Professional Documents

Culture Documents

Tourism Jan 2023 Final

Uploaded by

Thenu GananOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tourism Jan 2023 Final

Uploaded by

Thenu GananCopyright:

Available Formats

SRI LANKA: The Distressed Tourism

Sector On The Verge of a Boom

Sector fighting hard amidst hope of a

gradual correction in SL’s economic woes…

Analyst : Shadini Silva January 2023

A BLOOMING MEDIUM TERM OUTLOOK

• Arrivals for 2022 touched ~720k whilst navigating through the present challenging economic sentiments

• Arrival numbers likely to double in 2023E to reach +1.5 mn and then by 2024E likely to surpass its historic high of ~2.3 mn

arrivals boosted by revenge travel and LKR dip

• Local Resort occupancies may improve to c.75% levels and could witness a possible upward trend in room rates from Dec

2022E – 1Q2023E

• Leading local hotels with Maldivian exposure expected to thrive amidst rising arrivals in Maldives and higher ARRs

• Local City Hotels to benefit in the medium term with a gradual recovery in country’s economic and political outset and expect

occupancy levels to be north of ~60% given the fast tracking of major development projects including Port City

• A probable boost in Sri Lankas top five tourist source markets including India, China and UK amidst continuous efforts by the

Government to attract high spending tourists from Western Europe whilst tapping into new markets could re-rate selected

stocks with stable fundamentals

Key picks with 12 Months Fair Values :

Aitken Spence Hotels (AHUN.N: LKR50.8) – TP: LKR69.0

John Keells Hotels (KHL.N: LKR16.5) – TP: LKR21.8

Asian Hotels and Properties (AHPL.N: LKR37.4)- TP: LKR71.7

Aitken Spence (SPEN.N: LKR128.0) – TP: LKR180.0

John Keells Holdings (JKH.N: LKR137.7) – TP: LKR190.0

Softlogic Stockbrokers (Pvt) Ltd 2

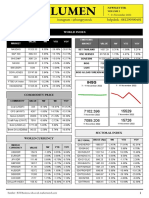

SECTOR SNAPSHOT

Share Price Annual Rev Fair Value -

Price NAV Price to TTM EPS

Ticker 02.01.2023 per Room Gearing (%) PBV (x) Medium Upside

YoY % (LKR) Sales (x) (LKR)

(LKR) (LKR mn) term (LKR)

AHPL SL 37.4 -15% 7.7 71.3 6% 2.5 -0.6 0.5 74.2 98%

KHL SL 16.5 12% 12.2 23.8 61% 1.1 -0.3 0.7 27.8 69%

RCH SL 66.1 -35% 3.0 249.1 0% 8.9 84.2 0.3 109.6 66%

RENU SL 368.8 4% 1.4 1,332.7 0% 19.0 580.7 0.3 586.4 59%

SHOT SL 8.1 -61% 1.3 22.9 39% 1.0 -4.6 0.4 12.6 56%

RPBH SL 22.5 -18% 3.7 53.0 1% 2.4 0.1 0.4 34.4 53%

CHOT SL 17.0 -8% 1.4 47.2 20% 4.2 4.3 0.4 25.9 53%

AHUN SL 50.8 20% 12.4 64.0 71% 0.5 2.3 0.8 74.9 47%

PALM SL 55.3 -54% 45.7 241.7 45% 1.8 -73.9 0.2 79.8 44%

LHL SL 30.0 -14% 7.3 66.5 12% 2.2 -1.6 0.5 43.2 44%

CITH SL 5.0 -26% 8.6 16.2 41% 1.8 -1.9 0.3 7.1 43%

KHC SL 7.2 -14% 1.5 15.0 8% 15.0 -0.1 0.5 9.7 35%

PEG SL 32.5 -15% 4.8 65.7 13% 1.6 -4.8 0.5 42.7 31%

TANG SL 59.1 -10% 2.6 157.7 2% 2.8 -3.7 0.4 75.7 28%

Source : Bloomberg/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 3

A TECHNICAL EXPLANATION: Lucrative growth in the near term

The consumer services index is the benchmark index for the overall tourism sector. A benchmark index analysis could shed some light on the mid-term

expectations for the entire industry. The index has been experiencing ranging price action after a retracement from its upward trend which broke the

market structure to the upside. Currently it's hovering around its support zone as the overall market is in a retracement stage. While the index is below

both its 50-day and 20-day moving average, a break above the averages and the resistance trendline induced by positive news from the tourism sector

could propel the index with its counters to move higher.

Softlogic Stockbrokers (Pvt) Ltd 4

Arrivals during 2022 surged by +3x YoY and touched 720k amidst lifting of

travel advisories and stringent management processes followed by SL…

The country observed encouraging tourist arrivals during 2022 which touched ~720k mainly owing to the lifting of many Covid-19

related travel bans which prevailed across main source markets during previous years. Moreover the stringent processes followed by

the country in order to overcome certain shortages in essential commodities such as fuel, food and medicine during the period

concerned acted as a major boost to entice arrival numbers.

Monthly Tourist Arrivals to SL has seen a stable improvement during 4Q2022 with Dec’22 arrivals hitting ~92k

300,000 (Monthly Arrivals)

250,000

200,000

150,000

100,000

50,000

-

January February March April May June July August September October November December

2019 2020 2021 2022

Source : SLTDA/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 5

Sri Lanka could hit an arrivals number of +1.5 mn tourists for 2023E …

Light at the end of the tunnel: Given the unprecedented situation that occurred in the country owing to the economic crisis, which has led

to shortages of necessities including fuel, food and medicines and an unstable security situation, many nations including UK issued travel

warnings to their citizen to avoid non-essential travel to Sri Lanka. Nevertheless, with the implementation of necessary and quick

measures, these issues has thus far seen immense improvements. Hence this may pave the way for a rise in arrival numbers from 1Q2023E

onwards and more towards 2023E and likely to record an inflow of +1.5 mn arrivals whilst driving earnings north of USD2.5 bn.

A gradual uptick in arrivals may result earnings above USD2.5 bn in 2023E

2,500 4,500

4,000

2,000 3,500

3,000

1,500

2,500

2,000

1,000

1,500

500 1,000

500

- -

Tourist Arrivals ('000) - RHS Tourism Earnings (USD mn) - LHS

Source : SLTDA/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 6

Depreciating LKR cf. many currencies remain favorable for travelers…

LKR depreciation to entice arrivals to SL: Given the steep depreciation of LKR by ~80% YTD against the greenback, makes it more

affordable and worth the spend for all tourists when visiting SL which greatly compensates for the price increases that has taken place

amidst soaring inflation in the country.

LKR dipped ~80% YoY cf. USD LKR slipped ~64% YoY cf. GBP LKR slipped ~64% YoY cf. INR

500

400

450 6

350 400

5

300 350

250 300 4

200 250

3

200

150

150 2

100

100

50 1

50

0 0 0

Oct-18

Oct-19

Oct-20

Oct-21

Oct-22

Jan-18

Apr-18

Jan-19

Apr-19

Jan-20

Apr-20

Jan-21

Apr-21

Jan-22

Apr-22

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

Oct-18

Oct-19

Oct-20

Oct-21

Oct-22

Jan-18

Apr-18

Jan-19

Apr-19

Jan-20

Apr-20

Jan-21

Apr-21

Jan-22

Apr-22

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

Oct-18

Oct-19

Oct-20

Oct-21

Oct-22

Jan-18

Apr-18

Jan-19

Apr-19

Jan-20

Apr-20

Jan-21

Apr-21

Jan-22

Apr-22

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

Source : Bloomberg/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 7

Rapid currency dip may pave the way to see an uptick in daily spend

of a tourist…

Depreciation a blessing in disguise: Given the rapid LKR dip witnessed against many major currencies, the average daily spend of a

tourist has been on the rise over the past 10 years increasing over the period to touch around USD190 in 2022 cf. USD 103 in 2012.

Receipt from a tourist per day (USD) on the path to recovery led by LKR dip

200.0 190

180.0

160.0

140.0

120.0

103.0

100.0

80.0

60.0

40.0

20.0

0.0

Source : SLTDA/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 8

Sri Lanka’s top 5 source markets account for +75% of arrivals in normal

circumstances…

High spenders might relook at SL: India, China and UK have been the key source markets for SL over the past years. With the gradual

normalization of the pandemic spread in all parts of the world, we could expect the main source markets to see renewed interest in Sri

Lanka amidst the country being much more affordable to the high spenders than before.

SL’s Key Source Markets in 2018

3% India

4%

5% China

5% 26% United Kingdom

Germany

7%

Australia

7% France

Maldives

10% 17% United States Of America

Russia

16% Netherlands

Source : SLTDA/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 9

Tourism earnings could boom from 2023E amidst increased room nights…

Earnings likely to pick up from 2023E onwards: Despite the setbacks observed during 2019 – 2022 owing to various reasons such as

Easter Sunday attack and the pandemic spread, we believe now the things are falling back in place for Sri Lanka. Hence expect the

annual room nights to take a spur from 2023E to around ~15-18 mn levels boosting overall tourism income north of USD2.5 bn.

30,000 Tourist room nights peaked in 2018 hitting an all time high of ~25 mn

25,000

20,000

15,000

10,000

5,000

Tourist Nights '000 (LHS)

Source : SLTDA/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 10

Revenge travel and attractive large scale projects over medium term may

drive occupancies in local resorts and city hotels respectively…

SL resorts may see higher demand over the near – medium term fuelled by revenge travel. We believe, losses at local resorts could

curtail by 4Q-2022E with an anticipated revival in the persistent economic shocks. Conversely, efficient roll out of vaccines in SL and

around the world may further uplift the appetite for revenge travel and reinforce SL’s leisure industry with a probable increase in

forward bookings over the medium term for the segment to sustain its profits.

Business travel may increase with the commencement of many large scale projects such as Port City. This hence will result in a rise

in occupancy rates at SL City hotels over the forecast years north of ~60% cf. current ~30% levels bolstering overall segmental profits

of the main city hotel operators.

100 JKH Occupancy (%)

450 ARR (USD)

90

400

80

350

70

300

60

250

50

40 200

30 150

20 100

10 50

0 0

1QFY22 2QFY22 3QFY22 4QFY22 1QFY23 2QFY23 1QFY22 2QFY22 3QFY22 4QFY22 1QFY23 2QFY23

City Hotels Resorts Sri Lanka Resorts Maldives City Hotels Resorts Sri Lanka Resorts Maldives

Source : JKH Reports/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 11

Hotels with Maldivian exposure to be more insulated than the rest…

Listed hotels with exposure to Maldivian resorts to see a special thrust: Since Maldivian borders were re-opened on 15th Jul’20

amidst strict health & safety guidelines, the arrivals to Maldives have been on the rise recording much higher numbers of arrivals when

compared to SL arrivals. Hence, the listed hotels which has a notable exposure to Maldivian resorts such as KHL and AHUN may see a

strong earnings growth triggering from its Maldivian Leisure segment which may bode well to compensate for the short lived losses

that could arise from the local hotel operations.

Maldivian Tourist Arrivals has already crossed pre-pandemic Tourist Arrivals to Maldives showcased a robust

levels and reached 1.6 mn as of end-Dec’2022 growth outperforming arrivals to SL in 2022

200,000 180,000

180,000 160,000

160,000 140,000

140,000 120,000

120,000 100,000

100,000 80,000

80,000 60,000

60,000 40,000

40,000 20,000

20,000 -

-

Tourist Arrivals - To SL Tourist Arrivals - To Maldives

2019 2020 2021 2022

Source : Ministry of Tourism Maldives/SLTDA/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 12

Sector however remains highly geared and could be impacted from soaring rates;

Nevertheless extended moratoriums to be of some comfort to bounce back…

Debt moratoriums for tourism sector to aid the listed players to find some breathing space: The tourism sector was under a moratorium

scheme from mid-2020 amidst pandemic induced negative sentiments whilst it came to an expiry on 30th Jun 2022. Many local hotel

operators in the listed space thus came under distress with the cash crunch experienced amidst their refurbishment and expansion plans and

surging cost pressures intensifying working capital management. Conversely given the decision taken by the Central Bank (CBSL) to urge

banks to extend the debt moratorium to all businesses including Tourism and individuals hit from the ongoing economic crisis would be a

major positive for the tourism sector. Moreover, this should be an added benefit for all renown local hoteliers to get back on track once the

industry recovers over the coming quarters.

Refurbishment plans and working capital requirements expanded the gearing of listed hotels

140%

120%

100%

Gearing Ratio (%) as of 3Q2022

80%

60%

40%

20%

0%

Source : Bloomberg/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 13

Tourism Snapshot

Share Price Annual Rev Currency

Market Cap Price YoY TTM EPS TTM PER TTM Adj Net Price to

Ticker 02.01.2023 Shares mn per Room PBV (x) NAV (LKR) Gearing (%) Adjusted EV EV/Room

(LKR mn) % (LKR) (x) Sales (LKR mn) Sales (x)

(LKR) (LKR mn) (LKR)

KHL SL 16.5 1,456.15 24,026.4 12% 12.2 -0.28 - 0.7 23.80 18,018 61% 1.09 76,184.4 51.6

AHUN SL 50.8 336.29 17,083.5 20% 12.4 2.31 22 0.8 64.00 35,155 71% 0.47 97,178.0 34.4

AHPL SL 37.4 442.78 16,559.8 -15% 7.7 -0.56 - 0.5 71.32 6,490 6% 2.52 21,687.3 25.6

EDEN SL 17.6 528.00 9,292.8 -47% 5.9 -7.39 - 0.6 30.92 1,371 40% 6.67 38,746.5 165.6

TRAN SL 45 200.00 9,000.0 -18% 8.1 0.42 107 1.6 28.54 2,806 16% 3.21 10,055.9 29.1

GHLL SL 12.5 500.83 6,260.4 -44% 2.4 -0.21 - 0.8 16.62 1,059 0% 5.92 3,337.4 7.5

JETS SL 10.4 563.52 5,860.6 -7% 5.8 -2.32 - 2.1 4.86 1,853 69% 3.62 12,645.7 39.9

KHC SL 7.2 577.50 4,158.0 -14% 1.5 -0.14 - 0.5 14.97 277 8% 14.99 4,867.9 27.0

SERV SL 8.5 484.00 4,114.0 -11% 11.8 -0.60 - 5.2 1.64 2,949 74% 1.40 6,271.6 25.1

CHOT SL 17 180.03 3,060.5 -8% 1.4 4.34 122 0.4 47.16 742 20% 4.15 5,017.7 9.5

NEH SL 1265.25 2.19 2,765.9 2% 5.7 40.50 31 0.6 2,260.59 882 0% 3.14 1,597.5 10.3

RCH SL 66.1 40.30 2,663.7 -35% 3.0 84.18 1 0.3 249.06 298 0% 8.93 3,913.6 39.5

RENU SL 368.75 7.00 2,581.3 4% 1.4 580.66 1 0.3 1,332.67 136 0% 18.96 -5695.1 -57.5

PALM SL 55.3 43.27 2,392.7 -54% 45.7 -73.86 - 0.2 241.70 1,371 45% 1.76 36,275.9 1,209.2

CONN SL 21.1 103.17 2,176.8 -6% 1.9 -11.16 - 1.2 17.59 1,282 63% 1.38 5,104.1 7.4

STAF SL 31.7 63.24 2,004.8 0% 3.1 -2.35 - 0.6 57.00 322 24% 3.47 2,245.1 21.6

RHTL SL 15.9 110.89 1,763.1 19% 8.9 0.99 16 1.1 14.53 470 4% 3.75 1,351.7 25.5

REEF SL 6 267.23 1,603.4 -33% 4.8 -2.32 - 0.6 10.80 1,163 48% 1.40 6,622.8 27.6

CITH SL 5 284.90 1,424.5 -26% 8.6 -1.91 - 0.3 16.23 777 41% 1.83 5,254.3 58.4

CITW SL 2.5 559.86 1,399.6 -32% 3.1 -0.96 - 0.6 3.94 472 49% 2.97 3,452.6 23.0

LHL SL 30 46.00 1,380.0 -14% 7.3 -1.63 - 0.5 66.47 620 12% 2.23 1,794.6 21.1

TANG SL 59.1 20.00 1,182.0 -10% 2.6 -3.72 - 0.4 157.68 458 2% 2.75 850.5 4.8

RPBH SL 22.5 50.00 1,125.0 -18% 3.7 0.10 230 0.4 52.99 474 1% 2.37 654.0 5.1

PEG SL 32.5 33.77 1,097.5 -15% 4.8 -4.75 - 0.5 65.66 639 13% 1.61 1,263.1 9.5

SHOT SL 8.1 111.53 903.4 -61% 1.3 -4.63 - 0.4 22.93 885 39% 1.01 5,700.6 8.1

BERU SL 1.2 537.84 645.4 -20% 2.0 -0.55 - 14.8 0.08 207 82% 3.09 1,417.6 13.4

MRH SL 12.5 47.07 588.3 -27% 4.5 -4.13 - 0.9 14.44 500 34% 1.18 915.4 8.2

BRR SL 10 53.73 537.3 -7% 2.4 0.15 75 2.2 4.46 71 0% 8.23 572.7 19.1

RFL SL 26.2 20.00 524.0 19% 1.6 -0.13 - 0.9 28.52 71 1% 7.41 520.7 11.6

Source : Bloomberg/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 14

PALM, AHUN and KHL lead the pack with the highest revenue per room

Annual Rev per Room (LKR mn)

50.0

40.0

30.0

20.0

10.0

-

AHUN, SHOT and KHL has the lowest Price to sales

Price to Sales (x)

20.00

15.00

10.00

5.00

-

Source : SLTDA/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 15

PALM, RCH and RENU has the highest disparity in Share Price vs. NAV

2500 500%

2000 400%

1500 300%

1000 200%

500 100%

0 0%

Share Price 02.01.2023 (LKR) -LHS NAV (LKR) - LHS Price vs NAV - RHS

Many hotel stocks currently trade below book

PBV (x)

6.0

5.0

4.0

3.0

2.0

1.0

-

PALM RCH RENU CITH SHOT CHOT TANG RPBH LHL KHC PEG AHPL REEF STAF NEH EDEN CITW KHL GHLL AHUN MRH RFL RHTL CONN TRAN JETS BRR SERV

SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL SL

Source : Bloomberg/ SSB Research

Softlogic Stockbrokers (Pvt) Ltd 16

KEY PICKS

John Keells Hotels (KHL SL: LKR16.5) – TP: LKR21.8

Share details

KHL operates 12 resorts with a total room capacity of +1,400 spread across Sri Lanka and Bloomberg Ticker JKHL SL

Reuters Ticker KHL CM

Maldives under the Cinnamon brand. In Sri Lanka, the group operates 8 resort hotel Market Cap. (LKR Bn) 24.0

properties accounting for nearly 1,022 rooms and in the Maldives, the properties account for (USD Mn) 65.6

N - Issued Shares (mn) 1,456.1

a total room capacity of 454. Given the rising arrival numbers to Maldives, KHL’s occupancy Free Float (%) 19.7

rate at Maldivian resorts rose to 86% in 2Q’23 cf. 76% in 2Q’22. Further occupancies

increased at SL resorts up to 31% in 2Q’23 cf. 18% in 2Q’22. Conversely Maldivian resorts SHARE MOVEMENT YTD 3M 12M

touched an ARR of USD316 which is almost the pre pandemic levels and remain promising N- High (LKR) 17.0 18.5 20.9

Low (LKR) 16.1 15.0 9.3

over the forecast period given the encouraging tourist arrivals to Maldives where the YTD KHL.N (%) 3.0 3.1 4.3

arrivals till end Dec’22 rose upto 1.6 mn. Furthermore, SL resorts ARRs too grew to USD57 cf. Avg. Daily T/O (LKR Mn) 0.2 3.1 4.3

ASPI (%) 0.3 (8.3) (33.8)

USD38 in 2Q’22. With an expected bounce back in overall sentiment of the country with the

expectation of striking a deal with IMF to sort out some of the dire conditions and regain ASPI Vs Share Price

some forex flows to purchase the much needed items, may further bode well and could boost

14000 22

tourist arrivals to SL from 1Q2023E which is also the peak season for the island nation. 13000 20

12000 18

Valuation: Based on a replacement cost valuation KHL derives a TP of LKR19.7. Further 11000

16

10000

14

based on an implied PBV multiple of 0.9x and with an expected increase of ~20% in NAV, KHL 9000

8000 12

derives a fair value of LKR23.9. Hence the stock derives an average TP of LKR21.8 (upside of 7000 10

+32%) and has value enhanced by an expected normalization of sentiments in SL and faster 6000 8

Aug-22

Apr-22

Jan-22

Jul-22

Sep-22

Jan-23

Mar-22

Nov-22

May-22

Dec-21

Feb-22

Jun-22

Oct-22

growth in Maldivian arm.

CSEALL Index (LHS) JKHL SL Equity (RHS)

Prices as of 2nd Jan’23

Softlogic Stockbrokers (Pvt) Ltd 17

A TECHNICAL EXPLANATION ON KHL

The counter is currently bouncing from its upward trendline in an attempt to get above its horizontal resistance and to build a base above its 50-day

moving average. In order for the counter to reach higher prices, a break above its resistance trendline is crucial while maintaining its position above both

the moving averages.(20-day and 50-day MAs)

Resistance: Horizontal resistance and the two moving averages

Risk management: A confirming break below the upward trendline would invalidate our upward thesis.

Softlogic Stockbrokers (Pvt) Ltd 18

KEY PICKS

Share details

Aitken Spence Hotel Holdings (AHUN SL: LKR50.8) – TP LKR74.9 Bloomberg Ticker AHUN SL

Reuters Ticker AHUN CM

AHUN is Sri Lanka’s largest hotel operator (1,564 rooms), whilst also has a strong presence Market Cap. (LKR Bn) 16.5

across Asia (Oman – 386 rooms and India 140 rooms) and is the largest international resort (USD Mn) 44.9

N - Issued Shares (mn) 336.6

chain operator in Maldives (750 rooms). AHUN’s total assets base stood at LKR 118 bn as of Free Float (%) 25.4

end 1HFY23. Whilst holding a NAV of ~LKR64, the stock with great exposure to USD linked

revenue streams would be the driving factor for AHUN given the steep LKR depreciation SHARE MOVEMENT YTD 3M 12M

which would boost its revenue generation. Additionally, AHUN being the largest local N- High (LKR) 50.0 59.6 68.0

Low (LKR) 49.0 49.0 28.0

hotelier with the highest number of rooms in Maldives would see incremental earnings SPEN.N (%) (3.5) (14.3) 16.9

growth in the Maldivian segment over the coming quarters. Avg. Daily T/O (LKR Mn) 1.1 2.2 3.3

ASPI (%) 0.3 (8.3) (33.8)

However, the stock has a relatively higher gearing ratio of ~71% given the increased

ASPI Vs Share Price

borrowings. This may be a negative given the steep rise in interest rates. Nevertheless, with

the extension of the debt moratoriums granted for the Tourism sector, it could give some 14000 70

13000

breathing space for the group to gradually bounce back in the coming quarters. 12000

60

11000 50

Valuation: Based on an implied PBV multiple of 0.9x and with an expected increase of 10000

40

9000

~30% in NAV, AHUN derives a fair value of LKR74.9 which indicates a price upside of +47% 8000

30

7000

to the CMP. Hence the stock remains attractive given its higher exposure to overseas hotel 6000 20

operations, specially given the higher exposure in Maldives coupled with a gradual

Jul-22

Sep-22

Jan-22

Mar-22

Apr-22

Nov-22

Jan-23

May-22

Aug-22

Feb-22

Jun-22

Oct-22

Dec-21

recovery expected in the local leisure operations over the coming quarters.

CSEALL Index (LHS) AHUN SL Equity (RHS)

Prices as of 2nd Jan’23

Softlogic Stockbrokers (Pvt) Ltd 19

A TECHNICAL EXPLANATION ON AHUN

The counter is currently testing its lower bound support with a possible bounce from its support range. While the counter is reaching a demand zone, a

possible bounce from the zone which induces price to break above its resistance trendline would enable price to move higher.

Resistance: 20-day and 50-day moving averages and its resistance trendline

Risk management: A break below both its support zones should be concerning leading to an invalidation of our thesis.

Softlogic Stockbrokers (Pvt) Ltd 20

KEY PICKS

Asian Hotels and Properties (AHPL SL: LKR37.4) – TP : LKR71.7 Share details

Bloomberg Ticker AHPL SL

AHPL is JKH’s city hotel arm which comprise two leading hotels Cinnamon Grand with a Reuters Ticker AHPL CM

total room inventory of 501 and Cinnamon Lakeside having a total room count of 346. Market Cap. (LKR Bn) 16.4

(USD Mn) 44.9

Furthermore, the stock holds a prime freehold land bank of ~8 acres in central Colombo N - Issued Shares (mn) 442.8

(the premises of Cinnamon Grand). This holds as a greater value given the appreciating Free Float (%) 4.0%

land prices in the country which has seen a steep rise thus far. Meanwhile AHPL’s city

SHARE MOVEMENT YTD 3M 12M

hotels occupancy went up to ~29% in 2Q’23 cf. 20% in 2Q’22 whilst ARRs for City hotels

N- High (LKR) 37.0 41.9 49.4

too grew to USD62 in 2Q’23 (cf. +USD50 levels before). Low (LKR) 35.1 33.5 27.0

AHPL.N (%) (6.1) (12.7) (19.5)

Moreover, with the expected revival in business travel, with many mega mixed projects Avg. Daily T/O (LKR Mn) 0.4 0.4 0.7

ASPI (%) 0.3 (8.3) (33.8)

including Port City getting back to full swing over the coming years amidst a gradual

normalization of SL’s economic sentiments, the local city hotels including AHPL will see ASPI Vs Share Price

improved occupancy over the coming quarters. 14000 55

13000 50

Valuation: Given the prime land bank AHPL holds, based on a replacement cost valuation 12000

45

11000

AHPL derives an average TP of ~LKR121 which derives a potential price upside of +100%. 10000 40

9000

Further based on an implied PBV multiple of 0.7x and with an expected increase of ~10% 35

8000

in NAV, AHPL derives a fair value of LKR54.3. Hence the stock remains attractive in the 7000 30

6000 25

listed City hotel space and on average derives a TP of LKR71.7 (upside of +92%) over the

Apr-22

Jan-22

Feb-22

Mar-22

Jul-22

Sep-22

Nov-22

Jan-23

May-22

Aug-22

Jun-22

Oct-22

Dec-21

medium term.

CSEALL Index (LHS) AHPL SL Equity (RHS)

. Prices as of 2nd Jan’23

Softlogic Stockbrokers (Pvt) Ltd 21

KEY PICKS

Share details

John Keells Holdings (JKH SL: LKR135.25) - TP: LKR190.0 Bloomberg Ticker JKH SL

Reuters Ticker JKH CM

Being the holding company of AHPL and KHL having a direct ownership of +78% and +80% Market Cap. (LKR Bn) 190.8

respectively, JKH remains as a direct beneficiary of the improved performance in its Leisure (USD Mn) 520.5

N - Issued Shares (mn) 1,384.9

arm with an anticipated recovery in country’s sentiments in the near – medium term. Free Float (%) 98.9%

Hence, we remain bullish on JKH as well.

SHARE MOVEMENT YTD 3M 12M

N- High (LKR) 163.8 151.0 170.0

Low (LKR) 118.3 128.5 116.3

Leisure contributed ~11% to JKH’s topline in 2QFY23 whilst narrowing losses JKH.N (%) (3.5) 8.8 0.5

Avg. Daily T/O (LKR Mn) 154.5 120.1 149.0

ASPI (%) 0.3 (8.3) (33.8)

1%

5% Retail ASPI Vs Share Price

11% Consumer Foods 14000 170

13000 160

4% 35% Transportation

12000 150

Financial Services 11000

5% 140

10000

Others 130

9000

120

Leisure 8000

7000 110

27% Property 6000 100

12%

Jan-22

Mar-22

Apr-22

Jan-23

Jul-22

Sep-22

Nov-22

Aug-22

May-22

Jun-22

Oct-22

Dec-21

Feb-22

Financial Services

Prices as of 2nd Jan’23 CSEALL Index (LHS) JKH SL Equity (RHS)

Softlogic Stockbrokers (Pvt) Ltd 22

KEY PICKS

Aitken Spence (SPEN SL: LKR128.0) – TP: LKR180.0 Share details

Bloomberg Ticker SPEN SL

Being the holding company of AHUN having a direct ownership of +71%, SPEN remains as a Reuters Ticker SPEN CM

direct beneficiary of AHUN’s anticipated revival in the near – medium term. Hence, we Market Cap. (LKR Bn) 51.9

(USD Mn) 141.8

remain bullish on SPEN when considering the Tourism sector along with the other positive N - Issued Shares (mn) 406.0

contributions from its core segments including Strategic investments and Logistics. Free Float (%) 45.7

SHARE MOVEMENT YTD 3M 12M

Leisure contributed to ~48% of SPEN’s topline in 2QFY23 N- High (LKR) 130.0 144.5 155.0

Low (LKR) 127.3 120.8 60.0

Services sector SPEN.N (%) (0.6) (3.0) 57.1

2% Avg. Daily T/O (LKR Mn) 1.0 8.8 16.9

Strategic ASPI (%) 0.3 (8.3) (33.8)

investments

23%

ASPI Vs Share Price

14000 160

13000 140

Tourism sector 12000

48% 11000 120

10000 100

9000 80

8000

7000 60

6000 40

Maritime &

Aug-22

Jan-22

Apr-22

Jul-22

Sep-22

Jan-23

Mar-22

Oct-22

Nov-22

May-22

Dec-21

Feb-22

Jun-22

logistics

27%

CSEALL Index (LHS) SPEN SL Equity (RHS)

Prices as of 2nd Jan’23

Softlogic Stockbrokers (Pvt) Ltd 23

SRI LANKA EQUITY RESEARCH Softlogic Stockbrokers (Pvt) Ltd

Level #16, One Galle Face Tower, Colombo 02, Sri Lanka

Equity Research Telephone +94 117 277 000 |Fax +94 117 277 099

Mahesh Udugampala

E-mail research@softlogicstockbrokers.lk

mahesh.udugampala@softlogicstockbrokers.lk

+94 11 7277030, +94 769 637 638

Equity Sales

Shadini Silva

Dihan Dedigama dihan@softlogic.lk Colombo +94 11 7277010 / +94 117277955,

shadini.silva@softlogicstockbrokers.lk

+94 777689933

+94 11 7277032, +94 773 627 792

Hussain Gani gani@softlogic.lk Colombo +94 11 7277020 / +94 777992086

Raynal Wickremeratne Prasanna Chandrasekera prasanna.chandrasekera@equity.softlogic.lk Colombo +94 11 7277056

raynal.wickremeratne@softlogicstockbrokers.lk Eardley Kern e.kern@softlogic.lk Colombo +94 11 7277053, +94 777348018

+94 11 7277034, +94 77 5268282 Andre Lowe andre.lowe@equity.softlogic.lk Colombo +94 11 7277052, +94 777230040

Dilip Fernando dilip.fernando@equity.softlogic.lk Colombo +94 11 7277000, +94 77 3379730

Nishanthi Hettiarachchi Dinesh Rupasinghe dinesh.rupasinghe@equity.softlogic.lk Colombo +94 11 7277059, +94 77 2072397

nishanthi.hettiachchi@softlogicstockbrokers.lk Tharindu Senadheera tharindu.senadeera@equity.Softlogic.lk Colombo + 94 11 7277000, +0773505094

+94 11 7277033, +94 77 1078499 Madushanka Rathnayaka madushanka.rathnayaka@equity.softlogic.lk Panadura +94 34 7451000, +94 773566465

Achindi Silva achindi@equity.softlogic.lk Colombo +94 11 7277000, +94 773825087

Technical Analyst :

Gratian Nirmal gratain.nirmal@equity.softlogic.lk Jaffna +94 774510000/+94 21 7451 000

Ashean Irugalbandara

ashean.irugalbandara@softlogicstockbrokers.lk Krishan Williams krishan.williams@equity.softlogic.lk Negombo +94 31 7451000, +94 773569827

+94 76 8882110 Lakshan Rathnapala lakshan.rathnapala@softlogic.lk Colombo +94 11 7277000, 077 8329698

Isuru Adamsz isuru.adamsz@softlogic.lk Colombo + 074 1502884

Disclaimer Asendra Wijesiri asendra.wijesiri@softlogic.lk Galle + 091 745 1000, 077 6470632

Local & Non-USA based clients

The information contained in this report is for general information purposes only. This report and its content is copyright of Softlogic Stockbrokers and all rights reserved. This report- in whole or in part- may not, except with the

express written permission of Softlogic Stockbrokers be reproduced or distributed or commercially exploited in any material form by any means whether graphic, electronic, mechanical or any means. Nor may you transmit it or store

it in any other website or other form of electronic retrieval system. Any unauthorised use of this report will result in immediate proceedings. The report has been prepared by Softlogic Stockbrokers, Sri Lanka. The information and

opinions contained herein has been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith. Such information has not been independently verified and no guaranty,

representation or warranty, express or implied is made as to its accuracy, completeness or correctness, reliability or suitability. All such information and opinions are subject to change without notice. This document is for information

purposes only, descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell

any securities or other financial instruments. In no event will Softlogic Stockbrokers be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising

out of, or in connection with the use of this report and any reliance you place on such information is therefore strictly at your own risk.

Softlogic Stockbrokers may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Not all

customers will receive the material at the same time. Softlogic Stockbrokers, their respective directors, officers, representatives, employees, related persons and/or Softlogic Stockbrokers may have a long or short position in any of the

securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from

time to time in the open market or otherwise, in each case either as principal or agent. Softlogic Stockbrokers may make markets in securities or other financial instruments described in this publication, in securities of issuers

described herein or in securities underlying or related to such securities. Softlogic Stockbrokers may have entirely underwritten the securities of an issuer mentioned herein.

Softlogic Stockbrokers (Pvt) Ltd 24

You might also like

- Top 10 Most Powerful Openings in Chess PDFDocument12 pagesTop 10 Most Powerful Openings in Chess PDFsyaf file gwNo ratings yet

- Trading SecretsDocument99 pagesTrading SecretsGary100% (3)

- The Anti Cancer Essential Oil ReferenceDocument9 pagesThe Anti Cancer Essential Oil ReferenceΡαφαέλα ΠηλείδηNo ratings yet

- Indian Banking - Sector Report - 15-07-2021 - SystematixDocument153 pagesIndian Banking - Sector Report - 15-07-2021 - SystematixDebjit AdakNo ratings yet

- Sales Manager Job DescriptionDocument8 pagesSales Manager Job Descriptionsalesmanagement264No ratings yet

- Similarities and Differences Between Theravada and Mahayana BuddhismDocument10 pagesSimilarities and Differences Between Theravada and Mahayana BuddhismANKUR BARUA89% (9)

- Hard Rock Miner - S Handbook - Jack de La Vergne - Edition 3 - 2003Document330 pagesHard Rock Miner - S Handbook - Jack de La Vergne - Edition 3 - 2003Adriel senciaNo ratings yet

- BRS Morning Shout 20.11.2023Document2 pagesBRS Morning Shout 20.11.2023Lakmal SilvaNo ratings yet

- Lumen Vol 2Document6 pagesLumen Vol 2Daniel AldianNo ratings yet

- BRS Market Report: Week IVDocument7 pagesBRS Market Report: Week IVSudheera IndrajithNo ratings yet

- KTrade 2023 Strategy Report - Where To Invest in 2023Document51 pagesKTrade 2023 Strategy Report - Where To Invest in 2023Amir MarwatNo ratings yet

- BRS Weekly Report 14.10.2022Document13 pagesBRS Weekly Report 14.10.2022Sudheera IndrajithNo ratings yet

- Morning Breifing 27-01-2020Document17 pagesMorning Breifing 27-01-2020afnaniqbalNo ratings yet

- Diwali Picks 2023 NBRRDocument16 pagesDiwali Picks 2023 NBRRSharwan KumarNo ratings yet

- Central Bank of India Result UpdatedDocument10 pagesCentral Bank of India Result UpdatedAngel BrokingNo ratings yet

- JM - SailDocument10 pagesJM - SailSanjay PatelNo ratings yet

- Fund Select: Monthly Aums of Mutual Fund Industry Increased by PKR 38Bn To PKR 611BnDocument11 pagesFund Select: Monthly Aums of Mutual Fund Industry Increased by PKR 38Bn To PKR 611Bnmuddasir1980No ratings yet

- Samsung Electronics: Earnings Release Q2 2016Document8 pagesSamsung Electronics: Earnings Release Q2 2016Syed Mohd AliNo ratings yet

- Havells India Ltd. - INDSECDocument12 pagesHavells India Ltd. - INDSECResearch ReportsNo ratings yet

- NMDC Result UpdatedDocument7 pagesNMDC Result UpdatedAngel BrokingNo ratings yet

- Morning - India 20210825 Mosl Mi PG008Document8 pagesMorning - India 20210825 Mosl Mi PG008vikalp123123No ratings yet

- Daily Trade Journal - 29.07.2013Document6 pagesDaily Trade Journal - 29.07.2013Randora LkNo ratings yet

- Trader's Daily Digest 15.11.2022Document8 pagesTrader's Daily Digest 15.11.2022Sudheera IndrajithNo ratings yet

- Rollover AnalysisDocument9 pagesRollover Analysismallesh kNo ratings yet

- Corporation Bank Result UpdatedDocument11 pagesCorporation Bank Result UpdatedAngel BrokingNo ratings yet

- Property & REIT Sector 200903Document3 pagesProperty & REIT Sector 200903Brian StanleyNo ratings yet

- Presentation Final Paper 2Document21 pagesPresentation Final Paper 2Hoang LeNo ratings yet

- NSE India - Nov22 - EUDocument9 pagesNSE India - Nov22 - EUpremalgandhi10No ratings yet

- Storytel Interim Report January June 2021 210806Document21 pagesStorytel Interim Report January June 2021 210806Beth DeichmannNo ratings yet

- Crossings Carry The Turnover To A 2-Week High Led by BFI SectorDocument7 pagesCrossings Carry The Turnover To A 2-Week High Led by BFI SectorRandora LkNo ratings yet

- Daily Market Report 14 11 2022Document2 pagesDaily Market Report 14 11 2022Nwagwu ChukwuemekaNo ratings yet

- South Indian Bank Result UpdatedDocument13 pagesSouth Indian Bank Result UpdatedAngel BrokingNo ratings yet

- NG Cares: Results and ReimbursementsDocument9 pagesNG Cares: Results and ReimbursementsBimadraj Sharan SinhaNo ratings yet

- Daily Trade Journal - 26.12.2013Document6 pagesDaily Trade Journal - 26.12.2013Randora LkNo ratings yet

- Index Reversed But On A Slow Note : Wednesday, July 10, 2013Document7 pagesIndex Reversed But On A Slow Note : Wednesday, July 10, 2013Randora LkNo ratings yet

- Index Dipped Amidst Profit Taking : Tuesday, April 30, 2013Document7 pagesIndex Dipped Amidst Profit Taking : Tuesday, April 30, 2013Randora LkNo ratings yet

- Profit Lags As Chengdu Revenue Recognition Delayed, Mall Recovery StallsDocument8 pagesProfit Lags As Chengdu Revenue Recognition Delayed, Mall Recovery StallsJajahinaNo ratings yet

- Allahabad Bank Result UpdatedDocument11 pagesAllahabad Bank Result UpdatedAngel BrokingNo ratings yet

- LLUB Corporate Update 22-10-15 HOLD 2Document11 pagesLLUB Corporate Update 22-10-15 HOLD 2Nuwan Tharanga LiyanageNo ratings yet

- Report On Stock Trading Report by Mansukh Investment & Trading Solutions 6/07/2010Document5 pagesReport On Stock Trading Report by Mansukh Investment & Trading Solutions 6/07/2010MansukhNo ratings yet

- Daily Digest - 15 June, 2023Document2 pagesDaily Digest - 15 June, 2023Anant VishnoiNo ratings yet

- Morning Cuppa 14-DecDocument2 pagesMorning Cuppa 14-DecKeshav KhetanNo ratings yet

- Morning Breifing 04-10-2019Document18 pagesMorning Breifing 04-10-2019afnaniqbalNo ratings yet

- Bank of Baroda: Performance HighlightsDocument12 pagesBank of Baroda: Performance HighlightsAngel BrokingNo ratings yet

- Reliance Communication Result UpdatedDocument11 pagesReliance Communication Result UpdatedAngel BrokingNo ratings yet

- Karnataka Bank 2022 PerfomaceDocument59 pagesKarnataka Bank 2022 Perfomacesahal95264No ratings yet

- Banks - Sector Update - 16 Nov 23Document8 pagesBanks - Sector Update - 16 Nov 23krishna_buntyNo ratings yet

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- Morning Cuppa 22-FebDocument2 pagesMorning Cuppa 22-FebNitin ChauhanNo ratings yet

- United Bank of India Result UpdatedDocument12 pagesUnited Bank of India Result UpdatedAngel BrokingNo ratings yet

- UOB Company Results 3Q23 BBCA 23 Oct 2023 Maintain Buy TP Rp10 300Document5 pagesUOB Company Results 3Q23 BBCA 23 Oct 2023 Maintain Buy TP Rp10 300edwardlowisworkNo ratings yet

- SouthIndianBank 2QFY2013RU NWDocument13 pagesSouthIndianBank 2QFY2013RU NWAngel BrokingNo ratings yet

- Case Study ExerciseDocument12 pagesCase Study Exercisesushant ahujaNo ratings yet

- Daily Trade Journal - 05.03.2014Document6 pagesDaily Trade Journal - 05.03.2014Randora LkNo ratings yet

- Canara Bank Result UpdatedDocument11 pagesCanara Bank Result UpdatedAngel BrokingNo ratings yet

- COT DatabaseDocument55 pagesCOT Databases pNo ratings yet

- Chevron Lubricants Lanka PLC LLUB Q1 FY 16 HOLD PDFDocument11 pagesChevron Lubricants Lanka PLC LLUB Q1 FY 16 HOLD PDFNuwan Tharanga LiyanageNo ratings yet

- Oriental Bank of Commerce: Performance HighlightsDocument11 pagesOriental Bank of Commerce: Performance HighlightsAngel BrokingNo ratings yet

- Daily Trade Journal - 20.02.2014Document6 pagesDaily Trade Journal - 20.02.2014Randora LkNo ratings yet

- Adro Mirae 02 Nov 2023 231102 150020Document9 pagesAdro Mirae 02 Nov 2023 231102 150020marcellusdarrenNo ratings yet

- LG Balakrishnan Bros - HSL - 180923 - EBRDocument11 pagesLG Balakrishnan Bros - HSL - 180923 - EBRSriram RanganathanNo ratings yet

- Doddy Bicara InvestasiDocument34 pagesDoddy Bicara InvestasiAmri RijalNo ratings yet

- Investor Digest: Equity Research - 24 January 2022Document5 pagesInvestor Digest: Equity Research - 24 January 2022Radityo Hari WibowoNo ratings yet

- Order: Signal: Tickers:: My Presets Ticker Asc None (All StocksDocument1 pageOrder: Signal: Tickers:: My Presets Ticker Asc None (All StocksAshraful AlamNo ratings yet

- Bonds - July 8 2020Document3 pagesBonds - July 8 2020Lisle Daverin BlythNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Unlocking the Potential of Digital Services Trade in Asia and the PacificFrom EverandUnlocking the Potential of Digital Services Trade in Asia and the PacificNo ratings yet

- LableDocument3 pagesLableThenu GananNo ratings yet

- Short Term Rental AgreementDocument2 pagesShort Term Rental AgreementThenu GananNo ratings yet

- Action PlanDocument5 pagesAction PlanThenu GananNo ratings yet

- Aec TornurmentDocument4 pagesAec TornurmentThenu GananNo ratings yet

- Megalithic Landscape in The Site of Gunung Padang Analysis of Environmental Studies IJERTV5IS110285Document4 pagesMegalithic Landscape in The Site of Gunung Padang Analysis of Environmental Studies IJERTV5IS110285Thenu GananNo ratings yet

- BY DR Muhammad Akram M.C.H.JeddahDocument32 pagesBY DR Muhammad Akram M.C.H.JeddahMuhammad Akram Qaim KhaniNo ratings yet

- Windows Server Failover Clustering On HPE SimpliVity Technical White Paper-A50000833enwDocument15 pagesWindows Server Failover Clustering On HPE SimpliVity Technical White Paper-A50000833enwYeraldo MarinNo ratings yet

- Introduction To Personal FinanceDocument15 pagesIntroduction To Personal FinanceMa'am Katrina Marie MirandaNo ratings yet

- Term Coalition Has Been Derived From The Latin Word 'Coalitio' Which Means To Grow Up TogetherDocument2 pagesTerm Coalition Has Been Derived From The Latin Word 'Coalitio' Which Means To Grow Up TogetherShree MishraNo ratings yet

- Rule 110 CasesDocument102 pagesRule 110 Casesアブドゥルカリム エミールNo ratings yet

- Exams With Proctorio Students 2603Document1 pageExams With Proctorio Students 2603Nicu BotnariNo ratings yet

- Finman CH 18 SolmanDocument32 pagesFinman CH 18 SolmanJoselle Jan Claudio100% (1)

- Geometry Unit: Congruence and Similarity: Manasquan High School Department: MathematicsDocument5 pagesGeometry Unit: Congruence and Similarity: Manasquan High School Department: MathematicsabilodeauNo ratings yet

- Essay On Stamp CollectionDocument5 pagesEssay On Stamp Collectionezmt6r5c100% (2)

- (Downloadsachmienphi.com) Bài Tập Thực Hành Tiếng Anh 7 - Trần Đình Nguyễn LữDocument111 pages(Downloadsachmienphi.com) Bài Tập Thực Hành Tiếng Anh 7 - Trần Đình Nguyễn LữNguyên NguyễnNo ratings yet

- Tectos Falsos Stretch Caracteristicas TecnicasDocument37 pagesTectos Falsos Stretch Caracteristicas TecnicasVadymNo ratings yet

- Battle RoyaleDocument4 pagesBattle RoyalerwNo ratings yet

- Memperkuat Nasionalisme Indonesia Di Era Globalisasi ) Oleh Dwi Ari Listyani. )Document20 pagesMemperkuat Nasionalisme Indonesia Di Era Globalisasi ) Oleh Dwi Ari Listyani. )PinaSeeYouNo ratings yet

- ch27 Matrices and ApplicationsDocument34 pagesch27 Matrices and Applicationschowa fellonNo ratings yet

- Flokulan Air Limbah PDFDocument21 pagesFlokulan Air Limbah PDFanggunNo ratings yet

- 1040 A Day in The Life of A Veterinary Technician PDFDocument7 pages1040 A Day in The Life of A Veterinary Technician PDFSedat KorkmazNo ratings yet

- Cambridge IGCSE: PHYSICS 0625/63Document16 pagesCambridge IGCSE: PHYSICS 0625/63...No ratings yet

- G.R. No. 178511 - Supreme Court of The PhilippinesDocument4 pagesG.R. No. 178511 - Supreme Court of The PhilippinesJackie Z. RaquelNo ratings yet

- Contoh DVDocument5 pagesContoh DVHiruma YoishiNo ratings yet

- Gremath Set8-1Document48 pagesGremath Set8-1uzairmetallurgistNo ratings yet

- Investor Presentation (Company Update)Document17 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Jacksonville's Taste 2012Document100 pagesJacksonville's Taste 2012Ali KhanNo ratings yet

- Formulating Affective Learning Targets: Category Examples and KeywordsDocument2 pagesFormulating Affective Learning Targets: Category Examples and KeywordsJean LabradorNo ratings yet