Professional Documents

Culture Documents

BIR Letter For LOA Compliance

BIR Letter For LOA Compliance

Uploaded by

maeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Letter For LOA Compliance

BIR Letter For LOA Compliance

Uploaded by

maeCopyright:

Available Formats

______________

________________________

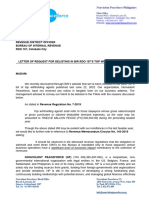

REVENUE DISTRICT OFFICER

____________________________

BUREAU OF INTERNAL REVENUE

ATTN.: ________________

Group Supervisor

____________________

Revenue Officer

SUBJECT: LETTER OF AUTHORITY (LOA) – __________________ dated _________

In compliance to LOA-________________ dated ______________, I am submitting the

documentary requirements, viz.:

1. Letter of Authority;

2. BIR Certificate of Registration (BIR Form 2303);

3. Annual Registration Fee (0605) with proof of payment for ________;

4. Quarterly Income Tax Return (1701Q) with proof of payments and required

attachments (2307) for the 1st, 2nd and 3rd quarters;

5. Annual Income Tax Return with all the required attachments including the audited

Financial Statements (1702), 2307 and SAWT;

6. Monthly VAT Declarations (2550M) and Quarterly VAT (2550Q) returns with proof of

payments;

7. Quarterly Summary List of Sales and Purchases (SLSP) with proof of submission;

8. Monthly withholding taxes (expanded withholding taxes and compensation) with

proof of payments (1601E & C) and Monthly Alphalist of Payees (MAP); and

9. BIR Form 1604-CF with Annual Alphalist of Employees and BIR Form 1604-E

I hope you find the attached documents in order. Nonetheless, I will be very glad for any

document/s that you may still find necessary for us to submit to your good office.

Respectfully yours,

__________________________

President

You might also like

- FLI - Response LetterDocument1 pageFLI - Response LetterSay QuintanaNo ratings yet

- Request For Rulings - NAP 3.20.14Document3 pagesRequest For Rulings - NAP 3.20.14ConnieAllanaMacapagaoNo ratings yet

- SEC SMR Format 2yrs - 2018 - 10 CopiesDocument1 pageSEC SMR Format 2yrs - 2018 - 10 CopiesMarvin CeledioNo ratings yet

- Compliance Monitoring CertificateDocument1 pageCompliance Monitoring CertificateEly SibayanNo ratings yet

- PFF053 MembersContributionRemittanceForm V02-FillableDocument2 pagesPFF053 MembersContributionRemittanceForm V02-FillableCYvelle TorefielNo ratings yet

- Articles of Incorporation and By-Laws - Non Stock CorporationDocument10 pagesArticles of Incorporation and By-Laws - Non Stock CorporationlividNo ratings yet

- Cash Disbursement PolicyDocument5 pagesCash Disbursement PolicyRia Dumapias100% (1)

- Cyp Accounting, Taxation, Management and Audit ServicesDocument1 pageCyp Accounting, Taxation, Management and Audit ServicesCarol Ledesma Yap-PelaezNo ratings yet

- SMR - ItrDocument1 pageSMR - ItrBaldovino VenturesNo ratings yet

- Process For Application To Use LooseleafDocument1 pageProcess For Application To Use LooseleafFrancis MartinNo ratings yet

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-IndJyznareth Tapia75% (4)

- BIR Ruling 302-08 - Funeral AssistanceDocument13 pagesBIR Ruling 302-08 - Funeral AssistanceJerwin DaveNo ratings yet

- RR 15-2010 Additional Notes To Financial StatementsDocument9 pagesRR 15-2010 Additional Notes To Financial StatementsMary Grace Caguioa AgasNo ratings yet

- Statement of Management's Responsibility For Annual Income TaxDocument2 pagesStatement of Management's Responsibility For Annual Income TaxJohn Heil96% (25)

- 7 Sure-Ways To Cancel Bir Letters of Authority Internal Revenue ServiceDocument3 pages7 Sure-Ways To Cancel Bir Letters of Authority Internal Revenue ServiceDante Bauson JulianNo ratings yet

- Fs - Evilla, E. (Vertam Farms Opc) 2020Document44 pagesFs - Evilla, E. (Vertam Farms Opc) 2020Ma Teresa B. Cerezo100% (2)

- Engagementletter AKROSS TAXFILINGDocument5 pagesEngagementletter AKROSS TAXFILINGDv AccountingNo ratings yet

- Expanded Withholding Taxes On Government Income PaymentsDocument172 pagesExpanded Withholding Taxes On Government Income PaymentsBien Bowie A. CortezNo ratings yet

- General Audit Procedures and Documentation-BirDocument3 pagesGeneral Audit Procedures and Documentation-BirAnalyn BanzuelaNo ratings yet

- S&M - ProposalDocument7 pagesS&M - ProposalRheneir MoraNo ratings yet

- Cover Sheet: For Audited Financial StatementsDocument1 pageCover Sheet: For Audited Financial StatementsPamela Fayel SalazarNo ratings yet

- Letter of Request For Data FixDocument1 pageLetter of Request For Data FixTANCITY INC100% (1)

- Engagement Letter SampleDocument1 pageEngagement Letter SampleCarol Ledesma Yap-Pelaez100% (1)

- Engagement Letter FINALDocument3 pagesEngagement Letter FINALPatricia SantosNo ratings yet

- Additonal Disclosure RR 15 2010Document5 pagesAdditonal Disclosure RR 15 2010Emil A. MolinaNo ratings yet

- BIR - Affidavit of Preservation of Working PapersDocument1 pageBIR - Affidavit of Preservation of Working PapersLimuel Balestramon RazonalesNo ratings yet

- SEC Requirements For Accreditation of CPAs in Public PracticeDocument2 pagesSEC Requirements For Accreditation of CPAs in Public PracticemelissaNo ratings yet

- Engagement Letter SampleDocument2 pagesEngagement Letter SampleSuzette VillalinoNo ratings yet

- Letter of Intent BIR-eFPSDocument1 pageLetter of Intent BIR-eFPSsheNo ratings yet

- Engagement LetterDocument4 pagesEngagement LetterJessicaGonzalesNo ratings yet

- CS Form 101-CSE-PR 07 December 2023Document2 pagesCS Form 101-CSE-PR 07 December 2023alvin ramosNo ratings yet

- RMC 69-2020 POS Cancellation New RequirementDocument2 pagesRMC 69-2020 POS Cancellation New RequirementGreyNo ratings yet

- Supplemental Written Statement of AuditorDocument1 pageSupplemental Written Statement of AuditorJuan Frivaldo100% (1)

- Annex - A - Ptu LooseleafDocument1 pageAnnex - A - Ptu LooseleafPaola VirataNo ratings yet

- RR 2-98 Section 2.57 (B) - CWTDocument3 pagesRR 2-98 Section 2.57 (B) - CWTZenaida LatorreNo ratings yet

- BIR Accreditation For CPAsDocument1 pageBIR Accreditation For CPAsECMH ACCOUNTING AND CONSULTANCY SERVICESNo ratings yet

- How To File Form 2316 and Annex FDocument4 pagesHow To File Form 2316 and Annex FIvan Benedicto100% (1)

- Engagementletter-SEC REGISTRATION - DVDocument4 pagesEngagementletter-SEC REGISTRATION - DVDv AccountingNo ratings yet

- SEC Cover SheetDocument1 pageSEC Cover SheetAya PulidoNo ratings yet

- Request Letter For Compromise - KbindustrialDocument1 pageRequest Letter For Compromise - KbindustrialJedah Ibarra VillaflorNo ratings yet

- Bir EfpsDocument1 pageBir EfpspangskotoNo ratings yet

- 141.protesting BIR Assessments - dds.04.29.2010Document2 pages141.protesting BIR Assessments - dds.04.29.2010Arnold ApduaNo ratings yet

- E-Sales Locked of Account - FormatDocument1 pageE-Sales Locked of Account - FormatJudith Ann AntiponNo ratings yet

- EFPS Letter of Intent SampleDocument1 pageEFPS Letter of Intent SampleBernardino PacificAceNo ratings yet

- BIR Ruling No. 242-18 (Gift Certs.)Document7 pagesBIR Ruling No. 242-18 (Gift Certs.)LizNo ratings yet

- Letter For Delisting BIRDocument2 pagesLetter For Delisting BIRFreann Sharisse AustriaNo ratings yet

- Letter To BIR - Correction of Return PeriodDocument1 pageLetter To BIR - Correction of Return PeriodmaeNo ratings yet

- Engagementletter - Business Closure20Document4 pagesEngagementletter - Business Closure20Dv AccountingNo ratings yet

- SPM Permit Application ProcedureDocument11 pagesSPM Permit Application ProcedureMay Ann MeramNo ratings yet

- Sample SMRDocument1 pageSample SMRearl0917No ratings yet

- NOLCO ReportDocument9 pagesNOLCO ReportfebwinNo ratings yet

- BirDocument4 pagesBirAnonymous fnlSh4KHIgNo ratings yet

- RMC 72-2004 PDFDocument9 pagesRMC 72-2004 PDFBobby LockNo ratings yet

- Sales and Tax Declaration Form 2020Document1 pageSales and Tax Declaration Form 2020k act100% (1)

- CAR 2D Expanded Engagement Ltr-Compilation (5-17)Document8 pagesCAR 2D Expanded Engagement Ltr-Compilation (5-17)Andy RossNo ratings yet

- New Income Tax Return BIR Form 1702 - November 2011 RevisedDocument6 pagesNew Income Tax Return BIR Form 1702 - November 2011 RevisedBusinessTips.Ph100% (4)

- Cover Sheet: Month Day Month DayDocument1 pageCover Sheet: Month Day Month DayWilliam S. FeridaNo ratings yet

- Certification Statement of Management's Responsibility (Itr)Document1 pageCertification Statement of Management's Responsibility (Itr)Earl Jhune Amoranto100% (1)

- Transmittal BIRDocument1 pageTransmittal BIRSylvia EnovisoNo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementDaisuke InoueNo ratings yet

- Service Agreement RmeDocument3 pagesService Agreement RmehydrolikoenterprisesNo ratings yet

- Authorization LetterDocument1 pageAuthorization LettermaeNo ratings yet

- Letter To ClientsDocument1 pageLetter To ClientsmaeNo ratings yet

- Letter To Third Party For Erroneous SalesDocument1 pageLetter To Third Party For Erroneous SalesmaeNo ratings yet