Professional Documents

Culture Documents

Inventory Cost Valuation

Uploaded by

krishna aroraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inventory Cost Valuation

Uploaded by

krishna aroraCopyright:

Available Formats

Inventory Cost Valuation

Description

Inventory includes raw materials, work-in-progress, and finished goods. The way firms value their

stock has a direct impact on the costs of goods sold, inventory ending value, and hence overall

profitability.

This template illustrates how inventory purchase prices affect inventory costs, under three different

cost flow methods:

• First-In, First-Out (FIFO)

• Last-In, First-Out (LIFO)

• Weighted Average Cost (WAVCO)

In Scenario 1 - we calculate and compare COGS, Gross Profit, and Inventory Closing Balance under

the assumption of rising prices (inflationary environment).

In Scenario 2 - we calculate and compare COGS, Gross Profit, and Inventory Closing Balance under

the assumption of falling prices (deflationary environment).

This Excel model is for educational purposes only. Strictly Confidential

All content is Copyright material of 365 Financial Analyst ®

© 2021, 365 Financial Analyst ®

Strictly Confidential

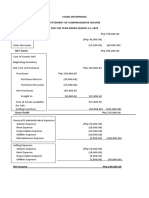

Scenario 1

Inventory cost

Inflationary environment

Quantity Price Value

Inventory flows (# of items) (per item) (in USD)

1st January (Beginning Inventory) - - -

April 1st 500 13.70 6,850

June 15th 400 15.00 6,000

July 10th 600 20.50 12,300

October 1st 400 22.50 9,000

December 20th 1,100 23.50 25,850

Total purchases 3,000 20 60,000

FIFO

Quantity Price Value

(# of items) (per item) (in USD)

Sales 2,000 50 100,000

(6,850) 500@13.7

(6,000) 400@15

(12,300) 600@20.5

(9,000) 400@22.5

(2,350) 100@23.5

COGS (2,000) (18.25) (36,500)

Gross profit 63,500

Inventory balance 1,000 23.50 23,500

Weighted average cost (WAVCO)

Quantity Price Value

(# of items) (per item) (in USD)

Sales 2,000 50 100,000

(10,000) 500@20

(8,000) 400@20

(12,000) 600@20

(8,000) 400@20

(22,000) 100@20

COGS (2,000) (20.00) (40,000)

Gross profit 60,000

Inventory balance 1,000 20.00 20,000

LIFO

Quantity Price Value

(# of items) (per item) (in USD)

Sales 2,000 50 100,000

(25,850) 1,100@23.5

(9,000) 400@22.5

(10,250) 500@20.5

COGS (2,000) (22.55) (45,100)

Gross profit 54,900

Inventory balance 1,000 14.90 14,900

Scenario 2

Inventory cost

Deflationary environment

Quantity Price Value

Inventory flows (# of items) (per item) (in USD)

1st January (Beginning Inventory) - - -

April 1st 500 23.20 11,600

June 15th 400 21.40 8,560

July 10th 600 20.00 12,000

October 1st 400 19.00 7,600

December 20th 1,100 18.40 20,240

Total purchases 3,000 20 60,000

FIFO

Quantity Price Value

(# of items) (per item) (in USD)

Sales 2,000 50 100,000

(11,600) 500@23.2

(8,560) 400@21.4

(12,000) 600@20

(7,600) 400@19

(1,840) 100@18.4

COGS (2,000) (20.80) (41,600)

Gross profit 58,400

Inventory balance 1,000 18.40 18,400

Weighted average cost (WAVCO)

Quantity Price Value

(# of items) (per item) (in USD)

Sales 2,000 50 100,000

(10,000) 500@20

(8,000) 400@20

(12,000) 600@20

(8,000) 400@20

(22,000) 100@20

COGS (2,000) (20.00) (40,000)

Gross profit 60,000

Inventory balance 1,000 20.00 20,000

LIFO

Quantity Price Value

(# of items) (per item) (in USD)

Sales 2,000 50 100,000

(20,240) 1,100@18.4

(7,600) 400@19

(10,000) 500@20

COGS (2,000) (18.92) (37,840)

Gross profit 62,160

Inventory balance 1,000 22.16 22,160

Summary

Inventory costs

Scenario 1 Scenario 2

(rising prices) (falling prices)

Weighted Weighted

FIFO average LIFO FIFO average LIFO

COGS (36,500) (40,000) (45,100) (41,600) (40,000) (37,840)

Gross profit 63,500 60,000 54,900 58,400 60,000 62,160

Inventory balance 23,500 20,000 14,900 18,400 20,000 22,160

You might also like

- Bootcamp Template (Version 1)Document10 pagesBootcamp Template (Version 1)Myron BrandwineNo ratings yet

- Lewis Corporation Case 6-2: Cartoons Unit Price Total Price CartoonsDocument6 pagesLewis Corporation Case 6-2: Cartoons Unit Price Total Price CartoonsAnindya BasuNo ratings yet

- Syndicate 2 - Aggregate Planning TopicDocument37 pagesSyndicate 2 - Aggregate Planning TopicDina Rizkia RachmahNo ratings yet

- SBR1 Dummy With Cash FlowDocument15 pagesSBR1 Dummy With Cash Flowakansha.associate.workNo ratings yet

- Group 2 - Lap3Document12 pagesGroup 2 - Lap3Vũ Lan OfficialNo ratings yet

- Inventory-Cost of Goods Sold Analysis1Document2 pagesInventory-Cost of Goods Sold Analysis1Wahab Ahmad KhanNo ratings yet

- Project Analysis (NPV)Document20 pagesProject Analysis (NPV)EW1587100% (1)

- Nur Haliza Daeng Besse - Inventory Dan Aktiva TetapDocument28 pagesNur Haliza Daeng Besse - Inventory Dan Aktiva TetapNurhaliza DaengNo ratings yet

- Inventory-Cost of Goods Sold Analysis1Document2 pagesInventory-Cost of Goods Sold Analysis1HoudaifaNo ratings yet

- ACC123 InventoryCostFlowDocument3 pagesACC123 InventoryCostFlowkhryzellia lagurinNo ratings yet

- Exhibit 2 Product Class Cost Analysis (Normal Year) : Units UnitsDocument6 pagesExhibit 2 Product Class Cost Analysis (Normal Year) : Units UnitsSangtani PareshNo ratings yet

- Total Receipts 100,400 132,400 153,000Document3 pagesTotal Receipts 100,400 132,400 153,000Marissa Jem ClaveriaNo ratings yet

- May TechDocument6 pagesMay TechMonica LlenaresasNo ratings yet

- Shortage and OverageDocument6 pagesShortage and Overagesherryl caoNo ratings yet

- LCNRV - SolutionDocument3 pagesLCNRV - SolutionMagadia Mark JeffNo ratings yet

- Inventory-Cost of Goods Sold Analysis1Document2 pagesInventory-Cost of Goods Sold Analysis1arabindapradhan92650No ratings yet

- 02 Activity Cost BehaviorDocument11 pages02 Activity Cost BehaviordesyNo ratings yet

- IA Chapter-11-14Document7 pagesIA Chapter-11-14Christine Joyce EnriquezNo ratings yet

- Inventory Valuation: Rajesh Pathak GIM, GoaDocument21 pagesInventory Valuation: Rajesh Pathak GIM, GoaI.E. Business SchoolNo ratings yet

- Interaction of Supply and DemandDocument19 pagesInteraction of Supply and DemandSarah Jane Greso100% (1)

- Lecture 8 - Exercises - SolutionDocument8 pagesLecture 8 - Exercises - SolutionIsyraf Hatim Mohd TamizamNo ratings yet

- Operating+Leverage +exerciseDocument126 pagesOperating+Leverage +exerciseAniNo ratings yet

- Intermediate Accounting 1 - Meeting 2 (Answers Sheets)Document4 pagesIntermediate Accounting 1 - Meeting 2 (Answers Sheets)WILLIAM CHANDRANo ratings yet

- Bab16 BepDocument17 pagesBab16 Bepnovia272No ratings yet

- UnitRon Case SolutionDocument5 pagesUnitRon Case SolutionsaNo ratings yet

- Homework 4Document5 pagesHomework 4BẢO NGÂN HUỲNH PHANNo ratings yet

- Simulasi FIFO Vs Average CostDocument11 pagesSimulasi FIFO Vs Average CostDastin DarmawanNo ratings yet

- Inventory ValuationDocument6 pagesInventory ValuationJane Bagui LaluñoNo ratings yet

- LO2 Prepare and Interpret A CostDocument8 pagesLO2 Prepare and Interpret A CostGayle SanchezNo ratings yet

- Account Debit CreditDocument4 pagesAccount Debit CreditMcKenzie WNo ratings yet

- Costing Methods-Part 2Document29 pagesCosting Methods-Part 2pinkNo ratings yet

- Chapter 14 AnswersevenDocument4 pagesChapter 14 AnswersevenJulianne Mejia100% (1)

- An Analysis of Variances For Crocker CompanyDocument6 pagesAn Analysis of Variances For Crocker Companyrohan_rungtaNo ratings yet

- Cost Structures and Flexibility - CompleteDocument2 pagesCost Structures and Flexibility - CompleteRemmy MuneneNo ratings yet

- SDocument2 pagesSdebate ddNo ratings yet

- Assets, Liabilities and Equity of ARA Galleries Pty LTD As at 30 June 2017Document4 pagesAssets, Liabilities and Equity of ARA Galleries Pty LTD As at 30 June 2017BáchHợpNo ratings yet

- C. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Document1 pageC. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Shaira GampongNo ratings yet

- Swimskin Inc.: ParametersDocument25 pagesSwimskin Inc.: ParametersAbhijeet singhNo ratings yet

- WP Assignment Week 3 HM 73.9 & Soal EmasDocument5 pagesWP Assignment Week 3 HM 73.9 & Soal EmasIndahna SulfaNo ratings yet

- Book 3 ADocument2 pagesBook 3 ACece CastroNo ratings yet

- UntitledDocument3 pagesUntitledJomar PenaNo ratings yet

- Chapter 11Document4 pagesChapter 11AnonnNo ratings yet

- Midterms I Answer KeyDocument5 pagesMidterms I Answer Keyaldric taclanNo ratings yet

- 04 August Crop ProjectionsDocument6 pages04 August Crop ProjectionsKyle MushongaNo ratings yet

- IA Ch. 11Document14 pagesIA Ch. 11DarleneNo ratings yet

- Unitron - Teuku AldefaDocument2 pagesUnitron - Teuku AldefaTeuku AldefaNo ratings yet

- Đặng Nguyên Khoa - 31211020926Document11 pagesĐặng Nguyên Khoa - 31211020926Nguyen Khoa DangNo ratings yet

- Stark Enterprises (Sci)Document1 pageStark Enterprises (Sci)Jarren James ParungaoNo ratings yet

- Adv1 bb16Document5 pagesAdv1 bb16dewiNo ratings yet

- Boomerang Part Number Flight Range (Meters) : VLOOKUP Delivers A Value To A Cell Exact MatchDocument7 pagesBoomerang Part Number Flight Range (Meters) : VLOOKUP Delivers A Value To A Cell Exact MatchSania MirzaNo ratings yet

- Chapter 2 DoodlesDocument6 pagesChapter 2 DoodlesMatt GilleNo ratings yet

- Final Output Intacc PDFDocument7 pagesFinal Output Intacc PDFCj BarrettoNo ratings yet

- Yohannes Wibowo - Akuntansi Keuangan Dasar I - Akuntansi D TM13Document8 pagesYohannes Wibowo - Akuntansi Keuangan Dasar I - Akuntansi D TM13KINGOFSB GTNo ratings yet

- Strategic Cost Management 101Document8 pagesStrategic Cost Management 101Hoope JisonNo ratings yet

- ACC123 InventoryCostFlow Problem11-6 LagurinDocument2 pagesACC123 InventoryCostFlow Problem11-6 Lagurinkhryzellia lagurinNo ratings yet

- Variance Analysis: Prof. Guru Prasad Faculty Member Inc GunturDocument14 pagesVariance Analysis: Prof. Guru Prasad Faculty Member Inc GunturPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (2)

- Price/Quantity Sensitivity: Revenue 1,500,000 Gross Profit 1,000,000 Operating Income 500,000Document4 pagesPrice/Quantity Sensitivity: Revenue 1,500,000 Gross Profit 1,000,000 Operating Income 500,000Eldana AshebirNo ratings yet

- Inventory Inward FIFO Cost of Inventory Outward For A001: Total Unit Sold: IdDocument3 pagesInventory Inward FIFO Cost of Inventory Outward For A001: Total Unit Sold: IdZyra StdioNo ratings yet

- In Late 2020, The Nicklaus Corporation Was Formed. The Corporate Charter Authorizes The Issuance ofDocument5 pagesIn Late 2020, The Nicklaus Corporation Was Formed. The Corporate Charter Authorizes The Issuance ofkrishna aroraNo ratings yet

- AgeingDocument4 pagesAgeingkrishna aroraNo ratings yet

- BB RegulationsDocument41 pagesBB Regulationskrishna aroraNo ratings yet

- FIFO LIFO PracticalDocument16 pagesFIFO LIFO Practicalkrishna aroraNo ratings yet

- Quantity Survey Estimation and Valuation NumericalsDocument122 pagesQuantity Survey Estimation and Valuation NumericalsAditya Mane33% (3)

- Siebel Systems Sales Part 2Document4 pagesSiebel Systems Sales Part 2he20003009No ratings yet

- Hacof Company Profile 2021 Revised 8Document12 pagesHacof Company Profile 2021 Revised 8Ahmed HanadNo ratings yet

- NBR 1355 - Solo-Cimento - Ensaio de Durabilidade Por Molhagem e Secagem - Método de Ensaio (2012)Document8 pagesNBR 1355 - Solo-Cimento - Ensaio de Durabilidade Por Molhagem e Secagem - Método de Ensaio (2012)Lennon TomasiNo ratings yet

- UntitledDocument9 pagesUntitledRexi Chynna Maning - AlcalaNo ratings yet

- Mastery Program Module TwoDocument149 pagesMastery Program Module TwoJinNo ratings yet

- Profood International CorporationDocument26 pagesProfood International CorporationYew MercadoNo ratings yet

- Auditing Theories and Problems Quiz WEEK 1Document19 pagesAuditing Theories and Problems Quiz WEEK 1Sarah GNo ratings yet

- Project List & KPI - Ahmad Dzikrul FikriDocument3 pagesProject List & KPI - Ahmad Dzikrul Fikrikenny williamNo ratings yet

- Iron CastingsDocument49 pagesIron Castingsmathias alfred jeschke lopezNo ratings yet

- Welspun Corp Annual Report 2021 Interactive PDF 090821Document335 pagesWelspun Corp Annual Report 2021 Interactive PDF 090821Piyush Ashokchand ChopdaNo ratings yet

- An Empirical Analysis of Growth of Msme in India and Role of SidbiDocument14 pagesAn Empirical Analysis of Growth of Msme in India and Role of SidbiShubhi SinghNo ratings yet

- DeepWeb LinkDocument16 pagesDeepWeb LinkLucas Javier75% (4)

- Confirmed - Exhibitors ElecramaDocument9 pagesConfirmed - Exhibitors ElecramaMujib AlamNo ratings yet

- Marketing Analsyis For Fish Farming BusinessDocument12 pagesMarketing Analsyis For Fish Farming BusinessNabeel AhmadNo ratings yet

- Sfom Impl B2ceDocument28 pagesSfom Impl B2cesergio paredesNo ratings yet

- Usha Letter Head CurvedDocument1 pageUsha Letter Head Curvedsales7705No ratings yet

- Harris Center Unionization ResolutionDocument2 pagesHarris Center Unionization ResolutionRob LauciusNo ratings yet

- Operational Data StoreDocument0 pagesOperational Data StorerajsalgyanNo ratings yet

- Bottle Manufacturing UnitsDocument17 pagesBottle Manufacturing UnitsVIJAY PAREEKNo ratings yet

- Module 3.2 - Preferential Taxation Keyworded Lecture NotesDocument8 pagesModule 3.2 - Preferential Taxation Keyworded Lecture NotesGabs SolivenNo ratings yet

- Chapter 7 Logistics ManagementDocument16 pagesChapter 7 Logistics Managementmariam jamilNo ratings yet

- Joseph and The Law of ProcessDocument8 pagesJoseph and The Law of ProcessjohncalebandalNo ratings yet

- ACS 1000 Preventive MaintenanceDocument2 pagesACS 1000 Preventive Maintenanceazultenue780% (1)

- Atf-Ls-4.5 Subcontracting of Tests - Final 0 3Document2 pagesAtf-Ls-4.5 Subcontracting of Tests - Final 0 3Jeji HirboraNo ratings yet

- Brand DecisionsDocument38 pagesBrand Decisionssonalidhanokar9784100% (2)

- Pepsi ParadoxDocument5 pagesPepsi ParadoxSalman MalikNo ratings yet

- Chapter 13 Intermediate AccountingDocument18 pagesChapter 13 Intermediate AccountingDanica Mae GenaviaNo ratings yet

- Money-Time Relationships and EquivalenceDocument22 pagesMoney-Time Relationships and EquivalenceKorinaVargas0% (1)

- Macro EcomomicsDocument120 pagesMacro EcomomicsHATCATENo ratings yet