Professional Documents

Culture Documents

Individual Assignment

Uploaded by

Kiya AbdiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Individual Assignment

Uploaded by

Kiya AbdiCopyright:

Available Formats

Individual Assignment

1 Construction Company acquired a new crane for Birr 360,500 at the beginning of year 1.

The crane has an estimated residual value of Birr 35,000 and an estimated useful life of five

years. The crane is expected to last 10,000 operating hours. It was used 1800 hours in year 1,

2000 hours in year 2 and 2500 hours in year 3. Based on the information given above:

Compute the annual depreciation and the carrying value for the crane for each of the first

three years under each of the following methods:

A. Straight line method,

B. Units of production method,

2 What are the types of inventory found in merchandise business and manufacturing

business?

3 What is the purpose of holding inventory?

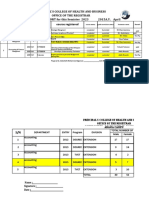

4 Given the following information from Berta Trading Inc. compute cost of ending inventory

and cost of goods sold.

April 1 410 units @ Br.95 = Br.38,950 (Beginning Inventory)

May 15 Purchases 120 units @ Br.90 = Br.10,800

July 3 Purchases 500 units @ Br.98 = Br.49,000

June 26 Purchases 85 units @Br. 102 = Br.8,670

Assume that 400 units are remained on hand

5 Use the following illustrative to compute cost of goods sold and ending inventory value.

September 1.Beginning inventory Br.82, 300

Purchases during September (net) 240,000

Merchandise available for sales Br. 322,300

Sales in the month of September (Net) Br.290, 000

(Assume that based on experience gross profit rate is 35% of net sales)

GOOD LUCK

PREPARED BY ENGIDA

Submission date Monday after final exam

You might also like

- Financial & Cost Accounting - ITMXMBA14 - Lecture11Document10 pagesFinancial & Cost Accounting - ITMXMBA14 - Lecture11Mohit GuptaNo ratings yet

- Material CostDocument1 pageMaterial CostLaxman ZaggeNo ratings yet

- Tutorial Budget StudentDocument4 pagesTutorial Budget StudentDanial NorazmanNo ratings yet

- 4 5868563740395309829Document3 pages4 5868563740395309829Abdi0% (1)

- Management Accounting 9mrQc9m4HBDocument3 pagesManagement Accounting 9mrQc9m4HBMadhuram SharmaNo ratings yet

- Inventory Valuation ProblemsDocument7 pagesInventory Valuation ProblemsRahul SinghNo ratings yet

- Budgeting Quizer - MASDocument5 pagesBudgeting Quizer - MASPrincess Joy VillaNo ratings yet

- Question Chapter3 Final 1Document16 pagesQuestion Chapter3 Final 1Mạnh Đỗ ĐứcNo ratings yet

- Revision Questions On Management AccountingDocument15 pagesRevision Questions On Management AccountingSyazliana Kasim100% (1)

- (ACMR 216) Budgeting Practices Mid-ExamDocument4 pages(ACMR 216) Budgeting Practices Mid-ExamJosuaNo ratings yet

- Revision Test Paper Cap-Ii: Advanced Accounting Questions Accounting For DepartmentsDocument279 pagesRevision Test Paper Cap-Ii: Advanced Accounting Questions Accounting For Departmentsshankar k.c.No ratings yet

- Addition Exercises - Chapter 1 To 3Document4 pagesAddition Exercises - Chapter 1 To 3Raymond GuillartesNo ratings yet

- Insurance Claim PDFDocument15 pagesInsurance Claim PDFbinuNo ratings yet

- Case Study 1Document2 pagesCase Study 1ain abbaNo ratings yet

- Computerised Accounting Test 1Document3 pagesComputerised Accounting Test 1oloka GeorgeNo ratings yet

- Assignment I-Cost & MGT Acc IDocument2 pagesAssignment I-Cost & MGT Acc IzewdieNo ratings yet

- CMA Online Final Assessment Spring 2020Document4 pagesCMA Online Final Assessment Spring 2020Waqar AhmadNo ratings yet

- Work Sheet 1Document6 pagesWork Sheet 1Sourabh PatidarNo ratings yet

- Budgeting QuestionsDocument8 pagesBudgeting QuestionsumarNo ratings yet

- Exam 2Document3 pagesExam 2tamene woldeNo ratings yet

- Budgeting and Cost ControlDocument7 pagesBudgeting and Cost Controlnags18888No ratings yet

- INS2098 - Revision For FinalDocument16 pagesINS2098 - Revision For FinalVũ Hồng NgânNo ratings yet

- Valuation of Inventories: Dangal QuestionsDocument28 pagesValuation of Inventories: Dangal Questionsmonudeep aggarwalNo ratings yet

- Question Paper 2015: Punjab UniversityDocument4 pagesQuestion Paper 2015: Punjab UniversityTahreem FizzaNo ratings yet

- Sheet 3 First YearDocument11 pagesSheet 3 First Yearmagdy kamelNo ratings yet

- Material CostingDocument18 pagesMaterial CostingRaj KumarNo ratings yet

- 1.model Problems On BudgetingDocument1 page1.model Problems On BudgetingHasim SaiyedNo ratings yet

- Assignments For All Chapters Principle of Accounting IIDocument6 pagesAssignments For All Chapters Principle of Accounting IITolesa MogosNo ratings yet

- SwatiDocument5 pagesSwatiOmkar Dhamapurkar0% (1)

- Mastering Depreciation TestbankDocument18 pagesMastering Depreciation TestbankLade PalkanNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Document4 pagesLoyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Charles VinothNo ratings yet

- FA II AssignmentDocument7 pagesFA II AssignmentmapNo ratings yet

- Assessment TasksDocument5 pagesAssessment TasksLDB Ashley Jeremiah Magsino - ABMNo ratings yet

- Basic Mas ConceptsDocument7 pagesBasic Mas Conceptsjulia4razoNo ratings yet

- AKUNTANSI KEUANGAN MENENGAH I - CH 11Document1 pageAKUNTANSI KEUANGAN MENENGAH I - CH 11ini viaNo ratings yet

- Cost Accounting P1Document6 pagesCost Accounting P1Cindy ApriliaNo ratings yet

- Case Study 3Document2 pagesCase Study 3ain abbaNo ratings yet

- Accounting Level IV Coc: Project OneDocument5 pagesAccounting Level IV Coc: Project OneTewodros BekeleNo ratings yet

- Exercise Chap 11Document7 pagesExercise Chap 11JF FNo ratings yet

- Cost of Goods Sold Problems PDF 1 3Document3 pagesCost of Goods Sold Problems PDF 1 3Janine padronesNo ratings yet

- Cost Accounting ExamsDocument6 pagesCost Accounting Examsaroridouglas880No ratings yet

- 2.3 Paper 2.3 - Accounting For Business - 1Document6 pages2.3 Paper 2.3 - Accounting For Business - 1Himanshu SinghNo ratings yet

- FOA II AssignmentDocument5 pagesFOA II AssignmentYomif ChalchisaNo ratings yet

- PPEDocument18 pagesPPECarl Yry BitzNo ratings yet

- Material CostingDocument20 pagesMaterial Costingrafiq5002No ratings yet

- Question Paper Unit f014 01 RB Management Accounting Resource BookletDocument8 pagesQuestion Paper Unit f014 01 RB Management Accounting Resource Bookletjt7qdbvqhvNo ratings yet

- AbdulSamad 12 15796 1 DepreciationDocument12 pagesAbdulSamad 12 15796 1 DepreciationSyed SumamaNo ratings yet

- Exercises On InventoriesDocument19 pagesExercises On InventoriesJoel Christian Mascariña0% (1)

- Module 5 - PpsDocument4 pagesModule 5 - PpsMIGUEL JOSHUA VILLANUEVANo ratings yet

- Cost AccountingDocument14 pagesCost AccountingAdv Kamran Liaqat50% (2)

- Notre Dame of Midsayap College: AssignmentDocument2 pagesNotre Dame of Midsayap College: AssignmentMarites AmorsoloNo ratings yet

- AAU Worksheet Accounting-IIDocument5 pagesAAU Worksheet Accounting-IIHaftom YitbarekNo ratings yet

- Unit V Budgetory ControlDocument16 pagesUnit V Budgetory ControlShobha AkulaNo ratings yet

- 3rd Sem Cost AccountingDocument3 pages3rd Sem Cost AccountingkapilchandanNo ratings yet

- Management Accounting AssignmentDocument8 pagesManagement Accounting AssignmentAjay VatsavaiNo ratings yet

- Assignment 2024Document5 pagesAssignment 2024edwardphirijoshua656No ratings yet

- Principles of Accounitng Part II WorksheetDocument5 pagesPrinciples of Accounitng Part II WorksheetYonas80% (5)

- Workshop-8-Qs Warwick Assignments AndvsolutionsvDocument3 pagesWorkshop-8-Qs Warwick Assignments AndvsolutionsvNaresh SehdevNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Auditing 2 - Chapter SevenDocument10 pagesAuditing 2 - Chapter SevenPatrick MachiridzaNo ratings yet

- Unit-2 Audit of Cash and Marketable SecuritiesDocument6 pagesUnit-2 Audit of Cash and Marketable SecuritiesKiya AbdiNo ratings yet

- Registration For Sene 2016 E C Exit ExamDocument2 pagesRegistration For Sene 2016 E C Exit ExamKiya AbdiNo ratings yet

- New Doc 2022-10-29 14.46.56Document2 pagesNew Doc 2022-10-29 14.46.56Kiya AbdiNo ratings yet

- MARCH 2023 Adama Staff SalaryDocument24 pagesMARCH 2023 Adama Staff SalaryKiya AbdiNo ratings yet

- Comasionated Part I and Part IIDocument32 pagesComasionated Part I and Part IIKiya AbdiNo ratings yet

- 2023 Degree Regestration Format-1Document3 pages2023 Degree Regestration Format-1Kiya AbdiNo ratings yet

- Law of SalesDocument16 pagesLaw of SalesKiya AbdiNo ratings yet

- March Report FinalDocument3 pagesMarch Report FinalKiya AbdiNo ratings yet

- Law, Business Law, and Law of PersonDocument14 pagesLaw, Business Law, and Law of PersonKiya AbdiNo ratings yet

- PHBC Nursing CurriculumDocument260 pagesPHBC Nursing CurriculumKiya AbdiNo ratings yet

- Law of AgencyDocument17 pagesLaw of AgencyKiya AbdiNo ratings yet

- Law of Business OrganizationsDocument26 pagesLaw of Business OrganizationsKiya AbdiNo ratings yet

- Law of ContractsDocument59 pagesLaw of ContractsKiya AbdiNo ratings yet

- Cma - Chapter OneDocument19 pagesCma - Chapter OneKiya AbdiNo ratings yet

- Final Principals Ayer Tena Health Science and Business College TvetDocument4 pagesFinal Principals Ayer Tena Health Science and Business College TvetKiya AbdiNo ratings yet

- Cost IIiiiiiDocument77 pagesCost IIiiiiiKiya AbdiNo ratings yet

- Schedule PlannedDocument21 pagesSchedule PlannedKiya AbdiNo ratings yet

- Chapter - Service DPT Cost Allocation 2010Document13 pagesChapter - Service DPT Cost Allocation 2010Kiya AbdiNo ratings yet

- Nurs ProjectDocument1 pageNurs ProjectKiya AbdiNo ratings yet

- UC Morality and Professional EthicsDocument4 pagesUC Morality and Professional EthicsKiya AbdiNo ratings yet

- Instructor ChecklistDocument1 pageInstructor ChecklistKiya AbdiNo ratings yet

- Module II-Entrepreneurship and EmployabilityskillDocument10 pagesModule II-Entrepreneurship and EmployabilityskillKiya Abdi67% (6)

- TM-Entrepreneurship and Employabilityskill - TwoDocument228 pagesTM-Entrepreneurship and Employabilityskill - TwoKiya Abdi100% (1)

- TM Morality and Professional EthicsDocument126 pagesTM Morality and Professional EthicsKiya Abdi100% (2)

- Curriculum Morality and Professional EthicsDocument11 pagesCurriculum Morality and Professional EthicsKiya Abdi100% (2)

- Chapter 6-Service DPT Cost Allocation 2010Document14 pagesChapter 6-Service DPT Cost Allocation 2010Kiya AbdiNo ratings yet

- TM-Entrepreneurship and Employabilityskill - TwoDocument227 pagesTM-Entrepreneurship and Employabilityskill - TwoKiya Abdi100% (2)

- TM Morality and Professional EthicsDocument126 pagesTM Morality and Professional EthicsKiya AbdiNo ratings yet

- Module I-Entrepreneurship and EmployabilityskillDocument10 pagesModule I-Entrepreneurship and EmployabilityskillKiya Abdi100% (2)