Professional Documents

Culture Documents

Sample Questions For Publication-Mbaf 601-Oct-2022

Uploaded by

Laud ListowellOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Questions For Publication-Mbaf 601-Oct-2022

Uploaded by

Laud ListowellCopyright:

Available Formats

QUESTION 2 - SIMILAR

SOLUTION

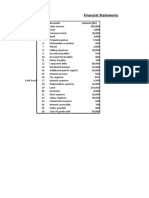

Expense amount Income amount

Investment fair value

2,300 Revenue 182,500

Decrease

Investment

Cost of sales 128,500 800

income

Admin expense(25000-1850 dividend) 23,150

Distribution cost 8,500

Loan note interest 2,400

Bank interest 300

Provision for tax 5,600

Defered tax liability 3,750

Net profit after tax 8,800

183,300 183,300

Dividend 1,850 8,800

Net profit for appropriation 6,950

8,800 8,800

Statement of financial position

Liabilities AmountAssets Amount

Land & building

Equity (43+1.2+67.4- 98,200

13.4)

Stated capital 61,000

Profit and loss 6,950 investments 13,500

Capital surplus(7000+1200)

8,200 inventory 19,800

Increase in land value

Income surplus(12100-900

11,200 receivables 29,000

previous year tax)

Other surplus 3,000

Liabilities

Loan note 30,600

bank 4,600

Trade payables 21,700 receivables 000

Deferred tax(4000+3750) 7,750

Income tax livability 5,600

Total 160,600 160,600

statement of changes in equity

Equityretained earnings other reservestotal

Opening balance 58,90012,100 10,000 81,000

Issues of right shares2,100

Net profit for year 6,950

Dividend paid (1,850)

Previous year tax (900)

Land and building

1,200

Revaluation

Closing balance 61,00016,300 11,200 88,500

statement of other comprehensive income

Expense Amt income amount

Net profit before other

Net profit 6,950 8,050

comprehensive income

Decrease in

2,300revaluation of land 1,200

investment value

9,250 9,250

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Sample Questions For Publication-Mbaf 601-Oct-2022-SolutionsDocument3 pagesSample Questions For Publication-Mbaf 601-Oct-2022-SolutionsLaud ListowellNo ratings yet

- 11 ACC CH 6.11 To 6.16 MemosDocument19 pages11 ACC CH 6.11 To 6.16 Memosora mashaNo ratings yet

- OLC Chap 5Document6 pagesOLC Chap 5Isha SinghNo ratings yet

- Tutor 1Document6 pagesTutor 1Elaine LimNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Golden LTD Statement of Profit and Loss and Other Comprehensive Income For The Year Ended 30 September 2018Document10 pagesGolden LTD Statement of Profit and Loss and Other Comprehensive Income For The Year Ended 30 September 2018Sheilla BonsuNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- Assets 2018 2019 Forecast: Balance SheetDocument12 pagesAssets 2018 2019 Forecast: Balance SheetJosephAmparoNo ratings yet

- SOLUTION DEC 2018 No TicksDocument8 pagesSOLUTION DEC 2018 No Ticksanis izzatiNo ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Statement of Cash Flows Lecture Questions and AnswersDocument9 pagesStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiNo ratings yet

- 20201015012755Document57 pages20201015012755hasharawanNo ratings yet

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Document27 pagesLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- CFAB - Accounting - QB - Chapter 13Document14 pagesCFAB - Accounting - QB - Chapter 13Huy NguyenNo ratings yet

- Problem 8-9 Akl 2Document4 pagesProblem 8-9 Akl 2andi nanaNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Assignment 7 - RosalDocument4 pagesAssignment 7 - RosalGinie Lyn RosalNo ratings yet

- Hebner Housing Corporation: Sales 1,250,000Document3 pagesHebner Housing Corporation: Sales 1,250,000Christine Joy LanabanNo ratings yet

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocument4 pagesProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Individual AssignmentDocument22 pagesIndividual AssignmentEda LimNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Buscom-Asset AcquisitionDocument7 pagesBuscom-Asset AcquisitionRenelyn DavidNo ratings yet

- ACCT101 9n10 SCFDocument17 pagesACCT101 9n10 SCFVedanshi BihaniNo ratings yet

- OCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesOCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- Solution FAR 2Document20 pagesSolution FAR 2ANo ratings yet

- Financial Statements: S.No Accounts Amount (RS)Document2 pagesFinancial Statements: S.No Accounts Amount (RS)I190030 Muhammad AbdullahNo ratings yet

- Fa Pilot Paper AnswerDocument11 pagesFa Pilot Paper Answer刘宝英No ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Solution Key To Problem Set 1Document6 pagesSolution Key To Problem Set 1Ayush RaiNo ratings yet

- Problem 12-10 SolutionDocument9 pagesProblem 12-10 SolutionKELLY DANGNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- ACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONDocument2 pagesACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONPravallika RavikumarNo ratings yet

- ACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Document1 pageACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Tenghour LyNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Additional Case K17409 - Ias 7Document2 pagesAdditional Case K17409 - Ias 7Vy DangNo ratings yet

- Illustration 1 & 2Document5 pagesIllustration 1 & 2faith olaNo ratings yet

- Statements of Financial Position As at 30 June 20X8 20X7Document4 pagesStatements of Financial Position As at 30 June 20X8 20X7Nguyễn Ngọc HàNo ratings yet

- Published Financial StatementsDocument13 pagesPublished Financial StatementsLoh Jin WenNo ratings yet

- ACCT 3061 Asignación Cap 4 y 5Document4 pagesACCT 3061 Asignación Cap 4 y 5gpm-81No ratings yet

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- Cash FlowDocument5 pagesCash FlowDivesh BabariaNo ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- Seminar 2 FeedbackDocument5 pagesSeminar 2 FeedbackjekaterinaNo ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- Tutorial 8Document6 pagesTutorial 8WEI QUAN LEENo ratings yet

- 1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramDocument3 pages1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramLê Minh TríNo ratings yet

- Retained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Document21 pagesRetained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Umar Razi QasimNo ratings yet

- Question 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireDocument5 pagesQuestion 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireLaud ListowellNo ratings yet

- Question 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Document6 pagesQuestion 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Laud ListowellNo ratings yet

- Question 13c Financial Reporting May 2017 Question 2bDocument3 pagesQuestion 13c Financial Reporting May 2017 Question 2bLaud ListowellNo ratings yet

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- Question 1 - Fr-April-2022 - FannyDocument6 pagesQuestion 1 - Fr-April-2022 - FannyLaud ListowellNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- QUESTION 4 - Financial-Reporting - QUESTION 4 - NEETADocument7 pagesQUESTION 4 - Financial-Reporting - QUESTION 4 - NEETALaud ListowellNo ratings yet

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocument14 pagesUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNo ratings yet

- QUESTION 5 - Financial-Reporting-May-2021 - TAFO, TAFO BONSODocument5 pagesQUESTION 5 - Financial-Reporting-May-2021 - TAFO, TAFO BONSOLaud ListowellNo ratings yet

- FR Tutorials 2022 - Some Theory Question SolutionDocument26 pagesFR Tutorials 2022 - Some Theory Question SolutionLaud Listowell100% (2)

- Upsa 2019 CFS Tutorial Questions 2 - Some Soulutions and AnswersDocument9 pagesUpsa 2019 CFS Tutorial Questions 2 - Some Soulutions and AnswersLaud ListowellNo ratings yet

- TAX-101 (Estate Tax)Document11 pagesTAX-101 (Estate Tax)Edith DalidaNo ratings yet

- Tax NoteDocument170 pagesTax NoteHamza HafeezNo ratings yet

- Dividend Decision NotesDocument6 pagesDividend Decision NotesSavya SachiNo ratings yet

- Samsung Understanding FS Tutorial QuestionsDocument5 pagesSamsung Understanding FS Tutorial QuestionsLim ShawnNo ratings yet

- Chapter 5 - Worksheet and The Financial StatementsDocument21 pagesChapter 5 - Worksheet and The Financial StatementsFrancis MateosNo ratings yet

- Test Bank For South Western Federal Taxation 2021 Corporations Partnerships Estates and Trusts 44th Edition William A Raabe James C Young Annette Nellen William H Hoffman JR David M MalDocument14 pagesTest Bank For South Western Federal Taxation 2021 Corporations Partnerships Estates and Trusts 44th Edition William A Raabe James C Young Annette Nellen William H Hoffman JR David M MalCathy Booe100% (23)

- Accounts AssignmentDocument22 pagesAccounts AssignmentRaheel IqbalNo ratings yet

- FA Work BookDocument59 pagesFA Work BookUnais AhmedNo ratings yet

- TX-UK J24-M25 Syllabus and Study Guide - FinalDocument24 pagesTX-UK J24-M25 Syllabus and Study Guide - FinalKhin Lapyae TunNo ratings yet

- 2021 Trial 3 Oct/N0Vember Internal Examination: Kenya Certificate of Secondary Education (K.C.S.E.)Document16 pages2021 Trial 3 Oct/N0Vember Internal Examination: Kenya Certificate of Secondary Education (K.C.S.E.)otienorNo ratings yet

- Intermediate Accounting Chapters 9,10Document31 pagesIntermediate Accounting Chapters 9,10Jonathan NavalloNo ratings yet

- B326 TMA 23-24 (Fall) V1Document9 pagesB326 TMA 23-24 (Fall) V1Reham Abdelaziz100% (2)

- PDF 04Document7 pagesPDF 04Hiruni LakshaniNo ratings yet

- CTPM ProblemsDocument31 pagesCTPM ProblemsViraja GuruNo ratings yet

- OrcaDocument201 pagesOrcaFritzie Ann ZartigaNo ratings yet

- Families With Children 2021Document2 pagesFamilies With Children 2021Finn KevinNo ratings yet

- Practice Exam 1 Financial Accounting 0Document13 pagesPractice Exam 1 Financial Accounting 0KatjiuapengaNo ratings yet

- BFJPIA Cup Level 3 P1Document9 pagesBFJPIA Cup Level 3 P1Blessy Zedlav LacbainNo ratings yet

- Tax Law 1 Course Outline 2021Document6 pagesTax Law 1 Course Outline 2021Sunny 022No ratings yet

- Profit and Loss Account For The Year Ended 31 March, 2009: ST STDocument2 pagesProfit and Loss Account For The Year Ended 31 March, 2009: ST STRanjan DasguptaNo ratings yet

- Fin 4424 Sample ProjectDocument15 pagesFin 4424 Sample ProjectEduardo VillarrealNo ratings yet

- Tenant Application - FormDocument10 pagesTenant Application - FormGODBLESSNo ratings yet

- MAS CVP Analysis HandoutsDocument8 pagesMAS CVP Analysis HandoutsMartha Nicole MaristelaNo ratings yet

- 7 - Financial Literacy - Review AssignmentDocument8 pages7 - Financial Literacy - Review AssignmentSm KimNo ratings yet

- 2001 ITAD RulingsDocument306 pages2001 ITAD RulingsJerwin DaveNo ratings yet

- Form PDF 696574080230622Document6 pagesForm PDF 696574080230622RUBY SHARMANo ratings yet

- AC Chapter 9Document19 pagesAC Chapter 9Minh AnhNo ratings yet

- C4 - Advanced Taxation - SyllabusDocument6 pagesC4 - Advanced Taxation - SyllabusEmmaNo ratings yet

- Statement of Comprehensive Income (SOCI) and Statement of Financial Position (SOFP)Document37 pagesStatement of Comprehensive Income (SOCI) and Statement of Financial Position (SOFP)Iris NguNo ratings yet

- IncTax and PostEmpBenDocument42 pagesIncTax and PostEmpBenMarcus MonocayNo ratings yet