Professional Documents

Culture Documents

Kingsman LTD

Uploaded by

Tran NganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kingsman LTD

Uploaded by

Tran NganCopyright:

Available Formats

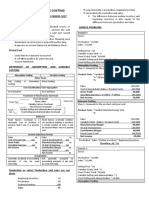

Kingsman Ltd (Kingsman) started business on 1 September manufacturing a single product, the A356.

The budgeted production cost per unit of the A356 is as follows:

£

Variable materials 78

Variable labour 12

Variable production overhead 6

Fixed production overheads 18

The budget showed production and sales for the first six months of 1,200 units. The budgeted selling price is £170 per unit.

The budgeted selling, distribution and administration costs are as follows:

Fixed = £36,000 per annum

Variable = £2.50 per unit

Inventory at the end of September was 20 units of the A356. In October Kingsman sold 150 units and manufactured 155 units. Budgeted fixed costs are incurred evenly per month. Actual costs and the selling price were as

budgeted except for the fixed selling, distribution and administration costs, which were 12.5% lower than budgeted.

Requirement

2.1 Calculate the profit or loss for October using both absorption costing and marginal costing.

Enter costs as negative values.

Absorption Marginal

£ £ £ £

Sales

Variable production costs

Fixed production costs absorbed

Opening inventory

Closing inventory

Production cost of sales

Under/over absorption

Variable selling, administration and distribution

Fixed selling, administration and distribution

Fixed production costs

Profit/loss

2.2 In the second six months of the year Kingsman plans to introduce the B786, a deluxe version of the A356. The budgeted total absorption cost for the B786 is £420 per unit including £40 per unit for fixed overheads. In

order to set a selling price Kingsman plans to use a margin of 25% on the absorption cost.

Requirements

Select the correct answer.

If there is no inventory of the B786 at the end of the first six months of production, the profits calculated under marginal costing will be those calculated under absorption costing.

• Higher than

• Lower than

• The same as

2.3 Calculate the percent mark-up for the B786 using marginal costing and the planned selling price.

%

Total: 20 marks

You might also like

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Variable and Absorption Costing Problems Without SolutionsDocument4 pagesVariable and Absorption Costing Problems Without SolutionsMeca CorpuzNo ratings yet

- Xcostman Pa1Document2 pagesXcostman Pa1Aaliyah Christine GuarinNo ratings yet

- Marginal CostingDocument2 pagesMarginal CostingpalaviyaNo ratings yet

- 9Document16 pages9Asal IslamNo ratings yet

- T10 - NoteDocument7 pagesT10 - NoterbnbalachandranNo ratings yet

- ICICI Direct On Ador WeldingDocument9 pagesICICI Direct On Ador WeldingDhittbanda GamingNo ratings yet

- Information For Decision MakingDocument33 pagesInformation For Decision Makingwambualucas74No ratings yet

- 006 Camist Ch04 Amndd Hs PP 79-102 Branded BW RP SecDocument25 pages006 Camist Ch04 Amndd Hs PP 79-102 Branded BW RP SecMd Salahuddin HowladerNo ratings yet

- Assignment On Transfer PricingDocument1 pageAssignment On Transfer PricingEliseNo ratings yet

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalNo ratings yet

- Acorn AAT L4 ManagementAccountingDecisionAndControl MockExamOneDocument49 pagesAcorn AAT L4 ManagementAccountingDecisionAndControl MockExamOneBos BosNo ratings yet

- Absorption and Marginal CostingDocument26 pagesAbsorption and Marginal CostingsandyisinsaneNo ratings yet

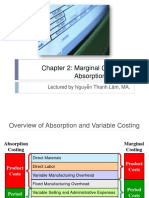

- Chapter 2 Marginal CostingDocument21 pagesChapter 2 Marginal CostingLan Nhi NguyenNo ratings yet

- MAS Product Costing Part IDocument2 pagesMAS Product Costing Part IMary Dale Joie BocalaNo ratings yet

- Absorption and Marginal CostingDocument57 pagesAbsorption and Marginal CostingkashafNo ratings yet

- Managerial Accounting: Tools For Business Decision-MakingDocument69 pagesManagerial Accounting: Tools For Business Decision-MakingdavidNo ratings yet

- Costman Variable CostingDocument2 pagesCostman Variable CostingJeremi BernardoNo ratings yet

- Module 13 - Breakeven AnalysisDocument9 pagesModule 13 - Breakeven AnalysisGRACE ANN BERGONIONo ratings yet

- Chapter 6 Variable Costing and AnalysisDocument33 pagesChapter 6 Variable Costing and AnalysisVeronica JaraNo ratings yet

- MASDocument2 pagesMASClarisse AlimotNo ratings yet

- Yomight PM Mock Nov 2022 SolutionDocument34 pagesYomight PM Mock Nov 2022 SolutionORIYOMI KASALINo ratings yet

- Presentation - Chapter3 & 9Document49 pagesPresentation - Chapter3 & 9rajeshaisdu009No ratings yet

- Analisis Diferencial y Fijación de PreciosDocument43 pagesAnalisis Diferencial y Fijación de Preciosnutrihome100% (1)

- Variable Costing: A Tool For Management: © 2010 The Mcgraw-Hill Companies, IncDocument29 pagesVariable Costing: A Tool For Management: © 2010 The Mcgraw-Hill Companies, IncTurbo TechNo ratings yet

- Ac407 2010 04Document8 pagesAc407 2010 04Tanaka MapiyeNo ratings yet

- Marginal Costing & Absorption CostingDocument56 pagesMarginal Costing & Absorption CostingHoàng Phương ThảoNo ratings yet

- Examination Midterm MASDocument4 pagesExamination Midterm MASPrincess Claris ArauctoNo ratings yet

- Absorption and Variable CostingDocument3 pagesAbsorption and Variable CostingDhona Mae FidelNo ratings yet

- Finance 1Document19 pagesFinance 1theonesmk01No ratings yet

- 1 - ACG021 - Strategic Business Analysis - QuestionnaireDocument6 pages1 - ACG021 - Strategic Business Analysis - Questionnairedavis lizardaNo ratings yet

- 1 - ACG021 - Strategic Business Analysis - QuestionnaireDocument6 pages1 - ACG021 - Strategic Business Analysis - Questionnairedavis lizardaNo ratings yet

- Week 67 and 9 Absorption Costing Vs Marginal Costing Costing MethodDocument31 pagesWeek 67 and 9 Absorption Costing Vs Marginal Costing Costing MethodMai LyNo ratings yet

- Variable CostingDocument7 pagesVariable CostingRainie LopezNo ratings yet

- Chapter 11 Relevant Costing ExercisesDocument3 pagesChapter 11 Relevant Costing ExercisesNCT100% (1)

- GNBCY SM Chap05 Absorption Costing and Variable CostingDocument86 pagesGNBCY SM Chap05 Absorption Costing and Variable CostingvasuuumNo ratings yet

- Objectives of Cost-Volume-Profit AnalysisDocument7 pagesObjectives of Cost-Volume-Profit AnalysisAnonNo ratings yet

- (Finished Goods/stock in Trade) (Work - In-Progress) (Raw Material, Stores and Spares, Etc.)Document20 pages(Finished Goods/stock in Trade) (Work - In-Progress) (Raw Material, Stores and Spares, Etc.)razorNo ratings yet

- Break Even Analyses SlidesDocument36 pagesBreak Even Analyses SlidesBlessing 14mulaloNo ratings yet

- LT - 081914Document8 pagesLT - 081914Jun Guerzon PaneloNo ratings yet

- Exercises Differential Cost Analysis Relevant CostingDocument5 pagesExercises Differential Cost Analysis Relevant CostingBSIT 1A Yancy CaliganNo ratings yet

- Target Costing and Consumer Profitability AnalysisDocument32 pagesTarget Costing and Consumer Profitability AnalysisMuhammad AsadNo ratings yet

- Short-Term Decision MakingDocument26 pagesShort-Term Decision MakingSanjeev JayaratnaNo ratings yet

- Accounting Standard 2Document18 pagesAccounting Standard 2Tushar Gauba0% (1)

- Lecture 4 - 5 17102022 032709am 07032023 090715pm 17102023 015148pmDocument41 pagesLecture 4 - 5 17102022 032709am 07032023 090715pm 17102023 015148pmmurtaza haiderNo ratings yet

- Refrensi Akmen Tugas 3Document8 pagesRefrensi Akmen Tugas 3Nana NurhayatiNo ratings yet

- Costing Series 2-2009Q6Document2 pagesCosting Series 2-2009Q6May CcmNo ratings yet

- Absorption and Variable Costing - Illustrative Example - PagaddutDocument4 pagesAbsorption and Variable Costing - Illustrative Example - PagaddutLovely Rose GuinilingNo ratings yet

- Marginal Costing Chapter Satelite Centers PDFDocument17 pagesMarginal Costing Chapter Satelite Centers PDFSwasNo ratings yet

- CH - 13Document39 pagesCH - 13divya kalyaniNo ratings yet

- Problems 1: Marginal Costing TechniqueDocument2 pagesProblems 1: Marginal Costing TechniqueRajesh GuptaNo ratings yet

- Final MGMT X2 f09Document3 pagesFinal MGMT X2 f09Asif BashirNo ratings yet

- Wuolah-free-9-Overview of Variable and Absorption CostingDocument8 pagesWuolah-free-9-Overview of Variable and Absorption CostinglexieeeeyangNo ratings yet

- F2 Marginal Costing & Contribution TheoryDocument7 pagesF2 Marginal Costing & Contribution TheoryCourage KanyonganiseNo ratings yet

- Module 4 Acc Fevelyn R EcotDocument9 pagesModule 4 Acc Fevelyn R EcotMary Cris DalumpinesNo ratings yet

- Absorption and Variable CostingDocument5 pagesAbsorption and Variable CostingKIM RAGANo ratings yet

- Session-16-17-18-CVP AnalysisDocument78 pagesSession-16-17-18-CVP Analysis020Abhisek KhadangaNo ratings yet

- CH 1 CM Cost-Volume-Profit Analysis, Absorption, and Variable CostingDocument15 pagesCH 1 CM Cost-Volume-Profit Analysis, Absorption, and Variable CostingOROM VINE100% (5)

- PROBLEM 1. Duif Company: Under VariableDocument6 pagesPROBLEM 1. Duif Company: Under VariableUchayyaNo ratings yet

- Managerial Accounting: Tools For Business Decision-MakingDocument68 pagesManagerial Accounting: Tools For Business Decision-MakingdavidNo ratings yet

- Best Cover Letter Examples For Executive AssistantDocument6 pagesBest Cover Letter Examples For Executive Assistantafiwiafoc100% (1)

- Research Proposal MemorandumDocument3 pagesResearch Proposal Memorandumapi-509280376No ratings yet

- Class XII Loc CHK List 2022-23Document41 pagesClass XII Loc CHK List 2022-23Teena VermaNo ratings yet

- Borrowing Costs That Are Directly Attributable To The Acquisition, Construction orDocument4 pagesBorrowing Costs That Are Directly Attributable To The Acquisition, Construction orJustine VeralloNo ratings yet

- Chapter 6 8 Organization and ManagementDocument17 pagesChapter 6 8 Organization and Managementandrea balabatNo ratings yet

- Audit Case StudyDocument3 pagesAudit Case StudyTaha AhmedNo ratings yet

- Joint Drug Investigation Leads To Arrest of Three Women in MckenzieDocument1 pageJoint Drug Investigation Leads To Arrest of Three Women in MckenzieSabrina BatesNo ratings yet

- Pizza CompanyDocument5 pagesPizza CompanyStella 2001No ratings yet

- IJRPR6250Document3 pagesIJRPR6250dienanurbasyithahNo ratings yet

- Consumers, Producers, and The Efficiency of Markets: Multiple ChoiceDocument36 pagesConsumers, Producers, and The Efficiency of Markets: Multiple ChoiceHuy BảoNo ratings yet

- Melcs EntrepDocument1 pageMelcs EntrepErlie100% (5)

- OB Chapter 1Document44 pagesOB Chapter 1habteNo ratings yet

- Ab401a Development CommunicationDocument6 pagesAb401a Development CommunicationJanica Seguido HandayanNo ratings yet

- Agoda Seawind Resort BookingDocument2 pagesAgoda Seawind Resort BookingJayjay FarconNo ratings yet

- Amul Functional ManagementDocument57 pagesAmul Functional ManagementSafwan Quraishi100% (1)

- Kostecki - Naray. Commercial Diplomacy and International Bussines PDFDocument42 pagesKostecki - Naray. Commercial Diplomacy and International Bussines PDFccascante77No ratings yet

- Catawba Industrial Company SlidesDocument15 pagesCatawba Industrial Company SlidesCR7pNo ratings yet

- Eastern Mediterranean Maritime LTDDocument1 pageEastern Mediterranean Maritime LTDLolit CarlosNo ratings yet

- Southwest Versus DeltaDocument16 pagesSouthwest Versus DeltaSoumik ChatterjeeNo ratings yet

- Forex Risk and Lot-Size Calculator Base Currency USD v1.2Document7 pagesForex Risk and Lot-Size Calculator Base Currency USD v1.2Khairul AbidinNo ratings yet

- A Study On Fixed Asset ManagementDocument8 pagesA Study On Fixed Asset ManagementShrid GuptaNo ratings yet

- SMC SWOT Analysis PDFDocument9 pagesSMC SWOT Analysis PDFmonica macaleNo ratings yet

- Partnership Agreement TemplateDocument16 pagesPartnership Agreement TemplateȘtiri din BanatNo ratings yet

- Gig-Economy Rev.09.30.20Document2 pagesGig-Economy Rev.09.30.20Hermie CasquejoNo ratings yet

- Cost Planning and Cost Estimating: By: Engr. Nelson S. Tapsirul Bsce, Mba, MSCMDocument22 pagesCost Planning and Cost Estimating: By: Engr. Nelson S. Tapsirul Bsce, Mba, MSCMNelson TapsirulNo ratings yet

- ŠUMART INTERDISCIPLINARY CONFERENCE November 2023Document10 pagesŠUMART INTERDISCIPLINARY CONFERENCE November 2023Jelena SimićNo ratings yet

- The Rise of Affluent IndiaDocument46 pagesThe Rise of Affluent IndiaSegaran RG100% (2)

- How Is Entrepreneurship Good For Economic Growth?: Zoltan AcsDocument22 pagesHow Is Entrepreneurship Good For Economic Growth?: Zoltan AcsshuchiroyNo ratings yet

- Termination Contract BlankDocument1 pageTermination Contract BlankManu Khanna0% (1)

- Business Facilitation ActDocument31 pagesBusiness Facilitation ActcybervediNo ratings yet