Professional Documents

Culture Documents

Question 13c Financial Reporting May 2017 Question 2b

Uploaded by

Laud ListowellOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question 13c Financial Reporting May 2017 Question 2b

Uploaded by

Laud ListowellCopyright:

Available Formats

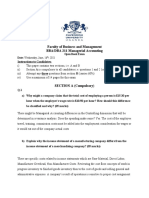

b) The following costs were incurred in 2016 in the design and construction of a new office

building over a nine-month period during 2016:

GH¢000

Feasibility study 8

Architects' fees 100

Site clearance (by external demolition professionals) 80

Construction materials 600

Cost of own inventories used in the construction

(net realisable value if sold outside the company GH¢24,000) 30

Internal construction staff salaries during period of construction 360

External contractor costs 2,400

Income from renting out part of site as storage depot

during early phase of construction (12)

3,566

Required:

In accordance with IAS 16 Property, plant and equipment, calculate the amount that

should be capitalised as property in the financial statements for the year ending 31

December 2016. (4 marks)

MARKING SCHEME

QUESTION TWO

b) GH¢’000

Feasibility study – expensed by analogy with

SIC-32 para 2(a)/9(a) in accordance with IAS 8 para 11(a) -

Architects’ fees (IAS 16 para 17(b)) 100

Site clearance (IAS 16 para 17(b)) 80

Construction materials 600

Cost of own inventories used in the construction

(IAS 2 is applied first before use on the project) 24

Internal construction staff salaries (IAS 16 para 17(a)) 360

External contractor costs 2,400

Income from renting out part of the site as storage depot

during early phase of construction (IAS 16 para 21) -

3,564

(4 marks)

Page 16 of 29

You might also like

- Cebu Institute of Technology - University: Use The Following Information For The Next Two QuestionsDocument13 pagesCebu Institute of Technology - University: Use The Following Information For The Next Two QuestionsPrima Facie50% (2)

- Final Examination Final ExaminationDocument14 pagesFinal Examination Final ExaminationTricia Mae FernandezNo ratings yet

- Question Paper Code: X10115: Reg. NoDocument3 pagesQuestion Paper Code: X10115: Reg. NoBhuvanaNo ratings yet

- MECH-ND-2020-ME 2027-Process Planning and Cost Estimation-179851325-X60823 (ME2027 - GE1452)Document3 pagesMECH-ND-2020-ME 2027-Process Planning and Cost Estimation-179851325-X60823 (ME2027 - GE1452)pariNo ratings yet

- 26th JULY 2017 BUS 3313cost Accounting RoyDocument4 pages26th JULY 2017 BUS 3313cost Accounting RoyVinsmoke KaidoNo ratings yet

- Jar Water PlantDocument9 pagesJar Water Planttarique2009No ratings yet

- Cost C. Test EM Question 03.03.2023 VI-1, VDI-1Document2 pagesCost C. Test EM Question 03.03.2023 VI-1, VDI-1harish jangidNo ratings yet

- Question Paper CodeDocument2 pagesQuestion Paper CodeDebasis DasNo ratings yet

- Mawn Company Bought Land and Built A Warehouse During 2016Document1 pageMawn Company Bought Land and Built A Warehouse During 2016Hassan JanNo ratings yet

- Abu Dhabi Municipality Design Check ListDocument6 pagesAbu Dhabi Municipality Design Check ListShamim Ahsan ZuberyNo ratings yet

- Acd10403 Solution Tutorial Manufacturing Account 2018Document9 pagesAcd10403 Solution Tutorial Manufacturing Account 2018Atqh ShamsuriNo ratings yet

- Assignment 3 ManufacturingDocument5 pagesAssignment 3 Manufacturingandrei batoNo ratings yet

- Ex. 2 CostsDocument1 pageEx. 2 Costsahmetganiozturk2No ratings yet

- P.K.O Engineering Service: Invoice For The Underlisted Works Complete Set of Working Drawings For Cheng Guang LiangDocument1 pageP.K.O Engineering Service: Invoice For The Underlisted Works Complete Set of Working Drawings For Cheng Guang LiangNana BarimaNo ratings yet

- Management Accounting FinalDocument10 pagesManagement Accounting FinalMAGOMU DAN DAVID100% (1)

- Structural Design Report - Sludge Tank - Rev-00 - FinalDocument26 pagesStructural Design Report - Sludge Tank - Rev-00 - FinalRaymund Dale P. BallenasNo ratings yet

- Ca Final Compiler Paper 5 Advanced Management Accounting PDFDocument432 pagesCa Final Compiler Paper 5 Advanced Management Accounting PDFAnn SerratoNo ratings yet

- Questions Tutorial 8 and 9Document5 pagesQuestions Tutorial 8 and 9siamesamuel229No ratings yet

- Audit of Property, Plant and Equipment: Auditing ProblemsDocument5 pagesAudit of Property, Plant and Equipment: Auditing ProblemsLei PangilinanNo ratings yet

- Skema Test 1 Sem 2 20162017Document7 pagesSkema Test 1 Sem 2 20162017Farhan Amira100% (1)

- Comslab 1Document41 pagesComslab 1NemkeNo ratings yet

- IAS16 ExamplesDocument17 pagesIAS16 ExamplesJeyam Kannan ChandrasekaranNo ratings yet

- FR - 02Document20 pagesFR - 02Sayyam KhanNo ratings yet

- OSA Question - Cost AccountingDocument9 pagesOSA Question - Cost AccountingMohola Tebello GriffithNo ratings yet

- Project Case Study - Acc116 Oct-Feb 2023Document5 pagesProject Case Study - Acc116 Oct-Feb 2023Vishnu MenonNo ratings yet

- Quiz 3 Ppe QuestionsDocument4 pagesQuiz 3 Ppe QuestionsJessica Marie MigrasoNo ratings yet

- QUIZ - CHAPTER 15 - PPE PART 1 - 2020edDocument3 pagesQUIZ - CHAPTER 15 - PPE PART 1 - 2020edjanna napili100% (1)

- ABC Case - PCMR ElectronicsDocument1 pageABC Case - PCMR ElectronicsOrduna Mae Ann0% (1)

- AFAR - Revenue Recognition 2019Document4 pagesAFAR - Revenue Recognition 2019Joanna Rose DeciarNo ratings yet

- NFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesSano ManjiroNo ratings yet

- CM 19 - 20 - Sem 1Document5 pagesCM 19 - 20 - Sem 1Mukmin ShukriNo ratings yet

- 2016 Vol 1 CH 8 AnswersDocument7 pages2016 Vol 1 CH 8 AnswersIsla PageNo ratings yet

- CA Inter Costing RTP May 2023Document27 pagesCA Inter Costing RTP May 2023karnimasoni12No ratings yet

- Accountancy & Auditing-I 2021Document2 pagesAccountancy & Auditing-I 2021Zeeshan Ashraf MalikNo ratings yet

- Name: Mercado, Kath DATE: 01/15 Score: Activity Answer The Following Items On A Separate Sheet of Paper. Show Your Computations. (4 Items X 5 Points)Document2 pagesName: Mercado, Kath DATE: 01/15 Score: Activity Answer The Following Items On A Separate Sheet of Paper. Show Your Computations. (4 Items X 5 Points)Kathleen MercadoNo ratings yet

- LEC03B - BSA 2102 - 012021-Problems, Part IDocument3 pagesLEC03B - BSA 2102 - 012021-Problems, Part IKatarame LermanNo ratings yet

- Movement Schedule of Non-Current AssetsDocument6 pagesMovement Schedule of Non-Current AssetsMichael BwireNo ratings yet

- CH 10Document9 pagesCH 10Saleh RaoufNo ratings yet

- 3 - CostDocument27 pages3 - CostSONALI DHARNo ratings yet

- Ch.19 Acc HW PDFDocument2 pagesCh.19 Acc HW PDFyizhou FengNo ratings yet

- Ca - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursDocument7 pagesCa - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursPROFESSIONAL WORK ROHITNo ratings yet

- Pakistan: Extra Reading Time: 15 Minutes Writing Time: 02 Hours 45 Minutes Maximum Marks: 90 Roll No.Document4 pagesPakistan: Extra Reading Time: 15 Minutes Writing Time: 02 Hours 45 Minutes Maximum Marks: 90 Roll No.Abdul BasitNo ratings yet

- DEA Report of AMS Apparels LTD 21-01-24Document155 pagesDEA Report of AMS Apparels LTD 21-01-24Abdul JabberNo ratings yet

- Seven TutorialDocument3 pagesSeven TutorialMudit SinhaNo ratings yet

- Exercise 3 - Interim Payment... (V3) PDFDocument3 pagesExercise 3 - Interim Payment... (V3) PDFSafea NajwaNo ratings yet

- Tender Submission (RSE)Document1 pageTender Submission (RSE)Man HongNo ratings yet

- Chapter 10 - Plant Assets & Depreciation Methods: Practice ExercisesDocument8 pagesChapter 10 - Plant Assets & Depreciation Methods: Practice ExercisesLý Nguyễn Tuyết MaiNo ratings yet

- Audit of PPE AnnotatedDocument10 pagesAudit of PPE AnnotatedLloydNo ratings yet

- 2006 Unit 2 Paper 2Document7 pages2006 Unit 2 Paper 2Mia ColemanNo ratings yet

- TATA CHEMICALS-Operating CycleDocument4 pagesTATA CHEMICALS-Operating CyclesarangdharNo ratings yet

- RUNNING ACCOUNT RECEIPT Kolkata 2021 222222Document7 pagesRUNNING ACCOUNT RECEIPT Kolkata 2021 222222Jay Raj KattaNo ratings yet

- AS 2159 & 3600 Concrete Pile Design - SkyCiv Cloud Structural Analysis SoftwareDocument10 pagesAS 2159 & 3600 Concrete Pile Design - SkyCiv Cloud Structural Analysis SoftwarelsatchithananthanNo ratings yet

- Quiz Chapter 15 Ppe Part 1 2020ed 1Document3 pagesQuiz Chapter 15 Ppe Part 1 2020ed 1Mark Rafael MacapagalNo ratings yet

- Assessment No. 3-Midterm - Exam SheetDocument7 pagesAssessment No. 3-Midterm - Exam Sheetarnel buanNo ratings yet

- Past Year Exam Paper Folder SLDocument50 pagesPast Year Exam Paper Folder SLAdouko Jean-Eudes E AssiriNo ratings yet

- Cost Sheet - Extra SumsDocument12 pagesCost Sheet - Extra SumsPiyush ChhimwalNo ratings yet

- INATCT2 (Inatngible)Document1 pageINATCT2 (Inatngible)Vee YaNo ratings yet

- Cost Test 2Document4 pagesCost Test 2sebastian mlingwaNo ratings yet

- Question 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireDocument5 pagesQuestion 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireLaud ListowellNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- Question 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Document6 pagesQuestion 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Laud ListowellNo ratings yet

- Question 1 - Fr-April-2022 - FannyDocument6 pagesQuestion 1 - Fr-April-2022 - FannyLaud ListowellNo ratings yet

- QUESTION 4 - Financial-Reporting - QUESTION 4 - NEETADocument7 pagesQUESTION 4 - Financial-Reporting - QUESTION 4 - NEETALaud ListowellNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- QUESTION 5 - Financial-Reporting-May-2021 - TAFO, TAFO BONSODocument5 pagesQUESTION 5 - Financial-Reporting-May-2021 - TAFO, TAFO BONSOLaud ListowellNo ratings yet

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocument14 pagesUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNo ratings yet

- Upsa 2019 CFS Tutorial Questions 2 - Some Soulutions and AnswersDocument9 pagesUpsa 2019 CFS Tutorial Questions 2 - Some Soulutions and AnswersLaud ListowellNo ratings yet

- FR Tutorials 2022 - Some Theory Question SolutionDocument26 pagesFR Tutorials 2022 - Some Theory Question SolutionLaud Listowell100% (2)

- Sample Questions For Publication-Mbaf 601-Oct-2022Document3 pagesSample Questions For Publication-Mbaf 601-Oct-2022Laud ListowellNo ratings yet

- Sample Questions For Publication-Mbaf 601-Oct-2022-SolutionsDocument3 pagesSample Questions For Publication-Mbaf 601-Oct-2022-SolutionsLaud ListowellNo ratings yet

- Taxation Law CIA 1 (B) Salary AnalysisDocument3 pagesTaxation Law CIA 1 (B) Salary Analysisawinash reddyNo ratings yet

- Lumber/gold AnalysisDocument20 pagesLumber/gold AnalysisVaibhaw ShiwarkarNo ratings yet

- Project and Parent Cash FlowsDocument3 pagesProject and Parent Cash FlowsSita AuliaNo ratings yet

- An Introduction To ReinsuranceDocument188 pagesAn Introduction To Reinsurancecruzer11290No ratings yet

- Economics For Today 5Th Asia Pacific Edition by Layton Full ChapterDocument41 pagesEconomics For Today 5Th Asia Pacific Edition by Layton Full Chapterphilip.prentice386100% (24)

- Introduction Accrual Accounting PDFDocument118 pagesIntroduction Accrual Accounting PDFHi nice to meet you100% (1)

- Globalization ManagementDocument34 pagesGlobalization ManagementMc Keteqman100% (2)

- Ch. 1: Conceptual Framework: Intermediate Accounting I Spring 2017Document38 pagesCh. 1: Conceptual Framework: Intermediate Accounting I Spring 2017Dyana AlkarmiNo ratings yet

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahNo ratings yet

- What Workers ThinkDocument8 pagesWhat Workers ThinkUnions TwentyOneNo ratings yet

- Gr11 - Worksheet - Demand & SupplyDocument2 pagesGr11 - Worksheet - Demand & Supplysnsmiddleschool2020No ratings yet

- History of Banking in IndiaDocument5 pagesHistory of Banking in IndiamylahNo ratings yet

- Assignment No 1Document6 pagesAssignment No 1Hassan Raza0% (1)

- Strategy Session 3Document3 pagesStrategy Session 3Maria Alejandra RamirezNo ratings yet

- Cash Basis Accounting Vs Accrual SystemDocument3 pagesCash Basis Accounting Vs Accrual SystemAllen Jade PateñaNo ratings yet

- Consumer Durable IndustryDocument20 pagesConsumer Durable Industryvipul tutejaNo ratings yet

- Kibor (Karachi Interbank Offered RateDocument25 pagesKibor (Karachi Interbank Offered Ratemateenyunas100% (1)

- CH 4 AnswersDocument9 pagesCH 4 AnswersElaineSmith83% (6)

- Study Questions Risk and ReturnDocument4 pagesStudy Questions Risk and ReturnAlif SultanliNo ratings yet

- 54 - Donny LerilleDocument17 pages54 - Donny LerilleAnonymous vRG3cFNjANo ratings yet

- HuaweiDocument47 pagesHuaweiayaanNo ratings yet

- Somya Bhasin 24years Pune: Professional ExperienceDocument2 pagesSomya Bhasin 24years Pune: Professional ExperienceS1626No ratings yet

- Presentation On Money Market BangladeshDocument25 pagesPresentation On Money Market BangladeshAminul Haque100% (1)

- Full Set PMTH001 Q Set 2Document14 pagesFull Set PMTH001 Q Set 2L YNo ratings yet

- Specimen 2020 QP - Paper 1 CIE Economics IGCSEDocument10 pagesSpecimen 2020 QP - Paper 1 CIE Economics IGCSEDd KNo ratings yet

- The Case For Flexible HousingDocument18 pagesThe Case For Flexible HousingMariaIliopoulouNo ratings yet

- JetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSDocument6 pagesJetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSMuhammad FahamNo ratings yet

- 42 42 Characteristics of Working CapitalDocument22 pages42 42 Characteristics of Working Capitalpradeepg8750% (2)

- Squad3.fire NSD GPMDocument7 pagesSquad3.fire NSD GPMMac CorpuzNo ratings yet

- Chap016 Managerial ControlDocument40 pagesChap016 Managerial ControlHussain Ali Y AlqaroosNo ratings yet