pagesINVOICE BPK LTD CKM Drg. Rendhy .AYudi ArdiansahNo ratings yet

- 12 Accountancy Keynotes Ch09 Redemption of DebenturesDocument4 pages12 Accountancy Keynotes Ch09 Redemption of DebenturesiisjafferNo ratings yet

- Status of Primary Market Response in Nepal: Jas Bahadur GurungDocument13 pagesStatus of Primary Market Response in Nepal: Jas Bahadur GurungSonam ShahNo ratings yet

- Emergence of Entreprenurial ClassDocument23 pagesEmergence of Entreprenurial ClassShweta GoelNo ratings yet

- Logistics 1Document36 pagesLogistics 1Quỳnh Nguyễn NhưNo ratings yet

- CCASBBAR20Document60 pagesCCASBBAR20Mani KumarNo ratings yet

- Limitations of Market SegmentationDocument6 pagesLimitations of Market SegmentationIQRA YOUSAFNo ratings yet

- EJOT Eta 13 0177 Fastening Screws Ja JZ JT JF ENDocument50 pagesEJOT Eta 13 0177 Fastening Screws Ja JZ JT JF ENyashiro732No ratings yet

- School Based Assessment: To Assess The Cause and Effects of Inflation On Small Businesses in The Greater Portmore RegionDocument22 pagesSchool Based Assessment: To Assess The Cause and Effects of Inflation On Small Businesses in The Greater Portmore RegionOniel BryanNo ratings yet

- Advanced Introduction To Post Keynesian Economics - J. E. King Edward Elgar Publishing (2015) (Elgar Advanced Introductions)Document169 pagesAdvanced Introduction To Post Keynesian Economics - J. E. King Edward Elgar Publishing (2015) (Elgar Advanced Introductions)Lucas Jean de Miranda CoelhoNo ratings yet

- Caso Tata SteelDocument7 pagesCaso Tata SteelGaby Mendieta100% (1)

- GST 307Document300 pagesGST 307Lawal OlanrewajuNo ratings yet

- Ogl 182681680521100076Document5 pagesOgl 182681680521100076Rajesh KumarNo ratings yet

- Revision Questions 2020 Part VDocument18 pagesRevision Questions 2020 Part VJeffrey KamNo ratings yet

- Structures of GlobalizationDocument8 pagesStructures of Globalizationlkyn272No ratings yet

- ISCDL - Problem Statements For State Level HackthonDocument6 pagesISCDL - Problem Statements For State Level HackthonSarvesh DubeyNo ratings yet

- Cost and Return Analysis (Fish)Document9 pagesCost and Return Analysis (Fish)Nikko PatunganNo ratings yet

- DETAILS ON GROUP and INDIVIDUAL ASSIGNMENTDocument1 pageDETAILS ON GROUP and INDIVIDUAL ASSIGNMENTANIS SURAYA NOOR AZIZANNo ratings yet

- Approval of Calibration Certificates and Permissible Error Limits - A Process ApproachDocument4 pagesApproval of Calibration Certificates and Permissible Error Limits - A Process ApproachProvedor AnalistaNo ratings yet

- Dwnload Full Introduction To Corporate Finance 5th Edition Frino Test Bank PDFDocument36 pagesDwnload Full Introduction To Corporate Finance 5th Edition Frino Test Bank PDFundidsmartly1944h100% (12)

- ESP318 Unit 1 Written Test - Form ADocument4 pagesESP318 Unit 1 Written Test - Form ACamila ArayaNo ratings yet

- Peopleware Chapter 20Document14 pagesPeopleware Chapter 20Umar AshrafNo ratings yet

- Cayman Islands Funds Update Q1 2020 OgierDocument12 pagesCayman Islands Funds Update Q1 2020 OgierR TNo ratings yet

- SGS.G20 5.SewMachines - DurexDocument56 pagesSGS.G20 5.SewMachines - DurexNguyễn BáNo ratings yet