Professional Documents

Culture Documents

Subway2 36

Uploaded by

sll994Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Subway2 36

Uploaded by

sll994Copyright:

Available Formats

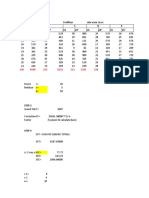

From this regression we calculated the expected PE for 2005 (using S&P 500 forecasted

PE as calculated by Standards & Poor’s) at 21.37 which is close to the current industry

average of 21.05. Nevertheless we believe that this P/E is too high given the nature of the

company and we were surprised to find that the correlation between the two PEs was

very low at .004. As a result we will not use this forecasted PE.

2. We then ran three different regressions in order to get a broader picture of the expected

PE and the relation of S&P 500 PE and that of MCD.

MCD

Year S&P MCD (High PE+Low PE)/ 2 MCD high low

2004

20.962 16 18 14

2003

28.978 16.5 23 10

2002

41.449 30 40 20

2001

36.892 24 28 20

2000

29.267 24 30 18

1999

32.899 31 36 26

1998

26.703 28 36 20

1997

22.321 21 24 18

1996

19.213 22 25 19

1995 16.516 19.5 24 15

Correlation 0.64 0.705 0.411

Regression

Line MCD AVG = 11.690 +.418SPX R-sq =40.66%

20.22

MCD HIGH = 11.454 +.616SPX R-sq= 49.66%

24.03

36

You might also like

- Technical Tables for Schools and Colleges: The Commonwealth and International Library Mathematics DivisionFrom EverandTechnical Tables for Schools and Colleges: The Commonwealth and International Library Mathematics DivisionNo ratings yet

- Subway2 35Document1 pageSubway2 35sll994No ratings yet

- Peso Estatura Xi Yi Xiyi XiDocument4 pagesPeso Estatura Xi Yi Xiyi Xianon-494447No ratings yet

- Jawaban Mid Ekonomi Mikro Ir. H.M. NuriDocument24 pagesJawaban Mid Ekonomi Mikro Ir. H.M. NuriperiskarasmaNo ratings yet

- Fisicoquimica - TP 2 - Des Molares Parciales Auto Guard Ado)Document6 pagesFisicoquimica - TP 2 - Des Molares Parciales Auto Guard Ado)BeToxl RoblNo ratings yet

- Land Use Land Cover AnalysisDocument6 pagesLand Use Land Cover AnalysisKashfia Tasnim NishthaNo ratings yet

- Autos Buses Camiones: Chart TitleDocument7 pagesAutos Buses Camiones: Chart TitleLuis CarlosNo ratings yet

- Regression ExcelDocument4 pagesRegression ExcelPriyal BaidNo ratings yet

- Annual Program 2017 Divisi F3+++Document436 pagesAnnual Program 2017 Divisi F3+++taufik purnomoNo ratings yet

- Regression Statistics: Summary OutputDocument14 pagesRegression Statistics: Summary OutputIonut NicodimNo ratings yet

- Final Exp 2Document3 pagesFinal Exp 2MuhammedNayeemNo ratings yet

- Ahmet ÖzmanDocument1 pageAhmet ÖzmanedariciNo ratings yet

- Ahmet ÖzmanDocument1 pageAhmet ÖzmanedariciNo ratings yet

- Tabel FDocument15 pagesTabel FALIFIANo ratings yet

- Pearl y Gompertz AlumnosDocument5 pagesPearl y Gompertz Alumnosmarco gradoNo ratings yet

- Tilt and TurnDocument9 pagesTilt and TurnMohsin KhanNo ratings yet

- QatarGas Simulate Hit TImeDocument32 pagesQatarGas Simulate Hit TImeAbdi AnsharyNo ratings yet

- Stapro ExelDocument4 pagesStapro ExellesmanandaNo ratings yet

- Kurva Standar AntibiotikDocument8 pagesKurva Standar AntibiotikarinmayaNo ratings yet

- HW1 DataDocument3 pagesHW1 DataSittichost ChevapurkeNo ratings yet

- Anggun Theresia Manurung - 119280011 - Statistika11Document5 pagesAnggun Theresia Manurung - 119280011 - Statistika11RBAnggun Theresia Manurung 011No ratings yet

- Tiempo (Min.) Concentracion RXN N de Datos X Mínimo X Máximo N de ClasesDocument10 pagesTiempo (Min.) Concentracion RXN N de Datos X Mínimo X Máximo N de ClasesAngie J MarleyNo ratings yet

- Curvas de Capacidad de Embalse Lampazuni yDocument22 pagesCurvas de Capacidad de Embalse Lampazuni yRaul SanchezNo ratings yet

- Alejandro LDocument12 pagesAlejandro LALEJANDRO GABRIEL RIVERA FERRERNo ratings yet

- ANOVA CalculatorDocument4 pagesANOVA CalculatorABC XYZNo ratings yet

- CE19D019 Abhishek Kumar Task 1Document4 pagesCE19D019 Abhishek Kumar Task 1Nani RujaNo ratings yet

- Salarizarea PersonaluluiDocument6 pagesSalarizarea PersonaluluiTudor NeacsuNo ratings yet

- TT3D RatiosDocument1 pageTT3D RatiosAnthony Da Silva GuglielmettoNo ratings yet

- TX To RX ObstructedDocument5 pagesTX To RX ObstructedKamin AgyaoNo ratings yet

- Payment Made at The Beginning: Beginning Monthly Payment Balance Instalment Period Due PaymentDocument4 pagesPayment Made at The Beginning: Beginning Monthly Payment Balance Instalment Period Due PaymentChi IuvianamoNo ratings yet

- Stats Assignment 4 CorrelationDocument8 pagesStats Assignment 4 CorrelationSanthoshNo ratings yet

- Tugas RegresiDocument10 pagesTugas RegresiAnwar MahameruNo ratings yet

- Pathu Compilation September 2009Document4 pagesPathu Compilation September 2009tendilkar08No ratings yet

- Nifty PE PB Dividend Yield ChartDocument12 pagesNifty PE PB Dividend Yield ChartJayaprakash MuthuvatNo ratings yet

- Answers For Speed Enhancement Tests - 1 To 30Document7 pagesAnswers For Speed Enhancement Tests - 1 To 30diveshNo ratings yet

- Assignment2 Dhairya - ShahDocument7 pagesAssignment2 Dhairya - ShahAvani PatilNo ratings yet

- Ling KaranDocument4 pagesLing KaranMuhammad AlfatihNo ratings yet

- X Variable 1 Residual Plot X Variable 1 Line Fit Plot: Regression StatisticsDocument26 pagesX Variable 1 Residual Plot X Variable 1 Line Fit Plot: Regression StatisticsIsmi TrifiamolaNo ratings yet

- 2351 Mixing TimeDocument8 pages2351 Mixing TimeMuhammad FaqihNo ratings yet

- Cartera de Curva Circular 2 RadiosDocument2 pagesCartera de Curva Circular 2 RadiosCRISTIAN JOEL CAMARGO VELASQUEZNo ratings yet

- Buatlah Grafik Kurva Tegangan Regangan Dengan DataDocument2 pagesBuatlah Grafik Kurva Tegangan Regangan Dengan Datawahyu KasimNo ratings yet

- Pension Calculator 2022 SindhDocument2 pagesPension Calculator 2022 SindhshanjokhiooooNo ratings yet

- Central O2Document94 pagesCentral O2Icikiwir IpsrsNo ratings yet

- Evelyne Aprilia Yunus - Presensi 2Document20 pagesEvelyne Aprilia Yunus - Presensi 2Ramadhania YunusNo ratings yet

- Home Assignment 1Document2 pagesHome Assignment 1TÂM MAINo ratings yet

- Ex Amen Me TodosDocument25 pagesEx Amen Me TodosSebastian ReinosoNo ratings yet

- Data ProcessingDocument9 pagesData ProcessingDaddy BumNo ratings yet

- Mid Exam Solution by EsayasDocument20 pagesMid Exam Solution by EsayasChanako DaneNo ratings yet

- RegressionDocument6 pagesRegressionUtkristSrivastavaNo ratings yet

- Jeongcheol CorrelatioDocument3 pagesJeongcheol Correlatiomariellebecera695No ratings yet

- Libro1FISICA 4Document4 pagesLibro1FISICA 4Tania Gutiérrez AlanyaNo ratings yet

- 08 Quiz 1Document4 pages08 Quiz 1Jr YansonNo ratings yet

- KLJNDocument19 pagesKLJNrenzoNo ratings yet

- RatiosDocument2 pagesRatiosEkambaram Thirupalli TNo ratings yet

- Demand Estimation Using RegressionDocument7 pagesDemand Estimation Using RegressionMoidin AfsanNo ratings yet

- Regression StatisticsDocument4 pagesRegression StatisticsAnkur KulkarniNo ratings yet

- T 85°C T 90°C: Axis Title Axis TitleDocument3 pagesT 85°C T 90°C: Axis Title Axis TitleYenny Fernanda FlorezNo ratings yet

- TallyDocument1 pageTallyMar Johfelson FriasNo ratings yet

- Bill LL All LLL LLLLLDocument2 pagesBill LL All LLL LLLLLLuka ModrićNo ratings yet

- A Level Accouting O/n 2020 ThresholdDocument2 pagesA Level Accouting O/n 2020 ThresholdImanNo ratings yet

- Subway2 47Document1 pageSubway2 47sll994No ratings yet

- Subway2 37Document1 pageSubway2 37sll994No ratings yet

- Subway2 24Document1 pageSubway2 24sll994No ratings yet

- Subway2 19Document1 pageSubway2 19sll994No ratings yet

- Subway2 21Document1 pageSubway2 21sll994No ratings yet

- Subway2 20Document1 pageSubway2 20sll994No ratings yet

- Subway2 12Document1 pageSubway2 12sll994No ratings yet

- Subway2 11Document1 pageSubway2 11sll994No ratings yet

- Subway2 18Document1 pageSubway2 18sll994No ratings yet

- Subway2 23Document1 pageSubway2 23sll994No ratings yet

- Subway2 10Document1 pageSubway2 10sll994No ratings yet

- Subway2 22Document1 pageSubway2 22sll994No ratings yet