Professional Documents

Culture Documents

The Difference Between FASB and IASB Conceptual Framework 18 AIS 013

Uploaded by

Mazharul IslamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Difference Between FASB and IASB Conceptual Framework 18 AIS 013

Uploaded by

Mazharul IslamCopyright:

Available Formats

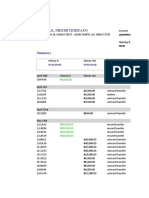

The difference between FASB and IASB conceptual framework :

FASB IASB

Presentation of Conceptual The Conceptual The International

Framework Framework of Accounting Standard

Concept Statements Board issued the

No.8 includes: revised Conceptual

Framework for

● Chapter 1 Financial Reporting

● Chapter 3 in March 2018,

● Chapter 4 which is a

● Chapter 7 comprehensive set

● Chapter 8 of concepts for

● Concepts Statement financial reporting,

No.7 which identify the

● Concepts Statement following :

No.5

● Chapter 2

● Chapter 2

● Chapter 3

● Chapter 4

● Chapter 5

● Chapter 6

● Chapter 7

● Chapter 8

Purpose of Conceptual The Conceptual To assist the Board

Framework Framework is to develop IFRSs

intended to set for standards based on

the fundamental consistent concepts,

concepts that will be resulting in financial

the basis for information that is

development of useful to investors,

financial accounting lenders and other

and reporting creditors

standards To assist preparers

It is intended to of financial reporting

serve the public to develop consistent

interest by providing accounting policies

structure and for transactions or

direction to financial other events when

accounting and no Standard applies

report to facilitate the or Standard allows a

provision of choice of accounting

unbiased financial policies

and related To assist all parties

information to understand and

interpret Standards

Primary Users Many existing and Users of financial

potential investors, reports are entities

lenders and other existing and potential

creditors cannot investors, lenders

require reporting and others creditors.

entities to provide These users must

information directly rely on financial

to them and must reports for much of

rely on general the financial

purpose financial information they

reports for much of need

the financial

information they

need

Objective of Financial The objective of To provide financial

Reporting general purpose information that is

financial report is to useful to users in

provide financial making decisions

information and the relating to providing

reporting entity that resources to the

is useful to existing entity

and potential

investors, lenders

and other creditors in

making decision

Qualitative Characteristics Fundamental Fundamental

Characteristics : Characteristics :

● Relevance ● Relevance

● Faithful ● Faithful

Representati Representati

on on

Enhancing Enhancing

Characteristic : Characteristics :

● Comparability ● Comparability

● Verifiability ● Verifiability

● Timelines ● Timelines

● Understanda ● Understanda

bility bility

The Elements of Financial There are two Assets

Statement different types of Liabilities

elements of financial Equity

statements. Income

1. The first types

Expenses

included :

● Assets

● Liabilities

● Equities

2.The second type of

elements describe :

● Revenues

● Gains

● Expenses

● Losses

● Investment

by owners

● Distribution

by owners

Constraints Cost benefit Cost constraint

Materiality

Industry practice

Conservatism

Measurements The measurements The measurements

depending on: bases on:

● The nature of ● Historical

item cost

● The measurement

relevance bases

● Reliability of ● Current value

attribute Measurement

measured bases

1. Fair

value

2. Value

in use

3. Curre

nt

cost

Assumptions Economic entity Economic entity

Going concern Going concern

Monetary unit Accrual basis

Accrual basis Stable measuring

unit

Periodicity

Principle Measurement Matching

Revenue recognition Revenue recognition

Expense recognition and realisation

Full disclosure Measurement

Conservatism Full disclosure

Consistency

Reporting entity The Board will An entity that is

considered because required or chooses

some aspect are not to prepare financial

addressed statements

Not necessarily a

legal entity could be

a portion of an entity

or compromise more

than one entity

You might also like

- CFASDocument3 pagesCFASMeybilene BernardoNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 2 - NotesDocument5 pagesConceptual Framework and Accounting Standards - Chapter 2 - NotesKhey KheyNo ratings yet

- Encoded Finacc2 Topic 2Document14 pagesEncoded Finacc2 Topic 2MARY MARGARETTE ROANo ratings yet

- FAR 001 Conceptual FrameworkDocument4 pagesFAR 001 Conceptual FrameworkdreianyanmaraNo ratings yet

- Financial Reporting StandardsDocument15 pagesFinancial Reporting StandardsQuennie Kate RomeroNo ratings yet

- Conceptual Framework 2020Document14 pagesConceptual Framework 2020Aryadna Sandi CimarraNo ratings yet

- ACCA - Chapter 1-4Document5 pagesACCA - Chapter 1-4Bianca Alexa SacabonNo ratings yet

- Conceptual Framework - LG Qualitative PDFDocument48 pagesConceptual Framework - LG Qualitative PDFKarl AndresNo ratings yet

- Article Summary Week 3Document15 pagesArticle Summary Week 3khunaina il khafa ainul NazilatulNo ratings yet

- Review of Conceptual Framework and Accounting RulesDocument18 pagesReview of Conceptual Framework and Accounting RulesIvory ClaudioNo ratings yet

- Conceptual FrameworkDocument11 pagesConceptual FrameworkAshianna KimNo ratings yet

- Revised Conceptual Framework: Rainiel C. Soriano, CPA, MBADocument60 pagesRevised Conceptual Framework: Rainiel C. Soriano, CPA, MBAMila VeranoNo ratings yet

- Acca - Chapter 1-9 SummaryDocument5 pagesAcca - Chapter 1-9 SummaryBianca Alexa SacabonNo ratings yet

- 2 Conceptual Framework For Financial ReportingDocument50 pages2 Conceptual Framework For Financial ReportingMa. Franceska Loiz T. RiveraNo ratings yet

- Conceptual Framework 1 PDFDocument9 pagesConceptual Framework 1 PDFMay RamosNo ratings yet

- Topic 2 - Conceptual FrameworkDocument36 pagesTopic 2 - Conceptual FrameworkA2T5 Haziqah HousnaNo ratings yet

- 02 Chapter 02 - The Conceptual FrameworkDocument17 pages02 Chapter 02 - The Conceptual Frameworknourhanw977No ratings yet

- Intermediate AccountingDocument48 pagesIntermediate AccountingRachelle BulawanNo ratings yet

- Information in The Preparation and Presentation of StatementsDocument4 pagesInformation in The Preparation and Presentation of StatementsLucille Rose MamburaoNo ratings yet

- Module 002 Week001-Finacct3 Financial Statements and Conceptual Framework For Financial ReportingDocument10 pagesModule 002 Week001-Finacct3 Financial Statements and Conceptual Framework For Financial Reportingman ibeNo ratings yet

- FASB Vs IASBDocument4 pagesFASB Vs IASBMazharul IslamNo ratings yet

- Confras 2Document8 pagesConfras 2Dwight Gabriel C. GarciaNo ratings yet

- (Cfas) M1&2 Final NotesDocument5 pages(Cfas) M1&2 Final NotesMa. Alessandra BautistaNo ratings yet

- M1&2 Final NotesDocument5 pagesM1&2 Final NotesMa. Alessandra BautistaNo ratings yet

- Far0 Chapter2Document3 pagesFar0 Chapter2yeeaahh56No ratings yet

- Status and Purpose of The Framework, Objective and Qualitative CharacteristicsDocument35 pagesStatus and Purpose of The Framework, Objective and Qualitative CharacteristicsCharmaine Mari OlmosNo ratings yet

- Cfas Chapter2Document6 pagesCfas Chapter2Ashley Jean CosmianoNo ratings yet

- Topic 1 To 17Document85 pagesTopic 1 To 17Ava JohnNo ratings yet

- Week 2Document11 pagesWeek 2Criselito EnigrihoNo ratings yet

- Cfas CH02Document5 pagesCfas CH02Jan DecemberNo ratings yet

- L2Document2 pagesL2Emilrose SadiasaNo ratings yet

- Financial Reporting Framework: Accountancy DepartmentDocument14 pagesFinancial Reporting Framework: Accountancy DepartmentJayson ChanNo ratings yet

- Conceptual and Regulatory Frameworks For Financial ReportingDocument20 pagesConceptual and Regulatory Frameworks For Financial ReportingDhanushika SamarawickramaNo ratings yet

- The Conceptual Framework For Financial ReportingDocument40 pagesThe Conceptual Framework For Financial ReportingRinaNo ratings yet

- Lesson1. FS and NotesDocument61 pagesLesson1. FS and NotesDenise Jane RoqueNo ratings yet

- Lecture02 Conceptual FrameworkDocument51 pagesLecture02 Conceptual FrameworkAnnaNo ratings yet

- PDF Conceptual Framework Pas 1 With Answer Keydocx - CompressDocument11 pagesPDF Conceptual Framework Pas 1 With Answer Keydocx - CompressJullianneBalase0% (1)

- Chapter 1 - Introduction To Financial AccountingDocument28 pagesChapter 1 - Introduction To Financial AccountingTaehyung KimNo ratings yet

- Conceptual Framework For Financial ReportingDocument67 pagesConceptual Framework For Financial ReportinglowfiNo ratings yet

- Far 02 Conceptual Framework For Financial Reporting CompressDocument11 pagesFar 02 Conceptual Framework For Financial Reporting CompressDaphnie Loise CalderonNo ratings yet

- FAR 02 Conceptual Framework For Financial ReportingDocument11 pagesFAR 02 Conceptual Framework For Financial ReportingKimberly NuñezNo ratings yet

- Conceptual Framework SummaryDocument2 pagesConceptual Framework SummaryPhoebe AbadNo ratings yet

- Chapter 1 - Financial StatementsDocument2 pagesChapter 1 - Financial StatementsclarizaNo ratings yet

- UNEC FrlessonDocument22 pagesUNEC FrlessonTaKo TaKoNo ratings yet

- Chapter 8 of Cfas by ValixDocument7 pagesChapter 8 of Cfas by ValixLukaNo ratings yet

- KothariCh2 PDFDocument38 pagesKothariCh2 PDFArcely GundranNo ratings yet

- Sesion 2 Marco ConceptualDocument95 pagesSesion 2 Marco ConceptualLeo NardoNo ratings yet

- IFRS Conceptual FrameworkDocument7 pagesIFRS Conceptual FrameworkhemantbaidNo ratings yet

- Study Unit 1 Conceptual Framework PART A-2Document10 pagesStudy Unit 1 Conceptual Framework PART A-2machabelanosiphoNo ratings yet

- ACYFAR NOTES Standard Setting IAS 1 Conceptual FrameworkDocument34 pagesACYFAR NOTES Standard Setting IAS 1 Conceptual FrameworkFritzey Faye RomeronaNo ratings yet

- Supplement 86 GL IFRSDocument4 pagesSupplement 86 GL IFRSFerry SihalohoNo ratings yet

- Module 1 - Purpose, Scope and Limitation: - IntroductionDocument3 pagesModule 1 - Purpose, Scope and Limitation: - IntroductionCriselito EnigrihoNo ratings yet

- Advanced Financial Reporting ModuleDocument15 pagesAdvanced Financial Reporting ModuleMax MasiyaNo ratings yet

- FR2 ConceptualFramework (Stud)Document29 pagesFR2 ConceptualFramework (Stud)duong duongNo ratings yet

- Conceptual FrameworkDocument40 pagesConceptual FrameworkQuennie Kate RomeroNo ratings yet

- 02 Conceptual Framework - RevisedDocument13 pages02 Conceptual Framework - RevisedRazel MhinNo ratings yet

- Basic English Level 1Document12 pagesBasic English Level 1Ahmed Hossam BehairyNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Internship Report: Page - I ©daffodil International UniversityDocument30 pagesInternship Report: Page - I ©daffodil International UniversityMazharul IslamNo ratings yet

- Effects of Interest Rate On The ProfitabDocument13 pagesEffects of Interest Rate On The ProfitabMazharul IslamNo ratings yet

- Fasb Standard Setter Update 1q 2022Document9 pagesFasb Standard Setter Update 1q 2022Mazharul IslamNo ratings yet

- Janatabank Feb10 2020Document68 pagesJanatabank Feb10 2020Mazharul IslamNo ratings yet

- Pool of Ideas For Virtual National STEM C2021Document5 pagesPool of Ideas For Virtual National STEM C2021Mazharul IslamNo ratings yet

- FASB Vs IASBDocument4 pagesFASB Vs IASBMazharul IslamNo ratings yet

- Strategic Solution (1-5)Document92 pagesStrategic Solution (1-5)Mazharul IslamNo ratings yet

- TOYOTA Development ProcessDocument21 pagesTOYOTA Development ProcessCornel IvanNo ratings yet

- Larry Williams Stock Trading and Investing Video GuideDocument4 pagesLarry Williams Stock Trading and Investing Video GuideDeepak KansalNo ratings yet

- Valiant Organics ET (Q4-FY 22)Document20 pagesValiant Organics ET (Q4-FY 22)beza manojNo ratings yet

- BUS 206 - Ethical TestDocument5 pagesBUS 206 - Ethical TestAngela PerrymanNo ratings yet

- Larry Williams Accumulation DistributionDocument22 pagesLarry Williams Accumulation DistributionLupistrikis hernandezNo ratings yet

- Cotton Cultivation &ginningDocument3 pagesCotton Cultivation &ginningJack PhelpsNo ratings yet

- 2021 Annual Member StatementDocument9 pages2021 Annual Member Statementkz2w4tx6prNo ratings yet

- Technical Clarification Sheet For Valves PaintingDocument6 pagesTechnical Clarification Sheet For Valves Paintingnishant singhNo ratings yet

- DC ThomsonDocument4 pagesDC ThomsonIskender IskenNo ratings yet

- Ms Thesis Last Final FinalDocument54 pagesMs Thesis Last Final FinalgizaskenNo ratings yet

- (Nov 11, 2016) CMR - Cash Out To Marek PDFDocument2 pages(Nov 11, 2016) CMR - Cash Out To Marek PDFDavid HundeyinNo ratings yet

- Customer StatementDocument20 pagesCustomer StatementDonaldNo ratings yet

- Case Study GMDocument2 pagesCase Study GMmaan_88No ratings yet

- List of Payment Purpose Code KRDocument10 pagesList of Payment Purpose Code KRあいうえおかきくけこNo ratings yet

- FAP - Jul 2010 - West DownloadDocument79 pagesFAP - Jul 2010 - West Downloadsandip rajpuraNo ratings yet

- Iffco at A GlanceDocument74 pagesIffco at A Glancelokesharya1No ratings yet

- Sebi Consultation PaperDocument19 pagesSebi Consultation Paperblack venomNo ratings yet

- JomPAY GuideDocument6 pagesJomPAY GuideSai Arein KiruvanantharNo ratings yet

- Career Planning NotesDocument5 pagesCareer Planning NotessreeyaNo ratings yet

- Hesham Saafan - MSC - CPL - Othm: ContactDocument3 pagesHesham Saafan - MSC - CPL - Othm: Contactnemoo80 nemoo90No ratings yet

- INTERNATIONAL TRADE LAW - HTML PDFDocument111 pagesINTERNATIONAL TRADE LAW - HTML PDFVinod Thomas EfiNo ratings yet

- H430TTM Sofitel Case Study PaperDocument16 pagesH430TTM Sofitel Case Study PaperMark XiarwilleNo ratings yet

- Notification LetterDocument2 pagesNotification LetterALNo ratings yet

- F050 Social Media Marketing in Fashion Industry 2Document6 pagesF050 Social Media Marketing in Fashion Industry 2safa kNo ratings yet

- Social Entrepreneurship NotesDocument6 pagesSocial Entrepreneurship NotesVeronica BalisiNo ratings yet

- Engl4 klk1Document13 pagesEngl4 klk1jelena bozinovicNo ratings yet

- Inclusive Talent Development As A Key Talent ManagementDocument23 pagesInclusive Talent Development As A Key Talent Managementdevi susanto sibagariangNo ratings yet

- Exercise 1 - Chapter 1Document4 pagesExercise 1 - Chapter 1ᴀǫɪʟ RᴀᴍʟɪNo ratings yet

- MKT 337 Course OutlineDocument6 pagesMKT 337 Course OutlineMadiha Kabir ChowdhuryNo ratings yet

- Free Trade: A Path Towards DevelopmentDocument5 pagesFree Trade: A Path Towards DevelopmentRamlloyd SuelloNo ratings yet