Professional Documents

Culture Documents

Central Bank of India

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Central Bank of India

Uploaded by

Angel BrokingCopyright:

Available Formats

1QFY2012 Result Update | Banking

August 2, 2011

Central Bank of India

Performance Highlights

Particulars (` cr) NII Pre-prov. profit PAT 1QFY12 1,330 792 281 4QFY11 1,429 331 133 % chg (qoq) (6.9) 139.1 111.6 1QFY11 1,118 668 337 % chg (yoy) 18.9 18.6 (16.6)

NEUTRAL

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Banking 7,164 1.1 212/110 3,39,195 10 18,110 5,457 CBI.BO CBOI@IN

`111 -

Source: Company, Angel Research

For 1QFY2012, Central Bank of India posted a 16.6% yoy decline in its net profit primarily due to higher provisions. However, results were above our estimates on lower-than-estimated operating expenses. A sharp sequential dip in NIM and high slippages despite the pending switchover to system-based NPA platform were the key highlights of the results. We maintain our Neutral view on the stock. NIM dips on lower yield on investments; slippages remain elevated: The banks business momentum slowed during the usually lean quarter. Advances declined by 2.8% qoq (up 17.2% yoy) and deposits increased by 3.6% qoq (up 20.3% yoy). CASA deposits growth moderated to 14.7% yoy, resulting in a 259bp qoq decline in CASA ratio to 32.6%. Bulk deposits and CDs constituted a relatively higher ~33% of total deposits. The reduction in CASA ratio and the higher interest rate environment resulted in a sharp 72bp qoq rise in cost of deposits to 6.8%. The yield on advances went up by 77bp qoq to 11.4%. Reported NIM declined sharply by 48bp qoq to 3.0% primarily due to fall in yield on investments (fall of 73bp qoq). The sequential decline in NIM was exacerbated by the benefit of interest on income tax refund of ~`130cr in 4QFY2011. Overall asset quality of the bank deteriorated during the quarter, with annualised slippage ratio remaining elevated at 1.8% (1.1% in 1QFY2011) and net NPAs rising by 27.7% qoq. Slippages remained elevated at 1.8% as compared to 1.1% in 1QFY2011. Provision coverage ratio including technical write-offs declined to 65.2% from 67.6% in 4QFY2011. The bank is yet to switchover to the system-based NPA recognition platform, which could result in a substantial rise in slippages given the banks rural branches (37%) and a relatively large agri (16%) portfolio. Outlook and valuation: At the CMP, the stock is trading at cheap valuations of 0.8x FY2013E ABV compared to its trading range of 0.51.5x with a median of 1.1x since listing in 2007. However, due to near-term asset-quality concerns because of system-based NPA recognition, we remain Neutral on the stock. Key financials

Y/E March (` cr) NII % chg Net profit % chg NIM (%) EPS (`) P/E (x) P/ABV (x) RoA (%) RoE (%)

Source: Company, Angel Research

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 80.2 8.5 3.0 8.3

Abs. (%) Sensex Central BoI

3m (4.7) (17.3)

1yr 0.2 (23.8)

3yr 23.6 120.8

FY2010 2,545 14.2 998 85.3 1.6 24.7 4.5 1.1 0.6 25.4

FY2011 5,325 109.2 1,121 18.3 2.8 27.7 4.0 0.9 0.6 23.2

FY2012E 5,434 2.0 1,017 (6.0) 2.5 15.7 7.0 0.9 0.4 14.6

FY2013E 6,014 10.7 1,326 26.3 2.4 20.5 5.4 0.8 0.5 14.4

Vaibhav Agrawal

022 3935 7800 Ext: 6808 vaibhav.agrawal@angelbroking.com

Shrinivas Bhutda

022 3935 7800 Ext: 6845 shrinivas.bhutda@angelbroking.com

Varun Varma

022 3935 7800 Ext: 6847 varun.varma@angelbroking.com

Please refer to important disclosures at the end of this report

Central Bank of India | 1QFY2012 Result Update

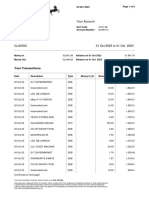

Exhibit 1: 1QFY2012 performance

Particulars (` cr) Interest earned - on Advances / Bills - on investments - on balance with RBI & others - on others Interest Expended Net Interest Income Other income Other income excl. treasury - Fee Income - Treasury Income - Recov. from written off a/cs - Others Operating income Operating expenses - Employee expenses - Other Opex Pre-provision Profit Provisions & Contingencies - Provisions for NPAs - Provisions for Investments - Other Provisions PBT Provision for Tax PAT Effective Tax Rate (%)

Source: Company, Angel Research

1QFY12 4QFY11 % chg (qoq) 1QFY11 % chg (yoy) 4,558 3,524 1,010 24 3,228 1,330 282 178 134 104 17 27 1,612 821 588 233 792 393 263 108 22 399 118 281 29.6 4,232 3,122 971 8 131 2,804 1,429 523 357 181 166 75 101 1,951 1,620 1,320 300 331 306 196 41 69 25 (108) 133 7.7 12.9 4.0 177.6 (100.0) 15.1 (6.9) (46.1) (50.2) (26.0) (37.3) (77.3) (73.4) (17.4) (49.4) (55.5) (22.4) 139.1 28.3 34.4 161.8 (68.6) 1,489.9 (209.8) 111.6 3,411 2,479 915 17 2,292 1,118 247 187 130 60 65 (8) 1,366 698 481 217 668 196 232 (43) 7 472 135 337 28.6 33.6 42.2 10.4 41.5 40.8 18.9 14.0 (5.0) 3.1 73.3 (73.8) 18.1 17.5 22.0 7.6 18.6 100.6 13.4 (348.6) 200.1 (15.4) (12.4) (16.6) 101bp

Exhibit 2: Actual vs. Angel estimates

Particulars (` cr) NII Non-Interest Income Operating Income Operating Expenses Pre-Prov. Profit Provisions & Cont. PBT Prov. for Taxes PAT

Source: Company, Angel Research

Actual 1,330 282 1,612 821 792 393 399 118 281

Estimates 1,353 279 1,632 894 737 416 322 87 235

Variation (%) (1.7) 1.0 (1.2) (8.3) 7.3 (5.5) 24.0 36.0 19.6

August 2, 2011

Central Bank of India | 1QFY2012 Result Update

Exhibit 3: 1QFY2012 performance analysis

Particulars Advances (` cr) Deposits (` cr) Credit-to-Deposit Ratio (%) Current deposits (` cr) Saving deposits (` cr) CASA deposits (` cr) CASA ratio (%) CAR (%) Tier 1 CAR (%) Profitability Ratios (%) Cost of deposits Yield on advances Yield on investments Reported NIM Cost-to-income ratio Asset quality Gross NPAs (` cr) Gross NPAs (%) Net NPAs (` cr) Net NPAs (%) Provision Coverage Ratio (%) Slippage ratio (%) Credit cost (%)

Source: Company, Angel Research

1QFY12

4QFY11

% chg (qoq)

1QFY11 % chg (yoy) 17.2 20.3 (178)bp 17.5 14.0 14.7 (159)bp (12)bp 122bp 127bp 172bp 42bp 13bp (22)bp 10.4 (14)bp 32.7 10bp (359)bp 75bp (2)bp

126,044 129,725 185,885 179,356 67.8 12,686 47,867 60,553 32.6 12.7 7.8 6.8 11.4 7.1 3.0 50.9 2,883 2.3 1,082 0.9 65.2 1.8 0.5 72.3 15,431 47,645 63,076 35.2 11.7 6.4 6.1 10.6 7.9 3.5 83.0 2,394 1.8 847 0.7 67.6 2.3 0.4

(2.8) 107,561 3.6 154,559 (452)bp (17.8) 0.5 (4.0) (259)bp 100bp 148bp 72bp 77bp (73)bp (48)bp (3,214)bp 20.4 47bp 27.7 22bp (248)bp (48)bp 11bp 69.6 10,799 42,004 52,803 34.2 12.8 6.6 5.5 9.7 6.7 2.9 51.1 2,611 2.4 815 0.8 68.8 1.1 0.5

Business growth moderates

The banks business momentum slowed during the usually lean quarter. Advances declined by 2.8% qoq (up 17.2% yoy) and deposits increased by 3.6% qoq (up 20.3% yoy). Loan growth was driven by MSME lending (up 27.1% yoy) and retail credit (up 25.5% yoy). Corporate credit, which accounts for 63.4% of advances, grew at a slower pace of 14.0%. Among retail loans, housing loan growth was moderate at 9.5%; however, education loans grew at healthy 38.0%.

Exhibit 4: Seasonally lean quarter for business growth

Adv. qoq chg (%) 15.0 10.0 5.0 69.6 67.8 Dep. qoq chg (%) 71.3 72.3 CDR (%, RHS) 80.0 67.8 70.0 60.0 50.0 40.0 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

Source: Company, Angel Research

Exhibit 5: CASA ratio comes off ~260bp qoq

CASA ratio (%) 36.0 22.2 34.5 33.0 13.0 14.7 23.6 22.1 20.0 CASA yoy growth (%, RHS) 30.0

2.1

5.7 8.6

2.3

11.5 10.0

3.6

(4.7)

(2.8)

(2.8)

34.2

34.4

34.9

35.2

(10.0)

30.0 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

Source: Company, Angel Research

32.6

(5.0)

31.5

10.0

August 2, 2011

Central Bank of India | 1QFY2012 Result Update

The widening of spread between saving account interest rate and term deposit interest rate resulted in moderation in CASA deposits growth to 14.7% yoy. CASA ratio declined by 259bp qoq and 159bp yoy to 32.6%. Bulk deposits and CDs constituted a relatively higher ~33% of total deposits.

NIM dips qoq on lower yield on investments, one-offs in 4QFY11

Reduction in CASA ratio and the higher interest rate environment resulted in a sharp 72bp qoq rise in cost of deposits to 6.8%. However, yield on investments declined by 73bp qoq to 7.1%. Yield on advances increased by 77bp qoq to 11.4%. Reported NIM declined sharply by 48bp qoq to 3.0% primarily due to fall in yield on investments. The sequential decline in NIM was exacerbated by the benefit of interest on income tax refund of ~`130cr in 4QFY2011. Management is targeting to maintain NIM above 3.0% levels for FY2012 (3.3% in FY2011) on the back of focus on higher-yielding retail and SME advances.

Exhibit 6: A sharp uptick in cost on deposits...

(%) 7.00 6.08 6.00 5.53 5.50 5.68 6.80

Exhibit 7: ...leads to a 48bp qoq dip in reported NIM

(%) 3.50 3.00 2.50 2.86 3.43 3.45 3.47 2.99

5.00

2.00 1.50 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

4.00

Source: Company, Angel Research

Source: Company, Angel Research

Sluggish fee income; recoveries dip sharply

Fee income growth was muted (3.1% yoy) in spite of the strong rise in retail credit and overall yoy advances growth of 17.2%. Other income growth was primarily driven by treasury gains, which rose by 73.3% yoy to `104cr. Recoveries from written-off accounts dipped sharply to `17cr as compared to `65cr in 1QFY2011. Out of the written-off accounts pool of ~`2,200cr, management is targeting to recover 30% (~`650cr) in FY2012, which looks a tough ask given the performance in 1QFY2012.

Exhibit 8: Sluggish fee income; recoveries dip sharply

Particulars (` cr) CEB Treasury Recoveries Others Other income Other income excl. treasury

Source: Company, Angel Research

1QFY12 4QFY11 134 104 17 27 282 178 181 166 75 101 523 357

% chg (qoq) 1QFY11 (26.0) (37.3) (77.3) (73.4) (46.1) (50.2) 130 60 65 (8) 247 187

% chg (yoy) 3.1 73.3 (73.8) (442.3) 14.0 (5.0)

August 2, 2011

Central Bank of India | 1QFY2012 Result Update

Slippages rise in spite of the non-migration to system-based NPA recognition platform

Overall asset quality of the bank deteriorated during the quarter, with annualised slippage ratio remaining elevated at 1.8% (1.1% in 1QFY2011) and net NPAs rising by 27.7% qoq to `1,082cr. There was a chunky account of `450cr from the textiles sector, which slipped into NPA during the quarter. Provision coverage ratio including technical write-offs declined to 65.6% in 1QFY2012 from 67.6% in 4QFY2011. The bank is yet to switchover to system-based NPA recognition platform. The banks peers, especially those with higher rural branches and higher agricultural loan portfolio, who have at least partially migrated to system-based platform, have reported considerably larger slippages due to the switchover. The bank is planning to implement the new platform for accounts either above `1cr or `50lakhs by 2QFY2012 and has asked the RBI for an extension up to 3QFY2012 for migration of the smaller accounts. The switchover is likely to result in outsized slippages given the banks rural branch network (37% of the branches) and a relatively high 15.7% exposure to agricultural loans. Management is targeting to contain gross NPAs at 2.25% (already at 2.29% as of 1QFY2012) and net NPAs at 1.0% (0.9% as of 1QFY2012) on the back of focus on recovery or upgradation of substandard accounts pool of `1,235cr. Management had in 4QFY2011 guided for containment of slippages at ~`1,000cr during FY2012 (slippages ratio of ~0.8% vs. 1.3% in FY2011). However, we had built in slippage ratio of ~1.5%. Considering the pace of slippages in 1QFY2012 and the pending switchover to system-based NPA recognition platform, we have further revised our slippages estimate upward to 2.0% for FY2012.

Exhibit 9: Credit costs rise

(%) 0.6 0.5 0.4 0.3 0.2 0.2

Exhibit 10: Asset quality deteriorates

Gross NPAs (%) 0.5 2.5 2.0 1.5 1.0 68.8 70.5 Net NPAs (%) 70.3 67.6 65.2 64.0 PCR (%, RHS) 72.0

0.4

68.0

2.4 0.8

2.3 0.7

2.3 0.7

1.8 0.7

1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

1QFY11 2QFY11 3QFY11 4QFY11 1QFY12

2.3 0.9

60.0

0.5

Source: Company, Angel Research

Source: Company, Angel Research; Note: PCR including tech. write-offs

Capital adequacy improves post allotment of rights

The banks capital adequacy profile improved during the quarter on the back of allotment of shares against the rights issue. Overall CAR stood at 12.7% with a tier-I CAR of 7.8%. CAR will be further improved post the inclusion of 1QFY2012 audited profits.

August 2, 2011

Central Bank of India | 1QFY2012 Result Update

Investment concerns

Low branch productivity and structurally higher opex structure

The bank suffers from low branch and employee productivity in terms of business per branch as well as business per employee. Business per branch of the bank for FY2011 was ~34% lower than large and medium PSU peer banks. Due to this, the bank suffers from structurally higher operating expenses, as reflected in opex to average assets ratio of ~1.6% during FY200911.

Near-term concerns on asset quality

Unlike most other PSU banks, Central Bank of India is yet to switch over to system-based NPA recognition system. Going forward, as witnessed in case of most other PSU banks that have switched over to system-based NPA recognition, the switchover for Central Bank of India is also likely to result in higher slippages because of its relatively larger presence in rural areas (accounting for ~37% of overall branch network as of 1QFY2012). Even in 1QFY2012, the banks annualized slippage ratio rose to 1.8% from 1.1% in 1QFY2011. Also, the banks exposure to the infrastructure sector is relatively higher at 20.8% of the funded exposure as of 1QFY2012 with the power sector accounting for over two-thirds of the same. Major constituent of power exposure has been SEBs (~10% of the advances).

Outlook and valuation

At the CMP, the stock is trading at cheap valuations of 0.8x FY2013E ABV compared to its trading range of 0.51.5x with a median of 1.1x since listing in 2007. However, due to near-term concerns on asset quality due to system-based NPA recognition, we maintain our Neutral view on the stock.

Exhibit 11: Key assumptions

Particulars (%) Credit growth Deposit growth CASA ratio NIMs Other income growth Growth in staff expenses Growth in other expenses Slippages Treasury gain/(loss) (% of investments)

Source: Angel Research

Earlier estimates FY2012 19.0 16.0 34.3 2.6 (2.7) (10.0) 10.0 1.5 0.2 FY2013 18.0 16.0 33.4 2.5 16.5 10.0 10.0 1.4 0.2

Revised estimates FY2012 16.0 16.0 34.3 2.5 (4.5) (15.0) 5.0 2.0 0.2 FY2013 18.0 16.0 33.4 2.4 16.8 10.0 10.0 1.9 0.2

August 2, 2011

Central Bank of India | 1QFY2012 Result Update

Exhibit 12: Change in estimates

FY2012 Particulars (` cr) NII Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Angel Research

FY2013 Earlier estimates 6,153 1,433 7,586 4,187 3,400 1,060 2,339 759 1,580 Revised Var. (%) estimates 6,014 1,412 7,426 3,967 3,459 1,259 2,200 714 1,486 (2.3) (1.5) (2.1) (5.3) 1.8 18.8 (6.0) (6.0) (6.0)

Earlier estimates 5,511 1,230 6,742 3,806 2,936 1,155 1,781 481 1,300

Revised Var. (%) estimates 5,434 1,209 6,643 3,606 3,037 1,467 1,569 392 1,177 (1.4) (1.8) (1.5) (5.3) 3.4 27.0 (11.9) (18.4) (9.5)

Exhibit 13: P/ABV band

Price (`) 250 200 150 100 50 0 0.3x 0.6x 0.9x 1.2x 1.5x

Nov-08

May-11

Aug-07

Dec-10

Apr-09

Jul-10

Source: Company, Angel Research

August 2, 2011

Mar-12

Feb-10

Sep-09

Oct-11

Jan-08

Jun-08

Central Bank of India | 1QFY2012 Result Update

Exhibit 14: Recommendation summary

Company AxisBk FedBk HDFCBk ICICIBk* SIB YesBk AllBk AndhBk BOB BOI CanBk CentBk CorpBk DenaBk IDBI# IndBk IOB J&KBk OBC PNB SBI* SynBk UcoBk UnionBk UtdBk VijBk Reco. Buy Buy Accumulate Buy Accumulate Accumulate Neutral Accumulate Buy Buy Buy Neutral Buy Neutral Neutral Buy Accumulate Neutral Accumulate Accumulate Buy Buy Neutral Buy Buy Neutral CMP (`) 1,343 405 484 1,022 23 310 198 136 867 376 434 111 493 84 125 217 136 871 345 1,093 2,277 117 82 278 92 62 Tgt. price (`) 1,648 483 519 1,324 26 353 145 1,018 434 516 608 255 155 383 1,217 2,845 139 327 107 Upside (%) 22.7 19.4 7.3 29.6 13.4 13.6 6.1 17.5 15.4 18.9 23.4 17.2 14.3 10.9 11.3 25.0 18.8 17.8 17.1 FY2013E P/ABV (x) 2.2 1.1 3.3 1.9 1.2 2.0 0.9 0.9 1.2 1.0 0.8 0.8 0.8 0.6 0.8 0.9 0.8 0.9 0.8 1.3 1.7 0.8 0.9 1.0 0.8 0.8 FY2013E Tgt P/ABV (x) 2.7 1.3 3.5 2.4 1.4 2.3 1.0 1.4 1.2 1.0 1.0 1.0 1.0 0.9 1.4 2.1 0.9 1.2 0.9 FY2013E P/E (x) 11.1 8.2 16.8 14.4 7.2 10.5 5.6 5.7 6.5 5.9 5.0 5.4 4.6 4.0 5.7 4.6 5.2 5.8 5.8 6.8 8.4 4.9 4.8 5.9 6.1 6.7

#

FY2011-13E EPS CAGR (%) 20.9 20.2 30.5 25.8 11.6 19.1 9.2 3.1 10.8 18.7 (2.4) (14.0) 6.1 7.0 14.3 10.4 22.4 8.8 7.5 7.4 44.2 14.6 16.5 20.0 6.1 61.9

FY2013E RoA (%) 1.5 1.3 1.7 1.5 0.9 1.2 0.9 1.0 1.1 0.8 0.9 0.5 0.9 0.8 0.7 1.4 0.7 1.2 0.9 1.0 1.1 0.7 0.6 0.8 0.5 0.4

FY2013E RoE (%) 21.0 14.1 20.9 16.0 17.2 20.6 17.8 16.8 19.6 18.0 17.2 14.4 17.9 16.5 14.5 20.4 16.4 17.0 14.4 20.0 22.6 17.0 17.1 17.9 12.5 11.7

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), Without adjusting for SASF

August 2, 2011

Central Bank of India | 1QFY2012 Result Update

Income statement

Y/E March (` cr) Net Interest Income - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Prov. & Cont. - YoY Growth (%) Profit Before Tax - YoY Growth (%) Prov. for Taxation - as a % of PBT PAT - YoY Growth (%) Preference Dividend PAT avl. to Eq. SH - YoY Growth (%) FY08 2,223 (10.2) 902 60.6 3,125 2.9 1,746 3.7 1,380 2.0 528 (19.6) 852 22.5 302 35.4 550 10.5 80 470 (5.5) FY09 2,228 0.2 1,070 18.6 3,298 5.5 1,862 6.6 1,437 4.1 512 (3.0) 925 8.6 354 38.2 571 3.8 78 494 5.0 FY10 2,545 14.2 1,735 62.2 4,281 29.8 2,222 19.4 2,059 43.3 509 (0.5) 1,550 67.5 491 31.7 1,058 85.3 61 998 102.1 FY11 5,325 109.2 1,265 (27.1) 6,590 54.0 3,999 80.0 2,591 25.9 932 83.2 1,659 7.1 407 24.5 1,252 18.3 131 1,121 12.4 FY12E 5,434 2.0 1,209 (4.5) 6,643 0.8 3,606 (9.8) 3,037 17.2 1,467 57.4 1,569 (5.4) 392 25.0 1,177 (6.0) 160 1,017 (9.3) FY13E 6,014 10.7 1,412 16.8 7,426 11.8 3,967 10.0 3,459 13.9 1,259 (14.2) 2,200 40.2 714 32.4 1,486 26.3 160 1,326 30.4

Balance sheet

Y/E March (` cr) Share Capital - Equity - Preference Reserve & Surplus Deposits - Growth (%) Borrowings Tier 2 Capital Other Liab. & Prov. Total Liabilities Cash Balances Bank Balances Investments Advances - Growth (%) Fixed Assets Other Assets Total Assets - Growth (%) FY08 1,204 404 800 4,739 110,320 33.3 449 2,432 4,812 123,956 11,537 1,302 31,455 72,997 40.9 2,320 4,344 123,956 33.3 FY09 1,321 404 917 5,091 131,272 19.0 804 3,854 5,313 147,655 11,037 1,214 43,061 85,483 17.1 2,278 4,582 147,655 19.1 FY10 1,771 404 1,367 5,921 162,107 23.5 2,751 4,575 5,545 182,672 17,012 2,205 50,563 105,383 23.3 2,343 5,165 182,672 23.7 FY11 2,021 404 1,617 6,827 179,356 10.6 7,283 5,605 8,666* 209,757 14,082 1,201 54,504 129,725 23.1 2,425 7,819 209,757 14.8 FY12E 2,264 647 1,617 9,949 208,053 16.0 8,448 6,502 8,103 243,318 13,523 3,650 63,864 150,481 16.0 2,729 9,070 243,318 16.0 FY13E 2,264 647 1,617 11,087 241,341 16.0 9,800 7,673 10,085 282,249 15,687 4,234 71,168 177,568 18.0 3,071 10,522 282,249 16.0

Note: * including Share Application Money of `2,026cr

August 2, 2011

Central Bank of India | 1QFY2012 Result Update

Ratio analysis

Y/E March Profitability ratios (%) NIMs Cost to Income Ratio RoA RoE B/S ratios (%) CASA Ratio Credit/Deposit Ratio CAR - Tier I Asset Quality (%) Gross NPAs Net NPAs Slippages Loan Loss Prov. /Avg. Assets Provision Coverage Ratio Per Share Data (`) EPS ABVPS (75% cover.) DPS Valuation Ratios PER (x) P/ABVPS (x) Dividend Yield DuPont Analysis NII (-) Prov. Exp. Adj. NII Treasury Int. Sens. Inc. Other Inc. Op. Inc. Opex PBT Taxes RoA Pref. Div. RoA post Pref Div Leverage RoE 2.0 0.5 1.6 0.1 1.7 0.7 2.4 1.6 0.8 0.3 0.5 0.1 0.4 38.7 16.8 1.6 0.4 1.3 0.3 1.6 0.5 2.1 1.4 0.7 0.3 0.4 0.1 0.4 41.2 15.0 1.5 0.3 1.2 0.5 1.7 0.6 2.3 1.3 0.9 0.3 0.6 0.0 0.6 42.1 25.4 2.7 0.5 2.2 0.2 2.4 0.5 2.9 2.0 0.8 0.2 0.6 0.1 0.6 40.6 23.2 2.4 0.6 1.8 0.1 1.8 0.5 2.3 1.6 0.7 0.2 0.5 0.1 0.4 32.4 14.6 2.3 0.5 1.8 0.1 1.9 0.5 2.3 1.5 0.8 0.3 0.6 0.1 0.5 28.5 14.4 9.5 1.7 1.8 9.1 1.5 1.8 4.5 1.1 2.0 4.0 0.9 3.1 7.0 0.9 1.8 5.4 0.8 2.3 11.6 65.1 2.0 12.2 74.3 2.0 24.7 105.2 2.2 27.7 125.1 3.4 15.7 127.0 2.0 20.5 142.1 2.5 3.2 1.5 1.2 0.3 54.9 2.7 1.2 1.2 0.2 54.1 2.3 0.7 1.2 0.2 70.4 1.8 0.7 1.3 0.3 67.6 2.8 1.1 2.0 0.5 65.0 3.3 1.2 1.9 0.4 65.0 36.1 66.2 10.4 5.4 33.4 65.1 12.2 6.5 34.4 65.0 11.5 6.4 35.2 72.3 10.9 5.9 34.3 72.3 12.8 7.9 33.4 73.6 12.6 7.6 2.2 55.9 0.4 16.8 1.7 56.4 0.4 15.0 1.6 51.9 0.6 25.4 2.8 60.7 0.6 23.2 2.5 54.3 0.4 14.6 2.4 53.4 0.5 14.4 FY08 FY09 FY10 FY11 FY12E FY13E

August 2, 2011

10

Central Bank of India | 1QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Central Bank of India No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

August 2, 2011

11

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- My Home Is Mine PDFDocument36 pagesMy Home Is Mine PDFRoger Christensen100% (7)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 10 CrimeAndCryptoDocument84 pages10 CrimeAndCryptoayush agarwalNo ratings yet

- HW 2-SolnDocument9 pagesHW 2-SolnZhaohui ChenNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Lloyds Bank 1Document8 pagesLloyds Bank 1KabanNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- My Project of Vijaya BankDocument103 pagesMy Project of Vijaya Banktamizharasid100% (1)

- ABRISH Final NEWDocument40 pagesABRISH Final NEWGetachew AliNo ratings yet

- Kerala 3 Days 2 Nights Munnar Cochin DECDocument3 pagesKerala 3 Days 2 Nights Munnar Cochin DECabinashrock619No ratings yet

- Tax CalculatorDocument2 pagesTax CalculatorJeffree Lann AlvarezNo ratings yet

- S. Thomas Aquinas - PoliticsDocument20 pagesS. Thomas Aquinas - PoliticsbimonthlygrainNo ratings yet

- Study Guide - Chapter 10Document6 pagesStudy Guide - Chapter 10Peko YeungNo ratings yet

- Subject: Financial Management: Yes Bank CrisisDocument9 pagesSubject: Financial Management: Yes Bank Crisisaryan sharmaNo ratings yet

- Set ADocument5 pagesSet ASomersNo ratings yet

- Money and Credit Important Questions and Answers PDFDocument12 pagesMoney and Credit Important Questions and Answers PDFAkkajNo ratings yet

- Franklin India Ultra Short Bond Fund - (No. of Segregated Portfolio in The Scheme - 1) - (Under Winding Up) $$$Document45 pagesFranklin India Ultra Short Bond Fund - (No. of Segregated Portfolio in The Scheme - 1) - (Under Winding Up) $$$Ghanshyam Kumar PandeyNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsSiva Sagar JaggaNo ratings yet

- Co Operative BanksDocument13 pagesCo Operative Banksamyncharaniya100% (4)

- Piramal PhytocareDocument3 pagesPiramal PhytocareDynamic LevelsNo ratings yet

- Financial Statement - With Adjustments - DPP 13Document4 pagesFinancial Statement - With Adjustments - DPP 13dhruvNo ratings yet

- (N. Gregory Mankiw) Macroeconomics (9th Edition) (BookFi) - Pages-176-182-DikompresiDocument7 pages(N. Gregory Mankiw) Macroeconomics (9th Edition) (BookFi) - Pages-176-182-DikompresiNoveliaNo ratings yet

- QA Cash Flow Statement 25.1.2010 PDFDocument8 pagesQA Cash Flow Statement 25.1.2010 PDFJanine padronesNo ratings yet

- Nirmal Bang On CCL Products - Upside of 20%Document7 pagesNirmal Bang On CCL Products - Upside of 20%Alok DashNo ratings yet

- Other SourceDocument43 pagesOther SourceJai RajNo ratings yet

- Basic Concepts 1Document42 pagesBasic Concepts 1puneet80% (5)

- Chapter 16Document2 pagesChapter 16Faizan Ch100% (1)

- Colloquim Jan 29 Abstract Corrected Jan 6Document87 pagesColloquim Jan 29 Abstract Corrected Jan 6bryan001935No ratings yet

- Funding African InfrastructureDocument4 pagesFunding African InfrastructureKofikoduahNo ratings yet

- People vs. SevillaDocument3 pagesPeople vs. SevillajieNo ratings yet

- Account Receivable ClassDocument30 pagesAccount Receivable ClassBeast aNo ratings yet

- Problems On Margin Account-Dr. Shalini H SDocument2 pagesProblems On Margin Account-Dr. Shalini H Sraj rajyadav0% (1)

- Quiz 562Document5 pagesQuiz 562Haris NoonNo ratings yet