Professional Documents

Culture Documents

Entity

Uploaded by

Sto Kanigiri0 ratings0% found this document useful (0 votes)

7 views1 pageEntity

Original Title

entity

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEntity

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageEntity

Uploaded by

Sto KanigiriEntity

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

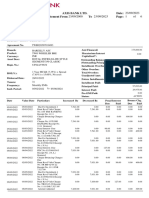

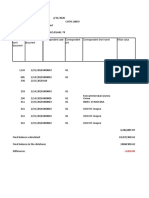

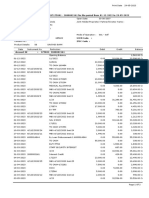

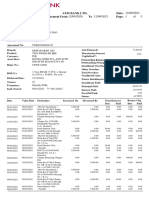

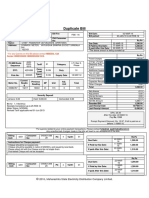

Pensioner Income Tax Calculation Statement for the FY 2022-2023

CFMS ID : 80240576 Name : Y.CH.VENKATESWARLU . DOB : 01-07-1951

Age : 070 TAN No : HYDS18339G PAN No : ABAPY5855C

Bank ID : SBIN0000959 Acc No : 30875095063 Type : N - Normal Pension

DDO : 07080702001-S.T.O.KANIGIRI PPO : 17-01638

STO : 7706-STO - Kanigiri

Pension Category : 01 - CIVIL PENSION

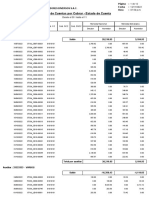

Month Gross Amount VR-Amount IT-Recovered VR-IT Amount

03/2022 54,007.00 0.00 0.00 0.00

04/2022 54,007.00 -18,940.00 0.00 0.00

05/2022 54,007.00 0.00 0.00 0.00

06/2022 54,007.00 0.00 0.00 0.00

07/2022 54,007.00 0.00 0.00 0.00

08/2022 54,007.00 0.00 0.00 0.00

09/2022 54,007.00 0.00 0.00 0.00

10/2022 54,007.00 0.00 0.00 0.00

11/2022 54,007.00 -56,820.00 3,621.00 0.00

12/2022 54,007.00 0.00 7,560.00 0.00

01/2023 0.00 0.00 0.00 0.00

02/2023 0.00 0.00 0.00 0.00

Total 540,070.00 -75,760.00 11,181.00 0.00

Total DR : 104,170.00 Gross Amount : 629,144.00

House Rent Exmt. : 0.00 STD Deduction : 50,000.00

Gross Total Income : 579,144.00 Deduction under Section 80-C : 2,700.00

Net Taxable Income : 576,444.00 IT on Total Income : 25,289.00

Health and Education Cess : 1,011.55 Tax Payable : 26,301.00

Total Tax Deducted : 11,181.00 Tax to be paid : 15,120.00

Signature of the Treasury Officer

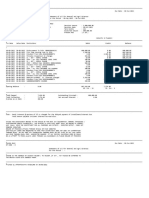

Note:- Out of the Total Income / Gross Amount Shown above, two Dearness relief installment

bills amounting to Rupees : 104170.00/- shown against total DR column is not paid as on

31-03-2021 which may be brought to the notice of auditor at the time of filing the Income tax

return and carried forward to FY 2021-2022.

You might also like

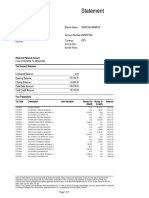

- Bank Name: Medak DCC Bank LTD Branch Name: Siddipet Reportdate: 09-06-2022 Userid: 170601 Selection CriteriaDocument2 pagesBank Name: Medak DCC Bank LTD Branch Name: Siddipet Reportdate: 09-06-2022 Userid: 170601 Selection CriteriaPonnam VenkateshamNo ratings yet

- P4I5PHF2141826 Repayment ReportDocument4 pagesP4I5PHF2141826 Repayment ReportAartiNo ratings yet

- DELPHI-TVS PF STATEMENTDocument1 pageDELPHI-TVS PF STATEMENTsrinivasankNo ratings yet

- Adhe Nur AfdiDocument1 pageAdhe Nur Afdiel fitriana susantiNo ratings yet

- Contoh Angsuran LeasingDocument2 pagesContoh Angsuran LeasingBoston Trikora MahardikaNo ratings yet

- StatmentDocument2 pagesStatmentRatan SinghNo ratings yet

- Engkus Kusnadi - AmorDocument1 pageEngkus Kusnadi - AmorEngkus KusnadiNo ratings yet

- 403SPFGP670479 RPSDocument5 pages403SPFGP670479 RPSAfzal RNo ratings yet

- Jmo RSJHTDocument2 pagesJmo RSJHTGani Damara Adi SaputraNo ratings yet

- Cuentas Por Cobrar Al 12.11.2022Document12 pagesCuentas Por Cobrar Al 12.11.2022Javier RamosNo ratings yet

- Agreement Cardview 04762121002689 IndraDocument1 pageAgreement Cardview 04762121002689 IndrasalmanNo ratings yet

- 1676983262212PL PDFDocument2 pages1676983262212PL PDFAnuj ChaudharyNo ratings yet

- Repayment ScheduleDocument3 pagesRepayment ScheduleAarti ThdfcNo ratings yet

- View Customer CardDocument1 pageView Customer CardRocky SapuletteNo ratings yet

- AmorDocument1 pageAmorsyamsul hidayatNo ratings yet

- 4632300070_DARRYL JANITRA ADIGRAHA_AMORTISASIDocument3 pages4632300070_DARRYL JANITRA ADIGRAHA_AMORTISASIAry Samsul MangadilNo ratings yet

- rptExAnnualSlip WoRefLoanDocument1 pagerptExAnnualSlip WoRefLoanumesh chitrodaNo ratings yet

- NullDocument2 pagesNullKishore NithyaNo ratings yet

- 1699516930152-4622308668 Dwi Junita Elfikasari AmortisasiDocument3 pages1699516930152-4622308668 Dwi Junita Elfikasari AmortisasiDeny SubrotoNo ratings yet

- 160000818390Document2 pages160000818390Ashok FerraoNo ratings yet

- Scadentar ImprumutDocument5 pagesScadentar ImprumutNidelea mirelNo ratings yet

- HDFC Bank personal loan repayment scheduleDocument3 pagesHDFC Bank personal loan repayment scheduleSALES AMBATTUR - KUN VWNo ratings yet

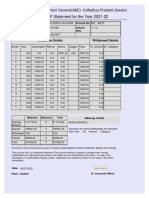

- GPF Statement 2021-22Document1 pageGPF Statement 2021-22SHIVGOPAL KULHADENo ratings yet

- 8116937Document5 pages8116937utkarshlegal96No ratings yet

- Half Yearly StatementDocument3 pagesHalf Yearly StatementGayan HewageNo ratings yet

- TN3004TW0093130Document2 pagesTN3004TW0093130Dhanaseelan PeriyasamyNo ratings yet

- Absa - Statement BwinaDocument1 pageAbsa - Statement BwinaAllan NgetichNo ratings yet

- Soa TN3004CD0230097Document2 pagesSoa TN3004CD0230097SaravananNo ratings yet

- TWR 020507016893Document6 pagesTWR 020507016893adimaygupta1123No ratings yet

- Customer Card 8051011910338Document2 pagesCustomer Card 8051011910338Vincent AnarkiNo ratings yet

- 09-2022 - NKDDocument5 pages09-2022 - NKDsrinivasNo ratings yet

- Aged - 2022-07-25T135817.589Document2 pagesAged - 2022-07-25T135817.589Meli GarzonNo ratings yet

- RPS 1699239810161Document4 pagesRPS 1699239810161Shashï SingħNo ratings yet

- Template BS QueryDocument3 pagesTemplate BS QueryllrafaellNo ratings yet

- HDFC Bank LTD Repayment Schedule: Date: 08/05/2020Document3 pagesHDFC Bank LTD Repayment Schedule: Date: 08/05/2020K Jayakumar KandasamyNo ratings yet

- Amortization scheduleDocument1 pageAmortization scheduleKiararesty MeliantyNo ratings yet

- HDFC Bank LTD Repayment Schedule: Date: 11/05/2020Document3 pagesHDFC Bank LTD Repayment Schedule: Date: 11/05/2020K Jayakumar KandasamyNo ratings yet

- Amour 18 BulanDocument1 pageAmour 18 BulanNabila SekarNo ratings yet

- HDFC Bank personal loan repayment scheduleDocument3 pagesHDFC Bank personal loan repayment scheduleSALES AMBATTUR - KUN VWNo ratings yet

- View Agreement CardDocument1 pageView Agreement CardOka ArtawanNo ratings yet

- UntitledDocument1 pageUntitledYogesh SureshNo ratings yet

- STMT of Ac F12Document2 pagesSTMT of Ac F12Asco Bank ArakkulamNo ratings yet

- TWR028206828157 - Soa MDocument5 pagesTWR028206828157 - Soa Madimaygupta1123No ratings yet

- Member Statement - 2022: Your Personal DetailsDocument2 pagesMember Statement - 2022: Your Personal Detailschii1000jhayNo ratings yet

- TWR 028206762182Document5 pagesTWR 028206762182adimaygupta1123No ratings yet

- Informe General de Facturación-20210505183014Document3 pagesInforme General de Facturación-20210505183014omar perezNo ratings yet

- report (40)Document1 pagereport (40)marty65432164No ratings yet

- Raswan - 5132216948Document1 pageRaswan - 5132216948aghosuryana525No ratings yet

- Aditya Birla Sun Life Insurance Company Limited Full and Final Settlement Jan-2022Document1 pageAditya Birla Sun Life Insurance Company Limited Full and Final Settlement Jan-2022Praneeth Sasanka TadepalliNo ratings yet

- Girdhar51 1603693312542 PDFDocument2 pagesGirdhar51 1603693312542 PDFjignesh parmarNo ratings yet

- Sarwoto - 023614Document5 pagesSarwoto - 023614Mardi AntoNo ratings yet

- W02frpgi764846 RPSDocument5 pagesW02frpgi764846 RPSKailash Ch Sahu SahuNo ratings yet

- Construction Loan Repayment ScheduleDocument3 pagesConstruction Loan Repayment ScheduleMahesh JhaNo ratings yet

- GPF No.: Subscriber's Name Date of Birth:-DDO Code & Name: - Rate of Interest FromDocument4 pagesGPF No.: Subscriber's Name Date of Birth:-DDO Code & Name: - Rate of Interest FromHema SoodNo ratings yet

- Soa 1675156371002Document3 pagesSoa 1675156371002SachinNo ratings yet

- HDFC Bank LTDDocument2 pagesHDFC Bank LTDMd SharidNo ratings yet

- TN3004TW0099998Document2 pagesTN3004TW0099998Dhanaseelan PeriyasamyNo ratings yet

- General Provident Fund Ledger Card For Financial Year 2021-2022 Form 47Document2 pagesGeneral Provident Fund Ledger Card For Financial Year 2021-2022 Form 47Horticulture Sericulture GadwalNo ratings yet

- Account Statement ReportDocument6 pagesAccount Statement ReportKhaja Naseeruddin MuhammadNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 14th Finance Funds For Development of AP Villages 2016-2020Document5 pages14th Finance Funds For Development of AP Villages 2016-2020పైలా ఫౌండేషన్100% (7)

- Fin02-160134-7-2020-F Sec-DtaDocument2 pagesFin02-160134-7-2020-F Sec-DtaSto KanigiriNo ratings yet

- CurrentDocument1 pageCurrentSto KanigiriNo ratings yet

- EntityDocument1 pageEntitySto KanigiriNo ratings yet

- GO. No - 58Document2 pagesGO. No - 58Sto KanigiriNo ratings yet

- DocDocument2 pagesDocSto KanigiriNo ratings yet

- New Doc 2020-01-27 19.12.23Document3 pagesNew Doc 2020-01-27 19.12.23Sto KanigiriNo ratings yet

- New Doc 2020-01-27 19.11.09Document1 pageNew Doc 2020-01-27 19.11.09Sto KanigiriNo ratings yet

- Additional Income and Adjustments To Income: Schedule 1Document1 pageAdditional Income and Adjustments To Income: Schedule 1Betty Ann LegerNo ratings yet

- ErrorsDocument31 pagesErrorsmoNo ratings yet

- Gross To Nett - Yarra VlogDocument2 pagesGross To Nett - Yarra VlogRichardo Putra SiahaanNo ratings yet

- 1 Jeanie Acquires An Apartment Building in 2003 For 260 000Document1 page1 Jeanie Acquires An Apartment Building in 2003 For 260 000hassan taimourNo ratings yet

- Chapter 16Document6 pagesChapter 16张心怡No ratings yet

- Duplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallDocument1 pageDuplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CalldineshsirasatNo ratings yet

- 1 Useful Calender For Every Accountant 2010Document13 pages1 Useful Calender For Every Accountant 2010bharat100% (1)

- Custom DutyDocument7 pagesCustom DutyPriyanshuNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- Non Current Asset Held For SaleDocument18 pagesNon Current Asset Held For SaleAbby NavarroNo ratings yet

- TCSDocument23 pagesTCSSatyendra13kumarNo ratings yet

- Exclusions from gross income; compensation incomeDocument2 pagesExclusions from gross income; compensation incomeHomer SimpsonNo ratings yet

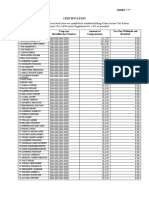

- Annex ' F '' Certification: Taxpayer Identification Number Amount of Compensation Tax Due Withheld and RemittedDocument4 pagesAnnex ' F '' Certification: Taxpayer Identification Number Amount of Compensation Tax Due Withheld and Remittedivs accountingNo ratings yet

- Form16 Parta AQLPK9881A 2018-19Document2 pagesForm16 Parta AQLPK9881A 2018-19Rakesh KumarNo ratings yet

- Taxation Management Final ExamDocument10 pagesTaxation Management Final ExamWASEEM AKRAMNo ratings yet

- Income Tax of Individuals: Income Taxation 5Th Edition (By: Valencia & Roxas)Document19 pagesIncome Tax of Individuals: Income Taxation 5Th Edition (By: Valencia & Roxas)Love FreddyNo ratings yet

- DonationS UNDE INCOME TAX ACTDocument2 pagesDonationS UNDE INCOME TAX ACTManjeet KaurNo ratings yet

- LP 8 TaxationDocument2 pagesLP 8 TaxationJames CorpuzNo ratings yet

- Deed of Conditional Sale123Document4 pagesDeed of Conditional Sale123VanNo ratings yet

- Appeal Tax Procedure (Malaysia)Document2 pagesAppeal Tax Procedure (Malaysia)Zati TyNo ratings yet

- Adjustment and TransactionsDocument6 pagesAdjustment and TransactionsEasin Mohammad RomanNo ratings yet

- Karla Company Comprehensive IncomeDocument3 pagesKarla Company Comprehensive Incomeakiko dilemNo ratings yet

- S20 TX ZWE Sample AnswersDocument9 pagesS20 TX ZWE Sample AnswersKAH MENG KAMNo ratings yet

- Finnish-Tax-Administration Form6148ev18 7.2.2020Document2 pagesFinnish-Tax-Administration Form6148ev18 7.2.2020agustin domecqNo ratings yet

- Depreciation - WikipediaDocument10 pagesDepreciation - Wikipediapuput075No ratings yet

- Chapter 4 Class Homework Solutions PDFDocument10 pagesChapter 4 Class Homework Solutions PDFAmin MNo ratings yet

- Customizing R/3 FI for VAT Processing in 3 StepsDocument8 pagesCustomizing R/3 FI for VAT Processing in 3 StepsJunling Xu100% (2)

- Test 1-Theory (1 PT Each) - Write Only The Letter Which Corresponds To Your Chosen AnswerDocument3 pagesTest 1-Theory (1 PT Each) - Write Only The Letter Which Corresponds To Your Chosen AnswerJazel Mae CelerinosNo ratings yet

- Deferred Tax Lecture SlidesDocument38 pagesDeferred Tax Lecture Slidesmd salehinNo ratings yet

- VAT Module OverviewDocument9 pagesVAT Module OverviewCSJNo ratings yet