Professional Documents

Culture Documents

MGT101 GDB 1 Solution

Uploaded by

Kinza LaiqatCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MGT101 GDB 1 Solution

Uploaded by

Kinza LaiqatCopyright:

Available Formats

MGT101 GDB 1 Solution

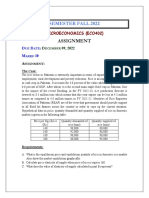

GDB Question:

ABC Brothers have an opening inventory of Rs.7,000 and a closing inventory of

Rs.8,000. Purchases for the year were Rs.90,000, carriage inward was Rs.5,000

and carriage outward was Rs.4,500. ABC Brothers sold some items of inventory

for Rs.2,000 in cash during the year, which was purchased for Rs.2,500. The

owners of business brought an additional capital of Rs.8,000 during the year and

withdrew goods of Rs. 3,000 from the business for his private use. At the end of

the year profit reported in income statement is Rs. 72,000. Owner’s equity at

the beginning of the period was Rs.100,000.

What will be the:

Cost of goods sold.

Owners equity at the end of the year.

Effect of sale of inventory on assets (Just mention the effect as: Increase

in asset by Rs.??? or Decrease in asset by Rs.??? or No Effect on asset).

Effect of sale of inventory on owners equity of business (Just mention the

effect as: Increase in owners equity by Rs.??? or Decrease in owners

equity by Rs.??? or No Effect on owners equity). Note: only the effect of

sale of inventory on owners equity is required in this part. Effect of given

net profit of Rs. 72,000 on owners equity is not required.

Solution

Cost of Goods Sold

Opening Inventory 7,000

Purchases (Add) 90,000

Carriage Inward (Add) 5,000

Closing Inventory (Less) 8,000

Cost of Goods Sold 94,000

Owner Equity

Opening Owner's equity 100,000

Additional Capital (Add) 8,000

Retained Earnings (Add) 72,000

Drawings (Less) 3,000

Owner Equity 177,000

Effect of sale of Inventory on Assets: The assets that we have decreased, this is

the case given to us above, according to the calculation that we have sold out

the inventory. Sold some items of Inventory Rs, 2000 in cash and which was

purchased for Rs, 2500.

Effect of sale of Inventory on Equity: Our equity will also decrease because our

items were worth 2500 and we sold them for 2000, so there has been a loss of

Rs, 500. If we have profit, then we add it in the form of retained earnings, if we

have loss, then we show it and the loss is minus from owner's equity.

You might also like

- Advance Chapter 3Document12 pagesAdvance Chapter 3abel habtamuNo ratings yet

- Design For LivingDocument2 pagesDesign For LivingshanzaywowNo ratings yet

- Chapter 3Document12 pagesChapter 3Solomon AbebeNo ratings yet

- HI 5020 Corporate Accounting: Session 8b Intra-Group TransactionsDocument16 pagesHI 5020 Corporate Accounting: Session 8b Intra-Group TransactionsFeku RamNo ratings yet

- Consolidated FS (Sale of Inventory)Document4 pagesConsolidated FS (Sale of Inventory)Arn KylaNo ratings yet

- MGT101 GDB 1 SolutionDocument3 pagesMGT101 GDB 1 Solutionabid princeNo ratings yet

- Activity 5Document11 pagesActivity 5Ebs DandaNo ratings yet

- C5B Profitability AnalysisDocument6 pagesC5B Profitability AnalysisSteeeeeeeephNo ratings yet

- Accounting For Lawyers Part 2: Parvesh AghiDocument46 pagesAccounting For Lawyers Part 2: Parvesh AghiUnknown UnknownNo ratings yet

- Spjimr - PGPM - Management Accounting - 2023: Topic: CVP AnalysisDocument3 pagesSpjimr - PGPM - Management Accounting - 2023: Topic: CVP AnalysisAshish KumarNo ratings yet

- Inventories Notes2 170419181823Document28 pagesInventories Notes2 170419181823Ebsa AdemeNo ratings yet

- Question Compilation - 230316 - 072454Document9 pagesQuestion Compilation - 230316 - 072454Ranjan DhakalNo ratings yet

- Topic 8 - Budgeting (Student Version)Document37 pagesTopic 8 - Budgeting (Student Version)Khairuna anishaNo ratings yet

- Practical Example - 1: C. Gain On Sale of Personal Car Rs. 350,000Document16 pagesPractical Example - 1: C. Gain On Sale of Personal Car Rs. 350,000Muhammad RamzanNo ratings yet

- Exercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its ProductsDocument2 pagesExercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its ProductsThaa Manitha DinataNo ratings yet

- Cost-Volume-Profit (CVP) AnalysisDocument57 pagesCost-Volume-Profit (CVP) AnalysisSHUBHAM DIXITNo ratings yet

- Financial AccountingDocument3 pagesFinancial AccountingSimran MittalNo ratings yet

- Chapter 12 ProblemsDocument40 pagesChapter 12 ProblemsInciaNo ratings yet

- CH 22 Exercises ProblemsDocument3 pagesCH 22 Exercises ProblemsAhmed El Khateeb100% (1)

- Tutorial 1Document5 pagesTutorial 1FEI FEINo ratings yet

- Advanced Accounting: Intercompany Profit Transactions - InventoriesDocument44 pagesAdvanced Accounting: Intercompany Profit Transactions - InventoriesWang JukNo ratings yet

- Ae 191 F-Test 1Document3 pagesAe 191 F-Test 1Venus PalmencoNo ratings yet

- Cost of Goods SoldDocument2 pagesCost of Goods SoldHAROON EDITZNo ratings yet

- Intercompany Sales Business CombiDocument26 pagesIntercompany Sales Business CombiElai grace FernandezNo ratings yet

- Module 5 Supplemental Problems-SMALL BUSINESS MANAGEMENTDocument5 pagesModule 5 Supplemental Problems-SMALL BUSINESS MANAGEMENTPhát GamingNo ratings yet

- Practical Question For ManagementDocument10 pagesPractical Question For ManagementAbrantie JoeNo ratings yet

- Accounting For Merchandising Businessesss 1224048145696217 8Document73 pagesAccounting For Merchandising Businessesss 1224048145696217 8Mohit SharmaNo ratings yet

- SDocument59 pagesSmoniquettnNo ratings yet

- CBSE Class 11 Accounting-End of Period AccountsDocument34 pagesCBSE Class 11 Accounting-End of Period AccountsRudraksh PareyNo ratings yet

- Chapter 3 DiscussionsDocument22 pagesChapter 3 Discussionsの変化 ナザレNo ratings yet

- UntitledDocument19 pagesUntitledRahul BharadwajNo ratings yet

- Working Capital NumericalsDocument3 pagesWorking Capital NumericalsShriya SajeevNo ratings yet

- Statement of Comprehensive IncomeDocument22 pagesStatement of Comprehensive IncomeAd BeeNo ratings yet

- MGT 4110 Midterm 2 Posted Solution Fall 2013-2Document3 pagesMGT 4110 Midterm 2 Posted Solution Fall 2013-2Zubair ChaudhryNo ratings yet

- Answers To Quick Tests: Unit 3.1: Income StatementsDocument7 pagesAnswers To Quick Tests: Unit 3.1: Income StatementsJaved MushtaqNo ratings yet

- Problem Ratio 2022Document1 pageProblem Ratio 2022Mohd shariqNo ratings yet

- CASH FLOW STATEMENT For ClassDocument28 pagesCASH FLOW STATEMENT For ClassPradeepNo ratings yet

- Sample ProblemDocument4 pagesSample ProblemLealyn CuestaNo ratings yet

- SOLETRADER ACCOUNTING Handout 2Document4 pagesSOLETRADER ACCOUNTING Handout 2DenishNo ratings yet

- Statement of Comprehensive IncomeDocument30 pagesStatement of Comprehensive IncomeSheilaMarieAnnMagcalas100% (4)

- Short-Term Business DecisionsDocument15 pagesShort-Term Business DecisionsZiad NehadNo ratings yet

- Capital Intensive Labor Intensive: Required: Determine The FollowingDocument2 pagesCapital Intensive Labor Intensive: Required: Determine The FollowingMahediNo ratings yet

- Ratio Analysis-1Document4 pagesRatio Analysis-1Aakash RamakrishnanNo ratings yet

- PROBLEM 1. Duif Company: Under VariableDocument6 pagesPROBLEM 1. Duif Company: Under VariableUchayyaNo ratings yet

- Marginal CostingDocument4 pagesMarginal CostingFareha Riaz100% (3)

- KL Business Finance Nov Dec 2016Document3 pagesKL Business Finance Nov Dec 2016Towhidul IslamNo ratings yet

- ACC501 Short Notes PDFDocument37 pagesACC501 Short Notes PDFFun N100% (1)

- Financial Statements For Manufacturing BusinessesDocument9 pagesFinancial Statements For Manufacturing BusinessesTokie TokiNo ratings yet

- PROBLEM 2 Problem and AnswerDocument3 pagesPROBLEM 2 Problem and AnswerRemie Rose BarcebalNo ratings yet

- MB20202 CF Unit V Working Capital Management Application QuestionsDocument4 pagesMB20202 CF Unit V Working Capital Management Application QuestionsSarath kumar CNo ratings yet

- Basic Financial StatementsDocument12 pagesBasic Financial StatementsJayvee TasaneNo ratings yet

- GivenDocument17 pagesGivenApurvAdarshNo ratings yet

- Installment Method of Revenue RecognitionDocument4 pagesInstallment Method of Revenue RecognitionDanaNo ratings yet

- Goodwill ValuationDocument15 pagesGoodwill ValuationREHANRAJ100% (1)

- Financial StatementDocument7 pagesFinancial StatementZaara AshfaqNo ratings yet

- Symbiosis Center For Management & HRDDocument3 pagesSymbiosis Center For Management & HRDKUMAR ABHISHEKNo ratings yet

- Financial Statements Formate 3.1Document15 pagesFinancial Statements Formate 3.1vkvivekkm163No ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- Project Question: Financial Management 1ADocument4 pagesProject Question: Financial Management 1AHashimRazaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- PAK301 Assignment 1 Solution 2022.pdf MOHSINDocument2 pagesPAK301 Assignment 1 Solution 2022.pdf MOHSINKinza LaiqatNo ratings yet

- Fall 2022 - CS101 - 1 - BC210426386Document2 pagesFall 2022 - CS101 - 1 - BC210426386Kinza LaiqatNo ratings yet

- Fall 2022 - MTH302 - 1Document2 pagesFall 2022 - MTH302 - 1Kinza LaiqatNo ratings yet

- Fall 2022 - ECO402 - 1Document3 pagesFall 2022 - ECO402 - 1Kinza LaiqatNo ratings yet

- Fall 2022 - CS101 - 1 - BC210424490Document2 pagesFall 2022 - CS101 - 1 - BC210424490Kinza LaiqatNo ratings yet

- Fall 2022 - ECO402 - 1 - BC210424490Document4 pagesFall 2022 - ECO402 - 1 - BC210424490Kinza LaiqatNo ratings yet

- Fall 2022 - MTH302 - 1 - BC210424490Document5 pagesFall 2022 - MTH302 - 1 - BC210424490Kinza LaiqatNo ratings yet

- CS201 GDB-1 Solution-2022 SpringDocument1 pageCS201 GDB-1 Solution-2022 SpringKinza LaiqatNo ratings yet

- MTH101 Assignment 2 Solution 2022Document1 pageMTH101 Assignment 2 Solution 2022Kinza LaiqatNo ratings yet

- Fall 2022 - MTH202 - 2 - BC210426386Document2 pagesFall 2022 - MTH202 - 2 - BC210426386Kinza LaiqatNo ratings yet

- MGT101 GDB Solution SpringDocument2 pagesMGT101 GDB Solution SpringKinza LaiqatNo ratings yet

- Cs201 Midterm Solved Mcqs With Reference3Document15 pagesCs201 Midterm Solved Mcqs With Reference3Kinza LaiqatNo ratings yet

- MGT101 Midterm Past PaperDocument117 pagesMGT101 Midterm Past PaperKinza LaiqatNo ratings yet

- MTH202 Assignment 2 Sol 2022Document3 pagesMTH202 Assignment 2 Sol 2022Kinza LaiqatNo ratings yet

- Cs101 GDB 1 Solution 2022Document1 pageCs101 GDB 1 Solution 2022Kinza LaiqatNo ratings yet

- Cs101 - 250+ Most Important Quiz For Mid - Term 2023 by Muhammad ZamanDocument288 pagesCs101 - 250+ Most Important Quiz For Mid - Term 2023 by Muhammad ZamanKinza LaiqatNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Eco402 Midterm Solved Mcqs More Than 150 NewDocument22 pagesEco402 Midterm Solved Mcqs More Than 150 NewKinza LaiqatNo ratings yet

- Cs101 - Current MID - Term Important MCQS, Questions Solution by STUDENT INFO 5Document18 pagesCs101 - Current MID - Term Important MCQS, Questions Solution by STUDENT INFO 5Kinza LaiqatNo ratings yet

- CS101 Abbreviations From Lectures 1 To 81Document7 pagesCS101 Abbreviations From Lectures 1 To 81Kinza LaiqatNo ratings yet