Professional Documents

Culture Documents

Subway2 35

Uploaded by

sll994Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Subway2 35

Uploaded by

sll994Copyright:

Available Formats

XIV.

Valuation

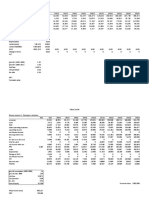

Relative Valuation (PE Valuation)

In conducting our PE valuation, we use the expected earnings for 2005 and an expected

P/E ratio derived from a regression analysis with the P/E of the S&P 500 and MCD itself.

We believe that the current P/E for MCD of 14.8 is very low both based on the historical

PE ratios of the company and its current financial position.

Expected P/E for 2005

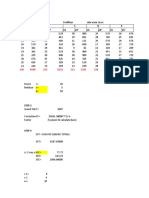

In order to derive the expected P/E we ran several regressions between the PE of the S&P

500 and that of MCD:

1. The first regression used the S&P 500 annual PE for the last 10 years. For MCD we

found the monthly average PE and then based on the monthly averages PE we calculated

the average annual PE.

SPX MCD

2004 20.962 17.324

2003 28.978 15.297

2002 41.449 16.664

2001 36.892 19.785

2000 29.267 23.183

1999 32.899 32.188

1998 26.703 26.19

1997 22.321 21.509

1996 19.213 23.378

1995 16.516 20.922

1994 19.588 18.857

Correlation 0.006

Regression MCD = 21.293

Line +0.004SPX

21.37

35

You might also like

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Subway2 36Document1 pageSubway2 36sll994No ratings yet

- Fisicoquimica - TP 2 - Des Molares Parciales Auto Guard Ado)Document6 pagesFisicoquimica - TP 2 - Des Molares Parciales Auto Guard Ado)BeToxl RoblNo ratings yet

- Case 5 NPV IRR CaseDocument2 pagesCase 5 NPV IRR CaseMustafa MuhamedNo ratings yet

- Peso Estatura Xi Yi Xiyi XiDocument4 pagesPeso Estatura Xi Yi Xiyi Xianon-494447No ratings yet

- Sampa Video Case SolutionDocument10 pagesSampa Video Case SolutionrahulsinhadpsNo ratings yet

- Question 1.2 EuropeDocument22 pagesQuestion 1.2 EuropenishantNo ratings yet

- Pension Calculator 2022 SindhDocument2 pagesPension Calculator 2022 SindhshanjokhiooooNo ratings yet

- Nabila Silfa 2201103010145 TugasDocument9 pagesNabila Silfa 2201103010145 TugasNabila SilfaNo ratings yet

- Particulars 2001 2002 2003 2004: Less LessDocument7 pagesParticulars 2001 2002 2003 2004: Less LessrishabhaaaNo ratings yet

- Stattools Report: Multiple Regression For MPGDocument22 pagesStattools Report: Multiple Regression For MPGnishantNo ratings yet

- EOB Presentation Slides - Feb 2021Document39 pagesEOB Presentation Slides - Feb 2021888 BiliyardsNo ratings yet

- Full Yr IndexingDocument1 pageFull Yr IndexingbhuvaneshkmrsNo ratings yet

- Regression RaihanAaDocument2 pagesRegression RaihanAaRaihan AljabaNo ratings yet

- 08 Quiz 1Document4 pages08 Quiz 1Jr YansonNo ratings yet

- Advance Stat Seatwork 2Document9 pagesAdvance Stat Seatwork 2Christian Joe QuimioNo ratings yet

- Rezistenta La InaintareDocument5 pagesRezistenta La InaintareCip GrecuNo ratings yet

- Autos Buses Camiones: Chart TitleDocument7 pagesAutos Buses Camiones: Chart TitleLuis CarlosNo ratings yet

- MC17 Fax TDocument1 pageMC17 Fax Tsivaji_ssNo ratings yet

- Ajanta Pharma LTD.: Margins On Income On Total IncomeDocument2 pagesAjanta Pharma LTD.: Margins On Income On Total IncomeDeepak DashNo ratings yet

- Experiment-1: Date: 11/01/2021 AimDocument5 pagesExperiment-1: Date: 11/01/2021 AimVishal ManwaniNo ratings yet

- Cartografie: Lucrarea 3Document4 pagesCartografie: Lucrarea 3sadxNo ratings yet

- QatarGas Simulate Hit TImeDocument32 pagesQatarGas Simulate Hit TImeAbdi AnsharyNo ratings yet

- 1summary 93SNA QtrlyDocument24 pages1summary 93SNA QtrlygaoiranallyNo ratings yet

- Transaction Deatils From Payment Gateway April MonthDocument14 pagesTransaction Deatils From Payment Gateway April Monthjanmejay sahuNo ratings yet

- EconometricsDocument4 pagesEconometricsAru KimNo ratings yet

- Sanskriti Jain, 1062232473, Div 9Document9 pagesSanskriti Jain, 1062232473, Div 9neemaseemjain7No ratings yet

- KLJNDocument19 pagesKLJNrenzoNo ratings yet

- Data Volume KoDocument118 pagesData Volume KoSamuelNo ratings yet

- Ashok LeylandDocument27 pagesAshok LeylandBerkshire Hathway coldNo ratings yet

- InfosysDocument19 pagesInfosysKetan JajuNo ratings yet

- NEW FootingDocument45 pagesNEW Footingkimkov119No ratings yet

- FPR - Studentwork Sheet.Document32 pagesFPR - Studentwork Sheet.Abhinav KumarNo ratings yet

- 1) The Sunk Costs Are As FollowDocument2 pages1) The Sunk Costs Are As FollowLucky LuckyNo ratings yet

- Manhattan SlidesManiaDocument23 pagesManhattan SlidesManiachris garciaNo ratings yet

- 15 Points) : Test 1: Time 100 Minutes NameDocument7 pages15 Points) : Test 1: Time 100 Minutes Nameimran_chaudhryNo ratings yet

- Cross Section No.: Scale Vertical: S/D Cross Section No.: Scale HorizontalDocument37 pagesCross Section No.: Scale Vertical: S/D Cross Section No.: Scale Horizontalcecep rustianaNo ratings yet

- Volumen de Volumen de Cromat. Pozo 1 Pozo 2 Planta CRC-cada Compon Cada Comp. Con Facilid. Sin Facilid %mol Residual MMPC Alim MMPC SalidDocument4 pagesVolumen de Volumen de Cromat. Pozo 1 Pozo 2 Planta CRC-cada Compon Cada Comp. Con Facilid. Sin Facilid %mol Residual MMPC Alim MMPC SalidCleisman Blanco FernandezNo ratings yet

- Perhitungan Struktur Berdasarkan Hasil Analisis SAP2000Document18 pagesPerhitungan Struktur Berdasarkan Hasil Analisis SAP2000Alfian WiratamaNo ratings yet

- Aim 113Document10 pagesAim 113ayesha rehmanNo ratings yet

- Ahmet ÖzmanDocument1 pageAhmet ÖzmanedariciNo ratings yet

- Ahmet ÖzmanDocument1 pageAhmet ÖzmanedariciNo ratings yet

- REITDocument7 pagesREITakbhatia09No ratings yet

- Trabajo de MercadosDocument16 pagesTrabajo de MercadosMARIA JOSE CORRALES FREIRENo ratings yet

- ANOVA CalculatorDocument4 pagesANOVA CalculatorABC XYZNo ratings yet

- Eje CircularDocument1 pageEje CircularDayana RamirezNo ratings yet

- Deepak NitriteDocument10 pagesDeepak Nitritechandrajit ghoshNo ratings yet

- Stats Assignment 4 CorrelationDocument8 pagesStats Assignment 4 CorrelationSanthoshNo ratings yet

- PharmacyclicsDocument2 pagesPharmacyclicsanupam2401840% (1)

- Butler Lumber PDFDocument2 pagesButler Lumber PDFanjali shilpa kajalNo ratings yet

- Nguyễn Ngọc Phương Anh - Additional Case Chap 5Document4 pagesNguyễn Ngọc Phương Anh - Additional Case Chap 5Phương Anh NguyễnNo ratings yet

- Escuela Politécnica Nacional Facultad de Ingeniería Mecánica Máquinas CNC Nombre: Hernán Quishpe Fecha: 28/01/2018Document3 pagesEscuela Politécnica Nacional Facultad de Ingeniería Mecánica Máquinas CNC Nombre: Hernán Quishpe Fecha: 28/01/2018Hernan QuishpeNo ratings yet

- Aim 112Document9 pagesAim 112ayesha rehmanNo ratings yet

- Lbo 1Document3 pagesLbo 1pranavNo ratings yet

- NetscapeDocument3 pagesNetscapeulix1985No ratings yet

- FORCESDocument217 pagesFORCESAnonymous 3sHEQDNo ratings yet

- Nomer Suhu/c (X) Busuk (Y) X.Y X Y: Telur MembusukDocument4 pagesNomer Suhu/c (X) Busuk (Y) X.Y X Y: Telur MembusukIlyas PriambodoNo ratings yet

- ION ExchangeDocument11 pagesION ExchangeSiddharthaNo ratings yet

- Formula 1 Rolex Magyar Nagydíj 2021 - Budapest: First Practice Session Lap TimesDocument4 pagesFormula 1 Rolex Magyar Nagydíj 2021 - Budapest: First Practice Session Lap Timesarunji76884No ratings yet

- X y Xy x2: I. Activity #1Document2 pagesX y Xy x2: I. Activity #1Jariel CatacutanNo ratings yet

- Subway2 47Document1 pageSubway2 47sll994No ratings yet

- Subway2 37Document1 pageSubway2 37sll994No ratings yet

- Subway2 19Document1 pageSubway2 19sll994No ratings yet

- Subway2 12Document1 pageSubway2 12sll994No ratings yet

- Subway2 20Document1 pageSubway2 20sll994No ratings yet

- Subway2 24Document1 pageSubway2 24sll994No ratings yet

- Subway2 21Document1 pageSubway2 21sll994No ratings yet

- Subway2 23Document1 pageSubway2 23sll994No ratings yet

- Subway2 11Document1 pageSubway2 11sll994No ratings yet

- Subway2 18Document1 pageSubway2 18sll994No ratings yet

- Subway2 22Document1 pageSubway2 22sll994No ratings yet

- Subway2 10Document1 pageSubway2 10sll994No ratings yet