Professional Documents

Culture Documents

Aditya Gupta Task 1

Uploaded by

ADITYA GUPTA0 ratings0% found this document useful (0 votes)

17 views2 pagesThis document provides financial ratio data for several major Indian companies across different sectors for the periods ending March 2022, March 2021 and March 2020. The ratios included are debt to equity, price to earnings (P/E), earnings per share (EPS), return on capital employed (ROCE) and return on equity (ROE). The sectors covered include infrastructure/real estate (DLF), banking (State Bank of India), information technology (Infosys), power generation (Tata Power), and automobile (Tata Motors).

Original Description:

Stock Market

Original Title

Aditya Gupta Task 1 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides financial ratio data for several major Indian companies across different sectors for the periods ending March 2022, March 2021 and March 2020. The ratios included are debt to equity, price to earnings (P/E), earnings per share (EPS), return on capital employed (ROCE) and return on equity (ROE). The sectors covered include infrastructure/real estate (DLF), banking (State Bank of India), information technology (Infosys), power generation (Tata Power), and automobile (Tata Motors).

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views2 pagesAditya Gupta Task 1

Uploaded by

ADITYA GUPTAThis document provides financial ratio data for several major Indian companies across different sectors for the periods ending March 2022, March 2021 and March 2020. The ratios included are debt to equity, price to earnings (P/E), earnings per share (EPS), return on capital employed (ROCE) and return on equity (ROE). The sectors covered include infrastructure/real estate (DLF), banking (State Bank of India), information technology (Infosys), power generation (Tata Power), and automobile (Tata Motors).

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Task 1

Infrastructure/Real Estate Sector

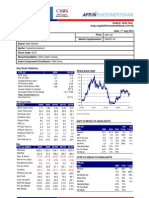

DLF

Financial Ratios Mar 22 Mar 21 Mar 20

Debt to Equity 0.14 0.16 0.17

Ratio

P/E Ratio 50.1 −57.1 19.9

EPS Ratio 5.39 4.35 9.15

ROCE Ratio (%) 7.76 6.49 9.49

ROE Ratio (%) 4.90 3.88 8.44

Banking Sector

State Bank of India

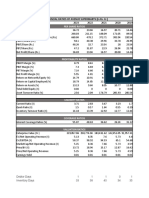

Financial Ratios Mar 22 Mar 21 Mar 20

Debt to Equity

Ratio

P/E Ratio 11.1 14.0 12.5

EPS Ratio 35.49 22.87 16.23

ROCE Ratio (%) 1.42 1.64 1.79

ROE Ratio (%) 12.33 8.86 6.95

Information Technology Sector

Infosys

Financial Ratios Mar 22 Mar 21 Mar 20

Debt to Equity 0 0 0

Ratio

P/E Ratio 25.4 31.6 15.5

EPS Ratio 50.49 42.37 36.50

ROCE Ratio (%) 38.46 32.23 31.28

ROE Ratio (%) 30.63 25.23 24.97

Power Generation Sector

Tata Power

Financial Ratios Mar 22 Mar 21 Mar 20

Debt to Equity 2.27 1.11 1.17

Ratio

P/E Ratio 30.8 25.5 15.7

EPS Ratio 8.71 2.88 0.55

ROCE Ratio (%) 10.44 7.41 10.82

ROE Ratio (%) 25.57 5.45 1.07

Automobile Sector

Tata Motors

Financial Ratios Mar 22 Mar 21 Mar 20

Debt to Equity 1.17 1.14 1.14

Ratio

P/E Ratio −12.6 −6.8 −22.2

EPS Ratio -3.63 -6.26 -20.26

ROCE Ratio (%) 1.07 0.37 -7.18

ROE Ratio (%) -6.97 -12.57 -39.64

You might also like

- SAPMDocument10 pagesSAPMNikhilNo ratings yet

- FedEx (FDX) Financial Ratios and Metrics - Stock AnalysisDocument2 pagesFedEx (FDX) Financial Ratios and Metrics - Stock AnalysisPilly PhamNo ratings yet

- RatiosDocument10 pagesRatiossakthiNo ratings yet

- ACC 2006 2007 2008 2009 2010 SGR ROE (1-DPO) / (1-ROE (1-DPO) ) Sales Growth Rate (%) D/EDocument10 pagesACC 2006 2007 2008 2009 2010 SGR ROE (1-DPO) / (1-ROE (1-DPO) ) Sales Growth Rate (%) D/Estudymat12No ratings yet

- Peer GRP Compsn BankingDocument2 pagesPeer GRP Compsn Bankinganupnayak123No ratings yet

- By Rajesh NarayananDocument22 pagesBy Rajesh NarayananTusharNo ratings yet

- By Rajesh NarayananDocument22 pagesBy Rajesh NarayananTusharNo ratings yet

- DABUR Easy Ratio AnalysisDocument4 pagesDABUR Easy Ratio AnalysisLakshay TakhtaniNo ratings yet

- Finance Departrment 1Document5 pagesFinance Departrment 1Vansh RanaNo ratings yet

- Group 8Document8 pagesGroup 8saket kumarNo ratings yet

- Weighted Average Cost of Capital: WACC X + X (1-t)Document10 pagesWeighted Average Cost of Capital: WACC X + X (1-t)abhi vermaNo ratings yet

- Samsung FY16 Q3 PresentationDocument8 pagesSamsung FY16 Q3 PresentationJeevan ParameswaranNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- Hiap Teck RN 20100701 AffinDocument3 pagesHiap Teck RN 20100701 Affinlimml63No ratings yet

- CH 13 Mod 3 Financial IndicatorsDocument2 pagesCH 13 Mod 3 Financial IndicatorsAkshat JainNo ratings yet

- Key Financial Ratios of JK Tyre and IndustriesDocument3 pagesKey Financial Ratios of JK Tyre and IndustriesAchal JainNo ratings yet

- CCS G4Document14 pagesCCS G4Harshit AroraNo ratings yet

- Ratio Analysis - Jubilant Foodworks-1Document8 pagesRatio Analysis - Jubilant Foodworks-1ABC XYZNo ratings yet

- Samsung FY17 Q1 PresentationDocument8 pagesSamsung FY17 Q1 PresentationJeevan ParameswaranNo ratings yet

- Private Bank AnalysisDocument16 pagesPrivate Bank AnalysisfundeepNo ratings yet

- Lebanon in FiguresDocument4 pagesLebanon in FiguresSara HaddaraNo ratings yet

- ValueResearchFundcard KotakGiltInvestmentRegular 2010nov24Document6 pagesValueResearchFundcard KotakGiltInvestmentRegular 2010nov24zankurNo ratings yet

- Kavveri TelecomDocument1 pageKavveri TelecomrohitbhuraNo ratings yet

- Valuation Ratio: Mar 2009 Mar 2008 Mar 2007 MarDocument4 pagesValuation Ratio: Mar 2009 Mar 2008 Mar 2007 MarDeepak RehalNo ratings yet

- Christ University Christ UniversityDocument3 pagesChrist University Christ Universityvijaya senthilNo ratings yet

- FSA - End Term Qs Paper - BFS Prof. Sachin Choudhry (6450)Document2 pagesFSA - End Term Qs Paper - BFS Prof. Sachin Choudhry (6450)sandeep mishraNo ratings yet

- MBA FM - 3102 Security Analysis and Portfolio ManagementDocument6 pagesMBA FM - 3102 Security Analysis and Portfolio ManagementAsh KoulNo ratings yet

- Lulu 2022 RatiosDocument2 pagesLulu 2022 RatiostlovkeshNo ratings yet

- Income Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2Document9 pagesIncome Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2ramarao1981No ratings yet

- Berger Paints RatiosDocument1 pageBerger Paints RatiosDeepNo ratings yet

- Particulars Mar 2013 Mar 2012 Mar 2011 Mar 2010 Mar 2009: Operational & Financial RatiosDocument2 pagesParticulars Mar 2013 Mar 2012 Mar 2011 Mar 2010 Mar 2009: Operational & Financial Ratioskhushma8No ratings yet

- 100 BaggerDocument12 pages100 BaggerRishab WahalNo ratings yet

- Finstreet - AutomobileDocument14 pagesFinstreet - AutomobileMOHD SHARIQUE ZAMANo ratings yet

- Attock Cement LimitedDocument9 pagesAttock Cement Limitedmuhammad farhanNo ratings yet

- Productivitatea MunciiDocument3 pagesProductivitatea MunciiAlex ViorelNo ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Union Bank - MP: Result TableDocument4 pagesUnion Bank - MP: Result TableManjunath ManjuNo ratings yet

- Ratio AnalysisDocument2 pagesRatio Analysisaditya karokarNo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- Financial HighlightsDocument3 pagesFinancial HighlightsSalman SaeedNo ratings yet

- Sawmi Vivekananda Life and WorkDocument6 pagesSawmi Vivekananda Life and WorkChetan NagarNo ratings yet

- Ratios Analysis Abhinav Srivastava CT1 FMand PDocument7 pagesRatios Analysis Abhinav Srivastava CT1 FMand PAbhinav srivastavaNo ratings yet

- RatiosDocument7 pagesRatiosAbhinav srivastavaNo ratings yet

- Crecendo 20100630 TADocument2 pagesCrecendo 20100630 TAlimml63No ratings yet

- RATIOSDocument2 pagesRATIOSMuhammad FaizanNo ratings yet

- Retail Company With Simple DCFDocument51 pagesRetail Company With Simple DCFJames Mitchell100% (1)

- Keppel Pacific Oak US REIT Financial StatementsDocument155 pagesKeppel Pacific Oak US REIT Financial StatementsAakashNo ratings yet

- Samsung FY16 Q4 PresentationDocument8 pagesSamsung FY16 Q4 PresentationJeevan ParameswaranNo ratings yet

- Bibliograbhy: BooksDocument21 pagesBibliograbhy: Bookskabita chandNo ratings yet

- EBLSL Daily Market Update 5th August 2020Document1 pageEBLSL Daily Market Update 5th August 2020Moheuddin SehabNo ratings yet

- Tvs MotorDocument6 pagesTvs MotortusharbwNo ratings yet

- Dipawali ReportDocument16 pagesDipawali ReportKeval ShahNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument27 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialUpendra KumarNo ratings yet

- BOLT Graham Formula ValuationDocument1 pageBOLT Graham Formula ValuationOld School ValueNo ratings yet

- Samsung FY17 Q2 PresentationDocument8 pagesSamsung FY17 Q2 PresentationJeevan ParameswaranNo ratings yet

- 2016-17 Revenue (In Rs CR) Net Profit (In Rs CR) EPS ROEDocument11 pages2016-17 Revenue (In Rs CR) Net Profit (In Rs CR) EPS ROEMOKSHA CHOUDHARYNo ratings yet

- Tata MotorsDocument11 pagesTata MotorsshrishtiNo ratings yet

- Analyst Presentation (Mar 10)Document32 pagesAnalyst Presentation (Mar 10)agarwalomNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Evs Air & Noise PollutionDocument11 pagesEvs Air & Noise PollutionADITYA GUPTANo ratings yet

- EVS - Unit 1 - EcosystemsDocument21 pagesEVS - Unit 1 - EcosystemsADITYA GUPTANo ratings yet

- Evs Unit1 ResourcesDocument14 pagesEvs Unit1 ResourcesADITYA GUPTANo ratings yet

- Task 2 SWOT AnalysisDocument5 pagesTask 2 SWOT AnalysisADITYA GUPTANo ratings yet

- Analysing On The Recruitment and Selection Process of Employees of Finploy TechnologiesDocument10 pagesAnalysing On The Recruitment and Selection Process of Employees of Finploy TechnologiesADITYA GUPTANo ratings yet

- Task 3 by Aditya GuptaDocument7 pagesTask 3 by Aditya GuptaADITYA GUPTANo ratings yet

- Management Information System Assignment FileDocument22 pagesManagement Information System Assignment FileADITYA GUPTANo ratings yet

- Task 4 Aditya GuptaDocument9 pagesTask 4 Aditya GuptaADITYA GUPTANo ratings yet

- Ism Practical File NothingDocument84 pagesIsm Practical File NothingADITYA GUPTANo ratings yet

- THE Indian GrillDocument7 pagesTHE Indian GrillADITYA GUPTANo ratings yet